North America Fluids and Lubricant Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD5218

December 2024

96

About the Report

North America Fluids and Lubricants Market Overview

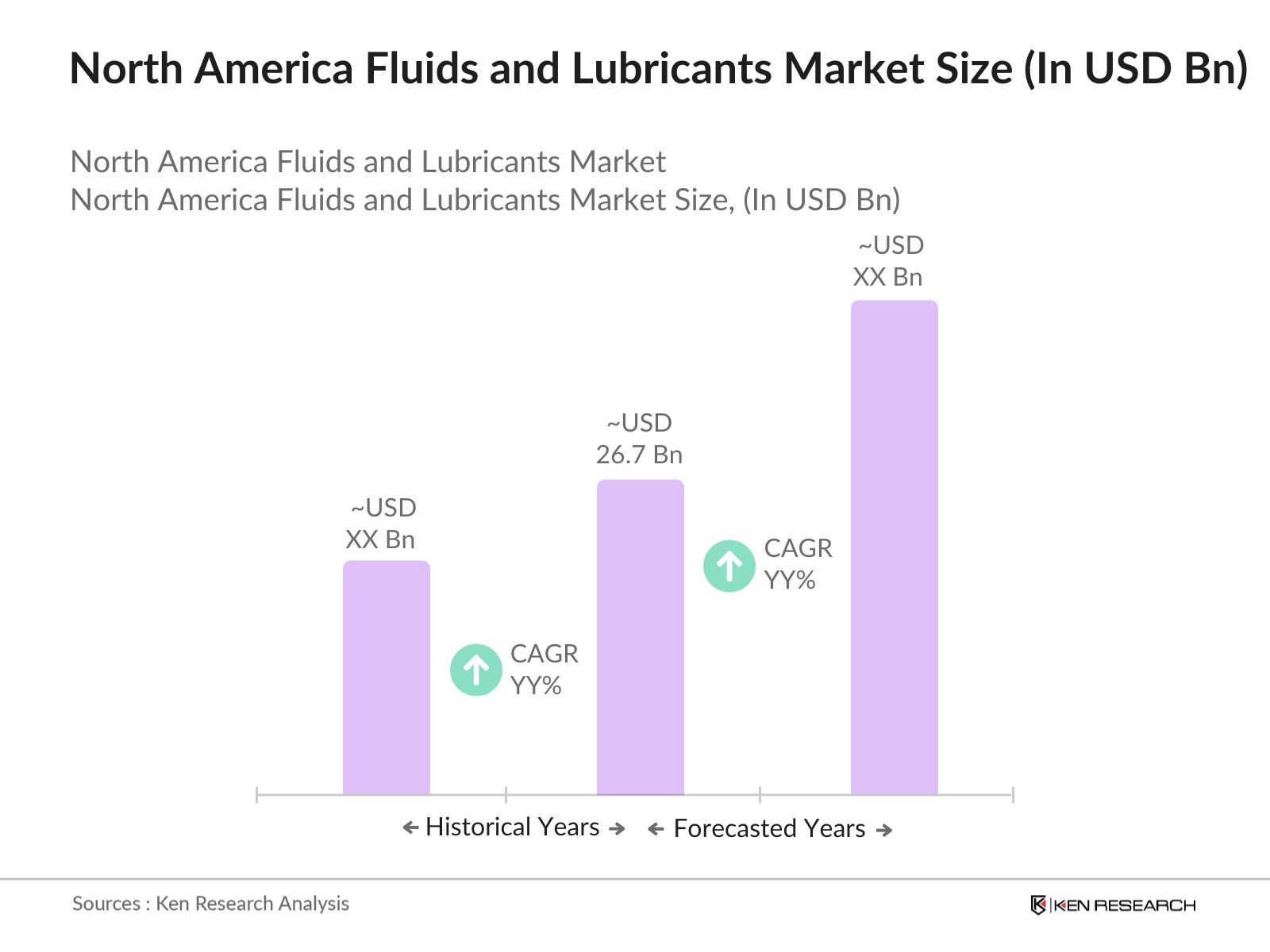

- The North America Fluids and Lubricants market is valued at USD 26.7 billion, based on a five-year historical analysis. This market size is largely driven by the region's thriving automotive, industrial, and power generation sectors. The increasing demand for high-performance synthetic lubricants and industrial fluids, especially within the automotive and manufacturing industries, has contributed to the market's size. Furthermore, innovations in lubricant technologies, stringent regulations on emissions, and the shift towards energy efficiency have also played a crucial role in driving this market.

- The United States is the dominant country in the North American Fluids and Lubricants market. Its dominance stems from the extensive presence of manufacturing hubs, a large automotive market, and advanced industrial infrastructure. In addition, the U.S. is home to major players like ExxonMobil and Chevron, who invest in research and development. Canada and Mexico also play major roles in the market due to their growing automotive sectors and increasing industrialization, but they trail behind the U.S. in terms of market dominance.

- The Environmental Protection Agency (EPA) continues to implement stringent guidelines for lubricant manufacturers in North America. In 2023, the EPA mandated the use of low-VOC lubricants in automotive and industrial applications, compelling manufacturers to reformulate products to meet these guidelines. This regulation affects over 50% of the lubricants produced in the region, particularly in sectors such as automotive and manufacturing. The EPAs push towards cleaner, environmentally sustainable lubricants is a major driving force behind the shift to bio-based and synthetic products, with compliance ensuring continued market access.

North America Fluids and Lubricants Market Segmentation

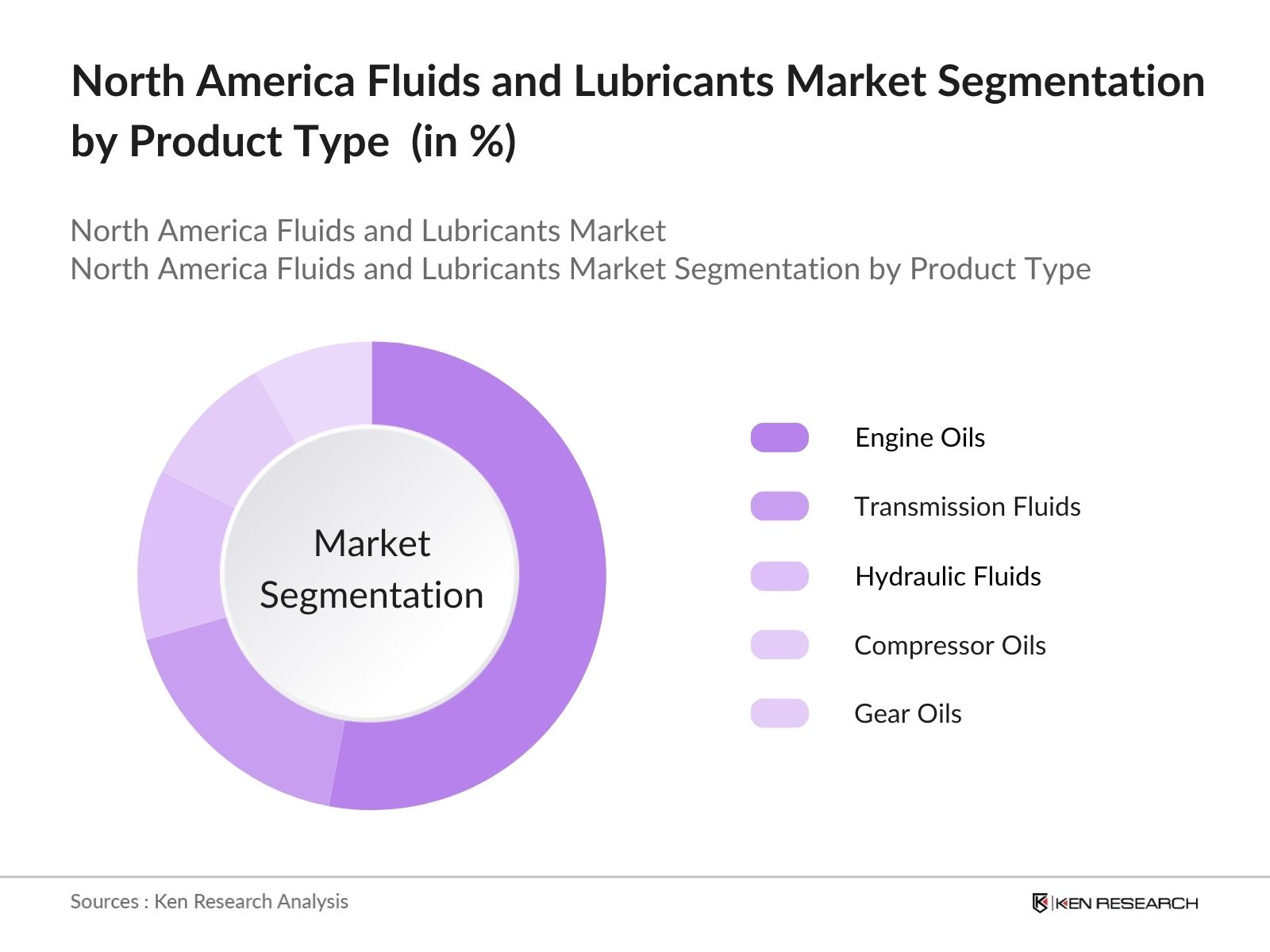

- By Product Type: The North America Fluids and Lubricants market is segmented by product type into engine oils, transmission fluids, hydraulic fluids, compressor oils, and gear oils. Among these, engine oils dominate the market share due to their widespread usage in the automotive sector, particularly for passenger cars and heavy-duty trucks. The automotive industrys consistent demand for high-performance engine oils, combined with the increasing number of vehicles on the road, has cemented its leadership within this segment. Moreover, advancements in synthetic engine oils have increased their market share as they offer better protection and performance, further driving their dominance.

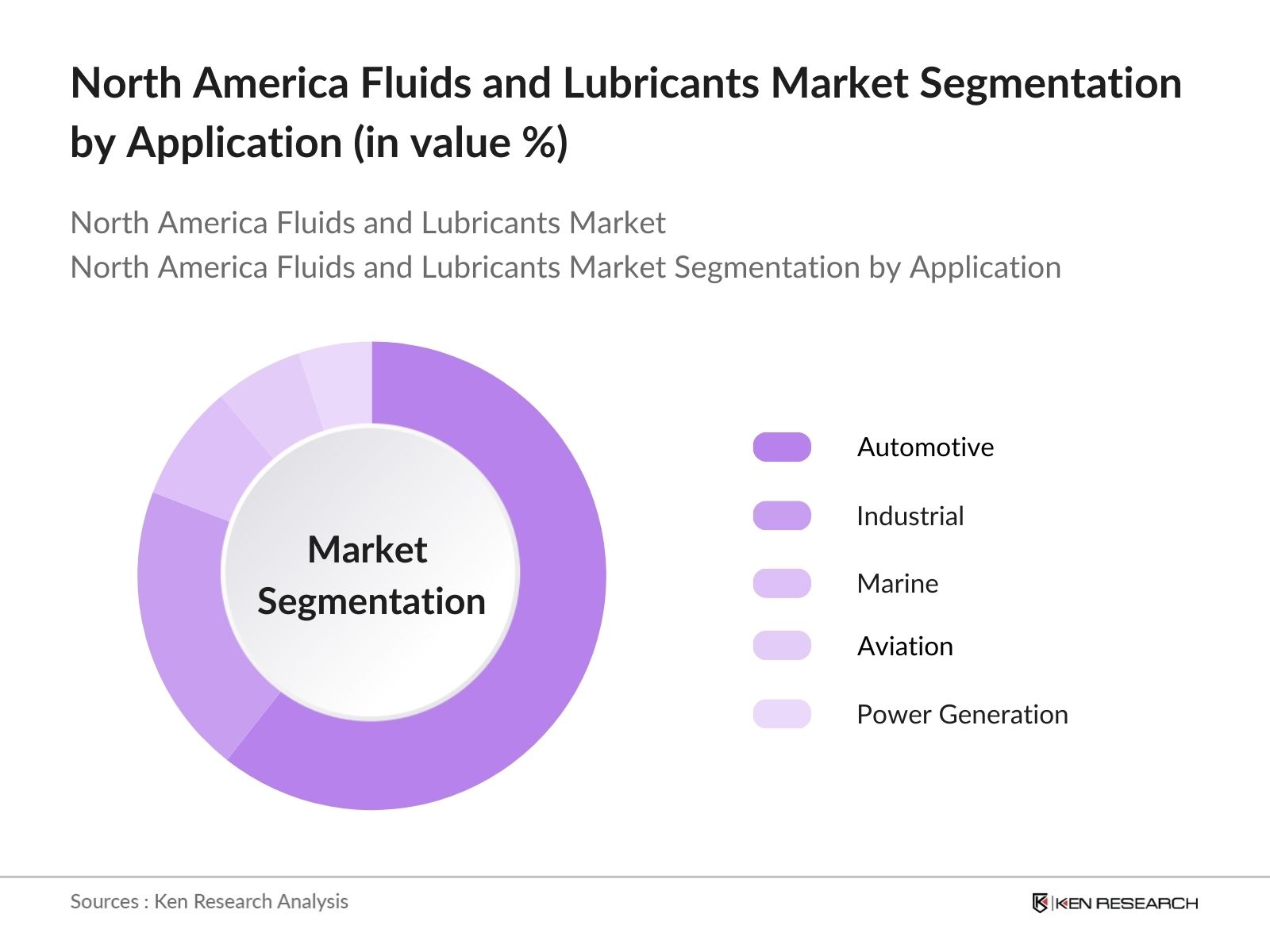

- By Application: The market is also segmented by application into automotive, industrial, marine, aviation, and power generation. The automotive sector dominates the application segment, driven by the sheer size of the North American automobile market, particularly in the U.S. With millions of vehicles requiring regular oil changes and lubricant applications, the automotive industry remains the largest consumer of fluids and lubricants. The shift towards electric vehicles, although growing, has not yet impacted the demand for automotive lubricants, keeping this segment at the forefront of market demand.

North America Fluids and Lubricants Market Competitive Landscape

The North America Fluids and Lubricants market is dominated by both global and regional players. Major companies like ExxonMobil, Chevron, and Royal Dutch Shell lead the market, backed by strong R&D, extensive distribution networks, and strategic partnerships. These players hold a influence over the market due to their ability to innovate and offer diverse product portfolios. Additionally, companies are focusing on sustainability initiatives and shifting towards bio-based and environmentally friendly lubricants to meet evolving market demands.

|

Company |

Establishment Year |

Headquarters |

R&D Expenditure |

Production Capacity |

Number of Patents |

Geographic Reach |

Sustainability Initiatives |

|

ExxonMobil Corporation |

1870 |

Irving, Texas, USA |

- |

- |

- |

- |

- |

|

Chevron Corporation |

1879 |

San Ramon, California |

- |

- |

- |

- |

- |

|

Royal Dutch Shell |

1907 |

The Hague, Netherlands |

- |

- |

- |

- |

- |

|

Fuchs Petrolub SE |

1931 |

Mannheim, Germany |

- |

- |

- |

- |

- |

|

Valvoline Inc. |

1866 |

Lexington, Kentucky |

- |

- |

- |

- |

- |

North America Fluids and Lubricants Market Analysis

North America Fluids and Lubricants Market Growth Drivers

- Increasing Industrial Activity: The North American industrial sector, particularly in oil & gas, automotive, aviation, and heavy machinery, has shown growth. According to the U.S. Energy Information Administration (EIA), crude oil production in the U.S. reached 11.7 million barrels per day in 2023. This increase in industrial activity has led to a growing demand for fluids and lubricants to maintain machinery efficiency. The automotive industry in North America, which produced 14.9 million vehicles in 2022, also drives demand for lubricants, especially in heavy-duty vehicles used for industrial purposes. Growth in these sectors is bolstered by robust infrastructure development.

- Rising Demand for Synthetic Lubricants: Synthetic lubricants are gaining traction in the North American market due to their superior performance in extreme temperatures and high-pressure environments. The U.S. automotive sector has witnessed a notable shift towards synthetic lubricants, especially in high-performance and electric vehicles, with nearly 35% of lubricants used in the automotive industry now being synthetic. This is driven by the need for extended drain intervals and enhanced fuel efficiency. The industrial and aviation sectors are also transitioning towards synthetic lubricants to improve equipment longevity and reduce maintenance costs.

- Environmental and Sustainability Regulations: North America's stringent environmental and sustainability regulations, such as ISO 14001, are driving the adoption of eco-friendly lubricants. As of 2023, more than 20,000 companies across the U.S. and Canada have adopted ISO 14001 standards, promoting the use of environmentally sustainable lubricants. The Environmental Protection Agency (EPA) has also increased pressure on industries to minimize the environmental impact of lubricants, which has accelerated the transition towards bio-based and synthetic lubricants. These regulations ensure that lubricants meet environmental performance criteria, driving demand for cleaner, sustainable products.

North America Fluids and Lubricants Market Challenges

- Price Volatility in Raw Materials: The fluids and lubricants market in North America is highly sensitive to fluctuations in crude oil prices, as base oils derived from crude oil are critical in production. In 2023, crude oil prices fluctuated between $65 and $85 per barrel, creating cost pressures for lubricant manufacturers. Such volatility can impact the profit margins of manufacturers, leading to price instability for end consumers. The North American market is particularly affected due to its reliance on petroleum-based products, which make up approximately 85% of the lubricant market.

- Competition from Bio-Based Lubricants: Bio-based lubricants are emerging as strong competitors to traditional synthetic and mineral oils due to their eco-friendliness. In North America, the market share of bio-based lubricants has steadily increased, accounting for 12% of the total lubricant market in 2023. These lubricants, derived from renewable resources like vegetable oils, offer reduced environmental impact and compliance with stringent environmental regulations. However, their higher production costs and limited availability compared to petroleum-based products present challenges for market expansion. The growth of bio-lubricants is particularly evident in environmentally sensitive industries such as agriculture and forestry.

North America Fluids and Lubricants Market Future Outlook

Over the next five years, the North America Fluids and Lubricants market is expected to experience steady growth, driven by the expansion of the automotive and industrial sectors. Increasing environmental awareness and regulatory pressure will push manufacturers to innovate towards eco-friendly and energy-efficient lubricants. The rise in electric vehicle adoption and advancements in lubricant technology will also offer growth opportunities. Industrial sectors such as manufacturing and construction are anticipated to boost demand for specialty fluids and lubricants.

North America Fluids and Lubricants Market Opportunities

- Growing Automotive Sector in North America: The North American automotive sector continues to offer growth opportunities for the fluids and lubricants market. In 2023, the U.S. registered 1.2 million electric vehicles (EVs), a 26% increase from the previous year, highlighting the growing demand for specialized lubricants designed for EVs. In parallel, internal combustion engine (ICE) vehicles, which still dominate the automotive market with a production volume of 13.7 million units in 2023, create strong demand for traditional lubricants. The transition to electric vehicles is also driving innovation in coolant fluids for battery temperature management, further expanding market potential.

- Increasing Usage of Industrial Fluids in Manufacturing and Construction: North America's industrial fluids market is witnessing substantial growth, driven by increased activity in the manufacturing and construction sectors. The U.S. construction industry, valued at $1.8 trillion in 2023, relies heavily on hydraulic fluids, metalworking fluids, and lubricants to maintain machinery efficiency and reduce operational downtime. The manufacturing sector also presents opportunities, with the industrial machinery and equipment market growing by 4.5% in 2023. The expanding use of specialty fluids in high-performance manufacturing processes is creating lucrative opportunities for lubricant suppliers.

Scope of the Report

|

Product Type |

Engine Oils Transmission Fluids Hydraulic Fluids Compressor Oils Gear Oils |

|

Application |

Automotive (Passenger Cars, Heavy Duty Trucks) Industrial (Machinery, Mining, Agriculture) Marine (Shipping, Offshore) Aviation (Commercial, Military) Power Generation |

|

Base Oil Type |

Mineral Oils Synthetic Oils Semi-Synthetic Oils Bio-Based Oils |

|

Distribution Channel |

Direct Sales Distributors Online Retail |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Automotive Manufacturers (Ford, General Motors)

Industrial Machinery Manufacturers

Banks and Financial Institutions

Marine and Shipping Companies (Maersk, A.P. Moller)

Aviation Companies (Boeing, Lockheed Martin)

Power Generation Companies (General Electric, Siemens)

Government and Regulatory Bodies (EPA, U.S. Department of Transportation)

Investors and Venture Capitalist Firms

Oil and Gas Companies (ExxonMobil, Chevron)

Companies

Players Mentioned in the Market

ExxonMobil Corporation

Chevron Corporation

Royal Dutch Shell

BP PLC

Fuchs Petrolub SE

TotalEnergies

Valvoline Inc.

Phillips 66

Lubrizol Corporation

Table of Contents

1. North America Fluids and Lubricants Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Annual Growth Rate, Industry Specific)

1.4 Market Segmentation Overview

2. North America Fluids and Lubricants Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (New Product Launches, Regulatory Milestones, Strategic Partnerships)

3. North America Fluids and Lubricants Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Industrial Activity (Oil & Gas, Automotive, Aviation, Heavy Machinery)

3.1.2 Rising Demand for Synthetic Lubricants (Synthetic vs. Mineral Lubricants)

3.1.3 Advancements in Lubricant Additive Technologies

3.1.4 Environmental and Sustainability Regulations (ISO 14001 Standards)

3.2 Market Challenges

3.2.1 Price Volatility in Raw Materials (Crude Oil Price Fluctuations)

3.2.2 Competition from Bio-Based Lubricants

3.2.3 Stringent Environmental Regulations (Emissions Regulations, VOC Standards)

3.3 Opportunities

3.3.1 Growing Automotive Sector in North America (Electric Vehicles, ICE Vehicles)

3.3.2 Increasing Usage of Industrial Fluids in Manufacturing and Construction

3.3.3 Expansion in Specialty Fluids Market (Hydraulic Fluids, Compressor Oils, Metalworking Fluids)

3.4 Trends

3.4.1 Shift Towards High-Performance Synthetic Lubricants

3.4.2 Increasing Adoption of Green and Bio-Based Fluids

3.4.3 Adoption of Smart Lubricants and IoT-Based Monitoring (Lubricant Sensors, Predictive Maintenance)

3.5 Government Regulations

3.5.1 Environmental Protection Agency (EPA) Guidelines

3.5.2 Automotive Emissions Standards (CAFE Standards)

3.5.3 REACH Compliance (Registration, Evaluation, Authorization, and Restriction of Chemicals)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, Distributors, OEMs, Service Providers)

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Overview

4. North America Fluids and Lubricants Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Engine Oils

4.1.2 Transmission Fluids

4.1.3 Hydraulic Fluids

4.1.4 Compressor Oils

4.1.5 Gear Oils

4.2 By Application (In Value %)

4.2.1 Automotive (Passenger Cars, Heavy Duty Trucks)

4.2.2 Industrial (Machinery, Mining, Agriculture)

4.2.3 Marine (Shipping, Offshore)

4.2.4 Aviation (Commercial, Military)

4.2.5 Power Generation

4.3 By Base Oil Type (In Value %)

4.3.1 Mineral Oils

4.3.2 Synthetic Oils

4.3.3 Semi-Synthetic Oils

4.3.4 Bio-Based Oils

4.4 By Distribution Channel (In Value %)

4.4.1 Direct Sales

4.4.2 Distributors

4.4.3 Online Retail

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Fluids and Lubricants Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ExxonMobil Corporation

5.1.2 Chevron Corporation

5.1.3 Royal Dutch Shell

5.1.4 BP PLC

5.1.5 TotalEnergies

5.1.6 Fuchs Petrolub SE

5.1.7 Valvoline Inc.

5.1.8 Phillips 66

5.1.9 Petro-Canada Lubricants

5.1.10 Lubrizol Corporation

5.1.11 Castrol Limited

5.1.12 Idemitsu Kosan Co., Ltd.

5.1.13 Calumet Specialty Products Partners

5.1.14 Quaker Houghton

5.1.15 Amsoil Inc.

5.2 Cross Comparison Parameters (Market Share, Production Capacity, Product Portfolio, Sustainability Initiatives, Number of Patents, R&D Expenditure, Geographic Reach, Innovation Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Strategic Partnerships

5.8 Technological Advancements (Nanotechnology, Tribology)

6. North America Fluids and Lubricants Market Regulatory Framework

6.1 Environmental Standards (VOC Regulations, Greenhouse Gas Emissions)

6.2 Compliance Requirements (ISO Certifications, API Standards)

6.3 Certification Processes (Product Testing, Third-Party Certifications)

7. North America Fluids and Lubricants Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Electrification of Vehicles, Increased Industrialization)

8. North America Fluids and Lubricants Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Base Oil Type (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. North America Fluids and Lubricants Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves developing an ecosystem map encompassing major stakeholders in the North American Fluids and Lubricants market. This phase utilizes extensive desk research combined with proprietary databases to gather data on critical variables such as raw material availability, pricing trends, and consumption patterns. The goal is to define factors that influence market dynamics, including consumer behaviour and regulatory impacts.

Step 2: Market Analysis and Construction

In this phase, we compile historical data to assess market penetration, revenue generation, and industry growth trends. This involves evaluating the performance of different product segments (engine oils, hydraulic fluids) and analysing the regional dynamics in North America. Market statistics are cross-verified using industry reports and proprietary models.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the market's future growth and segmentation are validated through interviews with industry experts from leading lubricant manufacturers and distributors. This step ensures that real-time operational data is integrated into the analysis, allowing for precise and reliable market projections.

Step 4: Research Synthesis and Final Output

The final step integrates quantitative data with expert opinions to deliver a comprehensive and validated market report. Feedback from leading manufacturers and distributors provides additional insights on future trends, consumer preferences, and product innovations, ensuring the most accurate market analysis.

Frequently Asked Questions

01. How big is the North America Fluids and Lubricants Market?

The North America Fluids and Lubricants market is valued at USD 26.7 billion, primarily driven by the automotive and industrial sectors. The demand for high-performance lubricants and synthetic oils is contributing to its market size.

02. What are the challenges in the North America Fluids and Lubricants Market?

Challenges in the North America Fluids and Lubricants market include fluctuating crude oil prices, stringent environmental regulations, and growing competition from bio-based lubricants. These factors impact both raw material availability and production costs.

03. Who are the major players in the North America Fluids and Lubricants Market?

Major players in the North America Fluids and Lubricants market include ExxonMobil, Chevron, Royal Dutch Shell, Fuchs Petrolub SE, and Valvoline Inc. These companies dominate due to their extensive R&D efforts, broad product portfolios, and strong distribution networks.

04. What are the growth drivers of the North America Fluids and Lubricants Market?

The North America Fluids and Lubricants market is driven by increasing industrialization, demand for synthetic lubricants, and stringent regulations on emissions. The rise in electric vehicle usage is also expected to shape future demand for specialty lubricants.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.