North America Electrostatic Precipitator Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD2138

December 2024

93

About the Report

North America Electrostatic Precipitator Market Overview

- The North America Electrostatic Precipitator market is valued at USD 1.6 billion. The growth of this market is primarily driven by stringent environmental regulations aimed at reducing industrial emissions, particularly from industries such as power generation and cement manufacturing. These regulations, enforced by agencies such as the Environmental Protection Agency (EPA), have significantly boosted the adoption of electrostatic precipitators to maintain air quality standards. Furthermore, the increasing industrial output across the region has heightened the demand for effective pollution control technologies.

- Key countries dominating the market include the United States, Canada, and Mexico. The United States leads the market due to its well-established industrial base, strong regulatory framework, and significant investment in air pollution control technologies. Canada follows closely, driven by industrial activities in provinces like Alberta, where oil sands production contributes to pollution, thus necessitating the use of electrostatic precipitators. Mexico also demonstrates strong market participation, particularly in its expanding industrial and power generation sectors.

- Several North American industries, including cement, steel, and energy, are subject to specific emission standards, pushing demand for electrostatic precipitators. For example, the U.S. steel industry is required to reduce particulate matter emissions to below 0.1 lb/ton of steel produced, as per the EPA regulations in 2024.

North America Electrostatic Precipitator Market Segmentation

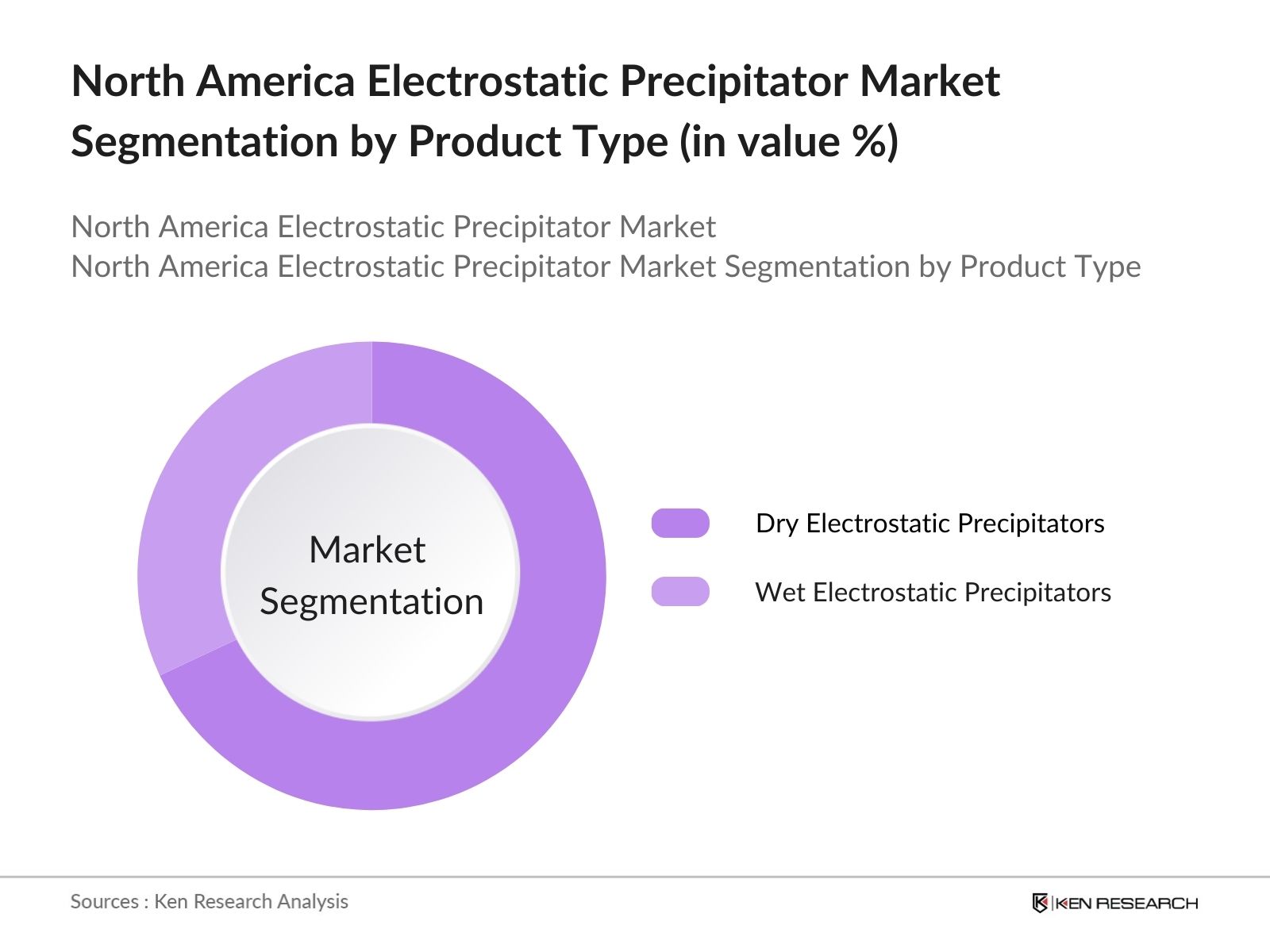

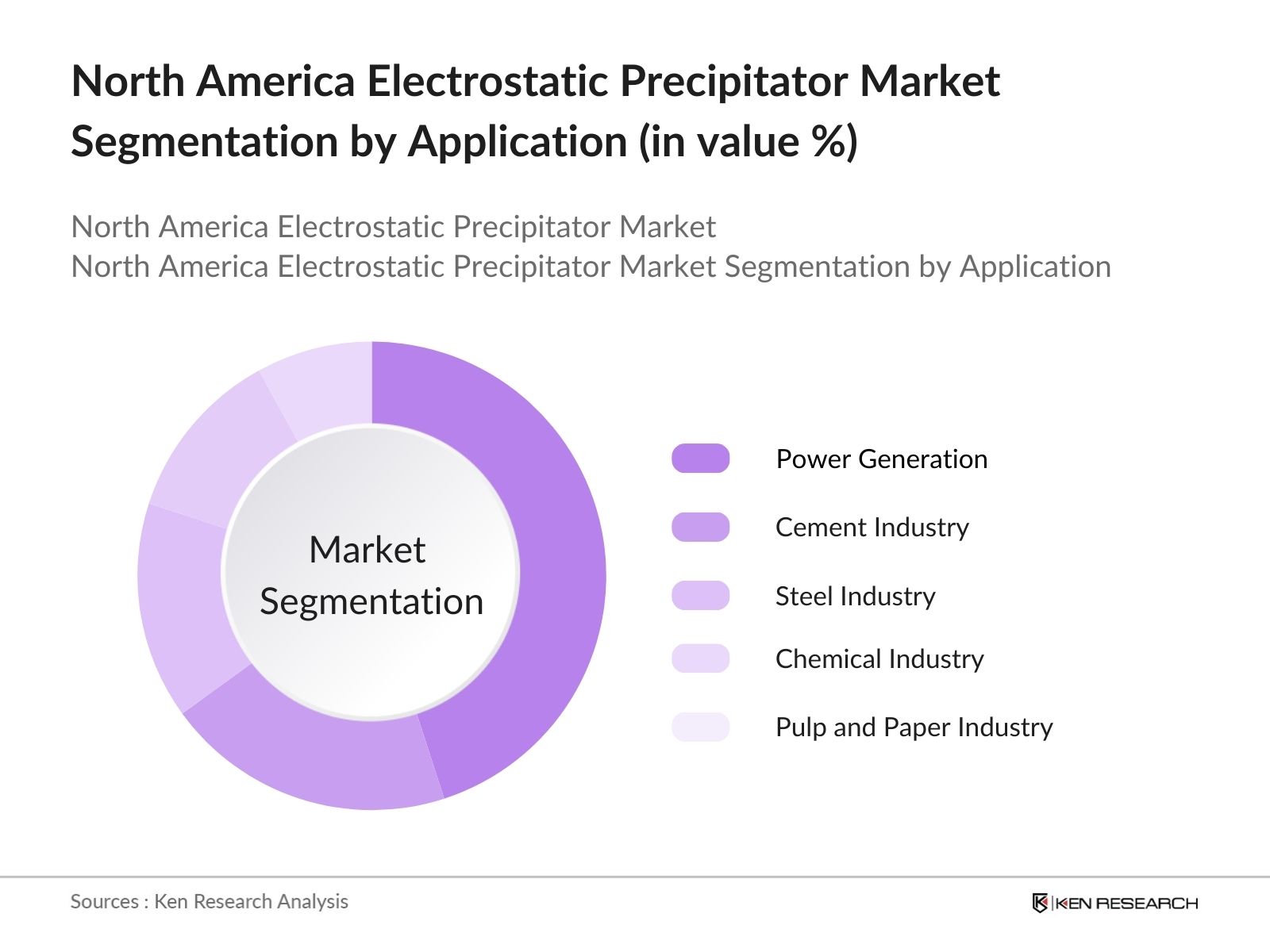

The North America Electrostatic Precipitator market is segmented by product type and by application.

- By Product Type: The market is segmented by product type into dry electrostatic precipitators and wet electrostatic precipitators. Dry electrostatic precipitators hold a dominant market share, driven by their widespread use in industries such as cement and power generation. These industries prefer dry electrostatic precipitators due to their ability to handle high-temperature emissions, along with their lower operational costs compared to wet systems. This preference is further bolstered by advancements in dry filtration technologies, which enhance particulate capture efficiency.

- By Application: The market is also segmented by application into power generation, cement industry, steel industry, chemical industry, and pulp and paper industry. The power generation sector dominates the market owing to the significant number of particulate emissions generated by coal-fired power plants. Electrostatic precipitators are widely used in these facilities to reduce airborne particles, enabling compliance with strict air quality standards imposed by regulatory bodies.

North America Electrostatic Precipitator Market Competitive Landscape

The North America Electrostatic Precipitator market is consolidated, with several key players leading the competition. These companies maintain dominance through their strong technological capabilities, extensive product portfolios, and strategic alliances.

The market's competitive landscape highlights the significant influence of these leading companies. General Electric, for example, has made substantial investments in research and development to enhance its electrostatic precipitator technologies, ensuring compliance with increasingly stringent environmental regulations. Siemens AG has similarly focused on expanding its product portfolio and increasing global presence through strategic partnerships.

|

Company |

Establishment Year |

Headquarters |

Technology Focus |

Product Portfolio |

Global Presence |

|

General Electric |

1892 |

Boston, USA |

|||

|

Babcock & Wilcox Enterprises Inc. |

1867 |

Akron, USA |

|||

|

Siemens AG |

1847 |

Munich, Germany |

|||

|

Mitsubishi Heavy Industries |

1870 |

Tokyo, Japan |

|||

|

Ducon Technologies Inc. |

1938 |

New York, USA |

North America Electrostatic Precipitator Industry Analysis

Market Growth Drivers

- Stringent Environmental Regulations: The market is driven by stringent regulations to curb industrial emissions. Under the U.S. Clean Air Act, industries are mandated to reduce particulate emissions significantly, especially in energy and manufacturing sectors. In 2024, the U.S. Environmental Protection Agency (EPA) continues to impose stringent rules, affecting over 15,000 industrial facilities nationwide, which are now required to install or upgrade emission control technologies like electrostatic precipitators. This has led to a rise in demand for these systems as industries aim to meet these requirements.

- Industrial Expansion: North America is seeing robust industrial growth, particularly in manufacturing, energy, and mining. In 2023, the U.S. manufacturing sector alone was valued at over $2.5 trillion in gross output, with similar trends observed in Canada. This industrial expansion drives demand for pollution control systems, including electrostatic precipitators, to ensure compliance with environmental norms. For example, coal-fired power plants, which contribute over 20% to the U.S. electricity grid, require these systems to manage particulate emissions.

- Adoption of Clean Technologies: The adoption of clean technologies is on the rise as industries strive to reduce their carbon footprints. By 2024, the U.S. Department of Energy reported a 12% increase in renewable energy generation compared to 2022, with industrial sectors following suit. This shift towards cleaner operations necessitates advanced emission control technologies like electrostatic precipitators, particularly in waste-to-energy plants, which are expanding rapidly across North America.

Market Challenges

- High Initial Investment: Electrostatic precipitators require substantial capital investment, often ranging between $1 million to $5 million for large industrial systems. In 2023, many mid-size manufacturers in North America cited high initial costs as a barrier to adopting these technologies. This is particularly challenging for smaller companies, which may struggle to allocate funds for both the equipment and the infrastructure upgrades required for installation. Government subsidies have been limited, making it difficult for companies to offset these costs.

- Maintenance Costs: In addition to high initial costs, maintenance expenses pose a significant challenge for companies using electrostatic precipitators. According to the U.S. Department of Energy, maintenance of these systems can cost upwards of $100,000 annually for large facilities, including routine cleaning, replacement of electrodes, and ensuring optimal operational efficiency. These recurring costs may deter smaller industries from opting for electrostatic precipitators, instead choosing alternative pollution control methods.

North America Electrostatic Precipitator Market Future Outlook

Over the next five years, the North America Electrostatic Precipitator market is expected to experience considerable growth, driven by ongoing environmental regulations, technological advancements in air filtration, and increasing industrial output. Governments across North America are pushing for cleaner industrial practices, which will further incentivize companies to adopt electrostatic precipitators. In addition, the integration of IoT and AI-based monitoring systems in these devices is expected to revolutionize the industry by improving performance monitoring and reducing downtime.

Future Market Opportunities

- Advancement in Filtration Technologies: The North American electrostatic precipitator industry is seeing innovations in filtration technology, such as the development of hybrid electrostatic precipitators, which combine electrostatic and mechanical filtration techniques. In 2024, new systems demonstrated a 20% increase in filtration efficiency compared to traditional systems, which is driving adoption across multiple industries, particularly in heavy-polluting sectors like power generation and cement manufacturing.

- Increasing Demand in Emerging Markets: With rising industrialization in Mexico, the demand for electrostatic precipitators is expected to grow as industries align with U.S. environmental regulations to support cross-border trade. In 2023, Mexicos industrial sector grew by 4.5%, particularly in manufacturing, which has driven demand for pollution control systems. North American manufacturers are expanding their footprints in Mexico, leading to increased investments in electrostatic precipitator technology.

Scope of the Report

Products

Key Target Audience

Industrial Manufacturers

Pollution Control Authorities (Environmental Protection Agency, Environment Canada)

Power Generation Companies

Cement and Steel Producers

Investment and Venture Capitalist Firms

Chemical Industry Operators

Banks and Financial Institutes

Government and Regulatory Bodies (EPA, National Environment Agency)

Industrial Equipment Distributors

Companies

Players Mention in the Report:

General Electric

Babcock & Wilcox Enterprises Inc.

Siemens AG

Mitsubishi Heavy Industries

Ducon Technologies Inc.

Thermax Limited

Trion Inc.

Beltran Technologies Inc.

Hamon Research-Cottrell

Fujian Longking Co. Ltd.

Southern Environmental Inc.

Envitech Inc.

Parker Hannifin Corporation

Feida Group Company Limited

Clean Tunnel Air International

Table of Contents

1. North America Electrostatic Precipitator Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Electrostatic Precipitator Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Electrostatic Precipitator Market Analysis

3.1 Growth Drivers

3.1.1 Industrial Expansion (Cement, Power Generation, Steel & Non-Ferrous Metals)

3.1.2 Stringent Environmental Regulations (EPA Standards, National Emission Standards)

3.1.3 Rising Adoption in Waste-to-Energy Plants

3.2 Market Challenges

3.2.1 High Installation and Maintenance Costs

3.2.2 Competition from Alternative Air Pollution Control Technologies

3.2.3 Technical Complexities in Retrofitting Existing Systems

3.3 Opportunities

3.3.1 Technological Advancements in Precipitation Efficiency

3.3.2 Demand for Dust and Particulate Emission Control in Emerging Industries

3.3.3 Growing Demand for Hybrid Systems (Wet & Dry ESPs)

3.4 Trends

3.4.1 Increasing Use of High-Voltage Power Supplies

3.4.2 Integration with Industrial IoT for Real-Time Monitoring

3.4.3 Growth in Demand for Compact and Modular ESP Systems

3.5 Government Regulation

3.5.1 National Ambient Air Quality Standards (NAAQS)

3.5.2 Emission Standards for Power Plants (Mercury and Air Toxics Standards)

3.5.3 Clean Air Act Regulations

3.5.4 Public and Private Sector Initiatives for Air Quality Improvement

3.6 SWOT Analysis

3.7 Stake Ecosystem (Suppliers, Manufacturers, Distributors, and End Users)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. North America Electrostatic Precipitator Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Dry Electrostatic Precipitators

4.1.2 Wet Electrostatic Precipitators

4.1.3 Plate Precipitators

4.1.4 Tubular Precipitators

4.2 By Application (In Value %)

4.2.1 Power Generation

4.2.2 Cement Industry

4.2.3 Chemicals & Petrochemicals

4.2.4 Steel & Non-Ferrous Metals

4.2.5 Pulp & Paper Industry

4.3 By Technology (In Value %)

4.3.1 Single-Stage ESP

4.3.2 Two-Stage ESP

4.3.3 Hybrid Systems

4.4 By Mode of Operation (In Value %)

4.4.1 High Voltage Direct Current (HVDC)

4.4.2 Pulse Energized ESPs

4.5 By Region (In Value %)

4.5.1 USA

4.5.2 Canada

4.5.3 Mexico

5. North America Electrostatic Precipitator Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 General Electric

5.1.2 Siemens AG

5.1.3 Babcock & Wilcox Enterprises, Inc.

5.1.4 Mitsubishi Power, Ltd.

5.1.5 Thermax Global

5.1.6 AMEC Foster Wheeler

5.1.7 Trion IAQ (Johnson Controls)

5.1.8 FLSmidth & Co. A/S

5.1.9 Hamon Corporation

5.1.10 PPC Air Pollution Control Systems

5.1.11 Ducon Technologies Inc.

5.1.12 Alstom SA

5.1.13 CECO Environmental

5.1.14 Beltran Technologies, Inc.

5.1.15 Elex AG

5.2 Cross Comparison Parameters (No. of Employees, Revenue, ESP Technology Expertise, Market Share, Product Innovation, M&A Activity, Strategic Alliances, Customer Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Electrostatic Precipitator Market Regulatory Framework

6.1 Emission Control Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. North America Electrostatic Precipitator Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Electrostatic Precipitator Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By Mode of Operation (In Value %)

8.5 By Region (In Value %)

9. North America Electrostatic Precipitator Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase involves creating an ecosystem map of the North America Electrostatic Precipitator Market, identifying all major stakeholders. Secondary research from industry reports, regulatory bodies, and proprietary databases forms the foundation for this step, ensuring that all relevant market variables are captured.

Step 2: Market Analysis and Construction

This step involves gathering and analyzing historical data on the adoption and performance of electrostatic precipitators in different industries. This includes evaluating emission control regulations, technological developments, and market penetration across key sectors such as power generation and cement manufacturing.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including electrostatic precipitator manufacturers, government regulators, and industry consultants, are interviewed to validate market hypotheses. These consultations provide insights into technological advancements and market trends, ensuring the accuracy of the analysis.

Step 4: Research Synthesis and Final Output

Finally, data from multiple sources, including manufacturers and industry databases, is synthesized to create a comprehensive market analysis. This includes product segmentation, market forecasts, and competitive landscape assessments, all verified through primary and secondary research.

Frequently Asked Questions

01. How big is the North America Electrostatic Precipitator Market?

The North America Electrostatic Precipitator market is valued at USD 1.6 billion. Its growth is largely attributed to the implementation of stringent environmental regulations and increasing industrialization.

02. What are the challenges in the North America Electrostatic Precipitator Market?

Challenges in North America Electrostatic Precipitator market include high initial capital investment, energy consumption during operations, and the need for regular maintenance, all of which may deter small- and medium-scale industries from adopting the technology.

03. Who are the major players in the North America Electrostatic Precipitator Market?

Key players in the North America Electrostatic Precipitator market include General Electric, Siemens AG, Mitsubishi Heavy Industries, Ducon Technologies Inc., and Babcock & Wilcox Enterprises Inc. These companies lead the market through strong technological advancements and extensive industrial networks.

04. What are the growth drivers of the North America Electrostatic Precipitator Market?

The North America Electrostatic Precipitator market is driven by the need to comply with stringent environmental regulations, the expansion of industrial activities, and growing awareness regarding the harmful effects of air pollution. Technological advancements in filtration and monitoring systems are also contributing to market growth.

05. What is the future outlook for the North America Electrostatic Precipitator Market?

The North America Electrostatic Precipitator market is expected to see robust growth, spurred by increasing government pressure to adopt cleaner technologies and the expansion of industrial sectors like power generation and steel manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.