North America Freight and Logistics Market Outlook to 2030

Region:Global

Author(s):Meenakshi

Product Code:KROD6952

November 2024

96

About the Report

North America Freight and Logistics Market Overview

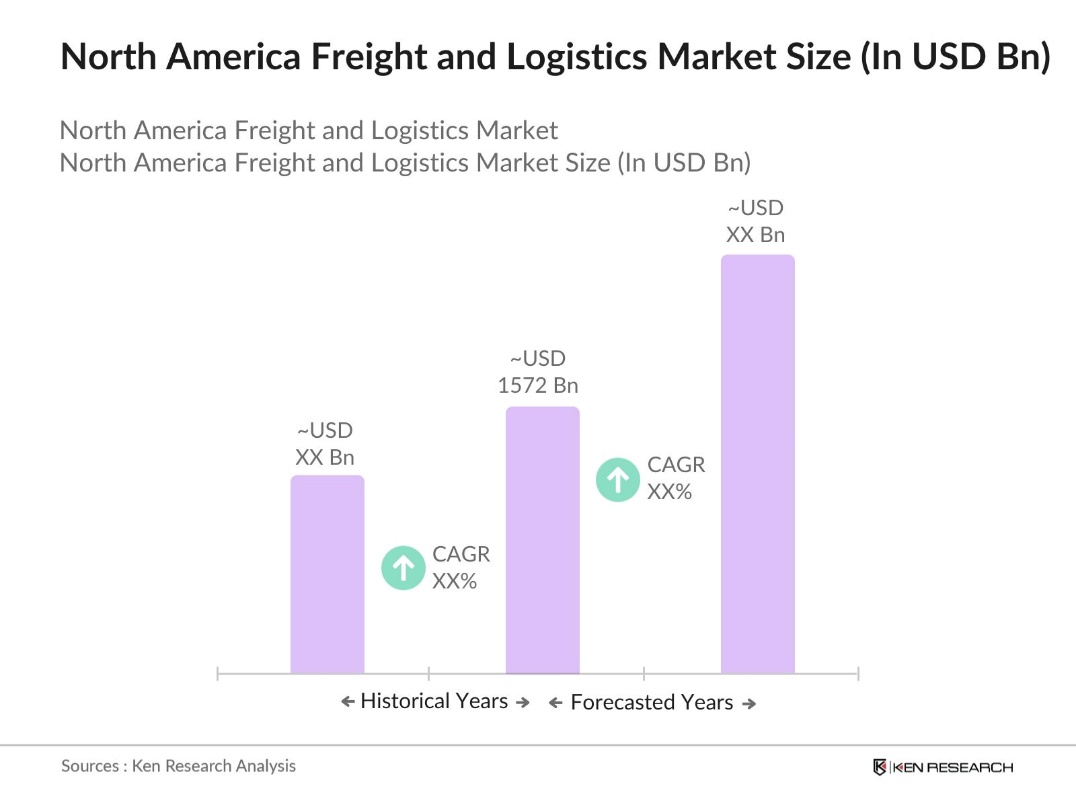

- The North America Freight and Logistics Market is valued at USD 1572 billion, with its growth being driven by several key factors. Among these drivers are the increasing demand for e-commerce, which has led to a surge in last-mile delivery services, and the rapid digitalization of freight management systems. Additionally, the U.S. governments investments in infrastructure improvements, such as the upgrading of highways, ports, and rail systems, have played a vital role in fostering market growth.

- The dominant regions in the North American Freight and Logistics market include major cities and trade hubs such as New York, Los Angeles, and Chicago in the U.S., along with Toronto in Canada and Mexico City in Mexico. These cities dominate due to their strategic location as key nodes in cross-border trade routes, extensive transportation networks (rail, road, air, and sea), and proximity to significant industrial and consumer markets.

- The Federal Motor Carrier Safety Administration (FMCSA) continues to enforce stringent safety regulations for freight carriers. In 2023, the FMCSA recorded over 3 million safety inspections across the U.S., ensuring compliance with rules on driver hours, vehicle maintenance, and electronic logging devices (ELDs). These regulations have improved overall safety metrics, reducing the number of accidents involving freight trucks.

North America Freight and Logistics Market Segmentation

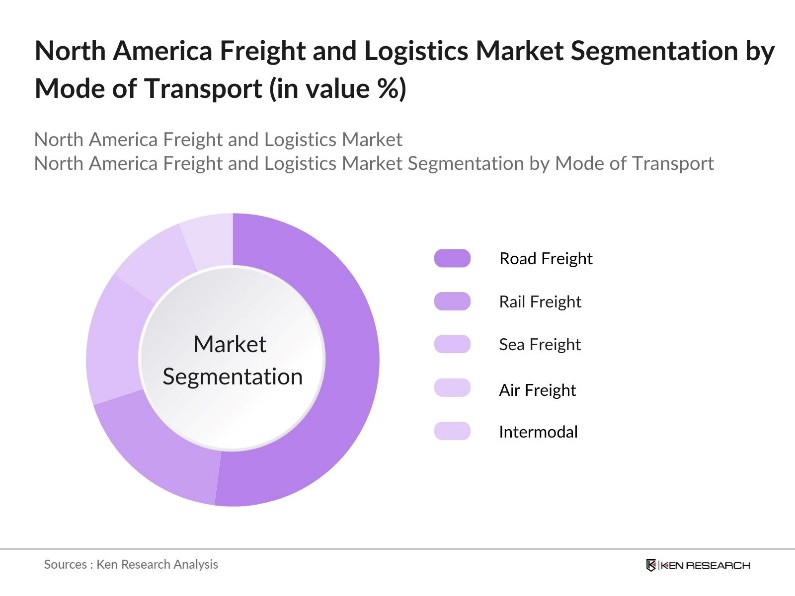

By Mode of Transport: The market is segmented by mode of transport into road freight, rail freight, sea freight, air freight, and intermodal. Road freight dominates the market due to its flexibility and cost-effectiveness for short- and medium-distance transport. This dominance is attributed to the vast interstate highway system in the U.S. and the heavy reliance of e-commerce companies on trucks for last-mile deliveries. With the growth of online retailing and demand for faster delivery, the road freight segment has continued to expand rapidly.

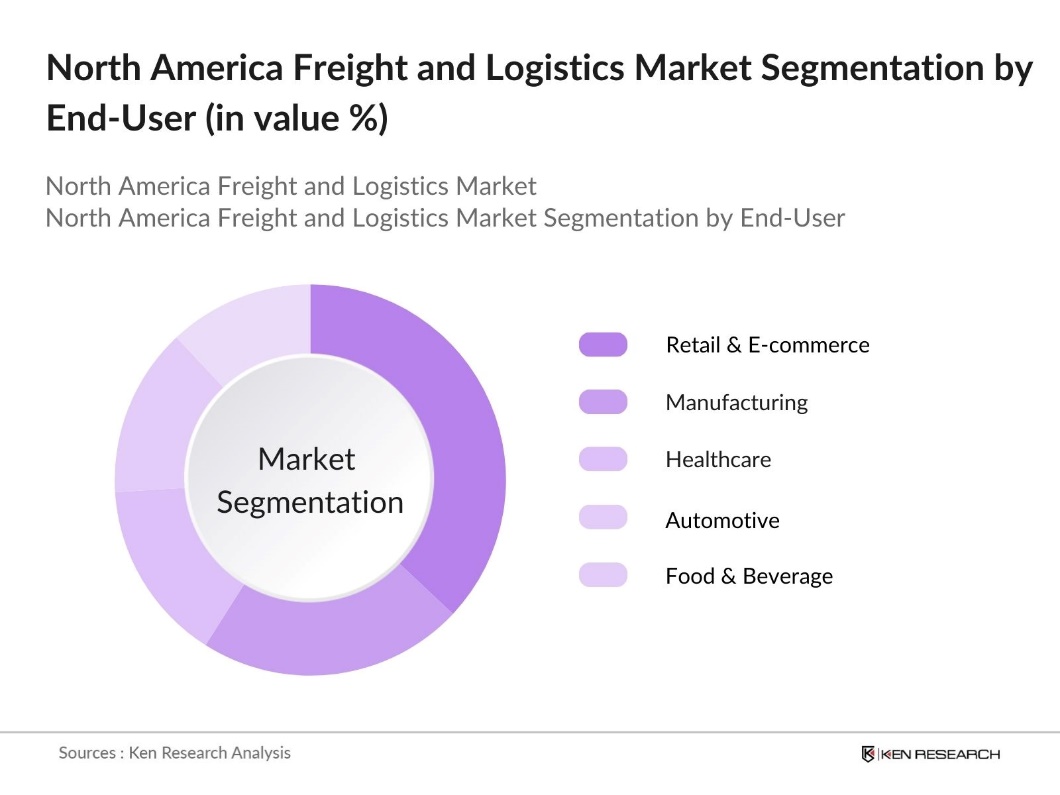

By End-User: The market is segmented by end-user into retail & e-commerce, manufacturing, healthcare, automotive, and food & beverage. The retail & e-commerce segment dominates the market share, driven by the surge in online shopping and the need for efficient supply chain management. Companies like Amazon and Walmart have pushed for quicker delivery times, requiring a robust logistics infrastructure. This has resulted in significant investments in warehouse automation and the expansion of distribution centers.

North America Freight and Logistics Market Competitive Landscape

The North America Freight and Logistics market is highly competitive, with key players focusing on technological advancements and strategic partnerships to maintain their market positions. The market is dominated by a mix of global logistics companies and regional players, offering services across road, rail, air, and sea transportation. These companies also provide integrated supply chain solutions, including warehousing and freight forwarding, to cater to the increasing demand for efficient logistics.

North America Freight and Logistics Industry Analysis

Growth Drivers

- Trade Volume Expansion (NAFTA, USMCA): The market has seen a significant boost in trade volume due to the implementation of the U.S. goods and services trade with the USMCA (United States-Mexico-Canada Agreement) countries totaled approximately $1.8 trillion in 2022, with exports at $789.7 billion and imports at $974.3 billion. The transportation of goods across borders, especially by truck and rail, is a crucial component of the logistics industry.

- E-commerce Boom (Last-Mile Delivery, Omni-Channel Retailing): E-commerce growth has been a key driver for logistics in North America. The rise in online shopping has led to increased demand for last-mile delivery services, a critical sector of the logistics market. The online retail sales, excluding travel, reached approximately $1.09 trillion, marking a 6.5% increase from the previous year. This boosting the need for efficient logistics networks to handle the rapid shipping requirements across omni-channel retail platforms.

- Technological Advancements (IoT, Blockchain, Telematics): Technological advancements like IoT, blockchain, and telematics are transforming North America's freight and logistics industry. Telematics optimizes routes and fuel use, while blockchain streamlines cross-border documentation, reducing paperwork and improving efficiency. These innovations enhance real-time tracking, increase supply chain transparency, and drive operational cost savings, making logistics processes more efficient and resilient across the region.

Market Challenges

- High Operational Costs (Fuel, Labor, Maintenance): The freight industry is grappling with rising operational costs driven by increases in fuel prices, labor shortages, and vehicle maintenance expenses. High fuel costs and a shortage of truck drivers are major contributors, making transportation more expensive. Additionally, maintaining and repairing freight vehicles has become more costly, adding further financial pressure on logistics companies as they strive to keep their fleets operational.

- Supply Chain Disruptions (Driver Shortages, Regulatory Changes, Environmental Regulations): Supply chain disruptions remain a significant challenge for the freight industry, exacerbated by driver shortages and evolving regulatory requirements. Environmental regulations, aimed at reducing emissions, are pushing companies to upgrade their fleets with newer, eco-friendly vehicles, which adds to costs. These disruptions affect freight capacity and delivery times, creating bottlenecks across logistics networks.

North America Freight and Logistics Market Future Outlook

The North America Freight and Logistics market is poised to undergo significant transformation over the coming years. Growing demand for eco-friendly and sustainable logistics solutions is likely to drive the adoption of electric and autonomous vehicles within the road freight segment. Technological advancements, such as AI-driven route optimization and the integration of blockchain in freight management, are expected to further enhance operational efficiency.

Market Opportunities

- Green Freight (Sustainability, Electric and Autonomous Vehicles): Green freight is a growing opportunity in North America, spurred by government initiatives promoting sustainability. The push for electric and autonomous vehicles aims to reduce reliance on fossil fuels and lower carbon emissions. Electric trucks and autonomous technologies offer the potential to decrease fuel costs and improve operational efficiency. These advancements are also aligning with broader goals of creating more environmentally-friendly logistics networks.

- Cross-border Trade Expansion (North America, Latin America Corridors): The expansion of cross-border trade between North America and Latin America presents new growth avenues for the freight market. Improved infrastructure and streamlined logistics have enhanced trade flows, reducing barriers and increasing efficiency. These trade corridors are especially vital for industries like automotive, agriculture, and manufacturing, where efficient transportation is critical for moving goods across borders seamlessly.

Scope of the Report

|

By Mode of Transport |

Road Freight Rail Freight Sea Freight Air Freight Intermodal |

|

By End-User |

Retail & E-commerce Manufacturing Healthcare Automotive Food & Beverage |

|

By Service Type |

Transportation Services Warehousing & Distribution Services Value-Added Services Freight Forwarding Courier & Parcel Services |

|

By Region |

U.S. Canada Mexico Central America |

|

By Cargo Type |

Bulk Cargo General Cargo Perishable Goods Dangerous Goods Express Cargo |

Products

Key Target Audience

E-commerce and Retail Companies

Automotive Manufacturers

Food and Beverage Companies

Government and Regulatory Bodies (Department of Transportation, Federal Motor Carrier Safety Administration)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

UPS

FedEx Corporation

XPO Logistics

J.B. Hunt Transport Services

C.H. Robinson

Schneider National Inc.

Union Pacific Corporation

DHL Supply Chain

Canadian National Railway

Maersk Line

Table of Contents

1. North America Freight and Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Road, Rail, Sea, Air, Warehousing, Courier & Parcel Services)

1.3. Market Growth Rate (Transportation Costs, Freight Volume Growth, Urbanization Impact)

1.4. Market Segmentation Overview (By Mode of Transport, By End-User, By Service Type, By Region)

2. North America Freight and Logistics Market Size (In USD Mn)

2.1. Historical Market Size (Freight Tonnage, Freight Revenue)

2.2. Year-On-Year Growth Analysis (Impact of Fuel Prices, Shipping Demand, E-commerce Growth)

2.3. Key Market Developments and Milestones (Digitalization of Freight, Expansion of Trade Routes, Government Infrastructure Initiatives)

3. North America Freight and Logistics Market Analysis

3.1. Growth Drivers

3.1.1. Trade Volume Expansion (NAFTA, USMCA)

3.1.2. E-commerce Boom (Last-Mile Delivery, Omni-Channel Retailing)

3.1.3. Technological Advancements (IoT, Blockchain, Telematics)

3.1.4. Infrastructure Modernization (Rail Upgrades, Port Expansions, Highway Improvements)

3.2. Market Challenges

3.2.1. High Operational Costs (Fuel, Labor, Maintenance)

3.2.2. Supply Chain Disruptions (Driver Shortages, Regulatory Changes, Environmental Regulations)

3.2.3. Increasing Regulatory Burden (FMCSA, Emission Regulations, Tariff Fluctuations)

3.3. Opportunities

3.3.1. Green Freight (Sustainability, Electric and Autonomous Vehicles)

3.3.2. Cross-border Trade Expansion (North America, Latin America Corridors)

3.3.3. Digital Freight Brokerage (Real-Time Tracking, Automation of Freight Contracts)

3.4. Trends

3.4.1. Adoption of Big Data and Analytics in Freight Management

3.4.2. Growth in Demand for Multi-modal Transportation Solutions

3.4.3. Development of Smart Ports and Warehousing (AI, Robotics Integration)

3.5. Government Regulations

3.5.1. North American Free Trade Agreements Impact (USMCA, CUSMA)

3.5.2. Freight Carrier Safety Regulations (FMCSA, DOT)

3.5.3. Emission Standards for Commercial Vehicles (EPA Regulations, Clean Truck Programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Freight Carriers, Logistics Providers, Freight Brokers, Government Agencies)

3.8. Porters Five Forces (Bargaining Power of Suppliers, Threat of New Entrants, Industry Rivalry, etc.)

3.9. Competition Ecosystem (Fragmented vs. Consolidated Markets, Emerging Logistics Startups)

4. North America Freight and Logistics Market Segmentation

4.1. By Mode of Transport (In Value %)

4.1.1. Road Freight

4.1.2. Rail Freight

4.1.3. Sea Freight

4.1.4. Air Freight

4.1.5. Intermodal

4.2. By End-User (In Value %)

4.2.1. Retail & E-commerce

4.2.2. Manufacturing

4.2.3. Healthcare

4.2.4. Automotive

4.2.5. Food & Beverage

4.3. By Service Type (In Value %)

4.3.1. Transportation Services

4.3.2. Warehousing & Distribution Services

4.3.3. Value-Added Services (Packaging, Labeling, etc.)

4.3.4. Freight Forwarding

4.3.5. Courier & Parcel Services

4.4. By Region (In Value %)

4.4.1. U.S.

4.4.2. Canada

4.4.3. Mexico

4.4.4. Central America

4.5. By Cargo Type (In Value %)

4.5.1. Bulk Cargo

4.5.2. General Cargo

4.5.3. Perishable Goods

4.5.4. Dangerous Goods

4.5.5. Express Cargo

5. North America Freight and Logistics Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. XPO Logistics

5.1.2. J.B. Hunt Transport Services

5.1.3. FedEx Corporation

5.1.4. United Parcel Service (UPS)

5.1.5. C.H. Robinson Worldwide

5.1.6. Schneider National Inc.

5.1.7. DHL Supply Chain

5.1.8. Kuehne + Nagel

5.1.9. Knight-Swift Transportation

5.1.10. Canadian National Railway

5.1.11. Union Pacific Corporation

5.1.12. Old Dominion Freight Line

5.1.13. Maersk Line

5.1.14. Landstar System Inc.

5.1.15. Werner Enterprises

5.2. Cross Comparison Parameters (Fleet Size, Warehouse Space, Geographic Presence, Revenue, Employee Count, Freight Capacity, Freight Rates, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

5.8. Venture Capital Funding

5.9. Government Grants and Subsidies

6. North America Freight and Logistics Market Regulatory Framework

6.1. Freight Industry Standards (Safety, Environmental)

6.2. Compliance Requirements (DOT, FMCSA, ELD Mandates)

6.3. Certification Processes (Carrier Safety Rating, Freight Handling Certifications)

7. North America Freight and Logistics Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Freight and Logistics Future Market Segmentation

8.1. By Mode of Transport (In Value %)

8.2. By End-User (In Value %)

8.3. By Service Type (In Value %)

8.4. By Region (In Value %)

8.5. By Cargo Type (In Value %)

9. North America Freight and Logistics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this stage, an ecosystem map is created, detailing the major stakeholders within the North America Freight and Logistics Market. Desk research involving secondary and proprietary databases is used to gather comprehensive market information, focusing on transportation modes, logistics services, and geographic distribution.

Step 2: Market Analysis and Construction

The market analysis phase involves collecting historical data on freight volumes, revenue, and service penetration. Key ratios, such as cargo volume per mode of transport and market concentration levels, are analyzed to create accurate revenue projections. Additionally, factors like service quality and delivery speed are examined to assess overall market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through consultations with industry experts via interviews and surveys. Experts from logistics firms, freight brokers, and regulatory bodies provide insight into market trends, operational challenges, and growth opportunities, thereby validating the data gathered.

Step 4: Research Synthesis and Final Output

In the final stage, data synthesis is performed by combining insights from both bottom-up and top-down approaches. This includes direct engagement with freight service providers to verify the collected data, ensuring the report provides a thorough and accurate representation of the North American Freight and Logistics market.

Frequently Asked Questions

01. How big is the North America Freight and Logistics Market?

The North America Freight and Logistics market is valued at USD 1572 billion, driven by the rise of e-commerce, infrastructure improvements, and digitalization efforts across logistics networks.

02. What are the challenges in the North America Freight and Logistics Market?

Challenges in North America Freight and Logistics market include rising operational costs, particularly fuel and labor expenses, as well as supply chain disruptions caused by driver shortages and regulatory changes. Environmental regulations also add pressure to logistics providers.

03. Who are the major players in the North America Freight and Logistics Market?

Major players in North America Freight and Logistics market include UPS, FedEx, XPO Logistics, J.B. Hunt, and C.H. Robinson. These companies dominate due to their vast transportation networks, technological innovations, and integrated logistics solutions.

04. What are the growth drivers of the North America Freight and Logistics Market?

Key growth drivers in North America Freight and Logistics market include the expansion of e-commerce, increased demand for last-mile delivery services, and significant investments in infrastructure modernization across ports, highways, and rail systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.