North America Drone Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD2928

November 2024

88

About the Report

North America Drone Market Overview

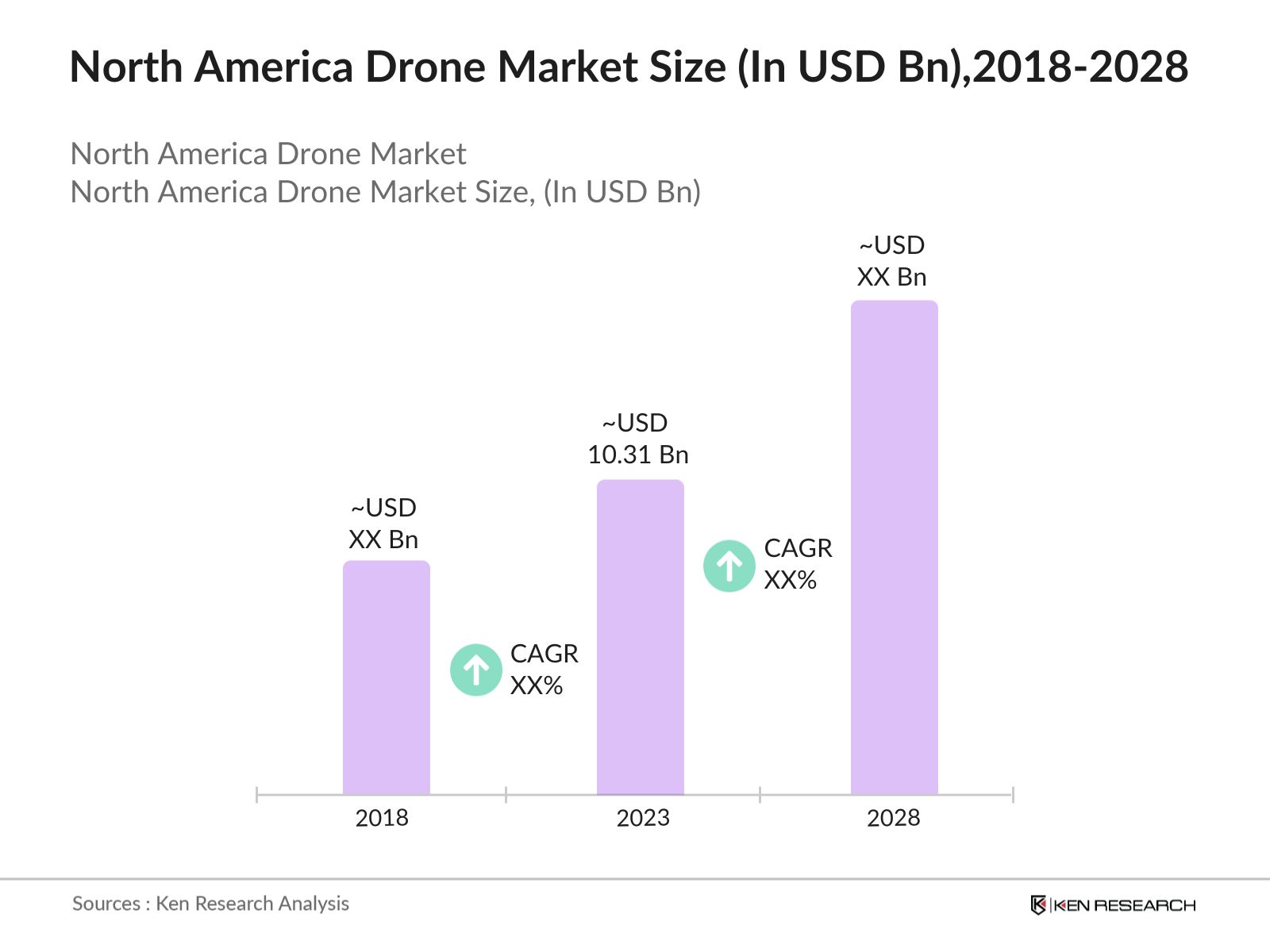

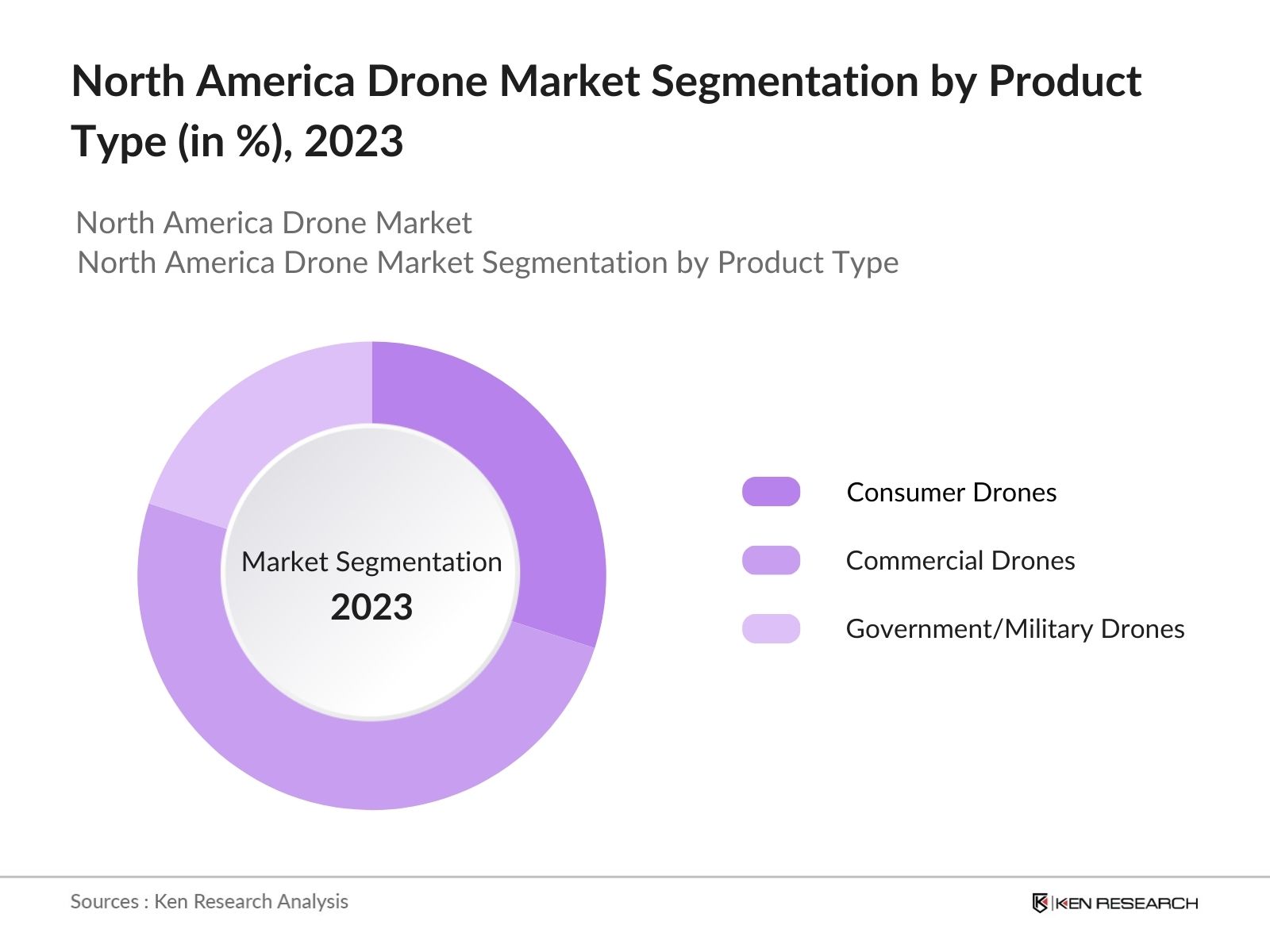

In 2023, the North America Drone Market was valued at USD 10.31 billion, driven by increased demand across sectors like defense, agriculture, and logistics. The market is segmented into consumer drones, commercial drones, and government/military drones, with commercial drones holding the largest market share due to growing applications in mapping, surveillance, and delivery services.

Key players in the market include DJI, Parrot, Lockheed Martin, Northrop Grumman, and Boeing, recognized for their innovation in drone technology and market dominance across different sectors.

The United States and Canada lead the market, driven by strong investments in drone technology, regulatory support, and growing use cases in precision agriculture, delivery services, and military applications.

In 2024, DJI launched a new line of industrial drones designed for large-scale infrastructure inspections and agricultural management, reflecting a shift towards specialized applications within the commercial drone segment.

North America Drone Market Segmentation

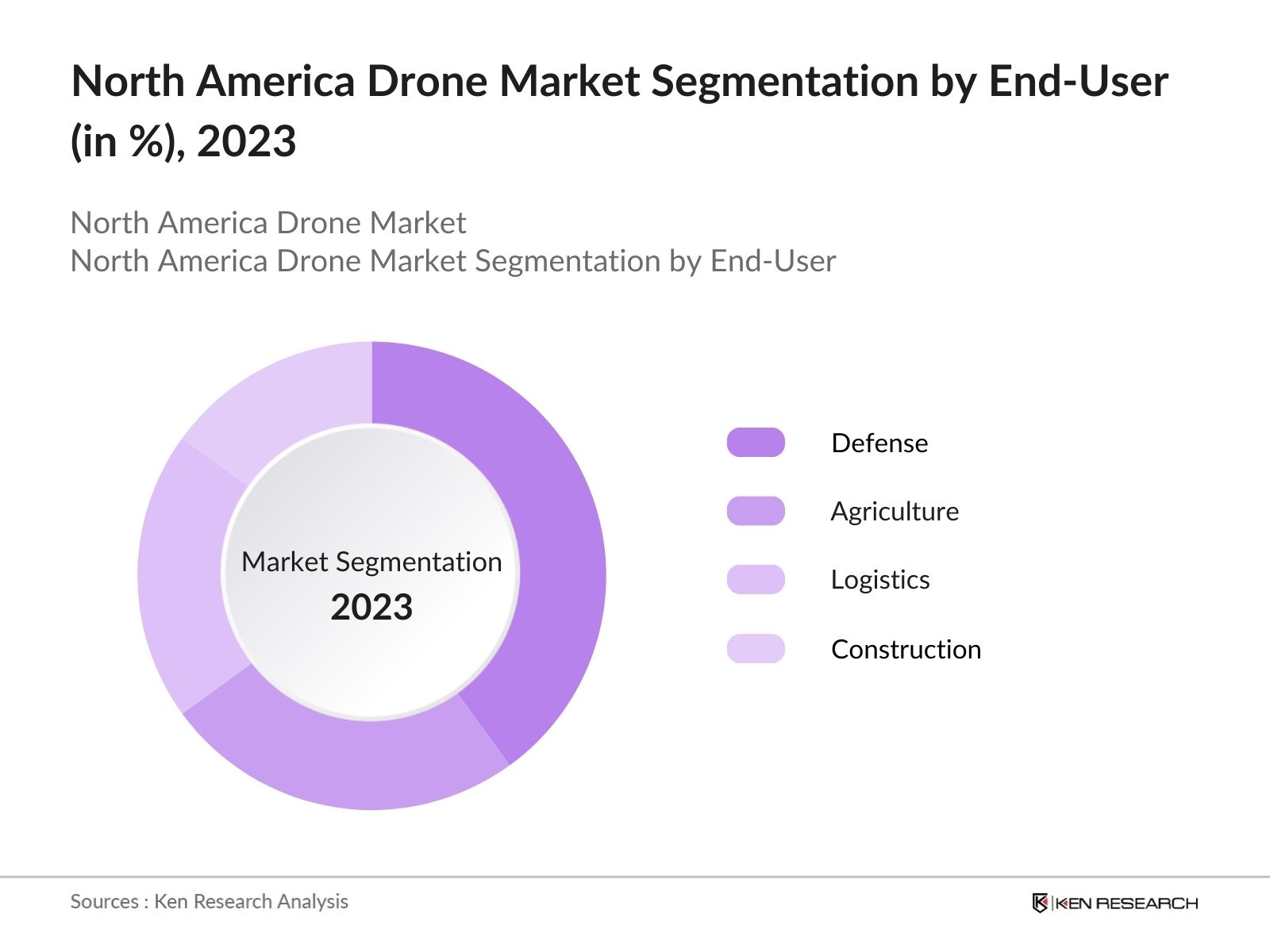

The North America Drone Market can be segmented by product type, end-user, and region:

By Product Type: The market is segmented into consumer drones, commercial drones, and government/military drones. In 2023, commercial drones dominate due to their widespread use in industries like logistics, agriculture, and public safety. Consumer drones remain popular for recreational purposes, while military drones see continued investment in defense.

By End-User: The market is divided into sectors like defense, agriculture, logistics, and construction. Defense remains the largest sector, with drones being integral for surveillance and combat missions. However, agriculture is rapidly growing, utilizing drones for crop monitoring and precision farming.

By Region: The market is segmented regionally into the U.S., Canada, and Mexico. The U.S. dominates with the highest market share due to strong R&D and government support, while Canada is emerging as a key player in the agricultural drone segment.

North America Drone Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

DJI |

2006 |

Shenzhen, China |

|

Parrot |

1994 |

Paris, France |

|

Lockheed Martin |

1912 |

Bethesda, USA |

|

Northrop Grumman |

1939 |

Falls Church, USA |

|

Boeing |

1916 |

Chicago, USA |

DJI: In 2024, DJI introduced a new series of industrial drones equipped with AI-driven technology for enhanced precision in infrastructure inspections and agricultural management. This launch targets the growing demand for specialized drones in commercial sectors, strengthening DJIs position as a leader in the drone industry, particularly in the agricultural and logistics markets. The new product line leverages DJIs advanced R&D capabilities and aligns with the increasing trend towards automation and smart technology.

Lockheed Martin: In 2025, Lockheed Martin expanded its product portfolio with a new line of autonomous drones focused on military and surveillance operations. These drones are designed to operate in high-risk environments, offering advanced AI-based threat detection and real-time data analysis. This innovation reinforces Lockheed Martins dominance in the military drone segment, reflecting the company's continued focus on technological advancements in defense.

North America Drone Market Analysis

Market Growth Drivers:

- Rising Commercial Use: The logistics and delivery sector is experiencing a surge in drone usage. In 2023, approximately 50,000 drones were deployed for delivery services, with companies like Amazon and UPS expanding their drone fleets to improve last-mile delivery efficiency.

- Agricultural Applications: The use of drones in agriculture is expanding rapidly, with drones monitoring over 10 million acres of farmland in the U.S. in 2023. This adoption is driven by the need for precision farming solutions to improve crop yields and optimize resource usage.

- Increasing Government Investments: The growing demand for drones in defense and public safety is being fueled by significant government investments. In 2023, the U.S. government allocated USD 1.2 billion towards drone technology, highlighting the importance of drones in national security and innovation.

Market Challenges:

- Airspace Regulations: Stringent regulations imposed by the FAA are creating operational challenges for drone manufacturers and operators. Compliance with these regulations, particularly in urban and sensitive areas, limits the expansion of commercial drone operations and affects the industry's growth potential.

- Privacy and Security Concerns: The increasing use of drones for surveillance and data collection is raising concerns over privacy and security. Governments are tightening regulations to prevent potential misuse, which could slow down the adoption of drones, particularly in the commercial and public sectors.

- Technological Integration: The integration of drones with existing systems, such as logistics networks or agricultural management platforms, poses a challenge for companies. Smaller firms may struggle with the high costs associated with developing and implementing compatible technologies, slowing down their entry into the market.

Government Initiatives:

- U.S. Department of Defense Drone Budget: The U.S. Department of Defense allocated USD 700 Million for drone-related defense initiatives in 2023. This budget covers research and development for military drones, including autonomous flight systems and advanced surveillance technologies, reflecting the growing importance of drones in national defense.

- Canadas Drone Strategy 2030: Canadas Drone Strategy 2030 was launched with an initial budget of CAD 200 million (approximately USD 150 million). The strategy aims to promote the use of drones in commercial sectors such as agriculture, logistics, and public safety, with a focus on regulatory support and technological advancements in autonomous flight.

Future Market Trends:

- Growth in Drone Delivery Services: With companies like Amazon investing in drone delivery solutions, this sector is expected to grow rapidly by 2028. The expansion of e-commerce is driving demand for fast, efficient delivery systems, positioning drones as a key solution for the future.

- Increased Focus on Autonomous Drones: The development of autonomous drones for industrial applications such as mining, construction, and environmental monitoring is projected to accelerate, driven by advances in AI and machine learning technology.

Scope of the Report

|

By Region |

U.S. Canada Mexico |

|

By End-User |

Defense Agriculture Logistics Construction |

|

By Product Type |

Consumer Drones Commercial Drones Government/Military Drones |

|

By Payload Capacity |

Lightweight Drones (0-2 kg) Medium Drones (2-25 kg) Heavy Drones (25+ kg) |

|

By Technology |

AI-Driven Drones BVLOS (Beyond Visual Line of Sight) |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Banks and Financial Institutions

Venture Capitalists

Government and Regulatory Bodies (FAA, Transport Canada, NASA)

Drone Manufacturers

Agricultural Technology Providers

Defense and Security Agencies

Retailers and Distributors

E-commerce and Delivery Companies

Drone Product Development Firms

Logistics and Supply Chain Companies

Construction and Infrastructure Firms

Energy and Utility Providers

Surveillance and Security Firms

Media and Entertainment Companies

Environmental Monitoring Organizations

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

DJI

Parrot

Lockheed Martin

Northrop Grumman

Boeing

General Atomics

AeroVironment

3D Robotics

Insitu (a Boeing Company)

Textron Systems

Thales Group

EHang

FLIR Systems

Yuneec

Teal Drones

Table of Contents

North America Drone Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Drone Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

North America Drone Market Analysis

3.1. Growth Drivers

3.1.1. Rising Commercial Use

3.1.2. Agricultural Applications

3.1.3. Increasing Government Investments

3.2. Restraints

3.2.1. Airspace Regulations

3.2.2. Privacy and Security Concerns

3.2.3. Technological Integration

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion into New Markets

3.4. Trends

3.4.1. Growth in Drone Delivery Services

3.4.2. Increased Focus on Autonomous Drones

3.5. Government Regulation

3.5.1. U.S. Department of Defense Drone Budget

3.5.2. Canadas Drone Strategy 2030

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

North America Drone Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Consumer Drones

4.1.2. Commercial Drones

4.1.3. Government/Military Drones

4.2. By End-User (in Value %)

4.2.1. Defense

4.2.2. Agriculture

4.2.3. Logistics

4.2.4. Construction

4.3. By Payload Capacity (in Value %)

4.3.1. Lightweight Drones (0-2 kg)

4.3.2. Medium Drones (2-25 kg)

4.3.3. Heavy Drones (25+ kg)

4.4. By Technology (in Value %)

4.4.1. AI-Driven Drones

4.4.2. BVLOS (Beyond Visual Line of Sight)

4.5. By Region (in Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

North America Drone Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. DJI

5.1.2. Parrot

5.1.3. Lockheed Martin

5.1.4. Northrop Grumman

5.1.5. Boeing

5.1.6. General Atomics

5.1.7. AeroVironment

5.1.8. 3D Robotics

5.1.9. Insitu (a Boeing Company)

5.1.10. Textron Systems

5.1.11. Thales Group

5.1.12. EHang

5.1.13. FLIR Systems

5.1.14. Yuneec

5.1.15. Teal Drones

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

North America Drone Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

North America Drone Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

North America Drone Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

North America Drone Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Payload Capacity (in Value %)

9.4. By Technology (in Value %)

9.5. By Region (in Value %)

North America Drone Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, and technological advancements in drone applications. We also assess regulatory impacts and market dynamics specific to the North American drone market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (consumer, commercial, and military drones), and the distribution of end-users (defense, agriculture, logistics). We also analyze market share and revenue generated by leading drone manufacturers and emerging trends in drone technology to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading drone manufacturers, defense agencies, and commercial users. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing trends, technological adoption, and regulatory challenges.

Step 4: Research Output

Our team interacts with drone manufacturers, government agencies, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and technological developments. This process helps validate the derived statistics using a bottom-up approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

How large is the North America Drone Market?

In 2023, the North America Drone Market was valued at approximately USD 10.31 billion. The market's growth is driven by increasing demand for drones in sectors like defense, agriculture, and logistics, along with advancements in drone technology.

What are the challenges in the North America Drone Market?

Key challenges include stringent airspace regulations imposed by the FAA, privacy and security concerns surrounding drone usage, and the potential for misuse in sensitive areas. Rising competition among manufacturers also poses challenges, particularly for new entrants.

Who are the major players in the North America Drone Market?

Major players include DJI, Parrot, Lockheed Martin, Northrop Grumman, and Boeing. These companies lead the market with cutting-edge technology, strong R&D investments, and wide-reaching applications across multiple industries.

What are the growth drivers of the North America Drone Market?

Key growth drivers include technological advancements such as AI-driven automation, the expansion of drone use in agriculture and logistics, and government initiatives aimed at integrating drones into the national airspace for commercial and defense purposes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.