North America Grain Silos and Ancillary Equipment Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD8932

December 2024

100

About the Report

North America Grain Silos and Ancillary Equipment Market Overview

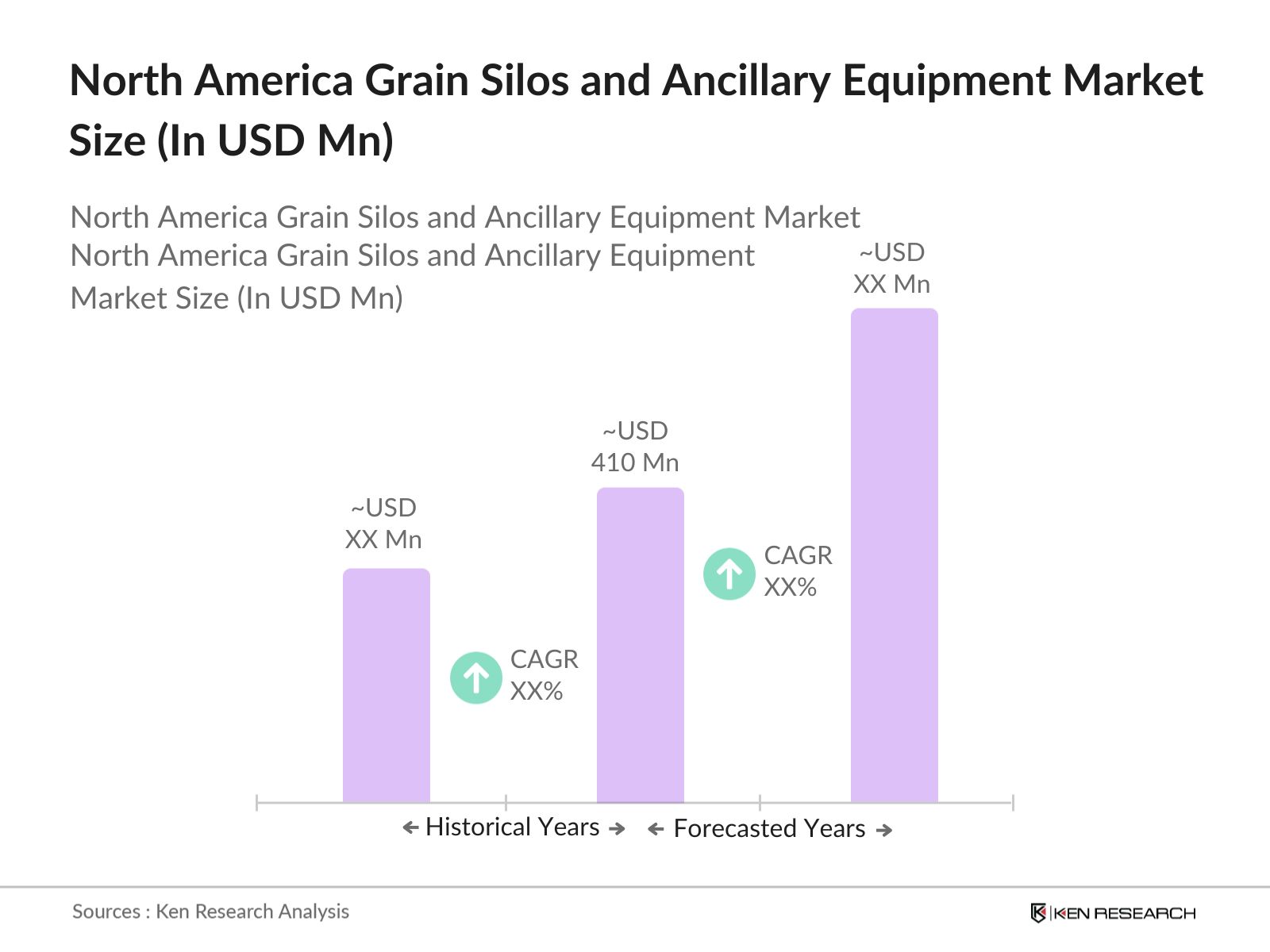

- The North America grain silos and ancillary equipment market is valued at USD 410 million, primarily driven by the increasing agricultural production, advancements in storage technologies, and the necessity for efficient grain handling systems. The market sees steady growth as farmers and agribusinesses invest in modern silos equipped with automation and IoT capabilities to improve operational efficiency and minimize post-harvest losses. Key factors such as the rising demand for grain storage solutions and the growth of the agribusiness sector contribute to the market's stability and long-term expansion, solidifying North America as a leading region for grain storage solutions globally.

- Major demand centers for grain silos and ancillary equipment in North America include the United States and Canada. The U.S. dominates due to its extensive agricultural production, particularly in corn and soybean, which requires substantial storage capacity and advanced handling systems. Canada also plays a significant role, supported by government policies that encourage modernization in agricultural infrastructure and an increasing emphasis on food security and quality storage practices. These countries drive market growth through their commitment to agricultural innovation and efficiency.

- Governments worldwide enforce stringent food safety standards to ensure the quality and safety of stored grains. In the United States, the Food and Drug Administration (FDA) mandates compliance with the Food Safety Modernization Act (FSMA), which includes preventive controls for grain storage facilities. Similarly, the European Union enforces regulations under the General Food Law, requiring traceability and hygiene in grain storage. These standards necessitate regular inspections, proper documentation, and adherence to best practices in storage management to prevent contamination and ensure consumer safety.

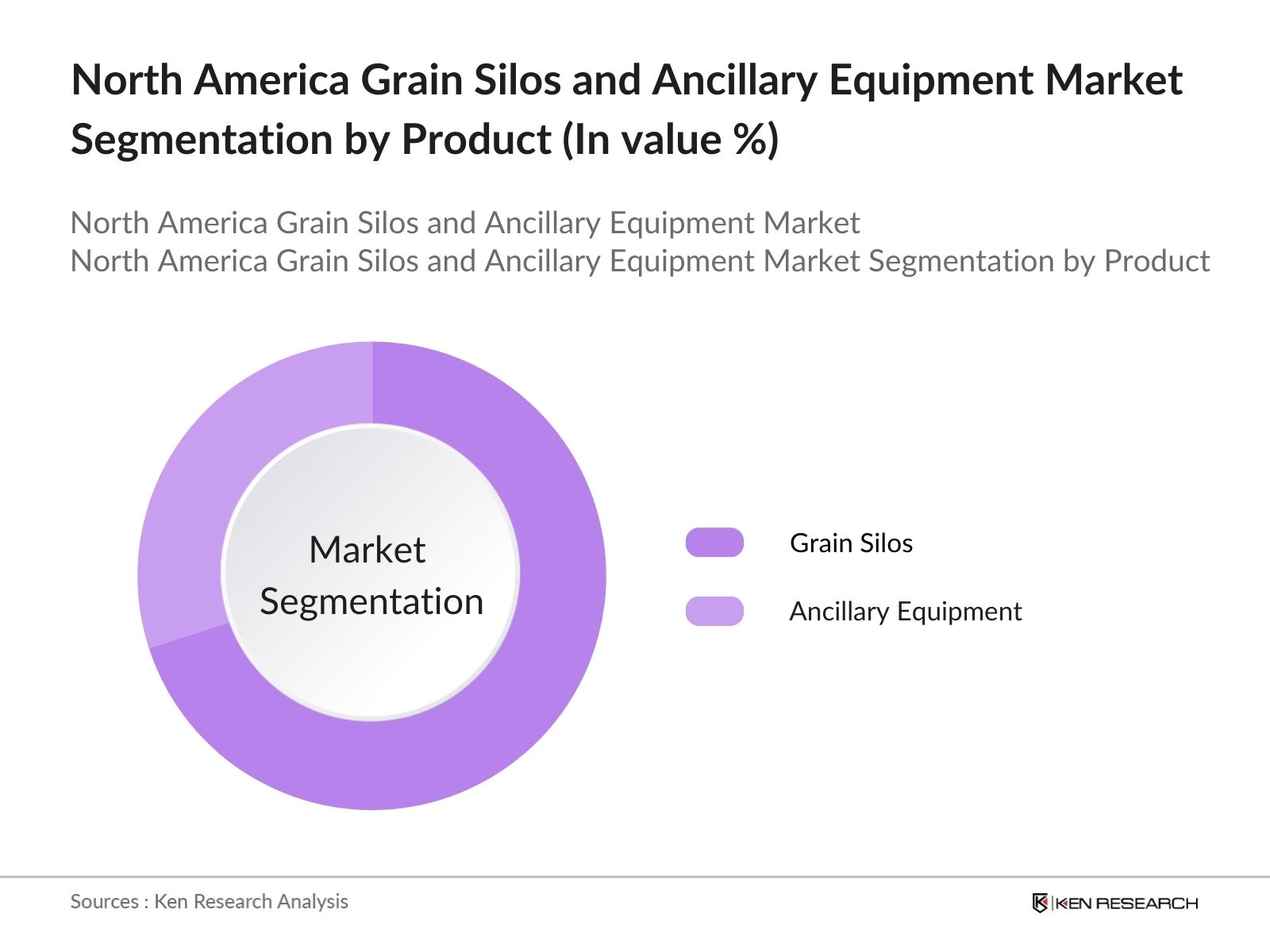

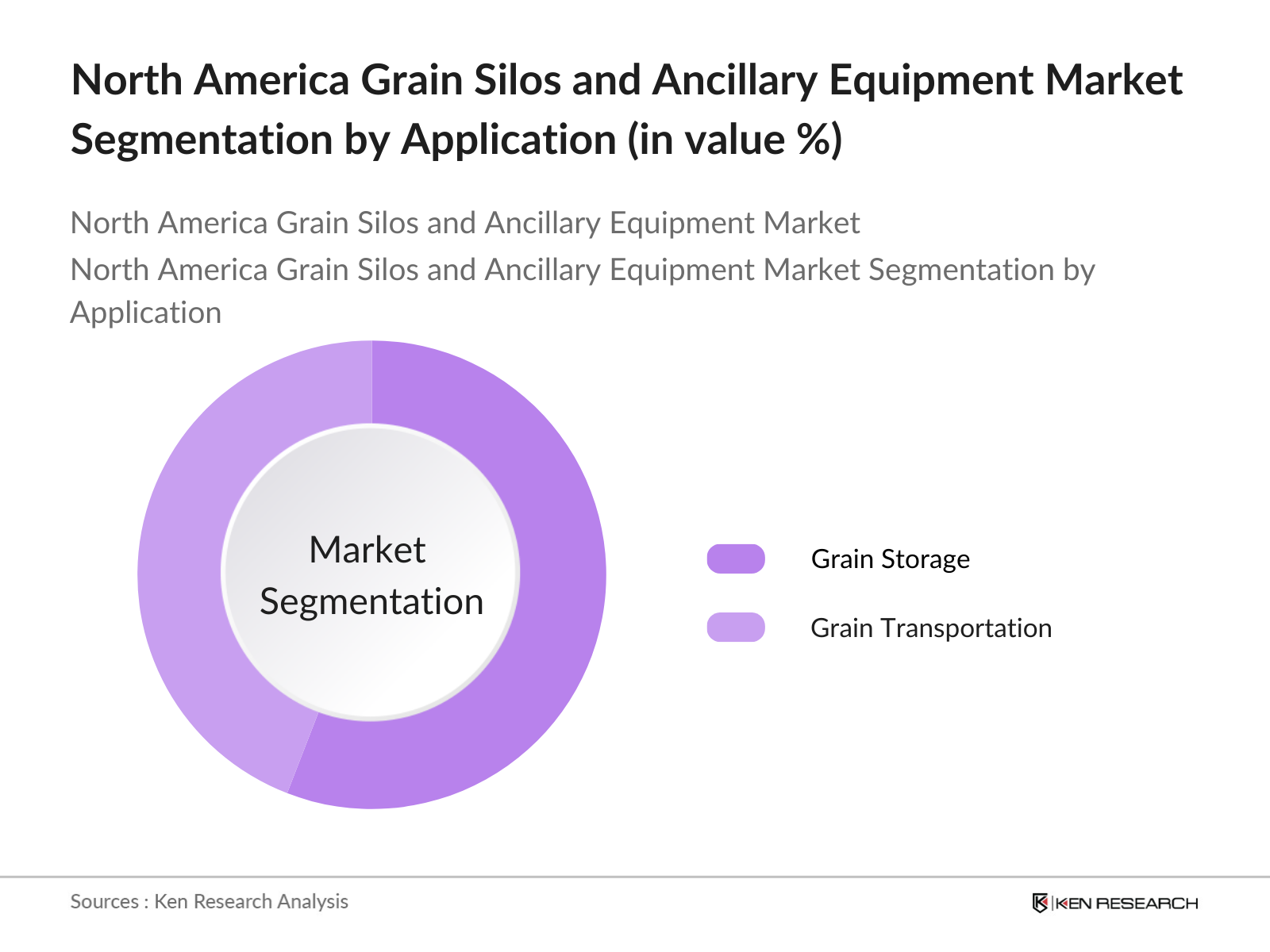

North America Grain Silos and Ancillary Equipment Market Segmentation

- By Product Type: The market is segmented by product type into grain silos and ancillary equipment. Recently, grain silos have held a dominant market share within this segmentation, primarily due to their critical role in bulk storage and preservation of grain quality. The growing trend towards integrated storage solutions that incorporate technology for monitoring and management further strengthens the dominance of this segment. Efficient storage not only prevents spoilage but also enhances the supply chain, allowing producers to store grain until market conditions are favorable.

- By Application: The market is also segmented by application into grain storage and grain transportation. Grain storage applications currently dominate, driven by the necessity to store large quantities of grain post-harvest to ensure a steady supply throughout the year. This segment's growth is further supported by investments in enhanced storage infrastructure and innovative technology that ensures optimal conditions for grain preservation, aligning with increasing consumer demand for food security and quality.

North America Grain Silos and Ancillary Equipment Market Competitive Landscape

The North America grain silos and ancillary equipment market is dominated by several key players, including AGCO Corporation, Ag Growth International, Brock Grain Systems, Sioux Steel Company, and GSI (Grain Systems Inc.). These companies leverage strong brand recognition, extensive distribution networks, and continuous investment in technological innovations to maintain their market leadership positions.

North America Grain Silos and Ancillary Equipment Market Analysis

Growth Drivers

- Increasing Agricultural Production: Global agricultural output has been on the rise, supported by advancements in farming techniques and favorable weather conditions, leading to increased cereal production and a growing need for efficient storage solutions to meet rising food demand. The Food and Agriculture Organization (FAO) reports that wheat production alone accounted for 787 million metric tons in 2023. Such increases necessitate enhanced storage solutions to prevent post-harvest losses and maintain grain quality, ensuring a stable food supply chain.

- Technological Advancements in Storage Solutions: The integration of technologies like the Internet of Things (IoT) and automation has revolutionized grain storage, bringing a new level of precision to monitoring and preservation. Modern silos equipped with sensors monitor temperature and humidity in real-time, reducing spoilage and improving quality. The global adoption of these technologies has led to a substantial reduction in post-harvest losses, as reported by the International Food Policy Research Institute (IFPRI). Such innovations enhance storage efficiency, grain preservation, and ultimately, food security.

- Government Initiatives and Subsidies: Governments worldwide are investing in agricultural infrastructure to ensure food security and support rural economies. In 2023, India allocated 1.25 trillion (USD 14.86 billion) to the agriculture sector, focusing on storage and supply chain improvements for sustained agricultural growth. Similarly, the U.S. Department of Agriculture (USDA) provided grants totalling USD 80 million to support grain storage projects. These initiatives aim to bolster storage capacities, reduce post-harvest losses, and improve the resilience of the agricultural sector.

Challenges

- High Initial Investment Costs: Establishing modern grain storage facilities requires substantial capital, which can be a significant barrier for small and medium-sized farmers, ultimately limiting the adoption of advanced storage solutions and impacting market growth. The high upfront expenses often necessitate additional financing options or government support. Establishing modern grain storage facilities requires substantial capital, making it challenging for small and medium-sized farmers to adopt advanced storage solutions, which in turn limits overall market growth potential.

- Maintenance and Operational Challenges: Maintaining optimal conditions in grain storage facilities is crucial to prevent spoilage, but challenges like pest infestations and equipment malfunctions continue to affect operations. Effective management requires consistent monitoring and maintenance investments, increasing overall operational costs and complexities. Maintaining optimal conditions in grain storage facilities is essential to prevent spoilage; however, persistent challenges like pest infestations and equipment malfunctions necessitate regular monitoring and maintenance, increasing operational demands and costs.

North America Grain Silos and Ancillary Equipment Market Future Outlook

The North America grain silos and ancillary equipment market is poised for robust growth, supported by advancements in storage technologies and increasing agricultural production. As farmers continue to prioritize efficiency and quality in grain handling, innovations such as automated and IoT-enabled systems are expected to play a crucial role in shaping the market landscape. The ongoing focus on sustainability and reducing post-harvest losses will further emphasize the need for modern storage solutions, setting a positive trajectory for future expansion.

Future Market Opportunities

- Adoption of Smart Technologies: The increasing incorporation of smart technologies in grain silos presents a significant opportunity for growth. By utilizing data analytics and machine learning, grain storage facilities can optimize operations, improve grain quality, and minimize losses. The anticipated rise in demand for intelligent storage solutions reflects a growing recognition of the value these technologies bring to the agricultural sector, positioning them as a central focus for future investments.

- Expansion into Emerging Markets: Emerging agricultural markets in North America, particularly in the Midwest and Great Plains regions, represent a substantial opportunity for growth in the grain silos and ancillary equipment market. As these areas see an increase in agricultural production and the establishment of new farms, the demand for reliable and efficient grain storage solutions will likely surge. Companies that strategically target these regions with tailored offerings can capture significant market share in the coming years.

Scope of the Report

|

By Product Type |

Grain Silos |

|

By Silo Type |

Flat Bottom Silos |

|

By Application |

Grain Storage |

|

By Capacity |

Small (Up to 500 Tons) |

|

By Country |

United States |

Products

Key Target Audience

Grain Producers and Farmers

Agricultural Equipment Manufacturers

Storage Solution Providers

Logistics and Transportation Companies

Government and Regulatory Bodies (e.g., U.S. Department of Agriculture)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Agricultural Cooperatives

Companies

Players Mentioned in the Report

AGCO Corporation

Ag Growth International (AGI)

Brock Grain Systems

Sioux Steel Company

SCAFCO Grain Systems

GSI (Grain Systems Inc.)

Behlen Mfg. Co.

Superior Grain Equipment

Sukup Manufacturing Co.

Meridian Manufacturing Inc.

Chief Industries, Inc.

Bentall Rowlands Silo Storage Ltd.

Symaga

PRADO SILOS

Silos Crdoba

Table of Contents

Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Agricultural Production

3.1.2 Technological Advancements in Storage Solutions

3.1.3 Government Initiatives and Subsidies

3.1.4 Rising Demand for Efficient Grain Transportation

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Maintenance and Operational Challenges

3.2.3 Fluctuating Raw Material Prices

3.3 Opportunities

3.3.1 Adoption of IoT and Automation

3.3.2 Expansion into Emerging Markets

3.3.3 Development of Energy-Efficient Systems

3.4 Trends

3.4.1 Integration of Smart Technologies

3.4.2 Modular and Scalable Storage Solutions

3.4.3 Emphasis on Sustainability and Eco-Friendly Materials

3.5 Government Regulations

3.5.1 Food Safety Standards

3.5.2 Environmental Compliance

3.5.3 Trade Policies Affecting Grain Storage

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Grain Silos

4.1.2 Ancillary Equipment

4.2 By Silo Type (In Value %)

4.2.1 Flat Bottom Silos

4.2.2 Hopper Silos

4.2.3 Grain Bins

4.2.4 Other Silo Types

4.3 By Application (In Value %)

4.3.1 Grain Storage

4.3.2 Grain Transportation

4.4 By Capacity (In Value %)

4.4.1 Small (Up to 500 Tons)

4.4.2 Medium (501 to 1,500 Tons)

4.4.3 Large (Above 1,500 Tons)

4.5 By Country (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 AGCO Corporation

5.1.2 Ag Growth International (AGI)

5.1.3 Silos Crdoba

5.1.4 PRADO SILOS

5.1.5 Symaga

5.1.6 SIMEZA

5.1.7 Bentall Rowlands Silo Storage Ltd

5.1.8 Mysilo

5.1.9 Sukup Manufacturing Co.

5.1.10 MICHAL

5.1.11 Priv SA

5.1.12 Dehsetiler Makina

5.1.13 MULMIX SpA Unipersonale

5.1.14 Polnet Sp. z o.o.

5.1.15 Brock Grain Systems

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Regional Presence, Recent Developments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Silo Type (In Value %)

8.3 By Application (In Value %)

8.4 By Capacity (In Value %)

8.5 By Country (In Value %)

Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North American grain silos and ancillary equipment market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North American grain silos and ancillary equipment market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North American grain silos and ancillary equipment market.

Frequently Asked Questions

How big is the North America Grain Silos and Ancillary Equipment Market?

The North America grain silos and ancillary equipment market is valued at USD 410 million, driven by the need for efficient grain storage and handling systems across the region.

What are the main growth drivers for the North America Grain Silos and Ancillary Equipment Market?

Key growth drivers in the North America grain silos and ancillary equipment market include rising agricultural production, technological advancements in storage solutions, and an increasing focus on minimizing post-harvest losses.

What challenges does the North America Grain Silos and Ancillary Equipment Market face?

Challenges in the North America grain silos and ancillary equipment market include high initial investment costs and fluctuating commodity prices, which can impact farmers' willingness to invest in new storage technologies.

Who are the major players in the North America Grain Silos and Ancillary Equipment Market?

Major players in the North America grain silos and ancillary equipment market include AGCO Corporation, Ag Growth International, Brock Grain Systems, Sioux Steel Company, and GSI (Grain Systems Inc.).

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.