North America Fintech Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD8893

November 2024

93

About the Report

North America Fintech Market Overview

- The North America Fintech market is valued at USD 41.2 billion, supported by a growing demand for digital financial services. Key drivers include the adoption of digital payment solutions, rapid advancements in blockchain, AI technology, and a strong preference for digital and contactless payments. Fintech firms are benefiting from the robust technological infrastructure across North America, allowing for greater scalability and efficiency in meeting consumer demand.

- The United States and Canada dominate the market due to their well-established financial ecosystems, high investment rates in Fintech startups, and favorable regulatory landscapes. Major cities like New York and San Francisco in the U.S. lead in innovation hubs due to strong capital inflows, while Toronto and Vancouver in Canada support a thriving Fintech scene with innovation-friendly policies and investor interest.

- The North American governments launched a cross-border digital payment program worth $200 million to reduce transaction times and costs, particularly between the U.S., Canada, and Mexico. This initiative supports businesses by simplifying international transactions, a benefit to the nearly 2 million firms that engage in cross-border trade, thereby boosting regional financial integration and business growth.

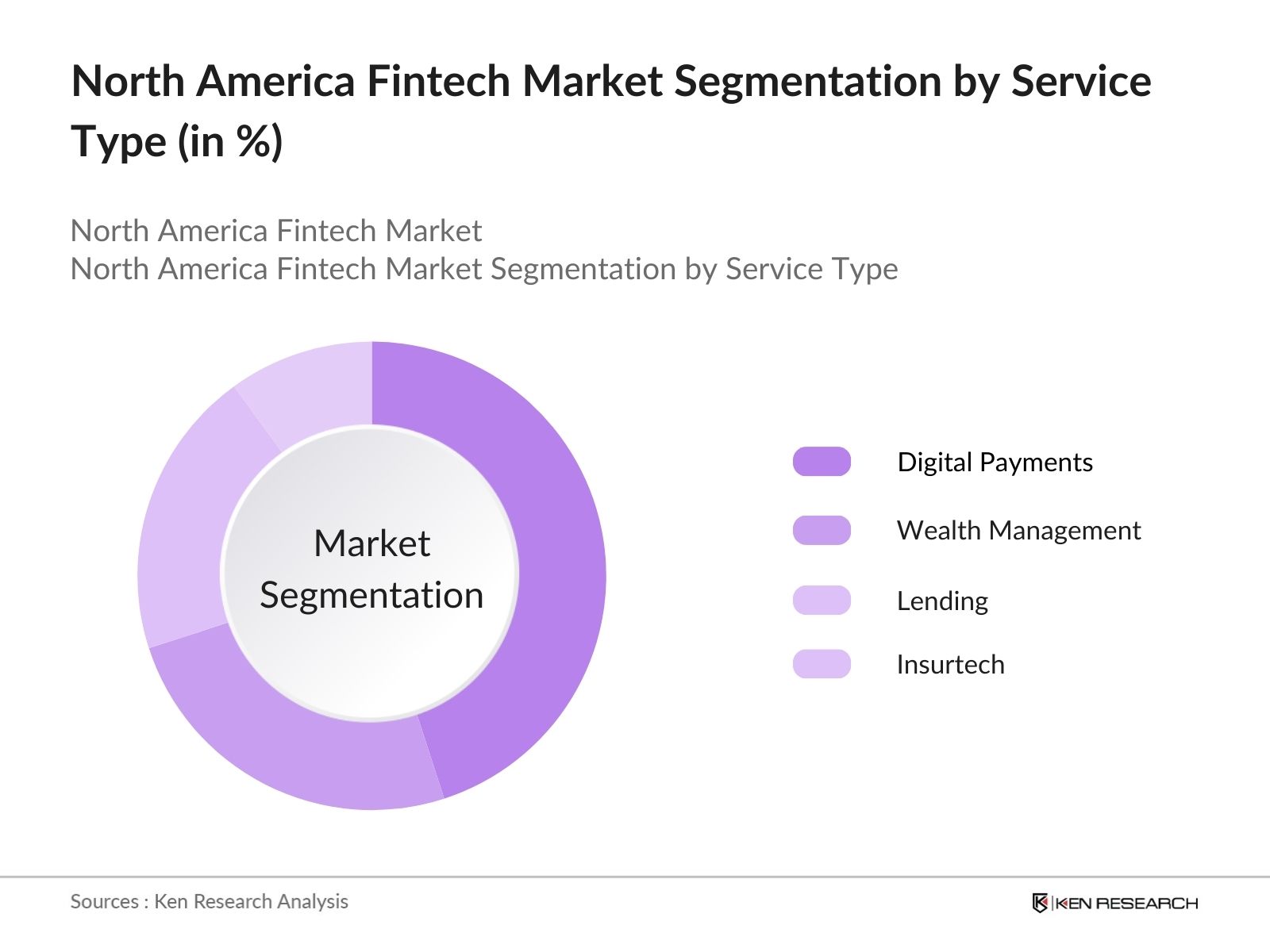

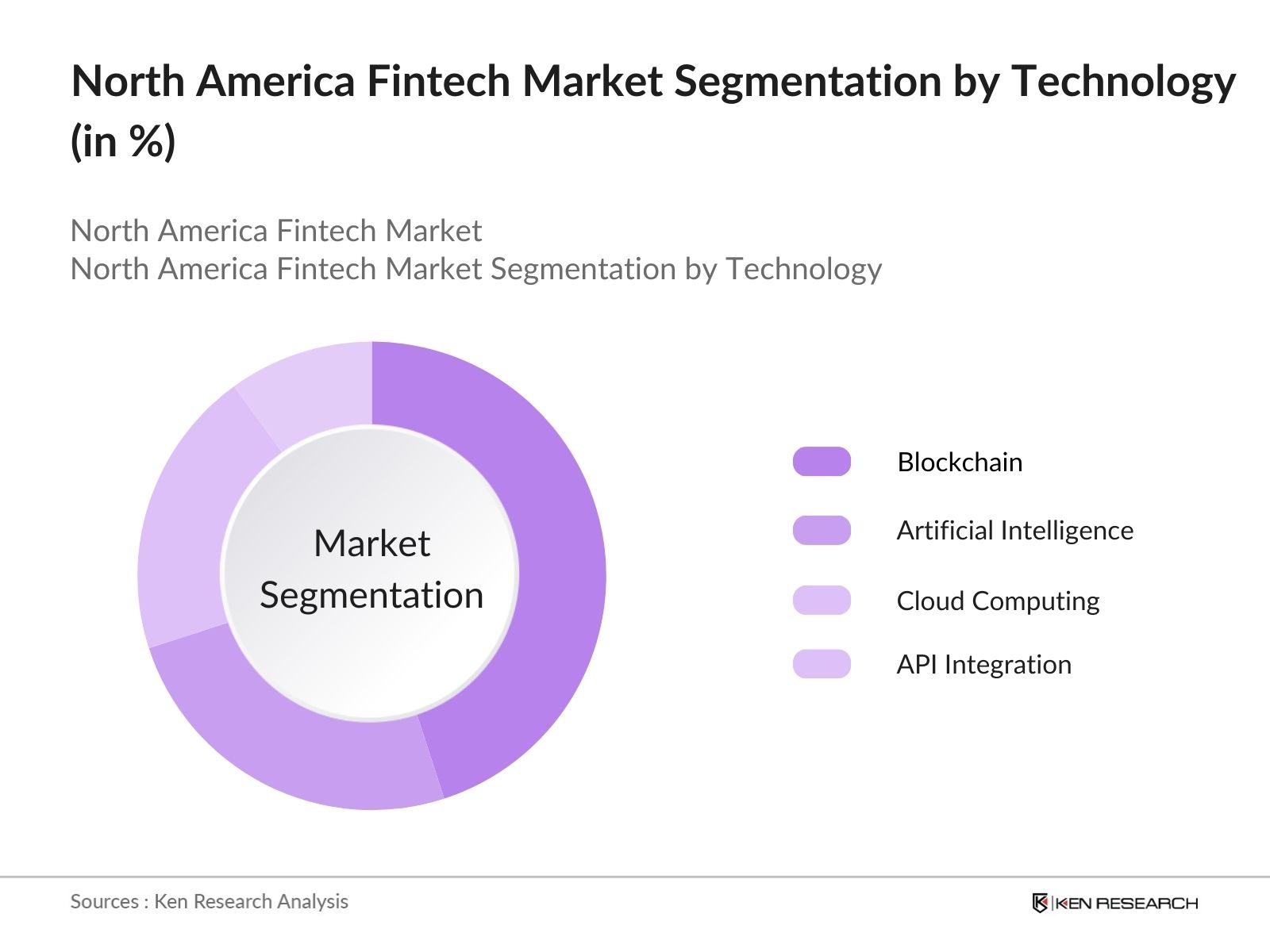

North America Fintech Market Segmentation

By Service Type: The market is segmented by service type, including digital payments, wealth management, lending, and insurtech. Recently, digital payments hold a dominant market share in the service type segmentation. This is due to the increasing preference for contactless transactions and the adoption of mobile wallets. Companies like PayPal and Stripe have cemented their market positions by providing seamless payment solutions across North America, encouraging rapid digital payment adoption.

By Technology: Technology segmentation includes blockchain, artificial intelligence, cloud computing, and API integration. Blockchain currently dominates the market, driven by heightened interest in decentralized finance and secure transaction frameworks. Companies like Coinbase and Ripple leverage blockchains ability to provide transparency and security, thus driving its popularity among both businesses and consumers.

North America Fintech Market Competitive Landscape

The market is marked by a competitive landscape with a few major players such as PayPal, Square, Stripe, and Coinbase. These companies benefit from their robust technology stacks, extensive user bases, and R&D investments, allowing them to maintain a strong market presence and drive innovation.

North America Fintech Market Analysis

Market Growth Drivers

- Increased Consumer Adoption of Digital Payments: North America's digital payment transactions are set to exceed 25 billion in 2024, driven by rising demand for fast and secure payment solutions. With over 350 million mobile users actively engaging in online transactions, the fintech ecosystem is benefiting from increased penetration of mobile banking applications. This growth aligns with the expectation that contactless payment systems, especially in the U.S. and Canada, will continue to expand, accommodating roughly 30% of overall retail transactions by the end of 2024.

- Rising Investments in Blockchain Technology: North Americas blockchain market, predominantly fueled by fintech applications in secure, decentralized transactions. Blockchains adaptability in creating immutable ledgers has drawn strong corporate interest, with over 1,000 firms in North America actively investing in blockchain integrations. This technology is anticipated to streamline operations, leading to reduced fraud, efficient cross-border payments, and enhanced transparency in financial processes, adding significant momentum to the fintech industry.

- Growing Demand for Credit Access among SMEs: In 2024, there were over 30 million small and medium enterprises (SMEs) in North America, many of which face challenges in securing funding through traditional banking channels. Fintech lenders have filled this gap, disbursing loans worth over $500 billion in the past year, thanks to more flexible, technology-based credit assessments. This shift is empowering SMEs with easier and faster access to working capital, enabling greater participation in the market and supporting economic growth.

Market Challenges

- Cybersecurity Threats and Fraud Incidents: In 2024, North America reported over 1.2 million cyber fraud cases affecting the financial sector, with estimated losses totaling $2.4 billion. Fintech platforms, being digital-first, are highly vulnerable to cyber-attacks. Maintaining advanced cybersecurity measures is critical but costly, and many smaller firms struggle to protect against sophisticated threats, which could compromise consumer trust in fintech services.

- Regulatory Compliance and Market Uncertainties: The regulatory environment for fintech remains complex, with around 600 new legislative amendments impacting financial technology enacted in the U.S. alone during 2024. These changes require fintech firms to adapt swiftly, which can be challenging and costly, especially for start-ups and SMEs.

North America Fintech Market Future Outlook

The North America Fintech industry is expected to experience robust growth over the next five years, fueled by increased investment in emerging technologies, the expansion of digital financial services, and progressive regulatory changes that foster innovation.

Future Market Opportunities

- Expansion of Embedded Finance Offerings: Over the next five years, embedded finance solutions in North America are projected to expand, with over 10,000 retail and tech companies anticipated to incorporate financial services into their platforms by 2029. This trend will make financial services increasingly accessible to end-users, revolutionizing how consumers engage with financial products.

- Surge in Artificial Intelligence for Predictive Financial Services: AI-driven predictive services will reshape the market, with financial advisory tools expected to support 30 million users in North America by 2029. These AI solutions will enable more precise risk assessment, personalized investment advice, and automated financial planning, setting a new standard for consumer-centric financial services.

Scope of the Report

|

By Technology |

Artificial Intelligence Blockchain Digital Payment Solutions Robo-Advisory |

|

By Application |

Banking and Personal Finance Wealth Management Insurance Capital Markets Lending |

|

By Deployment |

On-premise Cloud-Based |

|

By End-User |

Individuals SMEs Large Enterprises |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Retail Banks

Fintech Startups

Digital Payment Providers

Venture Capital and Private Equity Firms

Government and Regulatory Bodies (e.g., FDIC, SEC)

Blockchain and Cryptocurrency Platforms

Financial Services Software Providers

Insurance and Wealth Management Companies

Companies

PayPal

Square

Stripe

Coinbase

Robinhood

SoFi

Affirm

Chime

Plaid

Klarna

Table of Contents

1. North America Fintech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Fintech Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Fintech Market Analysis

3.1. Growth Drivers

3.1.1. Digital Banking Adoption

3.1.2. Rise of Contactless Payment Solutions

3.1.3. Government Initiatives for Digital Transformation

3.1.4. Increasing Investments in AI and Blockchain

3.2. Market Challenges

3.2.1. Cybersecurity Concerns

3.2.2. Regulatory Compliance

3.2.3. High Competition from Legacy Banking Systems

3.3. Opportunities

3.3.1. Expansion of Embedded Finance

3.3.2. Partnerships with Traditional Financial Institutions

3.3.3. Growth in Buy Now, Pay Later (BNPL) Solutions

3.4. Trends

3.4.1. Increased Adoption of API Integrations

3.4.2. Focus on Open Banking

3.4.3. Decentralized Finance (DeFi) Growth

3.5. Government Regulations

3.5.1. Digital Currency Guidelines

3.5.2. Privacy and Data Protection Acts

3.5.3. Anti-Money Laundering (AML) Standards

3.6. SWOT Analysis

3.7. Ecosystem Mapping

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Fintech Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Artificial Intelligence

4.1.2. Blockchain

4.1.3. Digital Payment Solutions

4.1.4. Robo-Advisory

4.2. By Application (In Value %)

4.2.1. Banking and Personal Finance

4.2.2. Wealth Management

4.2.3. Insurance

4.2.4. Capital Markets

4.2.5. Lending

4.3. By Deployment (In Value %)

4.3.1. On-premise

4.3.2. Cloud-Based

4.4. By End-User (In Value %)

4.4.1. Individuals

4.4.2. SMEs

4.4.3. Large Enterprises

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Fintech Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Stripe

5.1.2. PayPal

5.1.3. Square

5.1.4. Robinhood

5.1.5. SoFi

5.1.6. Chime

5.1.7. Affirm

5.1.8. Coinbase

5.1.9. Plaid

5.1.10. Klarna

5.1.11. Intuit

5.1.12. Wealthfront

5.1.13. Betterment

5.1.14. LendingClub

5.1.15. Green Dot

5.2. Cross-Comparison Parameters (Revenue, Customer Base, Technology Adoption, R&D Investment, M&A Activity, Partnerships, Product Innovation, Regulatory Compliance)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Fintech Market Regulatory Framework

6.1. Licensing and Compliance Requirements

6.2. Data Privacy and Security Regulations

6.3. Consumer Protection Laws

6.4. Digital Payment Regulations

7. North America Fintech Future Market Size (In USD Bn)

7.1. Market Size Projections

7.2. Factors Driving Future Market Growth

8. North America Fintech Future Market Segmentation

8.1. By Technology

8.2. By Application

8.3. By Deployment

8.4. By End-User

8.5. By Region

9. North America Fintech Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Product-Market Fit Strategies

9.3. Growth and Scaling Opportunities

9.4. White Space Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves developing a comprehensive ecosystem map covering key stakeholders in the North America Fintech Market. Extensive desk research from reputable databases is conducted to define influential variables in the markets growth.

Step 2: Market Analysis and Construction

Historical data on Fintech adoption, transaction volumes, and emerging technologies is analyzed. This stage involves examining competitive landscapes and financial metrics to provide reliable market estimates and segmentation insights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, offering operational insights directly from Fintech leaders and professionals. This validation refines the markets revenue and growth projections.

Step 4: Research Synthesis and Final Output

The final stage integrates qualitative and quantitative research findings to create an accurate, data-driven narrative, ensuring a comprehensive and validated analysis of the North America Fintech market.

Frequently Asked Questions

01. How big is the North America Fintech Market?

The North America Fintech market is valued at USD 41.2 billion, driven by advancements in digital banking and a significant increase in consumer adoption of digital payment solutions.

02. What are the challenges in the North America Fintech Market?

Challenges in the North America Fintech market include regulatory compliance, cybersecurity concerns, and market saturation among top players, impacting new entrants ability to gain market share.

03. Who are the major players in the North America Fintech Market?

Key players in the North America Fintech market include PayPal, Square, Stripe, Coinbase, and Robinhood, known for their robust technology frameworks and user-centric services.

04. What are the growth drivers of the North America Fintech Market?

The North America Fintech market is driven by technological advancements in blockchain and AI, growing consumer preference for contactless payments, and significant venture capital investment in Fintech innovation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.