North America Dispersing Agents Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD5614

December 2024

88

About the Report

North America Dispersing Agents Market Overview

- The North America Dispersing Agents Market is valued at approximately USD 2.23 billion, driven primarily by the regions industrial demand in sectors such as paints and coatings, construction, and oil & gas. Dispersing agents enhance the spread of solid particles in liquid mediums, essential in improving production efficiency across industries. Growth has been fueled by technological advancements in formulation techniques and the increasing use of bio-based dispersing agents in response to sustainability concerns.

- The United States dominates the North America Dispersing Agents Market due to its advanced industrial base, particularly in sectors such as paints and coatings, oil & gas, and automotive industries, which require efficient dispersing agents for process optimization. Additionally, Canadas construction and paper industries contribute significantly, driven by high urbanization rates and stringent environmental regulations encouraging the use of eco-friendly dispersing agents.

- The U.S. Environmental Protection Agency (EPA) continues to enforce strict regulations on the production and use of dispersing agents, particularly in industries like paints, coatings, and agrochemicals. In 2023, the EPA introduced new guidelines limiting the use of hazardous substances in chemical manufacturing, which directly impacts the formulation of dispersing agents. These regulations are part of a broader initiative to reduce environmental pollution and promote sustainable manufacturing practices across industries.

North America Dispersing Agents Market Segmentation

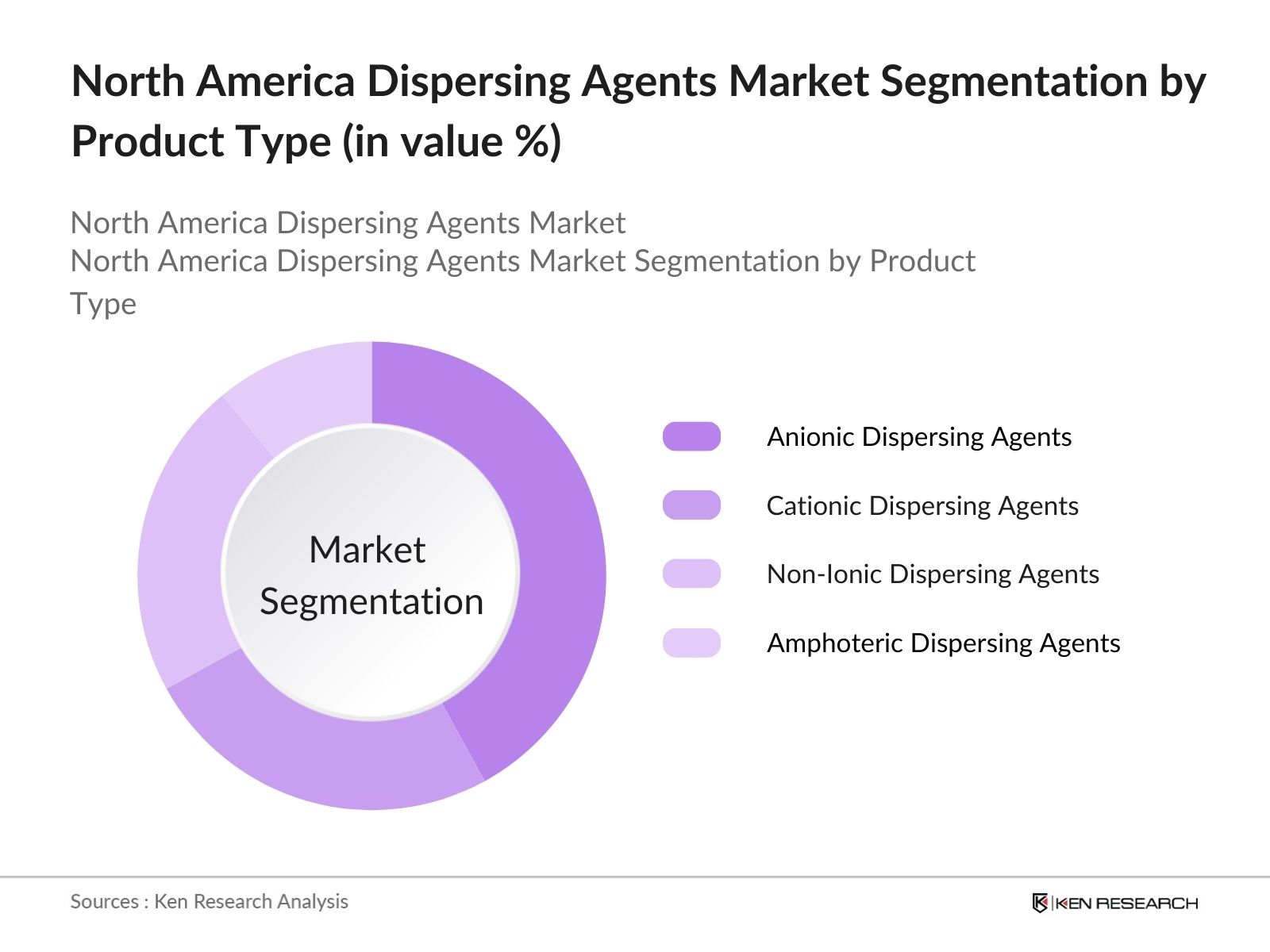

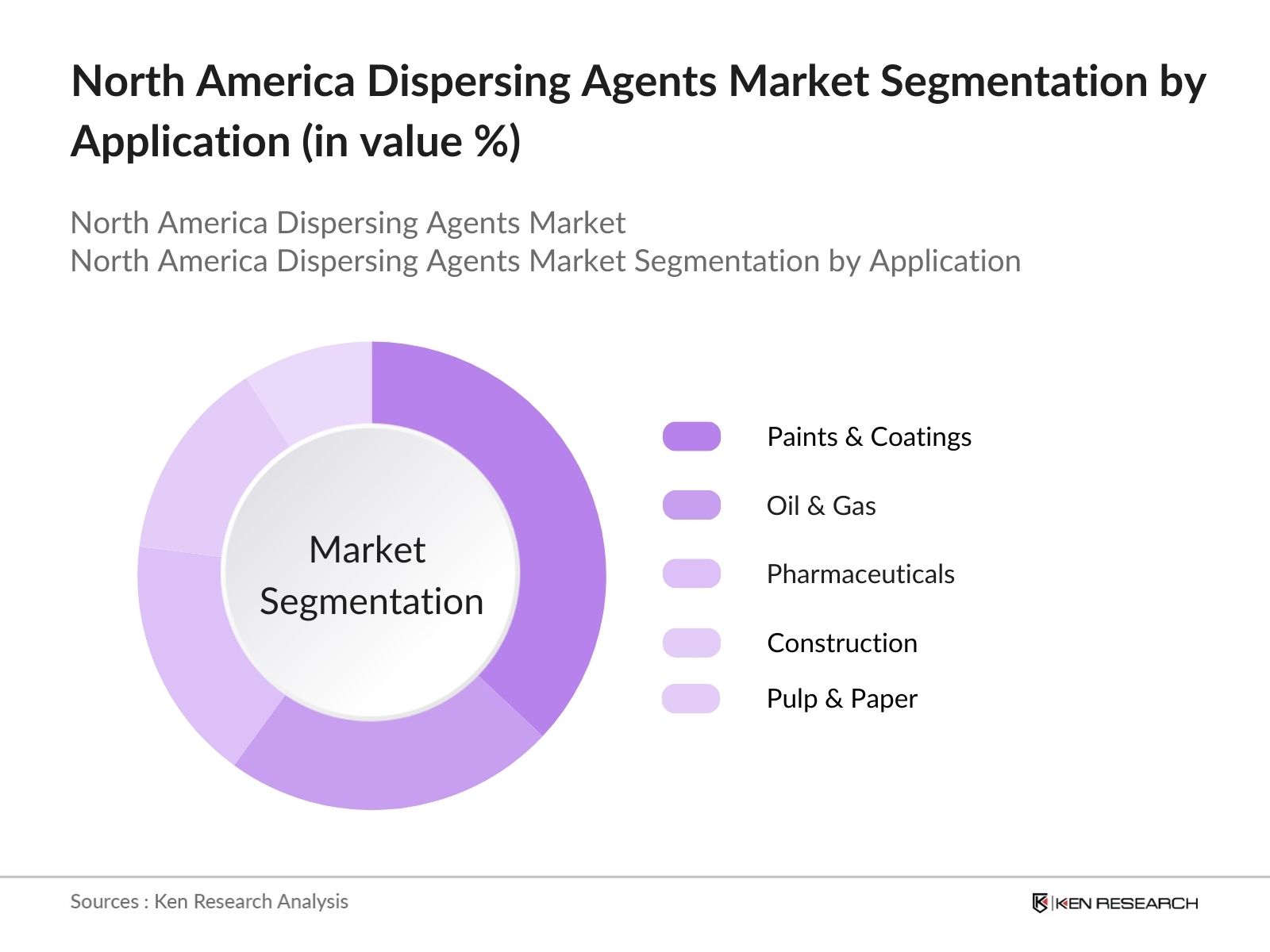

The North America Dispersing Agents Market is segmented by product type and segmented by application.

- By Product Type: The North America Dispersing Agents Market is segmented by product type into anionic dispersing agents, cationic dispersing agents, non-ionic dispersing agents, and amphoteric dispersing agents. Among these, anionic dispersing agents hold the dominant market share due to their widespread use in industrial coatings and pigments. Their ability to improve particle dispersion in various mediums, combined with low costs, has made them the preferred choice in paints and coatings industries. The growing demand for high-performance additives in automotive paints further cements the dominance of this segment.

- By Application: The market is also segmented by application into paints & coatings, oil & gas, pharmaceuticals, construction, and pulp & paper. The paints & coatings segment leads the market due to its extensive use of dispersing agents to ensure uniform pigment distribution and stability in formulations. The high demand for quality finishes in automotive, architectural, and industrial applications supports the dominance of this segment. Additionally, the increasing adoption of environmentally friendly coatings boosts the demand for dispersing agents that enhance paint performance.

North America Dispersing Agents Market Competitive Landscape

The North America Dispersing Agents Market is dominated by a mix of global chemical manufacturers and regional players with robust distribution networks. Companies such as BASF SE, Dow Inc., and Solvay SA have established themselves as market leaders, leveraging their advanced product portfolios and focus on sustainable product development. This competitive landscape highlights significant consolidation among a few key players, particularly those with strong R&D capabilities and strategic alliances.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

Revenue |

R&D Spending |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|||

|

Dow Inc. |

1897 |

Midland, Michigan, USA |

|||

|

Solvay SA |

1863 |

Brussels, Belgium |

|||

|

Clariant AG |

1995 |

Muttenz, Switzerland |

|||

|

Evonik Industries AG |

2007 |

Essen, Germany |

North America Dispersing Agents Industry Analysis

Growth Drivers

- Rising Demand for Efficient Additives: The demand for dispersing agents in North America is driven by the need for enhanced additives in coatings, paints, and detergents. In 2024, the North American chemical industry is valued at over $900 billion, with a substantial portion allocated to these sectors. Efficient dispersion is critical in ensuring uniform distribution of pigments in coatings and paints, improving the final product's quality. The use of dispersing agents in detergents also aids in enhancing stain removal performance. This demand aligns with increased production across industrial sectors like automotive and construction, which are major consumers of coatings.

- Technological Advancements in Dispersing Technologies: Innovations in chemical and mechanical dispersion processes are fueling the growth of dispersing agents in North America. Technological advancements like ultrasonication and nanotechnology-based dispersion methods have led to improved particle distribution in paints and coatings. The U.S. invests over $530 billion annually in research and development across industries, with significant investments directed toward chemical manufacturing. These innovations are essential in enhancing the efficacy of dispersing agents, particularly in applications like automotive coatings, where precision and durability are crucial

- Increasing Use in Industrial Applications: Dispersing agents are increasingly being utilized in industrial applications such as water treatment, oil and gas, and agrochemicals. The North American water treatment industry alone is valued at $300 billion in 2024, with dispersing agents playing a vital role in removing impurities and enhancing filtration. In the oil and gas sector, dispersing agents are used for drilling fluids and other applications, contributing to efficient resource extraction. The agrochemical sector also heavily relies on dispersing agents to ensure proper pesticide and herbicide delivery.

Market Challenges

- High Raw Material Costs: One of the major challenges facing the dispersing agents market in North America is the volatility of raw material costs, particularly those derived from petroleum. Crude oil prices, which reached $92 per barrel in 2023, have a direct impact on the production costs of dispersing agents, many of which are synthesized from petrochemical derivatives. This price fluctuation affects the overall cost structure of dispersing agent manufacturers and ultimately impacts profit margins in industries like paints and coatings

- Stringent Environmental Regulations: Stringent environmental regulations, particularly around volatile organic compounds (VOCs), pose a significant challenge to the dispersing agents market. In 2023, the U.S. Environmental Protection Agency (EPA) tightened VOC limits for chemical products, including coatings, which has forced manufacturers to reformulate their dispersing agents. The EPA's ongoing efforts to reduce industrial emissions are also expected to affect the production processes of dispersing agents used in various applications like industrial coatings and agrochemicals.

North America Dispersing Agents Market Future Outlook

Over the next five years, the North America Dispersing Agents Market is poised for significant growth, driven by technological advancements in dispersion technologies, the increasing demand for sustainable solutions, and the rise of bio-based dispersing agents. The development of innovative formulations in the paints & coatings and pharmaceuticals sectors will further push market growth, while environmental regulations will continue shaping product portfolios towards eco-friendly alternatives.

Market Opportunities

- Growth in Bio-based Dispersing Agents: The shift towards sustainability in industrial sectors is driving the growth of bio-based dispersing agents. These eco-friendly alternatives are gaining traction, particularly in sectors like coatings and agrochemicals, where environmental impact is a key concern. North America saw a 20% increase in the use of bio-based chemicals in the industrial sector from 2022 to 2024, driven by regulations and consumer demand for greener products. The market is being shaped by innovations in biomass conversion technologies, which allow for the production of dispersing agents from renewable sources.

- Emerging Applications in 3D Printing Materials: The use of dispersing agents in 3D printing materials, particularly nanomaterials, is an emerging opportunity in the North American market. As the 3D printing industry continues to expand, projected to exceed $50 billion in North America by 2025, the need for dispersing agents to stabilize nanoparticles in printing inks and materials is growing. Dispersing agents are essential in ensuring uniform distribution of nanomaterials, which is critical for the mechanical properties and quality of 3D printed products.

Scope of the Report

|

Anionic Dispersing Agents Cationic Dispersing Agents Non-ionic Dispersing Agents Amphoteric Dispersing Agents |

|

|

By Application |

Paints & Coatings Oil & Gas Pulp & Paper Pharmaceuticals Construction |

|

By Form |

Liquid Dispersing Agents Powder Dispersing Agents |

|

By Technology |

Mechanical Dispersion Electrostatic Dispersion Ultrasonic Dispersion |

|

By Region |

North East West South |

Products

Key Target Audience

Paints & Coatings Manufacturers

Chemical Industry Associations

Construction and Building Materials Companies

Automotive Manufacturers

Pharmaceuticals Companies

Pulp & Paper Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (EPA, Environment Canada)

Companies

Players Mention in the Report:

BASF SE

Dow Inc.

Solvay SA

Clariant AG

Evonik Industries AG

Huntsman Corporation

Ashland Inc.

Lubrizol Corporation

Croda International Plc

Arkema Group

Air Products and Chemicals, Inc.

Kemira Oyj

King Industries Inc.

Elementis Plc

Cargill, Incorporated

Table of Contents

1. North America Dispersing Agents Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Dispersing Agents Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Dispersing Agents Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Efficient Additives (Market-Specific: Demand for enhanced dispersion in coatings, paints, and detergents)

3.1.2 Technological Advancements in Dispersing Technologies (Market-Specific: Innovative methods in chemical and mechanical dispersion processes)

3.1.3 Increasing Use in Industrial Applications (Market-Specific: Industrial water treatment, oil & gas, and agrochemicals)

3.2 Market Challenges

3.2.1 High Raw Material Costs (Market-Specific: Volatility in petroleum-based raw materials)

3.2.2 Stringent Environmental Regulations (Market-Specific: Environmental regulations on volatile organic compounds)

3.3 Opportunities

3.3.1 Growth in Bio-based Dispersing Agents (Market-Specific: Increased focus on sustainability in industrial sectors)

3.3.2 Emerging Applications in 3D Printing Materials (Market-Specific: Dispersing agents for nanomaterials in additive manufacturing)

3.4 Trends

3.4.1 Shift Towards Eco-friendly Solutions (Market-Specific: Green chemistry for dispersing agents)

3.4.2 Use of Nanotechnology in Dispersing Agents (Market-Specific: Enhanced dispersions for advanced composites)

3.5 Government Regulations

3.5.1 EPA Regulations on Dispersing Agents

3.5.2 North American Emission Standards and Chemical Safety Compliance

4. North America Dispersing Agents Market Segmentation

4.1 By Type (In Value %)

4.1.1 Anionic Dispersing Agents

4.1.2 Cationic Dispersing Agents

4.1.3 Non-ionic Dispersing Agents

4.1.4 Amphoteric Dispersing Agents

4.2 By Application (In Value %)

4.2.1 Paints & Coatings

4.2.2 Oil & Gas

4.2.3 Pulp & Paper

4.2.4 Pharmaceuticals

4.2.5 Construction

4.3 By Form (In Value %)

4.3.1 Liquid Dispersing Agents

4.3.2 Powder Dispersing Agents

4.4 By Technology (In Value %)

4.4.1 Mechanical Dispersion

4.4.2 Electrostatic Dispersion

4.4.3 Ultrasonic Dispersion

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Dispersing Agents Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 BASF SE

5.1.2 Dow Inc.

5.1.3 Evonik Industries AG

5.1.4 Clariant AG

5.1.5 Solvay SA

5.1.6 Ashland Inc.

5.1.7 Croda International Plc

5.1.8 Huntsman Corporation

5.1.9 Lubrizol Corporation

5.1.10 Kemira Oyj

5.1.11 Arkema Group

5.1.12 Air Products and Chemicals, Inc.

5.1.13 Cargill, Incorporated

5.1.14 King Industries Inc.

5.1.15 Elementis Plc

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolio, Market Share, Global Presence, Innovation Capability, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Dispersing Agents Market Regulatory Framework

6.1 EPA and Industry Standards

6.2 Compliance Requirements for Dispersing Agents

6.3 Certification Processes for Bio-based Dispersing Agents

7. North America Dispersing Agents Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Dispersing Agents Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By Form (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. North America Dispersing Agents Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves the identification of key variables influencing the North America Dispersing Agents Market. This includes analyzing production and consumption patterns within industries such as paints & coatings, pharmaceuticals, and construction. Primary and secondary data are collected through credible sources such as government reports and industry publications.

Step 2: Market Analysis and Construction

In this phase, historical data are gathered, encompassing product innovations and regulatory developments. The data are used to construct a detailed analysis of industry penetration and market performance across the North American region, providing a comprehensive understanding of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through consultations with industry experts, including product managers and key decision-makers within the dispersing agents industry. These discussions provide deeper insights into trends, challenges, and future market opportunities.

Step 4: Research Synthesis and Final Output

The final synthesis of data results in the preparation of this comprehensive report, which integrates insights from primary and secondary sources. The bottom-up approach ensures accuracy, with the final output offering an actionable analysis for key stakeholders in the North American market.

Frequently Asked Questions

01. How big is the North America Dispersing Agents Market?

The North America Dispersing Agents Market is valued at USD 2.23 billion, driven by increasing demand from industries such as paints & coatings, oil & gas, and construction.

02. What are the challenges in the North America Dispersing Agents Market?

Challenges in North America Dispersing Agents Market include fluctuations in raw material prices, particularly petroleum-based chemicals, and stringent environmental regulations that drive the need for eco-friendly alternatives.

03. Who are the major players in the North America Dispersing Agents Market?

Key players in the North America Dispersing Agents Market include BASF SE, Dow Inc., Solvay SA, Evonik Industries AG, and Clariant AG, which dominate the market through their strong product portfolios and innovation capabilities.

04. What are the growth drivers of the North America Dispersing Agents Market?

The North America Dispersing Agents Market is propelled by the rise in industrial applications, growing demand for bio-based agents, and advancements in dispersion technologies that enhance production efficiency.

05. Which industries dominate the North America Dispersing Agents Market?

Industries such as paints & coatings, pharmaceuticals, and construction are the leading consumers of dispersing agents in North America, driven by their need for efficient and sustainable dispersion solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.