North America Contact Lens Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3336

December 2024

94

About the Report

North America Contact Lens Market Overview

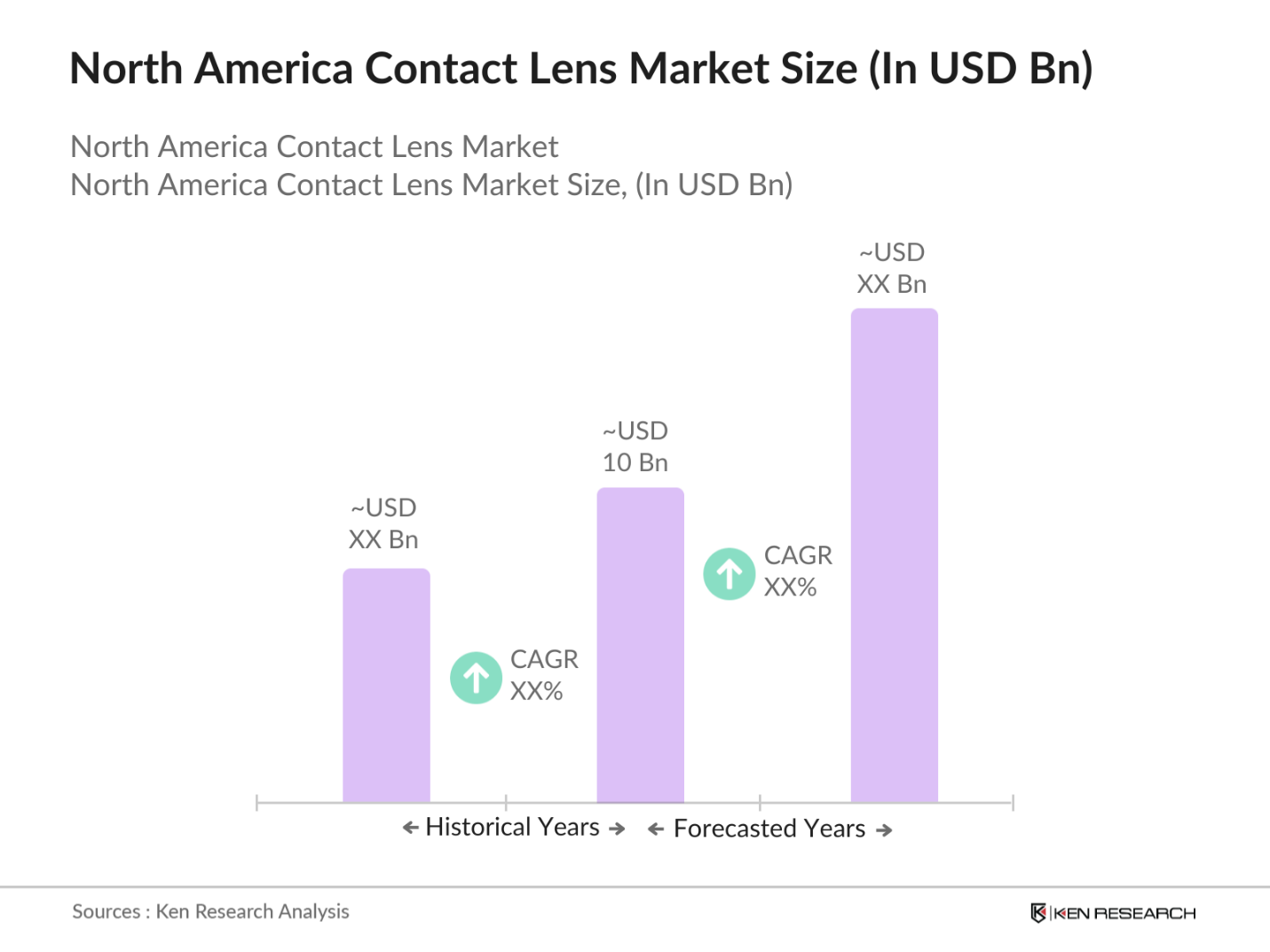

- The North America contact lens market is valued at USD 10 billion, according to recent industry reports. This market growth is primarily driven by a combination of increasing vision disorders like myopia and astigmatism and a rising preference for aesthetic enhancements. A key factor contributing to the market's expansion is the surge in demand for daily disposable lenses, as consumers increasingly seek convenience and hygiene. Additionally, technological advancements, such as the development of silicone hydrogel materials, further fuel market growth, providing enhanced comfort and oxygen permeability.

- In North America, the United States and Canada are the dominant regions for contact lens usage. The dominance of these countries can be attributed to their well-established healthcare systems, higher disposable incomes, and a large population base with vision correction needs. The U.S. in particular benefits from its advanced medical infrastructure and the presence of key industry players. Moreover, increasing consumer awareness regarding eye health and corrective lenses contributes to the expansion of the market in these regions.

- In 2024, the U.S. FDA continued to play a critical role in regulating the safety and effectiveness of contact lenses sold in the market. The FDAs increased focus on regulating non-prescription cosmetic lenses ensures that consumers have access to safe products. These regulations protect public health while promoting higher-quality products in the market, thereby driving consumer confidence and product adoption.

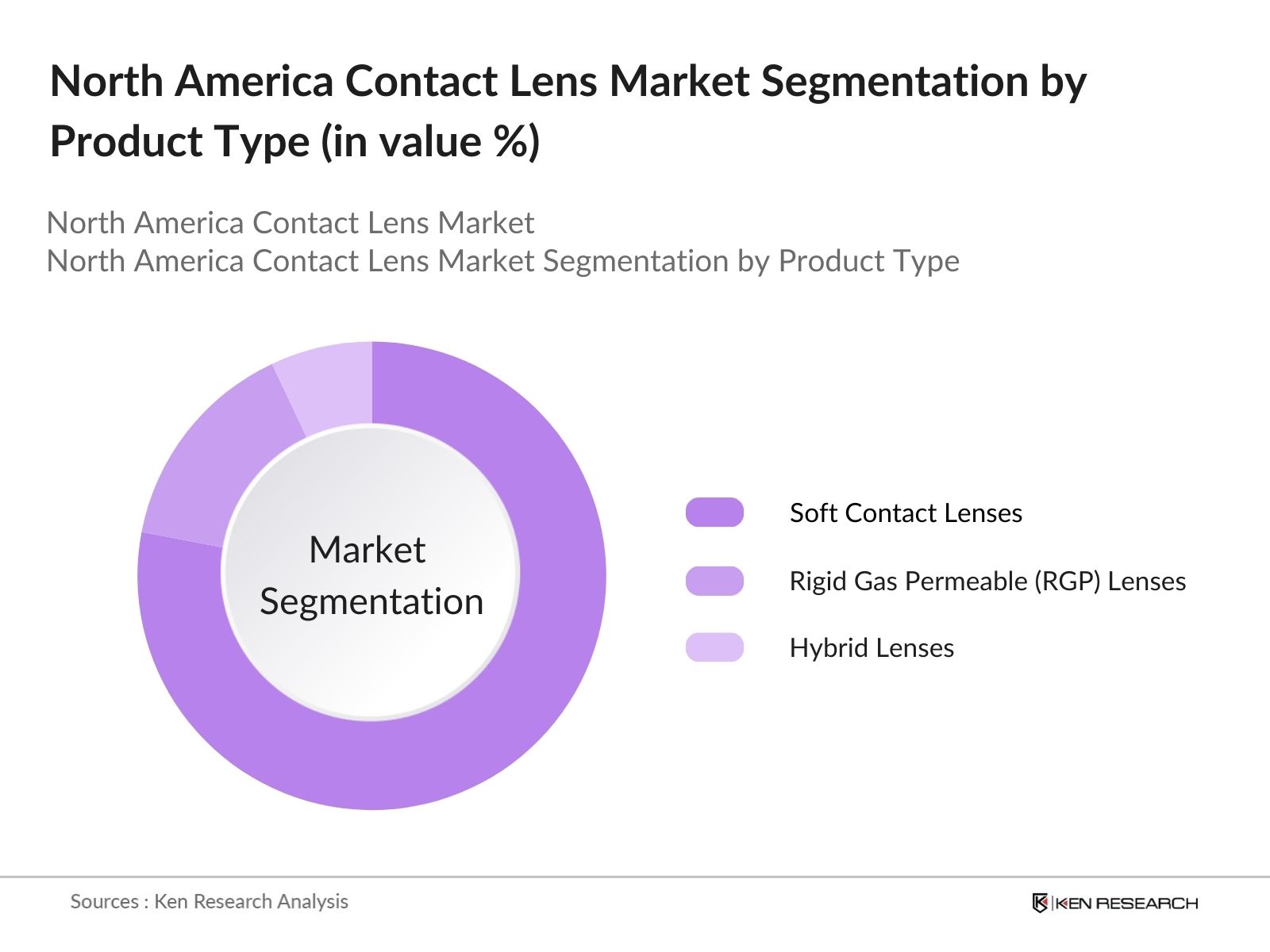

North America Contact Lens Market Segmentation

By Product Type: The North America contact lens market is segmented by product type into soft contact lenses, rigid gas permeable (RGP) lenses, and hybrid lenses. Among these, soft contact lenses dominate the market due to their comfort, flexibility, and broad availability. Brands like Acuvue and Bausch + Lomb have been instrumental in solidifying the popularity of soft lenses, which are more suited for extended wear and daily disposable use. The versatility of soft lenses in addressing various vision problems such as astigmatism and presbyopia further bolsters their market position.

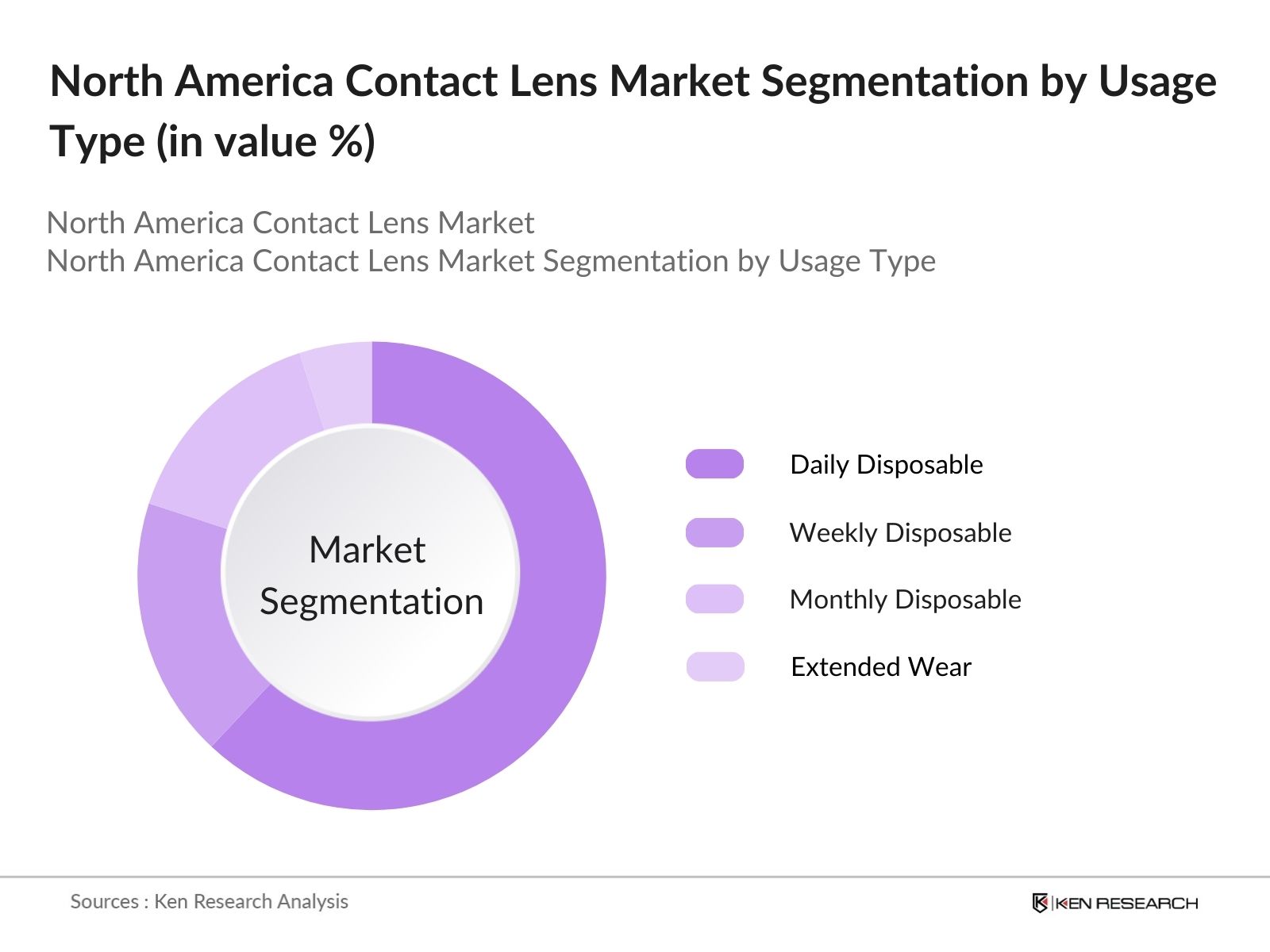

By Usage Type: In terms of usage type, the market is divided into daily disposable, weekly disposable, monthly disposable, and extended wear lenses. Daily disposable lenses have a dominant market share due to the increasing preference for hygiene and convenience. With no need for cleaning or maintenance, these lenses offer consumers an easy solution for vision correction. Additionally, the affordability of daily disposables has made them accessible to a larger demographic, driving their adoption in the region.

North America Contact Lens Market Competitive Landscape

The North America contact lens market is dominated by several global and regional players, which leads to strong competition. Major companies like Johnson & Johnson Vision Care, Alcon, and Bausch + Lomb continue to lead due to their innovative product portfolios, strong distribution networks, and consistent investments in research and development. These companies are further bolstered by their strategic partnerships with eye care professionals and clinics across the region, enhancing their market penetration.

|

Company |

Establishment Year |

Headquarters |

Market Focus |

R&D Investments |

Product Portfolio |

Global Presence |

Partnerships |

|

Johnson & Johnson Vision |

1981 |

New Jersey, USA |

|||||

|

Alcon |

1945 |

Geneva, Switzerland |

|||||

|

Bausch + Lomb |

1853 |

New York, USA |

|||||

|

CooperVision |

1958 |

Pleasanton, USA |

|||||

|

Hoya Corporation |

1941 |

Tokyo, Japan |

North America Contact Lens Market Analysis

Growth Drivers

- Rising Prevalence of Vision Disorders: The increasing prevalence of vision-related issues like myopia and presbyopia has fueled the demand for contact lenses in North America. According to the CDC, approximately 45 million people in the U.S. wear contact lenses, driven by the growing cases of eye conditions. Myopia affects nearly 33 million people in the U.S. alone, leading to an increased requirement for vision correction products like contact lenses in 2024. This creates a direct impact on market growth, as the rise in vision disorders continues to drive consumer demand for corrective lenses.

- Shift Toward Aesthetic Contact Lenses: The rising interest in cosmetic enhancement and fashion has contributed significantly to the market's expansion. The aesthetic contact lens segment, including color-changing and decorative lenses, has seen rapid growth, with a substantial number of consumers adopting these products for non-corrective purposes. This trend was supported by a notable increase in sales of cosmetic lenses in 2024, especially among younger demographics in urban areas, driving further market demand and diversification.

- Increasing Adoption of Daily Disposable Lenses: Daily disposable lenses have seen widespread adoption due to their convenience, hygiene benefits, and reduced risk of eye infections. The surge in sales for disposable lenses in 2024 indicates a shift in consumer preference toward these single-use lenses. These lenses cater to busy lifestyles while mitigating long-term care challenges, which are some of the major factors promoting their demand. Companies have reported increased production of disposable lenses to meet the growing consumer base.

Market Challenges

- High Cost of Specialty Contact Lenses: Specialty lenses, including those for astigmatism and multifocal lenses, are significantly more expensive compared to regular lenses. In 2024, the price for custom lenses remains a barrier to widespread adoption, particularly among middle-income consumers. This has resulted in a slower growth rate for the specialty lens segment. Many users opt for lower-cost alternatives or standard lenses, limiting the potential for the specialty lens market despite its clinical advantages.

- Regulatory Challenges and Safety Compliance: The contact lens industry faces strict regulatory scrutiny due to concerns over eye health and product safety. In 2024, the FDA and other regulatory bodies continue to implement stringent guidelines, especially for the sale of non-prescription and cosmetic lenses. These regulations, while necessary for consumer safety, add compliance costs and slow down the introduction of new products. Furthermore, companies face challenges with maintaining compliance across state and federal regulations, which can hinder market expansion.

North America Contact Lens Market Future Outlook

Over the next five years, the North America contact lens market is expected to witness considerable growth, driven by increasing consumer demand for comfort, aesthetic solutions, and convenience. The surge in daily disposable lenses and advancements in lens materials will play a critical role in market expansion. Additionally, the integration of smart technologies, such as augmented reality and health monitoring features in lenses, is likely to create new growth opportunities. The market will continue to be driven by innovation, as companies invest in R&D to enhance lens wearability and cater to a growing aging population in need of vision correction.

Future Market Opportunities

- Expansion into E-commerce Platforms: The growth of e-commerce in North America provides a lucrative opportunity for contact lens manufacturers to reach a broader consumer base. In 2024, e-commerce platforms saw a surge in contact lens sales as more consumers embraced online shopping for healthcare products. The convenience of home delivery and subscription services for daily disposable lenses has driven this trend. Online sales channels now account for a significant portion of the market, presenting a key growth opportunity for companies that invest in digital retail strategies.

- Growth in Customized and Prescription Lenses: Customized contact lenses that cater to specific eye conditions, such as keratoconus, are gaining traction in the market. This demand was bolstered by an increase in diagnostic precision and personalized eye care solutions in 2024. As more consumers opt for customized lenses, companies are focusing on expanding their product lines to include a wider range of prescriptions, allowing for greater market penetration and customer satisfaction.

Scope of the Report

|

By Product Type |

Soft Contact Lenses Rigid Gas Permeable (RGP) Lenses Hybrid Contact Lenses |

|

By Usage Type |

Daily Disposable Weekly Disposable Monthly Disposable Extended Wear |

|

By Material Type |

Hydrogel Silicone Hydrogel Polymers |

|

By Distribution Channel |

Online Retail Optical Stores Hospitals and Clinics Supermarkets and Pharmacies |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Contact Lens Manufacturers

Vision Care Clinics and Hospitals

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Health Canada)

Retailers (Optical Stores, Online Platforms)

Eye Care Professionals

Raw Material Suppliers

Technological Innovators in Vision Care

Companies

Major Players

Johnson & Johnson Vision Care

Alcon

Bausch + Lomb

CooperVision

Hoya Corporation

Menicon Co. Ltd.

Seed Co., Ltd.

Carl Zeiss AG

SynergEyes, Inc.

X-Cel Specialty Contacts

Table of Contents

1. North America Contact Lens Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Contact Lens Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Contact Lens Market Analysis

3.1 Growth Drivers (Market-specific)

3.1.1 Rising Prevalence of Vision Disorders

3.1.2 Shift Toward Aesthetic Contact Lenses

3.1.3 Increasing Adoption of Daily Disposable Lenses

3.1.4 Technological Advancements in Lens Materials

3.2 Market Challenges (Market-specific)

3.2.1 High Cost of Specialty Contact Lenses

3.2.2 Regulatory Challenges and Safety Compliance

3.2.3 Fluctuations in Raw Material Supply

3.2.4 Limited Consumer Awareness on Correct Lens Usage

3.3 Opportunities (Market-specific)

3.3.1 Expansion into E-commerce Platforms

3.3.2 Growth in Customized and Prescription Lenses

3.3.3 Innovations in Sustainable and Biodegradable Contact Lenses

3.3.4 Opportunities in the Pediatric Contact Lens Market

3.4 Trends (Market-specific)

3.4.1 Smart Contact Lenses with Augmented Reality Integration

3.4.2 Growing Demand for Colored and Cosmetic Lenses

3.4.3 Rising Popularity of Contact Lenses for Presbyopia

3.4.4 Increased Focus on Lens Comfort and Hydration

3.5 Government Regulation (Market-specific)

3.5.1 FDA Guidelines for Contact Lens Approval

3.5.2 Environmental Regulations for Manufacturing Lenses

3.5.3 Government Programs for Vision Care Accessibility

3.5.4 Safety Standards for Lens Packaging and Distribution

3.6 SWOT Analysis (Market-specific)

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Contact Lens Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Soft Contact Lenses

4.1.2 Rigid Gas Permeable (RGP) Lenses

4.1.3 Hybrid Contact Lenses

4.2 By Usage Type (in Value %)

4.2.1 Daily Disposable

4.2.2 Weekly Disposable

4.2.3 Monthly Disposable

4.2.4 Extended Wear

4.3 By Material Type (in Value %)

4.3.1 Hydrogel

4.3.2 Silicone Hydrogel

4.3.3 Polymers

4.4 By Distribution Channel (in Value %)

4.4.1 Online Retail

4.4.2 Optical Stores

4.4.3 Hospitals and Clinics

4.4.4 Supermarkets and Pharmacies

4.5 By Region (in Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Contact Lens Market Competitive Analysis

5.1 Detailed Profiles of Major Companies (15 Competitors)

5.1.1 Johnson & Johnson Vision Care

5.1.2 Alcon

5.1.3 Bausch + Lomb

5.1.4 CooperVision

5.1.5 Hoya Corporation

5.1.6 Carl Zeiss AG

5.1.7 Menicon Co. Ltd.

5.1.8 Seed Co., Ltd.

5.1.9 Contamac Ltd.

5.1.10 SynergEyes, Inc.

5.1.11 X-Cel Specialty Contacts

5.1.12 ABB Optical Group

5.1.13 Unilens Vision Inc.

5.1.14 Clerio Vision

5.1.15 UltraVision CLPL

5.2 Cross Comparison Parameters (Revenue, Headquarters, Employee Count, Product Portfolio, Lens Innovation, Market Share, Distribution Channels, Partnership Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Contact Lens Market Regulatory Framework

6.1 Environmental Standards (Material Usage, Waste Management)

6.2 Compliance Requirements (FDA, ISO Certifications)

6.3 Certification Processes (Safety and Efficacy)

7. North America Contact Lens Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Contact Lens Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Usage Type (in Value %)

8.3 By Material Type (in Value %)

8.4 By Distribution Channel (in Value %)

8.5 By Region (in Value %)

9. North America Contact Lens Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping the key stakeholders involved in the North America contact lens market. Through extensive desk research and database analysis, we identify critical factors influencing market dynamics, such as consumer behavior, product innovation, and regulatory frameworks.

Step 2: Market Analysis and Construction

This step involves compiling historical data to assess the market's growth trajectory. We analyze factors such as the adoption rates of various contact lens types, sales figures, and product pricing trends to establish an accurate picture of the market’s performance.

Step 3: Hypothesis Validation and Expert Consultation

We consult industry experts through structured interviews, gathering firsthand insights on operational and financial strategies in the contact lens sector. These insights enable us to validate our hypotheses and refine our market analysis.

Step 4: Research Synthesis and Final Output

In the final step, data from primary and secondary research is synthesized to produce a validated and comprehensive report on the North America contact lens market, ensuring that all findings are robust and credible.

Frequently Asked Questions

01. How big is the North America Contact Lens Market?

The North America contact lens market is valued at USD 10 billion, driven by factors such as the increasing incidence of vision disorders and rising demand for daily disposable lenses.

02. What are the challenges in the North America Contact Lens Market?

Challenges include high costs associated with specialty lenses, stringent regulatory requirements, and limited consumer awareness regarding proper lens care.

03. Who are the major players in the North America Contact Lens Market?

Key players include Johnson & Johnson Vision Care, Alcon, Bausch + Lomb, CooperVision, and Hoya Corporation. These companies dominate due to their innovative product lines and strong distribution networks.

04. What are the growth drivers of the North America Contact Lens Market?

Growth drivers include technological advancements in lens materials, increasing demand for corrective lenses, and the rise of e-commerce platforms for purchasing lenses.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.