North America Edge Data Centers Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD2258

December 2024

89

About the Report

North America Edge Data Centers Market Overview

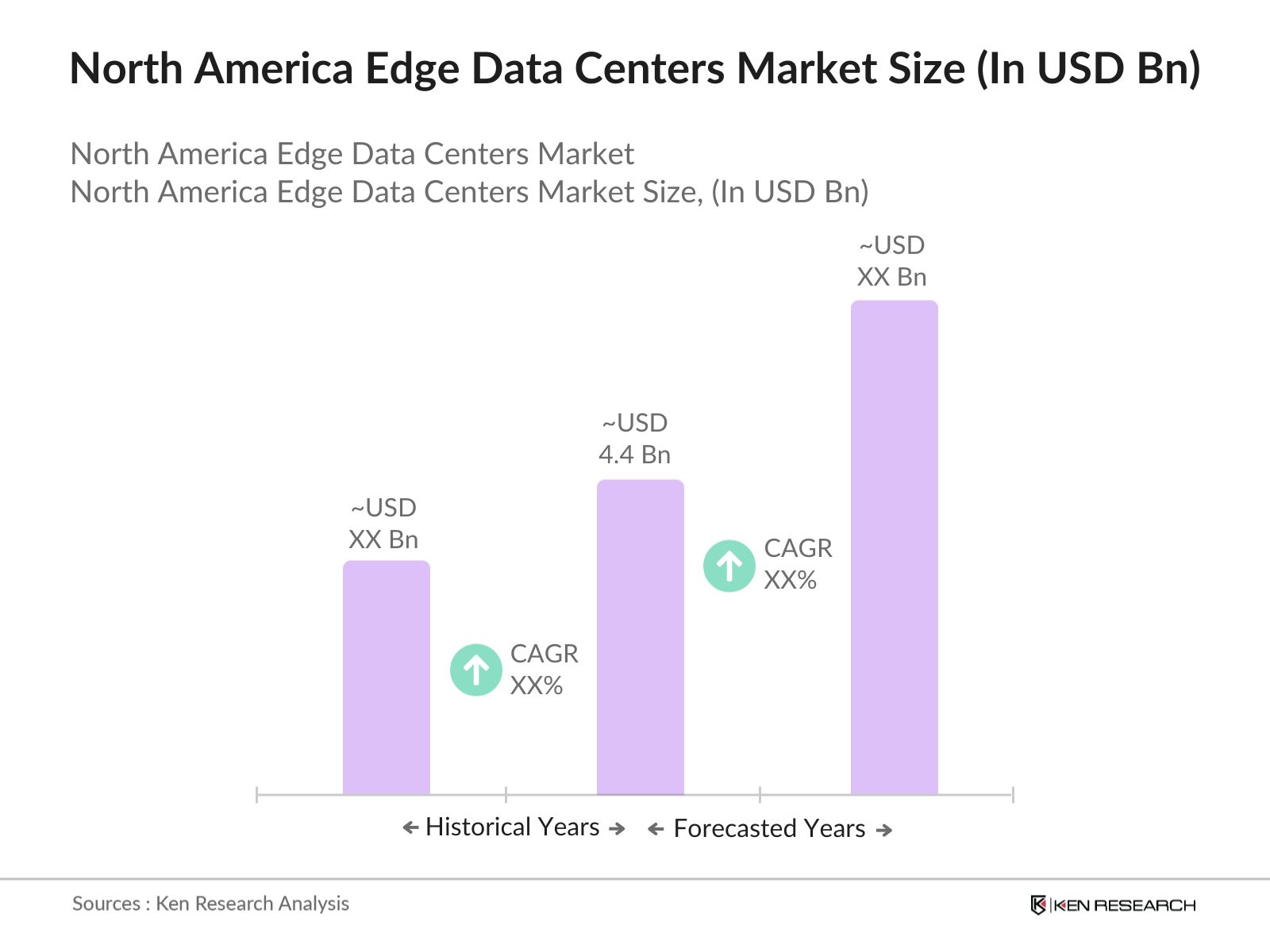

- The North America Edge Data Centers Market was valued at USD 4.4 billion. The market's growth is largely driven by the increasing demand for low-latency applications in areas such as content delivery, gaming, and autonomous vehicles. The shift to 5G networks and the growing need for processing data closer to its source are also key factors in driving the demand for edge data centers.

- The market features several prominent players, including Equinix, Digital Realty, EdgeConneX, Switch, and Flexential. These companies are investing heavily in expanding their data center footprints, focusing on edge locations to cater to industries requiring real-time data processing. They have established a strong presence in key regions across North America and continue to shape the competitive landscape.

- In July 2024, Digital Realty announced the acquisition of a data center campus in Slough, UK, for USD 200 million. The facility includes two data centers with a combined capacity of 15 megawatts, serving over 150 customers, including technology and financial firms. The campus will integrate with Digital Realtys existing Metro Connect solution and ServiceFabric platform, enhancing connectivity across Greater London.

- The cities like San Francisco, Dallas, and Chicago were dominating the market in 2023, driven by a high concentration of technology firms, cloud providers, and favorable infrastructure that supports real-time data processing. The robust 5G infrastructure and tech ecosystem make these cities pivotal to market growth.

North America Edge Data Centers Market Segmentation

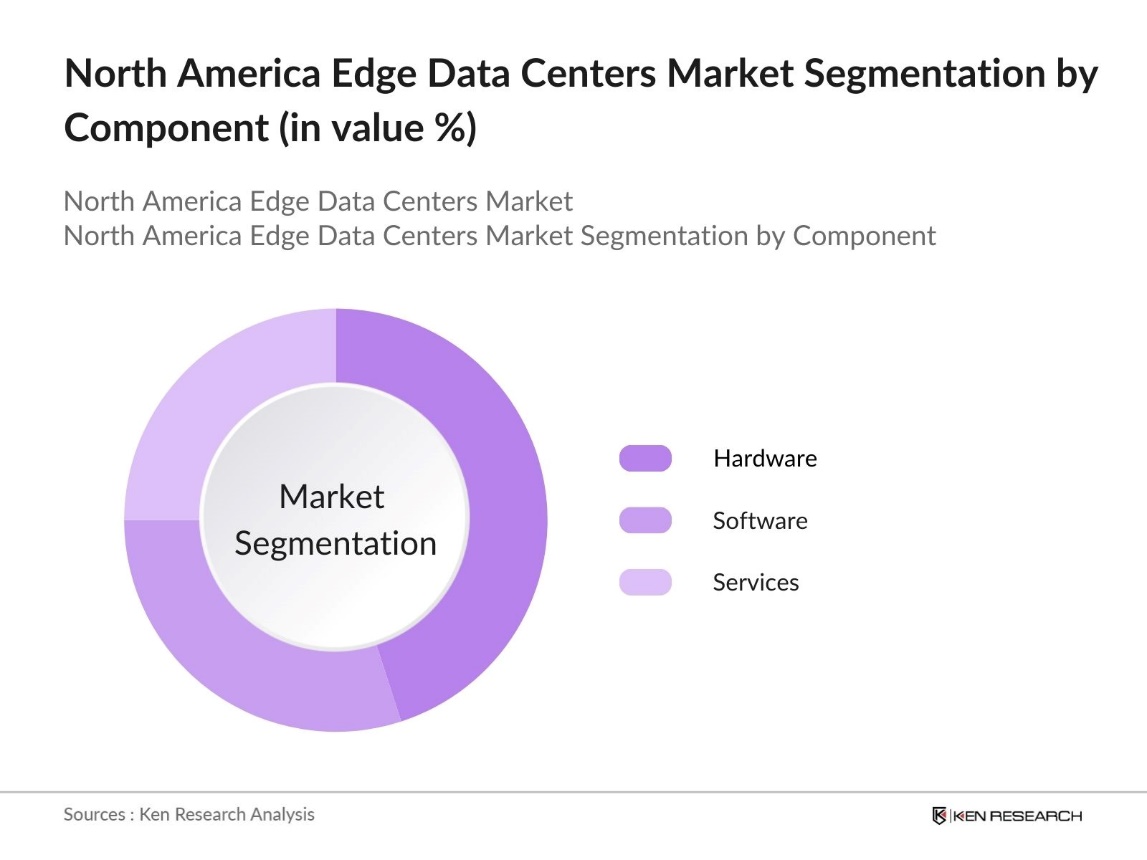

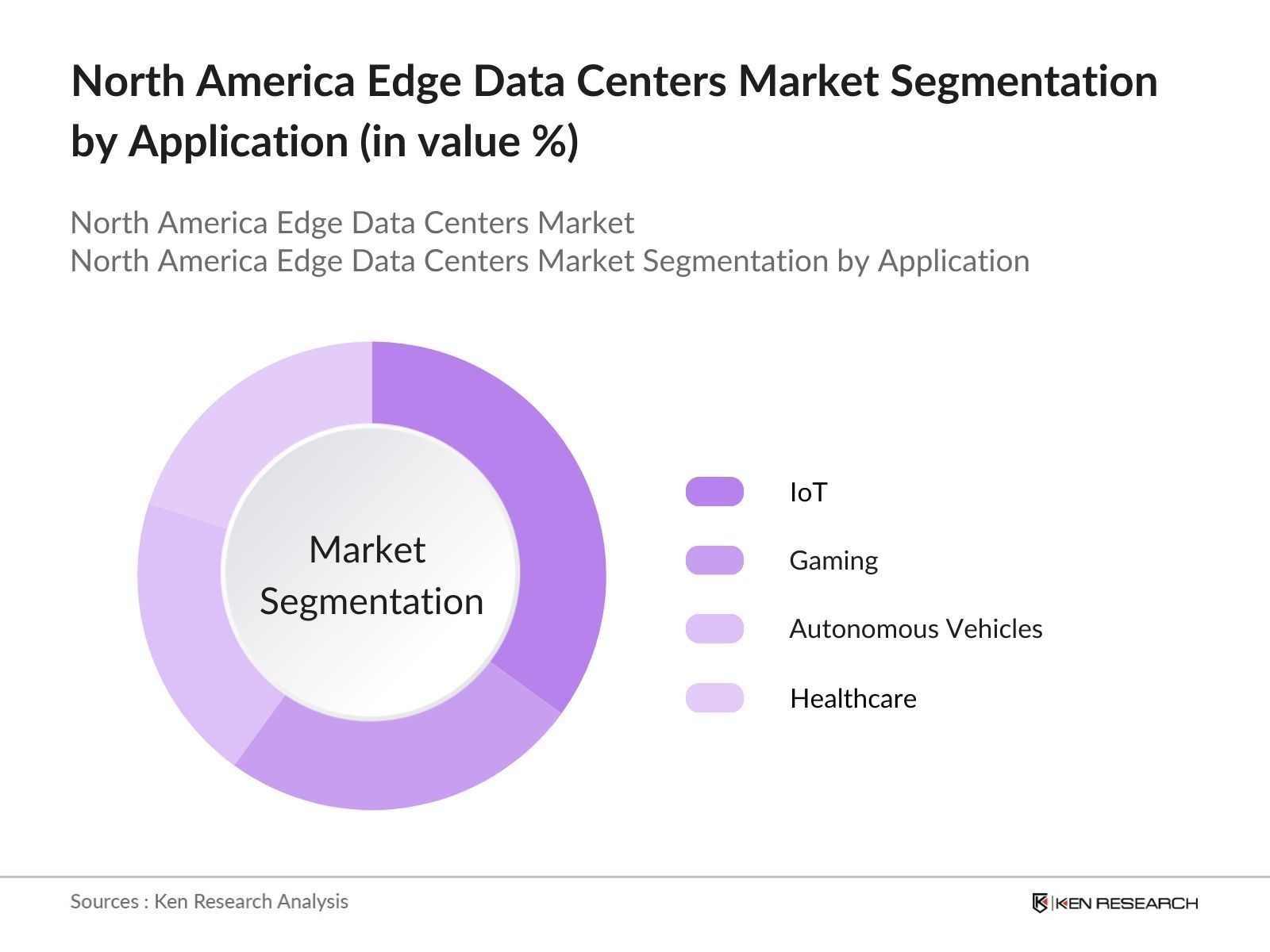

The North America Edge Data Centers Market is segmented into different factors like by component, by application and region.

By Component: The market is segmented by component into hardware, software, and services. In 2023, hardware accounted for a dominant market share, driven by the increasing demand for servers, storage, and networking equipment needed to establish edge facilities. This dominance is attributed to the high initial investments required to set up the physical infrastructure of edge data centers. The demand for specialized hardware that supports high-speed data processing closer to users has been a significant factor in the hardware segments growth.

By Application: The market is segmented by application into gaming, IoT, autonomous vehicles, and healthcare. In 2023, IoT held the largest market share, primarily driven by the increasing adoption of connected devices and sensors across various industries. The need for real-time data processing and storage solutions at the edge has been a key driver of growth in this segment. IoT applications in industries like manufacturing, retail, and logistics have created a significant demand for edge data centers to process data closer to the source.

By Region: The market is segmented by region into the United States and Canada. The United States dominated the market in 2023, owing to the strong presence of key industry players and advanced technological infrastructure. The countrys early adoption of edge computing technologies, supported by strong investment in 5G networks, has cemented its leading position in the market.

By Region: The market is segmented by region into the United States and Canada. The United States dominated the market in 2023, owing to the strong presence of key industry players and advanced technological infrastructure. The countrys early adoption of edge computing technologies, supported by strong investment in 5G networks, has cemented its leading position in the market.

North America Edge Data Centers Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Equinix |

1998 |

Redwood City, USA |

|

Digital Realty |

2004 |

San Francisco, USA |

|

EdgeConneX |

2013 |

Herndon, USA |

|

Switch |

2000 |

Las Vegas, USA |

|

Flexential |

1999 |

Charlotte, USA |

- EdgeConneX: In 2023, EdgeConneX recently secured $403.8 million in sustainability-linked financing to support its expansion in Asia, specifically focusing on a data center campus in Jakarta, Indonesia. This financing aligns with the company's sustainability goals, which include becoming carbon, waste, and water-neutral by 2030. The funds will help expand the Jakarta campus to 120MW, addressing growing demand for data center capacity driven by Indonesia's digital economy and supporting global cloud and IT infrastructure needs.

- Equinix: In February 2024, Equinix announced plans to expand its xScale hyperscale data centers into the U.S. for the first time. Previously limited to Europe and Asia, the xScale initiative supports the growing demand for hyperscale capacity from cloud providers and AI-driven workloads. The first U.S. facility will be located at the Silicon Valley campus. This expansion is part of a broader strategy to meet the rising demand for AI and cloud infrastructure, with future plans to significantly increase capacity across North America.

North America Edge Data Centers Market Analysis

Growth Drivers

- Adoption of 5G Networks and Edge Computing Expansion: The expansion of 5G networks in North America is driving the demand for edge data centers due to the need for low-latency data processing. Telecom operators are investing heavily, with projections suggesting around USD 380 billion will be spent on 5G infrastructure by 2025. This surge is leading companies to establish edge data centers closer to users, especially in major cities like New York, Dallas, and Los Angeles, to support the evolving telecommunications ecosystem.

- Increase in IoT Devices and Real-Time Processing Requirements: North America, with the highest density of IoT devices globally and 71.8% of homes having at least one device, is experiencing a data surge across industries like manufacturing, healthcare, and transportation. This necessitates edge data centers to manage local processing and storage. By minimizing latency and ensuring efficient data transmission, these centers are crucial for supporting IoT growth, especially in sectors where real-time insights are essential for operational efficiency.

- Rising Demand for Autonomous Vehicles: The automotive sector's shift toward autonomous vehicles (AVs) is significantly driving growth in the edge data center market. AVs require low-latency data processing for safe and efficient operation, making edge data centers essential. By processing data closer to the vehicle, these centers ensure minimal lag and faster decision-making. Companies like Tesla and Waymo are investing heavily in edge infrastructure to enhance their AV operations.

Challenges

- High Capital Investment for Edge Data Centers: The construction of edge data centers involves significant costs, making it a capital-intensive venture. This high investment threshold presents a challenge for smaller companies and new market entrants. The financial burden extends to maintaining and upgrading these facilities, especially as next-generation technologies such as AI and machine learning become integrated into the operations. This poses further financial challenges for market players.

- Limited Availability of Skilled Workforce: The demand for professionals with expertise in data center management, cloud infrastructure, and edge computing continues to outpace the available talent pool. The shortage of skilled workers, particularly in rural and underserved regions, results in operational inefficiencies and increased recruitment costs. This shortage impacts companies' ability to scale and manage their edge infrastructure effectively, creating a significant challenge for the industry.

Government Initiatives

- Canadian Digital Supercluster Program: In 2024, the Canadian government expanded its Digital Supercluster Program, providing over USD 298 million in funding for edge computing projects. This initiative supports the development of advanced data centers across major cities such as Toronto, Vancouver, and Montreal. The program is focused on driving innovation in industries like healthcare, smart cities, and manufacturing, where real-time data processing is critical.

- Enhancing Tax Relief for Individuals and Businesses: In Virginias 2023-2024 amended budget, a significant government initiative includes increasing the standard deduction for individual taxpayers and expanding deductions for businesses, such as the disallowed interest deductions under Section 163(j) of the Internal Revenue Code. This initiative is expected to save businesses millions in 2024 and ease tax burdens for individuals. The budget also reinstates the annual sales tax holiday and enhances benefits for veterans, boosting financial support for residents and businesses alike.

North America Edge Data Centers Market Future Outlook

The North America Edge Data Centers Market is projected to grow exponentially and driven by advancements in edge computing, 5G technology, and IoT deployment. The expansion of smart cities and autonomous technologies will also fuel the demand for edge data centers, as they enable faster data processing closer to the end user. This growth will be supported by continuous investments in infrastructure and technology by key players and governments in the region.

Future Market Trends

- Edge Data Centers Will Become Integral to Smart City Development: In the future the edge data centers will become crucial for smart city projects, providing real-time data processing for applications such as traffic control and public safety. As urban infrastructure evolves, integrating edge computing into city systems will enhance efficiency and operational management. This shift will support North American cities in modernizing their infrastructure and optimizing services, ensuring improved functionality and responsiveness in urban environments.

- Increased Adoption of AI and Machine Learning: The increasing adoption of AI and machine learning is set to drive significant expansion in edge data centers. Industries such as healthcare, finance, and retail will depend on edge computing to bolster real-time processing capabilities, enhancing performance and reducing latency in AI-driven applications. By bringing data processing closer to the source, edge data centers will play a crucial role in optimizing the efficiency and effectiveness of these advanced technologies.

Scope of the Report

|

By Component |

Hardware Software Services |

|

By Application |

IoT Gaming Autonomous Vehicles Healthcare |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecom Companies

Cloud service providers

Data center infrastructure

Manufacturing companies

Gaming companies

Media and entertainment firms

Banks and financial institutions

Government agencies (e.g., U.S. Department of Energy)

Investor and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Equinix

Digital Realty

EdgeConneX

Switch

Flexential

Cyxtera Technologies

QTS Realty Trust

Iron Mountain Data Centers

Cologix

H5 Data Centers

TierPoint

EdgeMicro

Vapor IO

Edgevana

DartPoints

Table of Contents

1. North America Edge Data Centers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Metrics (Drivers, Restraints, Opportunities)

1.4. Market Segmentation Overview

2. North America Edge Data Centers Market Size (in USD)

2.1. Historical Market Size (Financial metrics)

2.2. Current Market Size

2.3. Year-on-Year Growth Analysis

2.4. Key Developments and Milestones (Operational metrics)

3. North America Edge Data Centers Market Analysis

3.1. Growth Drivers

3.1.1. 5G Network Expansion

3.1.2. Rising Demand for IoT

3.1.3. Autonomous Vehicle Deployment

3.1.4. Smart City Projects Integration

3.2. Restraints

3.2.1. High Capital Investment

3.2.2. Lack of Skilled Workforce

3.2.3. Complex Regulatory Environment

3.2.4. Environmental Sustainability Concerns

3.3. Opportunities

3.3.1. Cloud Migration and Hybrid Computing

3.3.2. Investment in Energy-efficient Solutions

3.3.3. Rural and Underserved Area Development

3.3.4. Partnerships with Telecom Providers

3.4. Trends

3.4.1. AI and Machine Learning Adoption

3.4.2. Colocation and Hyperscale Data Centers Growth

3.4.3. Edge Computing in Smart Cities

3.4.4. Renewable Energy in Data Centers

4. Government Initiatives (North America)

4.1. U.S. Federal and State Initiatives

4.1.1. Smart Infrastructure Projects

4.1.2. Tax Incentives for Data Center Development

4.2. Canadian Government Support

4.2.1. Digital Supercluster Program

4.2.2. Energy-efficient Data Center Grants

5. North America Edge Data Centers Market Segmentation

5.1. By Component (Financial Metrics)

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. By Application (Operational Metrics)

5.2.1. IoT

5.2.2. Gaming

5.2.3. Autonomous Vehicles

5.2.4. Healthcare

5.3. By Enterprise Size (Financial Metrics)

5.3.1. Large Enterprises

5.3.2. SMEs

5.4. By Location

5.4.1. Urban

5.4.2. Suburban

5.4.3. Rural

5.5. By Region

5.5.1. United States

5.5.2. Canada

6. North America Edge Data Centers Market Competitive Landscape

6.1. Market Share Analysis (Financial and Operational Metrics)

6.2. Key Players Overview

6.2.1. Equinix

6.2.2. Digital Realty

6.2.3. EdgeConneX

6.2.4. Switch

6.2.5. Flexential

6.3. Strategic Initiatives

6.3.1. Mergers and Acquisitions

6.3.2. New Facility Investments

6.3.3. Technological Innovation

6.4. Cross Comparison (Revenue, Number of Employees, Operational Locations)

7. North America Edge Data Centers Market Regulatory Framework

7.1. Data Privacy and Security Regulations

7.2. Energy Efficiency Standards

7.3. Certification Processes for Data Centers

7.4. Environmental Compliance

8. Future Market Size and Projections (North America Edge Data Centers)

8.1. Future Growth Estimates

8.2. Factors Driving Future Market Growth

8.3. Market Forecast Scenarios (Operational Metrics)

9. North America Edge Data Centers Market Future Trends

9.1. By Component

9.2. By Application

9.3. By Location

9.4. By Enterprise Size

9.5. By Region

10. Analyst Recommendations

10.1. Total Addressable Market (TAM) and Serviceable Market

10.2. Key Investment Areas

10.3. Strategic Partnerships Recommendations

10.4. Regional Expansion Opportunities

11. Cross Comparison: Competitor Analysis

11.1. Detailed Profiles of Major Companies

11.1.1. Equinix

11.1.2. Digital Realty

11.1.3. EdgeConneX

11.1.4. Switch

11.1.5. Flexential

11.1.6. Cyxtera Technologies

11.1.7. QTS Realty Trust

11.1.8. Iron Mountain Data Centers

11.1.9. Cologix

11.1.10. TierPoint

11.1.11. EdgeMicro

11.1.12. Vapor IO

11.1.13. Edgevana

11.1.14. DartPoints

11.1.15. H5 Data Centers

Contact US

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on North America Edge Data Centers Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Edge Data Centers Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple technology companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from technology companies.

Frequently Asked Questions

01 How big is the North America Edge Data Centers Market?

The North America Edge Data Centers Market was valued at USD 4.4 billion, driven by demand for low-latency applications in content delivery, gaming, and autonomous vehicles.

02 What are the challenges in the North America Edge Data Centers Market?

Challenges in North America Edge Data Centers Market include high capital investment for construction and maintenance, a shortage of skilled workforce, regulatory hurdles, and environmental sustainability concerns related to energy consumption.

03 Who are the major players in the North America Edge Data Centers Market?

Key players in North America Edge Data Centers Market include Equinix, Digital Realty, EdgeConneX, Switch, and Flexential, which lead through their investments in edge locations and real-time data processing solutions.

04 What are the growth drivers of the North America Edge Data Centers Market?

Key growth in North America Edge Data Centers Market drivers include the expansion of 5G networks, increased IoT adoption, rising demand for autonomous vehicles, and the integration of edge computing in smart city projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.