North America Diesel Engine Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD2218

December 2024

90

About the Report

North America Diesel Engine Market Overview

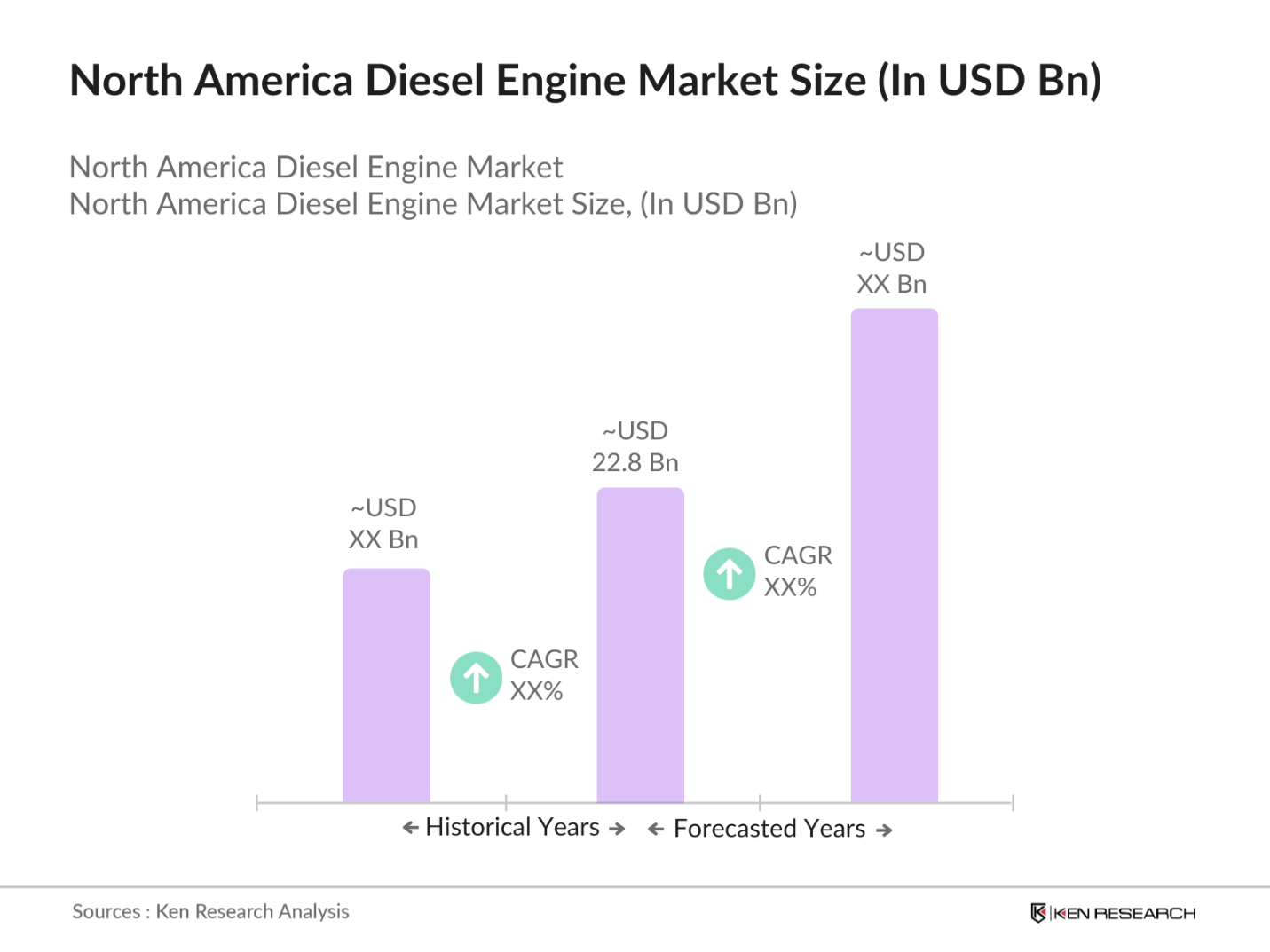

- The North America diesel engine market, valued at USD 22.8 billion, has experienced steady growth over the past five years. This expansion is primarily driven by the increasing demand for diesel engines across various sectors, including automotive, construction, and power generation. The reliability and efficiency of diesel engines make them a preferred choice in these industries.

- The United States stands as the dominant player in the North American diesel engine market. This dominance is attributed to the country's extensive industrial base, significant investments in infrastructure, and a robust automotive sector. Additionally, the presence of major diesel engine manufacturers and a well-established supply chain further solidify the United States' leading position in the market.

- Governments worldwide have implemented stringent emission standards to mitigate environmental pollution from diesel engines. In the United States, the Environmental Protection Agency (EPA) introduced the Heavy-Duty Engine and Vehicle Standards in 2023, mandating a significant reduction in nitrogen oxide (NOx) emissions for heavy-duty vehicles starting in model year 2027. These regulations require manufacturers to adopt advanced emission control technologies to comply with the new limits.

North America Diesel Engine Market Segmentation

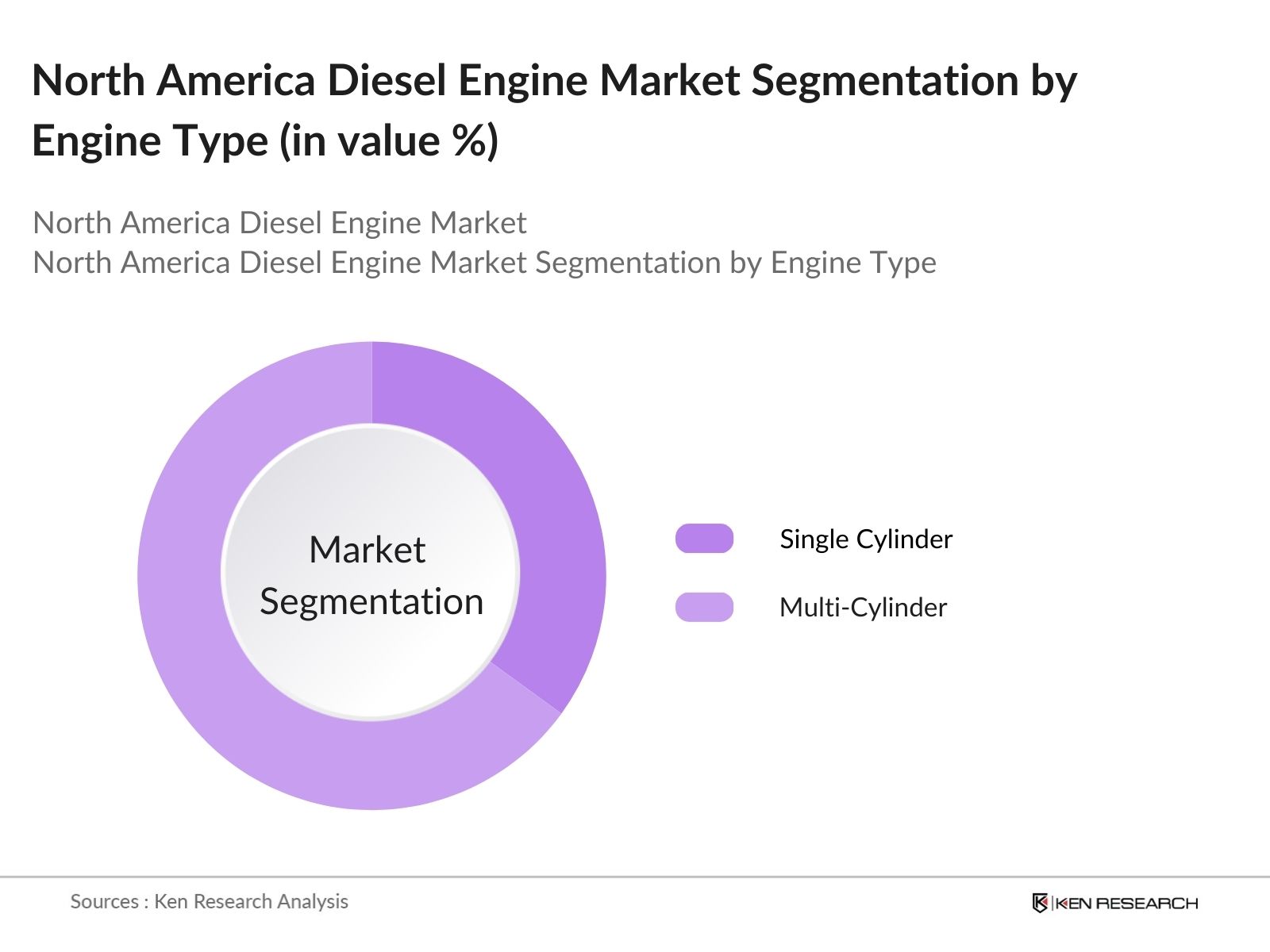

By Engine Type: The Market is segmented by engine type into single-cylinder and multi-cylinder engines. Multi-cylinder engines hold a dominant market share under this segmentation due to their versatility and application in larger vehicles and heavy machinery. Their robust power output and higher operational efficiency make them suitable for industrial applications, including construction and mining. These engines are widely used in sectors that require heavy-duty machinery, further strengthening their market position.

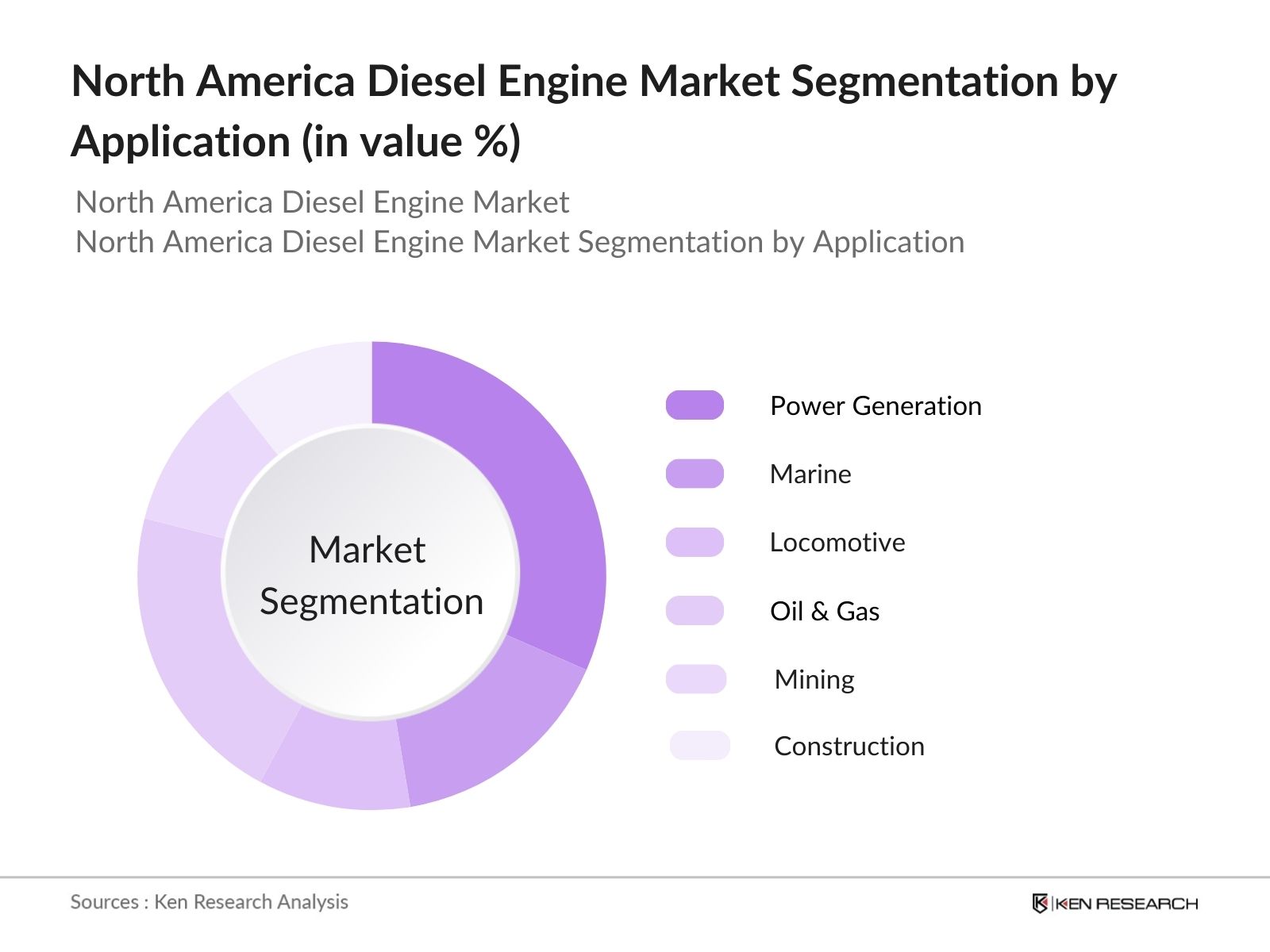

By Application: The market is segmented by application into power generation, marine, locomotive, oil & gas, mining, construction, and others. Power generation applications lead this segment, driven by the need for reliable backup and primary power sources across industries. Diesel engines are preferred for power generation due to their efficiency, durability, and cost-effectiveness. The increasing demand for standby power in commercial and industrial sectors is a primary factor for the dominance of this sub-segment.

North America Diesel Engine Market Competitive Landscape

The North America diesel engine market is characterized by the presence of several key players who contribute significantly to its growth. These companies are engaged in continuous research and development to enhance engine performance and comply with stringent emission regulations.

North America Diesel Engine Industry Analysis

Growth Drivers

- Industrialization and Infrastructure Development: The global diesel engine market is significantly influenced by ongoing industrialization and infrastructure projects. In 2023, the World Bank reported that global industrial production reached 1,500 million metric tons, reflecting a steady increase in manufacturing activities. Additionally, the International Energy Agency (IEA) noted that global energy consumption in the industrial sector was approximately 200 exajoules in 2023, indicating robust industrial growth. These developments drive the demand for diesel engines, which are essential for powering heavy machinery and equipment in construction and manufacturing sectors.

- Rising Demand for Backup Power Solutions: The need for reliable backup power solutions has escalated due to frequent power outages and the critical nature of continuous operations in various industries. According to the U.S. Energy Information Administration (EIA), in 2023, the average duration of power interruptions in the United States was 8 hours per customer, underscoring the necessity for backup power systems. Diesel generators are preferred for their efficiency and reliability, leading to increased adoption across sectors such as healthcare, data centers, and manufacturing.

- Expansion of Transportation Sector: The transportation sector's growth has bolstered the diesel engine market, particularly in freight and logistics. The International Road Transport Union (IRU) reported that global road freight volumes reached 1,857 billion tonne-kilometers in 2023, highlighting the sector's expansion. Diesel engines power a significant portion of commercial vehicles, including trucks and buses, due to their durability and fuel efficiency, meeting the rising demand for goods transportation.

Market Challenges

- Stringent Emission Regulations: Governments worldwide have implemented stringent emission regulations to combat environmental pollution. The Euro 6 emissions standards were introduced onSeptember 1, 2014, for new type approvals, and they became mandatory for most new registrations onSeptember 1, 2015, mandate that diesel engines emit no more than 80 mg/km of nitrogen oxides, significantly lower than previous limits. Compliance with such regulations requires substantial investment in emission control technologies, posing challenges for manufacturers and potentially increasing production costs.

- Competition from Alternative Power Sources: The rise of alternative power sources, such as electric and hydrogen fuel cell technologies, presents competition to diesel engines. The International Energy Agency (IEA) reported that global electric vehicle sales surpassed 10 million units in 2023, reflecting a growing shift towards cleaner energy solutions. This trend challenges the diesel engine market, especially in sectors where electrification is feasible and economically viable.

North America Diesel Engine Market Future Outlook

Over the next five years, the North America diesel engine market is expected to witness moderate growth. Factors such as advancements in diesel engine technology, increasing demand for backup power solutions, and the expansion of the construction and mining sectors are anticipated to drive this growth. However, the market may face challenges from stringent emission regulations and the growing adoption of alternative energy sources.

Future Market Opportunities

- Integration with Renewable Energy Systems: Integrating diesel engines with renewable energy systems offers opportunities for hybrid solutions that enhance reliability and efficiency. The International Renewable Energy Agency (IRENA) reported that global renewable energy capacity reached 3,000 GW in 2023, indicating a substantial increase in renewable energy adoption. Combining diesel generators with renewable sources like solar and wind can provide consistent power supply, especially in remote areas, creating a synergistic market opportunity.

- Development of Hybrid Diesel Engines: The development of hybrid diesel engines, which combine diesel power with electric or alternative fuel technologies, offers potential for improved efficiency and reduced emissions. The U.S. Department of Energy reported that hybrid powertrains can improve fuel economy by up to 35% compared to conventional diesel engines. This innovation aligns with global sustainability goals and provides a pathway for diesel engine manufacturers to remain competitive in a transitioning energy landscape.

Scope of the Report

|

Engine Type |

Single Cylinder |

|

Power Rating |

Below 0.5 MW |

|

Application |

Power Generation |

|

End User |

Industrial |

|

Country |

United States |

Products

Key Target Audience

Diesel Engine Manufacturers

Automotive OEMs

Construction Equipment Manufacturers

Marine Equipment Manufacturers

Power Generation Companies

Oil & Gas Companies

Mining Companies

Government and Regulatory Bodies (e.g., Environmental Protection Agency)

Companies

Major Players

Caterpillar Inc.

Cummins Inc.

Mitsubishi Heavy Industries, Ltd.

AB Volvo

Komatsu Ltd.

GE Transportation

MAN SE

Deere & Company

Rolls-Royce plc

Wrtsil Corporation

Yanmar Holdings Co., Ltd.

Kubota Corporation

Isuzu Motors Ltd.

Ford Motor Company

General Motors Company

Table of Contents

North America Diesel Engine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

North America Diesel Engine Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

North America Diesel Engine Market Analysis

3.1 Growth Drivers

3.1.1 Industrialization and Infrastructure Development

3.1.2 Rising Demand for Backup Power Solutions

3.1.3 Expansion of Transportation Sector

3.1.4 Technological Advancements in Diesel Engines

3.2 Market Challenges

3.2.1 Stringent Emission Regulations

3.2.2 Competition from Alternative Power Sources

3.2.3 Fluctuating Diesel Fuel Prices

3.3 Opportunities

3.3.1 Integration with Renewable Energy Systems

3.3.2 Growth in Emerging Markets

3.3.3 Development of Hybrid Diesel Engines

3.4 Trends

3.4.1 Adoption of Cleaner Technologies

3.4.2 Increased Use in Marine and Locomotive Applications

3.4.3 Advancements in Fuel Efficiency

3.5 Government Regulations

3.5.1 Emission Standards and Compliance

3.5.2 Incentives for Clean Energy Adoption

3.5.3 Trade Policies Affecting Diesel Engine Imports/Exports

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

North America Diesel Engine Market Segmentation

4.1 By Engine Type (In Value %)

4.1.1 Single Cylinder

4.1.2 Multi-Cylinder

4.2 By Power Rating (In Value %)

4.2.1 Below 0.5 MW

4.2.2 0.51 MW

4.2.3 12 MW

4.2.4 25 MW

4.2.5 Above 5 MW

4.3 By Application (In Value %)

4.3.1 Power Generation

4.3.2 Marine

4.3.3 Locomotive

4.3.4 Oil & Gas

4.3.5 Mining

4.3.6 Construction

4.3.7 Others

4.4 By End User (In Value %)

4.4.1 Industrial

4.4.2 Commercial

4.4.3 Residential

4.5 By Country (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

North America Diesel Engine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Caterpillar Inc.

5.1.2 Cummins Inc.

5.1.3 Mitsubishi Heavy Industries, Ltd.

5.1.4 AB Volvo

5.1.5 Komatsu Ltd.

5.1.6 GE Transportation

5.1.7 MAN SE

5.1.8 Deere & Company

5.1.9 Rolls-Royce plc

5.1.10 Wartsila Corporation

5.1.11 Yanmar Holdings Co., Ltd.

5.1.12 Kubota Corporation

5.1.13 Isuzu Motors Ltd.

5.1.14 Ford Motor Company

5.1.15 General Motors Company

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, R&D Investment, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

North America Diesel Engine Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

North America Diesel Engine Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

North America Diesel Engine Future Market Segmentation

8.1 By Engine Type (In Value %)

8.2 By Power Rating (In Value %)

8.3 By Application (In Value %)

8.4 By End User (In Value %)

8.5 By Country (In Value %)

North America Diesel Engine Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Diesel Engine Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the North America Diesel Engine Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple diesel engine manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Diesel Engine market.

Frequently Asked Questions

01. How big is the North America Diesel Engine Market?

The North America diesel engine market is valued at USD 22.8 billion, driven by demand across automotive, construction, and power generation sectors.

02. What are the challenges in the North America Diesel Engine Market?

Challenges in the North America diesel engine market include stringent emission regulations, competition from alternative power sources, and fluctuating diesel fuel prices, which may impact market growth.

03. Who are the major players in the North America Diesel Engine Market?

Key players in the North America diesel engine market include Caterpillar Inc., Cummins Inc., Mitsubishi Heavy Industries, Ltd., AB Volvo, and Komatsu Ltd., dominating due to extensive product portfolios and global presence.

04. What are the growth drivers of the North America Diesel Engine Market?

Growth in the North America diesel engine market is driven by factors such as industrialization, the demand for backup power solutions, and technological advancements in engine efficiency. Additionally, the expansion of the construction, mining, and transportation sectors has significantly contributed to the increased adoption of diesel engines.

05. Which application segment dominates the North America Diesel Engine Market?

The power generation segment dominates the North America diesel engine market. Diesel engines are a preferred choice for backup and emergency power supply due to their reliability and cost-efficiency, especially in industrial and commercial settings that require consistent power availability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.