North America Field Programmable Gate Array (FPGA) Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6924

December 2024

95

About the Report

North America Field Programmable Gate Array (FPGA) Market Overview

- The North America FPGA Market is valued at USD 2.5 billion, according to a five-year historical analysis. The market is driven by the increasing adoption of FPGAs in key sectors such as telecommunications, data centers, and automotive electronics. FPGAs are favored for their reconfigurability, allowing for custom-tailored solutions that enhance performance, reduce power consumption, and minimize latency.

- The United States dominates the North America FPGA market, driven by strong demand from the telecommunications, aerospace, and defense sectors. The country's leadership in innovation and investment in advanced technologies such as AI and autonomous systems positions it as the primary hub for FPGA solutions. Canada also plays a role in the market due to its growing data center market and adoption of IoT technologies.

- The U.S. government has stringent export controls on FPGAs, particularly in defense applications. As of 2023, FPGAs used in military systems are classified under the International Traffic in Arms Regulations (ITAR), restricting their export without proper licensing. These regulations are in place to protect national security and ensure that programmable hardware with military applications is not sold to adversarial nations. Companies in North America must comply with these controls when engaging in defense contracts, influencing FPGA market dynamics.

North America Field Programmable Gate Array (FPGA) Market Segmentation

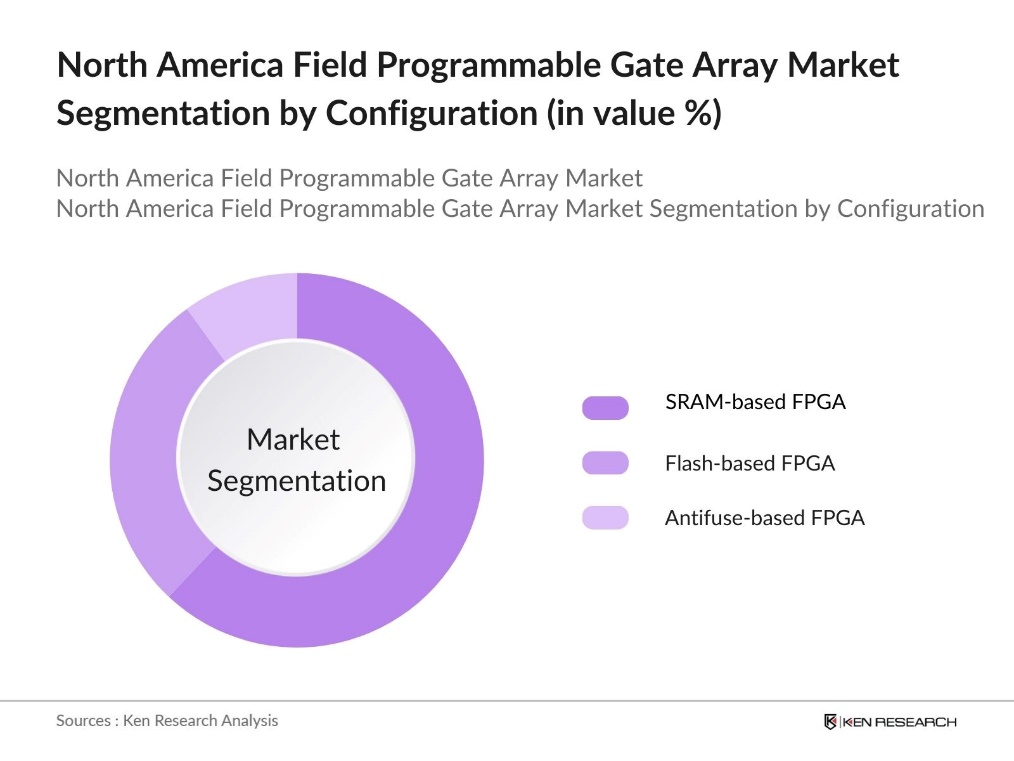

By Configuration: The North America FPGA market is segmented by configuration into SRAM-based FPGAs, flash-based FPGAs, and antifuse-based FPGAs. SRAM-based FPGAs dominate the market due to their high flexibility, ability to reprogram, and high-speed operation, which makes them suitable for industries such as telecommunications and aerospace. Flash-based FPGAs, while offering non-volatility and power efficiency, lag behind SRAM-based FPGAs due to their relatively slower speeds. However, their durability in harsh environments makes them popular in automotive applications.

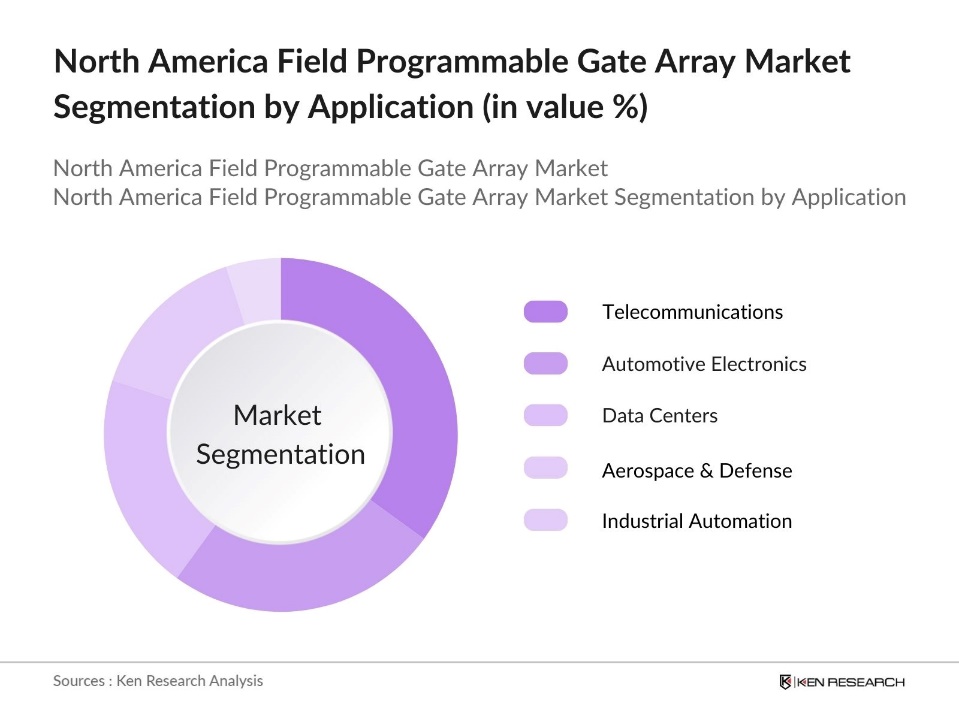

By Application: The North America FPGA market is also segmented by application into telecommunications, automotive electronics, data centers, aerospace & defense, and industrial automation. Telecommunications holds the largest share due to the increasing deployment of 5G infrastructure, where FPGAs are critical for their ability to process data at high speeds. In automotive electronics, the rising integration of advanced driver assistance systems (ADAS) and autonomous driving technologies has also bolstered the demand for FPGAs, which are essential for processing complex data streams in real time.

North America Field Programmable Gate Array (FPGA) Market Competitive Landscape

The North America FPGA market is dominated by both established global players and specialized firms focused on cutting-edge innovation. Major companies continue to invest heavily in R&D and strategic acquisitions to strengthen their market position and expand into new applications. It includes companies like Intel Corporation, Xilinx, Inc., Lattice Semiconductor Corporation etc.

|

Company Name |

Establishment Year |

Headquarters |

Product Offering |

Key Application Focus |

R&D Investment |

Revenue (USD) |

Employees |

|

Intel Corporation |

1968 |

Santa Clara, CA |

|||||

|

Xilinx, Inc. |

1984 |

San Jose, CA |

|||||

|

Lattice Semiconductor Corp. |

1983 |

Hillsboro, OR |

|||||

|

Microchip Technology Inc. |

1989 |

Chandler, AZ |

|||||

|

Achronix Semiconductor Corp. |

2004 |

Santa Clara, CA |

North America Field Programmable Gate Array (FPGA) Industry Analysis

Growth Drivers

- Increased Demand for Data Centers: The expansion of data centers across North America is a critical driver for FPGA adoption, particularly in AI, ML, and cloud computing. With the rise in data processing requirements, FPGAs are increasingly utilized for their ability to handle high volumes of data in parallel. As of 2023, the United States hosts over 2,990 data centers, making it the global leader. FPGA use in these centers has enabled faster processing, reducing latency in high-demand applications.

- Technological Advancements in AI and ML Applications: The integration of FPGAs in AI and ML applications is another key driver, given their reprogrammable nature and ability to process algorithms faster than traditional CPUs. FPGAs allow faster algorithm training and deployment, making them indispensable in industries like healthcare, autonomous vehicles, and robotics. For instance, Microsofts Bing search engine utilized FPGAs to achieve a 50% increase in throughput for search ranking tasks.

- Growth in Automotive Electronics: The automotive sector in North America is increasingly adopting FPGAs for autonomous driving, advanced driver-assistance systems (ADAS), and infotainment systems. FPGAs are critical for real-time sensor data processing, enhancing vehicle safety and operational efficiency. Their flexibility and programmability make them essential for advanced vehicular technologies, supporting the development of smarter, safer vehicles across the region. This highlights FPGAs' growing role in automotive electronics innovation.

Market Challenges

- High Development Costs: FPGA development is a significant challenge for market adoption, especially for smaller companies. The process of developing and programming FPGAs is capital-intensive, often requiring custom designs and specialized software tools. The complexity of FPGAs demands substantial initial investments in software infrastructure and design tools, which can deter many companies from adopting them. This makes FPGAs less appealing to cost-sensitive businesses, creating a barrier for widespread market adoption.

- Technical Complexity in Programming: Programming FPGAs requires highly specialized skills, limiting their broader adoption. The technical complexity involved in programming and optimizing FPGAs for specific applications leads to longer project timelines and increased costs. This creates higher entry barriers for companies, particularly when rapid prototyping or modifications are necessary. Additionally, the niche expertise required for FPGA programming further limits their accessibility across the industry.

North America Field Programmable Gate Array (FPGA) Market Future Outlook

The North America FPGA market is poised for significant growth in the coming years, driven by technological advancements in AI, machine learning, and 5G. Industries such as telecommunications, automotive, and aerospace are increasingly adopting FPGA technology to support high-speed data processing and reconfigurable architectures. Additionally, the rising demand for power-efficient and customizable computing solutions is expected to further boost market growth.

Market Opportunities

- Rising Demand for Customizable Computing Solutions: FPGA's flexibility is increasingly in demand across industries that require customized computing solutions. Its adaptability allows hardware to be reprogrammed based on specific needs, providing unmatched versatility. This eliminates the need for multiple hardware systems, enhancing efficiency across various sectors. FPGAs are particularly appealing for applications like high-frequency trading and personalized AI algorithms, where performance optimization and customization are critical for success.

- Expansion of Edge Computing Solutions: The growing adoption of edge computing is significantly boosting FPGA usage in North America. FPGAs are well-suited for edge computing due to their ability to process data close to the source, minimizing latency. This makes them ideal for applications requiring real-time data processing, such as healthcare, automotive, and industrial automation, where timely and efficient data handling is crucial for operational success.

Scope of the Report

|

By Configuration |

SRAM-based FPGA Flash-based FPGA Antifuse-based FPGA |

|

By Technology |

FPGA in DSP FPGA in AI/ML Applications FPGA in IoT Devices |

|

By Application |

Data Centers Automotive Electronics Telecommunications (5G) Aerospace & Defense Industrial Automation |

|

By End-User Industry |

Information Technology Consumer Electronics Healthcare Government & Defense Manufacturing |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

FPGA Manufacturers

Telecommunication Companies

Automotive Electronics Companies

Semiconductor Fabrication Facilities

Aerospace & Defense Contractors

Government & Regulatory Bodies (U.S. Department of Defense, Federal Communications Commission)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Intel Corporation

Xilinx, Inc.

Lattice Semiconductor Corporation

Microchip Technology Inc.

Achronix Semiconductor Corporation

Altera Corporation

Broadcom Inc.

QuickLogic Corporation

Cypress Semiconductor Corporation

Atmel Corporation

Table of Contents

1. North America FPGA Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America FPGA Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America FPGA Market Analysis

3.1. Growth Drivers (Key Technologies, AI/ML Integration, Autonomous Systems)

3.1.1. Increased Demand for Data Centers

3.1.2. Adoption in 5G Infrastructure

3.1.3. Technological Advancements in AI and ML Applications

3.1.4. Growth in Automotive Electronics

3.2. Market Challenges (Cost, Complexity, Market Fragmentation)

3.2.1. High Development Costs

3.2.2. Technical Complexity in Programming

3.2.3. Limited Skilled Workforce Availability

3.3. Opportunities (Customization, Edge Computing, Enhanced Connectivity)

3.3.1. Rising Demand for Customizable Computing Solutions

3.3.2. Expansion of Edge Computing Solutions

3.3.3. Advancements in Industrial Automation

3.4. Trends (Cloud Adoption, Multi-functionality, IoT Integration)

3.4.1. Growing Use of FPGAs in Cloud Computing

3.4.2. Enhanced Multi-functional Capabilities of FPGA Chips

3.4.3. Rising Adoption of FPGAs in IoT Devices

3.5. Government Regulations (IP Security, Cybersecurity Standards, Export Regulations)

3.5.1. Federal Regulations on FPGA Export and Use in Defense

3.5.2. Compliance with Cybersecurity Standards

3.5.3. IP Protection for Programmable Logic Devices

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America FPGA Market Segmentation

4.1. By Configuration (In Value %)

4.1.1. SRAM-based FPGA

4.1.2. Flash-based FPGA

4.1.3. Antifuse-based FPGA

4.2. By Technology (In Value %)

4.2.1. FPGA in DSP (Digital Signal Processing)

4.2.2. FPGA in AI/ML Applications

4.2.3. FPGA in IoT Devices

4.3. By Application (In Value %)

4.3.1. Data Centers

4.3.2. Automotive Electronics

4.3.3. Telecommunications (5G)

4.3.4. Aerospace & Defense

4.3.5. Industrial Automation

4.4. By End-User Industry (In Value %)

4.4.1. Information Technology

4.4.2. Consumer Electronics

4.4.3. Healthcare

4.4.4. Government & Defense

4.4.5. Manufacturing

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America FPGA Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Intel Corporation

5.1.2. Xilinx, Inc.

5.1.3. Microchip Technology Inc.

5.1.4. Lattice Semiconductor Corporation

5.1.5. QuickLogic Corporation

5.1.6. Achronix Semiconductor Corporation

5.1.7. Altera Corporation

5.1.8. Broadcom Inc.

5.1.9. Atmel Corporation

5.1.10. Achronix Semiconductor Corporation

5.1.11. Cypress Semiconductor Corporation

5.1.12. Achronix Semiconductor Corporation

5.1.13. Texas Instruments Incorporated

5.1.14. GlobalFoundries

5.1.15. SiliconBlue Technologies

5.2. Cross Comparison Parameters (Product Offering, Application Focus, Revenue, Employee Count, Key Customers, R&D Investment, Headquarters, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Contracts

5.8. Venture Capital Funding

6. North America FPGA Market Regulatory Framework

6.1. Intellectual Property Standards

6.2. Export Compliance Regulations

6.3. Cybersecurity Regulations for Programmable Logic Devices

7. North America FPGA Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America FPGA Future Market Segmentation

8.1. By Configuration

8.2. By Technology

8.3. By Application

8.4. By End-User Industry

8.5. By Region

9. North America FPGA Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation & Demand Mapping

9.3. Marketing & Expansion Strategy

9.4. New Market Entry Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, we construct an ecosystem map involving key stakeholders in the North America FPGA market. This involves secondary research from reputable industry databases to identify critical factors influencing the market, including technology adoption and regulatory standards.

Step 2: Market Analysis and Construction

We compile and analyze historical data on market penetration, growth rates, and application trends in the FPGA sector. Market performance is evaluated in the context of product segmentation, enabling a comprehensive understanding of demand patterns and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are refined through consultations with industry experts via phone interviews, collecting valuable insights on industry practices and operational challenges. These inputs are cross-referenced with primary research for accuracy.

Step 4: Research Synthesis and Final Output

The final step synthesizes insights from FPGA manufacturers and industry leaders, verifying data collected through secondary sources. This stage ensures the final market analysis is accurate and comprehensive, delivering a clear understanding of the market landscape.

Frequently Asked Questions

01 How big is the North America FPGA Market?

The North America FPGA Market is valued at USD 2.5 billion, driven by increasing applications in telecommunications, automotive electronics, and data centers.

02 What are the challenges in the North America FPGA Market?

Challenges in North America FPGA Market include the high cost of development, technical complexity in programming FPGAs, and the limited availability of skilled workforce for FPGA design.

03 Who are the major players in the North America FPGA Market?

Major players in North America FPGA Market include Intel Corporation, Xilinx, Inc., Lattice Semiconductor Corporation, Microchip Technology Inc., and Achronix Semiconductor Corporation.

04 What are the growth drivers of the North America FPGA Market?

The North America FPGA Market is driven by technological advancements in 5G infrastructure, AI, and the growing demand for reconfigurable and high-performance computing solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.