North America Flavored Water Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD10292

November 2024

80

About the Report

North America Flavored Market Overview

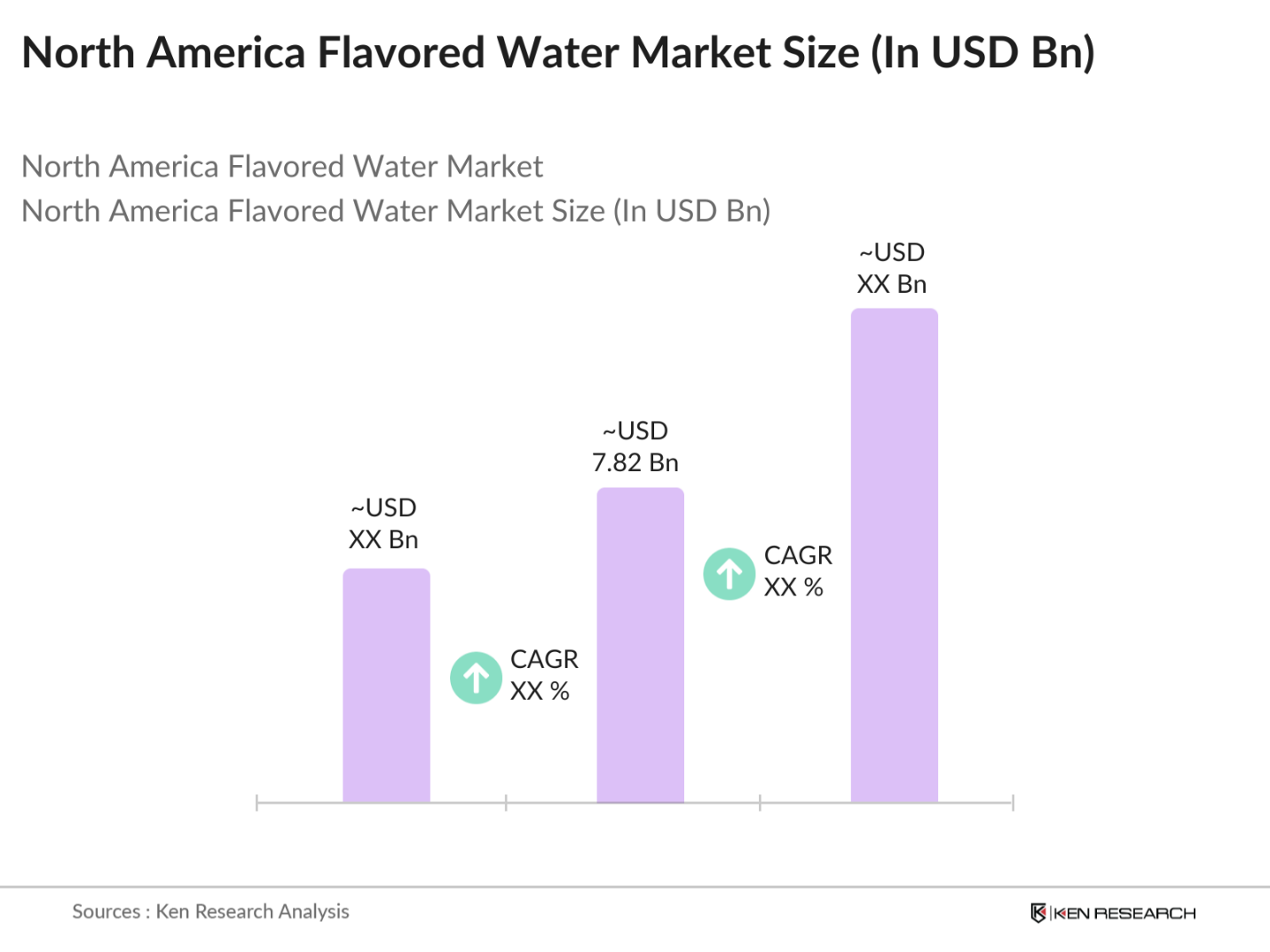

- The North America flavored water market is valued at USD 7.82 billion, based on a five-year historical analysis. This market is largely driven by the increasing consumer shift towards healthier, low-calorie beverage options as well as the rise in functional beverages with added benefits such as vitamins and antioxidants. The expanding variety of flavors and natural sweeteners has further propelled the market, meeting consumer demand for refreshing, health-conscious alternatives to sugary drinks.

- The United States dominates the North American flavored water market due to its large population, higher disposable incomes, and significant health-conscious consumer base. Additionally, the U.S. has seen considerable investment from leading beverage companies, promoting innovative flavors and sustainable packaging solutions, which further drive market dominance. Canada also shows strong market presence, bolstered by rising consumer awareness of health benefits and a growing preference for organic and natural beverages.

- Government health standards play a crucial role in shaping the beverage industry. The U.S. Food and Drug Administration (FDA) sets guidelines for permissible levels of various ingredients, including caffeine and sugar, in beverages. In 2022, the FDA updated its guidelines to recommend that added sugars should not exceed 10% of daily caloric intake, influencing beverage formulations. Similarly, the European Food Safety Authority (EFSA) provides regulations on the use of additives and health claims in beverages.

North America Flavored Market Segmentation

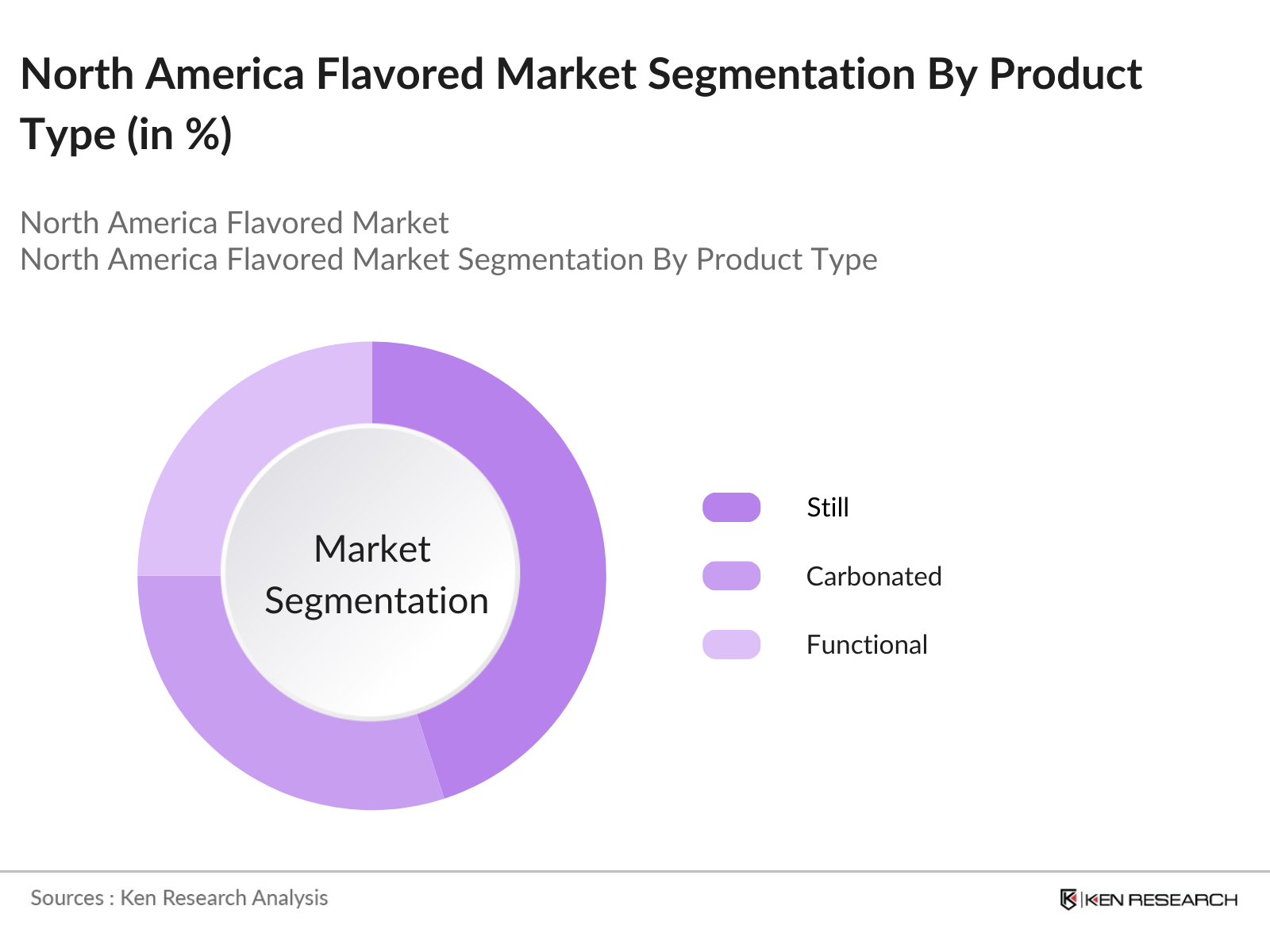

By Product Type: The North America flavored water market is segmented by product type into carbonated, still, and functional flavored waters. Recently, still flavored water has maintained a dominant market share due to its straightforward composition, low-calorie benefits, and natural ingredients, which align with the health-conscious preferences of North American consumers. Leading brands like Hint and LaCroix have established loyalty with their clear, flavorful options free of artificial sweeteners, appealing to a wide audience, including millennials and Gen Z, who prioritize health and taste.

By Distribution Channel: Flavored water in North America is distributed through various channels, including supermarkets, hypermarkets, convenience stores, and online platforms. Supermarkets and hypermarkets hold the leading share within this segmentation, as they provide broad visibility and variety for consumers looking to explore multiple brands and flavors in one visit. This distribution channel is particularly popular due to the convenience it offers and the increasing consumer preference for one-stop shopping experiences.

North America Flavored Market Competitive Landscape

The North America flavored water market is concentrated among a few key players, which strengthens competitive barriers and brand visibility within the region. Major players like PepsiCo and Coca-Cola leverage their established distribution networks and marketing power to capture a significant market share. This consolidation among a few industry giants highlights the influence of brand strength, innovation, and sustainability initiatives in determining market leadership.

North America Flavored Industry Analysis

Growth Drivers

- Health and Wellness Trend (Zero-calorie, antioxidant-rich beverages): The global emphasis on health and wellness has led to a significant increase in the consumption of zero-calorie and antioxidant-rich beverages. In 2023, the World Health Organization reported that noncommunicable diseases, often linked to poor dietary habits, accounted for 71% of all global deaths, underscoring the need for healthier beverage options. Additionally, the International Food Information Council's 2023 survey found that 59% of consumers actively seek out foods and beverages with health benefits, highlighting a strong market demand for functional waters that offer nutritional advantages without added calories.

- Consumer Preference Shift (Reduction in Sugary Drinks): There is a marked decline in sugary drink consumption as consumers become more health-conscious. The Centers for Disease Control and Prevention reported that, in 2022, 63% of adults in the U.S. reduced their intake of sugar-sweetened beverages due to health concerns. This shift is further supported by a 2023 Nielsen report indicating a 7% decrease in sales of sugary sodas, while sales of low-sugar and sugar-free beverages, including functional waters, saw a 12% increase.

- Innovations in Flavors (Berry, Citrus, Exotic Fruit): The beverage industry has seen a surge in flavor innovations, particularly in the functional water segment. In 2023, the International Food Information Council noted that 45% of consumers are more likely to try a new beverage if it offers unique flavors. Berry, citrus, and exotic fruit flavors have become particularly popular, with a 2022 Mintel report highlighting that 35% of new beverage launches featured these flavors, catering to diverse consumer palates and driving market growth.

Market Challenges

- High Price Point of Functional and Premium Waters: The elevated cost of functional and premium waters poses a challenge for widespread consumer adoption. According to a 2023 report by the Bureau of Labor Statistics, the average price of functional beverages is approximately 45% higher than standard bottled water. This price disparity can deter price-sensitive consumers, particularly in markets where disposable income is limited, thereby affecting market penetration and growth.

- Competitive Pressure from Non-Alcoholic Beverages: The functional water market faces intense competition from other non-alcoholic beverages, such as energy drinks, sports drinks, and flavored waters. Data from the Beverage Marketing Corporation in 2023 indicates that while functional water sales grew by 8%, energy drinks and sports drinks saw growth rates of 10% and 9%, respectively. This competitive landscape requires functional water brands to continuously innovate and differentiate their products to maintain and grow their market share.

North America Flavored Market Future Outlook

Over the next five years, the North America flavored water market is projected to experience steady growth. This expansion is anticipated due to an increasing consumer preference for healthy beverages, innovations in natural and functional ingredients, and enhanced distribution through digital channels. Continued investments from leading beverage companies in sustainable packaging and zero-calorie options will likely catalyze further growth.

Market Opportunities

- Expansion of Functional Ingredients (Vitamins, Herbs): There is a growing opportunity to enhance functional water products with additional health-promoting ingredients. A 2023 report by the National Institutes of Health indicates that 60% of adults take dietary supplements, reflecting a strong consumer interest in vitamins and herbal extracts. Incorporating these ingredients into functional waters can attract health-conscious consumers seeking convenient ways to meet their nutritional needs.

- Increasing Online Sales and Direct-to-Consumer Channels: The rise of e-commerce presents a significant growth avenue for functional water brands. The U.S. Census Bureau reported that online retail sales reached $870 billion in 2022, a 14% increase from the previous year. Direct-to-consumer models allow brands to engage customers directly, gather valuable data, and offer personalized experiences, thereby enhancing customer loyalty and expanding market reach.

Scope of the Report

|

Product Type |

Carbonated Still Functional |

|

Flavor |

Fruit Herbal Exotic |

|

Packaging Type |

Bottles Cans |

|

Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Online Other Retailers |

|

Country |

U.S. Canada Mexico Rest of North America |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Health Canada)

Flavored Water Manufacturers

Distribution Networks and Retailers

Consumer Goods and Beverage Industry Associations

Online Retailers and E-commerce Platforms

Environmental Organizations and NGOs

Packaging and Bottling Companies

Companies

Players Mentioned in the Report

PepsiCo, Inc.

The Coca-Cola Company

Nestle Waters

Hint, Inc.

Talking Rain Beverage Company

Danone S.A.

Polar Beverages

The Kraft Heinz Company

Bai (Keurig Dr Pepper)

Spindrift

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR)

1.4 Market Segmentation Overview

2. Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Health and Wellness Trend (Zero-calorie, antioxidant-rich beverages)

3.1.2 Consumer Preference Shift (Reduction in sugary drinks)

3.1.3 Innovations in Flavors (Berry, Citrus, Exotic fruit)

3.1.4 Environmental Concerns and Sustainable Packaging

3.2 Market Challenges

3.2.1 High Price Point of Functional and Premium Waters

3.2.2 Competitive Pressure from Non-Alcoholic Beverages

3.2.3 Plastic Packaging Reduction Initiatives

3.3 Opportunities

3.3.1 Expansion of Functional Ingredients (Vitamins, Herbs)

3.3.2 Increasing Online Sales and Direct-to-Consumer Channels

3.3.3 Market Expansion in Canada and Mexico

3.4 Emerging Trends

3.4.1 Demand for Sparkling Varieties

3.4.2 Low/No-Sugar Options

3.4.3 Use of Natural Sweeteners

3.5 Regulatory Landscape

3.5.1 Government Health Standards

3.5.2 Compliance and Labeling Requirements

3.5.3 Import and Export Regulations (U.S., Canada, Mexico)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Overview

4. Market Segmentation

4.1 By Product Type

4.1.1 Carbonated Flavored Water

4.1.2 Still Flavored Water

4.1.3 Functional Flavored Water

4.2 By Flavor

4.2.1 Fruit Flavors (e.g., berry, citrus)

4.2.2 Herbal and Botanical Flavors

4.2.3 Exotic Flavors (unique fruit combinations)

4.3 By Packaging Type

4.3.1 Bottles

4.3.2 Cans

4.4 By Distribution Channel

4.4.1 Supermarkets & Hypermarkets

4.4.2 Convenience Stores

4.4.3 Online Channels

4.4.4 Other Retailers

4.5 By Country

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

4.5.4 Rest of North America

5. Competitive Analysis

5.1 Key Market Players and Profiles

5.1.1 PepsiCo, Inc.

5.1.2 The Coca-Cola Company

5.1.3 Nestle Waters

5.1.4 Hint Inc.

5.1.5 Danone S.A.

5.1.6 The Kraft Heinz Company

5.1.7 Talking Rain Beverage Company

5.1.8 Polar Beverages

5.1.9 Crystal Geyser Water Company

5.1.10 Sunny Delight Beverage Company

5.1.11 Spindrift

5.1.12 Bai (Keurig Dr Pepper)

5.1.13 Essentia Water

5.1.14 Vita Coco

5.1.15 LaCroix (National Beverage)

5.2 Cross Comparison Parameters

Market Share (%)

Revenue (USD Billion)

Product Innovation Index

Sustainability Initiatives

Pricing Strategy (High, Mid, Low)

Regional Focus (U.S., Canada, Mexico)

Consumer Segment Focus (Millennials, Gen Z)

Digital Presence and E-commerce Reach

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Influx

5.8 Government Grants and Partnerships

5.9 Private Equity Investment Activity

6. Market Regulatory Framework

6.1 Environmental Standards and Sustainability

6.2 Food and Beverage Health Compliance

6.3 Labeling Requirements (Natural, Organic, Artificial Additives)

6.4 Import and Export Tariffs in North America

7. Future Market Size Projections (USD Billion)

7.1 Projected Growth Rate and Key Influencing Factors

7.2 Emerging Product Types and Innovations

7.3 Expansion Opportunities in New Market Segments

8. Future Market Segmentation

8.1 By Emerging Product Type

8.2 By Innovative Flavor Category

8.3 By Sustainable Packaging Options

8.4 By Growing Distribution Channels (Direct-to-Consumer)

8.5 By Country (U.S., Canada, Mexico)

9. Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Key Consumer Segmentation Insights

9.3 Market Penetration Strategies

9.4 White Space Opportunities in Premium Flavored Waters

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping the primary stakeholders and understanding the ecosystem in the North America flavored water market. The research identifies key industry variables through comprehensive desk research and consultations with experts.

Step 2: Market Analysis and Construction

Historical data analysis is conducted on flavored water segments, examining distribution ratios, flavor preferences, and revenue generation. Service quality metrics are analyzed to validate these findings.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market growth drivers and constraints are validated through structured interviews with industry experts, which provide insight into operational and financial trends.

Step 4: Research Synthesis and Final Output

This final phase integrates data from flavored water manufacturers, evaluating product segmentation and sales metrics. Findings are corroborated through the bottom-up approach to ensure a thorough and accurate analysis.

Frequently Asked Questions

01. How big is the North America flavored water market?

The North America flavored water market, valued at USD 7.82 billion, has grown due to rising consumer preference for healthier beverage alternatives and natural ingredients.

02. What are the main challenges in the North America flavored water market?

Key challenges include high production costs for natural and functional beverages, intense competition from other low-calorie drinks, and regulatory compliance for ingredient labeling.

03. Who are the major players in the North America flavored water market?

Major players include PepsiCo, The Coca-Cola Company, Hint, Talking Rain Beverage Company, and Nestle Waters, who dominate due to strong brand presence and product innovation.

04. What drives the growth of the North America flavored water market?

The market's growth is driven by consumer demand for zero-calorie and functional beverages, the health-conscious shift from sugary sodas, and innovation in natural flavors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.