North America Emission Monitoring Systems Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD5861

December 2024

82

About the Report

North America Emission Monitoring Systems Market Overview

- The North America Emission Monitoring Systems (EMS) market, with a robust valuation of USD 1.3 billion, is primarily driven by stringent environmental regulations, technological advancements, and growing industrial activities. Over a five-year historical analysis, the market has demonstrated steady growth due to regulatory frameworks pushing industries to adopt accurate and reliable monitoring solutions to meet compliance standards.

- Dominant regions in the North American EMS market include the United States and Canada, where stringent regulatory oversight and increased industrial emissions have fueled the adoption of advanced emission monitoring systems. The concentration of manufacturing and industrial operations in these countries has made compliance essential, positioning them as leading markets for EMS adoption.

- On December 2, 2023, the EPA finalized a rule that strengthens standards for methane and other air pollutants from oil and natural gas operations. This rule, known as Subpart OOOOb, will affect facilities that commence construction, modification, or reconstruction after December 6, 2022. The effective date for compliance is set for May 7, 2024.

North America Emission Monitoring Systems Market Segmentation

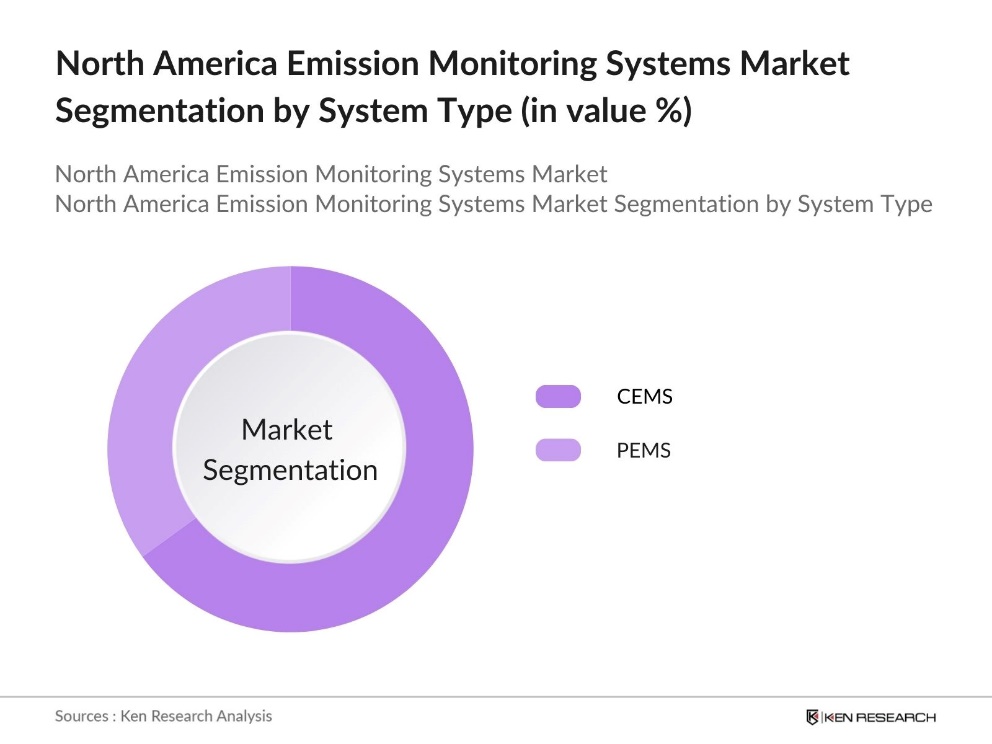

By System Type: The market is segmented by system type into Continuous Emission Monitoring Systems (CEMS) and Predictive Emission Monitoring Systems (PEMS). Among these, CEMS holds the dominant market share, attributed to its accuracy, real-time data reporting, and widespread application across various industries such as power generation, oil & gas, and chemicals. Regulatory demands for continuous data collection make CEMS a critical component of industry compliance.

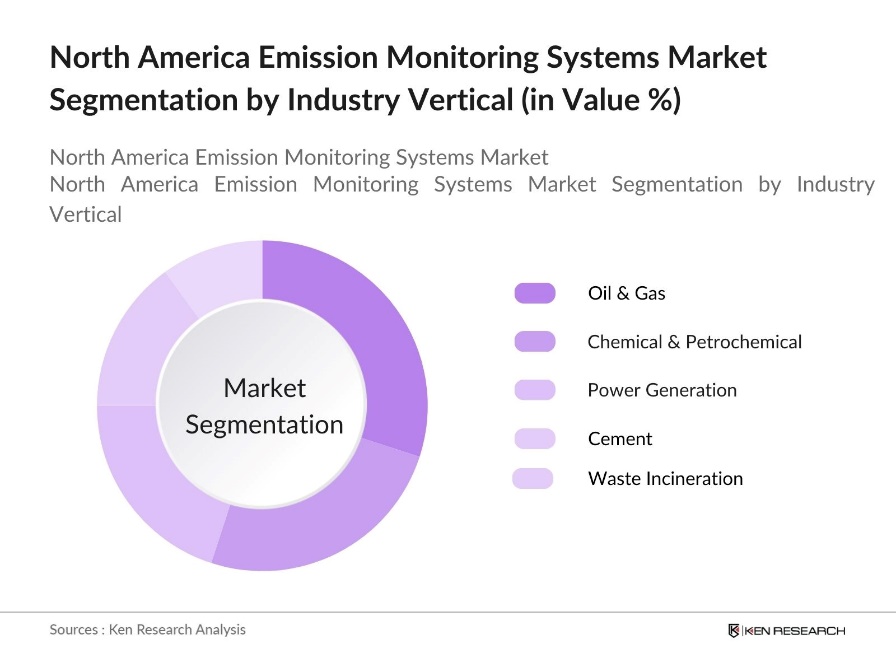

By Industry Vertical: The market is segmented by industry vertical, including Oil & Gas, Chemical & Petrochemical, Power Generation, Cement, and Waste Incineration. The oil & gas sector leads in EMS deployment due to its high emission rates and regulatory pressures, demanding constant monitoring and advanced data analytics. Emission monitoring in oil & gas operations is essential to minimize environmental impact, making it the largest sub-segment within this category.

North America Emission Monitoring Systems Market Competitive Landscape

The North America Emission Monitoring Systems market is dominated by a few major players, including established international and regional companies. This concentrated market structure underscores the competitive influence of key players, particularly in the areas of technological innovation, product quality, and environmental compliance.

North America Emission Monitoring Systems Industry Analysis

Growth Drivers

- Stringent Environmental Regulations: The North American emission monitoring systems (EMS) market is driven by environmental policies aimed at reducing industrial pollutants. The U.S. Environmental Protection Agency (EPA) requires industries like energy, manufacturing, and chemicals to strictly adhere to air quality standards, enforcing penalties for non-compliance. 51% of India's top 100 listed companies disclosed their Scope 3 emissions data for FY23. This demand is especially high in high-emission states such as Texas and California, where stringent controls apply.

- Advancements in Emission Monitoring Technology: Innovations in EMS, such as real-time data logging and remote sensor monitoring, have seen adoption across North America. The industrial facilities utilize advanced Continuous Emission Monitoring Systems (CEMS), enabling compliance with new regulations in sectors like power generation. In Canada, advanced EMS technologies track over 1.6 million metric tons of CO2 equivalent emissions annually, highlighting the system's efficiency.

- Demand for Accurate Emission Data: With a growing focus on net-zero goals, companies in North America increasingly prioritize accurate emission data to meet regulatory standards. Emission Monitoring Systems (EMS) provide real-time, precise data that supports compliance and helps avoid penalties. This shift reflects the industry's commitment to transparency and sustainability, enabling companies to track and reduce their environmental impact more effectively across various sectors.

Market Challenges

- High Installation Costs: The high installation costs of Emission Monitoring Systems (EMS) remain a significant barrier for small and medium enterprises. These systems require substantial investment, particularly for sectors like chemical and oil refineries, where unique emissions requirements further drive up expenses. While larger corporations can absorb these costs, smaller facilities often struggle, limiting the wider adoption of EMS technology.

- Technical Challenges in Remote Monitoring: Remote emission monitoring poses challenges, particularly in areas with limited connectivity. Many industrial facilities located in remote regions face difficulties in data transmission and timely analysis, which can impact data accuracy. These issues are especially pronounced in sectors like rural energy and mining, where compliance depends heavily on consistent monitoring and reporting.

North America Emission Monitoring Systems Market Future Outlook

The North America Emission Monitoring Systems market is set for promising growth over the coming years. Increasing governmental regulations and rising demand for emission transparency across industries will likely drive the adoption of EMS solutions. Furthermore, advancements in IoT-based emission technologies and data analytics are expected to enhance EMS capabilities, paving the way for next-generation monitoring solutions.

Market Opportunities

- Growth in Energy & Power Sectors; The North American EMS market is poised for growth alongside the expansion of energy and power projects. New renewable energy initiatives across the U.S. and Canada require advanced emission monitoring systems to comply with emission standards. This trend aligns with regional carbon reduction goals, driving EMS demand as a tool to verify and support environmental commitments in the energy sector.

- Adoption of Smart Emission Systems: The adoption of IoT-integrated Emission Monitoring Systems (EMS) is growing, with industries increasingly favoring smart systems that provide real-time pollutant readings. This trend is particularly prominent in manufacturing and power sectors, where precise, real-time emission data enhances compliance, operational efficiency, and environmental performance. The shift to smart EMS reflects a broader move toward innovation and automation in emission management.

Scope of the Report

|

System Type |

Continuous Emission Monitoring System (CEMS) Predictive Emission Monitoring System (PEMS) |

|

Industry Vertical |

Oil & Gas Chemical & Petrochemical Power Generation Cement Waste Incineration |

|

Offering Type |

Hardware Software Services |

|

Emission Type |

Carbon Monoxide (CO) Sulfur Dioxide (SO2) Nitrogen Oxides (NOx) Particulate Matter (PM) |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Environmental Monitoring Equipment Manufacturers

Industrial Emission Compliant Industries (Oil & Gas, Chemical & Petrochemical)

Large-Scale Manufacturing Firms

Power Generation Companies

Government and Regulatory Bodies (EPA, CARB)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

ABB Ltd.

Thermo Fisher Scientific

Siemens AG

Emerson Electric Co.

Teledyne Technologies

Horiba Ltd.

AMETEK, Inc.

Baker Hughes Company

General Electric

Rockwell Automation

Table of Contents

1. North America Emission Monitoring Systems Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Emission Monitoring Systems Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Emission Monitoring Systems Market Analysis

3.1 Growth Drivers

3.1.1 Stringent Environmental Regulations

3.1.2 Advancements in Emission Monitoring Technology

3.1.3 Rising Industrial Activities

3.1.4 Demand for Accurate Emission Data

3.2 Market Challenges

3.2.1 High Installation Costs

3.2.2 Technical Challenges in Remote Monitoring

3.2.3 Regulatory Compliance Barriers

3.3 Opportunities

3.3.1 Growth in Energy & Power Sectors

3.3.2 Adoption of Smart Emission Systems

3.4 Trends

3.4.1 Increased Adoption of IoT-based Emission Monitoring

3.4.2 Integration with Data Analytics Platforms

3.5 Regulatory Framework

3.5.1 EPA Emission Standards

3.5.2 Industry-Specific Emission Regulations

3.6 Competitive Landscape

3.6.1 Porters Five Forces

3.6.2 SWOT Analysis

3.7 Stakeholder Ecosystem

4. North America Emission Monitoring Systems Market Segmentation

4.1 By System Type

4.1.1 Continuous Emission Monitoring System (CEMS)

4.1.2 Predictive Emission Monitoring System (PEMS)

4.2 By Industry Vertical

4.2.1 Oil & Gas

4.2.2 Chemical & Petrochemical

4.2.3 Power Generation

4.2.4 Cement

4.2.5 Waste Incineration

4.3 By Offering Type

4.3.1 Hardware

4.3.2 Software

4.3.3 Services

4.4 By Emission Type

4.4.1 Carbon Monoxide (CO)

4.4.2 Sulfur Dioxide (SO2)

4.4.3 Nitrogen Oxides (NOx)

4.4.4 Particulate Matter (PM)

4.5 By Region

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Emission Monitoring Systems Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ABB Ltd.

5.1.2 Thermo Fisher Scientific

5.1.3 Siemens AG

5.1.4 Emerson Electric Co.

5.1.5 Teledyne Technologies Incorporated

5.1.6 Horiba Ltd.

5.1.7 AMETEK, Inc.

5.1.8 Baker Hughes Company

5.1.9 General Electric

5.1.10 Rockwell Automation

5.1.11 SICK AG

5.1.12 Yokogawa Electric Corporation

5.1.13 Fuji Electric Co., Ltd.

5.1.14 Enviro Technology Services Plc

5.1.15 Durag Group

5.2 Cross Comparison Parameters

5.2.1 Revenue

5.2.2 Product Portfolio

5.2.3 Market Share

5.2.4 Technological Innovation

5.2.5 Regional Presence

5.2.6 R&D Investments

5.2.7 Customer Base

5.2.8 Environmental Compliance Standards

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

6. North America Emission Monitoring Systems Market Regulatory Framework

6.1 Environmental Standards (EPA, Regional Compliance)

6.2 Certification Requirements (ISO 14001, Industrial Standards)

7. North America Emission Monitoring Systems Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Emission Monitoring Systems Future Market Segmentation

8.1 By System Type

8.2 By Industry Vertical

8.3 By Offering Type

8.4 By Emission Type

8.5 By Region

9. North America Emission Monitoring Systems Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Target Customer Profiles

9.3 Emerging Markets and Expansion Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map was constructed to include all major stakeholders in the North America Emission Monitoring Systems market. Extensive desk research and analysis of secondary sources were conducted to define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data were compiled and analyzed, including market penetration, revenue generation, and product availability, with a focus on CEMS and PEMS applications across key industries.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with industry experts across various sectors. Insights from these professionals provided essential information on operational and financial aspects.

Step 4: Research Synthesis and Final Output

In the final stage, feedback from key industry players helped refine the market analysis, ensuring accuracy in the data derived from bottom-up research methods.

Frequently Asked Questions

01 How big is the North America Emission Monitoring Systems Market?

The North America Emission Monitoring Systems market is valued at USD 1.3 billion, driven by industrial compliance requirements and advancements in monitoring technologies.

02 What are the challenges in the North America Emission Monitoring Systems Market?

Key challenges in North America Emission Monitoring Systems market include high installation costs, technical complexities, and stringent regulatory requirements that may hinder smaller firms from entering the market.

03 Who are the major players in the North America Emission Monitoring Systems Market?

Leading companies in North America Emission Monitoring Systems market include ABB Ltd., Thermo Fisher Scientific, Siemens AG, Emerson Electric Co., and Teledyne Technologies, with significant presence and influence in North America.

04 What are the growth drivers for the North America Emission Monitoring Systems Market?

The North America Emission Monitoring Systems market is primarily driven by environmental regulations, technological advancements in emission monitoring, and the growing demand for sustainable industrial practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.