North America Graphene Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD3170

December 2024

86

About the Report

North America Graphene Market Overview

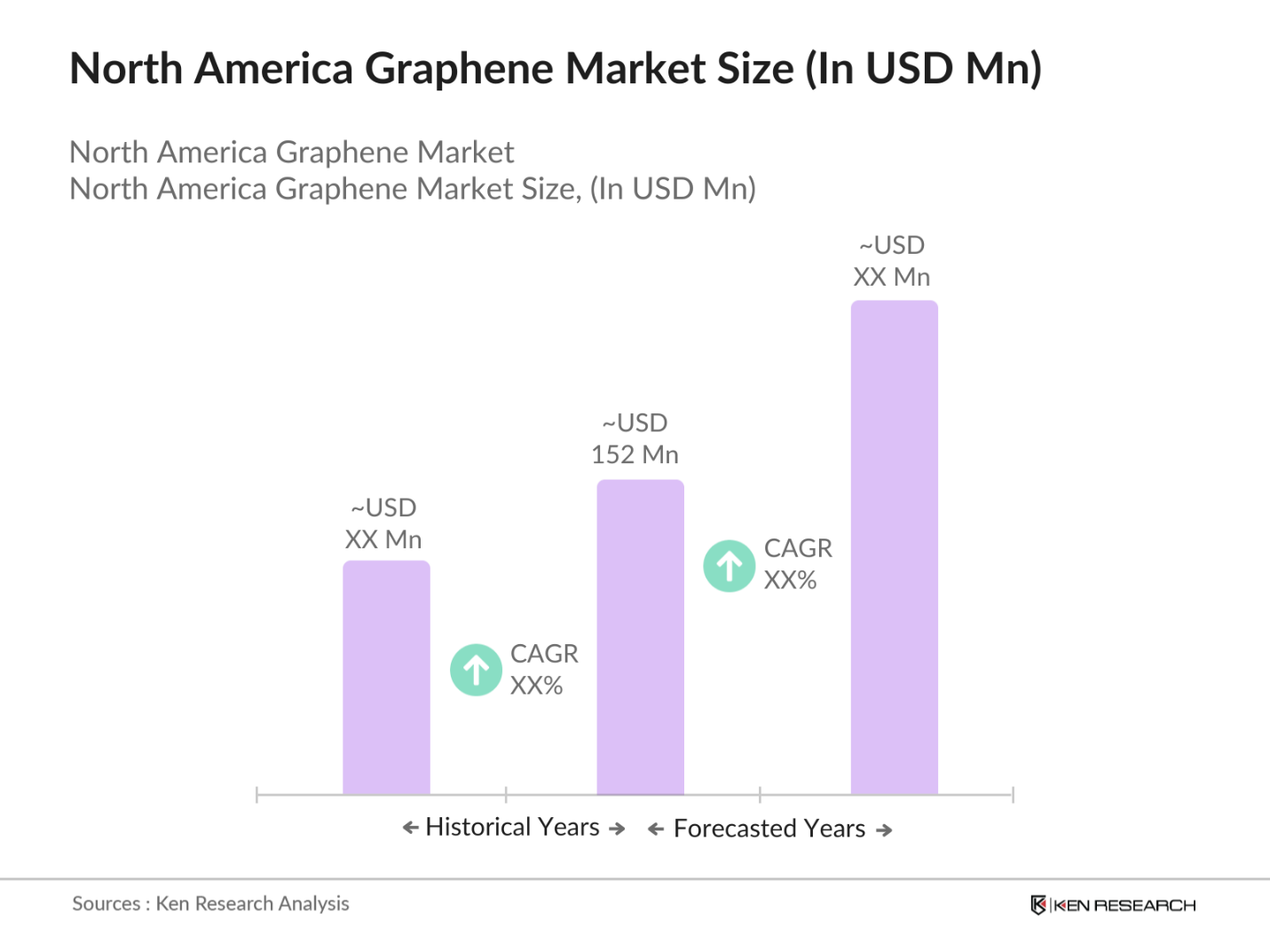

- The North American graphene market is valued at USD 152 million, based on a five-year historical analysis. This growth is driven by advancements in electronics, energy storage, and composite materials, where graphene's exceptional properties are increasingly utilized. The region's strong research and development infrastructure further propels market expansion.

- The United States leads the North American graphene market, attributed to substantial investments in research and development, a robust technological infrastructure, and the presence of key industry players. Canada also contributes significantly, with growing applications in automotive and aerospace sectors.

- The Occupational Safety and Health Administration (OSHA) provides guidelines for handling nanomaterials like graphene to protect worker health. OSHA emphasizes the importance of implementing engineering controls, personal protective equipment, and proper training to mitigate exposure risks. In 2023, OSHA and the EPA signed a Memorandum of Understanding to enhance coordination on chemical reviews, aiming to advance worker safety in industries utilizing nanomaterials.

North America Graphene Market Segmentation

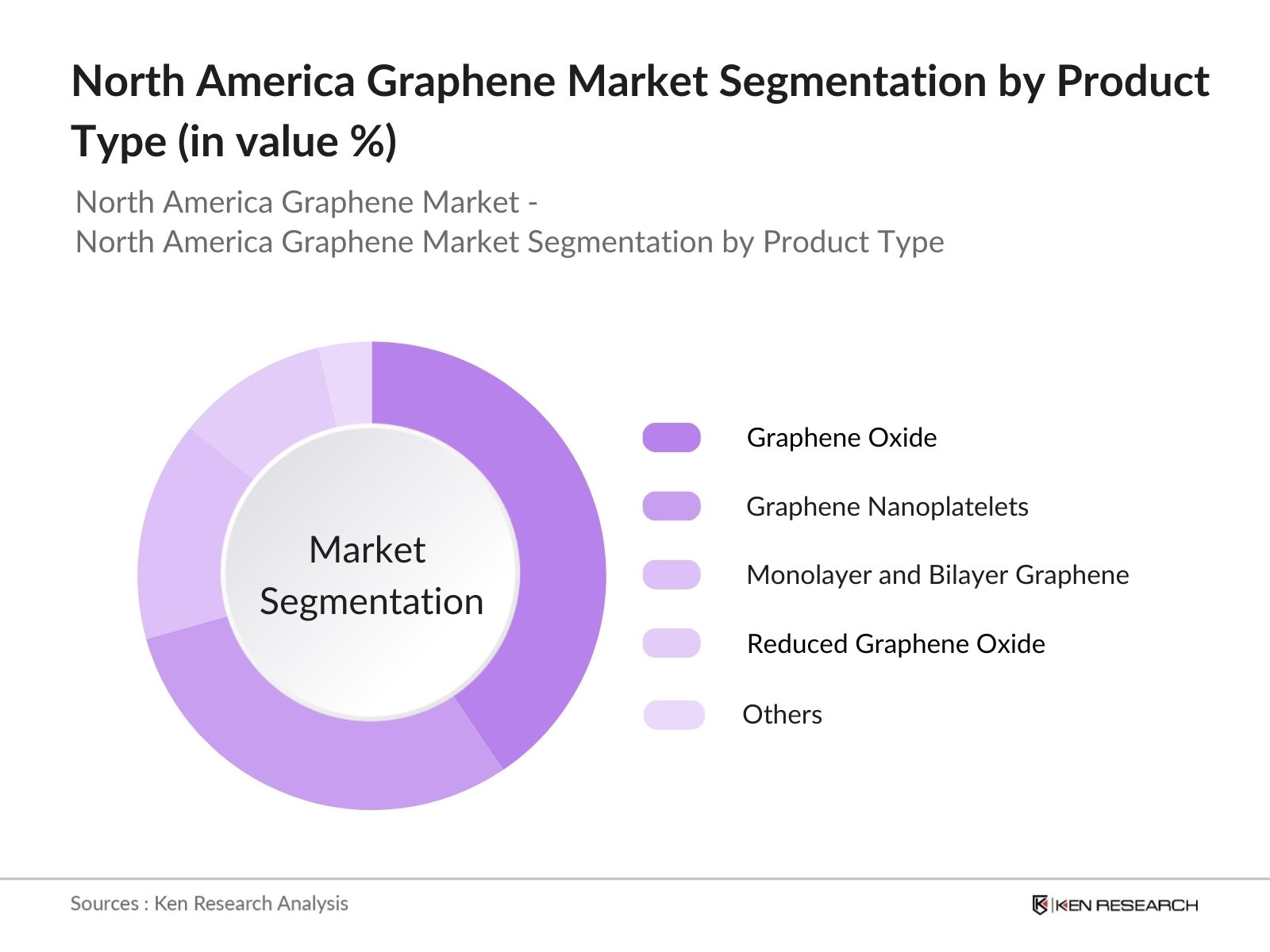

By Product Type: The market is segmented by product type into graphene oxide, graphene nanoplatelets, monolayer and bilayer graphene, reduced graphene oxide, and others. Graphene oxide holds a dominant market share due to its high dispersibility in water and organic solvents, making it versatile for various applications, including electronics and composites. Its cost-effectiveness and ease of large-scale production further enhance its market position.

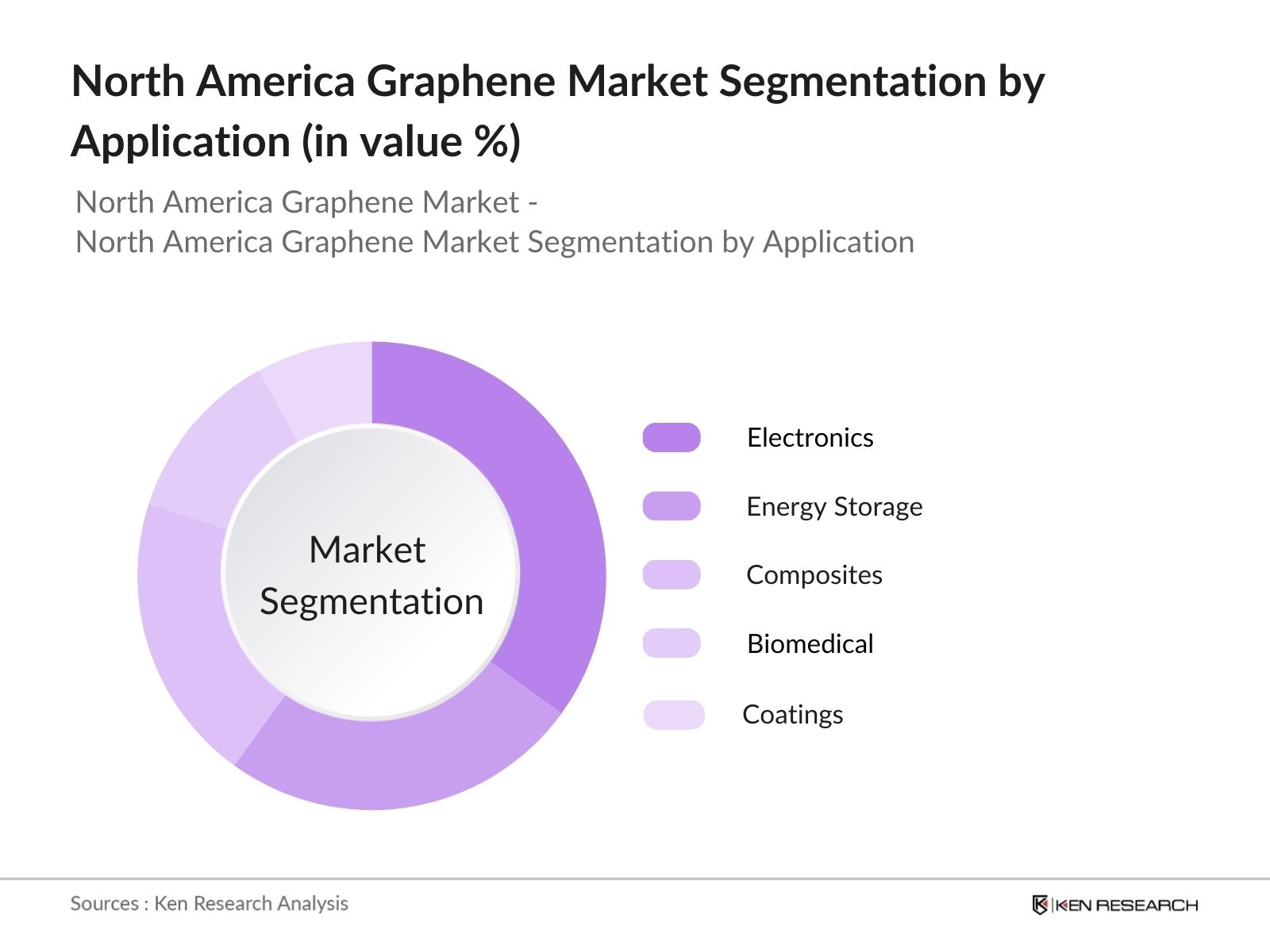

By Application: The market is segmented by application into electronics, energy storage, composites, biomedical, and coatings. The electronics segment dominates the market, driven by graphene's superior electrical conductivity and mechanical strength, which are essential for developing advanced electronic components such as transistors and sensors. The material's flexibility and lightweight nature also contribute to its widespread adoption in this sector.

North America Graphene Market Competitive Landscape

The North American graphene market is characterized by the presence of several key players, each contributing to the market's growth through innovation and strategic initiatives.

North America Graphene Industry Analysis

Growth Drivers

- Advancements in Electronics and Semiconductor Industries: The North American electronics and semiconductor sectors have experienced significant growth, with the U.S. semiconductor industry reporting sales of $258 billion in 2023. This expansion is driven by the increasing demand for advanced materials like graphene, which offers superior electrical conductivity and mechanical strength. Graphene's integration into electronic components enhances performance and efficiency, aligning with the industry's push towards miniaturization and higher processing speeds. The U.S. Department of Commerce highlights the critical role of advanced materials in maintaining the competitiveness of the electronics sector.

- Increasing Demand for Lightweight and Strong Materials in Automotive and Aerospace Sectors: The automotive and aerospace industries in North America are prioritizing lightweight and strong materials to improve fuel efficiency and performance. The U.S. automotive sector produced approximately 10 million vehicles in 2023, emphasizing the need for materials that reduce weight without compromising safety. Graphene's exceptional strength-to-weight ratio makes it an ideal candidate for components in these industries, contributing to enhanced vehicle efficiency and reduced emissions. The Federal Aviation Administration (FAA) supports the adoption of advanced materials to meet stringent performance standards in aerospace applications.

- Rising Investments in Research and Development: Investment in research and development (R&D) is a cornerstone of innovation in North America. In 2023, the U.S. allocated over $190 billion to R&D activities, with a significant portion directed towards advanced materials like graphene. These investments aim to explore graphene's potential across various applications, including electronics, energy storage, and biomedical fields. The National Science Foundation (NSF) emphasizes the importance of R&D in maintaining technological leadership and fostering economic growth.

Market Challenges

- Scalability Issues in Manufacturing: Scaling up graphene production while maintaining quality is a significant challenge. The transition from laboratory-scale synthesis to industrial-scale manufacturing often leads to inconsistencies in material properties. The U.S. Department of Energy highlights the importance of developing scalable production techniques to meet the growing demand for graphene in various industries.

- Regulatory and Environmental Concerns: The environmental impact of graphene production and the lack of comprehensive regulatory frameworks present challenges. The Environmental Protection Agency (EPA) is actively evaluating the environmental and health implications of nanomaterials, including graphene, to establish appropriate guidelines and standards.

North America Graphene Market Future Outlook

Over the next five years, the North American graphene market is expected to experience significant growth, driven by continuous advancements in graphene production techniques, increasing applications across various industries, and supportive government policies promoting nanotechnology research. The expansion of renewable energy projects and the growing demand for lightweight, high-strength materials in automotive and aerospace sectors are also anticipated to contribute to market growth.

Future Market Opportunities

- Emerging Applications in Biomedical and Healthcare Sectors: Graphene's biocompatibility and unique properties open new avenues in biomedical applications. The National Institutes of Health (NIH) is funding research into graphene-based biosensors and drug delivery systems, aiming to revolutionize diagnostics and therapeutics. These advancements have the potential to enhance patient outcomes and drive growth in the healthcare sector.

- Strategic Collaborations and Partnerships: Collaborations between academia, industry, and government agencies are fostering innovation in graphene applications. The U.S. Department of Energy's Advanced Research Projects Agency-Energy (ARPA-E) funds projects that bring together multidisciplinary teams to explore graphene's potential in energy storage and conversion. Such partnerships are instrumental in accelerating the commercialization of graphene technologies.

Scope of the Report

|

Product Type |

- Graphene Oxide |

|

Application |

- Electronics |

|

End-Use Industry |

- Automotive |

|

Country |

- United States |

|

Cross Comparison Parameters |

- Number of Employees |

Products

Key Target Audience

Automotive Manufacturers

Aerospace and Defense Contractors

Electronics and Semiconductor Companies

Energy Storage Solution Providers

Biomedical and Healthcare Companies

Coatings and Paints Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency, Occupational Safety and Health Administration)

Companies

Major Players

NanoXplore Inc.

Graphenea SA

Directa Plus S.p.A.

Haydale Graphene Industries PLC

Applied Graphene Materials PLC

G6 Materials Corp

Talga Group Ltd

CVD Equipment Corporation

Focus Graphite Inc.

Zentek Ltd

2D Carbon Technology

Thomas Swan & Co. Ltd

Graphensic AB

Graphene Square Inc.

AMO GmbH

Table of Contents

North America Graphene Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

North America Graphene Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

North America Graphene Market Dynamics

3.1 Growth Drivers

3.1.1 Increasing Demand in Electronics (Conductivity, Heat Resistance)

3.1.2 Rising Applications in Composite Materials (Strength, Flexibility)

3.1.3 Growth in Energy Storage Applications (Battery Efficiency, Lifespan)

3.1.4 Advancements in Biomedical Uses (Biocompatibility, Drug Delivery)

3.2 Market Challenges

3.2.1 High Production Costs (Material Sourcing, Manufacturing Processes)

3.2.2 Limited Scalability of Graphene Products (Bulk Production, Consistency)

3.2.3 Regulatory Uncertainties (Material Safety, Environmental Impact)

3.2.4 Technical Limitations in Integration (Compatibility, Durability)

3.3 Opportunities

3.3.1 Emerging Applications in Aerospace (Lightweight, Structural Strength)

3.3.2 Increased R&D Investments (Innovation, Application Expansion)

3.3.3 Adoption in Automotive Industry (Fuel Efficiency, Durability)

3.3.4 Collaborations with Academic Institutions (Innovation, Experimentation)

3.4 Trends

3.4.1 Commercialization of Graphene-Based Wearables

3.4.2 Integration with 3D Printing Technologies

3.4.3 Development of Flexible Electronics

3.4.4 Sustainable Graphene Production (Eco-Friendly, Recyclable Sources)

3.5 Government Regulations and Standards

3.5.1 Environmental Compliance (Waste Management, Emission Control)

3.5.2 Safety Standards (Workplace Handling, Consumer Safety)

3.5.3 Trade Regulations (Imports, Exports, Tariffs)

3.5.4 Research Grants and Incentives

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces

3.9 Competition Ecosystem

North America Graphene Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Graphene Oxide

4.1.2 Reduced Graphene Oxide

4.1.3 Graphene Nanoplatelets

4.1.4 Mono-layered Graphene

4.2 By Application (In Value %)

4.2.1 Electronics

4.2.2 Energy Storage

4.2.3 Composites

4.2.4 Biomedical

4.3 By End-User Industry (In Value %)

4.3.1 Automotive

4.3.2 Aerospace

4.3.3 Defense

4.3.4 Consumer Electronics

4.4 By Distribution Channel (In Value %)

4.4.1 Direct Sales

4.4.2 Distribution Networks

4.4.3 E-commerce

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

North America Graphene Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 CVD Equipment Corporation

5.1.2 Graphenea

5.1.3 Haydale Graphene Industries

5.1.4 First Graphene Ltd

5.1.5 ACS Material, LLC

5.1.6 Graphene Frontiers

5.1.7 Applied Graphene Materials

5.1.8 XG Sciences

5.1.9 NanoXplore Inc.

5.1.10 Thomas Swan & Co. Ltd

5.1.11 Vorbeck Materials Corp.

5.1.12 Lomiko Metals Inc.

5.1.13 G6 Materials Corp.

5.1.14 Global Graphene Group

5.1.15 Directa Plus S.p.A

5.2 Cross Comparison Parameters (Technology Focus, Revenue, Manufacturing Capacity, R&D Expenditure, Key Partnerships, Regional Presence, Application Portfolio, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

North America Graphene Market Regulatory Framework

6.1 Environmental Standards (Emission Guidelines, Material Disposal)

6.2 Compliance Requirements (Workplace Safety, Material Handling)

6.3 Certification Processes (Material Quality, Process Validation)

North America Graphene Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

North America Graphene Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

North America Graphene Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North American Graphene Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North American Graphene Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple graphene manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North American Graphene Market.

Frequently Asked Questions

How big is the North American Graphene Market?

The North American graphene market is valued at USD 152 million, based on a five-year historical analysis.

What are the challenges in the North American Graphene Market?

Challenges in the North American graphene market include high production costs, scalability issues in manufacturing, and regulatory constraints associated with environmental and safety standards, which can hinder widespread adoption.

Who are the major players in the North American Graphene Market?

Key players in this North American graphene market include NanoXplore Inc., Graphenea SA, Directa Plus S.p.A., Haydale Graphene Industries PLC, and Applied Graphene Materials PLC. These companies lead through continuous innovation, extensive R&D investments, and strategic partnerships.

What are the growth drivers for the North American Graphene Market?

The North American graphene market is propelled by advancements in electronics, the increasing demand for high-performance materials in automotive and aerospace sectors, and ongoing research and development in nanotechnology, which expands graphenes application potential.

How is graphene used in the North American automotive industry?

Graphene is widely used in the automotive industry for creating lighter, stronger composite materials and enhancing battery performance for electric vehicles, contributing to vehicle efficiency and sustainability in the North American graphene market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.