North America Flexible Packaging Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD6103

December 2024

96

About the Report

North America Flexible Packaging Market Overview

- The North America Flexible Packaging Market is valued at USD 46 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for lightweight, cost-effective, and sustainable packaging solutions across key industries like food & beverage, healthcare, and personal care. The shift towards eco-friendly packaging options, coupled with advancements in material science, is further propelling market growth. With a strong focus on reducing material usage and improving recyclability, flexible packaging is becoming a preferred choice for both manufacturers and consumers across the region.

- The United States dominates the North America flexible packaging market due to its robust consumer goods industry and advanced packaging technologies. Key cities like New York and Los Angeles serve as major hubs for consumer-driven industries that require innovative and efficient packaging solutions. The regions leadership is fueled by strong R&D investment and a solid infrastructure for recycling and waste management, ensuring compliance with stringent environmental regulations.

- Governments are introducing EPR programs, holding producers accountable for the lifecycle of their packaging, thereby encouraging the design of more sustainable and easily recyclable products. For instance, Oregon has passed an EPR law establishing a producer responsibility program for packaging, requiring producers to fund and manage recycling programs.

North America Flexible Packaging Market Segmentation

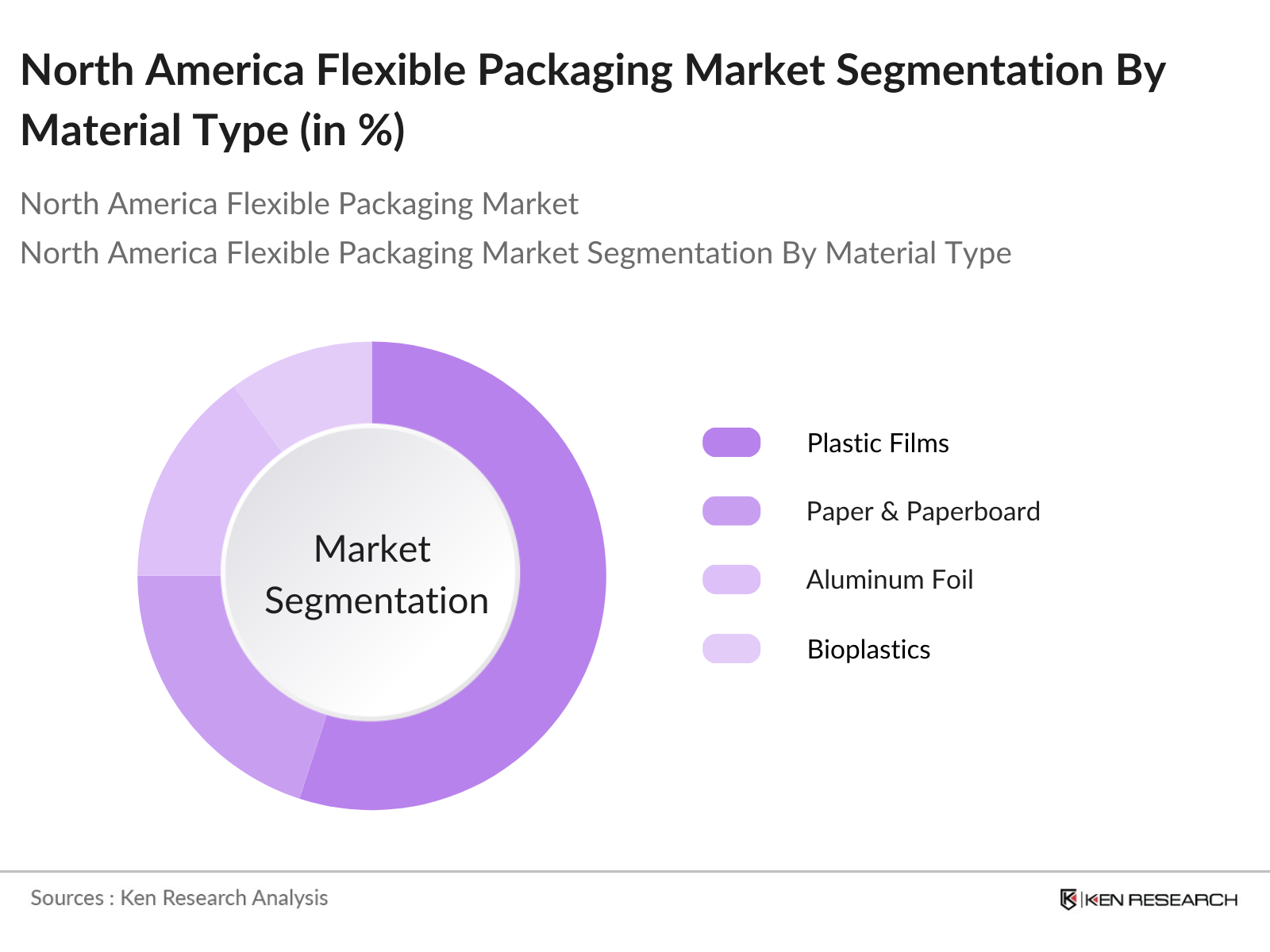

By Material Type: The market is segmented by material type into plastic films, paper & paperboard, aluminum foil, and bioplastics. In 2023, plastic films hold the dominant market share, particularly polyethylene and polypropylene, due to their versatility and cost-effectiveness in packaging applications. Their durability and ability to preserve product integrity make them the preferred choice for food and beverage packaging.

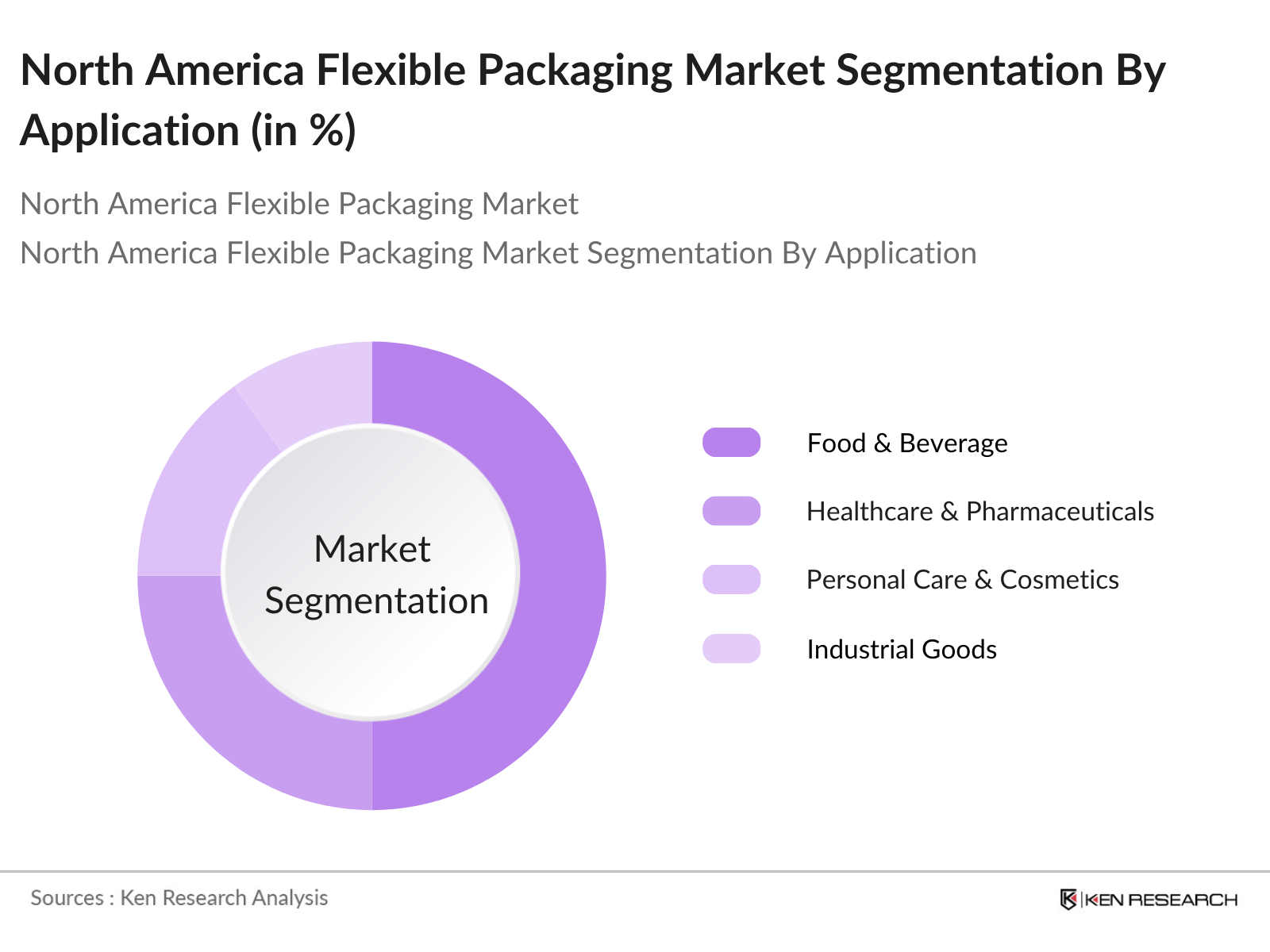

By Application: The market is further segmented by application into food & beverage, healthcare & pharmaceuticals, personal care & cosmetics, industrial goods, and household products. Food & beverage packaging holds a significant share in 2023 due to the growing demand for packaged and processed foods. The increasing focus on maintaining product freshness and extending shelf life has led to widespread adoption of flexible packaging in this segment.

North America Flexible Packaging Market Competitive Landscape

The North America flexible packaging market is highly consolidated, with a few key players dominating the industry. These companies leverage their extensive product portfolios, innovative technologies, and large-scale manufacturing capacities to maintain market leadership. Additionally, these firms are heavily investing in sustainable packaging solutions to cater to the rising demand for eco-friendly products.

North America Flexible Packaging Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Packaging Solutions: Consumers and businesses are prioritizing eco-friendly packaging to reduce environmental impact. This shift is driving the adoption of sustainable materials and practices in the flexible packaging industry. For instance, California mandates that plastic beverage bottles contain at least 15% post-consumer recycled (PCR) content, increasing to 25% by 2025 and 50% by 2030.

- Shift Towards E-commerce & Packaged Goods: The rise of e-commerce has amplified the need for durable and lightweight packaging to protect products during shipping. In the U.S., e-commerce sales reached $277.582 billion in Q2 2023, underscoring the growing demand for effective packaging solutions.

- Consumer Preference for Convenience and Portability: Modern lifestyles favor convenient and portable packaging options. Flexible packaging, such as stand-up pouches, offers ease of use and storage, aligning with consumer demands for on-the-go products. A study by the Flexible Packaging Association found that 60% of consumers are willing to pay more for packaging that offers easy storage, resealability, and extended shelf life.

Market Challenges

- Volatility in Raw Material Prices: Fluctuations in the cost of raw materials, such as plastics and aluminum, can impact production expenses and profit margins within the flexible packaging industry. For instance, the imposition of anti-dumping and countervailing duties on the import of aluminum foil from China by the U.S. has affected the price structure of aluminum foil, posing a barrier to the flexible packaging market.

- Regulatory Pressure on Plastic Usage (Environmental Policies): Governments are implementing stricter regulations to curb plastic waste, pushing the industry towards more sustainable practices. For example, several U.S. states have enacted laws requiring minimum PCR content in plastic packaging, aiming to reduce reliance on virgin plastic.

North America Flexible Packaging Market Future Outlook

Over the next five years, the North America flexible packaging market is expected to experience robust growth. This growth is driven by advancements in packaging materials, increasing demand for lightweight and sustainable solutions, and the expansion of e-commerce and retail sectors. Additionally, the market is witnessing a shift towards flexible packaging formats that reduce material usage and transportation costs, providing further impetus for growth.

Market Opportunities

- Innovation in Biodegradable and Compostable Packaging: Developing packaging solutions that are biodegradable and compostable addresses environmental concerns and aligns with consumer preferences for sustainable products. Companies are investing in research and development to create such eco-friendly packaging options, responding to the growing demand for sustainable alternatives.

- Growth in Flexible Packaging for Food and Beverage Industry: The food and beverage sector continues to expand, with flexible packaging playing a crucial role in ensuring product freshness, convenience, and safety, thereby driving market growth. The increasing demand for snacks and convenience foods and beverages is expected to fuel the market growth across the region.

Scope of the Report

|

By Material Type |

Plastic Films Paper & Paperboard Aluminum Foil Bioplastics |

|

By Application |

Food & Beverage Healthcare & Pharmaceuticals Personal Care & Cosmetics Industrial Goods Household Products |

|

By Technology |

Flexography Digital Printing Gravure Printing Extrusion Coating |

|

By Packaging Format |

Pouches Bags & Sacks Wrappers Blisters & Clamshells |

|

By Region |

U.S. Canada Mexico |

Products

Key Target Audience

Flexible Packaging Manufacturers

Food & Beverage Producers

Healthcare & Pharmaceutical Companies

Personal Care & Cosmetics Companies

Retailers & Distributors

Industrial Goods Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency, FDA)

Companies

Major Players in the Market

Amcor Plc

Berry Global Group Inc.

Sealed Air Corporation

Coveris Holdings S.A.

Huhtamki Oyj

Mondi Group

Sonoco Products Company

Bemis Company Inc.

ProAmpac LLC

Constantia Flexibles Group GmbH

Table of Contents

1. North America Flexible Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Flexible Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Flexible Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Sustainable Packaging Solutions

3.1.2. Shift Towards E-commerce & Packaged Goods

3.1.3. Consumer Preference for Convenience and Portability

3.1.4. Technological Advancements in Packaging Materials

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices

3.2.2. Regulatory Pressure on Plastic Usage (Environmental Policies)

3.2.3. Recycling and Disposal Infrastructure Gaps

3.3. Opportunities

3.3.1. Innovation in Biodegradable and Compostable Packaging

3.3.2. Growth in Flexible Packaging for Food and Beverage Industry

3.3.3. Expansion into Healthcare and Pharmaceutical Sectors

3.4. Trends

3.4.1. Adoption of Digital Printing for Customization

3.4.2. Rise of Smart Packaging Solutions (IoT-enabled Packaging)

3.4.3. Sustainable and Eco-friendly Packaging Innovations

3.5. Government Regulations

3.5.1. Single-use Plastic Bans (Regional Regulations)

3.5.2. Packaging Waste and Extended Producer Responsibility (EPR)

3.5.3. Tax Incentives for Green Packaging Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Flexible Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Plastic Films (Polyethylene, Polypropylene, Polyvinyl Chloride)

4.1.2. Paper & Paperboard

4.1.3. Aluminum Foil

4.1.4. Bioplastics

4.2. By Application (In Value %)

4.2.1. Food & Beverage

4.2.2. Healthcare & Pharmaceuticals

4.2.3. Personal Care & Cosmetics

4.2.4. Industrial Goods

4.2.5. Household Products

4.3. By Technology (In Value %)

4.3.1. Flexography

4.3.2. Digital Printing

4.3.3. Gravure Printing

4.3.4. Extrusion Coating

4.4. By Packaging Format (In Value %)

4.4.1. Pouches (Stand-up, Flat)

4.4.2. Bags & Sacks

4.4.3. Wrappers

4.4.4. Blisters & Clamshells

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Flexible Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amcor Plc

5.1.2. Berry Global Group Inc.

5.1.3. Sealed Air Corporation

5.1.4. Coveris Holdings S.A.

5.1.5. Huhtamki Oyj

5.1.6. Mondi Group

5.1.7. Sonoco Products Company

5.1.8. Bemis Company Inc.

5.1.9. ProAmpac LLC

5.1.10. Constantia Flexibles Group GmbH

5.1.11. Uflex Ltd.

5.1.12. Winpak Ltd.

5.1.13. Glenroy Inc.

5.1.14. Printpack Inc.

5.1.15. Clondalkin Group

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Packaging Innovation Capabilities, Sustainability Initiatives, Regional Focus, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Flexible Packaging Market Regulatory Framework

6.1. Environmental Standards for Flexible Packaging

6.2. Compliance Requirements (Material Use, Labelling)

6.3. Certification Processes (FDA, EPA Certifications)

7. North America Flexible Packaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Flexible Packaging Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Packaging Format (In Value %)

8.5. By Region (In Value %)

9. North America Flexible Packaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we identify all major stakeholders in the North America Flexible Packaging Market. Through extensive desk research, we gather relevant data from secondary and proprietary databases to map the market ecosystem and define critical market variables. The focus is on understanding factors such as material usage trends, regulatory impact, and consumer preferences.

Step 2: Market Analysis and Construction

Historical market data is collected and analyzed to evaluate market penetration, growth trends, and the economic impact of flexible packaging solutions across various sectors. This step involves a detailed analysis of industry trends, technological advancements, and product innovations that influence market growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by conducting interviews with industry experts and key opinion leaders. This step provides valuable insights from packaging manufacturers, sustainability experts, and major market players, allowing us to refine the data and ensure its accuracy.

Step 4: Research Synthesis and Final Output

In the final phase, the data collected is synthesized and verified through interactions with key stakeholders in the packaging industry. This process ensures the data is accurate, reliable, and presents a comprehensive overview of the North America Flexible Packaging Market.

Frequently Asked Questions

01. How big is the North America Flexible Packaging Market?

The North America Flexible Packaging Market is valued at USD 46 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for lightweight, cost-effective, and sustainable packaging solutions across key industries like food & beverage, healthcare, and personal care.

02. What are the challenges in the North America Flexible Packaging Market?

Challenges in the market include regulatory pressures on plastic usage, volatility in raw material prices, and the need for better recycling infrastructure to handle flexible packaging waste.

03. Who are the major players in the North America Flexible Packaging Market?

Key players include Amcor Plc, Berry Global Group Inc., Sealed Air Corporation, Huhtamki Oyj, and Mondi Group. These companies dominate due to their extensive product portfolios and strong presence in key regions.

04. What are the growth drivers of the North America Flexible Packaging Market?

The market is driven by increasing consumer demand for eco-friendly packaging solutions, advancements in material science, and the growth of the e-commerce and food delivery sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.