North America Food Technology Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD8897

November 2024

99

About the Report

North America Food Technology Market Overview

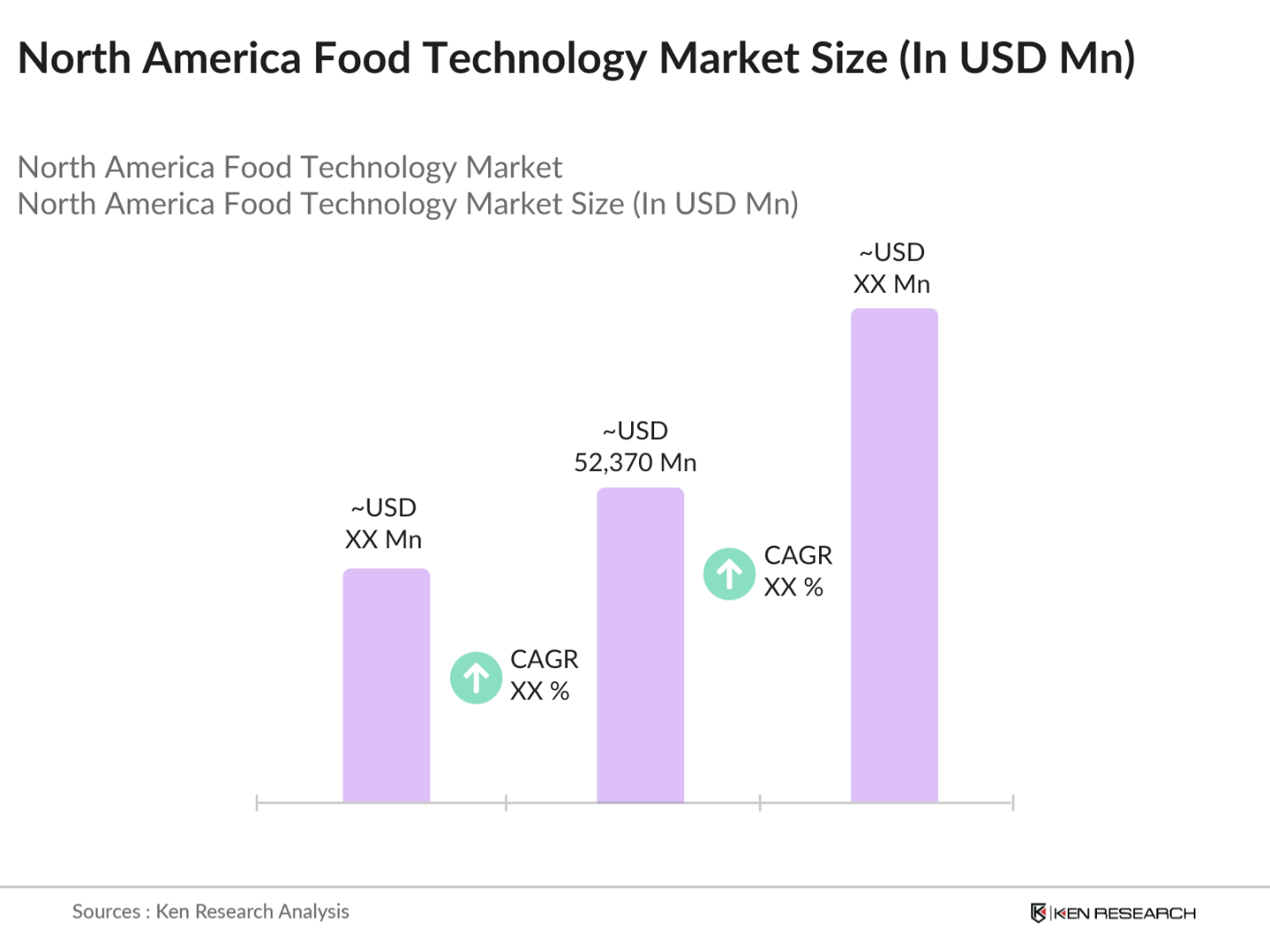

- The North America Food Technology market is valued at USD 52,370 million, based on a five-year historical analysis. This market's growth is driven by rapid advancements in food processing and packaging technologies, alongside increasing consumer demand for healthier, sustainable, and convenient food options. Innovations like AI-driven food safety checks and IoT-enabled supply chain tracking are gaining traction, especially in food safety and transparency initiatives, making food technology integral across applications such as plant-based foods, ready-to-eat meals, and quality assurance.

- The United States and Canada are the dominant regions in this market, primarily due to their large consumer bases and advanced infrastructure in food innovation. High investments in R&D, strong regulatory frameworks promoting food safety, and a significant presence of global food technology firms position these countries as leaders in driving technological advancements and consumer trust in food safety and sustainability initiatives.

- FDA compliance is foundational for food technology companies, mandating stringent safety and quality standards. In 2023, the FDA reported an increase of 1,200 inspections, focusing on compliance with updated health regulations. These inspections ensure adherence to safety standards, preventing contaminated products from reaching the market. The regulatory framework requires detailed tracking and documentation across all production phases, ensuring public safety.

North America Food Technology Market Segmentation

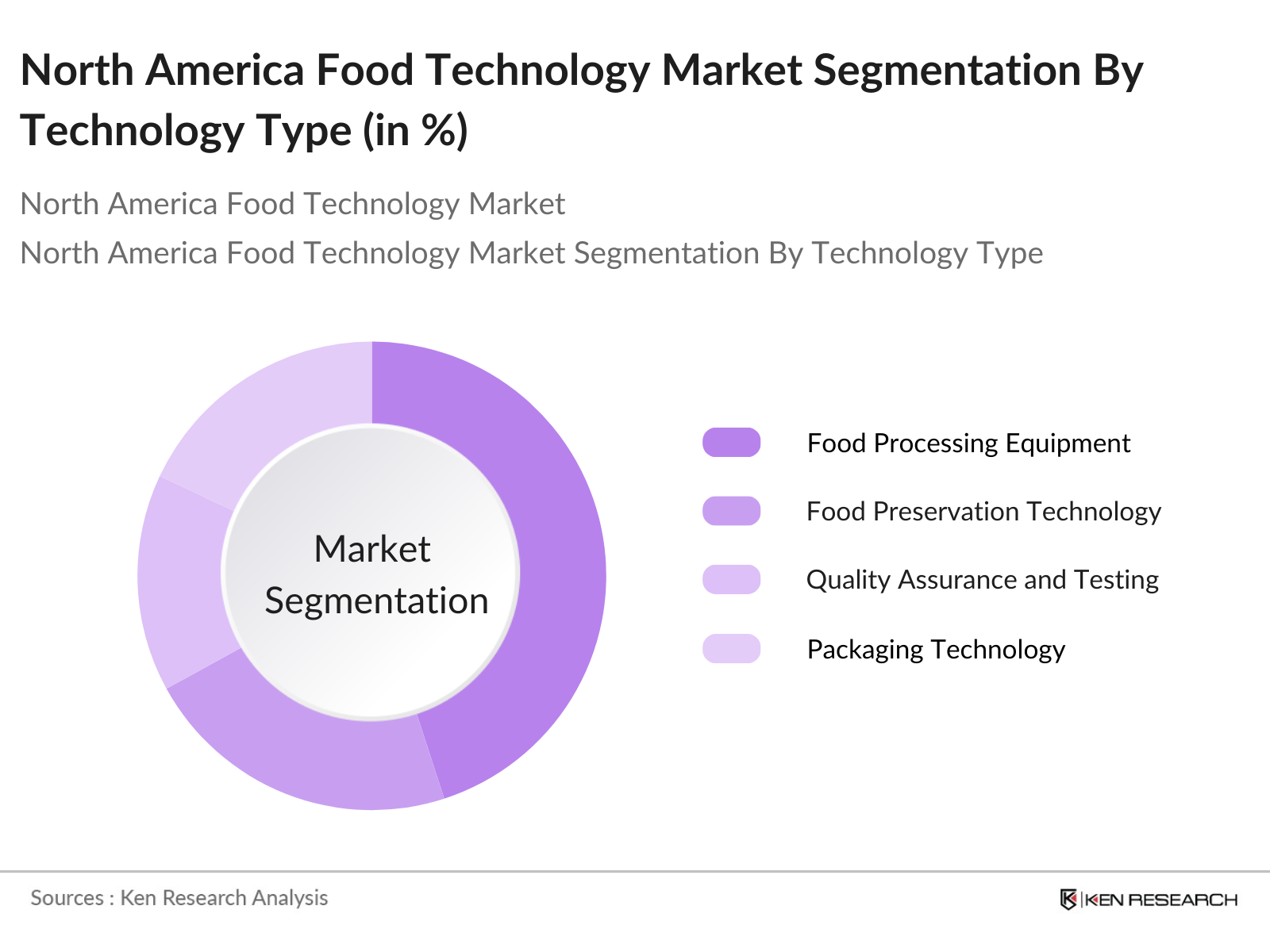

By Technology Type: The North America Food Technology market is segmented by technology type, including food processing equipment, food preservation technology, quality assurance and testing, packaging technology, and traceability solutions. Among these, food processing equipment holds the dominant market share due to its essential role in manufacturing, processing, and packaging a wide variety of food products, with innovations aimed at improving efficiency and reducing waste.

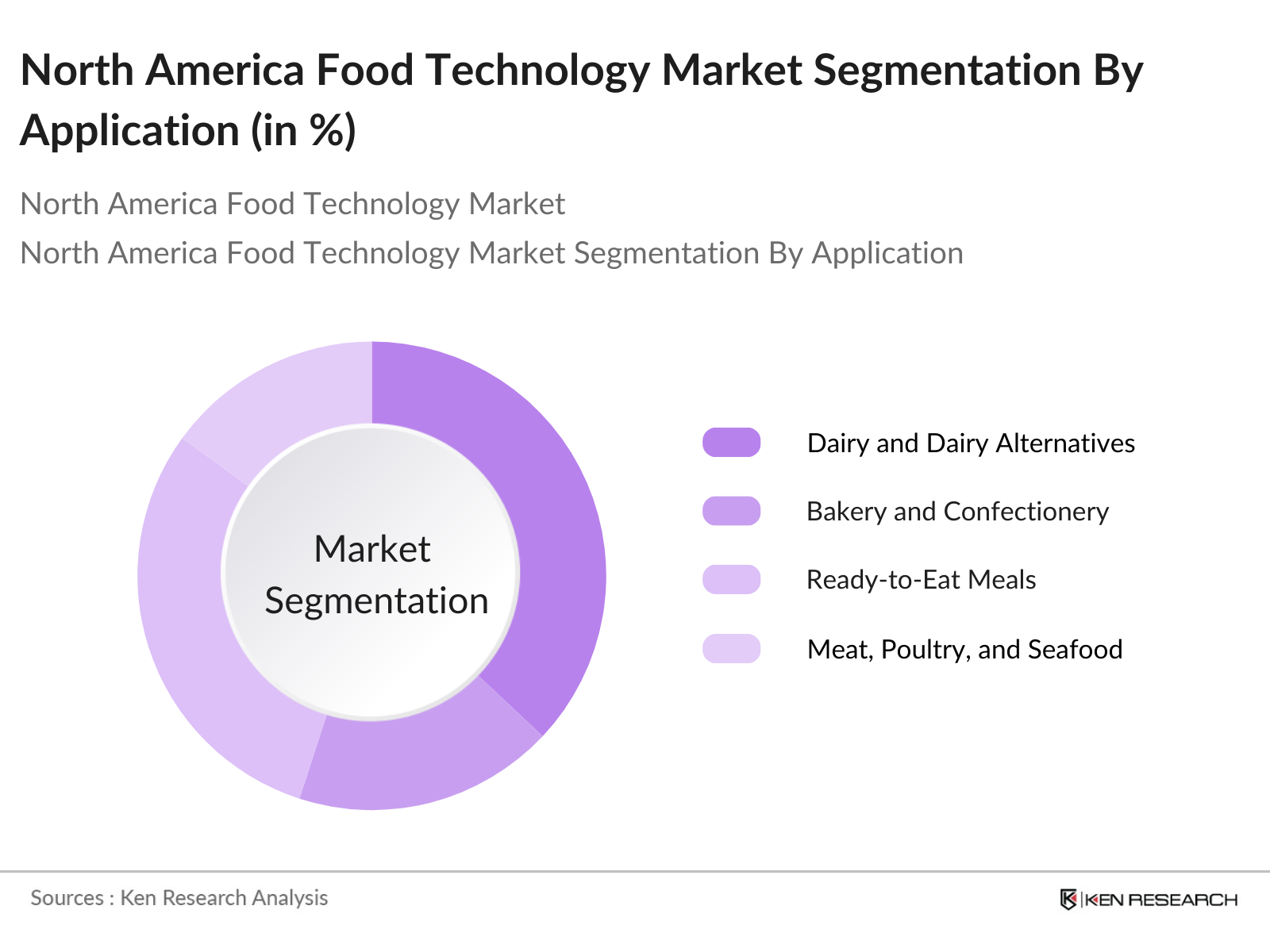

By Application: The market is segmented by application into dairy and dairy alternatives, bakery and confectionery, ready-to-eat meals, meat, poultry, and seafood, and beverages. Among these, the ready-to-eat meals segment holds the largest market share, as busy lifestyles have increased consumer demand for convenient meal options. Additionally, the availability of healthier, organic, and vegan options has expanded the consumer base, further boosting this segment's growth.

North America Food Technology Market Competitive Landscape

The North America Food Technology market is dominated by a few key players, with market consolidation reflecting the substantial influence of these companies in terms of resources, technology, and R&D capabilities.

North America Food Technology Industry Analysis

Growth Drivers

- Technological Advancements in Food Processing: The food processing sector has seen significant technological developments. In 2024, the U.S. Census Bureau reports over 80% of North American food manufacturers utilize automated equipment, up from 65% in 2022. With robotics and AI integration, productivity levels have increased by 15% annually, significantly optimizing food safety and production efficiency across the continent.

- Rising Demand for Sustainable and Plant-Based Alternatives: A 2024 USDA report highlights a 10% increase in North American demand for plant-based food products, driven by environmental concerns. The same report notes North Americas agricultural sector has expanded organic farming practices, increasing land use by 500,000 hectares in 2023 to support sustainable crops.

- Increased Focus on Food Safety and Transparency: With over 75% of consumers prioritizing food safety, North American manufacturers have implemented stricter protocols, with the FDA noting a 20% rise in food safety inspections in 2023. This is partly in response to the FDAs expanded regulations to ensure transparency in food labeling, impacting nearly 12,000 food processing firms in the region.

Market Challenges

- Regulatory Hurdles and Compliance: The U.S. Department of Agriculture has introduced 14 new regulations for the food industry between 2022 and 2024, increasing compliance demands. These adjustments have led to an increase of nearly 25% in operational costs for manufacturers, presenting barriers for smaller firms.

- High Initial Capital Requirements: New food technology entrants face significant capital requirements, with industry data from the U.S. Department of Commerce indicating an average $1.5 million investment needed to launch a medium-scale operation in 2024. This capital intensity is a barrier, limiting accessibility for smaller companies.

North America Food Technology Market Future Outlook

Over the next five years, the North America Food Technology market is expected to experience significant growth due to increasing consumer demand for health-conscious, plant-based, and sustainable food products. Key driving factors include continued technological advancements, a shift toward more efficient food production methods, and growing awareness of food security and sustainability.

Market Opportunities

- Integration of AI and IoT in Food Production: The adoption of AI and IoT technologies within food production offers transformative opportunities. AI integration in food manufacturing lines, for instance, has led to up to a 20% reduction in waste, according to the USDA. Meanwhile, IoT applications in supply chain tracking enhance traceability and operational efficiency, with over 6,000 food production facilities across North America adopting IoT in 2023.

- Expansion of Personalized Nutrition Solutions: Personalized nutrition is an emerging area with robust growth potential. Data from the U.S. Department of Health and Human Services indicate that nearly 10% of the U.S. adult population adopted personalized dietary plans in 2023. Advances in food technology have allowed companies to leverage AI algorithms for individualized diet recommendations, providing a niche but rapidly expanding market opportunity.

Scope of the Report

|

Technology Type |

Food Processing Equipment Food Preservation Technology Quality Assurance and Testing Packaging Technology Traceability and Blockchain Solutions |

|

Application |

Dairy and Dairy Alternatives Bakery and Confectionery Ready-to-Eat Meals Meat, Poultry, and Seafood Beverages and Beverages Alternatives |

|

Product Innovation |

Plant-Based Foods Functional Foods Clean Label Foods Organic and non-GMO Foods |

|

End User |

Food Manufacturers Food Service Providers Retail and E-Commerce Agriculture and Food Suppliers |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Food Manufacturing Companies

Food Processing Technology Providers

R&D Organizations in Food Science

Retail and Distribution Chains

Government and Regulatory Bodies (FDA, USDA)

Investments and Venture Capitalist Firms

Alternative Protein Companies

Packaging and Supply Chain Technology Providers

Companies

Players Mentioned in the Report

Cargill

ADM (Archer Daniels Midland)

Tyson Foods

Beyond Meat

Nestl USA

Maple Leaf Foods

Ingredion Incorporated

PepsiCo (Quaker Foods)

Danone North America

Conagra Brands

Table of Contents

1. North America Food Technology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate and Key Drivers

1.4. Market Segmentation Overview

2. North America Food Technology Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Major Developments and Milestones

3. North America Food Technology Market Dynamics

3.1. Growth Drivers

3.1.1. Technological Advancements in Food Processing

3.1.2. Rising Demand for Sustainable and Plant-Based Alternatives

3.1.3. Increased Focus on Food Safety and Transparency

3.1.4. Growth in E-commerce and Online Food Delivery

3.2. Market Challenges

3.2.1. Regulatory Hurdles and Compliance

3.2.2. High Initial Capital Requirements

3.2.3. Limited Skilled Workforce in Emerging Tech Areas

3.3. Opportunities

3.3.1. Integration of AI and IoT in Food Production

3.3.2. Expansion of Personalized Nutrition Solutions

3.3.3. Innovations in Alternative Proteins

3.4. Key Market Trends

3.4.1. Growth of Plant-Based and Lab-Grown Meat Markets

3.4.2. Adoption of Automation and Robotics

3.4.3. Data-Driven Supply Chain Optimization

3.5. Regulatory Overview

3.5.1. FDA Compliance Requirements

3.5.2. Food Safety Modernization Act (FSMA)

3.5.3. Nutritional Labeling and Transparency Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem Overview

4. North America Food Technology Market Segmentation

4.1. By Technology Type (In Value %)

4.1.1. Food Processing Equipment

4.1.2. Food Preservation Technology

4.1.3. Quality Assurance and Testing

4.1.4. Packaging Technology

4.1.5. Traceability and Blockchain Solutions

4.2. By Application (In Value %)

4.2.1. Dairy and Dairy Alternatives

4.2.2. Bakery and Confectionery

4.2.3. Ready-to-Eat Meals

4.2.4. Meat, Poultry, and Seafood

4.2.5. Beverages and Beverages Alternatives

4.3. By Product Innovation (In Value %)

4.3.1. Plant-Based Foods

4.3.2. Functional Foods

4.3.3. Clean Label Foods

4.3.4. Organic and Non-GMO Foods

4.4. By End User (In Value %)

4.4.1. Food Manufacturers

4.4.2. Food Service Providers

4.4.3. Retail and E-Commerce

4.4.4. Agriculture and Food Suppliers

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Food Technology Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Cargill

5.1.2. ADM (Archer Daniels Midland)

5.1.3. Tyson Foods

5.1.4. Impossible Foods

5.1.5. Beyond Meat

5.1.6. Kelloggs (Morningstar Farms)

5.1.7. Nestl USA

5.1.8. Maple Leaf Foods

5.1.9. Ingredion Incorporated

5.1.10. PepsiCo (Quaker Foods)

5.1.11. Danone North America

5.1.12. Conagra Brands

5.1.13. General Mills

5.1.14. Unilever (Ben & Jerrys)

5.1.15. Oatly Inc.

5.2. Cross Comparison Parameters (Headquarters, Market Position, Revenue, Employee Count, Research Expenditure, Sustainability Initiatives, Product Range, Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Landscape

5.7. Government Subsidies and Grants

5.8. Private Equity and Venture Capital Investments

6. North America Food Technology Market Regulatory Framework

6.1. Food Safety and Inspection Standards

6.2. Labeling and Nutritional Requirements

6.3. Environmental and Sustainability Standards

6.4. Intellectual Property and Patent Regulations

7. North America Food Technology Future Market Size (In USD Bn)

7.1. Forecasted Market Size and Growth Potential

7.2. Key Drivers of Future Market Growth

8. North America Food Technology Future Market Segmentation

8.1. By Technology Type (In Value %)

8.2. By Application (In Value %)

8.3. By Product Innovation (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. North America Food Technology Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Segment Attractiveness Analysis

9.3. Strategic Initiatives for Market Penetration

9.4. Opportunity Analysis and Market Entry Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase constructs an ecosystem map encompassing major stakeholders in the North America Food Technology Market. Extensive desk research and analysis through proprietary databases are conducted to identify critical variables influencing market trends and challenges.

Step 2: Market Analysis and Data Collection

In this phase, historical data on market size, industry growth, and technology adoption is gathered. Specific market segments and sub-segments are assessed, ensuring reliability and accuracy of revenue and growth estimates across the market.

Step 3: Hypothesis Validation and Expert Consultation

Formulated hypotheses are validated through computer-assisted telephone interviews (CATIs) with industry experts, providing direct insights on technological advancements and operational trends within the food technology sector.

Step 4: Data Synthesis and Final Report Compilation

The final phase involves synthesizing the validated data with direct insights from industry players, verifying segment dynamics, and ensuring an accurate, comprehensive analysis of the North America Food Technology Market.

Frequently Asked Questions

1. How big is the North America Food Technology Market?

The North America Food Technology market is valued at USD 52,370 million, based on a five-year historical analysis. This market's growth is driven by rapid advancements in food processing and packaging technologies, alongside increasing consumer demand for healthier, sustainable, and convenient food options.

2. What are the major challenges in the North America Food Technology Market?

Challenges include regulatory compliance, high initial investment requirements, and the limited availability of skilled labor for specialized technologies.

3. Who are the major players in the North America Food Technology Market?

Key players include Cargill, ADM, Tyson Foods, Beyond Meat, and Nestl USA, each dominating through innovations in food processing and sustainable product offerings.

4. What drives growth in the North America Food Technology Market?

Growth is driven by consumer interest in health-conscious diets, plant-based food options, and the adoption of advanced processing technologies aimed at enhancing food safety and sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.