North America Geospatial Analytics Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD7506

December 2024

83

About the Report

North America Geospatial Analytics Market Overview

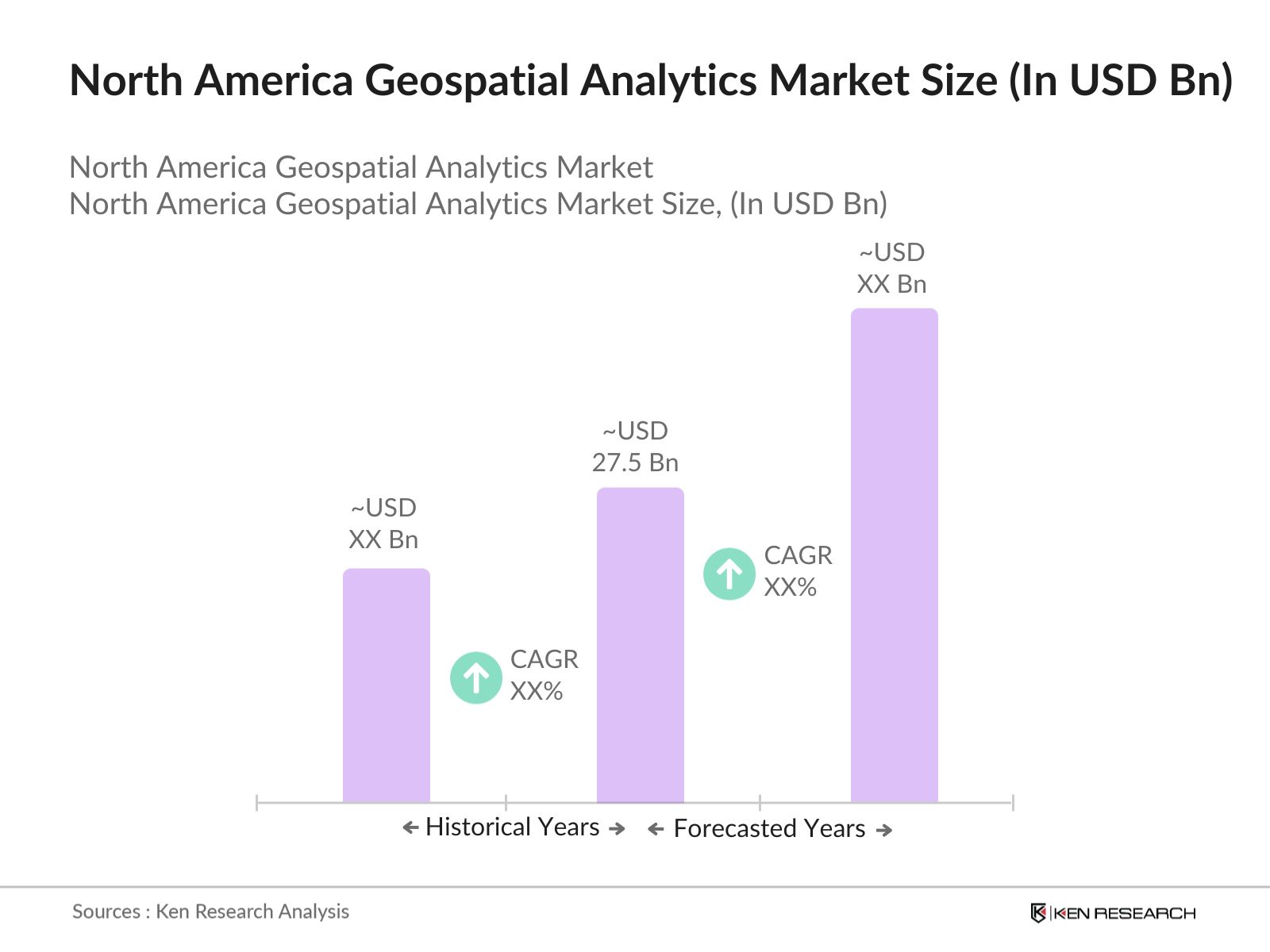

- The North America Geospatial Analytics Market, based on a five-year historical analysis, is valued at USD 27.5 billion, reflecting its growth driven by increasing demand across sectors like defense, urban planning, and logistics. The demand is notably fueled by the expansion of smart cities and infrastructure developments that rely heavily on spatial data analytics for efficient planning and operational insights. Additionally, government programs for enhanced geospatial intelligence have further bolstered the market.

- The market is prominently dominated by cities in the United States, particularly Washington, D.C., and New York, due to the high concentration of government agencies and large enterprises with extensive geospatial data needs. These cities prioritize geospatial technologies for various applications, from security and surveillance to urban management, making them significant hubs for the adoption of analytics solutions.

- The NSDI framework guides geospatial data standardization, facilitating interoperability across government and private sectors. Federal agencies, including the U.S. Geological Survey, comply with NSDI, creating unified data standards to streamline data sharing. Compliance with NSDI promotes transparency and efficiency in public services like disaster response.

North America Geospatial Analytics Market Segmentation

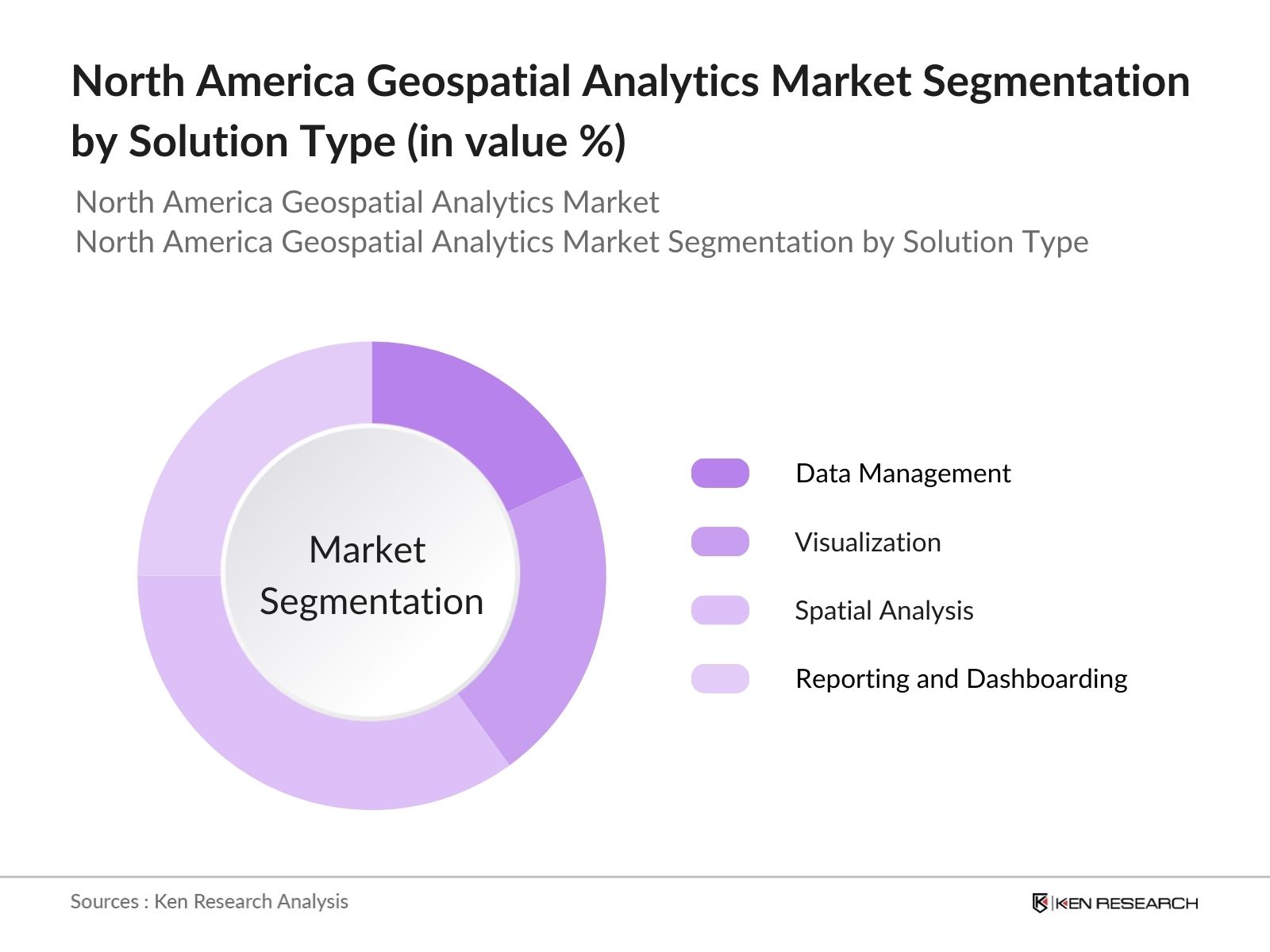

By Solution Type: The Market is segmented by solution type, including data management, visualization, spatial analysis, and reporting and dashboarding. Spatial analysis solutions are currently leading the market, driven by the need for real-time decision-making in critical sectors like transportation and defense. These solutions enable users to extract actionable insights from location-based data, supporting both strategic planning and immediate response needs.

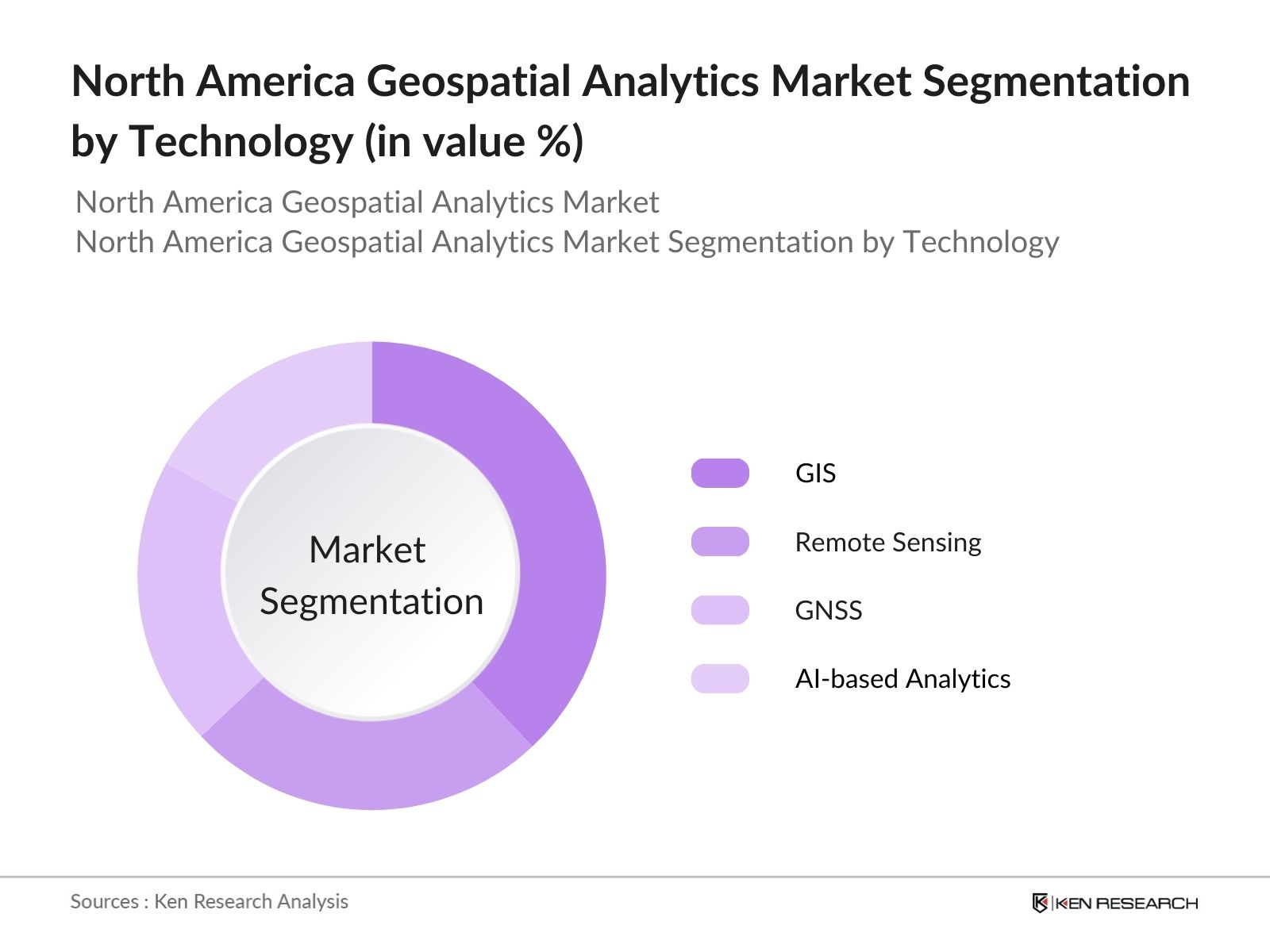

By Technology: The market is also segmented by technology, including GIS (Geographic Information Systems), remote sensing, GNSS (Global Navigation Satellite System), and AI-based geospatial analytics. GIS solutions dominate this segment as they provide comprehensive mapping and spatial data analysis, widely used in government and utility sectors. GIS technology remains essential for creating and managing spatial data layers, critical for infrastructure projects and urban planning.

North America Geospatial Analytics Market Competitive Landscape

The North America Geospatial Analytics Market is consolidated, with significant players like Esri and Maxar Technologies leading in product offerings and regional reach. The competitive landscape reflects a mix of global technology firms and specialized geospatial companies, each investing in innovative solutions to gain a competitive edge.

North America Geospatial Analytics Market Analysis

Growth Drivers

- Expansion of Smart Cities and Infrastructure Development: The growth of smart city projects across North America is spurring demand for geospatial analytics, with initiatives such as the U.S. Smart City Challenge investing $50 million in urban tech solutions to reduce congestion and improve transportation infrastructure. In Canada, the Smart Cities Challenge promotes data integration, awarding substantial grants to municipalities with innovative spatial data applications. According to the U.S. Department of Transportation, smart city infrastructure will reach $2 trillion in investments by 2025, indicating a need for advanced analytics in urban planning and management.

- Government Initiatives for Spatial Data Usage: The U.S. and Canadian governments emphasize geospatial data in various sectors. For instance, the U.S. National Geospatial-Intelligence Agency allocates substantial funding toward geographic information systems (GIS), driving data innovation. The U.S. Department of Homeland Security also applies geospatial analytics for disaster management, dedicating over $1 billion annually to spatial data integration. Similarly, Canadas GeoConnections program supports data interoperability standards, encouraging more accessible geospatial data use.

- Rising Demand for Location-Based Services: Demand for location-based services (LBS) is growing as businesses enhance customer experience through personalized data. Over 70% of North American businesses implement LBS for customer engagement, driven by advancements in real-time analytics. The North American market for location services was valued at over $7 billion in 2022, with applications in navigation, on-demand services, and mobile marketing. The rise of IoT devices is further boosting LBS demand, integrating geospatial analytics for enhanced consumer insights.

Market Challenges

- High Data Collection and Processing Costs: Geospatial data collection requires sophisticated technology, such as LIDAR and high-resolution satellites, leading to high operational costs. The U.S. Geological Survey invests millions annually in data acquisition, but with data costs rising, smaller agencies face barriers. For instance, processing a single terabyte of geospatial data costs around $1,000, hindering broader market adoption among small businesses.

- Privacy and Data Security Concerns: Data privacy is a significant issue, especially with GPS and real-time tracking. The U.S. Department of Homeland Security reported over 1,000 data breaches involving geospatial data in 2023 alone, costing companies millions in fines and litigation. Privacy concerns limit consumer trust, impacting industries like retail and insurance that rely on location data for services. New regulations mandate stricter data usage policies, adding complexity to geospatial analytics operations.

North America Geospatial Analytics Market Future Outlook

The North America Geospatial Analytics Market is projected to experience sustained growth due to the expanding applications of spatial data across diverse industries. This growth will be driven by technological advancements, particularly in AI and IoT, which are enhancing the utility of geospatial data for decision-making. Additionally, the continued emphasis on smart city initiatives and increased government spending on spatial data applications will support further market expansion.

Future Market Opportunities

- Growth in Autonomous Vehicle Technology: Autonomous vehicles (AVs) rely on geospatial data for navigation and safety, with over $3 billion invested in AV R&D in North America in 2023 alone. Companies like Waymo and GM Cruise utilize high-definition maps and real-time geospatial analytics, creating a significant opportunity for analytics providers to supply AV-specific data solutions. The AV markets expansion in North America underscores the importance of accurate, high-speed geospatial data.

- Integration of AI in Geospatial Analysis: Artificial intelligence enhances geospatial data accuracy and speed, reducing processing time by up to 60%. In North America, organizations are heavily investing in AI-based geospatial tools, with expenditures reaching nearly $500 million in 2023. Government bodies like NASA and the National Science Foundation support AI integration projects, promoting widespread adoption of these technologies in sectors like urban planning and environmental monitoring.

Scope of the Report

|

Solution Type |

Data Management Visualization Spatial Analysis Reporting and Dashboarding |

|

Technology |

GIS (Geographic Information Systems) Remote Sensing GNSS (Global Navigation Satellite System) AI-Based Geospatial Analytics |

|

Application |

Urban Planning and Management Disaster Management Climate Change Analysis Military and Defense |

|

Deployment Mode |

On-Premises Cloud-Based |

|

End-User Industry |

Government and Public Sector Utilities Transportation and Logistics Mining and Agriculture |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., National Geospatial-Intelligence Agency, U.S. Geological Survey)

Defense and Homeland Security Agencies

Urban Planning Departments

Transportation and Logistics Companies

Utility Companies

Technology and Data Management Companies

Investors and Venture Capitalist Firms

Environmental Monitoring Organizations

Companies

Major Players

Esri

Maxar Technologies

Hexagon AB

Trimble Inc.

Autodesk, Inc.

Oracle Corporation

General Electric

SAP SE

Google LLC

Fugro

Here Technologies

Harris Corporation

Pitney Bowes Inc.

IBM Corporation

Microsoft Corporation

Table of Contents

North America Geospatial Analytics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

North America Geospatial Analytics Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

North America Geospatial Analytics Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of Smart Cities and Infrastructure Development

3.1.2 Government Initiatives for Spatial Data Usage

3.1.3 Rising Demand for Location-Based Services

3.2 Market Challenges

3.2.1 High Data Collection and Processing Costs

3.2.2 Privacy and Data Security Concerns

3.2.3 Limited Access to Geospatial Infrastructure

3.3 Opportunities

3.3.1 Growth in Autonomous Vehicle Technology

3.3.2 Integration of AI in Geospatial Analysis

3.3.3 Expansion of Internet of Things (IoT) Applications

3.4 Trends

3.4.1 Adoption of Real-Time Spatial Data Analytics

3.4.2 Cloud Integration for Geospatial Services

3.4.3 3D and 4D Visualization in Urban Planning

3.5 Government Regulation

3.5.1 National Spatial Data Infrastructure (NSDI) Compliance

3.5.2 Geospatial Data Transparency Initiatives

3.5.3 Data Protection and Privacy Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

North America Geospatial Analytics Market Segmentation

4.1 By Solution Type (In Value %)

4.1.1 Data Management

4.1.2 Visualization

4.1.3 Spatial Analysis

4.1.4 Reporting and Dashboarding

4.2 By Technology (In Value %)

4.2.1 GIS (Geographic Information Systems)

4.2.2 Remote Sensing

4.2.3 GNSS (Global Navigation Satellite System)

4.2.4 Geospatial Analytics in AI

4.3 By Application (In Value %)

4.3.1 Urban Planning and Management

4.3.2 Disaster Management

4.3.3 Climate Change Analysis

4.3.4 Military and Defense

4.4 By Deployment Mode (In Value %)

4.4.1 On-Premises

4.4.2 Cloud-Based

4.5 By End-User Industry (In Value %)

4.5.1 Government and Public Sector

4.5.2 Utilities

4.5.3 Transportation and Logistics

4.5.4 Mining and Agriculture

North America Geospatial Analytics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Esri

5.1.2 Hexagon AB

5.1.3 Maxar Technologies

5.1.4 Trimble Inc.

5.1.5 General Electric

5.1.6 Oracle Corporation

5.1.7 SAP SE

5.1.8 Autodesk, Inc.

5.1.9 Harris Corporation

5.1.10 Pitney Bowes Inc.

5.1.11 Google LLC

5.1.12 Fugro

5.1.13 Here Technologies

5.1.14 IBM Corporation

5.1.15 Microsoft Corporation

5.2 Cross Comparison Parameters (Revenue, Market Reach, Key Technology Offerings, Strategic Partnerships, Regional Presence, Innovation Rate, Customer Segments, Industry Focus)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Funding

North America Geospatial Analytics Market Regulatory Framework

6.1 Standards for Data Collection and Processing

6.2 Compliance Requirements

6.3 Certification and Accreditation Processes

North America Geospatial Analytics Market Future Market Size (In USD Mn)

7.1 Projected Market Size Based on Current Trends

7.2 Key Factors Driving Future Market Demand

North America Geospatial Analytics Market Future Segmentation

8.1 By Solution Type

8.2 By Technology

8.3 By Application

8.4 By Deployment Mode

8.5 By End-User Industry

North America Geospatial Analytics Market Analysts Recommendations

9.1 Target Addressable Market Analysis

9.2 Customer Persona Insights

9.3 Growth Strategy Optimization

9.4 White Space Identification

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map of the North America Geospatial Analytics Market was constructed to identify all critical variables affecting market dynamics. This phase utilized comprehensive desk research and reputable databases to gather relevant industry-level information.

Step 2: Market Analysis and Construction

Historical data analysis was conducted to assess market penetration and revenue generation. The data collected also included evaluations of solution quality and sector-specific usage to ensure accuracy in the constructed market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses were validated through in-depth interviews with industry experts. These consultations helped refine data accuracy and provided firsthand insights from market practitioners on emerging trends and market dynamics.

Step 4: Research Synthesis and Final Output

The final report was created by synthesizing data and insights from interviews with geospatial analytics vendors. This phase verified all findings through bottom-up approaches, ensuring the reliability of the market data.

Frequently Asked Questions

01 How big is the North America Geospatial Analytics Market?

The North America Geospatial Analytics Market is valued at USD 27.5 billion, driven by the growing need for spatial data analysis across various sectors, including defense and infrastructure.

02 What challenges does the North America Geospatial Analytics Market face?

Key challenges in the North America Geospatial Analytics Market include high data collection costs, privacy concerns, and limited access to advanced geospatial technologies, which can restrict adoption in certain regions.

03 Who are the major players in the North America Geospatial Analytics Market?

Prominent players in the North America Geospatial Analytics Market include Esri, Maxar Technologies, Hexagon AB, and Trimble Inc., which dominate due to their extensive product portfolios and strong regional presence.

04 What drives the North America Geospatial Analytics Market?

The North America Geospatial Analytics Market is propelled by increasing applications in smart cities, defense, and environmental monitoring, as well as government investments in spatial data infrastructure.

05 Which segment dominates the North America Geospatial Analytics Market?

The spatial analysis segment currently leads in the North America Geospatial Analytics Market, owing to its critical role in real-time decision-making for urban planning and defense applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.