North America Food Glazing Agent Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD3206

December 2024

84

About the Report

North America Food Glazing Agent Market Overview

- The North America food glazing agent market is valued at USD 2.5 billion based on a five-year historical analysis. This market is driven by the increasing demand for processed and packaged foods, particularly in the bakery and confectionery sectors. Consumers in North America have a growing preference for visually appealing and longer-lasting food products, which require glazing agents for texture and shine. The use of glazing agents in fruits, vegetables, and dairy products also contributes to the market's expansion.

- Cities in the United States, such as New York, Los Angeles, and Chicago, dominate the North America food glazing agent market. These urban centers are major hubs for food processing and distribution, with large populations and extensive retail networks that drive higher consumption of processed and packaged foods. Additionally, the food and beverage industry in the US is highly developed, contributing to the dominance of these cities in the market.

- The USDAs National Organic Program (NOP) has set strict guidelines for the use of food additives, including glazing agents, in organic products. As of 2023, over 5.4 million acres of farmland in the United States have been certified organic, driving the demand for natural and organic glazing agents in food products. The program mandates the use of natural additives such as beeswax while prohibiting synthetic glazing agents in certified organic products.

North America Food Glazing Agent Market Segmentation

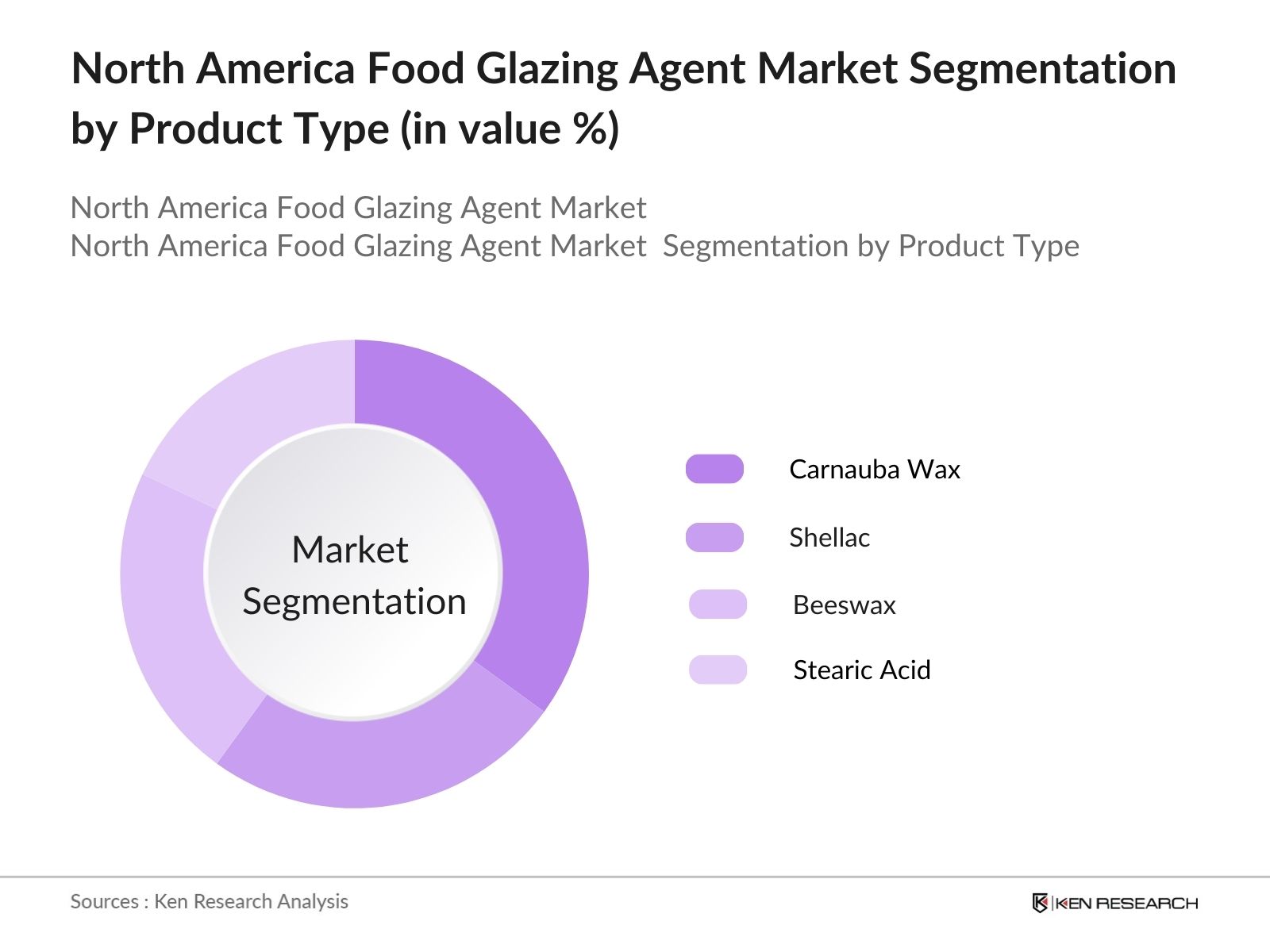

By Product Type: The North America food glazing agent market is segmented by product type into stearic acid, beeswax, carnauba wax, candelilla wax, and shellac. Shellac dominates the product type segmentation due to its widespread application in the confectionery industry, particularly for coating sweets, chocolates, and candies. Shellac is favored for its ability to enhance the gloss and improve the texture of food products, making it a preferred choice among manufacturers. It is also used for fruits and vegetables to extend their shelf life and preserve their aesthetic appeal.

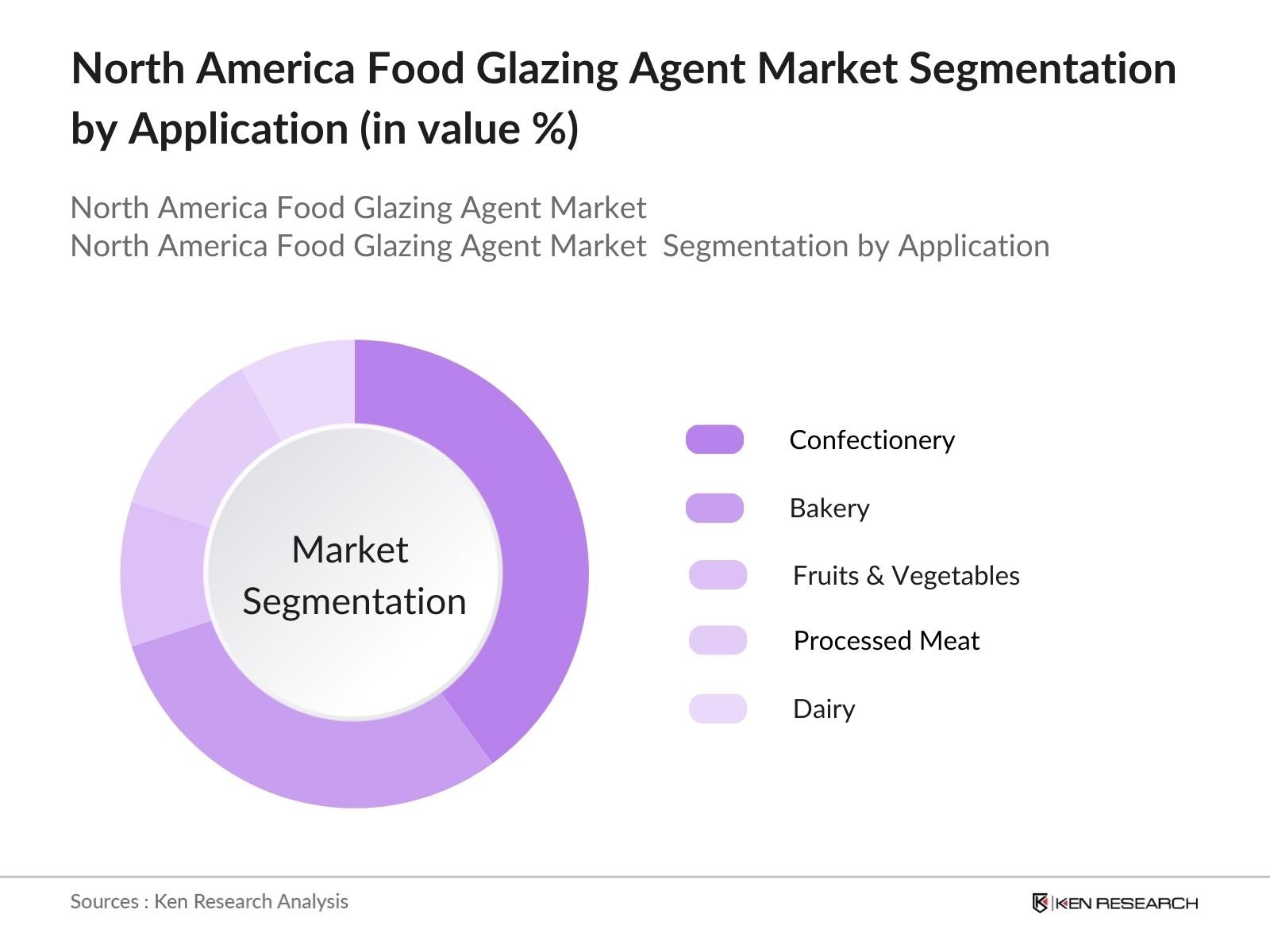

By Application: The North America food glazing agent market is also segmented by application into bakery, confectionery, fruits & vegetables, dairy, and processed meat. Confectionery leads the market share under application due to its high demand for glazing agents, which provide products with a shiny and appealing finish. Glazing agents are essential in the production of candies and chocolates, as they enhance product attractiveness and prevent moisture loss, ensuring a longer shelf life and higher consumer satisfaction.

North America Food Glazing Agent Market Competitive Landscape

The North America food glazing agent market is characterized by the presence of both global and regional players. These companies have established themselves as key contributors to the market through their extensive product portfolios, innovation capabilities, and distribution networks. The market is dominated by key players focusing on expanding their presence in the growing sectors of food processing, confectionery, and bakery.

|

Company |

Establishment Year |

Headquarters |

Product Innovation |

Distribution Network |

Sustainability Practices |

Raw Material Sourcing |

Market Penetration |

R&D Investments |

|

Mantrose-Haeuser Co., Inc. |

1876 |

Fairfield, Connecticut, USA | - | - | - | - | - | - |

|

Capol GmbH |

1975 |

Elmshorn, Germany | - | - | - | - | - | - |

|

Koster Keunen Inc. |

1852 |

Watertown, Connecticut, USA | - | - | - | - | - | - |

|

Strahl & Pitsch Inc. |

1904 |

West Babylon, New York, USA | - | - | - | - | - | - |

|

Paramelt B.V. |

1898 |

Heerhugowaard, Netherlands | - | - | - | - | - | - |

North America Food Glazing Agent Market Analysis

Growth Drivers

- Rise in Processed Food Demand: The demand for processed foods in North America has been consistently increasing due to busy consumer lifestyles and a preference for convenience-based products. According to the US Department of Agriculture, processed foods account for over 60% of total food intake in the US as of 2023. This trend is driving the need for glazing agents to improve product shelf life and appearance, with processed food manufacturing contributing $385 billion to the US economy in 2023.

- Expansion of the Confectionery and Bakery Sectors: The North American confectionery and bakery industries have seen substantial growth. This has increased the demand for glazing agents, which are essential in giving confectionery and bakery products their glossy and appealing finishes. The surge in exports, particularly from the United States, where confectionery product exports reached 1.2 million metric tons in 2023, underscores the growing need for high-quality glazing agents.

- Growing Preference for Natural and Organic Ingredients: Consumers are increasingly favoring products with natural and organic ingredients. Glazing agents derived from natural sources, such as beeswax, are seeing increased usage in response to this demand, with organic farms covering 5.4 million acres in the US as of 2023. This growing preference for organic food products is pushing manufacturers to switch from synthetic to natural glazing agents.

Market Challenges

- Regulatory Restrictions on Food Additives: Regulatory frameworks in North America, particularly the US Food and Drug Administration (FDA) and the USDA, impose strict guidelines on the use of additives in food products. The FDAs Food Additive Status List limits the number of approved foods glazing agents, allowing only a select few, such as shellac and beeswax. These regulations create challenges for manufacturers attempting to innovate or expand their product offerings with new or synthetic glazing agents, particularly within the organic food segment.

- Supply Chain Disruptions: Global supply chain disruptions have impacted the availability of raw materials like beeswax and shellac, which are crucial for the production of glazing agents. Data from the US Bureau of Labor Statistics in 2023 highlighted that material shortages caused a 12% drop in the availability of these key resources, affecting production capacities for North American manufacturers. Furthermore, trade restrictions have exacerbated the situation, increasing delays and cost challenges for businesses relying on imported materials.

North America Food Glazing Agent Market Future Outlook

Over the next five years, the North America food glazing agent market is expected to witness steady growth, driven by an increasing demand for natural and plant-based glazing agents. Consumers' growing preference for clean-label products, coupled with the expansion of the confectionery and bakery industries, will continue to propel market growth. Technological advancements in glazing agent production and increasing awareness regarding food safety and sustainability will also contribute to the market's expansion.

Market Opportunities

- Innovation in Edible Coatings: The food glazing agent market in North America is benefiting from innovations in edible coatings, particularly for fruits, vegetables, and ready-to-eat products. Researchers at the USDA Agricultural Research Service (ARS) have developed new biodegradable coatings that extend the shelf life of perishable items by up to 15 days. These innovations not only improve the visual appeal of products but also enhance their freshness. The adoption of such technology is expected to increase in 2024, as more retailers and food manufacturers seek to reduce food waste and meet consumer demand for fresh and attractive products.

- Rise of Vegan and Plant-based Food Glazing Agents: The growing demand for vegan and plant-based foods in North America has created a significant opportunity for vegan-friendly food glazing agents. In 2023, the Plant Based Foods Association (PBFA) reported that retail sales of plant-based foods in the United States reached $8 billion. As more consumers avoid animal-derived ingredients like beeswax and shellac, the market is witnessing the introduction of glazing agents made from plant-based sources such as carnauba wax and vegetable oils. This trend aligns with the broader consumer shift towards sustainable and ethical food production, driving demand for alternative glazing solutions in the market.

Scope of the Report

|

By Product Type |

Stearic Acid Beeswax Carnauba Wax Candelilla Wax Shellac |

|

By Source |

Animal-based Plant-based Synthetic |

|

By Application |

Confectionery Bakery Fruits & Vegetables Processed Meat Dairy |

|

By Region |

USA Canada Mexico |

Products

Key Target Audience

Food & Beverage Manufacturers

Bakery and Confectionery Industry Players

Fruits & Vegetables Processors

Dairy Product Manufacturers

Processed Meat Producers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Raw Material Suppliers

Companies

Players Mentioned in the Report:

Mantrose-Haeuser Co., Inc.

Capol GmbH

Strahl & Pitsch Inc.

Koster Keunen Inc.

Paramelt B.V.

Starinerie Dubois

Avril Group

Croda International Plc

ADM (Archer Daniels Midland)

DuPont

Table of Contents

1. North America Food Glazing Agent Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Annual growth rate based on applications such as Confectionery, Bakery, Fruits & Vegetables)

1.4 Market Segmentation Overview (Product type, Source, Application, Region)

2. North America Food Glazing Agent Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (New product launches, Ingredient innovations, Regulatory changes)

3. North America Food Glazing Agent Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Processed Food Demand

3.1.2 Growing Preference for Organic and Natural Ingredients

3.1.3 Expansion of Confectionery and Bakery Sectors

3.1.4 Increasing Demand for Food Aesthetic Appeal

3.2 Market Challenges

3.2.1 Regulatory Restrictions on Additives (FDA, USDA regulations)

3.2.2 Supply Chain Disruptions

3.2.3 Cost Fluctuations of Raw Materials (Beeswax, Shellac)

3.3 Opportunities

3.3.1 Innovation in Edible Coatings

3.3.2 Rise of Vegan and Plant-based Food Glazing Agents

3.3.3 Expansion into Emerging Markets (Cross-border expansion trends)

3.4 Trends

3.4.1 Adoption of Natural Glazing Agents

3.4.2 Increased Use of Sustainable and Eco-friendly Packaging

3.4.3 Growing Focus on Food Safety and Shelf Life Enhancement

3.5 Government Regulation

3.5.1 Food Additive Regulations (Regulations on glazing agent content)

3.5.2 Clean Label Initiatives

3.5.3 FDA, CFIA Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Food Glazing Agent Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Stearic Acid

4.1.2 Beeswax

4.1.3 Carnauba Wax

4.1.4 Candelilla Wax

4.1.5 Shellac

4.2 By Source (In Value %)

4.2.1 Animal-based

4.2.2 Plant-based

4.2.3 Synthetic

4.3 By Application (In Value %)

4.3.1 Confectionery

4.3.2 Bakery

4.3.3 Fruits & Vegetables

4.3.4 Processed Meat

4.3.5 Dairy

4.4 By Region (In Value %)

4.4.1 USA

4.4.2 Canada

4.4.3 Mexico

5. North America Food Glazing Agent Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mantrose-Haeuser Co., Inc.

5.1.2 Capol GmbH

5.1.3 Strahl & Pitsch Inc.

5.1.4 Masterol Foods Pty Ltd.

5.1.5 Poth Hille & Co Ltd.

5.1.6 The British Wax Refining Company Ltd.

5.1.7 Starinerie Dubois

5.1.8 Paramelt B.V.

5.1.9 Avril Group

5.1.10 Hainan Zhongxin Wanguo Chemical Co. Ltd.

5.1.11 Koster Keunen Inc.

5.1.12 ADM (Archer Daniels Midland)

5.1.13 DuPont

5.1.14 Kerry Group

5.1.15 Croda International Plc

5.2 Cross Comparison Parameters (Revenue, Manufacturing Capacity, Market Penetration, Innovation Capability, Raw Material Sourcing, Distribution Network, Sustainability Practices, Market Strategy)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Food Glazing Agent Market Regulatory Framework

6.1 Food Safety Standards

6.2 Ingredient Labeling Requirements

6.3 Import/Export Regulations

6.4 Certifications (Organic, Kosher, Halal)

7. North America Food Glazing Agent Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Shift towards clean label, natural additives)

8. North America Food Glazing Agent Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Source (In Value %)

8.3 By Application (In Value %)

8.4 By Region (In Value %)

9. North America Food Glazing Agent Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on building an ecosystem of the North America Food Glazing Agent market. Key players in food processing, manufacturing, and retail were identified, with the help of secondary research from trusted databases and industry reports.

Step 2: Market Analysis and Construction

In this step, historical data from industry reports was analyzed to estimate current market trends, market penetration of food glazing agents, and revenue generation. The goal was to establish the proportion of glazing agent consumption across different food categories.

Step 3: Hypothesis Validation and Expert Consultation

Experts from food production and ingredient manufacturing sectors were consulted through interviews and surveys. These insights were critical in confirming assumptions and verifying market data related to sales and market drivers.

Step 4: Research Synthesis and Final Output

Finally, data from food producers and processed food manufacturers were aggregated to ensure accuracy. This data was cross-verified with market statistics, and the final report provides a detailed, validated overview of the North America Food Glazing Agent market.

Frequently Asked Questions

01. How big is the North America Food Glazing Agent Market?

The North America Food Glazing Agent market is valued at USD 2.5 billion, primarily driven by the processed food industry and the growing consumer demand for visually appealing food products.

02. What are the challenges in the North America Food Glazing Agent Market?

Key challenges in the North America Food Glazing Agent market include fluctuating raw material costs, such as beeswax and carnauba wax, and stringent food additive regulations imposed by the FDA and USDA, which can impact the overall production cost and market entry.

03. Who are the major players in the North America Food Glazing Agent Market?

Major players in the North America Food Glazing Agent market include Mantrose-Haeuser Co., Inc., Capol GmbH, Strahl & Pitsch Inc., Masterol Foods Pty Ltd., and Starinerie Dubois, all of which dominate due to strong distribution networks, product innovation, and a focus on sustainable ingredients.

04. What are the growth drivers of the North America Food Glazing Agent Market?

The North America Food Glazing Agent market is driven by the expansion of the processed food industry, growing consumer preference for clean-label products, and increasing applications of glazing agents in bakery and confectionery items for better aesthetics and shelf life.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.