North America Food and Beverage Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1799

October 2024

88

About the Report

North America Food and Beverage Market Overview

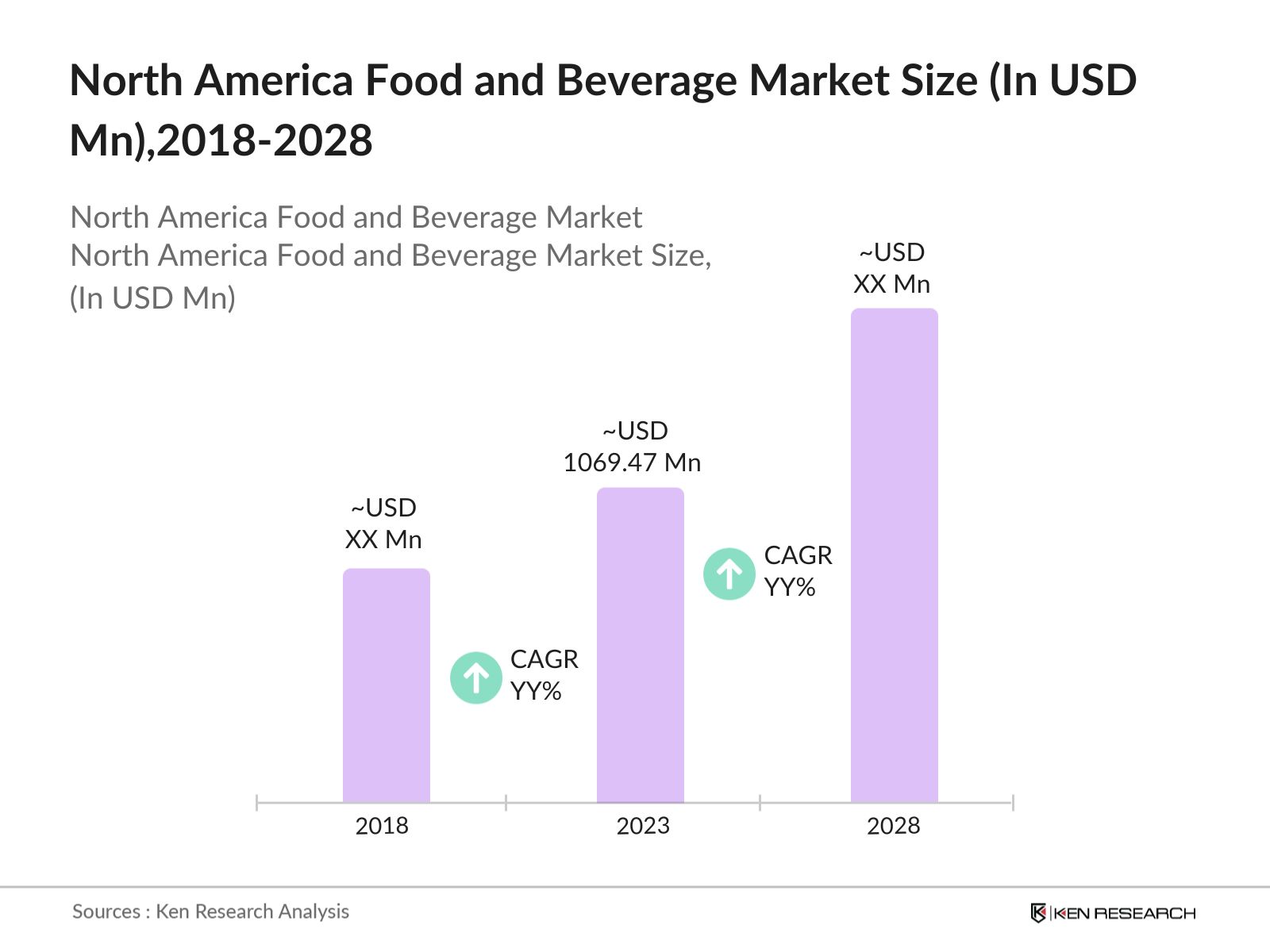

- The North America Food and Beverage Market was valued at USD 1069.47 Mn in 2023. The market's expansion is primarily driven by increasing consumer demand for convenience foods, rising health consciousness, and continuous innovation in product offerings, especially in the premium and organic segments.

- The market is highly competitive, with several key players including PepsiCo Inc., The Coca-Cola Company, Nestl USA, Tyson Foods Inc., and Kraft Heinz. These companies have established a strong foothold in the market through extensive product portfolios, innovative marketing strategies, and large-scale distribution networks.

- A notable development in the industry is the increasing investment in sustainable and plant-based products. Tyson Foods announced a significant expansion of its plant-based product line under the Raised & Rooted brand, aiming to capitalize on the growing demand for alternative proteins. This move aligns with the broader industry trend towards sustainability, driven by consumer awareness of environmental issues and health concerns.

- The United States is the dominant region in the market, due to its large population, diverse food culture, and significant agricultural output. The states has high demand for organic and locally sourced products. California's dominance is also attributed to its robust distribution networks and the presence of major food and beverage companies headquartered in the state, making it a crucial hub for the industry.

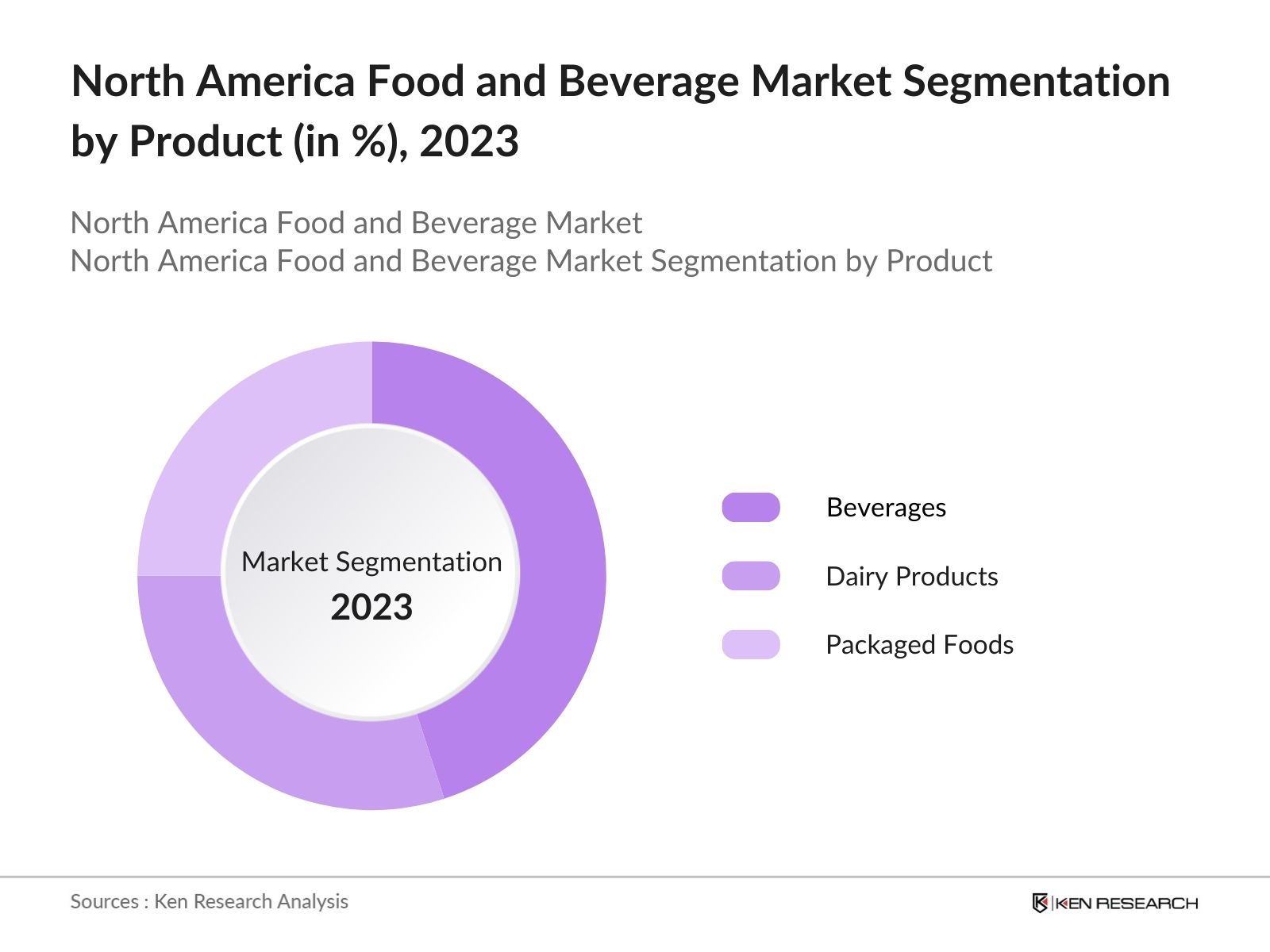

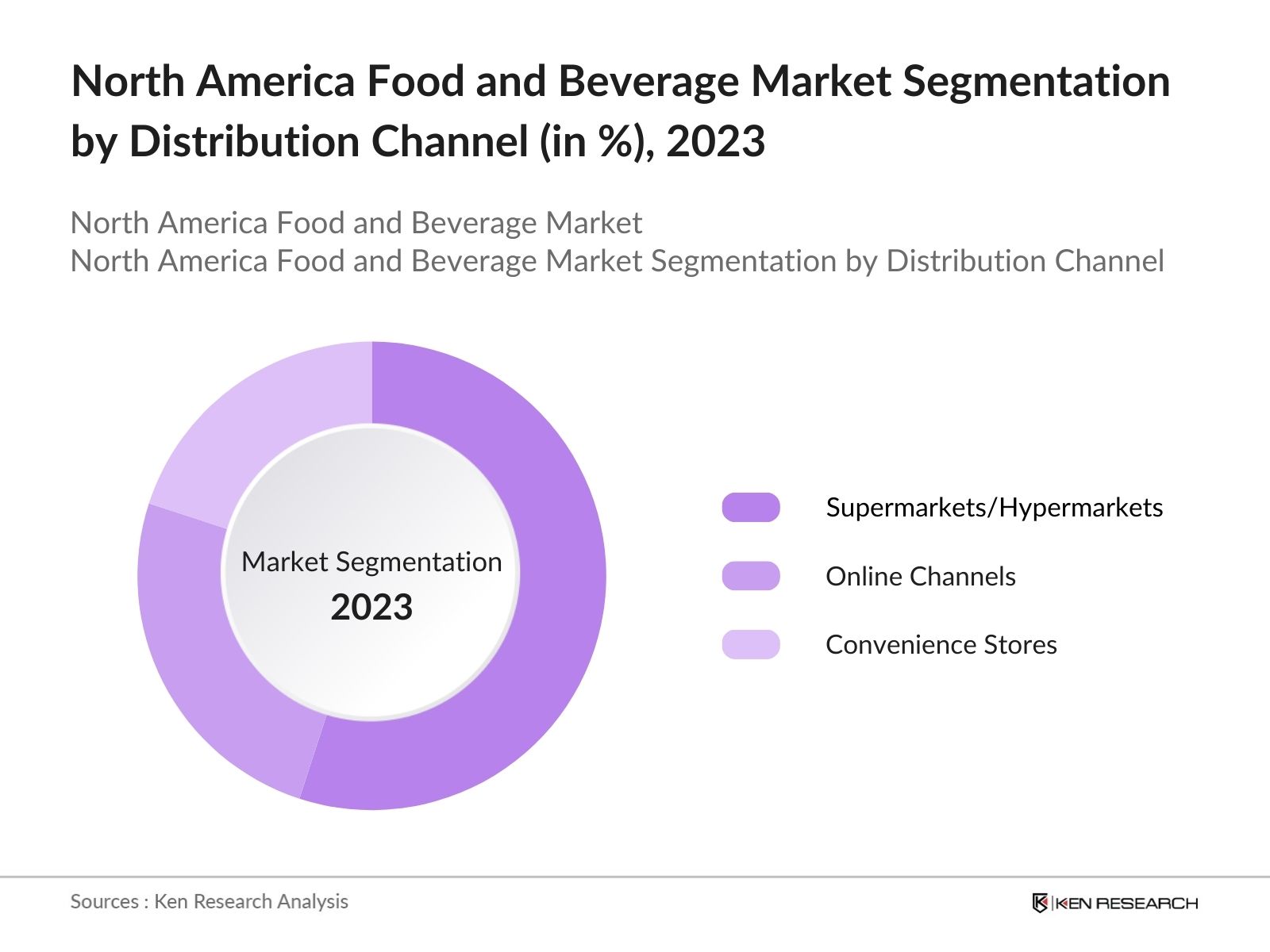

North America Food and Beverage Market Segmentation

The market is segmented into various factors like product, distribution channel, and region.

By Product: The market is segmented by product into beverages, dairy products, and packaged foods. In 2023, the beverages segment held the largest market share, due to the high consumption of carbonated soft drinks, energy drinks, and alcoholic beverages in the region.

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, online channels, and convenience stores. In 2023, supermarkets and hypermarkets dominated the distribution channel segment with a market share due to the convenience they offer in terms of a wide variety of products under one roof, competitive pricing, and attractive promotions.

By Region: The market is segmented by region into the United States and Canada. In 2023, the United States held the largest market share by its large consumer base, high disposable income, and advanced distribution infrastructure.

North America Food and Beverage Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

PepsiCo Inc. |

1965 |

Purchase, New York |

|

The Coca-Cola Company |

1892 |

Atlanta, Georgia |

|

Nestl USA |

1867 |

Arlington, Virginia |

|

Tyson Foods Inc. |

1935 |

Springdale, Arkansas |

|

Kraft Heinz |

2015 |

Chicago, Illinois |

- The Coca-Cola Company: Coca-Cola will launch its BodyArmor sports drink in Canada starting January 2025, marking its first international expansion since the brand's inception in 2011. The company aims to leverage its global bottling system and consumer insights to drive growth in new markets, targeting health-conscious consumers with its low-calorie options.

- PepsiCo Inc.: In 2024, Varun Beverages, a PepsiCo franchise partner, plans to invest $7 million each in Zimbabwe and Zambia to set up snack manufacturing units for the 'Simba Munchiez' brand, aiming to expand PepsiCo's footprint in the African snacks market.

North America Food and Beverage Market Analysis

Market Growth Drivers

- Expansion of E-commerce in Food and Beverage Distribution: The e-commerce sector has played a crucial role in the food and beverage industry, with online grocery sales in North America, the sales in the USA are expected USD 120 billion annually by 2028. This growth is supported by the increasing consumer preference for convenience and the wide variety of products available online. Major retailers and food brands have invested heavily in their online platforms, enhancing the user experience through personalized recommendations, subscription services, and same-day delivery options, thereby driving market expansion.

- Rising Demand for Functional Beverages: The market for functional beverages, including energy drinks, protein shakes, and enhanced waters, has seen robust growth in North America. This surge is attributed to the growing consumer interest in health and wellness, as functional beverages offer specific benefits such as hydration, energy boost, and immune support. Companies like PepsiCo and Coca-Cola have capitalized on this trend by introducing innovative products tailored to meet evolving consumer needs.

- Growth in Ethnic and Exotic Food Consumption: The market has experienced increased demand for ethnic and exotic foods. This trend is driven by the diverse population and the growing interest in global cuisines. The proliferation of international food festivals, cooking shows, and the availability of authentic ingredients in supermarkets have further contributed to the popularity of ethnic foods, making it a growth driver for the market.

Market Challenges

- Supply Chain Disruptions: In 2024, the North America food and beverage sector faced challenges due to ongoing supply chain disruptions, leading to delayed shipments and shortages of key ingredients. The impact of these disruptions was particularly felt in the fresh produce and dairy segments, where the delay in transportation led to spoilage and wastage of food. These challenges have forced companies to re-evaluate their supply chain strategies, investing in more resilient and localized supply networks.

- Rising Costs of Raw Materials: The cost of raw materials, including grains, dairy, and meat, has seen a sharp increase in 2024, with prices of key commodities like wheat and corn rising by 15% to 20% compared to the previous year. These rising costs are driven by factors such as adverse weather conditions, geopolitical tensions, and increased demand for biofuels. This has resulted in higher production costs for food and beverage companies, which are often passed on to consumers, leading to concerns about affordability and price sensitivity.

Government Initiatives

- Healthy Food Financing Initiative (HFFI): The USDA, in partnership with the Reinvestment Fund, has launched the Food Access and Retail Expansion Fund (FARE Fund) with $60 million in funding from the American Rescue Plan. This initiative aims to enhance access to healthy foods in underserved communities over the next five years, supporting food retailers with loans up to $5 million and grants up to $250,000.

- Nutrition North Canada Program Expansion: In 2024, the Canadian government allocated$23.2 millionfor the Nutrition North Canada program, aiming to enhance food security in remote communities. An additional$101.1 millionover three years will support local food initiatives. This investment seeks to improve access to nutritious foods and bolster local retailers.

North America Food and Beverage Market Future Outlook

The future trends of North America food and beverage include the continued growth of plant-based foods, expansion of the functional beverages segment, increased e-commerce sales, and a stronger focus on sustainable and ethical sourcing across the industry.

Future Market Trends

- Rising Demand for Plant-Based Alternatives: The demand for plant-based alternatives in North America continues to surge. This shift is largely driven by health-conscious consumers and a growing trend towards sustainable diets, leading to significant investments from companies like Tyson Foods in expanding their plant-based product lines.

- Focus on Sustainable and Ethical Sourcing: Sustainability and ethical sourcing will continue to be major themes in the food and beverage industry over the next five years. By 2028, it is estimated that over 50% of food and beverage products in North America will come from sustainably sourced ingredients.

Scope of the Report

|

By Product |

Packaged Food Beverages Dairy Products |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Channels |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Packaging Companies

Logistics and Supply Chain Companies

Government Regulatory Bodies (e.g., FSSAI)

Financial Institutions and Investors

Health and Wellness Product Companies

Beverage Companies

Venture Capitalist

Companies

Players Mentioned in the Report:

PepsiCo Inc.

The Coca-Cola Company

Nestl USA

Tyson Foods Inc.

Kraft Heinz

General Mills

Kellogg's

Conagra Brands

Mondelez International

Danone North America

Unilever North America

Mars, Incorporated

Campbell Soup Company

Hormel Foods

McCormick & Company

Table of Contents

1. North America Food and Beverage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Food and Beverage Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Food and Beverage Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Demand for Healthier Alternatives

3.1.2. Innovation in Packaging and Sustainability

3.1.3. Expansion of E-commerce Channels

3.1.4. Increased Consumer Spending on Premium Products

3.2. Restraints

3.2.1. Rising Costs of Raw Materials

3.2.2. Regulatory Compliance and Food Safety Standards

3.2.3. Labor Shortages in the Manufacturing Sector

3.3. Opportunities

3.3.1. Growth in Plant-Based Foods

3.3.2. Technological Advancements in Food Processing

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Growth of Functional Beverages

3.4.2. Increased Focus on Sustainable and Ethical Sourcing

3.4.3. Rise of Direct-to-Consumer Channels

3.5. Government Regulation

3.5.1. Healthy Food Financing Initiative

3.5.2. Nutrition North Canada

3.5.3. Food Waste Reduction Challenge

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America Food and Beverage Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Beverages

4.1.2. Dairy Products

4.1.3. Packaged Foods

4.2. By Distribution Channel (in Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online Channels

4.2.3. Convenience Stores

4.3. By Region (in Value %)

4.3.1. United States

4.3.2. Canada

5. North America Food and Beverage Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo Inc.

5.1.2. The Coca-Cola Company

5.1.3. Nestl USA

5.1.4. Tyson Foods Inc.

5.1.5. Kraft Heinz

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Food and Beverage Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Food and Beverage Market Regulatory Framework

7.1. Food Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Food and Beverage Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Food and Beverage Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Distribution Channel (in Value %)

9.3. By Region (in Value %)

10. North America Food and Beverage Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the North America Food and Beverage industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple food and beverage companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such food and beverage companies.

Frequently Asked Questions

01 How big is the North America Food and Beverage market?

The North America Food and Beverage Market was valued at USD 1069.47 Mn in 2023. The market's expansion is primarily driven by increasing consumer demand for convenience foods, rising health consciousness, and continuous innovation in product offerings, especially in the premium and organic segments.

02 What are the challenges in the North America Food and Beverage market?

Challenges in the North America Food and Beverage market include rising costs of raw materials, regulatory compliance with food safety standards, labor shortages in the manufacturing sector, and supply chain disruptions affecting the availability and pricing of products.

03 Who are the major players in the North America Food and Beverage market?

Key players in the North America Food and Beverage market include PepsiCo Inc., The Coca-Cola Company, Nestl USA, Tyson Foods Inc., and Kraft Heinz. These companies have significant market shares and influence through their extensive product offerings and distribution networks.

04 What are the main growth drivers of the North America Food and Beverage market?

The growth of the North America Food and Beverage market include increasing consumer demand for healthier and sustainable products, innovation in packaging, the expansion of e-commerce, and rising consumer spending on premium food and beverage products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.