North America Electric Vehicle Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD3598

December 2024

86

About the Report

North America Electric Vehicle Market Overview

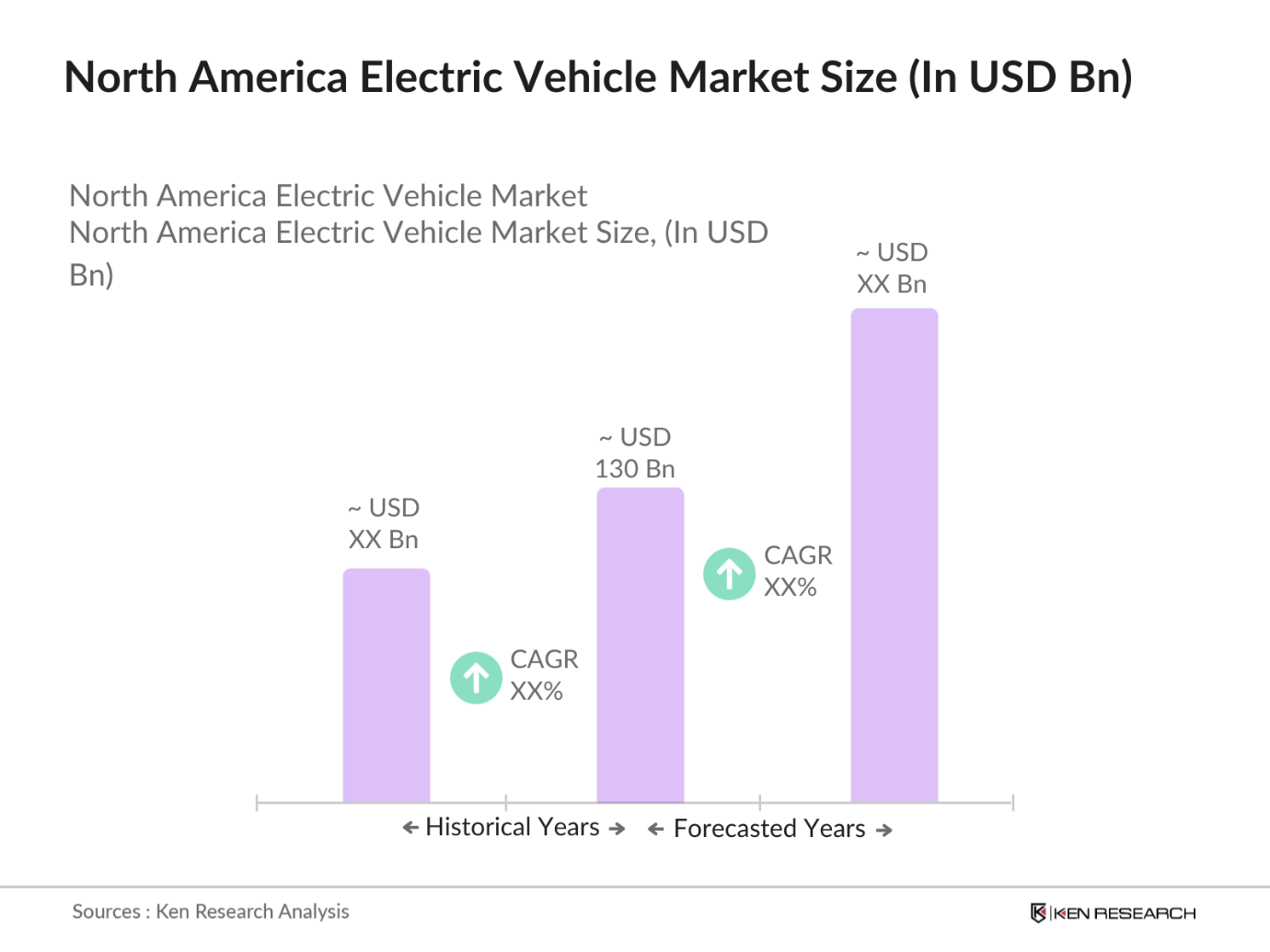

- The North America Electric Vehicle market is valued at USD 130 billion, based on a five-year historical analysis. This market is primarily driven by government incentives aimed at reducing carbon emissions and boosting the adoption of zero-emission vehicles. Increasing environmental awareness among consumers and the development of advanced battery technologies have further fueled the market's growth. Additionally, the expansion of charging infrastructure in key cities has enhanced consumer confidence in electric mobility, encouraging the adoption of EVs across the region.

- Cities like San Francisco, Los Angeles, and New York in the U.S., along with Toronto and Vancouver in Canada, dominate the North American EV market. This dominance is largely due to strong local government support, high consumer incomes, and well-developed charging infrastructure. These cities also have stringent emissions regulations and sustainability goals that encourage the adoption of EVs over conventional vehicles. Additionally, the presence of leading EV manufacturers and their dealerships in these cities boosts accessibility and availability of EV models.

- Increasing Consumer Awareness of Environmental Impact Consumer awareness of the environmental benefits of EVs has grown significantly, driven by concerns over climate change and air pollution. According to a 2023 survey by the Pew Research Center, around 60% of Americans now support phasing out gasoline-powered cars by 2035 to reduce emissions. This shift in consumer sentiment has led to higher demand for EVs, with sales reaching over 760,000 units in the U.S. alone in 2023, marking a 25% increase compared to 2022. Canada has similarly witnessed a surge in EV sales, driven by heightened environmental awareness.

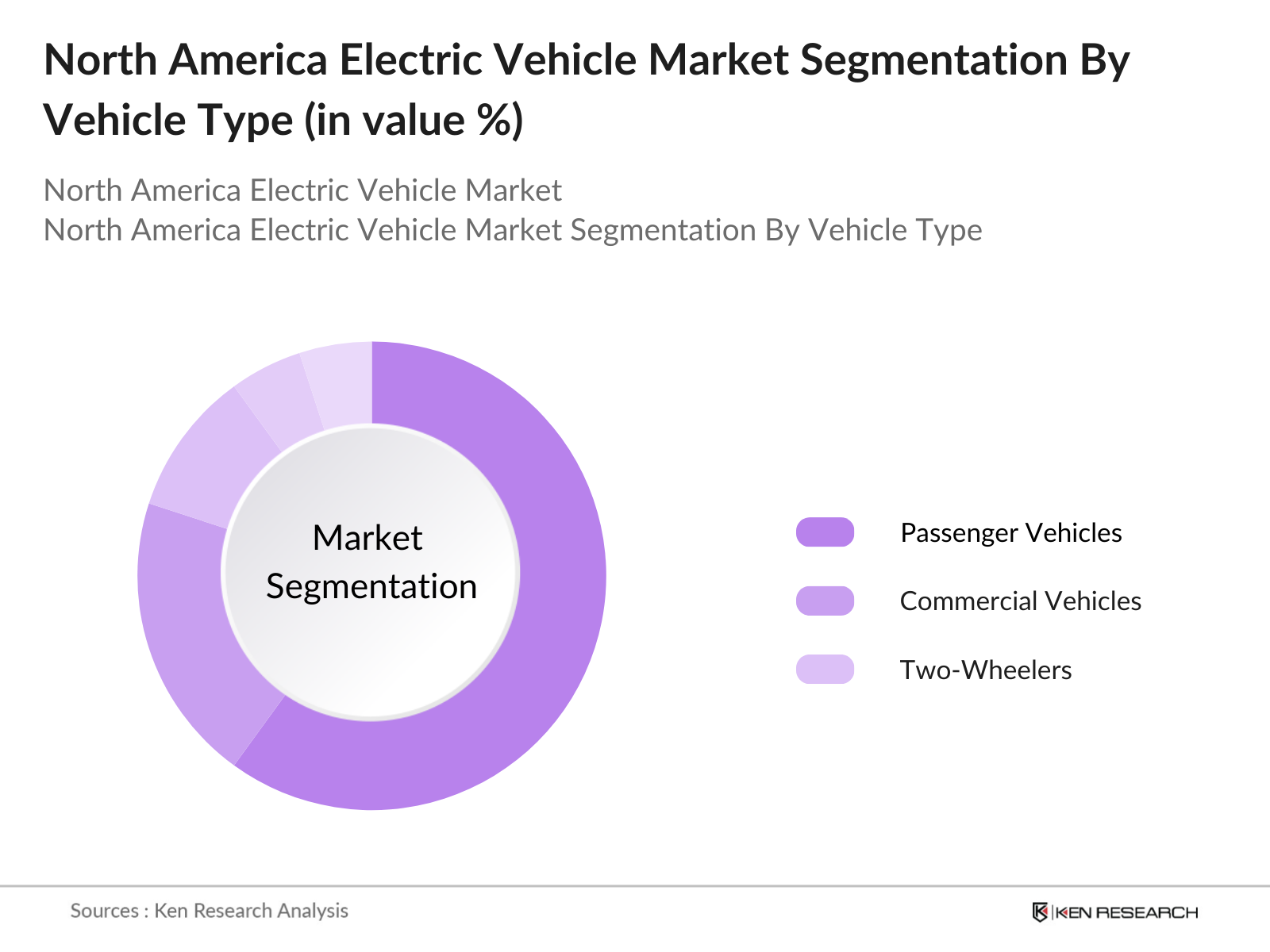

North America Electric Vehicle Market Segmentation

By Vehicle Type: The North America Electric Vehicle market is segmented by vehicle type into passenger vehicles, commercial vehicles, and two-wheelers. Passenger vehicles hold the largest market share due to the increasing availability of affordable models, coupled with rising consumer awareness of the benefits of zero-emission vehicles. Brands such as Tesla, Ford, and General Motors have captured the market's attention with their broad range of electric cars, which offer significant cost savings in terms of fuel and maintenance.

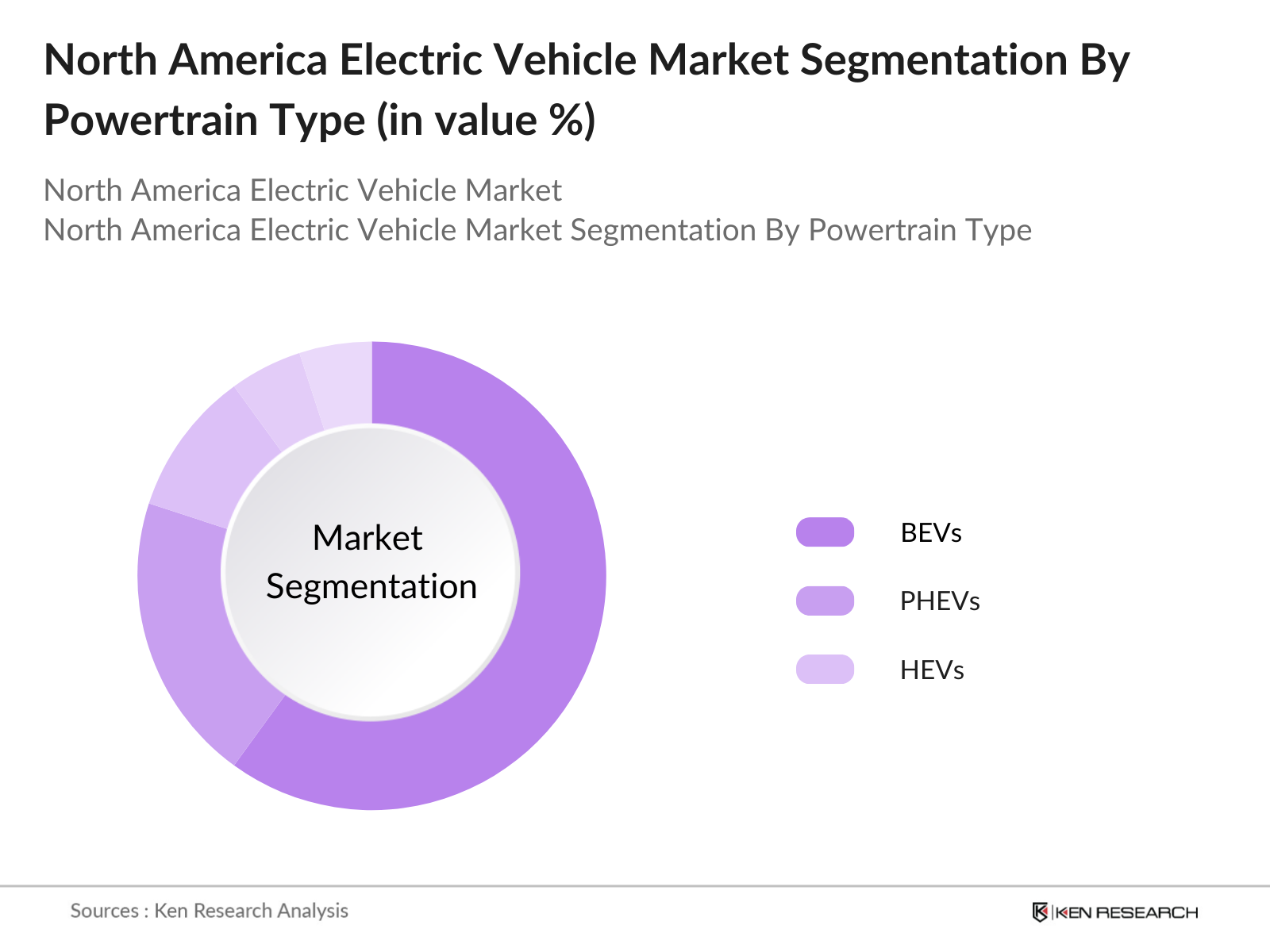

By Powertrain Type: The market is segmented by powertrain type into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs). BEVs dominate this segment due to the increasing range capabilities and lower maintenance costs compared to hybrid models. The rise in production efficiency has also resulted in a reduction in BEV prices, making them more accessible to a larger segment of the population.

North America Electric Vehicle Market Competitive Landscape

The North America Electric Vehicle market is dominated by key players who have established strong manufacturing, distribution, and technological capabilities. These companies continue to invest in research and development (R&D) to enhance the driving range, charging speed, and battery longevity of their EVs. The North American EV market is dominated by Tesla, Ford, and General Motors, with new entrants such as Rivian and Lucid Motors gaining market share. These companies have invested heavily in battery technology, autonomous driving, and the development of expansive charging networks to solidify their positions in the market. Teslas extensive Supercharger network and high vehicle range have made it a leader, while Ford and GMs commitment to electric trucks and SUVs has spurred growth in the commercial sector.

North America Electric Vehicle Market

Growth Drivers

- Government Incentives & Subsidies: Government incentives have played a key role in boosting the North American electric vehicle (EV) market. In the United States, the Inflation Reduction Act (IRA) of 2022 allocated billions of dollars in tax credits for EV buyers, with up to $7,500 in federal tax rebates available for qualifying models. In Canada, the federal iZEV program offers consumers up to CAD 5,000 as incentives to purchase EVs. These initiatives aim to promote domestic manufacturing and EV adoption. The U.S. government has also pledged to have 50% of all new vehicle sales be electric by 2030.

- Carbon Emission Reduction Targets: To meet international climate commitments, both the U.S. and Canada have set ambitious carbon emission reduction targets that directly benefit the EV market. The U.S. aims to cut emissions by 50-52% by 2030 from 2005 levels, while Canada targets a 40-45% reduction over the same period. With the transportation sector accounting for around 29% of greenhouse gas emissions in the U.S., electrification is a key strategy for achieving these targets. The Canadian governments Zero-Emission Vehicle (ZEV) mandate requires 100% of new light-duty vehicles to be ZEVs by 2035, boosting EV demand.

- Expansion of EV Charging Infrastructure: In North America, the lack of charging infrastructure has been a major obstacle to widespread EV adoption. However, recent government-led initiatives are addressing this gap. The U.S. Bipartisan Infrastructure Law of 2021 allocated $7.5 billion to develop a nationwide network of 500,000 charging stations by 2030. As of 2024, more than 145,000 public charging points are available across the U.S., with significant growth in urban and highway locations. Canada is also ramping up its efforts, with CAD 700 million invested to install over 50,000 new EV chargers by 2027.

Market Challenges

- High Initial Purchase Cost of EVs: Despite government incentives, the high initial cost of electric vehicles remains a significant barrier for many consumers. As of 2024, the average price of an EV in the U.S. stands at approximately $58,000, compared to around $48,000 for traditional gasoline-powered vehicles. While battery costs have declined over the past decade, they still account for roughly 30% of the total vehicle cost. Although price parity between EVs and conventional vehicles is expected by the end of the decade, the current financial hurdle limits EV adoption among cost-conscious buyers.

- Limited Range and Charging Infrastructure in Remote Areas: While urban regions have benefited from increased charging infrastructure, remote and rural areas in North America continue to face challenges. Currently, only about 15% of public charging stations in the U.S. are located in rural areas, leading to concerns about range anxiety for drivers in these locations. The average range for most EVs is around 250 to 300 miles, making it difficult for consumers in less densely populated areas to rely on electric vehicles for long-distance travel without adequate charging networks.

North America Electric Vehicle Future Outlook

The North America Electric Vehicle market is expected to witness significant growth over the next five years, driven by continuous advancements in EV technology, favorable government policies, and rising consumer demand for eco-friendly vehicles. The proliferation of EV charging infrastructure and improvements in battery technology are expected to drive adoption across both urban and rural areas. Furthermore, the introduction of electric trucks and commercial vehicles will play a pivotal role in expanding the market beyond the traditional passenger vehicle segment.

Market Opportunities

- Rise of EV Fleet and Ride-Sharing Programs: The adoption of electric vehicles for fleet operations and ride-sharing services presents a significant growth opportunity for the North American EV market. Companies like Uber and Lyft have announced plans to transition to fully electric fleets by 2030. In 2023, Amazon ordered over 100,000 electric delivery vans from Rivian, contributing to a growing demand for commercial EVs. This trend is supported by the U.S. governments push to electrify its federal fleet, with over 200,000 electric vehicles projected to be in operation by 2027.

- Technological Advancements in Battery Technology: Innovations in battery technology are rapidly improving the performance and cost-efficiency of electric vehicles. In 2023, solid-state batteries, which offer higher energy density and faster charging times, entered early-stage commercialization. Companies like QuantumScape and Solid Power have reported breakthroughs in extending battery life and reducing charging times to under 15 minutes. These advancements are expected to enhance the overall appeal of EVs, making them more competitive with internal combustion engine vehicles in terms of convenience and driving range.

Scope of the Report

|

Segment |

Sub-Segments |

|

Vehicle Type |

Passenger Vehicles, Commercial Vehicles, Two-Wheelers |

|

Powertrain Type |

Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

|

Charging Infrastructure |

Fast Charging, Slow Charging, Wireless Charging |

|

Battery Capacity |

<50 kWh, 50-100 kWh, >100 kWh |

|

Region |

U.S., Canada, Mexico |

Products

Key Target Audience

Automotive Manufacturers

Battery Suppliers

EV Charging Infrastructure Providers

Government and Regulatory Bodies (U.S. Department of Energy, Environmental Protection Agency)

Technology Providers (for autonomous driving, software integration)

Investors and Venture Capitalist Firms

Fleet Management Companies

Utility and Energy Companies

Companies

Major Players Mention in the Report

Tesla, Inc.

General Motors

Ford Motor Company

Rivian Automotive

Lucid Motors

Nissan Motor Co., Ltd.

BMW AG

Hyundai Motor Company

Volkswagen AG

Stellantis N.V.

Fisker Inc.

Polestar

Honda Motor Co., Ltd.

Toyota Motor Corporation

BYD Company Ltd.

Table of Contents

01. North America Electric Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. North America Electric Vehicle Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. North America Electric Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Government Incentives & Subsidies

3.1.2. Carbon Emission Reduction Targets

3.1.3. Expansion of EV Charging Infrastructure

3.1.4. Increasing Consumer Awareness of Environmental Impact

3.2. Market Challenges

3.2.1. High Initial Purchase Cost of EVs

3.2.2. Limited Range and Charging Infrastructure in Remote Areas

3.2.3. Shortage of Raw Materials (Lithium, Nickel, Cobalt)

3.3. Opportunities

3.3.1. Rise of EV Fleet and Ride-Sharing Programs

3.3.2. Technological Advancements in Battery Technology

3.3.3. Partnerships Between Automotive and Energy Companies

3.4. Trends

3.4.1. Increasing Adoption of Electric Trucks and Buses

3.4.2. Integration of Autonomous Driving with Electric Vehicles

3.4.3. Growth in Vehicle-to-Grid (V2G) Technology Adoption

3.5. Government Regulation

3.5.1. Zero Emission Vehicle (ZEV) Mandates

3.5.2. Clean Energy Tax Credits

3.5.3. CAFE Standards (Corporate Average Fuel Economy)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.7.1. Raw Material Suppliers

3.7.2. Battery Manufacturers

3.7.3. Automotive OEMs

3.7.4. Charging Infrastructure Providers

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

04. North America Electric Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Passenger Vehicles

4.1.2. Commercial Vehicles

4.1.3. Two-Wheelers

4.2. By Powertrain Type (In Value %)

4.2.1. Battery Electric Vehicles (BEVs)

4.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

4.2.3. Hybrid Electric Vehicles (HEVs)

4.3. By Charging Infrastructure (In Value %)

4.3.1. Fast Charging

4.3.2. Slow Charging

4.3.3. Wireless Charging

4.4. By Battery Capacity (In Value %)

4.4.1. <50 kWh

4.4.2. 50-100 kWh

4.4.3. >100 kWh

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

05. North America Electric Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla, Inc.

5.1.2. General Motors

5.1.3. Ford Motor Company

5.1.4. Rivian Automotive

5.1.5. Lucid Motors

5.1.6. Nissan Motor Co., Ltd.

5.1.7. BMW AG

5.1.8. Hyundai Motor Company

5.1.9. Volkswagen AG

5.1.10. Stellantis N.V.

5.1.11. Fisker Inc.

5.1.12. Polestar

5.1.13. Honda Motor Co., Ltd.

5.1.14. Toyota Motor Corporation

5.1.15. BYD Company Ltd.

5.2. Cross Comparison Parameters

No. of Employees, Headquarters, Inception Year, Revenue, EV Sales Volume, Market Share, Battery Supplier, Autonomous Vehicle Technology Partnership

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. North America Electric Vehicle Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. North America Electric Vehicle Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. North America Electric Vehicle Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Powertrain Type (In Value %)

8.3. By Charging Infrastructure (In Value %)

8.4. By Battery Capacity (In Value %)

8.5. By Region (In Value %)

09. North America Electric Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, a detailed ecosystem map of all stakeholders in the North America Electric Vehicle market is created. This includes major manufacturers, battery suppliers, and charging infrastructure providers. Data is collected through a combination of secondary research, including databases and publicly available reports, to identify key variables influencing the market.

Step 2: Market Analysis and Construction

In this step, historical data is collected to analyze market growth trends, including market penetration of electric vehicles and the proliferation of EV charging stations. Statistical analysis of vehicle sales and infrastructure development provides insights into market performance.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market hypotheses are developed and tested through interviews with industry experts. This includes consultations with manufacturers, charging infrastructure developers, and industry associations to validate the collected data and refine market projections.

Step 4: Research Synthesis and Final Output

The final research phase synthesizes data from various sources, including manufacturers' sales reports and market surveys, to present a comprehensive analysis of the market. This ensures the accuracy and reliability of the research, providing actionable insights for key stakeholders in the EV market.

Frequently Asked Questions

01. How big is the North America Electric Vehicle market?

The North America Electric Vehicle market is valued at USD 130 billion, driven by increasing government incentives, technological advancements, and growing environmental awareness.

02. What are the challenges in the North America Electric Vehicle market?

The primary challenges include the high initial purchase cost of EVs, limited charging infrastructure in remote areas, and shortages of key raw materials like lithium and nickel for battery production.

03. Who are the major players in the North America Electric Vehicle market?

The key players include Tesla, General Motors, Ford, Rivian, and Lucid Motors. These companies lead due to their robust manufacturing capabilities, R&D investments, and growing product portfolios.

04. What are the growth drivers of the North America Electric Vehicle market?

Growth drivers include favorable government policies, advancements in battery technology, expansion of the charging infrastructure, and rising consumer demand for eco-friendly transportation solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.