North America Educational Toys Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD5272

December 2024

88

About the Report

North America Educational Toys Market Overview

- The North America Educational Toys Market is valued at USD 23.51 billion, driven primarily by increasing awareness of the importance of early childhood education and growing investments by parents in educational tools that promote learning through play. This growth is supported by advancements in technology, including AI and AR, integrated into educational toys, which enhance interactive learning. The demand for STEM toys has also surged due to their effectiveness in teaching foundational skills in science, technology, engineering, and mathematics. The market has seen robust expansion, especially in metropolitan areas, where high disposable incomes allow parents to invest more in educational toys.

- The United States remains the dominant country in the North America educational toys market, largely due to its extensive consumer base, high awareness of the benefits of early learning, and strong purchasing power. Cities like New York, Los Angeles, and Chicago play a crucial role in market growth, driven by a robust retail infrastructure and widespread adoption of e-commerce platforms. Moreover, government initiatives aimed at promoting STEM education have further solidified the U.S. as a market leader. Canada also contributes significantly, with its increasing focus on educational toys as a tool for learning and cognitive development.

- The Government of Canada, in partnership with New Brunswick, announced a three-year Early Learning and Child Care Action Plan. The plan aims to create affordable, high-quality child care, with a goal of achieving $10-a-day child care by March 2026. The initiative includes $426 million in funding for affordability, access (creating 3,400 new child care spots), and quality through educator wage support and training. It also focuses on inclusivity, targeting rural and underserved communities and enhancing accessibility for Indigenous and vulnerable groups.

North America Educational Toys Market Segmentation

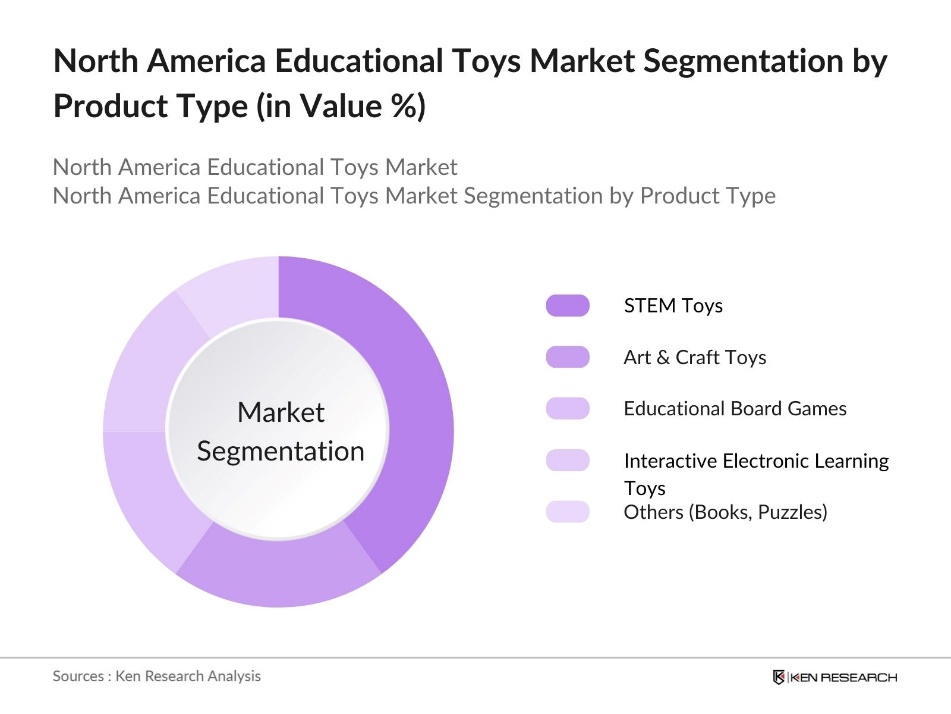

By Product Type: The North America educational toys market is segmented by product type into STEM toys, art & craft toys, educational board games, interactive electronic learning toys, and others (books, puzzles). Among these, STEM toys hold the dominant market share in North America due to the increasing focus on promoting science, technology, engineering, and mathematics skills among children. Parents and educators view STEM toys as an effective way to enhance critical thinking and problem-solving abilities in young learners, fostering a lifelong interest in these fields. The integration of coding kits and robotics into educational toys has further driven the growth of this sub-segment, making STEM toys the most sought-after category in the region.

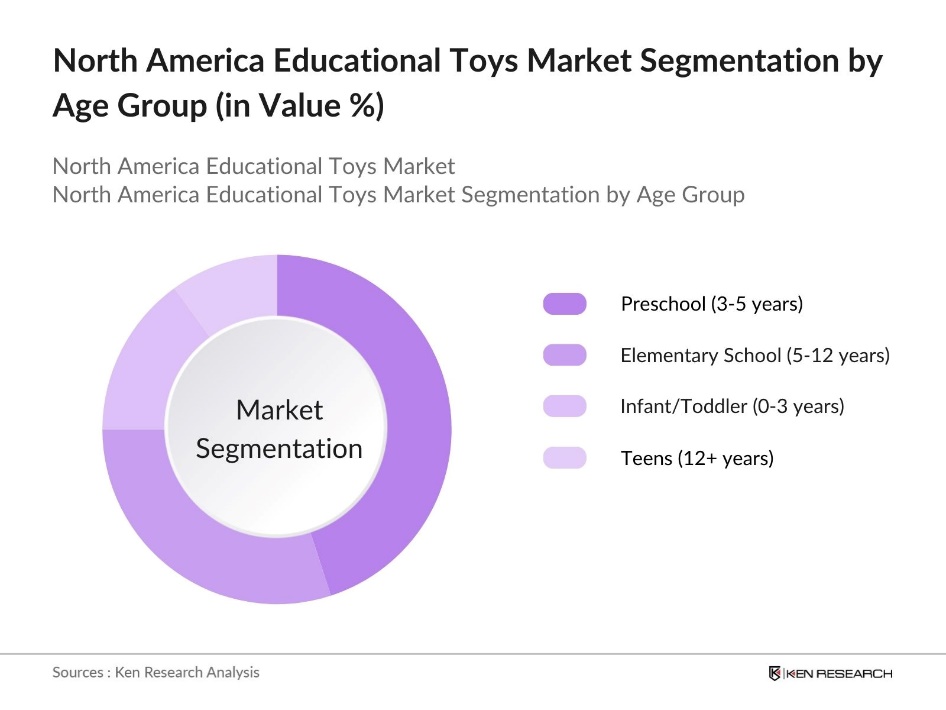

By Age Group: The North America educational toys market is segmented by age group into infant/toddler (0-3 years), preschool (3-5 years), elementary school (5-12 years), and teens (12+ years). Among these, the preschool segment dominates the market, capturing the largest share due to the critical role early education plays in cognitive and social development. Preschoolers are at an ideal age for learning through play, and educational toys that focus on developing motor skills, language, and numeracy are particularly popular. Parents are keen to invest in toys that aid in these early stages of development, making this segment highly lucrative.

North America Educational Toys Market Competitive Landscape

The market is dominated by a mix of global and regional players. These companies have established themselves as key players due to their strong product portfolios, distribution networks, and continued innovation in educational toy design. Companies are focusing on enhancing product offerings through technological integration, increasing investments in R&D, and expanding into new geographical markets.

|

Company |

Year Established |

Headquarters |

Product Portfolio |

R&D Investment |

Geographic Reach |

Sustainability Efforts |

Digital Integration |

Brand Loyalty |

Partnerships |

|

LEGO Group |

1932 |

Billund, Denmark |

|||||||

|

VTech Holdings Ltd. |

1976 |

Hong Kong |

|||||||

|

LeapFrog Enterprises |

1995 |

Emeryville, USA |

|||||||

|

Melissa & Doug |

1988 |

Wilton, USA |

|||||||

|

Spin Master Corp. |

1994 |

Toronto, Canada |

North America Educational Toys Industry Analysis

Growth Drivers

- Rising Disposable Income: Rising disposable incomes in North America have led to increased spending on educational products, including toys. U.S. household disposable income reached an average of $56,492 per capita in 2022, rise from previous years, as reported by the Bureau of Economic Analysis. This increase in disposable income has also facilitated a rise in the demand for technologically advanced toys, further driving market growth.

- Increasing Focus on Early Childhood Development: Governments across North America are investing heavily in early childhood development programs, which has spurred demand for educational toys. The Canadian government has made a transformative commitment of approximately CAD 30 billion over five years to support early learning and child care, with significant investments already flowing to provinces and territories since the introduction of the Canada-Wide Early Learning and Child Care (CWELCC) initiative.

- Technological Advancements: Technological advancements have significantly transformed educational toys by integrating artificial intelligence (AI) and augmented reality (AR), offering enhanced and interactive learning experiences for children. AI-powered toys can adapt to a child's learning pace and provide personalized educational content, while AR-based toys blend the physical and digital worlds, making learning more engaging. These innovations have been widely adopted across North America, where many educational toys now feature AI and AR components.

Market Challenges

- High Manufacturing Costs: The educational toy market in North America faces the challenge of high manufacturing costs, primarily due to the rising prices of raw materials and technological components. The production of technologically advanced toys requires significant investment in materials such as plastics, electronics, and specialized components, which has driven up overall production costs. These increasing costs are further impacted by high labor expenses, making it difficult for manufacturers to maintain profitability. As a result, companies are continually reevaluating their pricing strategies and production processes to manage costs while staying competitive in the market.

- Stringent Safety Regulations: Stringent safety regulations in North America have created challenges for educational toy manufacturers, as they must comply with rigorous government standards. Laws such as the Consumer Product Safety Improvement Act (CPSIA) require toys to meet specific safety requirements, including material testing and labeling. Adhering to these regulations involves significant investment in testing and compliance, which raises the cost of production. While these measures are crucial for ensuring child safety, they add financial pressure on manufacturers and can sometimes lead to delays in product development and market entry.

North America Educational Toys Market Future Outlook

Over the next five years, the North America educational toys market is expected to experience significant growth, driven by technological advancements, evolving consumer preferences, and increased investment in education-focused tools. The integration of augmented reality (AR) and artificial intelligence (AI) into educational toys is poised to reshape the learning experience for children, offering personalized and immersive learning environments. Additionally, rising awareness among parents and educators regarding the benefits of early education and play-based learning will continue to drive demand for innovative educational toys.

Market Opportunities

- Growth in E-commerce Platforms for Toy Sales: E-commerce platforms present substantial growth opportunities for the educational toy market, offering a convenient and diverse shopping experience for consumers. The rise in internet usage and the increasing adoption of digital payment methods have made online shopping more accessible for parents and educators seeking educational toys. Major e-commerce platforms provide a broad range of products, allowing customers to easily compare options and find toys tailored to specific learning objectives.

- Expansion into Developing Markets: Collaborations between educational toy manufacturers and schools offer a promising opportunity for market expansion. By partnering with educational institutions, toy companies can directly integrate their products into the classroom, enhancing the learning experience for students. These partnerships provide manufacturers with a consistent and reliable customer base, as schools seek to adopt toys that support early childhood development and STEM education.

Scope of the Report

|

Product Type |

STEM Toys, Art & Craft Toys, Educational Board Games Interactive Electronic Learning Toys Others |

|

Age Group |

Infant/Toddler (0-3 Years) Preschool (3-5 Years) Elementary School (5-12 Years) Teens (12+ Years) |

|

Distribution Channel |

E-commerce Specialty Stores Supermarkets/Hypermarkets Others |

|

Material Type |

Plastic Wood Others |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Toy Manufacturers

E-commerce Platforms

Manufacturers of Toy Packaging

Investor and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., U.S. Consumer Product Safety Commission)

Companies

Players Mentioned in the Report

LEGO Group

VTech Holdings Ltd.

LeapFrog Enterprises

Melissa & Doug

Spin Master Corp.

Ravensburger

Fat Brain Toys

Fisher-Price

MindWare

Goliath Games

EduScience

Clementoni

Hasbro Inc.

Mattel Inc.

Learning Resources

Table of Contents

1. North America Educational Toys Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (In Value and Units)

1.4. Market Segmentation Overview

2. North America Educational Toys Market Size (In USD Mn)

2.1. Historical Market Size (In Value and Units)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. Impact of COVID-19 on the Market

3. North America Educational Toys Market Analysis

3.1. Growth Drivers

3.1.1. Rise in STEM Education (STEM Toy Adoption Rates)

3.1.2. Increasing Focus on Early Childhood Development (Government and Parent Initiatives)

3.1.3. Rising Disposable Income (Household Spending on Education-Related Products)

3.1.4. Technological Advancements (Integration of AI and AR in Educational Toys)

3.2. Market Challenges

3.2.1. High Manufacturing Costs (Raw Material and Technological Components)

3.2.2. Stringent Safety Regulations (Government Compliance Standards)

3.2.3. Low Awareness in Underdeveloped Regions

3.2.4. Competition from Digital Learning Tools

3.3. Opportunities

3.3.1. Growth in E-commerce Platforms for Toy Sales

3.3.2. Expansion into Developing Markets (Partnerships with Schools)

3.3.3. Customization and Personalized Learning Toys (Tailored Educational Content)

3.4. Trends

3.4.1. Increase in Subscription-Based Models for Educational Toys

3.4.2. Sustainability Trends (Eco-Friendly Educational Toys)

3.4.3. Edutainment Toys (Combining Entertainment with Education)

3.5. Government Regulations

3.5.1. Regulatory Standards for Toy Safety (ASTM Standards and CPSIA)

3.5.2. Government Initiatives Supporting Early Childhood Education

3.5.3. Import and Export Regulations for Educational Toys (Tariffs, Trade Agreements)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Retailers, Distributors, Parents, Educators)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Market Fragmentation, Leading vs Emerging Players)

4. North America Educational Toys Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. STEM Toys

4.1.2. Art & Craft Toys

4.1.3. Educational Board Games

4.1.4. Interactive Electronic Learning Toys

4.1.5. Others (Books, Puzzles)

4.2. By Age Group (In Value %)

4.2.1. Infant/Toddler (0-3 Years)

4.2.2. Preschool (3-5 Years)

4.2.3. Elementary School (5-12 Years)

4.2.4. Teens (12+ Years)

4.3. By Distribution Channel (In Value %)

4.3.1. E-commerce

4.3.2. Specialty Stores

4.3.3. Supermarkets/Hypermarkets

4.3.4. Others (Pop-up Stores, Exhibitions)

4.4. By Material Type (In Value %)

4.4.1. Plastic

4.4.2. Wood

4.4.3. Others (Paper, Fabric)

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Educational Toys Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. LEGO Group

5.1.2. Mattel Inc.

5.1.3. Hasbro Inc.

5.1.4. VTech Holdings Ltd.

5.1.5. LeapFrog Enterprises

5.1.6. Melissa & Doug

5.1.7. Learning Resources

5.1.8. Fat Brain Toys

5.1.9. Spin Master Corp.

5.1.10. MindWare

5.1.11. Goliath Games

5.1.12. Ravensburger

5.1.13. Fisher-Price

5.1.14. EduScience

5.1.15. Clementoni

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Investments, Geographical Reach, Pricing Strategies, Sales Channels, Target Demographics, Brand Recognition)

5.3. Market Share Analysis (Major Competitors by Market Share %)

5.4. Strategic Initiatives (Collaborations, New Product Launches, Market Expansion)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Funding, Investments in R&D)

5.7. Venture Capital Funding (Education & Tech Startups)

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. North America Educational Toys Market Regulatory Framework

6.1. Compliance Standards for Toy Safety (ASTM, CPSC, CE Mark)

6.2. Certification Processes (ISO 8124, EN 71)

6.3. Licensing and IP Protection (Patents and Trademarks for Toy Designs)

6.4. Import and Export Regulations (Customs and Duties on Toys)

7. North America Educational Toys Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological Innovation, Educational Focus, Parent Spending)

8. North America Educational Toys Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. North America Educational Toys Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total, Serviceable, and Obtainable Market)

9.2. Customer Cohort Analysis (Demographics of Key Buyers: Parents, Schools, Educators)

9.3. Marketing Initiatives (Brand Positioning, Partnerships with Educators, E-commerce Focus)

9.4. White Space Opportunity Analysis (Emerging Product Categories, Geographic Expansion)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process began by mapping the educational toys market ecosystem, identifying key stakeholders such as manufacturers, retailers, and government bodies. We performed in-depth desk research using credible databases to gather industry-level information on key variables such as product trends, consumer preferences, and technological advancements in educational toys.

Step 2: Market Analysis and Construction

In this phase, historical data on market size, growth rates, and sales performance of educational toys were compiled and analyzed. We assessed the penetration of e-commerce platforms, trends in consumer spending on education-related products, and the impact of technological innovations like AR and AI on the learning experience.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses were tested through consultations with industry experts, including toy manufacturers, distributors, and child development specialists. These consultations provided insights into operational challenges, competitive dynamics, and emerging trends, which helped refine our analysis.

Step 4: Research Synthesis and Final Output

Finally, we synthesized all research data and expert insights into a comprehensive report, validated through primary interviews with key industry stakeholders. This process ensured accuracy and reliability in the market projections and strategic recommendations provided.

Frequently Asked Questions

01 How big is the North America Educational Toys Market?

The North America Educational Toys Market is valued at USD 23.51 billion. This valuation is driven by increased awareness of early education and advancements in technology such as augmented reality and artificial intelligence, which have made educational toys more interactive.

02. What are the challenges in the North America Educational Toys Market?

Challenges in North America Educational Toys Market include high manufacturing costs due to advanced technology integration, stringent safety regulations, and the growing competition from digital learning tools that may offer alternatives to traditional educational toys.

03. Who are the major players in the North America Educational Toys Market?

Major players in North America Educational Toys Market include LEGO Group, VTech Holdings Ltd., LeapFrog Enterprises, Melissa & Doug, and Spin Master Corp., each of which has a strong presence due to their innovation, brand loyalty, and extensive distribution networks.

04. What are the growth drivers of the North America Educational Toys Market?

Key growth drivers in North America Educational Toys Market include the increasing focus on STEM education, rising disposable incomes, and the growing awareness of the benefits of early childhood development through play-based learning. Technological advancements such as AI and AR integration also drive market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.