North America ERP Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD2652

November 2024

87

About the Report

North America ERP Market Overview

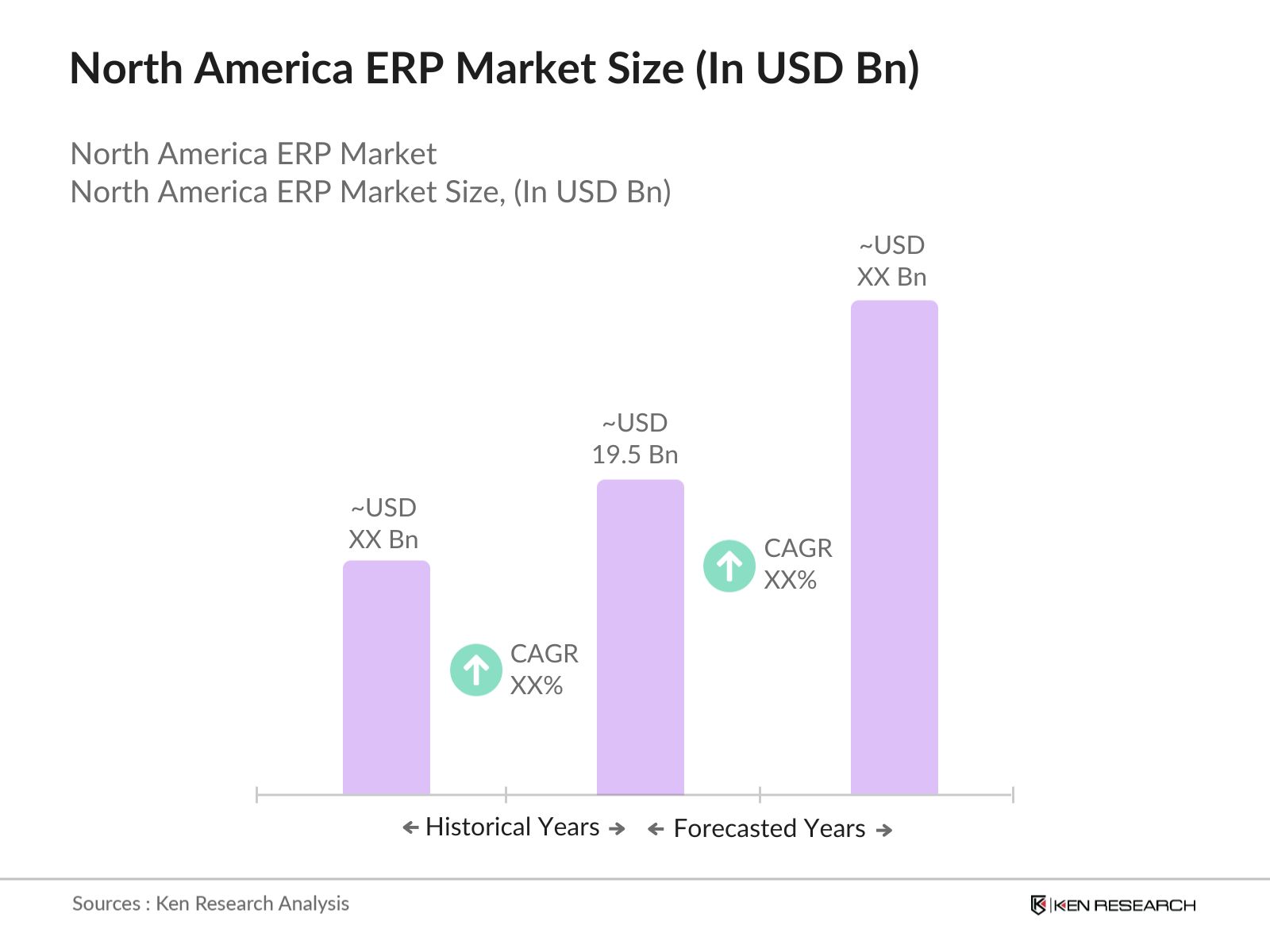

- The North America ERP (Enterprise Resource Planning) market is valued at USD 19.5 billion. This growth is primarily driven by the increasing adoption of cloud-based ERP solutions and the need for businesses to integrate digital tools for operational efficiency. Enterprises across various industries are leveraging ERP systems to streamline their processes, improve real-time reporting, and ensure compliance with regulatory standards. The rising demand for data-driven decision-making and enhanced customer management also supports the expansion of ERP systems.

- In terms of geographical dominance, the USA remains the largest contributor to the North America ERP market due to the presence of major ERP vendors and a well-established technology infrastructure. Leading cities like New York, San Francisco, and Dallas host the headquarters of many large enterprises that have heavily invested in ERP systems to manage large-scale operations and complex supply chains.

- Data protection regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) are shaping ERP implementations in North America. By 2024, over 1,000 data breaches had been reported in the U.S., with regulatory fines exceeding $100 million, according to the U.S. Federal Trade Commission (FTC). ERP systems are required to comply with these stringent regulations, ensuring that customer data is stored, processed, and transferred securely, particularly in sectors like finance, healthcare, and e-commerce.

North America ERP Market Segmentation

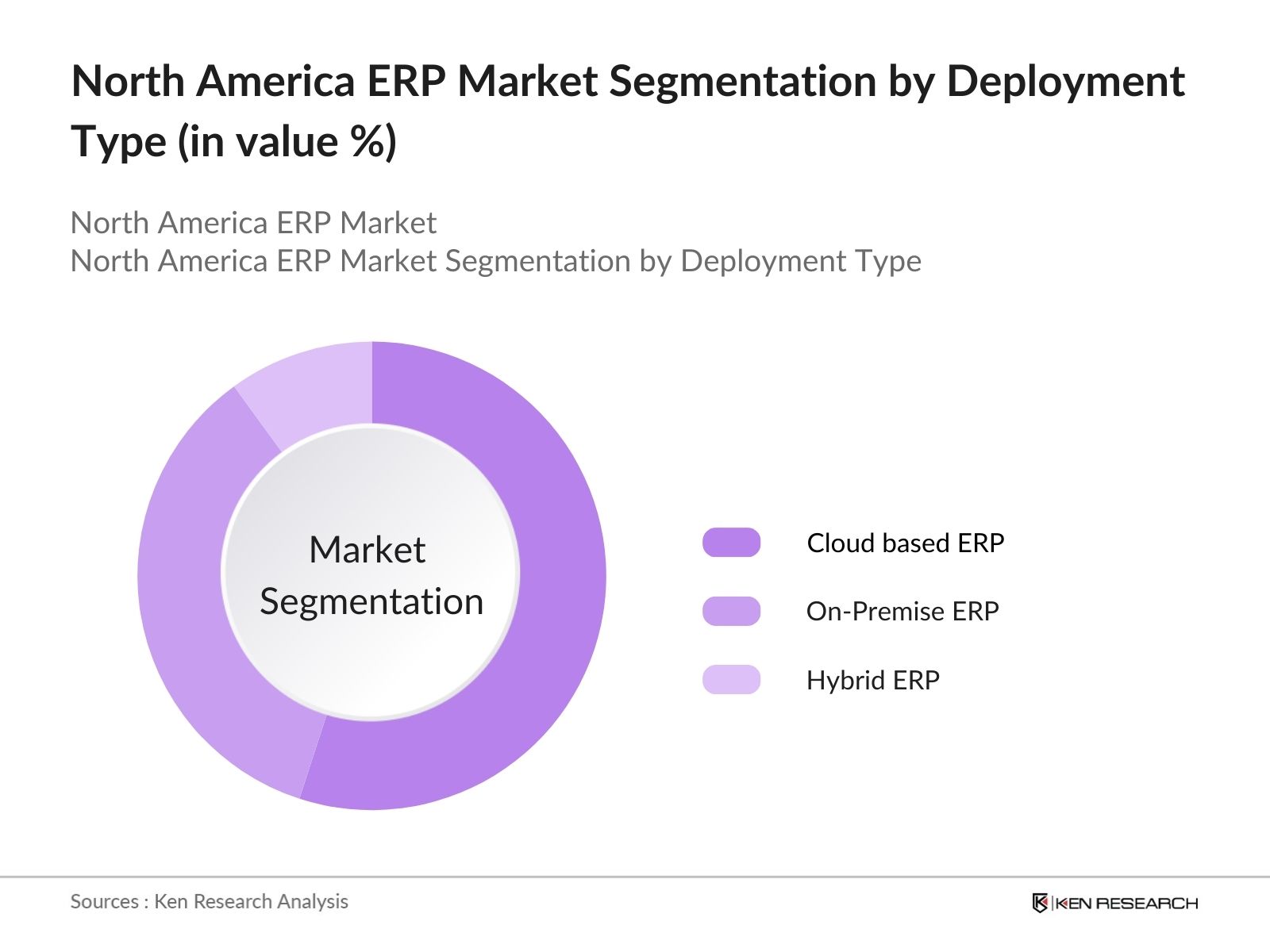

By Deployment Type: The North America ERP market is segmented by deployment type into Cloud-Based ERP, On-Premise ERP, and Hybrid ERP. Cloud-based ERP has captured a dominant market share due to its lower implementation costs, scalability, and flexibility. Enterprises are increasingly moving towards cloud-based solutions to benefit from the subscription-based pricing model, easy updates, and remote access. In contrast, on-premise ERP still holds a significant share in industries that require data control, such as government and finance. However, hybrid ERP systems, which combine both cloud and on-premise functionalities, are becoming popular as they offer a balanced approach to scalability and control.

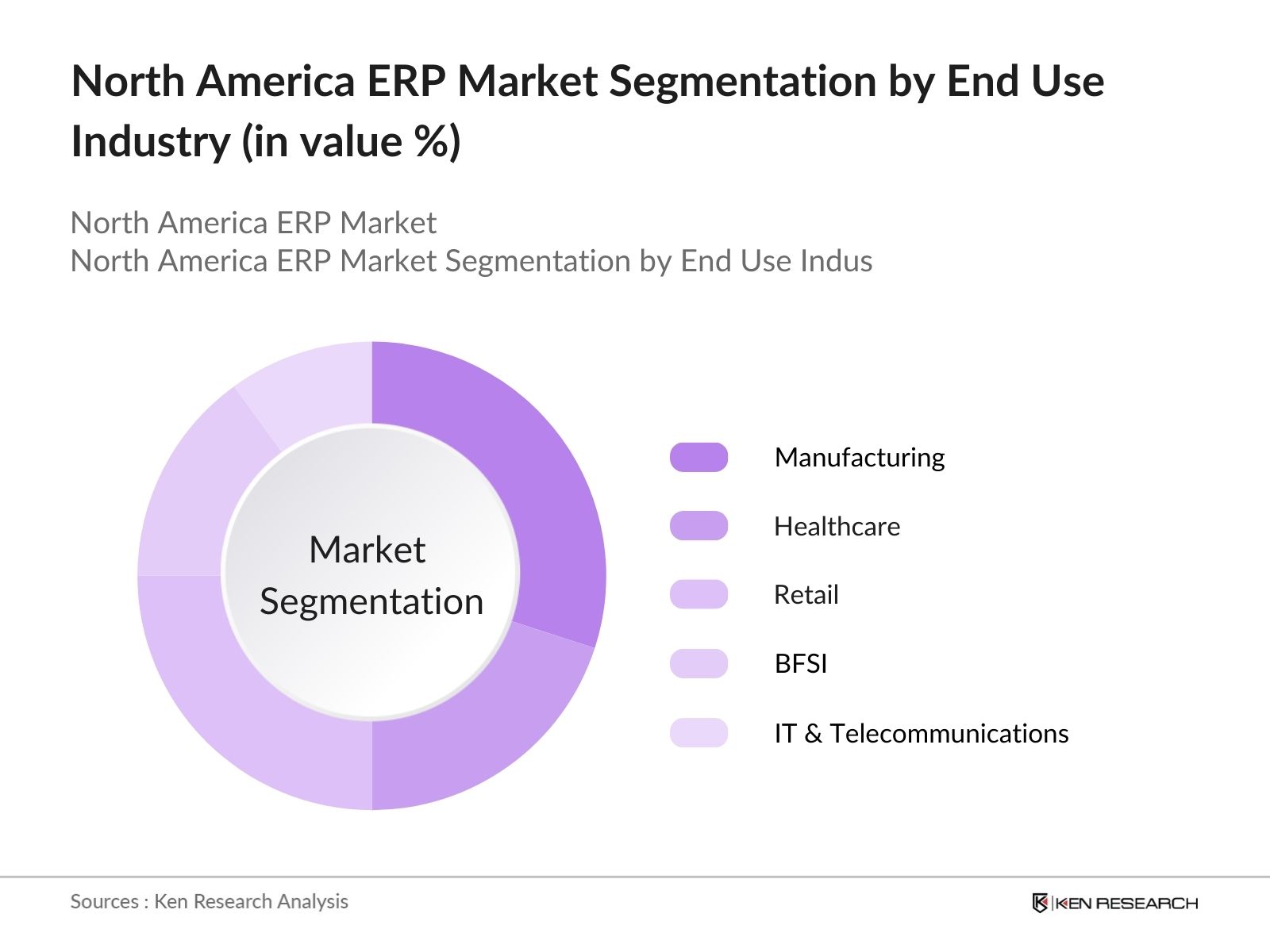

By End-Use Industry: The market is also segmented by end-use industry into Manufacturing, Healthcare, Retail, BFSI, and IT & Telecommunications. The manufacturing sector dominates the ERP market due to its need for comprehensive supply chain management, inventory control, and production planning capabilities. As more manufacturers embrace automation and digital transformation, ERP systems are becoming essential to ensure operational efficiency and minimize downtime. The retail sector is also a strong adopter of ERP systems, particularly in managing omnichannel operations, customer relationship management, and data analytics for demand forecasting.

North America ERP Market Competitive Landscape

The North America ERP market is dominated by a few key players who have established themselves through strategic acquisitions, strong product portfolios, and robust customer bases. The top players include SAP, Oracle, Microsoft, Infor, and Workday. These companies have significant influence due to their extensive market reach, innovative product offerings, and focus on vertical-specific ERP solutions.

The competitive landscape is further shaped by the rise of SaaS (Software as a Service) ERP solutions, which has led to increased competition from newer players like NetSuite and Acumatica. The consolidation of key players in the industry underscores their dominance, as they continue to innovate and expand their capabilities to cater to the evolving needs of businesses in various sectors.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Global Presence |

Revenue (2023) |

ERP Portfolio |

Cloud ERP Offerings |

|

SAP SE |

1972 |

Walldorf, Germany |

- |

- |

- |

- |

- |

|

Oracle Corporation |

1977 |

Austin, USA |

- |

- |

- |

- |

- |

|

Microsoft Corporation |

1975 |

Redmond, USA |

- |

- |

- |

- |

- |

|

Infor |

2002 |

New York, USA |

- |

- |

- |

- |

- |

|

Workday Inc. |

2005 |

Pleasanton, USA |

- |

- |

- |

- |

- |

North America ERP Market Analysis

Growth Drivers

- Cloud-Based ERP Adoption: The increasing demand for flexible and scalable ERP solutions has driven a significant shift toward cloud-based ERP systems in North America. Approximately98% of U.S. organizationshave adopted cloud services for at least some business operations, which includes a wide range of applications from simple storage solutions to complex cloud-native systems. The preference for cloud ERP solutions is due to reduced infrastructure costs and enhanced accessibility, particularly for remote work.

- Rise of AI and Machine Learning in ERP Systems: Artificial Intelligence (AI) and Machine Learning (ML) are transforming ERP systems by enabling predictive analytics and real-time decision-making. This integration improves process automation, enhances customer experiences, and reduces operational costs by identifying inefficiencies. The Department of Defense (DoD) has significantly increased its spending on AI, with commitments rising from$190 millionin 2022 to$557 millionin 2023, also drive innovation in the ERP sector, with a focus on advanced analytics and cognitive computing. Source: IMF

- Government Digital Initiatives: Government-driven digital initiatives across North America, such as tax reforms and regulatory compliance updates, are stimulating ERP adoption. For instance, the U.S. Internal Revenue Service (IRS) is pushing digital tax filing systems, with over 150 million electronic returns expected by 2024, which necessitates ERP integration in large enterprises. Similarly, Canada has adopted several e-invoicing and e-payment regulations under its digital strategy.

Challenges

- High Implementation Costs: The high initial cost of ERP implementation remains a major challenge in North America. According to the U.S. Bureau of Labor Statistics (BLS), the average implementation time for a cloud-based ERP system is around 12-18 months, with labor costs ranging between $100,000 to $500,000 per project. This financial burden makes ERP adoption less accessible for smaller companies.

- Data Security Concerns: Data security is a critical concern in ERP systems, particularly with the rise of cyberattacks. In 2024, North America has witnessed more than 300 million cyber incidents, according to the Federal Bureau of Investigation (FBI). Cloud-based ERP systems, though convenient, are more vulnerable to breaches if not adequately secured. Additionally, the cost of cybersecurity breaches averages over $4 million per incident, which impacts ERP investments.

North America ERP Future Market Outlook

The North America ERP market is expected to witness substantial growth in the coming years, driven by continued investment in cloud infrastructure, advancements in AI and machine learning, and the increasing need for real-time data analytics. Enterprises are expected to prioritize flexibility, scalability, and cost-effectiveness, which will drive the adoption of cloud-based ERP systems. The ongoing digital transformation across various industries, coupled with regulatory compliance requirements, will further enhance the demand for ERP systems, particularly in sectors like healthcare, manufacturing, and BFSI.

Market Opportunities

- Expansion of SaaS ERP Solutions: SaaS (Software as a Service) ERP models present substantial opportunities for businesses in North America. As of 2024, more than 60% of businesses have adopted SaaS-based solutions, reducing dependency on on-premise systems and lowering infrastructure costs. This shift is driven by the need for flexible, scalable solutions that offer real-time updates, particularly in industries like retail and logistics, where demand for operational efficiency is rising.

- SME ERP Adoption: Small and Medium Enterprises (SMEs) in North America represent a key growth area for ERP vendors. According to the U.S. Small Business Administration (SBA), there are over 30 million SMEs in the U.S. alone, many of which are rapidly adopting ERP systems to enhance operational efficiency. This trend is supported by government incentives for digital transformation in smaller enterprises

Scope of the Report

|

Segment |

Sub-Segment |

|

By Deployment Type |

Cloud-Based ERP |

|

On-Premise ERP |

|

|

Hybrid ERP |

|

|

By Enterprise Size |

Small and Medium Enterprises (SMEs) |

|

Large Enterprises |

|

|

By End-Use Industry |

Manufacturing |

|

Healthcare |

|

|

Retail |

|

|

BFSI |

|

|

Government and Utilities |

|

|

IT & Telecommunications |

|

|

By Functionality |

Finance and Accounting |

|

Human Resource Management |

|

|

Supply Chain Management |

|

|

Customer Relationship Management (CRM) |

|

|

By Region |

USA |

|

Canada |

|

|

Mexico |

Products

Key Target Audience

ERP Software Providers

Cloud Infrastructure Providers

IT & Telecommunications Companies

Manufacturing Companies

Government and Regulatory Bodies (U.S. Federal Communications Commission, Canadian Radio-television and Telecommunications Commission)

Investors and Venture Capitalist Firms

BFSI (Banking, Financial Services, and Insurance) Companies

Companies

List of Major Players

SAP SE

Oracle Corporation

Microsoft Corporation

Infor

Workday Inc.

Epicor Software Corporation

Sage Group

Acumatica

NetSuite (Oracle)

Deltek

Odoo SA

Unit4

IFS AB

Plex Systems

Syspro

Table of Contents

1. North America ERP Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America ERP Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America ERP Market Analysis

3.1. Growth Drivers

3.1.1. Cloud-Based ERP Adoption

3.1.2. Rise of AI and Machine Learning in ERP Systems

3.1.3. Government Digital Initiatives

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Data Security Concerns

3.3. Opportunities

3.3.1. Expansion of SaaS ERP Solutions

3.3.2. SME ERP Adoption

3.4. Trends

3.4.1. Hybrid ERP Models

3.4.2. Vertical-Specific ERP Solutions

3.5. Government Regulations

3.5.1. Data Protection Regulations

3.5.2. Tax Reforms and Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competitive Ecosystem

4. North America ERP Market Segmentation

4.1. By Deployment Type (In Market Share %)

4.1.1. Cloud-Based ERP

4.1.2. On-Premise ERP

4.1.3. Hybrid ERP

4.2. By End-Use Industry (In Market Share %)

4.2.1. Manufacturing

4.2.2. Healthcare

4.2.3. Retail

4.2.4. BFSI

4.2.5. IT & Telecommunications

4.3. By Enterprise Size

4.3.1. Small and Medium Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By Functionality

4.4.1. Finance and Accounting

4.4.2. Human Resource Management

4.4.3. Supply Chain Management

4.4.4. Customer Relationship Management (CRM)

4.5. By Region (In Market Share %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

5. North America ERP Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SAP SE

5.1.2. Oracle Corporation

5.1.3. Microsoft Corporation

5.1.4. Infor

5.1.5. Workday Inc.

5.2. Cross-Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. North America ERP Market Regulatory Framework

6.1. Data Protection and Privacy Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. North America ERP Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America ERP Future Market Segmentation

8.1. By Deployment Type (In Market Share %)

8.2. By End-Use Industry (In Market Share %)

8.3. By Enterprise Size

8.4. By Functionality

8.5. By Region

9. North America ERP Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step focuses on identifying key market variables, such as technological advancements, regulatory requirements, and macroeconomic factors that affect the ERP market in North America. Extensive desk research and consultations with industry stakeholders are conducted to gather relevant data.

Step 2: Market Analysis and Construction

In this phase, we collect historical data on ERP adoption rates, revenue growth, and the competitive landscape. This data is used to develop a market model that includes forecasting based on current trends and future projections.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses are validated through interviews with ERP providers and consultants. These insights help fine-tune the market model and verify key trends driving the market.

Step 4: Research Synthesis and Final Output

Finally, we synthesize all research findings and provide a comprehensive report, validated through cross-checking with ERP vendors and industry experts to ensure accuracy

Frequently Asked Questions

01. How big is the North America ERP Market?

The North America ERP market is valued at USD 19.5 billion. This growth is driven by digital transformation initiatives across industries and increasing demand for cloud-based ERP solutions.

02. What are the challenges in the North America ERP Market?

Challenges include high implementation costs, concerns over data security, and the complexity of integrating ERP systems with legacy infrastructure in certain industries.

03. Who are the major players in the North America ERP Market?

Key players include SAP, Oracle, Microsoft, Infor, and Workday. These companies dominate the market due to their extensive product offerings and global presence.

04. What drives growth in the North America ERP Market?

The market is propelled by the increasing demand for cloud-based ERP systems, advancements in AI, and the need for real-time data analytics. Businesses are focusing on improving operational efficiency and ensuring compliance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.