North America Dialysis Center Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD7062

December 2024

82

About the Report

North America Dialysis Center Market Overview

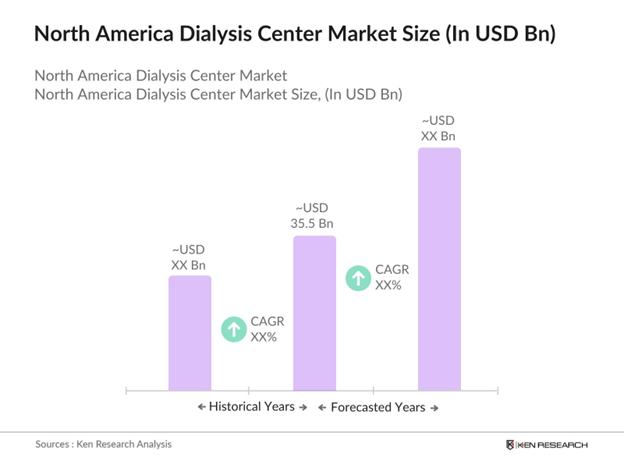

- North America Dialysis Center Market is valued at USD 35.5 billion, supported by the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD). This market is primarily driven by the rising number of patients requiring regular dialysis due to conditions like diabetes and hypertension. Government healthcare programs like Medicare, which subsidizes treatment for ESRD patients, have also played a pivotal role in supporting the markets growth.

- The United States, particularly urban centers such as New York, Los Angeles, and Chicago, dominates the North American dialysis market due to the high concentration of patients with CKD and ESRD. The country has well-established healthcare infrastructure, extensive insurance coverage, and a large aging population that is more susceptible to chronic diseases. Additionally, cities with dense populations and advanced medical facilities have the capability to cater to the growing number of patients needing specialized dialysis services.

- The National Kidney Foundation (NKF) plays a pivotal role in advocating for kidney health and supporting dialysis patients through education and public health initiatives. In 2024, the NKF launched a $10 million campaign aimed at raising awareness about CKD prevention and treatment options, including dialysis. These initiatives help patients make informed decisions about their care and promote early detection of kidney disease. The foundations programs also work to reduce disparities in access to dialysis services, particularly in underserved communities.

North America Dialysis Center Market Segmentation

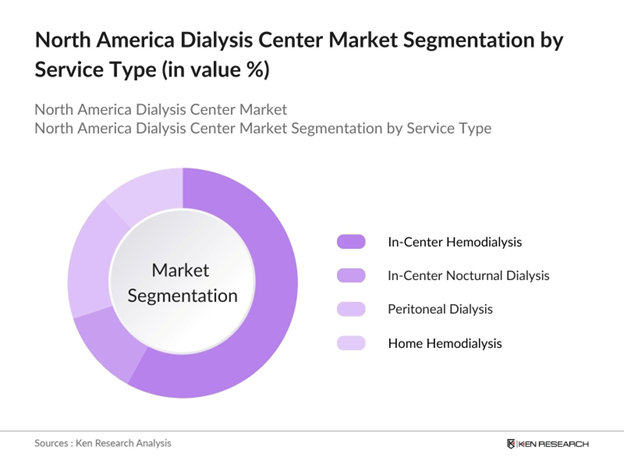

By Service Type: North America's dialysis center market is segmented by service type into In-Center Hemodialysis, In-Center Nocturnal Dialysis, Peritoneal Dialysis, and Home Hemodialysis. Among these, In-Center Hemodialysis holds the dominant market share due to its long-standing acceptance as the standard treatment method for ESRD patients. The preference for in-center treatment is primarily driven by the availability of skilled healthcare professionals, advanced equipment, and comprehensive monitoring, ensuring high-quality care for patients. This traditional service is especially prevalent among older populations who may be less likely to transition to home-based therapies.

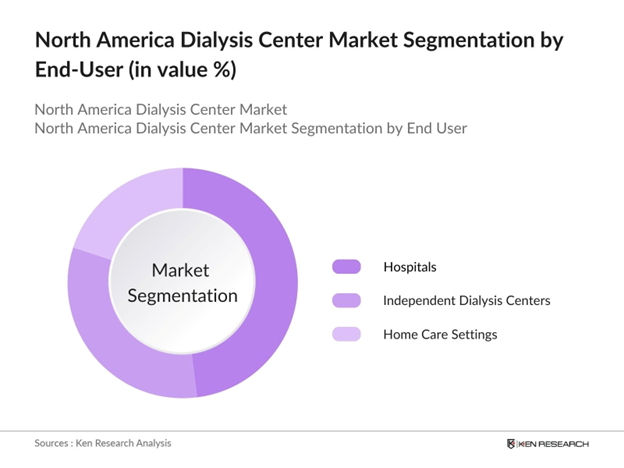

By End-User: The market is also segmented by end-user into Hospitals, Independent Dialysis Centers, and Home Care Settings. Hospitals dominate the end-user segment due to their established infrastructure and the ability to provide integrated care for dialysis patients, who often have comorbidities that require complex management. Hospitals also have access to advanced dialysis machines, skilled staff, and immediate access to emergency medical care, making them the preferred choice for many patients.

North America Dialysis Center Market Competitive Landscape

The North America Dialysis Center market is dominated by several key players, most of which have expanded their services through acquisitions and strategic partnerships. These companies have established networks of dialysis centers, offering a wide range of services that cater to both in-center and home-based patients. The North American dialysis center market is dominated by industry leaders such as DaVita Inc., Fresenius Medical Care, and US Renal Care. These companies have extensive geographic presence and are consistently investing in advanced dialysis technologies, such as home dialysis solutions, to capture a broader market.

|

Company |

Established |

Headquarters |

No. of Centers |

Dialysis Modalities |

Annual Revenue |

Geographic Presence |

Number of Employees |

Key Acquisitions |

Technology Investments |

|

DaVita Inc. |

1979 |

Denver, Colorado, USA |

- |

- |

- |

- |

- |

- |

- |

|

Fresenius Medical Care |

1996 |

Bad Homburg, Germany |

- |

- |

- |

- |

- |

- |

- |

|

US Renal Care |

2000 |

Plano, Texas, USA |

- |

- |

- |

- |

- |

- |

- |

|

Satellite Healthcare |

1974 |

San Jose, California, USA |

- |

- |

- |

- |

- |

- |

- |

|

American Renal Associates |

1999 |

Beverly, Massachusetts, USA |

- |

- |

- |

- |

- |

- |

- |

North America Dialysis Center Market Analysis

Growth Drivers

- Prevalence of Chronic Kidney Disease: The prevalence of chronic kidney disease (CKD) in North America continues to rise, with over 37 million adults in the United States alone affected by CKD as of 2024. This increasing patient population directly correlates with the growing demand for dialysis services. The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) reports that 660,000 Americans require dialysis treatment due to kidney failure. Additionally, the global burden of kidney disease contributes to rising mortality rates, making dialysis centers essential in managing the patient influx.

- Rising Medicare and Medicaid Expenditure: Government health programs, particularly Medicare and Medicaid, play a crucial role in funding dialysis services. In 2022, Medicare spent $37 billion on end-stage renal disease (ESRD) treatment, covering nearly 90% of all ESRD patients in the United States. The governments financial support is essential for dialysis centers, given the high costs associated with treatment. With healthcare budgets increasing yearly, expenditures on ESRD patients will remain significant, driving further development of dialysis centers and related infrastructure.

- Increasing Incidence of Diabetes and Hypertension: Diabetes and hypertension are the leading causes of CKD, and both conditions are rising in North America. In 2024, over 34 million Americans were diagnosed with diabetes, while 116 million suffer from high blood pressure, according to the CDC. These co-morbidities significantly increase the risk of developing CKD, thus escalating the demand for dialysis services. The healthcare system is under increasing pressure to provide timely care for these patients, necessitating a robust network of dialysis centers .

Challenges

- High Operational and Infrastructure Costs: Dialysis centers face high operational costs due to the need for advanced equipment, skilled staff, and large facilities. The annual operational costs for dialysis centers in North America can exceed $2 million, factoring in medical supplies, maintenance, rent, and staff salaries. Additionally, advanced dialysis machines cost around $25,000 to $30,000 per unit, placing a financial strain on smaller centers. Such expenses continue to challenge the profitability of dialysis centers, especially in regions with lower patient populations.

- Limited Access in Rural Areas: Rural areas in North America face significant disparities in access to dialysis care. In the United States, nearly 15% of the population lives in rural regions, where dialysis centers are less common. Patients in these areas often have to travel more than 50 miles to receive treatment, increasing the burden on individuals with CKD. This limited access to care is primarily due to the high costs of establishing and maintaining dialysis centers in remote areas. Government initiatives are essential to bridge this healthcare gap .

North America Dialysis Center Market Future Outlook

North American Dialysis Center market is expected to witness significant growth driven by the increasing prevalence of chronic diseases such as diabetes and hypertension. This growth will also be supported by advancements in dialysis technologies, especially home-based dialysis solutions that enable remote patient monitoring and management. Furthermore, healthcare reforms aimed at enhancing the accessibility and affordability of dialysis services are expected to contribute to market expansion.

Market Opportunities

- Expansion of In-Home Dialysis Services: The demand for in-home dialysis services is increasing, driven by patient preference for convenience and reduced healthcare facility visits. In 2024, over 60,000 patients in the U.S. opted for home dialysis, a significant rise from previous years. Home dialysis offers patients more control over their treatment schedules and decreases the need for frequent clinic visits. This trend has encouraged dialysis centers to expand their in-home treatment programs, providing an opportunity for market growth in the coming years.

- Telemedicine Integration for Dialysis Care: Telemedicine is transforming dialysis care by allowing patients to consult with healthcare professionals virtually. The U.S. government supports the integration of telemedicine in dialysis services through Medicare reimbursement for remote consultations. As of 2024, approximately 40% of dialysis centers in North America had adopted telemedicine technologies for virtual patient monitoring.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Service Type |

In-Center Hemodialysis In-Center Nocturnal Dialysis Peritoneal Dialysis Home Hemodialysis |

|

By End-User |

Hospitals Independent Dialysis Centers Home Care Settings |

|

By Dialysis Modality |

Hemodialysis Peritoneal Dialysis CAPD APD |

|

By Payment Source |

Medicare/Medicaid Private Insurance Out-of-Pocket Other Public Programs |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Dialysis Service Providers

Healthcare Equipment Manufacturers

Hospitals and Healthcare Networks

Private Insurance Companies

Medical Device Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (CMS, FDA, State Health Agencies)

Companies

Players Mentioned in the Report

DaVita Inc.

Fresenius Medical Care

US Renal Care

Satellite Healthcare

American Renal Associates

NxStage Medical

Medtronic (Dialysis Systems)

Baxter International Inc.

Outset Medical

Dialysis Clinic, Inc.

Table of Contents

1. North America Dialysis Center Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Dialysis Center Business Models (Private, Hospital-Owned, Joint Ventures)

1.4. Market Segmentation Overview

2. North America Dialysis Center Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Dialysis Center Market Analysis

3.1. Growth Drivers

3.1.1. Prevalence of Chronic Kidney Disease (Patient Population Growth)

3.1.2. Rising Medicare and Medicaid Expenditure (Government Health Funding)

3.1.3. Increasing Incidence of Diabetes and Hypertension (Co-morbidities Impact)

3.1.4. Technological Advancements in Dialysis Machines (Automation, Remote Monitoring)

3.2. Market Challenges

3.2.1. High Operational and Infrastructure Costs (Equipment, Staff Salaries, Rent)

3.2.2. Shortage of Skilled Dialysis Technicians and Nurses

3.2.3. Limited Access in Rural Areas (Regional Healthcare Disparities)

3.2.4. Stringent Regulatory Compliance (FDA, CMS, State Regulations)

3.3. Opportunities

3.3.1. Expansion of In-Home Dialysis Services (Growth in At-Home Treatments)

3.3.2. Telemedicine Integration for Dialysis Care (Virtual Consultations, Remote Supervision)

3.3.3. Mergers and Acquisitions in Dialysis Center Networks

3.3.4. Public-Private Partnerships for Dialysis Centers in Underserved Areas

3.4. Trends

3.4.1. Shift Towards Value-Based Care (Reimbursement and Outcome Focus)

3.4.2. Increasing Adoption of Portable Dialysis Devices

3.4.3. Integration of Electronic Health Records (EHR) for Dialysis Centers

3.4.4. Focus on Patient-Centered Care Models (Holistic Healthcare Approach)

3.5. Government Regulations

3.5.1. Medicare End-Stage Renal Disease (ESRD) Program (Reimbursement Policies)

3.5.2. FDA Regulations on Dialysis Equipment and Consumables (Safety and Standards)

3.5.3. State-Level Licensing for Dialysis Centers (Compliance)

3.5.4. National Kidney Foundation Initiatives (Public Health and Education)

3.6. Stakeholder Ecosystem

3.6.1. Dialysis Service Providers

3.6.2. Medical Device Manufacturers (Dialysis Machines, Consumables)

3.6.3. Insurance Providers (Private and Government Payers)

3.6.4. Government Health Agencies (CMS, HHS)

3.7. Porters Five Forces Analysis

3.7.1. Bargaining Power of Suppliers (Medical Equipment and Consumables)

3.7.2. Bargaining Power of Buyers (Patients, Insurance Providers)

3.7.3. Threat of New Entrants (Regulatory Barriers)

3.7.4. Threat of Substitutes (Peritoneal Dialysis, Kidney Transplant)

3.7.5. Competitive Rivalry (Top Dialysis Providers)

3.8. Competition Ecosystem

4. North America Dialysis Center Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. In-Center Hemodialysis (Standard Dialysis)

4.1.2. In-Center Nocturnal Dialysis

4.1.3. Peritoneal Dialysis

4.1.4. Home Hemodialysis

4.2. By End-User (In Value %)

4.2.1. Hospitals

4.2.2. Independent Dialysis Centers

4.2.3. Home Care Settings

4.3. By Dialysis Modality (In Value %)

4.3.1. Hemodialysis

4.3.2. Peritoneal Dialysis

4.3.3. Continuous Ambulatory Peritoneal Dialysis (CAPD)

4.3.4. Automated Peritoneal Dialysis (APD)

4.4. By Payment Source (In Value %)

4.4.1. Medicare/Medicaid

4.4.2. Private Insurance

4.4.3. Out-of-Pocket Payments

4.4.4. Other Public Programs

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Dialysis Center Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DaVita Inc.

5.1.2. Fresenius Medical Care

5.1.3. US Renal Care

5.1.4. Satellite Healthcare

5.1.5. American Renal Associates

5.1.6. Dialysis Clinic, Inc.

5.1.7. NxStage Medical

5.1.8. Outset Medical

5.1.9. Medtronic (Dialysis Systems)

5.1.10. Baxter International Inc.

5.2. Cross Comparison Parameters

5.2.1. Number of Centers

5.2.2. Dialysis Modalities Offered

5.2.3. Annual Revenue

5.2.4. Number of Patients Served

5.2.5. Number of Employees

5.2.6. Geographic Presence

5.2.7. Investment in Technology

5.2.8. Partnerships and Acquisitions

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. North America Dialysis Center Market Regulatory Framework

6.1. Medicare Conditions for Coverage (Compliance Guidelines)

6.2. FDA Medical Device Regulations for Dialysis Equipment

6.3. State Licensing Requirements for Dialysis Centers

6.4. Quality Standards and Patient Safety Regulations

7. North America Dialysis Center Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Dialysis Center Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Dialysis Modality (In Value %)

8.4. By Payment Source (In Value %)

8.5. By Region (In Value %)

9. North America Dialysis Center Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Expansion Strategies for New Entrants

9.3. Patient Acquisition and Retention Tactics

9.4. Competitive Differentiation Approaches

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all key stakeholders within the North America Dialysis Center Market. Extensive desk research is carried out, relying on secondary databases, proprietary resources, and government data to outline the key market variables. These variables include service type, end-user, modality, and geographic distribution.

Step 2: Market Analysis and Construction

Historical data, such as patient growth trends and dialysis service provider revenues, are assessed to determine market performance over the last five years. This involves evaluating patient demographics, market penetration by dialysis modality, and the impact of technological advancements on service delivery.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed during the research phase are validated through consultations with industry experts, healthcare practitioners, and dialysis equipment manufacturers. This process includes conducting interviews and surveys to ensure that data points, such as patient satisfaction rates and operational challenges, are accurate.

Step 4: Research Synthesis and Final Output

The final phase integrates data collected from industry stakeholders and government reports, providing a comprehensive outlook on the market. Market dynamics, including competitive strategies, technological innovations, and regulatory frameworks, are validated and synthesized to present a clear and reliable market report.

Frequently Asked Questions

01. How big is the North America Dialysis Center Market?

The North America Dialysis Center Market is valued at USD 35.5 billion, driven by the rising number of patients requiring treatment for chronic kidney disease and end-stage renal disease. Government healthcare subsidies like Medicare are crucial in sustaining market demand.

02. What are the key challenges in the North America Dialysis Center Market?

Key challenges in North America Dialysis Center Market include high operational and infrastructure costs, regulatory compliance with stringent healthcare standards, and the shortage of skilled dialysis technicians. Additionally, expanding access to rural areas remains a significant barrier.

03. Who are the major players in the North America Dialysis Center Market?

The major players in North America Dialysis Center Market include DaVita Inc., Fresenius Medical Care, US Renal Care, Satellite Healthcare, and American Renal Associates. These companies dominate the market due to their extensive dialysis networks and focus on technological innovation.

04. What are the growth drivers of the North America Dialysis Center Market?

Growth drivers in North America Dialysis Center Market include the increasing prevalence of chronic kidney disease, rising government funding through Medicare and Medicaid programs, and technological advancements in dialysis treatments, particularly in-home and remote dialysis solutions.

05. What are the emerging trends in the North America Dialysis Center Market?

Emerging trends include the shift toward home dialysis services, integration of telemedicine for patient monitoring, and the adoption of value-based care models that prioritize treatment outcomes over volume-based service models.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.