North America E-Sports Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4662

November 2024

83

About the Report

North America E-Sports Market Overview

- The North America E-Sports market is currently valued at USD 670 million, driven by the rapid expansion of the digital gaming ecosystem and increasing investments from media and entertainment companies. Key drivers of this market include the growing popularity of streaming platforms such as Twitch and YouTube Gaming, which has helped increase the exposure of e-sports events, resulting in substantial advertising and sponsorship revenues. The rise in infrastructure for high-speed internet, as well as the development of technologies like virtual reality (VR) and augmented reality (AR), is further supporting this growth.

- In North America, the United States leads the e-sports market due to its high concentration of tech-savvy populations, a robust gaming culture, and the presence of several key gaming companies. Cities like Los Angeles, New York, and San Francisco serve as major hubs for e-sports due to their established digital infrastructure, availability of professional teams, and the frequency of e-sports events and tournaments. These cities also host major gaming studios and attract large numbers of investors, making them central to the industry's growth.

- Several U.S. states, including New York and New Jersey, have imposed restrictions on gambling in e-sports to prevent underage betting and fraud. In 2023, Nevada, which allows regulated betting on e-sports, saw over $50 million in wagers on major tournaments. However, strict age verification protocols and betting limits are in place to protect minors and ensure responsible gambling. The growing prevalence of e-sports betting has prompted calls for tighter regulations, particularly concerning transparency and participant protection.

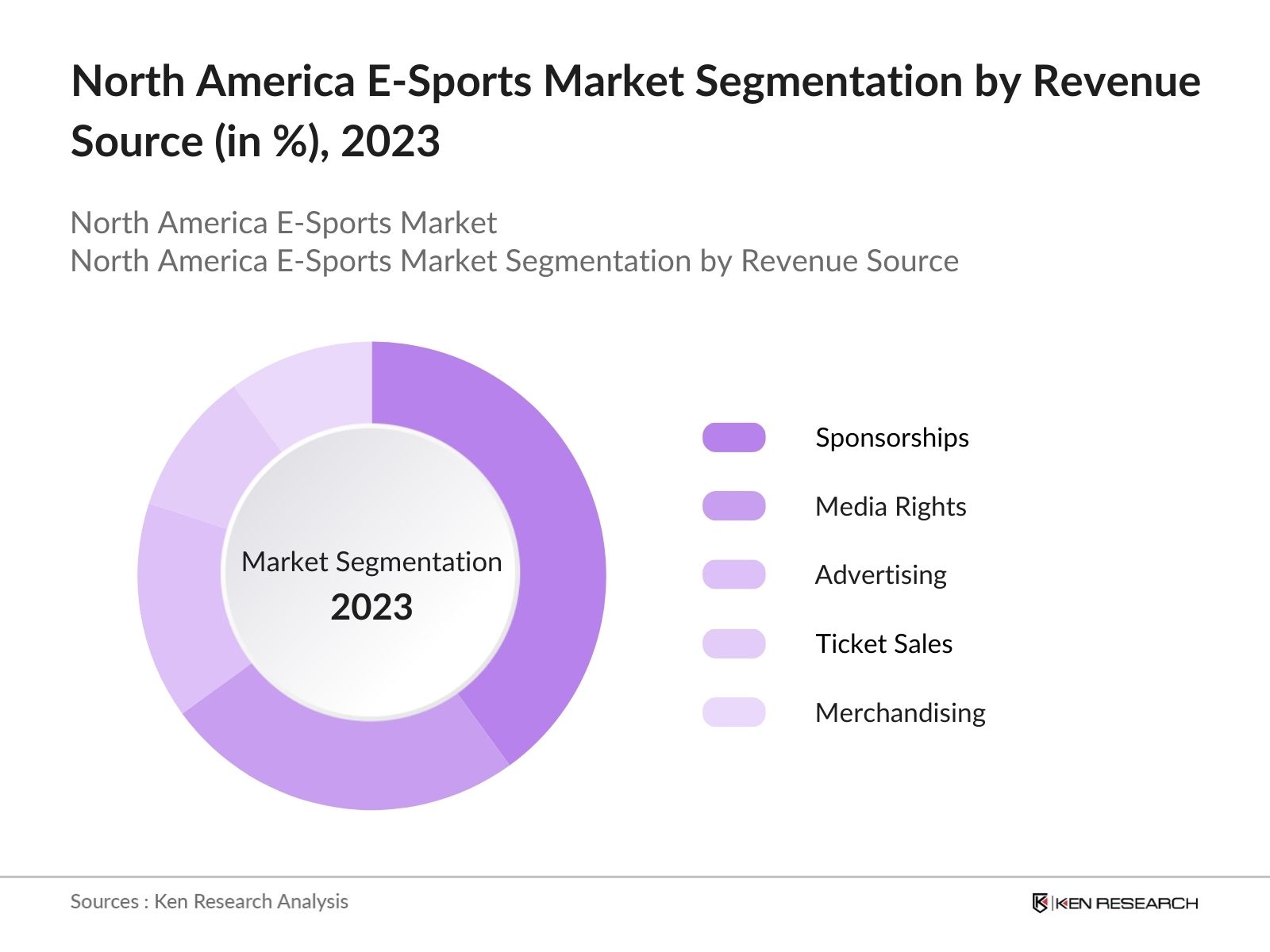

North America E-Sports Market Segmentation

By Revenue Source: The market is segmented by revenue source into sponsorships, media rights, advertising, ticket sales, and merchandising. Sponsorships hold a dominant market share within this segment. The dominance of sponsorship revenue is due to the substantial investments from both endemic and non-endemic brands. Major corporations, including tech giants and consumer goods companies, are keen on associating their brands with the dynamic and youthful e-sports audience. The direct brand exposure that sponsors receive through digital streaming platforms further fuels this segment's growth, making it the most lucrative revenue stream.

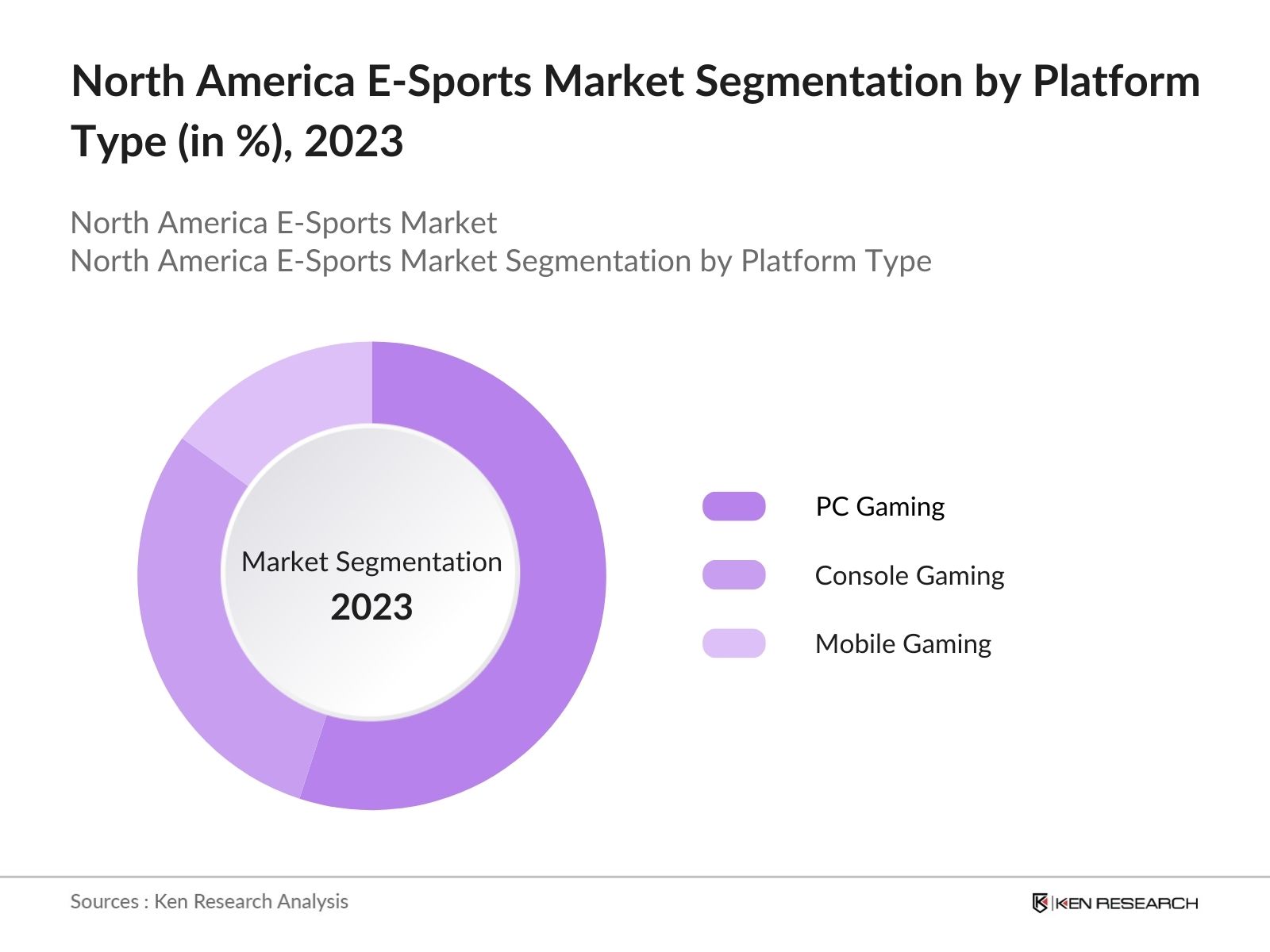

By Platform Type: The market is segmented by platform type into PC gaming, console gaming, and mobile gaming. PC gaming holds the largest market share in this segment, driven by the presence of popular e-sports titles like League of Legends, Dota 2, and Counter-Strike: Global Offensive. These games are highly optimized for PC platforms, and their dedicated fan bases contribute to the dominance of PC gaming. The superior hardware capabilities of PCs allow for smoother gameplay, higher graphical fidelity, and easier customization, making this segment a favorite among professional gamers.

By Platform Type: The market is segmented by platform type into PC gaming, console gaming, and mobile gaming. PC gaming holds the largest market share in this segment, driven by the presence of popular e-sports titles like League of Legends, Dota 2, and Counter-Strike: Global Offensive. These games are highly optimized for PC platforms, and their dedicated fan bases contribute to the dominance of PC gaming. The superior hardware capabilities of PCs allow for smoother gameplay, higher graphical fidelity, and easier customization, making this segment a favorite among professional gamers.

North America E-Sports Market Competitive Landscape

North America E-Sports Market Competitive Landscape

The North American E-Sports market is dominated by several key players that shape the competitive landscape. The consolidation of this market can be attributed to strategic investments, mergers and acquisitions, and a significant focus on brand partnerships. For instance, Activision Blizzard and Riot Games play critical roles in developing top-tier e-sports leagues and tournaments. Meanwhile, major streaming platforms like Twitch and YouTube Gaming are crucial for distributing e-sports content to global audiences.

|

Company |

Establishment Year |

Headquarters |

Key Metrics |

Game Portfolio |

Streaming Deals |

Sponsorship Revenue |

Audience Reach |

Team Partnerships |

Key E-Sports Leagues |

|

Activision Blizzard |

1979 |

Santa Monica, USA |

|||||||

|

Riot Games |

2006 |

Los Angeles, USA |

|||||||

|

Valve Corporation |

1996 |

Bellevue, USA |

|||||||

|

Electronic Arts (EA) |

1982 |

Redwood City, USA |

|||||||

|

Twitch (Amazon) |

2011 |

San Francisco, USA |

North America E-Sports Industry Analysis

Growth Drivers

- Increasing Digital Infrastructure: The rapid expansion of digital infrastructure across North America has bolstered the growth of e-sports, especially with widespread broadband internet reaching 93% of urban areas by 2023. The U.S. and Canada have invested heavily in 5G technologies, with the U.S. government allocating $65 billion for broadband deployment through the Infrastructure Investment and Jobs Act. This improved connectivity allows faster streaming and real-time gaming, essential for e-sports events and viewership. This infrastructure is foundational to the increasing adoption of e-sports platforms as more users now have stable connections for streaming and competitive gaming.

- Rise of Streaming Platforms and Influencers: Streaming platforms such as Twitch and YouTube Gaming have significantly increased their user base, with Twitch reaching an average of 31 million daily visitors in 2023. Influencers play a critical role in attracting a large audience to e-sports, with top streamers drawing millions of viewers during live broadcasts. YouTube Gaming recorded over 1.5 million concurrent viewers during major e-sports events, reflecting the growing interest and engagement in this sector. These platforms' dominance, supported by strong digital ecosystems in North America, has led to a robust demand for e-sports content.

- Technological Advancements: The integration of augmented reality (AR) and virtual reality (VR) technologies into e-sports has been a game-changer, enhancing the spectator experience and gameplay immersion. In 2024, over 10 million VR headsets were sold in North America, with a significant portion utilized for competitive gaming. The U.S. governments funding into research and development in the AR/VR space has amounted to over $1.5 billion, driving technological advancements that make these immersive experiences more accessible. This trend is pivotal in enhancing audience engagement in e-sports.

Market Challenges

- Lack of Standardized Regulations: One of the primary challenges in the North American e-sports market is the lack of standardized regulations across different states and countries. In the U.S., e-sports regulations vary significantly between states, leading to fragmented governance. The lack of cohesive regulatory frameworks complicates cross-border competitions and hinders large-scale tournament organization. Additionally, Canada has no federal regulatory body overseeing e-sports, creating uncertainties around legal compliance. This fragmentation impacts the growth and scalability of e-sports events.

- High Operational Costs for Tournament Hosting: Hosting large-scale e-sports tournaments involves substantial operational costs, including venue rentals, technology setup, and security measures. In 2023, the average cost of organizing a major e-sports event in North America exceeded $10 million, putting significant financial pressure on organizers. Furthermore, fluctuating costs associated with digital infrastructure, combined with rising labor expenses, have made it challenging for smaller organizations to host events. This creates a barrier to entry for potential new tournament hosts and limits the frequency of major competitions.

North America E-Sports Market Future Outlook

The North America E-Sports market is expected to see continuous growth driven by increasing investment in e-sports leagues, greater audience engagement through streaming platforms, and innovative content formats. The collaboration between traditional media companies and gaming firms will help expand the reach of e-sports to mainstream audiences. The rise of mobile e-sports in North America, particularly through casual gaming communities, will provide further opportunities for revenue generation, especially in advertising and sponsorships.

Future Market Opportunities

- Growth in Mobile E-Sports: Mobile gaming has become a significant segment of the e-sports market, with over 250 million mobile gamers in North America by 2023. As smartphone penetration reaches 89% of the U.S. population, mobile e-sports have witnessed a surge in participation. Mobile-based tournaments attract diverse audiences, particularly in underrepresented demographics. With improved mobile internet speeds, thanks to 5G rollout, mobile e-sports events have become more feasible and accessible, presenting a growing opportunity for e-sports expansion.

- Increased Investments from Media and Entertainment Firms: Media and entertainment firms have begun to invest heavily in e-sports, leveraging their platforms to broadcast tournaments and create original e-sports content. In 2023, entertainment companies invested over $1 billion in e-sports ventures, reflecting the increasing convergence of traditional media with digital gaming. Broadcasting rights for major e-sports events have become a valuable commodity, with platforms like ESPN and TBS signing multi-million-dollar deals to air tournaments. This trend presents significant opportunities for growth, as media firms help e-sports reach mainstream audiences.

Scope of the Report

|

Revenue Source |

Sponsorships Media Rights Advertising Ticket Sales Merchandising |

|

Platform Type |

PC Gaming Console Gaming Mobile Gaming |

|

Genre |

MOBA FPS Battle Royale Sports Simulation Fighting Games |

|

Audience Type |

Professional E-Sports Audience Casual Audience College and Amateur Players |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

E-Sports Organizations and Teams

Gaming Studios and Publishers

Streaming Platforms

Media and Broadcasting Companies

Sponsorship and Advertising Agencies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC, FTC)

Technology Providers (Gaming Hardware, VR/AR companies)

Companies

Major Players

Activision Blizzard

Riot Games

Valve Corporation

Electronic Arts (EA)

Microsoft Corporation

Epic Games

Twitch (Amazon)

YouTube Gaming (Google)

Facebook Gaming

ESL Gaming

DreamHack

TSM

Cloud9

Team Liquid

FaZe Clan

Table of Contents

North America E-Sports Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

North America E-Sports Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

North America E-Sports Market Analysis

3.1 Growth Drivers (Adoption rate, Audience Growth, Streaming Platforms Penetration)

3.1.1 Increasing Digital Infrastructure

3.1.2 Rise of Streaming Platforms and Influencers

3.1.3 Technological Advancements (AR, VR Integration)

3.1.4 Growing Sponsorship and Advertising Revenues

3.2 Market Challenges (Fragmentation, Regulatory Environment, Data Privacy Concerns)

3.2.1 Lack of Standardized Regulations

3.2.2 Cybersecurity and Cheating Issues

3.2.3 High Operational Costs for Tournament Hosting

3.3 Opportunities (Partnerships, Franchising, Cross-Industry Collaborations)

3.3.1 Growth in Mobile E-Sports

3.3.2 Expansion into Non-Endemic Markets

3.3.3 Increased Investments from Media and Entertainment Firms

3.4 Trends (Cloud Gaming, Cross-Platform Integration, Female Gamers Engagement)

3.4.1 Integration with Cloud Gaming Platforms

3.4.2 Rise of Collegiate E-Sports

3.4.3 Increasing Diversity in E-Sports Talent and Audience

3.5 Government Regulation (In-Game Transactions, Gambling Laws, Sponsorships)

3.5.1 Regional Compliance on Sponsorships and Partnerships

3.5.2 Regulatory Oversight on Prize Pools

3.5.3 Restrictions on Gambling and Betting in E-Sports

3.6 SWOT Analysis

3.7 Stake Ecosystem (Tournament Organizers, Streaming Platforms, Game Developers)

3.8 Porters Five Forces (Entry Barriers, Buyer Power, Threat of Substitutes)

3.9 Competition Ecosystem

North America E-Sports Market Segmentation

4.1 By Revenue Source (In Value %)

4.1.1 Sponsorships

4.1.2 Media Rights

4.1.3 Advertising

4.1.4 Ticket Sales

4.1.5 Merchandising

4.2 By Platform Type (In Value %)

4.2.1 PC Gaming

4.2.2 Console Gaming

4.2.3 Mobile Gaming

4.3 By Genre (In Value %)

4.3.1 MOBA (Multiplayer Online Battle Arena)

4.3.2 FPS (First-Person Shooter)

4.3.3 Battle Royale

4.3.4 Sports Simulation

4.3.5 Fighting Games

4.4 By Audience Type (In Value %)

4.4.1 Professional E-Sports Audience

4.4.2 Casual Audience

4.4.3 College and Amateur Players

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

North America E-Sports Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Activision Blizzard

5.1.2 Riot Games

5.1.3 Valve Corporation

5.1.4 Epic Games

5.1.5 Electronic Arts

5.1.6 Microsoft Corporation

5.1.7 Twitch (Amazon)

5.1.8 YouTube Gaming (Google)

5.1.9 Facebook Gaming

5.1.10 ESL Gaming

5.1.11 DreamHack

5.1.12 TSM

5.1.13 Cloud9

5.1.14 Team Liquid

5.1.15 FaZe Clan

5.2 Cross Comparison Parameters (Revenue, Active Players, Partnerships, Market Share, Content Monetization, Viewer Engagement, Sponsorship Deals, Streaming Platform Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

North America E-Sports Market Regulatory Framework

6.1 E-Sports Licensing

6.2 Compliance for Streaming and Broadcasting

6.3 Intellectual Property Laws in E-Sports

6.4 Data Privacy and Player Protection

North America E-Sports Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

North America E-Sports Future Market Segmentation

8.1 By Revenue Source (In Value %)

8.2 By Platform Type (In Value %)

8.3 By Genre (In Value %)

8.4 By Audience Type (In Value %)

8.5 By Region (In Value %)

North America E-Sports Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying the essential market variables influencing the North American E-Sports market, such as audience demographics, tournament revenues, and streaming platform penetration. This step is carried out using extensive desk research, drawing from both proprietary and secondary databases to ensure reliable data sources.

Step 2: Market Analysis and Construction

This step involves analyzing historical data, tracking e-sports tournament growth, media rights deals, and viewer engagement rates. The market structure is further assessed by examining sponsorship revenues, ticket sales for live events, and digital content consumption patterns on various streaming platforms.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from game publishers, e-sports organizations, and media platforms are engaged via in-depth interviews. Their insights on operational challenges and strategic initiatives help refine market estimates and growth trajectories, enhancing the accuracy of the overall market analysis.

Step 4: Research Synthesis and Final Output

This final phase consolidates primary and secondary research findings to develop a comprehensive market report. Detailed interactions with key market players enable us to validate data and projections, resulting in a final output that accurately captures the market's current and outlook.

Frequently Asked Questions

01. How big is the North America E-Sports Market?

The North America E-Sports market is currently valued at USD 670 million, driven by strong investments in gaming tournaments, streaming platforms, and sponsorships.

02. What are the major challenges in the North America E-Sports Market?

The major challenges in the North America E-Sports market include lack of standardized regulations, high operational costs for hosting large tournaments, and cybersecurity concerns related to online gaming platforms.

03. Who are the key players in the North America E-Sports Market?

Key players in the North America E-Sports market include Activision Blizzard, Riot Games, Valve Corporation, Microsoft Corporation, and Electronic Arts (EA), all of whom dominate through their game development and league operations.

04. What are the growth drivers for the North America E-Sports Market?

Growth drivers in the North America E-Sports market include the increasing popularity of streaming platforms like Twitch and YouTube Gaming, growing investment from non-endemic brands in sponsorship deals, and the rise of mobile e-sports.

05. How is mobile gaming contributing to the North America E-Sports Market?

Mobile gaming is gaining traction due to the rise of accessible and high-quality mobile games, engaging a more casual e-sports audience and offering new advertising and sponsorship opportunities in the North America E-Sports market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.