North America Dietary Supplements Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD10936

November 2024

88

About the Report

North America Dietary Supplements Market Overview

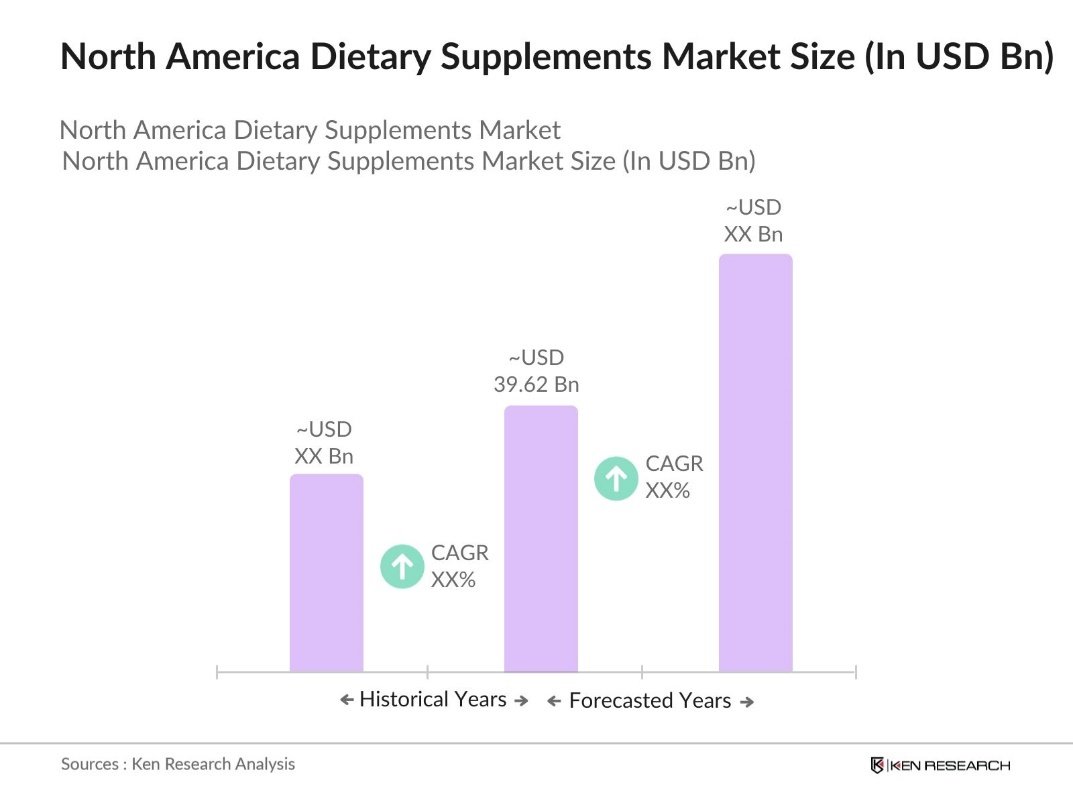

- The North America Dietary Supplements Market is valued at USD 39.62 billion, primarily driven by increased health awareness and a focus on preventive healthcare. Growing consumer preference for personalized nutrition and plant-based supplements further propels market growth. Factors such as the regions high disposable income and the aging population are accelerating demand for dietary supplements designed for general wellness, immunity, and age-related health concerns.

- The United States is the dominant player in the North American dietary supplements market due to its advanced healthcare infrastructure, consumer awareness, and regulatory support for quality standards. Canada also holds a significant position, supported by a rising demand for sports nutrition products and organic supplements. These countries exhibit high consumer expenditure on health products, with market penetration fueled by widespread access to online and offline distribution channels.

- The importation of dietary supplement ingredients is strictly controlled, with requirements that ensure the quality and safety of raw materials used in manufacturing. In 2023, the FDA issued a Dietary Supplement Ingredient Directory to inform consumers and industry stakeholders about specific ingredients that have raised safety concerns. Compliance with these import regulations is crucial to avoid delays and ensure the timely availability of ingredients

North America Dietary Supplements Market Segmentation

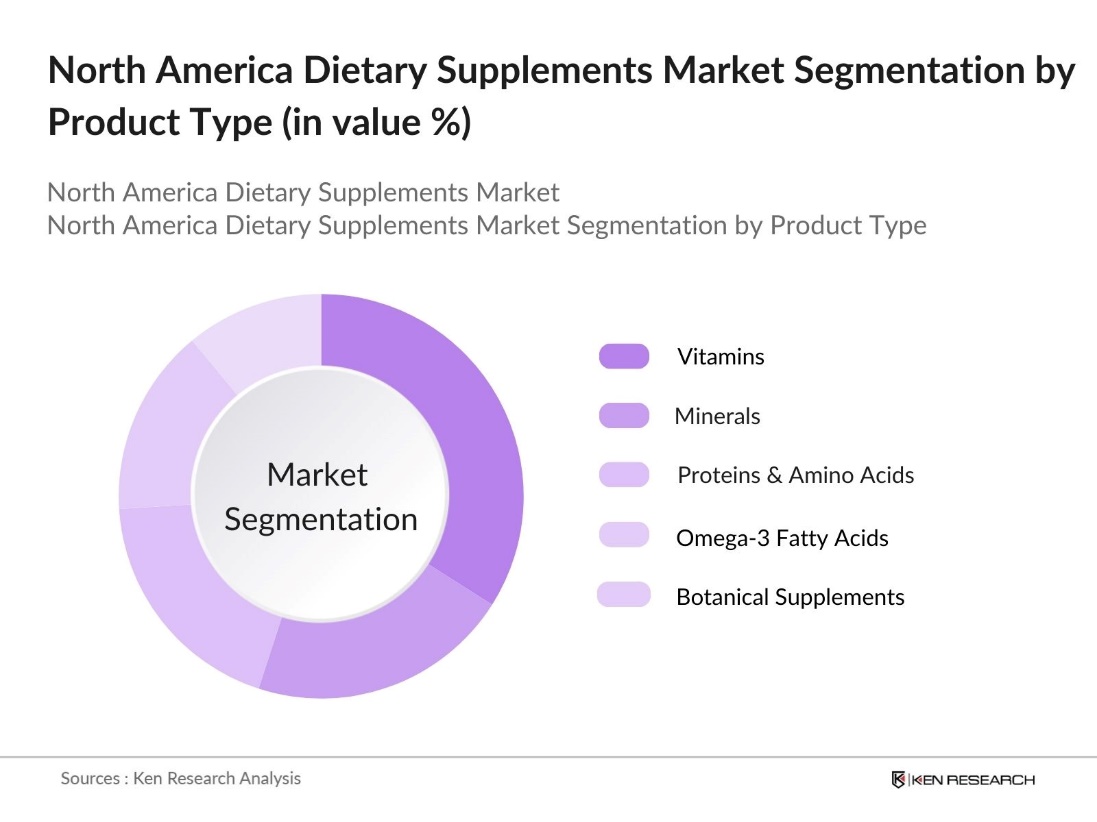

By Product Type: The market is segmented by product type into vitamins, minerals, proteins and amino acids, omega-3 fatty acids, and botanical supplements. Vitamins dominate this segment due to their essential role in general health and wellness, as well as targeted formulations that cater to immunity, energy, and beauty enhancement. Brands such as Natures Bounty and NOW Foods have built strong brand loyalty by offering diverse vitamin formulations that meet specific health needs.

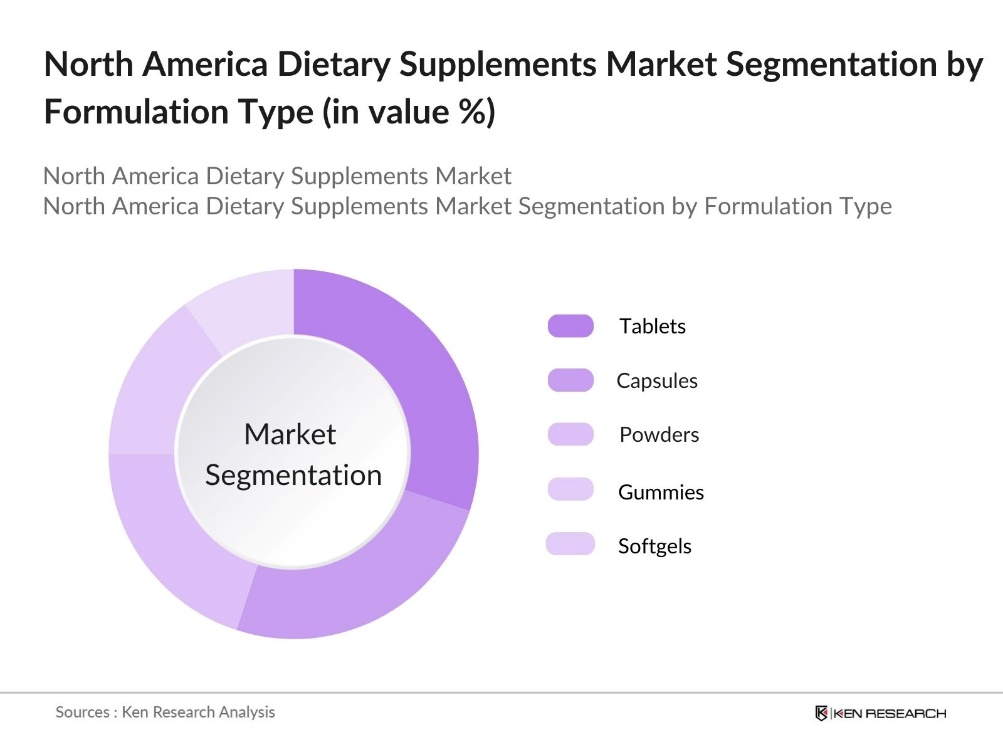

By Formulation Type: The market is segmented by formulation into tablets, capsules, powders, gummies, and softgels. Tablets have the largest market share in this segment due to their convenience, affordability, and extended shelf life. Consumers prefer tablets for ease of consumption and the ability to maintain a consistent supplement routine, especially for daily vitamins and minerals.

North America Dietary Supplements Market Competitive Landscape

The North America dietary supplements market is competitive, with prominent players leveraging branding and product innovation to capture market share. Established brands like Abbott Laboratories and Pfizer dominate through strategic positioning in both traditional and emerging product categories. The market is characterized by established companies focusing on innovation, branding, and expanding into new categories such as probiotics and omega-3 supplements to maintain their competitive edge

North America Dietary Supplements Industry Analysis

Growth Drivers

- Rising Health Awareness: The increasing focus on health among North Americans has driven higher demand for dietary supplements, reflecting broader wellness trends. For instance, Multivitamin-mineral (MVM) supplements were the most commonly consumed, with usage rates of 24% among men and women aged 20-39, increasing to 39.4% for those aged 60 and over. The market that aligns with consumer priorities in reducing illness risks and improving quality of life.

- Increasing Geriatric Population: North Americas aging population contributes significantly to dietary supplement demand, as older adults seek products that address age-related nutritional deficiencies. The population of those aged 65 and over is projected to reach about 84 million by 2054, making up an estimated 23% of the total U.S. population at that time. Additionally, public health expenditure related to elderly care encouraging individuals to invest in preventive supplements for long-term health.

- Preventive Healthcare Focus: The growing emphasis on preventive healthcare has strengthened the dietary supplements market in North America. Government-backed initiatives encourage the use of supplements as essential components for maintaining health and preventing chronic conditions. As consumers increasingly adopt supplements as part of proactive health routines, the market benefits from a broader focus on wellness and early intervention to support long-term health outcomes.

Market Challenges

- Regulatory Complexity: The regulatory environment for dietary supplements in North America poses challenges, particularly with stringent compliance requirements from bodies like the FDA and Health Canada. These agencies enforce rigorous standards on supplement safety, labeling, and health claims, requiring thorough testing and documentation. Such regulations, while essential for consumer protection, increase operational complexities and costs for manufacturers who must meet these strict compliance standards.

- Quality Control Issues: Quality control is a major concern in the dietary supplement market, as variations in product quality can directly affect consumer trust. Instances of contamination or product inconsistency underscore the need for stringent quality assurance practices. Maintaining high standards in ingredient sourcing, manufacturing, and testing is essential to ensure consumer safety and uphold the markets credibility, helping manufacturers meet regulatory expectations and build consumer confidence.

North America Dietary Supplements Market Future Outlook

The North American dietary supplements market is expected to grow steadily, driven by consumer demand for wellness products and a preference for natural, organic ingredients. Innovations in formulation, such as the introduction of plant-based and personalized supplements, are projected to shape the market landscape. Additionally, digital channels and subscription-based services will continue to streamline access, driving market penetration among diverse consumer groups.

Market Opportunities

- Technological Advancements in Supplement Formulation: Technological innovations in supplement formulation, such as microencapsulation and time-release delivery, are enhancing product efficacy and absorption. These advancements enable companies to create more targeted health solutions, catering to specific consumer needs. As a result, new, tailored supplements are increasingly available, meeting the demand for effective, high-quality products that align with consumers' specific health goals.

- Expansion of E-commerce Channels: The market benefits significantly from the expansion of e-commerce, which enhances consumer access and convenience. With broader availability online, consumers can more easily find and purchase supplements that meet their health needs. Supported by advanced digital infrastructure and targeted marketing, e-commerce channels continue to drive demand by simplifying the purchasing process and providing greater product accessibility.

Scope of the Report

|

By Product Type |

Vitamins Minerals Proteins and Amino Acids Omega-3 Fatty Acids Botanical Supplements |

|

By Formulation |

Tablets Capsules Powders Gummies Softgels |

|

By Distribution Channel |

Pharmacies Supermarkets/Hypermarkets E-commerce Specialty Stores Direct Sales |

|

By End User |

Adults Children Pregnant Women Elderly Athletes |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Pharmaceutical Manufacturers

Nutraceutical Companies

Healthcare Providers and Nutritionists

E-commerce Platforms

Government and Regulatory Bodies (FDA, Health Canada)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Amway Corporation

Herbalife Nutrition Ltd.

Abbott Laboratories

Bayer AG

Nestl Health Science

Natures Bounty Co.

Pfizer Inc.

GNC Holdings Inc.

NOW Foods

The Vitamin Shoppe

Table of Contents

1. North America Dietary Supplements Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate Analysis

1.4 Market Segmentation Overview

2. North America Dietary Supplements Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Dietary Supplements Market Analysis

3.1 Growth Drivers

3.1.1 Rising Health Awareness

3.1.2 Increasing Geriatric Population

3.1.3 Preventive Healthcare Focus

3.1.4 Demand for Plant-Based Ingredients

3.2 Market Challenges

3.2.1 Regulatory Complexity

3.2.2 Quality Control Issues

3.2.3 Ingredient Sourcing Constraints

3.2.4 Competition from Functional Foods

3.3 Opportunities

3.3.1 Technological Advancements in Supplement Formulation

3.3.2 Expansion of E-commerce Channels

3.3.3 Customization and Personalization Trends

3.3.4 Untapped Markets in Organic Supplements

3.4 Market Trends

3.4.1 Demand for Clean Label Products

3.4.2 Increased Focus on Nutraceutical Research

3.4.3 Rise of Dietary Supplements in Sports Nutrition

3.4.4 Growth in Subscription-Based Supplement Services

3.5 Government Regulations

3.5.1 FDA Compliance Requirements

3.5.2 Labeling and Health Claims Policies

3.5.3 Import Regulations for Raw Materials

3.5.4 Supplement Safety Standards

3.6 SWOT Analysis

3.7 Stake Ecosystem (Manufacturers, Distributors, Consumers)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Dietary Supplements Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Vitamins

4.1.2 Minerals

4.1.3 Proteins and Amino Acids

4.1.4 Omega-3 Fatty Acids

4.1.5 Botanical Supplements

4.2 By Formulation (in Value %)

4.2.1 Tablets

4.2.2 Capsules

4.2.3 Powders

4.2.4 Gummies

4.2.5 Softgels

4.3 By Distribution Channel (in Value %)

4.3.1 Pharmacies

4.3.2 Supermarkets/Hypermarkets

4.3.3 E-commerce

4.3.4 Specialty Stores

4.3.5 Direct Sales

4.4 By End User (in Value %)

4.4.1 Adults

4.4.2 Children

4.4.3 Pregnant Women

4.4.4 Elderly

4.4.5 Athletes

4.5 By Region (in Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Dietary Supplements Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amway Corporation

5.1.2 Herbalife Nutrition Ltd.

5.1.3 Abbott Laboratories

5.1.4 Bayer AG

5.1.5 Glanbia Plc

5.1.6 Natures Bounty Co.

5.1.7 Pfizer Inc.

5.1.8 GNC Holdings Inc.

5.1.9 Nestl Health Science

5.1.10 NOW Foods

5.1.11 The Vitamin Shoppe

5.1.12 SmartyPants Vitamins

5.1.13 Nordic Naturals

5.1.14 Jamieson Wellness

5.1.15 Bausch Health Companies Inc.

5.2 Cross Comparison Parameters (Revenue, Product Portfolio Diversity, Manufacturing Capacity, R&D Expenditure, Market Reach, Strategic Partnerships, Quality Certifications, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Dietary Supplements Market Regulatory Framework

6.1 FDA Compliance Standards

6.2 Ingredient and Safety Regulations

6.3 Labeling Requirements

6.4 Import and Export Regulations

7. North America Dietary Supplements Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Dietary Supplements Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Formulation (in Value %)

8.3 By Distribution Channel (in Value %)

8.4 By End User (in Value %)

8.5 By Region (in Value %)

9. North America Dietary Supplements Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Analysis

9.3 Marketing Strategy Recommendations

9.4 Unexplored Market Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step entails mapping the dietary supplements ecosystem within North America, using secondary data and proprietary databases to identify variables such as regulatory trends, consumer health preferences, and ingredient demand.

Step 2: Market Analysis and Construction

Historical data is compiled to determine market penetration and revenue generation by formulation and product type. Additional analysis includes assessing market shares across various distribution channels.

Step 3: Hypothesis Validation and Expert Consultation

Through CATIs with industry experts from major dietary supplement companies, we validate market assumptions and gather insights into consumer demand trends and potential market constraints.

Step 4: Research Synthesis and Final Output

The final phase integrates insights from suppliers, distributors, and manufacturers to refine the dataset, ensuring a comprehensive, verified analysis of the North American dietary supplements market.

Frequently Asked Questions

01. How big is the North America Dietary Supplements Market?

The North America dietary supplements market is valued at USD 39.62 billion, with a strong focus on vitamins, minerals, and proteins, driven by health-conscious consumers.

02. What are the challenges in the North America Dietary Supplements Market?

Challenges in North America dietary supplements market include regulatory compliance, quality control issues, and supply chain constraints, particularly for organic and non-GMO ingredients.

03. Who are the major players in the North America Dietary Supplements Market?

Leading companies in North America dietary supplements market include Amway, Abbott Laboratories, Bayer AG, Herbalife Nutrition Ltd., and Nestl Health Science, each dominating through specialized formulations and extensive distribution networks.

04. What are the growth drivers of the North America Dietary Supplements Market?

Key drivers in the North America dietary supplements market include rising health awareness, demand for preventive healthcare, and an increase in the elderly population, fueling demand for dietary supplements tailored for age-related health needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.