North America Cross-Laminated Timber Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD8315

December 2024

83

About the Report

North America Cross-Laminated Timber Market Overview

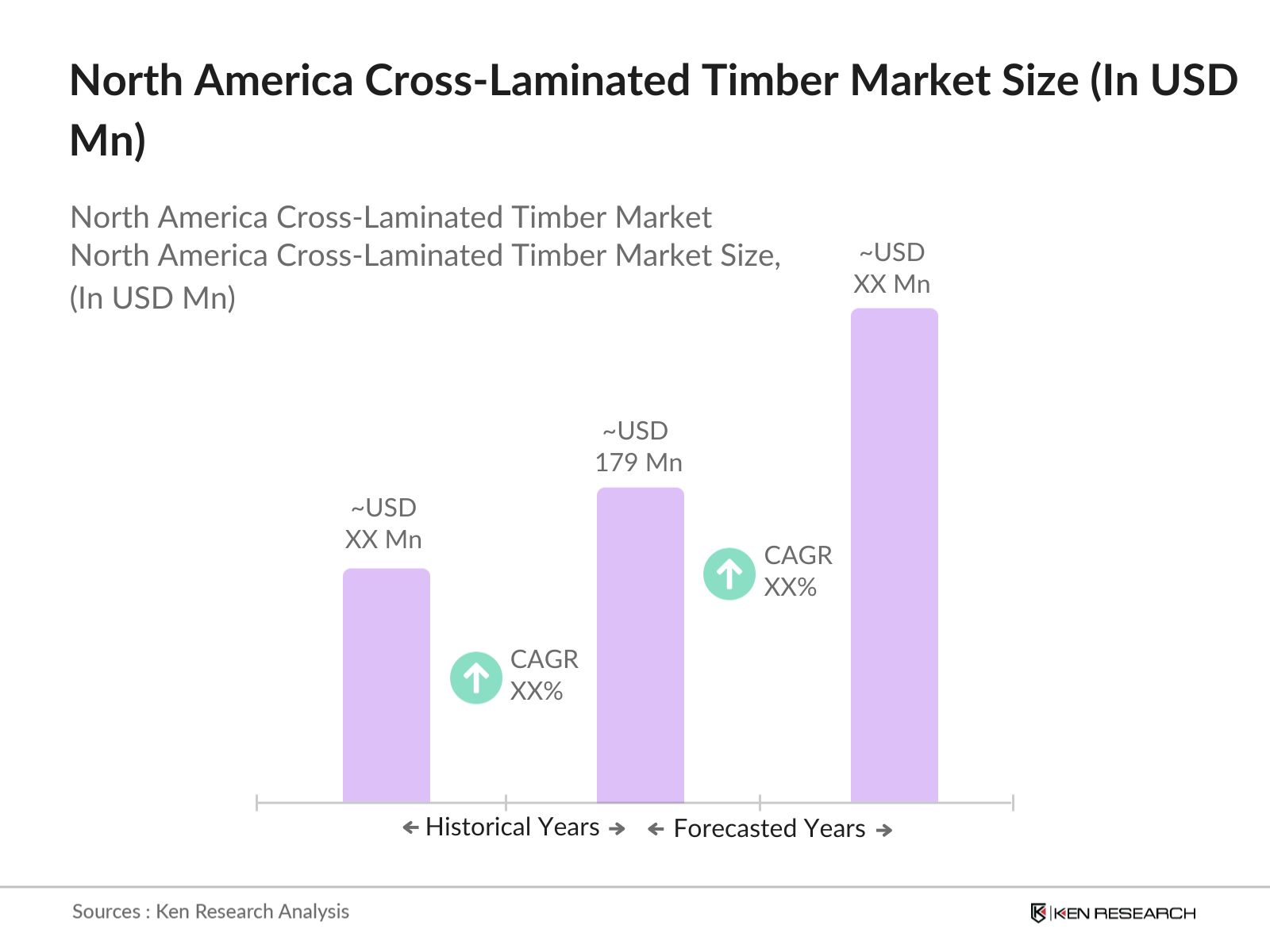

- The North American Cross-Laminated Timber (CLT) market is valued at USD 179 million, based on a five-year historical analysis. The market has seen significant growth due to the rising demand for sustainable building materials, driven by environmental awareness and government policies promoting the use of wood in construction. Factors such as lower carbon emissions during production and the shift towards eco-friendly construction materials contribute to the increasing market size of CLT in the region. Additionally, technological advancements in wood treatment have boosted the adoption of CLT in large-scale building projects.

- The dominant markets within North America are the U.S. and Canada, with the U.S. leading the region due to strong government support, a well-developed construction sector, and innovative wood architecture projects in urban areas. Major cities like Portland and Vancouver have seen significant growth in CLT adoption, driven by green building regulations and the availability of timber resources. In Canada, the abundance of softwood forests and governmental incentives for sustainable construction have further supported CLT's market dominance.

- National regulations across North America are evolving to support timber construction. The 2021 International Building Code (IBC) updated its standards to include provisions for mass timber structures up to 18 stories, directly impacting CLT adoption in the U.S. Similarly, Canada has updated its building codes to allow timber structures over six stories in urban areas. These regulatory shifts provide a more accommodating environment for the growth of CLT construction.

North America Cross-Laminated Timbe Market Segmentation

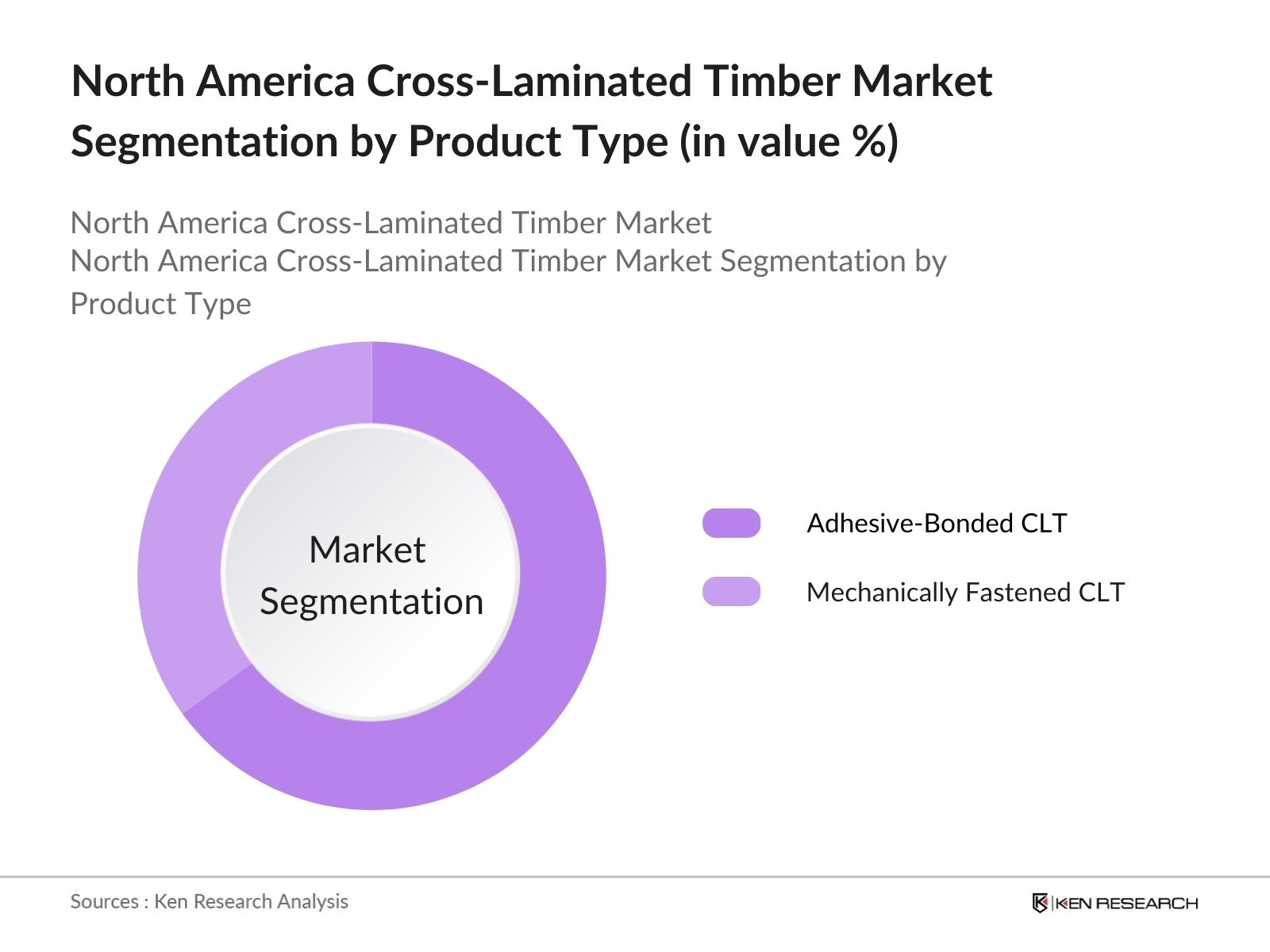

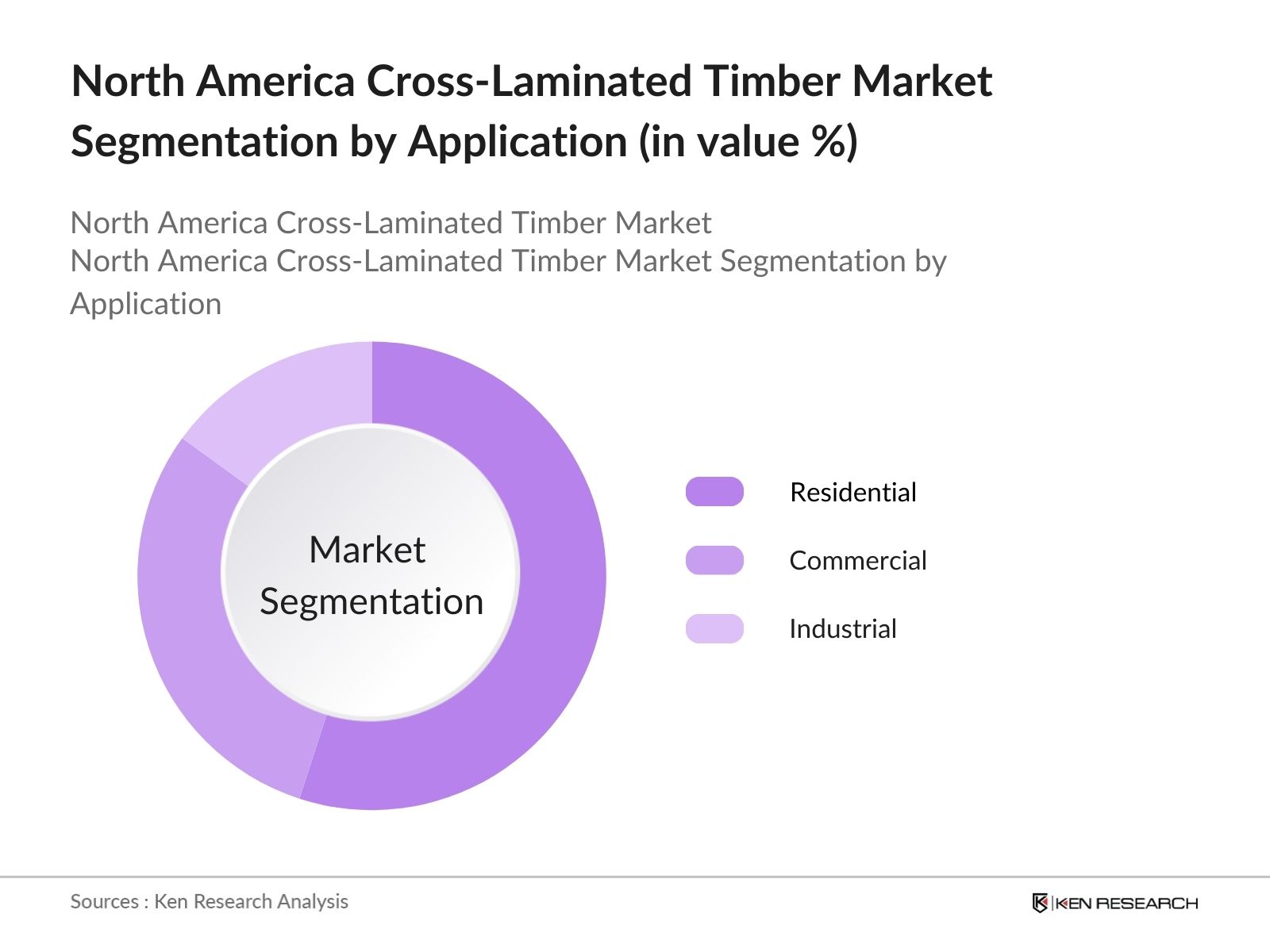

The North American Cross-Laminated Timber market is segmented by product type and by application.

- By Product Type: The market is segmented by product type into adhesive-bonded and mechanically fastened CLT panels. Adhesive-bonded CLT panels hold a dominant market share in this segment. The strong adhesion provided by polyurethane-based adhesives makes these panels highly resistant to moisture and other environmental factors, contributing to their widespread use in residential and commercial buildings. The ability to create large, structurally sound panels with strong bonding technology has fueled the adoption of adhesive-bonded CLT panels for large projects.

- By Application: The market is also segmented by application into residential, commercial, and industrial use. Residential applications dominate the market, driven by the increasing demand for sustainable and energy-efficient homes. Cross-laminated timber provides excellent insulation properties, which significantly reduces energy costs in homes. Additionally, the aesthetic appeal and versatility of CLT in design have led to its widespread adoption in high-end residential projects, especially in urban areas where environmental regulations are stricter.

North America Cross-Laminated Timber Market Competitive Landscape

The North American Cross-Laminated Timber market is dominated by a few key players who hold a significant portion of the market due to their extensive production capacities and strategic partnerships with construction firms. These players are increasingly focusing on enhancing the quality of their CLT panels and expanding their geographical presence through mergers and acquisitions. The North American CLT market is characterized by a high degree of consolidation, with a handful of key players controlling a large portion of the market. These companies have been instrumental in shaping the industrys regulatory framework and pushing for the adoption of wood-based construction solutions.

|

Company Name |

Establishment Year |

Headquarters |

Annual Production Capacity (cubic meters) |

Revenue |

R&D Spending |

|

Structurlam Mass Timber |

1962 |

British Columbia, CA |

|||

|

Nordic Structures |

2002 |

Quebec, CA |

|||

|

SmartLam North America |

2012 |

Montana, U.S. |

|||

|

KLH Massivholz GmbH |

1997 |

Austria |

|||

|

Stora Enso Oyj |

1998 |

Helsinki, FI |

North America Cross-Laminated Timber Industry Analysis

Growth Drivers

- Increased Focus on Sustainable Building Practices: The use of cross-laminated timber (CLT) is being propelled by the increased focus on sustainable construction methods. In North America, governments and private sectors are prioritizing low-carbon construction. Timber has a lower carbon footprint compared to concrete and steel. According to the U.S. Environmental Protection Agency, buildings contribute nearly 40% of total U.S. greenhouse gas emissions, and using timber construction could reduce emissions by up to 30%. The timber supply chain has seen steady growth, with U.S. timber production at over 500 million cubic meters annually.

- Cost-Effective Construction Solutions: Cross-laminated timber offers cost-effective solutions due to its prefabrication and faster assembly. Timber structures can reduce construction time by 30% compared to traditional materials like steel, which cuts labor costs. In Canada, construction companies have reported a 25% reduction in overall project costs by adopting CLT for low-rise commercial buildings. The decreased labor and material requirements are especially advantageous in urban developments, where labor costs have increased by 7.5% annually over the past three years.

- Government Regulations Promoting Timber Construction: In North America, regulatory bodies are encouraging the use of timber in construction through policies and incentives. The U.S. Forest Service has invested $250 million to promote sustainable forest management and timber usage in urban planning. Additionally, the Canadian government introduced the Tall Wood Building Demonstration Initiative, allocating $39.8 million to support timber construction, particularly in commercial and residential sectors. These programs significantly enhance the attractiveness of cross-laminated timber for developers.

Market Challenges

- Regulatory Barriers for Tall Timber Structures: Although timber is gaining traction, there are regulatory hurdles, especially for tall structures. In the U.S., building codes only allow wood buildings up to 85 feet, limiting the adoption of CLT in high-rise projects. Similarly, Canada has a six-story height limitation for wood buildings in most regions, with exceptions requiring special approval. These regulations restrict the use of cross-laminated timber in high-density urban areas, curbing potential growth despite growing interest in sustainable materials.

- Limited Awareness Among Builders and Architects: Another challenge is the limited awareness and experience among architects and builders regarding the application of CLT. A survey by the American Institute of Architects found that 60% of architects in the U.S. have limited knowledge of timber building techniques. This lack of familiarity results in fewer design and construction firms incorporating CLT into their projects. Educational programs and certifications are needed to expand the market's potential and align the industry with global timber construction practices.

North America Cross-Laminated Timber Market Future Outlook

Over the next five years, the North American Cross-Laminated Timber market is expected to show steady growth, driven by rising demand for green building materials and stricter government regulations on carbon emissions in the construction industry. The shift toward urbanization, particularly in major cities, and the increasing investment in sustainable infrastructure will further bolster CLT adoption in both residential and commercial sectors. Additionally, technological advancements in CLT production and its use in taller buildings are likely to expand the market significantly.

Market Opportunities

- Increased Adoption in Non-Residential Buildings: CLT is increasingly being adopted in commercial and industrial buildings. Timber construction accounted for 15% of non-residential projects in the U.S. in 2023, compared to only 8% in 2020. The U.S. Department of Agriculture has introduced grants to promote mass timber use in schools and public buildings, with $50 million allocated for timber adoption in public infrastructure projects. This trend is expected to support the further integration of CLT in commercial construction as urban planners seek sustainable alternatives.

- Government Investments in Sustainable Infrastructure: Government investments in infrastructure are promoting timber construction. The Canadian government is injecting $3 billion into green infrastructure projects, with a portion designated for timber-based buildings. Similarly, the U.S. Department of Energy has launched the Wood Innovation Grant program, with $93 million in funds to support mass timber projects. These investments aim to reduce emissions in the construction industry and promote sustainable building materials like CLT.

Scope of the Report

|

Adhesive-Bonded Cross-Laminated Timber Mechanically Fastened Cross-Laminated Timber |

|

|

By Application |

Residential |

|

By End-Use Sector |

Institutional Buildings |

|

By Panel Size |

Custom Sizes |

|

By Region |

US Canada Mexico |

Products

Key Target Audience

Construction Firms

Real Estate Developers

Timber Processing Companies

Architects and Urban Planners

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Agriculture, Canadian Forest Service)

Banks and Financial Institutes

Green Building Certification Agencies (LEED, Green Globes)

Prefabricated Building Manufacturers

Companies

Players Mention in the Report:

Structurlam Mass Timber Corporation

Nordic Structures

SmartLam North America

KLH Massivholz GmbH

Stora Enso Oyj

Binderholz GmbH

Mayr-Melnhof Holz

Schilliger Holz AG

XLam Ltd.

DRJ Wood Innovations

Katerra (Defunct)

IB EWP Inc.

Boise Cascade

Rothoblaas

Vaagen Timbers

Table of Contents

1. North America Cross-Laminated Timber Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Cross-Laminated Timber Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Cross-Laminated Timber Market Analysis

3.1. Growth Drivers (Sustainability Benefits, Carbon Footprint Reduction, Timber Supply Chain)

3.1.1. Increased Focus on Sustainable Building Practices

3.1.2. Cost-Effective Construction Solutions

3.1.3. Government Regulations Promoting Timber Construction

3.2. Market Challenges (Fire Safety Concerns, Regional Timber Supply Constraints)

3.2.1. Regulatory Barriers for Tall Timber Structures

3.2.2. Limited Awareness Among Builders and Architects

3.2.3. Supply Chain Bottlenecks and Regional Variability in Timber Availability

3.3. Opportunities (Commercial Construction, Mass Timber Adoption)

3.3.1. Increased Adoption in Non-Residential Buildings

3.3.2. Government Investments in Sustainable Infrastructure

3.3.3. Expansion into High-Rise Timber Construction

3.4. Trends (Digital Fabrication, BIM Integration, Prefabrication)

3.4.1. Integration of Building Information Modelling (BIM)

3.4.2. Rising Use of Prefabricated CLT Panels

3.4.3. Advancements in Timber Treatment and Fire Resistance

3.5. Government Regulations (Building Codes, Tax Incentives, Regional Timber Sourcing)

3.5.1. National Timber Building Standards

3.5.2. Zoning and Code Restrictions

3.5.3. Green Building Certifications for Timber

3.6. SWOT Analysis

3.7. Stake Ecosystem (Timber Producers, Builders, Contractors, Regulatory Bodies)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Market Share, Key Competitor Strategies)

4. North America Cross-Laminated Timber Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Adhesive-Bonded Cross-Laminated Timber

4.1.2. Mechanically Fastened Cross-Laminated Timber

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By End-Use Sector (In Value %)

4.3.1. Institutional Buildings

4.3.2. Multi-Family Residential

4.3.3. Office Spaces

4.4. By Panel Size (In Value %)

4.4.1. Custom Sizes

4.4.2. Standardized Panels

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Cross-Laminated Timber Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Structurlam Mass Timber Corporation

5.1.2. Nordic Structures

5.1.3. SmartLam North America

5.1.4. KLH Massivholz GmbH

5.1.5. Binderholz GmbH

5.1.6. Stora Enso Oyj

5.1.7. Mayr-Melnhof Holz

5.1.8. Schilliger Holz AG

5.1.9. XLam Ltd.

5.1.10. DRJ Wood Innovations

5.1.11. Katerra (Defunct - Strategic Acquisitions Noted)

5.1.12. IB EWP Inc.

5.1.13. Boise Cascade

5.1.14. Rothoblaas

5.1.15. Vaagen Timbers

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Production Capacity, Revenue, CLT Panel Sizes, R&D Spending, Timber Sources, Environmental Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Cross-Laminated Timber Market Regulatory Framework

6.1. Building Codes and Standards (IBC, APA, Local Building Regulations)

6.2. Certification Requirements (PEFC, FSC Certifications)

6.3. Environmental Compliance (LEED, BREEAM Standards)

7. North America Cross-Laminated Timber Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Cross-Laminated Timber Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Sector (In Value %)

8.4. By Panel Size (In Value %)

8.5. By Region (In Value %)

9. North America Cross-Laminated Timber Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key variables that influence the North American Cross-Laminated Timber market. Extensive desk research, supported by secondary data from proprietary databases, helped define critical factors such as production capacity, market demand, and regulatory influences.

Step 2: Market Analysis and Construction

Historical data related to the North American CLT market was analyzed to determine market penetration and the ratio of producers to consumers. Market quality statistics and revenue generation models were constructed using a combination of industry reports and proprietary data.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from major timber producers were consulted through CATIs to validate hypotheses around market growth, demand drivers, and challenges. These interviews provided key insights into operational strategies and financial outlooks, ensuring the accuracy of the data.

Step 4: Research Synthesis and Final Output

The final output involved compiling and synthesizing research insights into a comprehensive report. This stage included cross-referencing production data, market share estimates, and competitive positioning to provide a well-rounded analysis of the North American CLT market.

Frequently Asked Questions

01. How big is the North American Cross-Laminated Timber market?

The North American Cross-Laminated Timber market was valued at USD 179 million in 2023, driven by increased demand for sustainable building materials and growing regulatory support for timber-based construction.

02. What are the challenges in the North American CLT market?

Challenges in the North American Cross-Laminated Timber market include regulatory barriers for tall timber buildings, fire safety concerns, and the limited awareness of CLT among traditional construction firms. These factors hinder broader adoption in certain regions.

03. Who are the major players in the North American CLT market?

Key players in North American Cross-Laminated Timber market include Structurlam Mass Timber Corporation, Nordic Structures, SmartLam North America, and KLH Massivholz GmbH. These companies dominate the market due to their advanced production facilities, strong supply chains, and wide-ranging product portfolios.

04. What are the growth drivers of the North American CLT market?

The North American Cross-Laminated Timber market is propelled by increasing demand for green building materials, government regulations promoting sustainable construction, and the growth of urbanization. The eco-friendly properties of CLT also drive its adoption in large-scale construction projects.

05. What are the applications of CLT in North America?

Cross-laminated timber is widely used in residential, commercial, and industrial buildings. Its superior structural integrity and sustainability features make it an attractive option for constructing homes, offices, and public infrastructure projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.