North America Electric Trucks Market Outlook to 2030

Region:North America

Author(s):Mukul

Product Code:KROD1841

December 2024

80

About the Report

North America Electric Trucks Market Overview

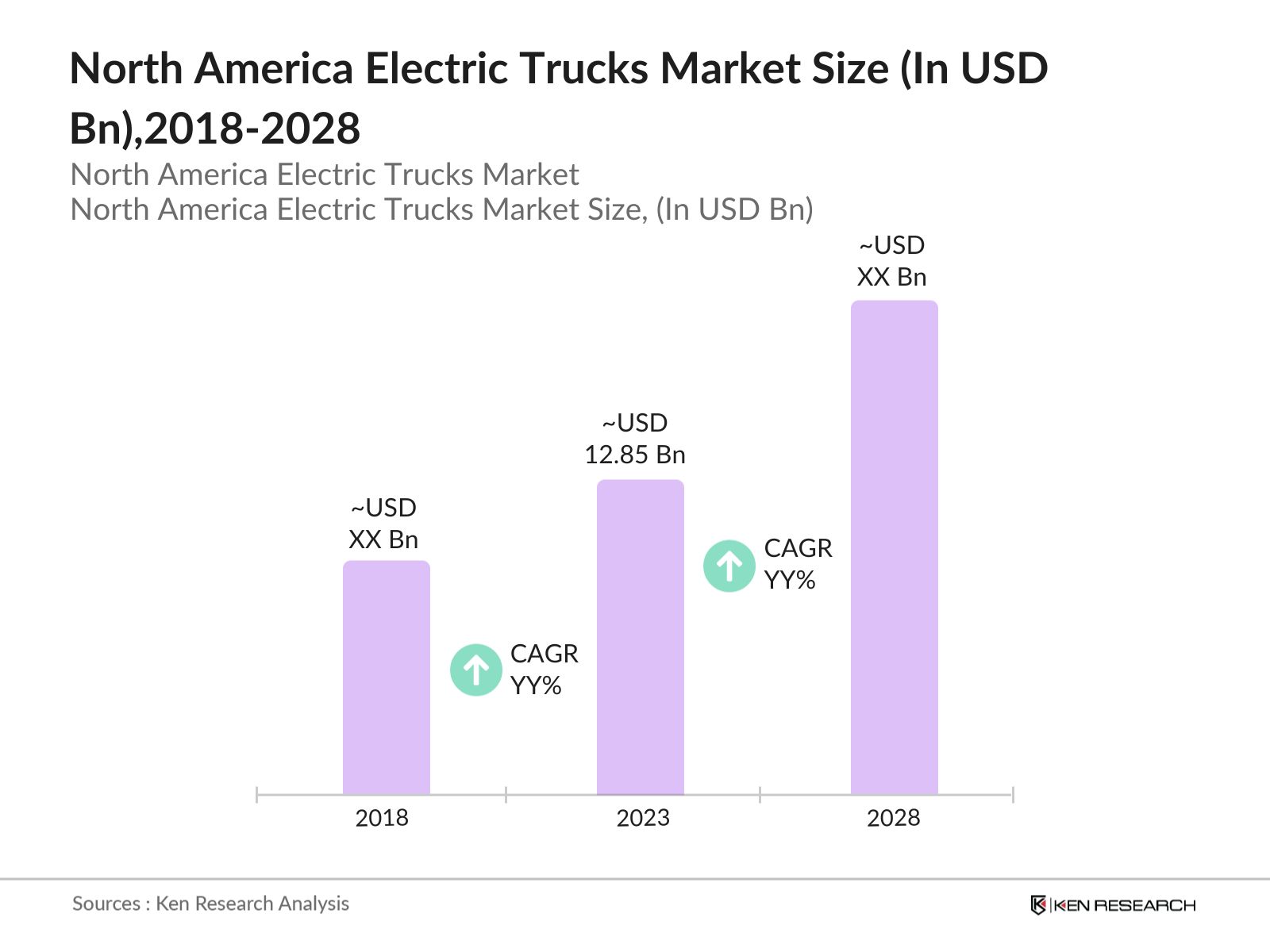

- The North America Electric Trucks market is estimated to have reached a market size of approximately USD 12.85 billion in 2023. This growth is primarily driven by increasing demand for environmentally friendly transportation solutions, stringent government regulations on emissions, and rising fuel costs. The adoption of electric trucks is further bolstered by advancements in battery technology, which have led to improved range and reduced charging times, making electric trucks a viable alternative to traditional diesel-powered vehicles.

- Key players in the North America Electric Trucks market include Tesla, Rivian, Daimler Trucks North America, Nikola Corporation, and Ford Motor Company. These companies lead the market due to their strong technological capabilities, extensive service networks, and substantial investments in research and development. Their continuous innovation in electric truck technologies, particularly in battery efficiency and autonomous driving features, helps them maintain a competitive edge in the market.

- Cities like Los Angeles, California, and New York City, New York, dominate the electric trucks market in North America due to their large urban populations and stringent emissions regulations. Los Angeless market leadership is driven by the citys aggressive clean energy goals and substantial investments in EV infrastructure. New York Citys dominance stems from its robust commitment to reducing vehicular emissions through the adoption of electric trucks for municipal and commercial use.

- In 2024, Tesla aimed to ramp up production of its electric Semi truck, with plans to significantly increase output to meet growing demand. However, mass production is now targeted for late 2025, with deliveries to external customers starting in 2026. Tesla is expanding its Megacharger network to support the Semi's adoption in the logistics sector.

North America Electric Trucks Market Segmentation

The North America Electric Trucks Market is divided into the following segments:

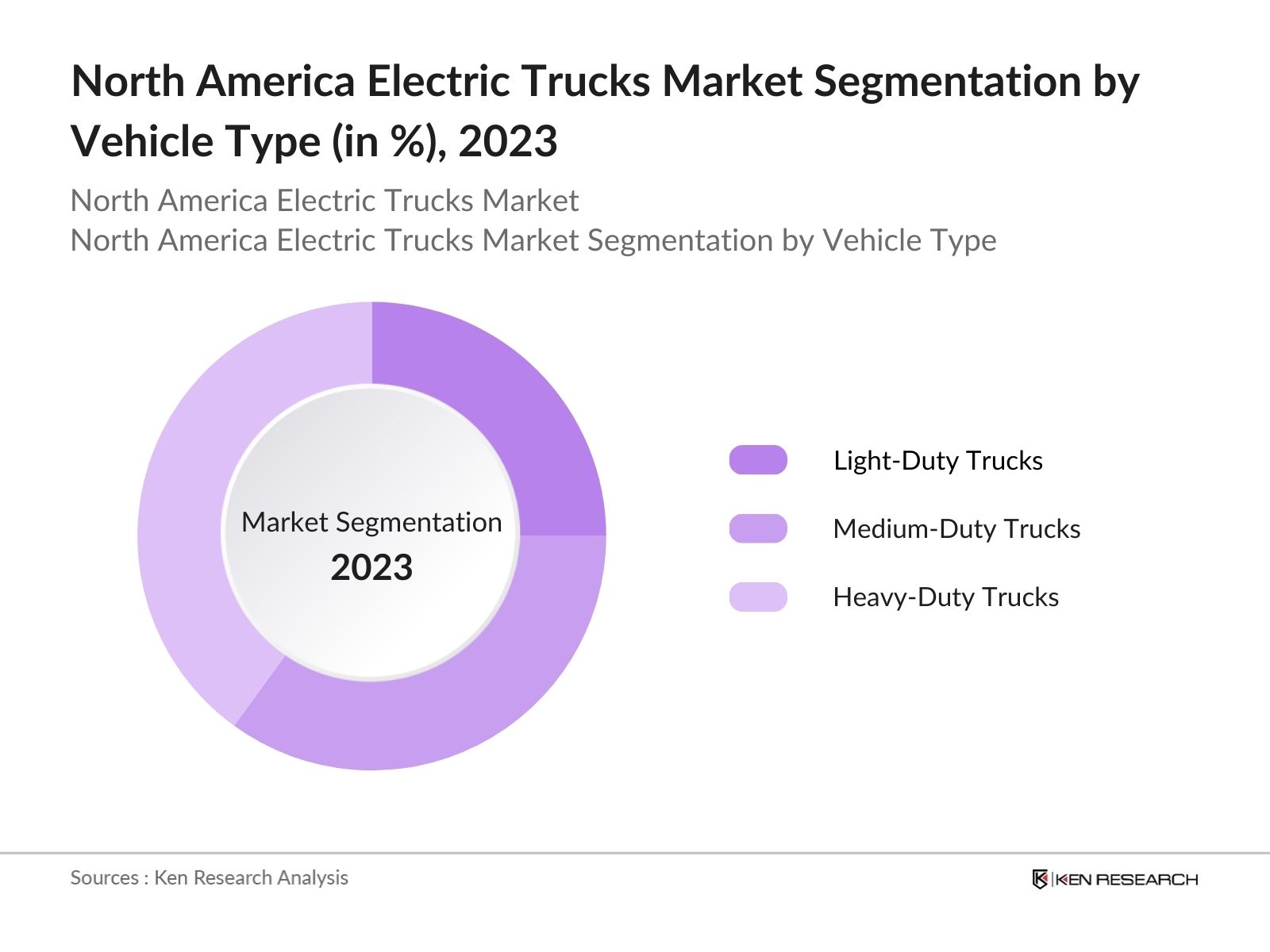

- By Vehicle Type: The North America Electric Trucks market is segmented by vehicle type into Light-Duty Trucks, Medium-Duty Trucks, and Heavy-Duty Trucks. In 2023, Heavy-Duty Trucks dominated the market due to their extensive use in long-haul transportation and the availability of high-capacity batteries. Companies like Nikola Corporation are focusing on developing electric trucks with advanced fuel cell technology, making them ideal for heavy-duty applications.

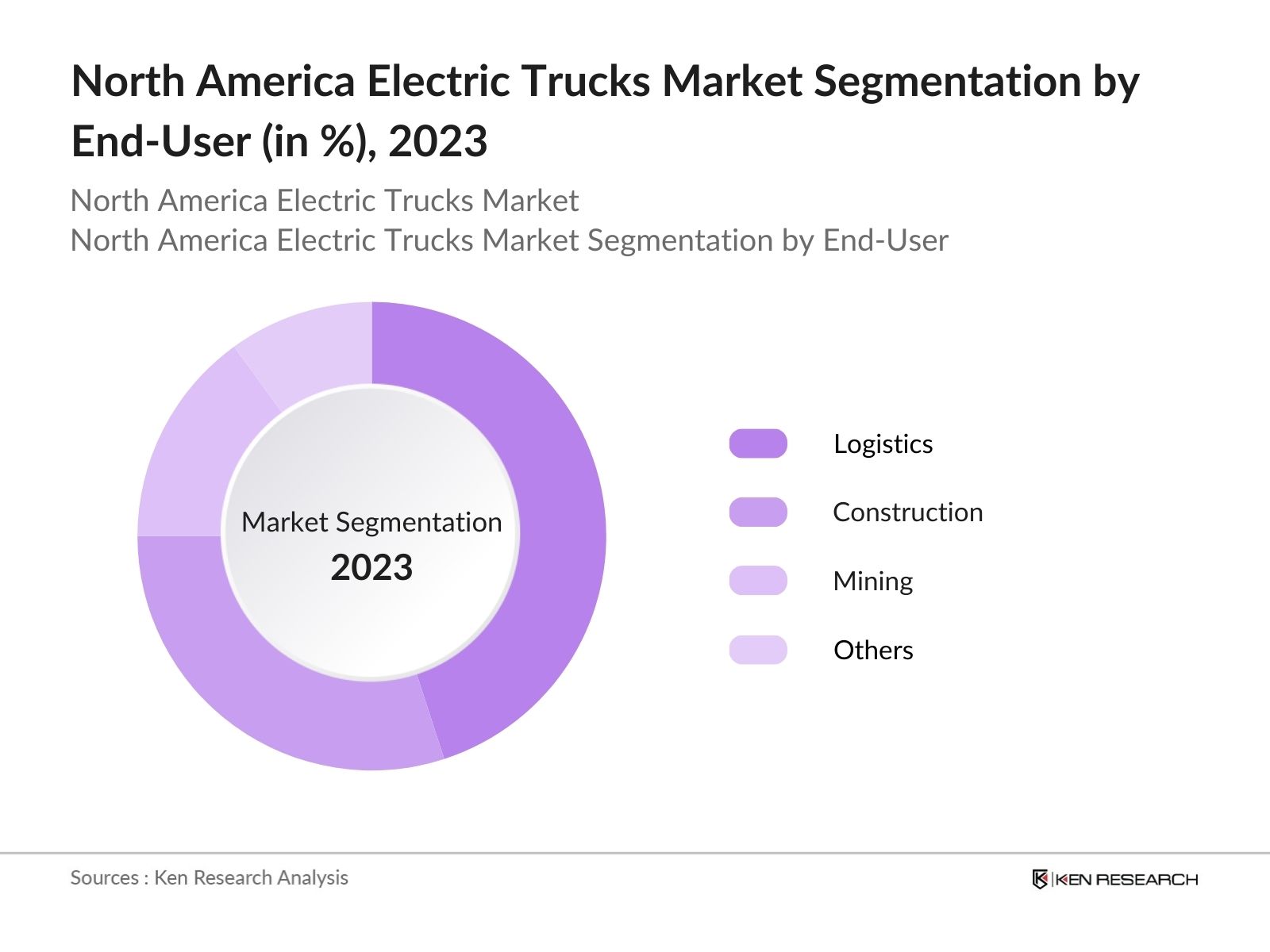

- By End-User: The North America Electric Trucks Market is segmented by end-user into Logistics, Construction, Mining, and Others. In 2023, the Logistics dominated the market due to the growing demand for last-mile delivery services and the push towards green logistics solutions. Companies such as Amazon and UPS have made significant investments in electric trucks to reduce their carbon footprints and meet sustainability targets.

- By Region: The North America Electric Trucks Market is segmented by region into the USA and Canada. In 2023, the USA dominated the market due to its larger market size, greater availability of charging infrastructure, and more aggressive government policies promoting electric vehicle adoption. The U.S. market is characterized by high investments in electric truck manufacturing and supportive policies that encourage fleet operators to transition to electric vehicles.

North America Electric Trucks Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Tesla, Inc. |

2003 |

Palo Alto, California, USA |

|

Rivian Automotive, LLC |

2009 |

Irvine, California, USA |

|

Daimler Trucks North America LLC |

2008 |

Portland, Oregon, USA |

|

Nikola Corporation |

2015 |

Phoenix, Arizona, USA |

|

Ford Motor Company |

1903 |

Dearborn, Michigan, USA |

- Rivian Automotive, LLC: In 2024, Rivian secured a significant contract with Amazon to supply additional electric delivery trucks, expanding their partnership. This deal aims to enhance Rivian's production capacity, supported by a new manufacturing facility in Georgia. Rivian's focus on electric trucks for last-mile delivery positions it strongly in the growing logistics sector, catering to rising demand for sustainable delivery solutions.

- Daimler Trucks North America LLC: In 2023, Daimler Trucks North America announced a significant order for 2,000 Freightliner eCascadia electric trucks from Walmart, supporting the retailer's goal of achieving zero emissions across its global supply chain by 2040. This order highlights Daimler's leadership in the heavy-duty electric truck segment and reflects the growing demand for sustainable logistics solutions.

North America Electric Trucks Industry Analysis

North America Electric Trucks Market Growth Drivers

- Expansion of Charging Infrastructure:

The North American electric truck market is heavily driven by the rapid expansion of charging infrastructure. The U.S. government, under the National Electric Vehicle Infrastructure (NEVI) program, aims to install 500,000 public EV chargers by 2024, significantly boosting the viability of electric trucks for long-haul operations. The availability of fast-charging stations, especially along major highways, will alleviate range anxiety and encourage fleet operators to adopt electric trucks for their operations. - Corporate Sustainability Initiatives: The adoption of electric trucks is driven by corporate sustainability initiatives, with large logistics companies like Amazon, UPS, and FedEx committing to electrify their fleets. Amazon's order of 15,000 electric delivery trucks from Rivian in 2021 exemplifies the growing demand for zero-emission vehicles. As companies prioritize reducing carbon footprints, this trend is expected to significantly drive electric truck market growth.

- Government Incentives and Subsidies:

Government incentives continue to play a pivotal role in the adoption of electric trucks. In 2023, the U.S. government provided USD 1.5 billion in grants under the Clean Trucks Initiative to support fleet operators transitioning from diesel to electric trucks. These incentives reduce the upfront costs of electric trucks, making them a more attractive option for businesses. Additionally, the California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) continues to offer substantial rebates, further stimulating market demand.

North America Electric Trucks Market Challenges

- Battery Performance and Range Limitations: Battery performance, especially in extreme weather conditions, poses a challenge to the widespread adoption of electric trucks. In cold climates, the range of electric trucks can decrease by up to 30%, impacting their reliability for long-haul operations. Additionally, current heavy-duty electric trucks offer a range of around 300 miles on a full charge, significantly lower than the 1,000-mile range of diesel trucks, which remains a critical concern for fleet operators.

- Supply Chain Constraints: The electric truck market is facing supply chain challenges, particularly in sourcing critical raw materials such as lithium and cobalt, essential for battery production. Global demand for these materials has surged, leading to supply shortages and price increases. The geopolitical tensions affecting major lithium-producing countries have further exacerbated supply constraints, potentially impacting production timelines and increasing costs for electric truck manufacturers.

North America Electric Trucks Market Government Initiatives

- National Electric Vehicle Infrastructure (NEVI) Program (2021):

Launched in 2021, the NEVI program is central to the U.S. governments strategy to support the adoption of electric vehicles, including electric trucks. The program aims to deploy 500,000 public EV chargers by 2024, with a significant focus on rural and underserved areas. This initiative is critical to addressing the charging infrastructure gap and facilitating the widespread adoption of electric trucks in long-haul and freight transportation sectors. - California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) (2023): The HVIP program, which was expanded in 2023, offers rebates of up to USD 120,000 per electric truck to fleet operators in California. This initiative is part of the states broader effort to achieve its zero-emission vehicle targets by 2035. The program has significantly boosted the adoption of electric trucks, particularly among logistics companies operating in heavily polluted areas like Los Angeles and San Francisco.

North America Electric Trucks Market Future Outlook

The North America Electric Trucks Market is poised for substantial growth by 2028, driven by the increasing demand for sustainable and efficient transportation solutions. The market is expected to benefit from continued advancements in battery technology, the expansion of charging infrastructure, and supportive government policies.

Future Market Trends

- Adoption of Autonomous Electric Trucks: Over the next five years, autonomous electric trucks are expected to become a significant trend in the North American market by 2028. Companies like Tesla and Waymo are already testing self-driving electric trucks, and as technology matures, these vehicles will be increasingly deployed for long-haul transportation. The combination of autonomy and electrification will offer significant cost savings and operational efficiency, driving the future of the logistics industry.

- Increased Use of Renewable Energy for Charging: Over the next five years, as the market for electric trucks grows, there will be a greater focus on using renewable energy sources to power EV charging stations. By 2028, many major truck stops and logistics hubs in North America are expected to install solar panels and wind turbines to provide clean energy for charging electric trucks. This trend will contribute to further reducing the carbon footprint of the transportation sector.

Scope of the Report

|

By Region |

United States Canada |

|

By Vehicle Type |

Light-Duty Trucks Medium-Duty Trucks Heavy-Duty Trucks |

|

By End-User |

Logistics Construction Mining Others |

|

By Propulsion Type |

Battery Electric Vehicle (BEV) Fuel Cell Electric Vehicle (FCEV) Plug-in Hybrid Electric Vehicle (PHEV) |

|

By Application |

Urban Delivery Long-Haul Transport Municipal Services Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, California Air Resources Board)

Fleet Management Companies

Logistics and Transportation Companies

Automotive Manufacturers

Electric Vehicle Charging Infrastructure Providers

Battery Manufacturers

Environmental Advocacy Groups

Commercial Real Estate Developers

Technology Providers for Fleet Electrification

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Tesla, Inc.

Rivian Automotive, LLC

Daimler Trucks North America LLC

Nikola Corporation

Ford Motor Company

Volvo Trucks North America

General Motors

PACCAR Inc.

Workhorse Group Inc.

Hino Motors Ltd.

Navistar International Corporation

Proterra Inc.

Hyliion Holdings Corp.

Xos, Inc.

Lion Electric Company

Table of Contents

1. North America Electric Trucks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Units Sold, Revenue, CAGR)

1.4. Market Segmentation Overview

2. North America Electric Trucks Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Electric Trucks Market Analysis

3.1. Growth Drivers

3.1.1. Electrification of Commercial Fleets

3.1.2. Government Incentives and Subsidies

3.1.3. Advancements in Battery Technology (Cost per kWh, Range)

3.1.4. Expansion of Charging Infrastructure

3.2. Market Challenges

3.2.1. High Initial Costs (Total Cost of Ownership vs. Diesel Trucks)

3.2.2. Limited Range and Payload Capacity

3.2.3. Supply Chain Constraints

3.3. Opportunities

3.3.1. Integration with Autonomous Driving Technologies

3.3.2. Partnerships with Logistics Companies

3.3.3. Emerging Markets for Mid- and Heavy-Duty Electric Trucks

3.4. Trends

3.4.1. Adoption of Hydrogen-Electric Hybrids

3.4.2. Development of Swappable Battery Systems

3.4.3. Increasing Use of AI in Fleet Management

3.5. Government Regulations

3.5.1. Zero-Emission Vehicle Mandates

3.5.2. Federal and State-Level Incentives (Tax Credits, Grants)

3.5.3. Emission Standards for Commercial Vehicles

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Battery Manufacturers, Fleet Operators)

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. North America Electric Trucks Market Segmentation

4.1. By Truck Type (In Value %)

4.1.1. Light-Duty Electric Trucks

4.1.2. Medium-Duty Electric Trucks

4.1.3. Heavy-Duty Electric Trucks

4.2. By Application (In Value %)

4.2.1. Logistics

4.2.2. Municipal Services

4.2.3. Construction

4.3. By Battery Type (In Value %)

4.3.1. Lithium-Ion

4.3.2. Solid-State Batteries

4.3.3. Others

4.4. By Charging Infrastructure (In Value %)

4.4.1. Depot Charging

4.4.2. Public Charging

4.4.3. Wireless Charging

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Electric Trucks Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla Inc.

5.1.2. Rivian Automotive, Inc.

5.1.3. Daimler AG

5.1.4. Volvo Group

5.1.5. BYD Company Limited

5.1.6. Nikola Corporation

5.1.7. Ford Motor Company

5.1.8. PACCAR Inc.

5.1.9. Workhorse Group Inc.

5.1.10. Navistar International Corporation

5.1.11. General Motors

5.1.12. Hyzon Motors

5.1.13. Freightliner Trucks

5.1.14. Hino Motors

5.1.15. Bollinger Motors

5.2. Cross Comparison Parameters (Production Capacity, Battery Range, Market Share, Pricing Strategy, Fleet Partnerships, Charging Network Coverage, Total Revenue, Customer Satisfaction Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Electric Trucks Market Regulatory Framework

6.1. Zero-Emission Standards

6.2. Federal and State-Level Compliance Requirements

6.3. Certification Processes

7. North America Electric Trucks Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Electric Trucks Future Market Segmentation

8.1. By Truck Type (In Value %)

8.2. By Application (In Value %)

8.3. By Battery Type (In Value %)

8.4. By Charging Infrastructure (In Value %)

8.5. By Region (In Value %)

9. North America Electric Trucks Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Identifying Key Variables

The research process for the North America Electric Trucks Market began with the identification of key variables such as market drivers, challenges, government regulations, and technological advancements. A comprehensive ecosystem analysis was conducted to identify major market players, stakeholders, and their interrelationships

Market Building

The next step involved collecting and collating statistics on the North America Electric Trucks Market. This included analyzing market penetration by different vehicle types (light-duty, medium-duty, heavy-duty), propulsion types (Battery Electric Vehicle, Fuel Cell Electric Vehicle, Plug-in Hybrid Electric Vehicle), and application areas (urban delivery, long-haul transport, municipal services).

Validating and Finalizing

Market hypotheses were constructed based on initial findings and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts. These experts included representatives from electric truck manufacturers, logistics companies, and government bodies involved in transportation policy and infrastructure development.

Research Output

The final research output involved engaging with key stakeholders in the electric trucks market, including fleet operators, battery manufacturers, and electric vehicle charging infrastructure providers. This engagement was vital in understanding product segments, sales trends, consumer preferences, and regional variations in electric truck adoption.

Frequently Asked Questions

How big is the North America Electric Trucks Market?

The North America Electric Trucks market is projected to have reached approximately USD 12.85 billion in 2023. This growth is primarily fueled by the rising demand for eco-friendly transportation options, stringent government regulations on emissions, and increasing fuel costs. These factors collectively contribute to the market's expansion as businesses seek sustainable alternatives for their logistics operations.

What are the challenges in the North America Electric Trucks Market?

Challenges in the North America Electric Trucks Market include the high upfront cost of electric trucks, battery performance limitations in extreme weather conditions, and supply chain constraints for critical raw materials like lithium and cobalt, which are essential for battery production.

Who are the major players in the North America Electric Trucks Market?

Key players in the North America Electric Trucks Market include Tesla, Rivian, Daimler Trucks North America, Nikola Corporation, and Ford Motor Company. These companies lead the market due to their advanced technology, extensive service networks, and significant investments in electric truck development.

What are the growth drivers of the North America Electric Trucks Market?

The North America Electric Trucks Market is driven by the expansion of EV charging infrastructure, corporate sustainability initiatives, and government incentives that lower the cost of adoption for fleet operators. Additionally, technological advancements in battery efficiency are accelerating market growth.

By Vehicle Type

By End-User

By Region

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.