North America Fencing Market Outlook to 2030

Region:North America

Author(s):Shubham

Product Code:KROD5825

November 2024

84

About the Report

North America Fencing Market Overview

- The North America Fencing Market is currently valued at USD 10 Bn, based on a five-year historical analysis. This markets growth is largely driven by rising demand for residential and commercial construction, increasing home improvement projects, and regulatory requirements for safety and security. Advancements in fencing materials, such as metal and composite options, are enhancing the durability and aesthetic appeal of fences, further contributing to market expansion. Additionally, the market benefits from technological innovations, including smart fencing solutions that integrate with security systems, fulfilling the demand for both privacy and enhanced security.

- The United States leads the North America Fencing Market, driven by high construction activity and demand for secure residential and commercial properties. Major cities like New York, Los Angeles, and Dallas play pivotal roles in shaping the market due to the increasing urban population, housing developments, and awareness around property security. The dominance of the U.S. is also supported by its mature residential sector, growing DIY trends, and the presence of major manufacturers. Canada and Mexico are also emerging as important regions, benefiting from infrastructure projects and increasing consumer demand for sustainable fencing solutions.

- The U.S. government has been actively investing in infrastructure security, particularly focusing on enhanced fencing along critical facilities, transportation hubs, and border areas. The Department of Homeland Security (DHS) allocated a substantial amount in 2023 for physical security improvements, including the installation and maintenance of high-security fencing across vulnerable public sites.

North America Fencing Market Segmentation

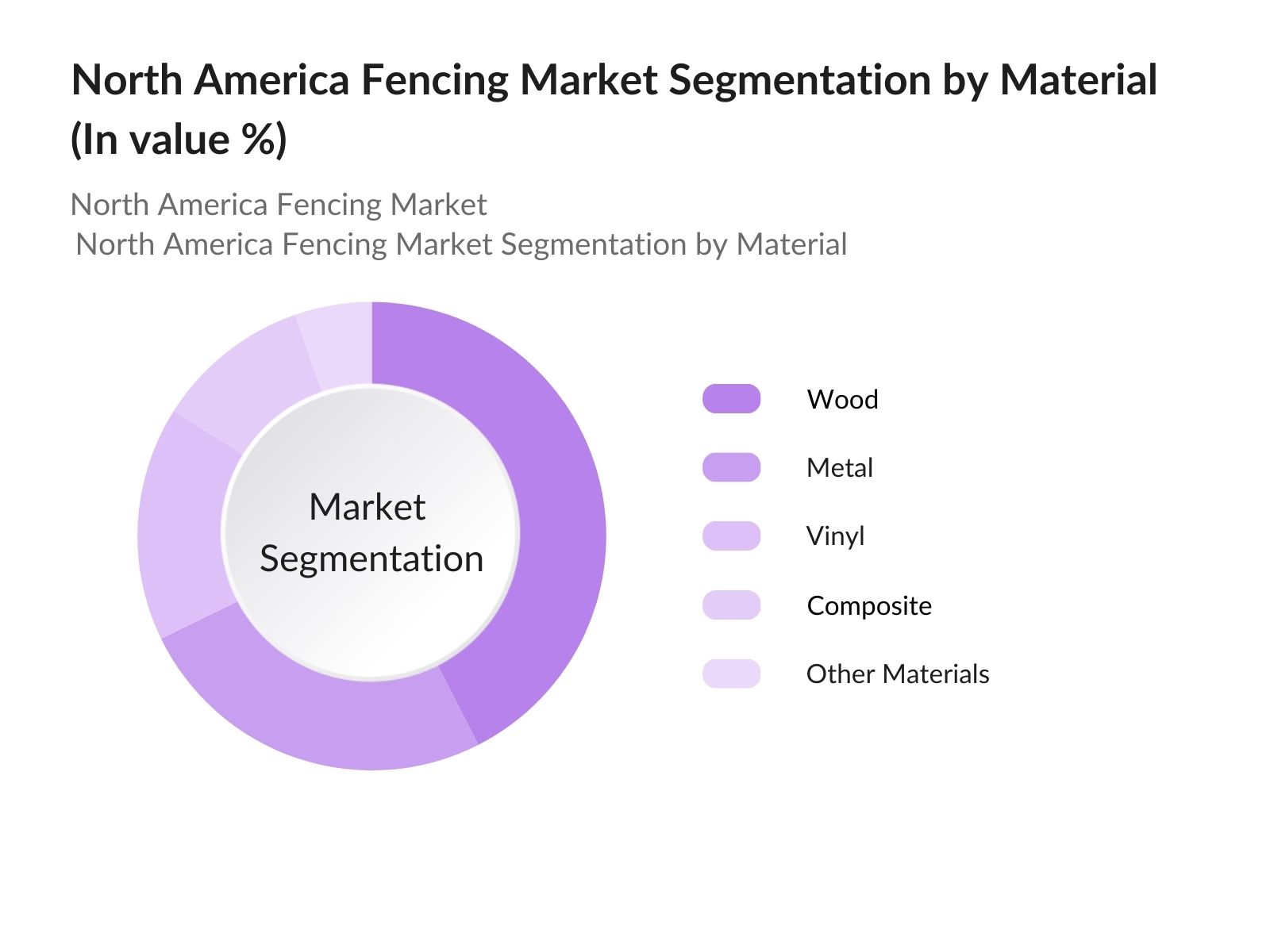

- By Material Type: The market is segmented by material type into wood, metal, vinyl, composite, and other materials. Wood fencing holds a dominant market share within this segment due to its affordability and aesthetic versatility, which are appealing to both residential and commercial consumers. Its natural appeal, combined with customization options, makes it a popular choice for fencing in suburban and rural areas across North America. However, despite weathering concerns, wood fencing remains popular due to its lower initial cost, ease of installation, and alignment with eco-conscious consumer preferences.

- By Application: The market is segmented by application into residential, commercial and industrial, agricultural, and public and government spaces. The residential application holds the highest market share, attributed to the ongoing expansion in housing developments and increasing preference for private, secure fencing. Homeowners prioritize fencing solutions that offer privacy, security, and visual appeal, with wood and vinyl being popular choices for this application. The trend of home improvement, influenced by the DIY movement, further supports the dominance of the residential sector in the fencing market, which includes boundary fencing, garden fencing, and decorative options.

North America Fencing Market Competitive Landscape

The North America Fencing Market is characterized by a mix of leading regional and international players, which focus on offering a broad product portfolio, investing in innovative materials, and developing strategic partnerships to maintain their competitive advantage. The competitive dynamics in this market reflect a high level of consolidation, where major players capitalize on market demand through strong distribution networks and sustainable production initiatives.

North America Fencing Market Industry Analysis

Growth Drivers

- Urbanization and Infrastructure Development: The North American fencing market has seen significant momentum, spurred by a strong trend in urbanization and increased infrastructure investment. In 2023, 83% of the U.S. population resided in urban areas, an increase from 82.4% in 2022, according to the U.S. Census Bureau. This trend is influencing residential and commercial fencing demand in urban and suburban zones to ensure safety, security, and property delineation. Additionally, the U.S. federal government has allocated over USD 480 Mn to infrastructure projects in 2024, bolstering fencing needs across transportation, utilities, and public safety domains.

- Rise in Residential and Commercial Construction: Residential and commercial construction growth is driving fencing market demand in North America, particularly in the U.S. and Canada. The U.S. construction industry witnessed over 1.4 million new residential building permits in 2023, up from 1.3 million in 2022, according to the U.S. Census Bureau. Additionally, Canada issued thousands of housing starts in 2023, supporting substantial demand for residential fencing. This growth in construction, coupled with urban sprawl, emphasizes the need for durable, aesthetic, and functional fencing solutions for security, privacy, and property enhancement.

- Advancements in Fence Materials and Technology: With a focus on sustainable infrastructure, advancements in fence materialssuch as composite, recycled plastics, and treated woodare reshaping the North American fencing landscape. These materials reduce resource strain while enhancing durability and lifecycle. In 2023, more than 4 million metric tons of recycled plastic were used in construction applications, including fencing, as reported by the U.S. Environmental Protection Agency (EPA). Technology integration, like IoT-enabled smart fencing, is also gaining traction in commercial and government applications for better monitoring and control.

Market Challenges

- High Costs of Premium Fencing Materials: In North America, the cost of raw materials like steel and vinyl, essential for fencing, continues to pressure market profitability. The steel industry's dependence on complex supply chains has led to pricing fluctuations, impacting affordability and slowing market growth. Additionally, vinyl resin shortages have heightened import reliance, challenging manufacturers to maintain competitive pricing. These factors affect affordability for end-users, making cost-efficient solutions challenging to implement while maintaining quality standards.

- egional Climate Adaptation Issues: North Americas diverse climatefrom harsh winters in Canada to extreme summer temperatures in the southwestern U.S.poses unique durability challenges for fencing materials. The regions temperature fluctuations have heightened the need for climate-adapted materials, like treated wood and rust-resistant steel, to withstand rapid weather changes and seasonal impacts. This climate variation contributes to accelerated wear and frequent material replacements, prompting manufacturers to innovate and invest in resilient, long-lasting fencing solutions.

North America Fencing Market Future Outlook

The North America Fencing Market is expected to maintain strong growth through 2028, supported by ongoing investments in infrastructure and rising consumer preference for property enhancement. Innovations in eco-friendly materials, alongside the adoption of smart fencing solutions, will continue to drive the market. The increasing popularity of e-commerce and direct-to-consumer sales channels further positions the market for expansion, as these avenues simplify access to a wide range of fencing products for consumers.

Future Market Opportunities

- Growth in Home Improvement Projects: North America has seen increased spending on home improvement projects, with U.S. homeowners allocating Mns in 2023 to enhance property aesthetics and security. This trend has accelerated fencing demand, as homeowners seek stylish, high-quality fencing materials to increase property value. The Joint Center for Housing Studies at Harvard University reports that nearly 60% of home improvement budgets included fencing installations, emphasizing this trend.

- Expanding Landscape of Green Fencing Solutions: The push toward sustainable development has catalyzed interest in eco-friendly fencing solutions, such as bamboo, recycled composite, and low-emission treated wood. In 2023, over 12 million square feet of green fencing material were installed across North America, backed by incentives from government sustainability programs. U.S. Green Building Council initiatives support eco-friendly fencing, addressing consumer preferences for environmentally conscious products and expanding the market for green fencing.

Scope of the Report

|

By Material |

Wood Fencing Metal Fencing (Aluminum, Steel, Iron) Vinyl Fencing Composite Fencing Others |

|

By Application |

Residential Commercial and Industrial Agricultural Public and Government Spaces |

|

By Distribution Channel |

Retail Online |

|

By Product Type |

Privacy Fencing Decorative Fencing Pool Fencing Boundary Fencing |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Residential Property Developers

Commercial Real Estate Firms

Agricultural Associations

Public Infrastructure Agencies

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Department of Housing and Urban Development)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Fencing Material Suppliers

Companies

Players Mentioned in the Report

Ameristar Fence Products

Allied Tube & Conduit

Jerith Manufacturing Company

Ply Gem Holdings Inc.

Long Fence Company

Poly Vinyl Creations Inc.

Merchants Metals

Betafence

CertainTeed Corporation

Associated Materials LLC

Gregory Industries Inc.

Stephens Pipe & Steel LLC

U.S. Fence Corporation

Superior Fence & Rail

Ideal Aluminum Products

Table of Contents

1. North America Fencing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Fencing Market Size (in USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Fencing Market Dynamics

3.1 Growth Drivers

3.1.1 Urbanization and Infrastructure Development

3.1.2 Rise in Residential and Commercial Construction

3.1.3 Advancements in Fence Materials and Technology

3.1.4 Regulatory Compliance for Safety and Security

3.2 Market Challenges

3.2.1 High Cost of Raw Materials (Steel, Vinyl)

3.2.2 Regional Climate Adaptation Issues

3.2.3 Environmental Regulations

3.3 Opportunities

3.3.1 Growth in Home Improvement Projects

3.3.2 Expanding Landscape of Green Fencing Solutions

3.3.3 Customization Demand for Aesthetic Fencing

3.4 Trends

3.4.1 Increase in Demand for Privacy and Security Fencing

3.4.2 Adoption of Smart Fencing Solutions

3.4.3 Focus on Sustainable and Eco-Friendly Fencing

3.5 Regulatory Overview

3.5.1 Zoning and Permit Regulations

3.5.2 Environmental Compliance Standards

3.5.3 Federal and State Construction Safety Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Fencing Market Segmentation

4.1 By Material (in Value %)

4.1.1 Wood Fencing

4.1.2 Metal Fencing (Aluminum, Steel, Iron)

4.1.3 Vinyl Fencing

4.1.4 Composite Fencing

4.1.5 Others (Concrete, Bamboo)

4.2 By Application (in Value %)

4.2.1 Residential

4.2.2 Commercial and Industrial

4.2.3 Agricultural

4.2.4 Public and Government Spaces

4.3 By Distribution Channel (in Value %)

4.3.1 Retail

4.3.2 Online

4.4 By Product Type (in Value %)

4.4.1 Privacy Fencing

4.4.2 Decorative Fencing

4.4.3 Pool Fencing

4.4.4 Boundary Fencing

4.5 By Region (in Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Fencing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Ameristar Fence Products

5.1.2. Allied Tube & Conduit

5.1.3. Jerith Manufacturing Company

5.1.4. Ply Gem Holdings Inc.

5.1.5. Long Fence Company

5.1.6. Poly Vinyl Creations Inc.

5.1.7. Merchants Metals

5.1.8. Betafence

5.1.9. CertainTeed Corporation

5.1.10. Associated Materials LLC

5.1.11. Gregory Industries Inc.

5.1.12. Stephens Pipe & Steel LLC

5.1.13. U.S. Fence Corporation

5.1.14. Superior Fence & Rail

5.1.15. Ideal Aluminum Products

5.2 Cross-Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Manufacturing Facilities, Distribution Network, Product Portfolio, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Investments

6. North America Fencing Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance and Safety Certifications

6.3 Industry Guidelines and Codes

7. North America Fencing Market Future Size (in USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Fencing Market Future Segmentation

8.1 By Material (in Value %)

8.2 By Application (in Value %)

8.3 By Distribution Channel (in Value %)

8.4 By Product Type (in Value %)

8.5 By Region (in Value %)

9. North America Fencing Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Key Customer Segment Analysis

9.3 Market Penetration Strategies

9.4 Emerging Opportunities Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step includes mapping key stakeholders within the North America Fencing Market. A combination of proprietary and secondary databases was used to extract critical data, focusing on material preferences, application sectors, and regional demand dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on fencing materials, consumer demand trends, and geographical segmentation was assessed. Analysis of production costs, material durability statistics, and product innovation trends ensured accurate market estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through structured interviews with industry experts, including manufacturers and suppliers. These consultations provided operational insights, verifying estimates on material demand, product preferences, and the impact of regulatory factors.

Step 4: Research Synthesis and Final Output

Data synthesis involved integrating expert insights with quantitative analysis. Final calculations were corroborated through a bottom-up approach, aligning findings with industry standards and recent market developments to provide a comprehensive analysis of the North America Fencing Market.

Frequently Asked Questions

01. How big is the North America Fencing Market?

The North America fencing market is valued at USD 10 Bn, largely driven by residential demand and increased infrastructure projects.

02. What are the major growth drivers of the North America Fencing Market?

The North America fencing market growth is driven by increasing construction activities, home improvement trends, and advancements in fencing materials that offer enhanced durability and security.

03. What challenges face the North America Fencing Market?

Challenges in the North America fencing market include fluctuating raw material prices, stringent environmental regulations, and high installation costs for premium fencing options.

04. Who are the major players in the North America Fencing Market?

Key players in the North America fencing market include Ameristar Fence Products, Ply Gem Holdings Inc., Merchants Metals, Betafence, and CertainTeed Corporation, who dominate with extensive product lines and strong distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.