North America Gaming Chairs Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6542

December 2024

98

About the Report

North America Gaming Chairs Market Overview

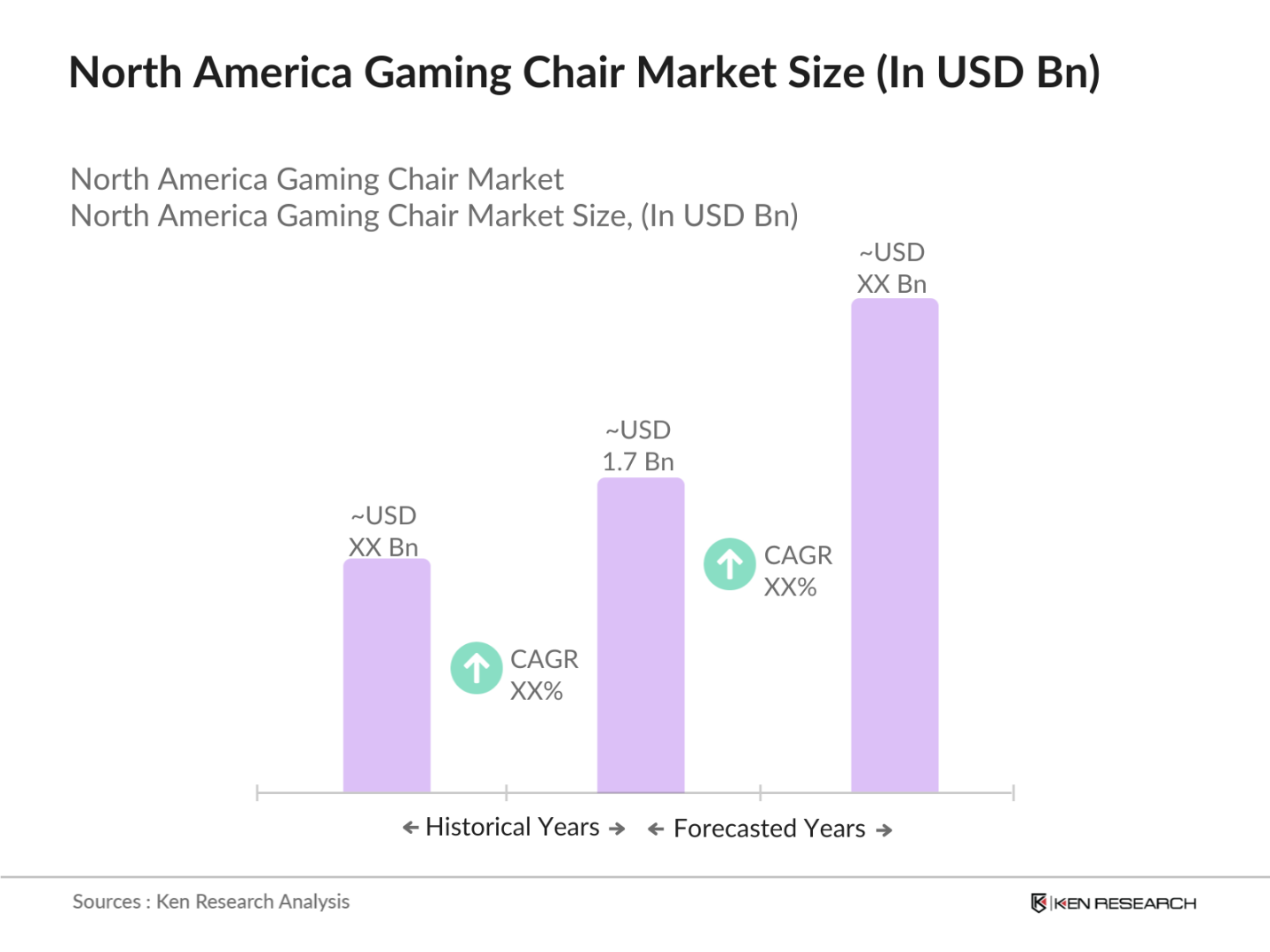

- The North America gaming chairs market is valued at USD 1.7 billion based on a five-year historical analysis. This growth is driven by the increasing popularity of video gaming, especially among millennials and Gen Z. The rising demand for ergonomically designed chairs to enhance gaming experience and prevent health issues like back pain has led to significant growth. The shift towards professional gaming and eSports has also contributed to the rising demand for specialized gaming chairs, which has fueled the market's expansion.

- In North America, the United States dominates the gaming chair market. This is largely due to its strong gaming culture, high disposable incomes, and the presence of major gaming events such as tournaments and conventions. Cities like Los Angeles and New York are home to significant gamer communities and serve as hubs for eSports and professional gaming teams. Canada follows closely, with an expanding gaming market driven by its tech-savvy population and growing interest in eSports.

- As sustainability becomes a priority for consumers, gaming chair manufacturers are focusing on eco-friendly materials. In 2023, over 70% of U.S. consumers reported a preference for products made from sustainable or recycled materials, according to the U.S. Environmental Protection Agency (EPA). This shift towards environmentally conscious buying behavior has encouraged gaming chair brands to incorporate eco-friendly and recycled components into their products, aligning with market trends and appealing to environmentally aware consumers.

North America Gaming Chairs Market Segmentation

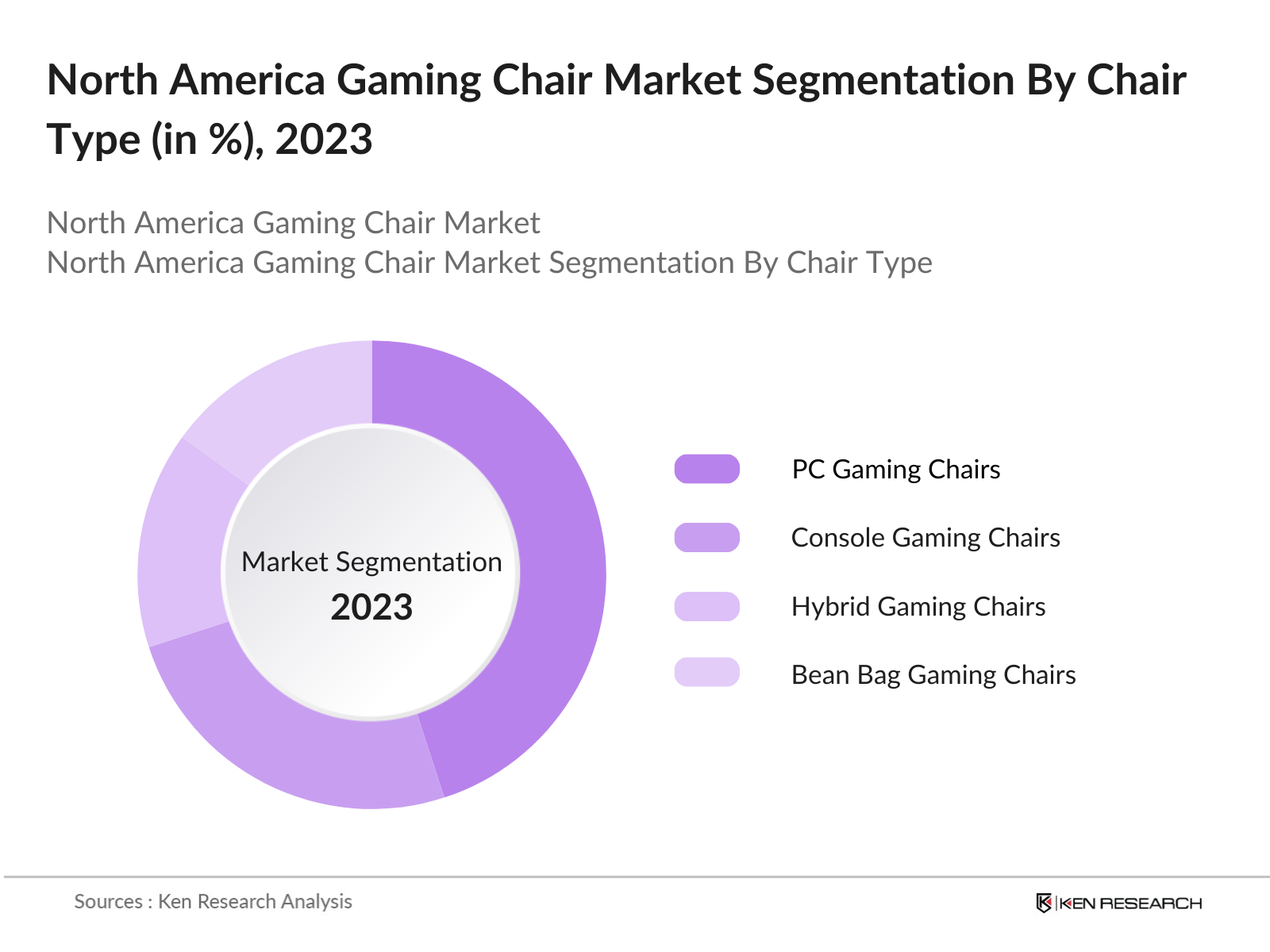

By Chair Type: The North America gaming chairs market is segmented by chair type into PC gaming chairs, console gaming chairs, hybrid gaming chairs, bean bag gaming chairs, and racing simulation chairs. Recently, PC gaming chairs have dominated the market due to the widespread use of personal computers for both casual and professional gaming. Their advanced ergonomics and customization options, such as adjustable armrests and lumbar support, are key factors contributing to their popularity. Additionally, the rise of live-streaming platforms like Twitch has fueled demand for high-quality PC gaming chairs.

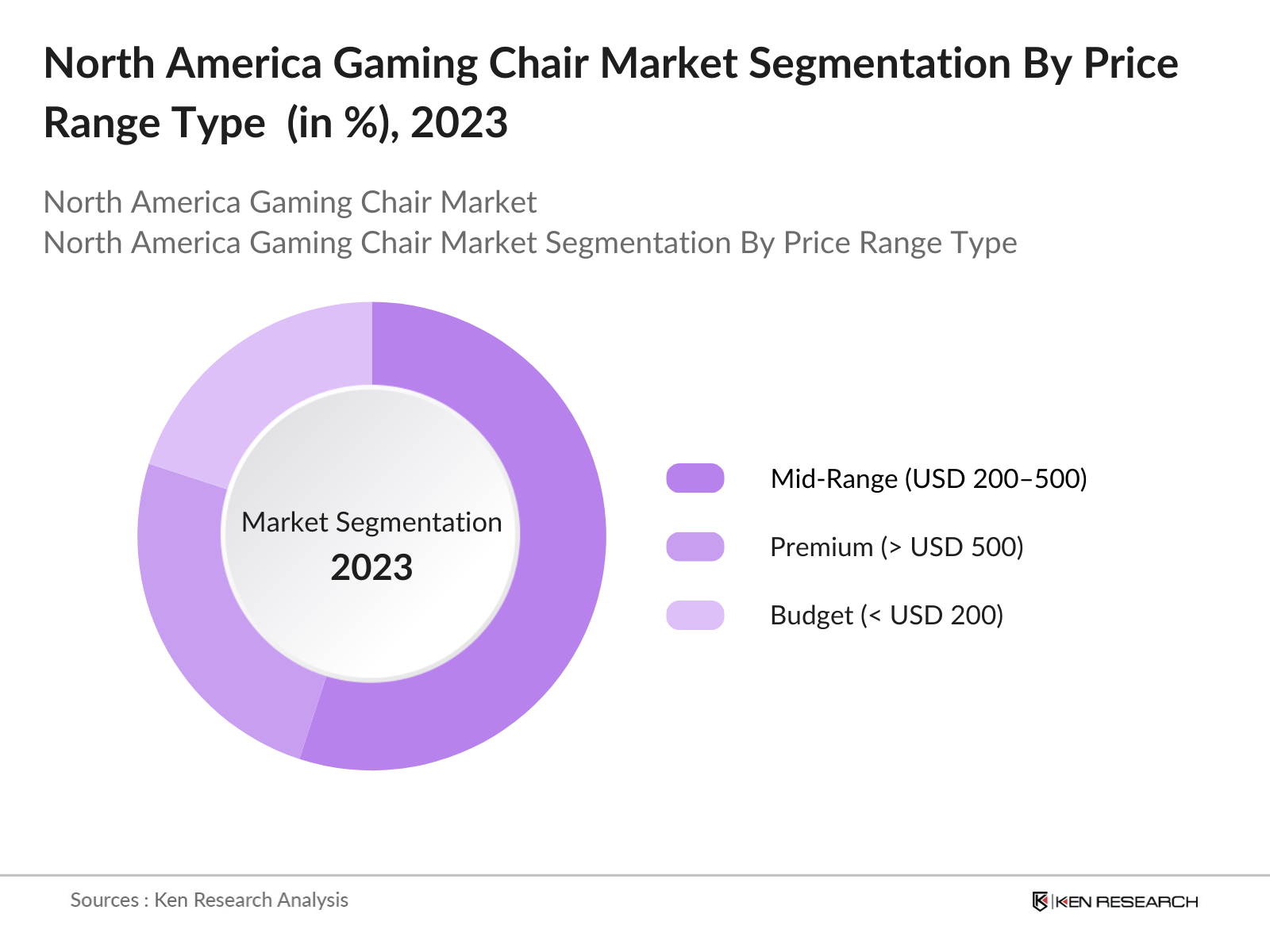

By Price Range: The gaming chairs market in North America is also segmented by price range, including budget (under USD 200), mid-range (USD 200500), and premium (above USD 500). The mid-range segment has a dominant market share because it offers the right balance of affordability and quality. Brands in this category provide consumers with well-designed chairs that cater to both casual and serious gamers, offering durability, comfort, and style. Mid-range chairs have been especially appealing to streamers and eSports players who want professional-quality features without paying premium prices.

North America Gaming Chairs Market Competitive Landscape

The North America gaming chairs market is dominated by both established global brands and rising regional players. Companies like Secretlab and DXRacer lead the market with their focus on premium-quality products and continuous innovation. These brands maintain a strong foothold due to their partnerships with eSports teams, sponsorships, and high visibility in online gaming communities. On the other hand, companies like Corsair and Razer are diversifying their product lines, contributing to an increase in market competition. The emergence of hybrid gaming chairs targeting both casual gamers and office professionals has also intensified competition.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Customization Options |

Technological Integration |

Sustainability Initiatives |

Partnerships |

Customer Service |

|

Secretlab |

2014 |

Singapore |

_ |

_ |

_ |

_ |

_ |

_ |

|

DXRacer |

2001 |

Michigan, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Corsair (T1 Race) |

1994 |

California, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Razer (Iskur) |

2005 |

California, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Noblechairs |

2015 |

Berlin, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

North America Gaming Chairs Industry Analysis

Growth Drivers

- Surge in eSports and Online Gaming: The rise of eSports has significantly driven the demand for gaming chairs in North America. As of 2023, the global eSports audience reached 540 million, with North America being one of the major contributors. With millions of gamers participating in or following eSports, there has been a significant increase in the demand for high-performance gaming equipment, including gaming chairs. Additionally, the gaming industry in North America generated revenue of over $65 billion in 2023, further emphasizing the purchasing power and market size for accessories like gaming chairs.

- Rising Home Office Setups: With the hybrid work model continuing in 2024, there is a growing trend of individuals investing in ergonomic furniture to enhance comfort during long hours at home. According to the U.S. Bureau of Labor Statistics, over 58 million Americans worked remotely at least part-time in 2023, contributing to a surge in demand for ergonomic gaming chairs, which offer both gaming and work-friendly features. Ergonomically designed chairs cater to the need for multi-purpose solutions, making them popular among home office setups across North America.

- Increasing Disposable Income: North America's rising disposable income has increased consumer spending on leisure and entertainment-related products, including gaming accessories. In 2023, the average disposable income per capita in the U.S. reached $57,000, according to the World Bank. This increase in disposable income has allowed consumers to spend more on enhancing their gaming experience, leading to higher demand for premium gaming chairs. Gaming accessories, including chairs, are becoming more popular as consumers prioritize

Market Challenges

- High Product Prices: Gaming chairs are often viewed as premium products, and their relatively high cost poses a challenge for the North American market. The U.S. Consumer Expenditure Survey indicated that while consumers spent an average of $2,500 annually on entertainment and leisure products in 2023, many are hesitant to invest in high-end accessories like gaming chairs. Price-sensitive customers are likely to opt for budget alternatives, making it difficult for high-end brands to capture a larger share of the market.

- Supply Chain Disruptions: The gaming chair market in North America has faced supply chain challenges, with raw material shortages and shipping delays significantly impacting production timelines. The U.S. Census Bureau reported that in 2022, disruptions in supply chains due to pandemic-related restrictions and global transportation bottlenecks caused delays in manufacturing processes, affecting the availability of gaming chairs in retail markets. These supply chain issues continue to hinder the markets ability to meet demand efficiently.

North America Gaming Chairs Market Future Outlook

The North America gaming chairs market is expected to witness steady growth in the coming years, driven by the rise of the gaming industry, increasing consumer awareness about ergonomics, and technological innovations in chair design. As eSports continue to grow and gaming becomes more mainstream, the demand for high-quality, durable, and comfortable gaming chairs is expected to surge. Moreover, the integration of smart technology and sustainable materials in product design is likely to create new opportunities for market players, catering to eco-conscious consumers and technology enthusiasts alike.

Opportunities

- Integration of Smart Technology: The integration of smart technology presents a promising opportunity for gaming chair manufacturers. As of 2023, 33% of households in North America were equipped with at least one IoT device, creating demand for gaming chairs with smart features like Bluetooth connectivity, vibration, and speakers. These tech-integrated chairs offer a unique gaming experience by syncing with consoles and mobile devices, appealing to tech-savvy consumers looking for enhanced interactivity and comfort in their gaming setups.

- Expansion into Non-Gaming Segments: The gaming chair market is expanding beyond its core audience of gamers, with increasing adoption in home office and entertainment setups. The number of remote workers and home-based entrepreneurs in North America reached over 58 million in 2023. This expansion into non-gaming segments allows manufacturers to market their products to a broader audience, including professionals seeking ergonomic solutions for work and relaxation, further driving demand.

Scope of the Report

|

Chair Type |

PC Gaming Chairs Console Gaming Chairs Hybrid Gaming Chairs Bean Bag Gaming Chairs Racing Simulation Chairs |

|

Price Range |

Budget (< USD 200) Mid-Range (USD 200 - 500) Premium (USD 500+) |

|

Material |

PU Leather Fabric PVC Leather Mesh |

|

Distribution Channel |

Online Stores Specialty Retailers Hypermarkets/Supermarkets Gaming Equipment Stores |

|

Region |

U.S. Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Gaming Equipment Companies

Distributors and Retailers

eSports Teams and Companies

Streaming Platforms Companies

Government and Regulatory Bodies (Consumer Product Safety Commission)

Investments and Venture Capitalist Firms

Furniture Retail Companies

Companies

Players Mentioned in the Report

Secretlab

DXRacer

AKRacing

RESPAWN

Noblechairs

Vertagear

AndaSeat

Corsair (T1 Race Gaming Chair)

Herman Miller x Logitech G

Cougar Armor

Table of Contents

1. North America Gaming Chairs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Gaming Chairs Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Gaming Chairs Market Analysis

3.1. Growth Drivers

3.1.1. Surge in eSports and Online Gaming (Impact of eSports Growth)

3.1.2. Rising Home Office Setups (Demand for Ergonomic Solutions)

3.1.3. Increasing Disposable Income (Consumer Spending in Gaming Accessories)

3.1.4. Growing Gamer Community (Demand for Personalized Gaming Setups)

3.2. Market Challenges

3.2.1. High Product Prices (Price Sensitivity of Consumers)

3.2.2. Supply Chain Disruptions (Raw Material Shortages and Shipping Delays)

3.2.3. Competitive Pricing (Low-Cost Alternatives Impacting Profit Margins)

3.3. Opportunities

3.3.1. Integration of Smart Technology (IoT-Enabled Chairs with Bluetooth Connectivity)

3.3.2. Expansion into Non-Gaming Segments (Home Office and Entertainment)

3.3.3. Customization Options (Modular Design, Material, and Branding Customizations)

3.4. Trends

3.4.1. Increased Focus on Health and Wellness (Ergonomics and Back Support)

3.4.2. Adoption of Sustainable Materials (Eco-friendly and Recycled Components)

3.4.3. Growing Popularity of RGB Lighting (Aesthetic and Gaming Experience Enhancements)

3.5. Government Regulations

3.5.1. Import Tariffs and Duties (Impact on Pricing and Profit Margins)

3.5.2. Health and Safety Regulations (Ergonomic Standards Compliance)

3.5.3. Environmental Compliance (Material and Manufacturing Standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers

3.7.2. Distributors

3.7.3. Online and Offline Retailers

3.7.4. Gamers and End-users

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. North America Gaming Chairs Market Segmentation

4.1. By Chair Type (In Value %)

4.1.1. PC Gaming Chairs

4.1.2. Console Gaming Chairs

4.1.3. Hybrid Gaming Chairs

4.1.4. Bean Bag Gaming Chairs

4.1.5. Racing Simulation Chairs

4.2. By Price Range (In Value %)

4.2.1. Budget (< USD 200)

4.2.2. Mid-Range (USD 200 - 500)

4.2.3. Premium (USD 500+)

4.3. By Material (In Value %)

4.3.1. PU Leather

4.3.2. Fabric

4.3.3. PVC Leather

4.3.4. Mesh

4.4. By Distribution Channel (In Value %)

4.4.1. Online Stores

4.4.2. Specialty Retailers

4.4.3. Hypermarkets/Supermarkets

4.4.4. Gaming Equipment Stores

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Gaming Chairs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Secretlab

5.1.2. DXRacer

5.1.3. AKRacing

5.1.4. RESPAWN

5.1.5. Noblechairs

5.1.6. Vertagear

5.1.7. AndaSeat

5.1.8. Corsair (T1 Race Gaming Chair)

5.1.9. Herman Miller x Logitech G

5.1.10. Cougar Armor

5.1.11. Arozzi

5.1.12. Razer (Iskur)

5.1.13. Thermaltake (ToughChair)

5.1.14. GT Omega

5.1.15. X Rocker

5.2. Cross Comparison Parameters (Revenue, Product Range, Customization, Ergonomics, Sustainability Initiatives, Technology Integration, Customer Support, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Gaming Chairs Market Regulatory Framework

6.1. Industry Safety Standards (ANSI/BIFMA, CPSC)

6.2. Ergonomics Certifications (ISO, EN Standards)

6.3. Material Sourcing Compliance (Eco-Friendly Materials)

7. North America Gaming Chairs Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Gaming Chairs Future Market Segmentation

8.1. By Chair Type (In Value %)

8.2. By Price Range (In Value %)

8.3. By Material (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. North America Gaming Chairs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping out the ecosystem of the North America gaming chairs market. This was done by leveraging secondary research from industry databases and proprietary sources to identify the critical variables that affect the market, such as consumer behavior, technological innovations, and pricing trends.

Step 2: Market Analysis and Construction

Historical data on market penetration, product segmentation, and pricing structures were analyzed to construct a comprehensive overview of the North America gaming chairs market. This analysis also included revenue generation and supply chain evaluations to ensure accurate financial insights.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts from key companies were conducted to validate initial market hypotheses. Insights gained through these discussions helped refine data accuracy and provided first-hand knowledge of current market trends and customer preferences.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from multiple sources, including primary interviews, secondary research, and proprietary databases. The research team engaged with top gaming chair manufacturers to further validate findings and ensure that the final report provides a complete and accurate analysis of the North America gaming chairs market.

Frequently Asked Questions

01. How big is the North America gaming chairs market?

The North America gaming chairs market is valued at USD 1.7 billion, driven by increasing demand for ergonomically designed chairs that cater to both casual gamers and professional eSports players.

02. What are the growth drivers of the North America gaming chairs market?

The growth of the North America gaming chairs market is propelled by the rising popularity of gaming and eSports, technological innovations in ergonomic design, and the growing trend of home office setups among consumers.

03. What are the challenges in the North America gaming chairs market?

Challenges in the North America gaming chairs market include high product prices, increasing competition from low-cost alternatives, and supply chain disruptions due to global economic conditions.

04. Who are the major players in the North America gaming chairs market?

Key players in the North America gaming chairs market include Secretlab, DXRacer, AKRacing, RESPAWN, and Noblechairs. These companies dominate the market due to their strong focus on quality, ergonomic innovation, and partnerships with eSports organizations.

TABLES

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.