North America Enterprise Content Management (ECM) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD8066

December 2024

86

About the Report

North America Enterprise Content Management (ECM) Market Overview

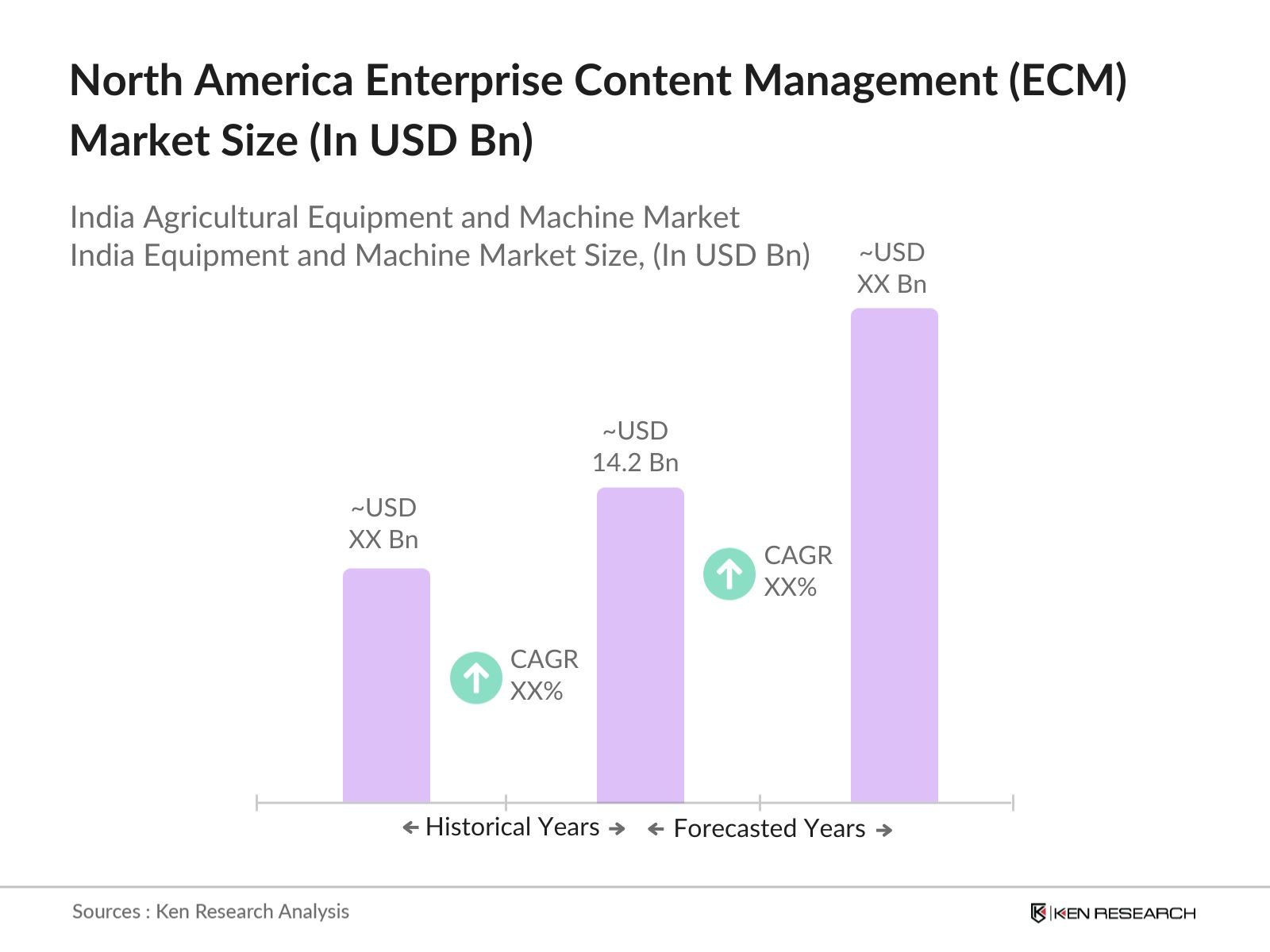

- The North America Enterprise Content Management (ECM) market is valued at USD 14.2 billion, driven by increasing data management needs in sectors like healthcare, finance, and government. This value is based on a comprehensive analysis of the markets evolution over the last five years, showing a steady rise due to the digitization of workflows, data security needs, and regulatory compliance requirements. Demand from large organizations looking to streamline document management, coupled with the growth of cloud-based solutions, remains a significant driver, enhancing efficiency and reducing operational costs.

- The United States holds a prominent position in the North American ECM market, primarily due to the presence of major ECM providers and advanced technological infrastructure. Large-scale adoption across multiple sectors, including healthcare, finance, and public administration, has been instrumental in establishing the U.S. as a key market leader. Canada also demonstrates substantial growth in ECM usage, supported by stringent data protection regulations and a digital-first approach by businesses in sectors such as finance and government.

- North Americas ECM market is influenced by stringent compliance requirements such as the GDPR and California Consumer Privacy Act (CCPA). In 2023, 90% of ECM providers ensured systems are compliant with these regulations, as non-compliance can result in heavy fines. The emphasis on secure data handling has led companies across sectors to invest in ECM solutions that prioritize data privacy, especially given the rising number of consumer privacy lawsuits, which reached over 1,500 cases in the U.S. in 2023

North America Enterprise Content Management (ECM) Market Segmentation

By Deployment Type: The market is segmented by deployment type into On-Premises, Cloud-Based, and Hybrid solutions. Currently, Cloud-Based ECM solutions dominate due to the scalability and flexibility they offer, allowing businesses to efficiently manage data from multiple locations. Cloud deployments align well with the trend towards remote work, providing companies with enhanced accessibility, data recovery, and reduced costs compared to on-premises solutions. The rapid advancements in cloud security further support its growing preference among enterprises.

By Industry Vertical: The market is segmented by industry vertical into Banking, Financial Services, and Insurance (BFSI); IT & Telecom; Government; Healthcare; and Manufacturing. The Banking and Financial Services (BFSI) sector leads in market share, largely driven by stringent compliance and regulatory requirements. ECM solutions in BFSI assist in document tracking, customer service improvement, and secure record management, ensuring data confidentiality while adhering to evolving standards in finance and data privacy.

North America Enterprise Content Management (ECM) Market Competitive Landscape

The North America ECM market is dominated by several major players, each contributing significantly to technological advancements and market stability. Key players such as IBM and Microsoft lead in market share due to their robust product portfolios and commitment to innovation. Other significant competitors include Oracle and OpenText, both well-positioned to cater to various industries through their expansive solutions.

|

Company |

Establishment Year |

Headquarters |

Key Parameters |

Revenue (USD Bn) |

Employees |

Patents |

Regional Presence |

Product Innovation |

Partnerships |

|

IBM Corporation |

1911 |

Armonk, NY |

|||||||

|

Microsoft Corp. |

1975 |

Redmond, WA |

|||||||

|

Oracle Corporation |

1977 |

Redwood City |

|||||||

|

OpenText Corp. |

1991 |

Waterloo, ON |

|||||||

|

Hyland Software Inc. |

1991 |

Westlake, OH |

North America Enterprise Content Management (ECM) Industry Analysis

Growth Drivers

- Rising Adoption of Cloud-Based ECM Solutions: The North American ECM market has experienced significant growth in cloud-based solutions, as businesses increasingly migrate from on-premises to cloud storage for scalability and remote access. In 2023, nearly 70% of companies across North America adopted cloud-based enterprise content management systems to handle rising volumes of digital data securely. The increased scalability that cloud solutions offer aligns with the growing data needs of sectors like healthcare and finance, which together accounted for over 30 million terabytes of stored data in North America in 2023, reflecting heavy reliance on cloud-based systems.

- Regulatory Compliance and Data Security: Regulatory frameworks like the U.S. Health Insurance Portability and Accountability Act (HIPAA) and Canada's Personal Information Protection and Electronic Documents Act (PIPEDA) have driven a strong demand for ECM solutions to ensure compliance and secure sensitive data. In 2022, North America saw a 20% rise in organizations adopting ECM systems to adhere to these frameworks, contributing to the widespread use of encryption protocols, which protect 50 million health records in the U.S. alone. The push for data compliance is further bolstered by an increase in data breach incidents, which cost the U.S. economy over $15 billion in 2023.

- Shift Towards Digital Transformation: Digital transformation in North America has accelerated ECM adoption as organizations aim to streamline operations and reduce physical documentation. The U.S. government reported a $5 billion allocation toward digital initiatives in 2023, fueling ECM deployment across public sector departments. Digitizing workflows has helped companies save over 1 million hours in document processing annually, especially in fields like insurance and banking. This demand for efficient digital records is a strong driver, particularly among small to medium enterprises aiming to enhance productivity.

Market Challenges

- Data Privacy and Security Concerns: The rising instances of data breaches in North America have underscored the challenges ECM systems face in ensuring data privacy and security. In 2023 alone, North America accounted for over 1,200 cyberattacks, resulting in substantial data loss. This vulnerability has driven increased regulatory scrutiny and has led 80% of ECM solution providers in North America to implement advanced security protocols, reflecting the sectors focus on bolstering cybersecurity.

- Integration Challenges with Legacy Systems: North American organizations face difficulties in integrating ECM solutions with legacy systems, especially in industries with outdated infrastructure like manufacturing and healthcare. Reports from 2022 indicate that up to 60% of companies find it challenging to adopt new ECM tools due to compatibility issues with older technology, slowing the implementation process. As of 2023, companies had spent approximately $1 billion to bridge integration gaps, signifying the economic impact of this challenge in the ECM market.

North America Enterprise Content Management (ECM) Market Future Outlook

The North America ECM market is expected to witness significant advancements, largely driven by increased demand for digital transformation across sectors and the adoption of AI-enabled content solutions. Key drivers include cloud migration, enhanced data analytics, and stringent data privacy regulations, all of which are anticipated to propel growth. Additionally, as more companies embrace hybrid work models, ECM solutions are likely to become essential for secure data management, supporting seamless accessibility and collaboration.

Future Market Opportunities

- AI and Machine Learning Enhancements: The integration of AI and machine learning in ECM systems presents new opportunities for intelligent data processing and automation. In 2023, North America saw over $2 billion invested in AI-powered ECM tools, with applications in predictive analytics and automated document classification. This development has enabled companies to reduce data retrieval times by 30%, particularly benefiting sectors with high document processing volumes, such as legal and insurance industries.

- Increasing Adoption in SMEs: ECM solutions are increasingly accessible to SMEs in North America due to improved affordability and tailored offerings. In 2022, about 45% of small to medium enterprises adopted ECM systems, a notable rise from previous years, as cloud-based solutions offer more scalable pricing. Federal and state-level incentives in the U.S., totaling around $200 million, have supported SMEs in adopting ECM to enhance data management, particularly in digitally intensive sectors such as e-commerce and retail.

Scope of the Report

|

Deployment Type |

On-Premises Cloud-Based Hybrid |

|

Organization Size |

Small & Medium Enterprises (SMEs) Large Enterprises |

|

Industry Vertical |

BFSI IT & Telecom Government Healthcare Manufacturing |

|

Component |

Solutions (Document Management, Workflow Management) Services (Consulting, Training, Support) |

|

Application |

Records Management Document Imaging and Capture Case Management Digital Asset Management Web Content Management |

Products

Key Target Audience

Banking and Financial Institutions

Healthcare Providers and Insurers

Government and Regulatory Bodies (e.g., Department of Commerce, Data Privacy Commissions)

Large Enterprises Across Sectors

Data Security Firms

IT and Telecom Firms

Investors and Venture Capitalist Firms

Technology and Cloud Service Providers

Companies

Major Players

IBM Corporation

Microsoft Corporation

Oracle Corporation

OpenText Corporation

Hyland Software, Inc.

Adobe Systems Incorporated

Xerox Corporation

Box, Inc.

Alfresco Software, Inc.

Everteam

Micro Focus

SAP SE

Infor

M-Files Corporation

Laserfiche

Table of Contents

1. North America Enterprise Content Management Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Lifecycle Stage

1.4 Key Market Dynamics

2. North America ECM Market Size (In USD Billion)

2.1 Historical Market Size (In Value %)

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America ECM Market Analysis

3.1 Growth Drivers (Scalability, Compliance Needs, and Digitization)

3.1.1 Rising Adoption of Cloud-Based ECM Solutions

3.1.2 Regulatory Compliance and Data Security

3.1.3 Shift Towards Digital Transformation

3.1.4 Increasing Demand for Data Management

3.2 Market Challenges (Security, High Cost, User Training)

3.2.1 Data Privacy and Security Concerns

3.2.2 Integration Challenges with Legacy Systems

3.2.3 High Initial Implementation Cost

3.2.4 Complexity of User Training

3.3 Opportunities (AI Integration, Mobile Accessibility)

3.3.1 AI and Machine Learning Enhancements

3.3.2 Increasing Adoption in SMEs

3.3.3 Rise in Mobile and Remote Access Solutions

3.4 Market Trends (AI, Automation, Collaboration Tools)

3.4.1 AI-Based Content Management Solutions

3.4.2 Workflow Automation and Collaboration Tools

3.4.3 Increased Demand for Customizable ECM Platforms

3.5 Regulatory Landscape (Data Compliance, Standards)

3.5.1 GDPR and CCPA Compliance

3.5.2 Industry-Specific Content Regulations

3.5.3 Regional Data Storage Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Overview

4. North America ECM Market Segmentation

4.1 By Deployment Type (In Value %)

4.1.1 On-Premises

4.1.2 Cloud-Based

4.1.3 Hybrid

4.2 By Organization Size (In Value %)

4.2.1 Small & Medium Enterprises (SMEs)

4.2.2 Large Enterprises

4.3 By Industry Vertical (In Value %)

4.3.1 Banking, Financial Services, and Insurance (BFSI)

4.3.2 IT & Telecom

4.3.3 Government

4.3.4 Healthcare

4.3.5 Manufacturing

4.4 By Component (In Value %)

4.4.1 Solutions (Document Management, Workflow Management)

4.4.2 Services (Consulting, Training, Support)

4.5 By Application (In Value %)

4.5.1 Records Management

4.5.2 Document Imaging and Capture

4.5.3 Case Management

4.5.4 Digital Asset Management

4.5.5 Web Content Management

5. North America ECM Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 IBM Corporation

5.1.2 Microsoft Corporation

5.1.3 Oracle Corporation

5.1.4 OpenText Corporation

5.1.5 Hyland Software, Inc.

5.1.6 M-Files Corporation

5.1.7 Box, Inc.

5.1.8 Laserfiche

5.1.9 Adobe Systems Incorporated

5.1.10 Xerox Corporation

5.1.11 Alfresco Software, Inc.

5.1.12 Everteam

5.1.13 Micro Focus

5.1.14 SAP SE

5.1.15 Infor

5.2 Cross Comparison Parameters (Revenue, No. of Patents, Market Penetration, Partnerships, Product Innovation Rate, Employee Strength, R&D Spending, Regional Presence)

5.3 Market Share Analysis (By Revenue and Volume)

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. North America ECM Market Regulatory Framework

6.1 Data Privacy Regulations (GDPR, CCPA)

6.2 Compliance Standards (SOX, HIPAA)

6.3 Certification Processes

6.4 Regional Data Retention Laws

7. North America ECM Future Market Size (In USD Billion)

7.1 Forecasted Market Size Projections

7.2 Key Growth Catalysts in Future Market

8. North America ECM Future Market Segmentation

8.1 By Deployment Type

8.2 By Organization Size

8.3 By Industry Vertical

8.4 By Component

8.5 By Application

9. North America ECM Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Strategic Partnership Analysis

9.3 Marketing and Sales Strategies

9.4 Innovation and White Space Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involved mapping the ecosystem of the North America ECM Market, covering all stakeholders. This research utilized multiple sources, including governmental publications and proprietary databases, to identify variables influencing market growth.

Step 2: Market Analysis and Construction

In this phase, historical data on market size and growth trends were gathered and analyzed. This process included assessing ECM adoption rates across sectors and the resulting revenue contribution to market growth, supported by qualitative analysis.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about ECM adoption trends and future growth potential were validated through industry expert interviews. Insights were collected via surveys and interviews with leading ECM providers to ensure data reliability.

Step 4: Research Synthesis and Final Output

Final data synthesis included consultation with ECM vendors to confirm data accuracy. This feedback, combined with a bottom-up approach, ensured that the final report provides a reliable, in-depth market analysis.

Frequently Asked Questions

01. How big is the North America Enterprise Content Management (ECM) Market?

The North America ECM market is valued at USD 14.2 billion, driven by increased data handling needs across sectors such as healthcare and finance.

02. What are the challenges in the North America ECM Market?

Key challenges in the North America ECM market include data privacy concerns, high implementation costs, and the complexity of integrating ECM solutions with legacy systems.

03. Who are the major players in the North America ECM Market?

Major players in the North America ECM market include IBM, Microsoft, Oracle, OpenText, and Hyland Software, with each offering diverse solutions and robust customer bases.

04. What are the growth drivers of the North America ECM Market?

Growth in the North America ECM market is propelled by digital transformation trends, cloud solution adoption, and stringent data protection regulations across various industries.

05. What is the primary deployment type in the North America ECM Market?

Cloud-based ECM solutions dominate the North America ECM market due to scalability and flexibility, which align with the growing demand for remote accessibility and cost-efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.