North America Flight Data Monitoring Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1572

December 2024

82

About the Report

North America Flight Data Monitoring Market Overview

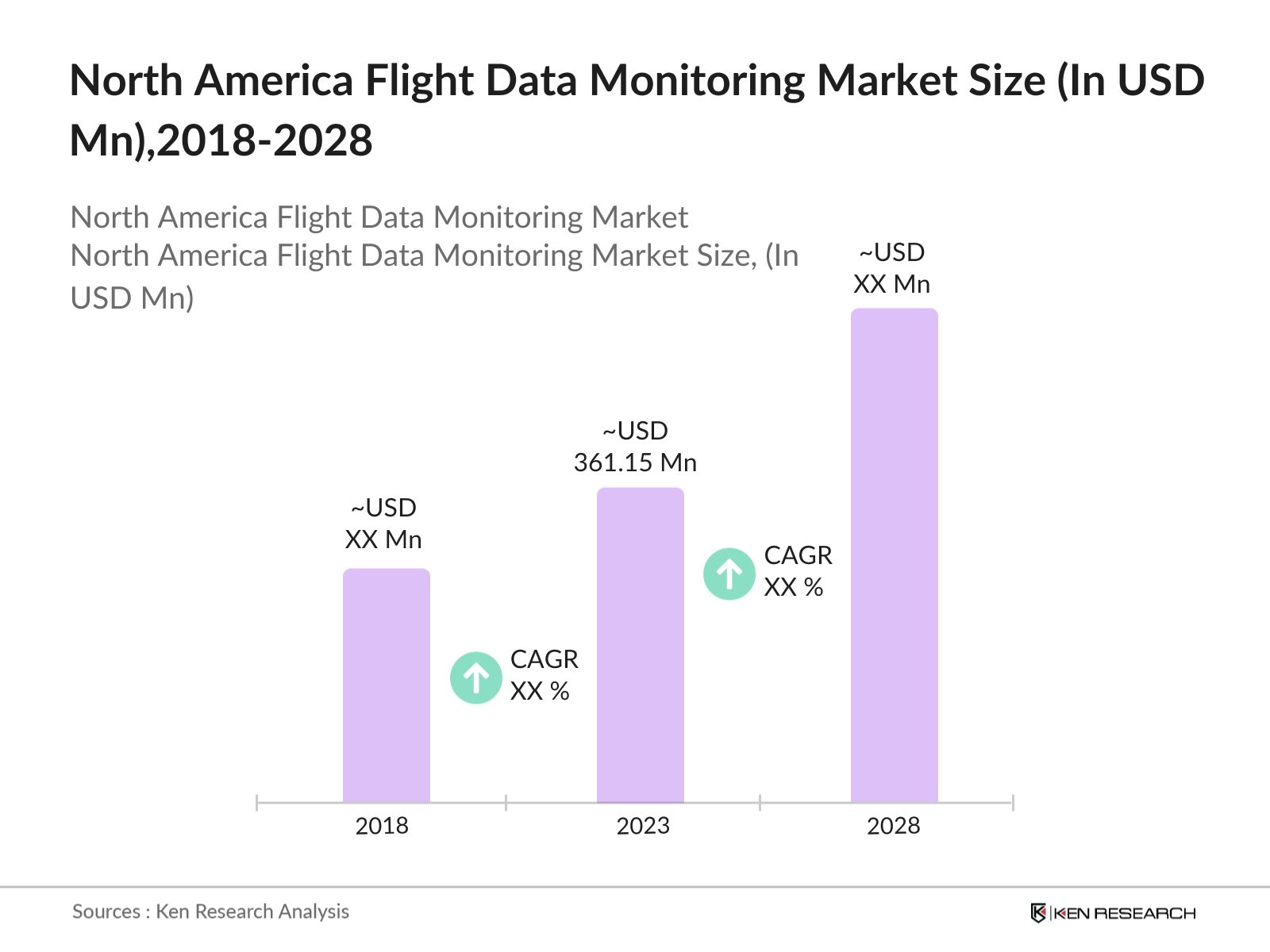

- The North America Flight Data Monitoring Market was valued at USD 361.15 million in 2023. The growth is primarily driven by the rising demand for real-time data analytics in aviation, stringent safety regulations imposed by aviation authorities like the Federal Aviation Administration (FAA), and the increasing adoption of advanced monitoring systems by commercial airlines and military organizations.

- Prominent companies in North America flight data monitoring market include Honeywell International Inc., L3Harris Technologies, Inc., Safran, Curtiss-Wright Corporation, and Teledyne Controls. These companies are at the forefront of developing sophisticated FDM systems that offer enhanced safety features and operational efficiency.

- In 2024, Honeywell International Inc. reported its full-year 2023 results and issued guidance for 2024. The company achieved $36.7 billion in net sales for 2023, with a 3% year-over-year increase. Honeywell's aerospace division saw a 15% organic sales growth, driven by strong demand in commercial aviation. The company also deployed $8.3 billion in capital in 2023 for share repurchases, dividends, and acquisitions.

- In 2023 Dallas-Fort Worth (DFW) in Texas was the dominant city in this market. DFW's dominance is attributed to its role as a major aviation hub, with Dallas-Fort Worth International Airport being one of the busiest airports globally. The presence of American Airlines, the world's largest airline, which operates an extensive fleet, further strengthens DFW's position.

North America Flight Data Monitoring Market Segmentation

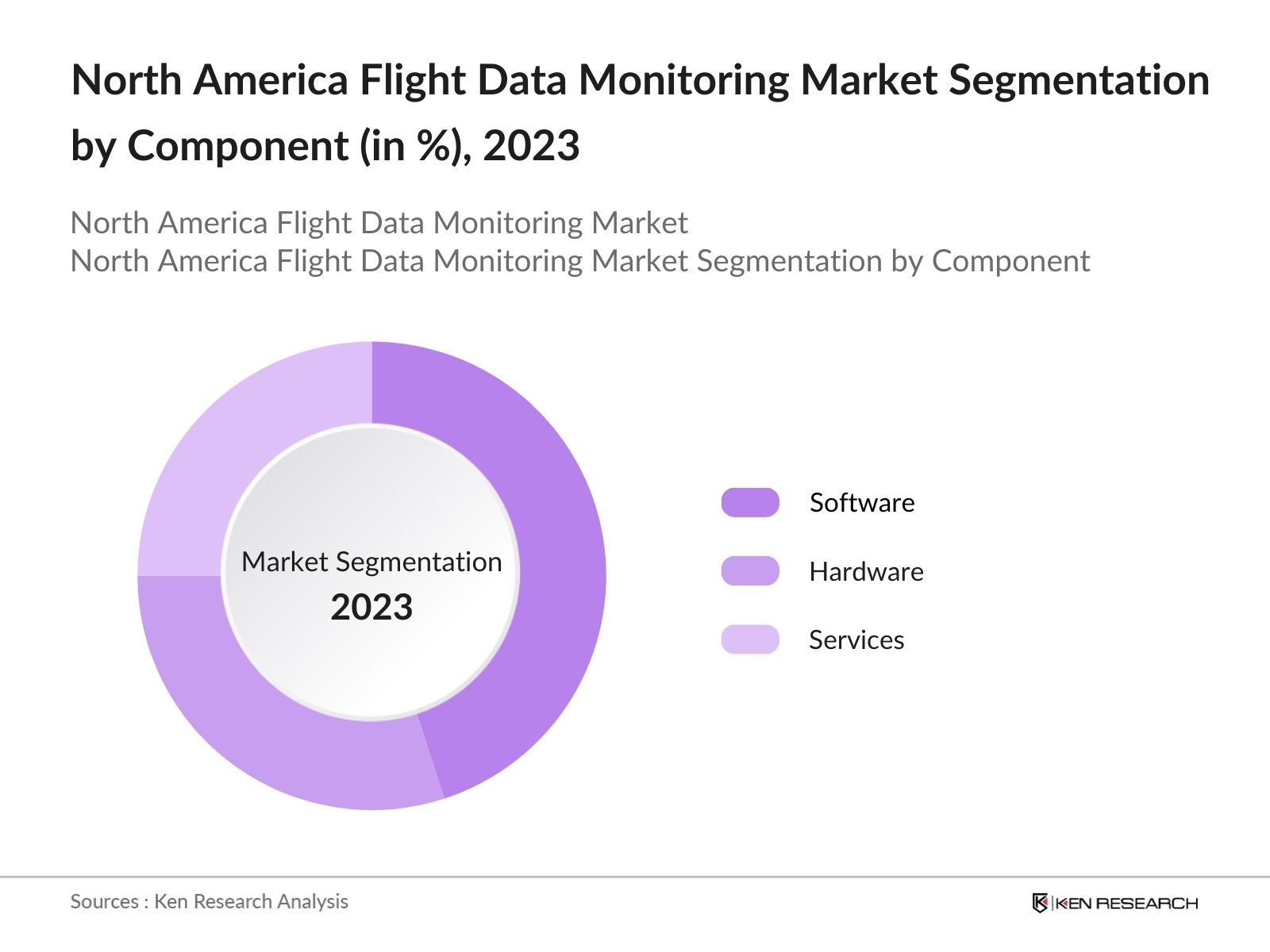

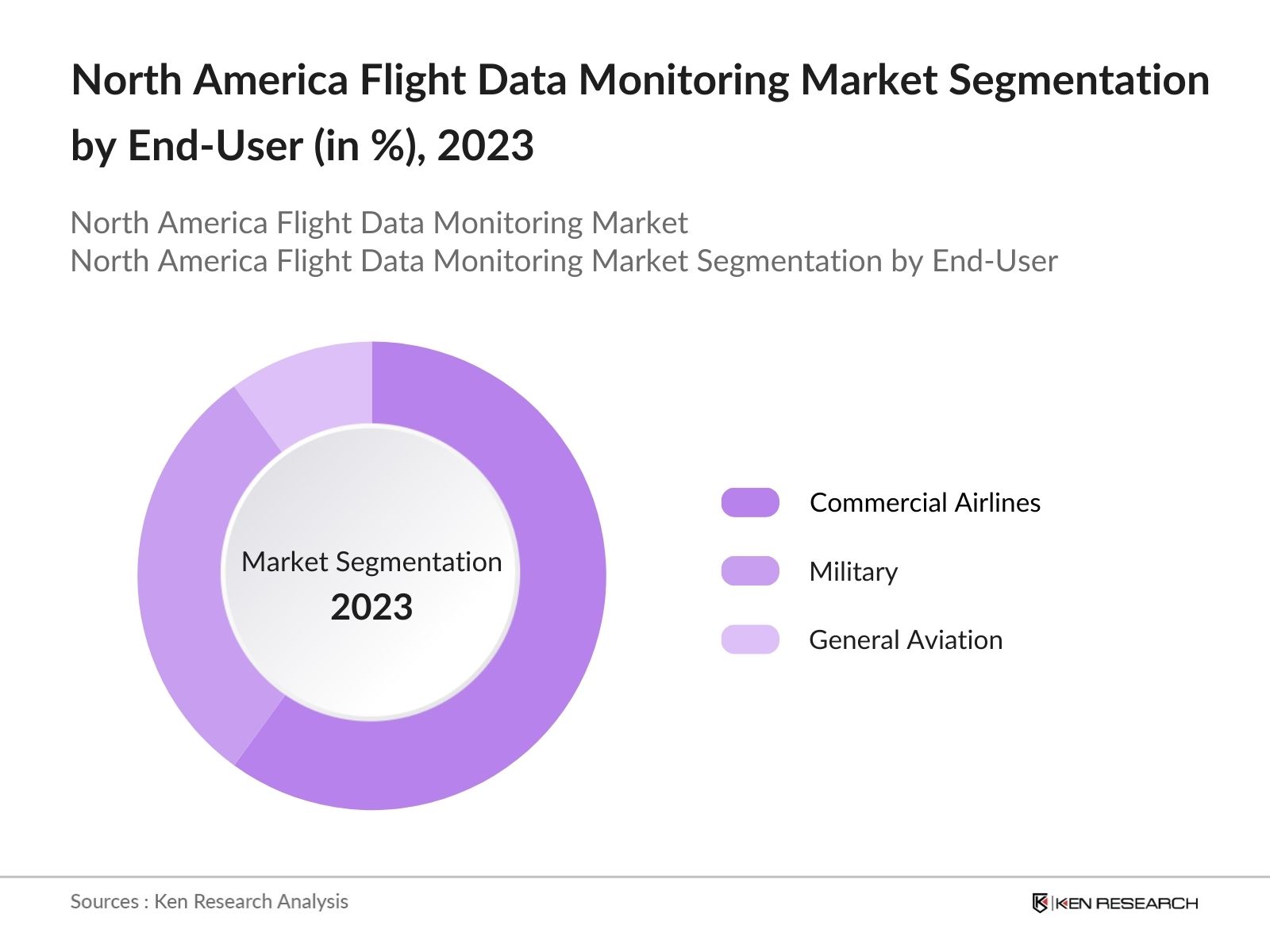

The North America Flight Data Monitoring Market is segmented into different factors like by component, by end user and region.

By Component: The market is segmented by component into hardware, software, and services. In 2023, the software segment was dominating the market due to its attributed to the increasing integration of advanced analytics and machine learning algorithms in Flight Data Monitoring systems. These software platforms are critical for real-time data processing, which allows airlines and aviation authorities to monitor flight operations and identify potential safety issues before they become critical.

By Region: The market is segmented by region into the United States and Canada. In 2023, the United States dominated the market due to several factors, including its large commercial aviation industry, extensive military aviation operations, and a well-established regulatory framework that mandates the use of FDM systems across various segments of the aviation industry. The U.S. aviation industry is home to some of the world's largest airlines, which operate extensive fleets requiring comprehensive monitoring systems to ensure safety and efficiency.

By End-User: The market is segmented by end-user into commercial airlines, military, and general aviation. In 2023, the commercial airlines segment was dominating the market, driven by the increasing fleet size and the stringent safety regulations that govern the commercial aviation sector. Commercial airlines are under constant pressure to ensure passenger safety, operational efficiency, and regulatory compliance, all of which necessitate the use of advanced FDM systems.

North America Flight Data Monitoring Market Competitive Landscape

North America Flight Data Monitoring Market Major Players

|

Company Name |

Year of Establishment |

Headquarters |

|---|---|---|

|

Honeywell International Inc. |

1906 |

Charlotte, North Carolina |

|

L3Harris Technologies, Inc. |

1895 |

Melbourne, Florida |

|

Safran |

2005 |

Paris, France |

|

Curtiss-Wright Corporation |

1929 |

Davidson, North Carolina |

|

Teledyne Controls |

1964 |

El Segundo, California |

- L3Harris Technologies, Inc.: In 2024, L3Harris Technologies has secured an $871 million Indefinite Delivery, Indefinite Quantity (IDIQ) contract from the U.S. Army to supply M762A1 and M767A1 Electronic-Time Fuzes. This five-year contract will support missions for the U.S., its allies, and partners, highlighting L3Harris's critical role in replenishing munitions inventories. The company brings 60 years of expertise in advanced fuzing and ordnance systems to this contract, reinforcing its position as a key supplier for the Department of Defense.

- Safran: In February 2022, Safran Electronics & Defense Services Asia is set to open a new MRO facility in Singapore. To prepare for the anticipated recovery in air travel, the company has introduced new repair capabilities and upgraded the facility. At this Singapore location, Safran Electronics & Defense Services Asia will perform Maintenance and Repair Operations on landing gear control systems, including tire pressure and brake temperature monitoring, for both business jets and civilian aircraft.

North America Flight Data Monitoring Market Analysis

North America Flight Data Monitoring Market Growth Drivers

- Increasing Air Traffic and Fleet Expansion: The North American Flight Data Monitoring (FDM) market is experiencing significant growth due to the rising air traffic and expansion of commercial and military aircraft fleets. In 2024, the Federal Aviation Administration (FAA) reported that over 540,000 active pilots are operating in the U.S., with more than 5,000 aircraft added to commercial and general aviation fleets. This expansion drives the demand for advanced FDM systems to monitor, analyze, and ensure the safety and efficiency of these growing fleets.

- Stringent Aviation Safety Regulations: In 2024, the FAA introduced new safety regulations mandating the use of flight data monitoring systems across all commercial aircraft by 2026. This regulatory push, coupled with the FAAs enforcement of real-time data monitoring for predictive maintenance, has led to a surge in the adoption of FDM systems. The President's Budget requests a base funding level of $19.8 billion for the FAA in FY 2024, a substantial increase that underscores the emphasis on flight safety and the demand for monitoring solutions.

- Increased Focus on Predictive Maintenance: There is a growing emphasis on predictive maintenance within the aviation industry, which is a key driver for the FDM market. Predictive maintenance relies on the analysis of flight data to anticipate and address potential issues before they result in costly repairs or downtime. The ability of FDM systems to provide early warnings and detailed diagnostics helps airlines maintain operational continuity and reduce maintenance costs.

North America Flight Data Monitoring Market Challenges

- Integration with Legacy Systems: Many airlines and aviation operators face challenges when integrating advanced Flight Data Monitoring (FDM) systems with older aircraft and legacy infrastructure. The technical complexity of retrofitting these systems into existing fleets can lead to significant downtime and increased operational costs. Compatibility issues between new FDM technologies and older avionics systems require specialized solutions, which can be both time-consuming and expensive.

- Cybersecurity Concerns: As FDM systems become more connected and reliant on real-time data transmission, they also become more vulnerable to cybersecurity threats. Protecting sensitive flight data from unauthorized access and potential cyber-attacks is a growing concern. Ensuring robust cybersecurity measures, such as encryption and secure data channels, adds layers of complexity and requires continuous monitoring and updates, which can be resource-intensive for aviation operators.

North America Flight Data Monitoring Market Government Initiatives

- FAA Facilities Funding Request: In 2023, a r $510.8 million request was made to improve air traffic control facilities, addressing the FAA's $5.3 billion maintenance backlog and supporting planning for replacing outdated sites. Many facilities are in poor condition, with the average age of air route traffic control centers and Combined Control Facilities at 61 years, and over 50% of terminal facilities being more than 40 years old.

- U.S. Department of Defense Aviation Safety Initiative: A request of $12.7 billion has been made to improve aviation safety and efficiency. The budget funds the Air Traffic Organization, managing air traffic control, and the Aviation Safety Organization (AVS), which ensures safe airline operations and certifies new aviation products. It also covers commercial space transportation regulation, FAA policy oversight, and management. This funding supports maintaining top safety standards and fostering innovation in national airspace.

North America Flight Data Monitoring Market Future Outlook

The North American FDM Market is projected to grow exponentially by 2028. The future of the market will be shaped by continuous advancements in artificial intelligence and machine learning, which will enable more sophisticated data analysis and predictive capabilities. Additionally, the increasing focus on sustainable aviation and the adoption of electric and hybrid aircraft will drive demand for advanced monitoring systems that can ensure the safe integration of new technologies.

Market Trends

- Growth in Predictive Maintenance Solutions: Predictive maintenance is expected to become a major focus for the aviation industry, with FDM systems playing a critical role. By 2028, it is anticipated that predictive maintenance solutions in North America, as airlines and military operators increasingly rely on FDM systems to monitor the health of their fleets and prevent costly downtime.

- Increased Integration of AI and Machine Learning in FDM Systems: Over the next five years, the integration of artificial intelligence (AI) and machine learning (ML) in FDM systems is expected to become more prevalent. By 2028, it is estimated that over 80% of new FDM systems will incorporate AI-driven analytics, enabling more accurate predictions of potential safety issues and more efficient maintenance scheduling.

Scope of the Report

|

By Component |

Hardware Software Services |

|

By End-User |

Commercial Airlines Military General Aviation |

|

By Region |

United States Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Commercial Airlines

Aviation Safety Authorities

Air Traffic Control Service Providers

Aerospace & Defense Contractors

Airlines Safety Managers

Insurance Companies

Aviation Data Analytics Firms

Government Transportation Agencies (e.g., FAA)

Investors and VC Firms

Banks and Financial Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Honeywell International Inc.

L3Harris Technologies, Inc.

Safran

Curtiss-Wright Corporation

Teledyne Controls

Garmin Ltd.

Rockwell Collins, Inc.

Universal Avionics Systems Corporation

Flight Data Services Ltd.

Aireon LLC

SITAONAIR

Gogo LLC

Flyht Aerospace Solutions Ltd.

GE Aviation

Meggitt PLC

Table of Contents

1. North America Flight Data Monitoring Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Flight Data Monitoring Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Flight Data Monitoring Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Air Traffic and Fleet Expansion

3.1.2. Stringent Aviation Safety Regulations

3.1.3. Growing Military Aviation Operations

3.1.4. Adoption of Unmanned Aerial Vehicles (UAVs)

3.2. Challenges

3.2.1. High Implementation Costs

3.2.2. Data Privacy and Security Concerns

3.2.3. Technical Complexity and Integration Issues

3.2.4. Regulatory Compliance and Evolving Standards

3.3. Government Initiatives

3.3.1. FAAs NextGen Program

3.3.2. U.S. Department of Defense Aviation Safety Initiative

3.3.3. Canadian Aviation Safety Improvement Program

3.3.4. U.S. Drone Safety Regulation Enhancement

3.4. Recent Developments

3.4.1. Honeywells Connected Aircraft Program Launch

3.4.2. L3Harris Technologies USD 1 Billion Defense Contract

3.4.3. Safrans Acquisition of Zodiac Aerospace

3.4.4. Teledyne Controls Wireless FDM System Development

3.5. Future Trends

3.5.1. Increased Integration of AI and Machine Learning in FDM Systems

3.5.2. Expansion of FDM Systems in Urban Air Mobility (UAM)

3.5.3. Growth in Predictive Maintenance Solutions

3.5.4. Adoption of FDM Systems in Electric and Hybrid Aircraft

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. North America Flight Data Monitoring Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By End-User (in Value %)

4.2.1. Commercial Airlines

4.2.2. Military

4.2.3. General Aviation

4.3. By Region (in Value %)

4.3.1. United States

4.3.2. Canada

4.3.3. Key Dominant City Analysis: Dallas-Fort Worth

5. North America Flight Data Monitoring Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Honeywell International Inc.

5.1.2. L3Harris Technologies, Inc.

5.1.3. Safran

5.1.4. Curtiss-Wright Corporation

5.1.5. Teledyne Controls

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Flight Data Monitoring Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Flight Data Monitoring Market Regulatory Framework

7.1. Aviation Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Flight Data Monitoring Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Flight Data Monitoring Future Market Segmentation, 2028

9.1. By Component (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

10. North America Flight Data Monitoring Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on North America Flight Data Monitoring Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Flight Data Monitoring Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple technology companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from technology companies.

Frequently Asked Questions

01 How big is the North America Flight Data Monitoring Market?

The North America Flight Data Monitoring Market was valued at 361.15 million in 2023, driven by advancements in aviation safety, regulatory requirements, and the growing adoption of real-time data analytics.

02 What are the challenges in the North America Flight Data Monitoring Market?

Challenges in North America Flight Data Monitoring Market include the high cost of implementation and maintenance, integration difficulties with legacy systems, cybersecurity concerns, and the need for continuous updates to meet evolving regulatory standards.

03 Who are the major players in the North America Flight Data Monitoring Market?

Key players in North America Flight Data Monitoring Market include Honeywell International Inc., L3Harris Technologies, Safran, Curtiss-Wright Corporation, and Teledyne Controls. These companies lead due to their advanced technological offerings and strategic partnerships within the aviation industry.

04 What are the growth drivers of the North America Flight Data Monitoring Market?

Growth drivers in North America Flight Data Monitoring Market include the rising demand for real-time data analytics, advancements in aviation safety standards, expansion of military and commercial aviation operations, and an increased focus on predictive maintenance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.