North America Genetic Testing Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD1521

November 2024

92

About the Report

North America Genetic Testing Market Overview

- The North America Genetic Testing Market is valued at USD 7 billion, based on a comprehensive historical analysis. The market has seen growth driven by increasing demand for personalized medicine, expanding healthcare infrastructure, and heightened awareness of genetic testing's role in preventive healthcare. The integration of advanced technologies, like next-generation sequencing and machine learning, has further accelerated adoption rates among healthcare providers and patients, solidifying genetic testing as a valuable diagnostic tool across multiple applications.

- The United States and Canada lead the North American genetic testing market, largely due to their well-established healthcare systems, high per capita healthcare spending, and favorable regulatory environments that support genetic research and testing innovations. The U.S., with its concentration of genetic testing companies, research institutions, and a receptive healthcare market, remains at the forefront. In Canada, government-supported healthcare and a growing emphasis on genomic research are similarly driving demand for genetic testing.

- Laboratories conducting genetic testing in the U.S. must comply with CLIA standards to ensure testing quality. By 2023, more than 5,000 labs were CLIA-certified, with oversight provided by the Centers for Medicare & Medicaid Services (CMS). These certifications ensure adherence to high standards, maintaining the accuracy of diagnostic tests. Compliance with CLIA helps reassure patients about test reliability, fostering confidence in genetic testing.

North America Genetic Testing Market Segmentation

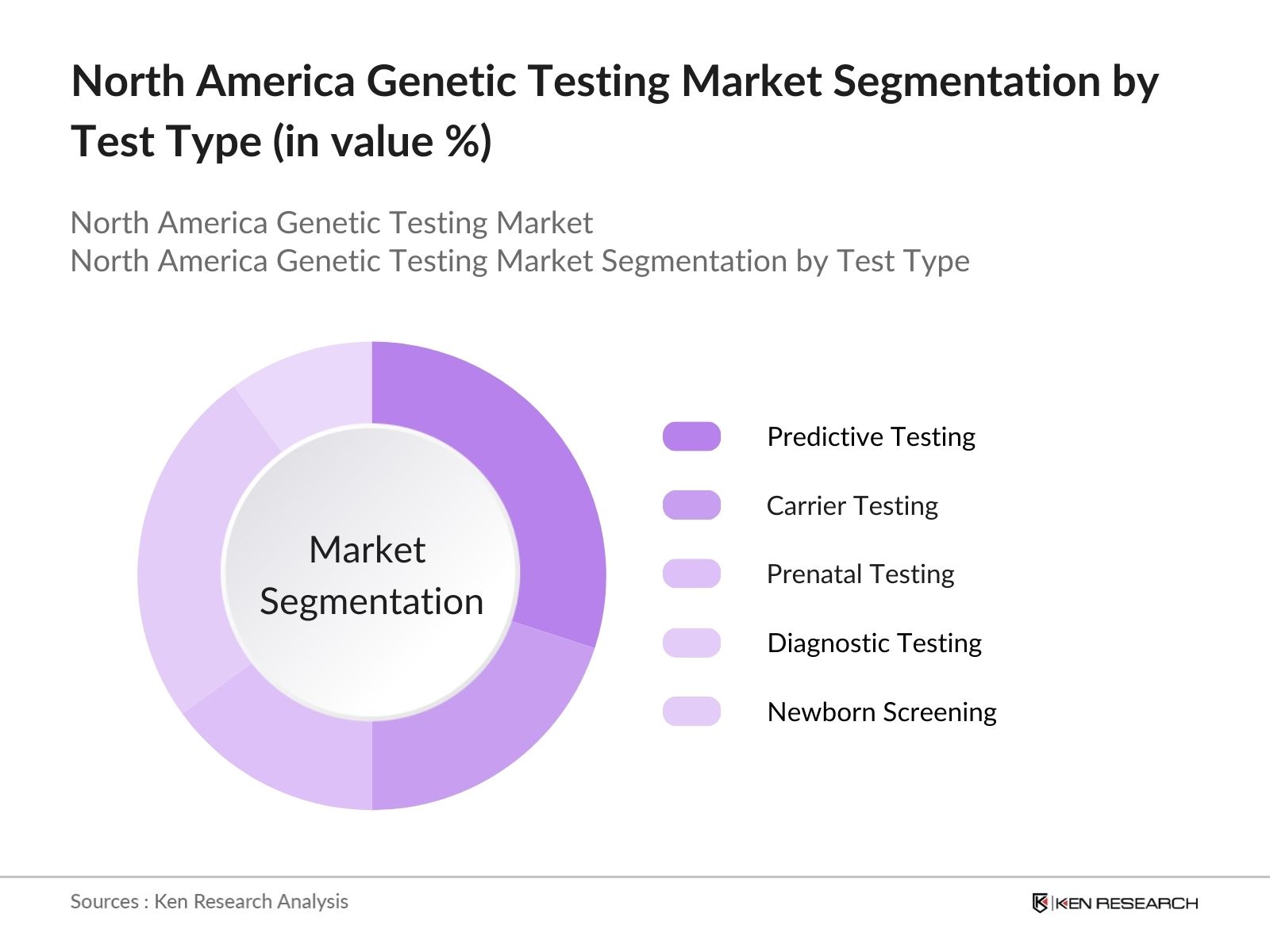

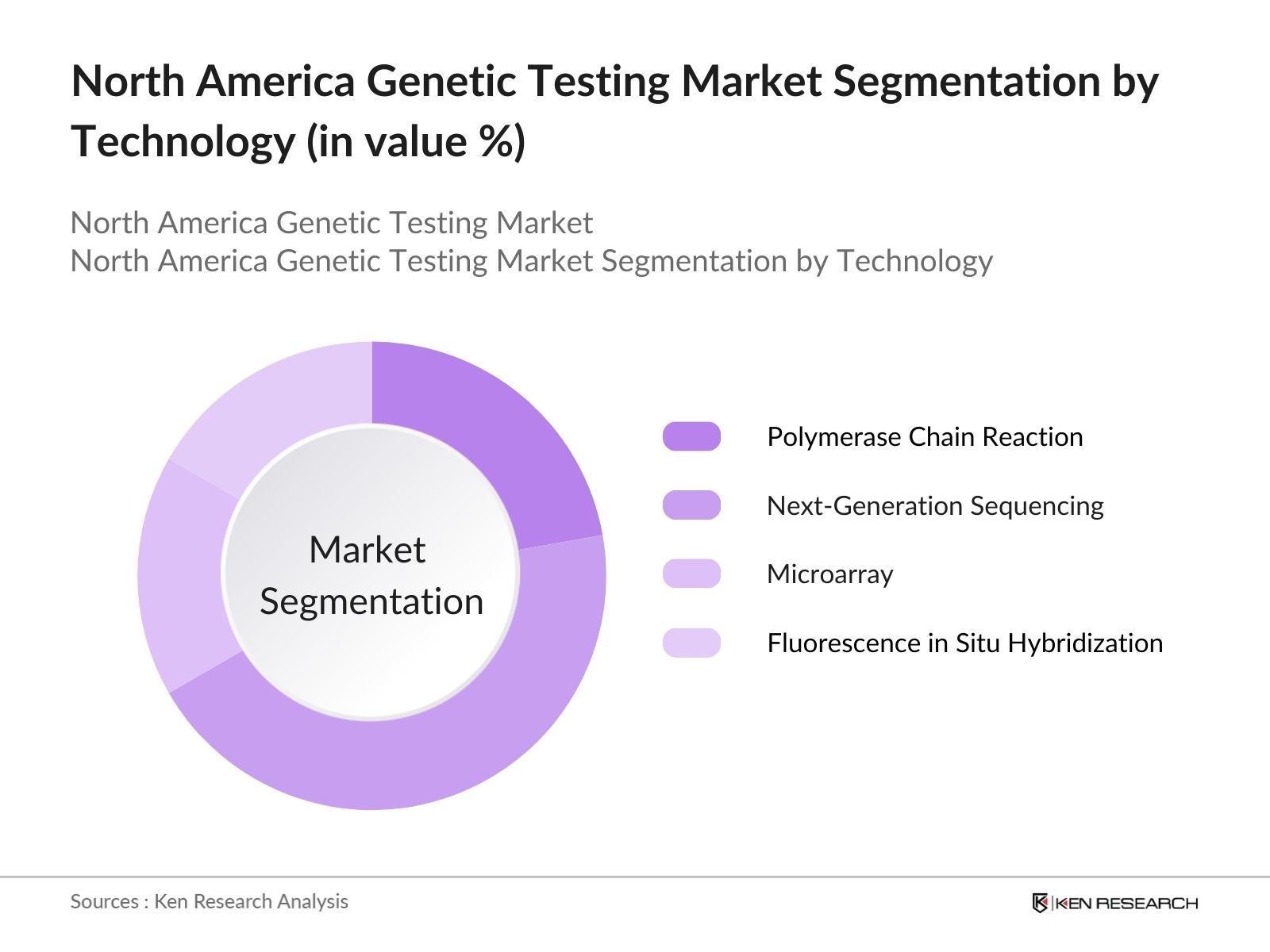

The North America Genetic Testing Market is segmented by test type and by technology.

- By Test Type: The market is segmented by test type into predictive testing, carrier testing, prenatal testing, diagnostic testing, and newborn screening. Predictive testing holds a dominant share due to its essential role in assessing risk for genetic diseases, particularly in oncology. Increasing awareness among individuals at risk of genetic disorders has heightened the demand for predictive tests, which provide insight into health predispositions and help in early disease management.

- By Technology: The market is also segmented by technology, including polymerase chain reaction (PCR), next-generation sequencing (NGS), microarray, fluorescence in situ hybridization (FISH), and others. Next-generation sequencing dominates the technology segment, as it provides high throughput, speed, and accuracy for comprehensive genomic analysis. NGS is preferred for applications such as prenatal testing and complex genetic analysis, as it allows for large-scale DNA sequencing at lower costs, which appeals to both clinical and research sectors.

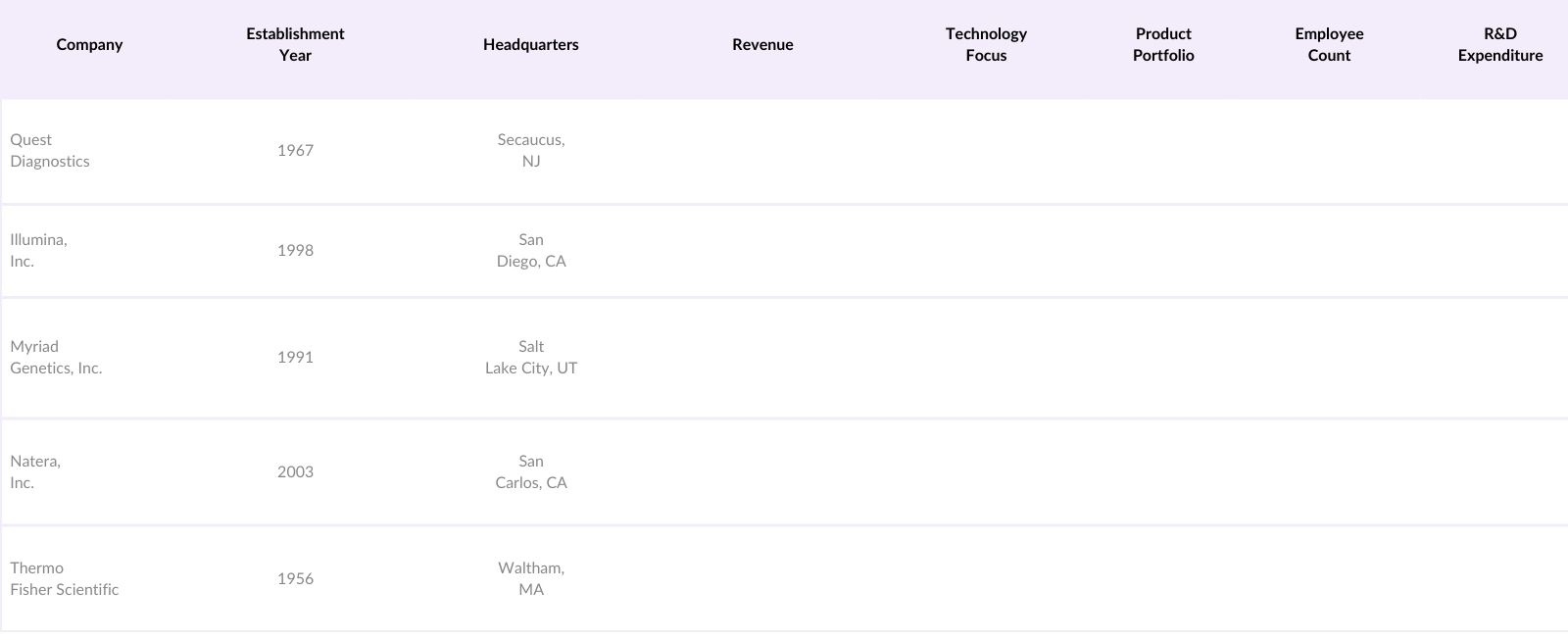

North America Genetic Testing Market Competitive Landscape

The North America Genetic Testing Market is dominated by a few major players, including key multinational and domestic firms with extensive R&D capabilities and broad portfolios. The competitive landscape is shaped by these companies capabilities to innovate and comply with regional regulatory standards, which sustain their strong market positions.

North America Genetic Testing Market Analysis

Growth Drivers

- Increased Awareness of Personalized Medicine: The growing understanding of personalized medicine has driven demand for genetic testing across North America. In 2023, over 72% of healthcare providers in the U.S. reported recommending personalized treatment options, with genetic testing being a key component of these services. The National Institutes of Health (NIH) indicated that 85% of U.S. hospitals are now considering genomic data in treatment plans. Additionally, Health Canada reported increased awareness initiatives in 2022, encouraging citizens to explore genetic-based health solutions. The adoption of personalized medicine in North America has significantly influenced patient care frameworks, promoting tailored healthcare solutions for the population.

- Rise in Genetic Disorders: Genetic disorders remain a critical concern in North America, with over 300 million cases reported in the region annually as of 2023. The Centers for Disease Control and Prevention (CDC) in the U.S. reports that genetic conditions affect 1 in 33 newborns, contributing to chronic health conditions that increase the demand for early and accurate diagnosis via genetic testing. Genetic disorders are a major driver for developing a robust genetic testing infrastructure, which enables timely diagnosis, enhances treatment, and significantly improves survival rates in affected populations.

- Technological Advancements in Genomic Testing: Technological advancements have transformed genetic testing, significantly boosting accuracy and accessibility. The NIH disclosed in 2023 that newer testing techniques, such as CRISPR and next-generation sequencing, offer more reliable results, with error rates under 0.5%a notable improvement over traditional methods. These innovations allow researchers to sequence whole genomes rapidly, aiding in precise diagnostics and personalized medicine applications. The Canadian government has funded numerous initiatives to support these advancements, further reinforcing the region's genomic infrastructure. This technological growth enhances the testing capabilities and overall healthcare quality in the North American market.

Market Challenges

- High Cost of Genetic Testing: Despite its advantages, the high cost of genetic testing remains a barrier for many North Americans. The average cost of a genetic test in the U.S. was approximately $1,000 in 2023, with certain advanced tests exceeding $10,000. This cost is prohibitive for uninsured populations, limiting accessibility. According to Canadas Ministry of Health, high out-of-pocket costs continue to restrict patient uptake, particularly for rare genetic conditions where testing expenses are even higher. While funding initiatives are increasing, out-of-pocket expenses remain a challenge for widespread adoption.

- Data Privacy and Security Concerns: Data privacy issues are heightened in genetic testing due to the sensitive nature of genomic data. In 2023, the U.S. reported over 3,000 cases of healthcare data breaches, impacting millions of citizens. Genetic data, which includes personal and familial health information, poses even greater risks, leading to stringent HIPAA compliance measures to safeguard patient privacy. Canada has also seen a rise in data security concerns, prompting the implementation of rigorous data protection laws like PIPEDA. Both countries are enhancing their regulatory structures to prevent misuse and ensure that genetic information is secure.

North America Genetic Testing Market Future Outlook

The North America Genetic Testing Market is projected to experience substantial growth driven by advancements in testing technology, increasing government and private investments, and rising awareness among consumers about preventive healthcare. The expansion of direct-to-consumer genetic testing services, paired with technological enhancements such as AI integration for genetic data analysis, will continue to drive market demand and innovation, especially in areas like oncology and prenatal care.

Future Market Opportunities

- Expansion in Direct-to-Consumer Genetic Testing: Direct-to-consumer (DTC) genetic testing has surged, offering consumers convenient access to genetic information without a healthcare intermediary. By 2023, more than 25 million people in North America had used DTC genetic tests, revealing a strong consumer interest in non-clinical genetic insights. DTC companies are expanding, with new players entering the market, emphasizing user-friendly and accessible genetic testing kits. The expansion into wellness and ancestry-focused genetic tests has broadened the market's scope and reach, providing opportunities for further growth.

- Integration with Artificial Intelligence and Machine Learning: Integrating artificial intelligence (AI) and machine learning (ML) into genetic testing enhances precision and efficiency. The NIH has demonstrated that AI algorithms reduce genetic testing time by nearly 40% and enhance data interpretation accuracy. This capability allows clinicians to offer faster, more reliable results. AI-powered tools also aid in identifying previously undetected genetic mutations, supporting the trend of personalized medicine. The integration of these technologies is positioning North America as a leader in genomic AI applications, creating substantial market opportunities.

Scope of the Report

|

||||

|

By Technology |

|

|||

|

By Application |

Oncology |

|||

|

By End User |

Hospitals and Clinics |

|||

|

By Region |

US Canada Mexico |

Products

Key Target Audience

Biotechnology Firms

Genetic Testing Laboratories

Hospital and Healthcare Systems

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, CMS)

Pharmaceutical Companies

Public and Private Research Institutions

Genetic Counseling Service Providers

Companies

Major Players in the Market

Quest Diagnostics

Illumina, Inc.

Myriad Genetics, Inc.

Natera, Inc.

Thermo Fisher Scientific

23andMe

PerkinElmer, Inc.

GeneDx

Fulgent Genetics

Color Genomics

NeoGenomics Laboratories

Progenity, Inc.

Sema4

LabCorp

Invitae Corporation

Table of Contents

1. North America Genetic Testing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Trends and Developments

1.4. Market Segmentation Overview

2. North America Genetic Testing Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Market Volume and Value Analysis

3. North America Genetic Testing Market Dynamics

3.1. Growth Drivers

3.1.1. Increased Awareness of Personalized Medicine

3.1.2. Rise in Genetic Disorders

3.1.3. Technological Advancements in Genomic Testing

3.1.4. Government and Private Funding Initiatives

3.2. Market Challenges

3.2.1. High Cost of Genetic Testing

3.2.2. Data Privacy and Security Concerns

3.2.3. Regulatory Complexities

3.3. Opportunities

3.3.1. Expansion in Direct-to-Consumer Genetic Testing

3.3.2. Integration with Artificial Intelligence and Machine Learning

3.3.3. Increasing Demand for Precision Medicine

3.4. Trends

3.4.1. Increased Utilization of Whole Genome Sequencing

3.4.2. Growing Adoption in Newborn Screening Programs

3.4.3. Collaborative Research Initiatives

3.5. Regulatory Landscape

3.5.1. FDA Guidelines for Genetic Testing Products

3.5.2. CLIA Certification Requirements

3.5.3. Data Protection and Compliance (HIPAA, GDPR)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. North America Genetic Testing Market Segmentation (Market Share in Value %)

4.1. By Test Type

4.1.1. Predictive Testing

4.1.2. Carrier Testing

4.1.3. Prenatal Testing

4.1.4. Diagnostic Testing

4.1.5. Newborn Screening

4.2. By Technology

4.2.1. Polymerase Chain Reaction (PCR)

4.2.2. Next-Generation Sequencing (NGS)

4.2.3. Microarray

4.2.4. Fluorescence in Situ Hybridization (FISH)

4.2.5. Others

4.3. By Application

4.3.1. Oncology

4.3.2. Infectious Diseases

4.3.3. Cardiovascular Diseases

4.3.4. Neurological Diseases

4.3.5. Genetic Disorders

4.4. By End User

4.4.1. Hospitals and Clinics

4.4.2. Diagnostic Laboratories

4.4.3. Academic and Research Institutions

4.4.4. Direct-to-Consumer

4.5. By Region

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Genetic Testing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Quest Diagnostics

5.1.2. Illumina, Inc.

5.1.3. Myriad Genetics, Inc.

5.1.4. Thermo Fisher Scientific

5.1.5. Natera, Inc.

5.1.6. Invitae Corporation

5.1.7. PerkinElmer, Inc.

5.1.8. Laboratory Corporation of America

5.1.9. GeneDx

5.1.10. 23andMe

5.1.11. Fulgent Genetics

5.1.12. Color Genomics

5.1.13. Progenity, Inc.

5.1.14. Sema4

5.1.15. NeoGenomics Laboratories

5.2 Cross Comparison Parameters (Revenue, Headquarters, Test Portfolio, Employee Count, R&D Expenditure, Technology Type, Service Model, Regulatory Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. Product Launches and Innovations

6. North America Genetic Testing Market Regulatory Framework

6.1. Overview of Regulatory Authorities (FDA, CMS, etc.)

6.2. Genetic Testing Authorization Process

6.3. Data Compliance Regulations (HIPAA, GDPR)

6.4. Quality Assurance Standards

7. North America Genetic Testing Future Market Size (in USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors for Future Market Growth

8. North America Genetic Testing Future Market Segmentation

8.1. By Test Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. North America Genetic Testing Market Analysts Recommendations

9.1. Target Addressable Market (TAM) Analysis

9.2. Segment-Specific Opportunity Assessment

9.3. Customer Cohort Analysis

9.4. Strategic Recommendations for Product Positioning

Research Methodology

Step 1: Identification of Key Variables

An initial framework was established by mapping key market stakeholders in the North America Genetic Testing Market. Using reputable secondary sources and proprietary databases, we identified critical market variables influencing growth, including technology adoption rates, regulatory environment, and market penetration.

Step 2: Market Analysis and Construction

Comprehensive data analysis was conducted on historical trends to assess market growth, consumer demographics, and revenue generation. This involved a meticulous evaluation of test utilization data, patient adoption rates, and service provider distribution to ensure reliability and accuracy of revenue insights.

Step 3: Hypothesis Validation and Expert Consultation

Validated market insights were obtained through CATI with industry experts, spanning various sectors within genetic testing. These consultations helped refine market projections and provided qualitative insights, ensuring data robustness across different market segments.

Step 4: Research Synthesis and Final Output

Data collected through expert interviews and secondary research was synthesized, followed by verification through direct engagement with industry practitioners. This comprehensive synthesis ensured an accurate representation of market dynamics for the North America Genetic Testing Market.

Frequently Asked Questions

How big is the North America Genetic Testing Market?

The North America Genetic Testing Market is valued at USD 7 billion, with strong demand from healthcare providers and consumers driven by advancements in personalized medicine.

What challenges does the North America Genetic Testing Market face?

Challenges in North America Genetic Testing Market include data privacy concerns, high testing costs, and the complex regulatory environment. These factors can impact market expansion, particularly for direct-to-consumer genetic testing.

Who are the key players in the North America Genetic Testing Market?

Major players in North America Genetic Testing Market include Quest Diagnostics, Illumina, and Thermo Fisher Scientific. These companies lead due to their advanced technology offerings, R&D investment, and extensive distribution networks.

What drives growth in the North America Genetic Testing Market?

North America Genetic Testing Market Growth is driven by increased awareness of genetic testing benefits, a high prevalence of genetic disorders, and government initiatives to expand access to genetic healthcare services.

Which regions lead in the North America Genetic Testing Market?

The United States leads due to extensive healthcare infrastructure, government funding, and a high adoption rate for new technologies in clinical diagnostics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.