North America Graphite Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD3451

October 2024

100

About the Report

North America Graphite Market Overview

- The North America Graphite Market is valued at USD 2 billion, driven by strong demand from various industries, especially electric vehicles (EVs), renewable energy, and metallurgy. Graphites essential role in lithium-ion batteries, primarily used in EVs and renewable energy storage systems, is a primary growth factor. The region's growth is further fueled by governmental initiatives promoting clean energy and reducing carbon emissions, which has encouraged the use of graphite in both battery technology and high-efficiency industrial applications. The market shows consistent year-on-year growth due to its integration in energy-efficient technologies.

- The market is dominated by the United States and Canada due to their established industrial infrastructure and ongoing investments in EV manufacturing and energy storage solutions. The U.S. leads in the production of synthetic graphite, primarily due to its advanced technological capabilities and significant investments in battery production. Canada, rich in natural graphite reserves, plays a pivotal role in the supply of high-quality graphite, making it a key supplier in the global value chain. Both countries benefit from robust mining regulations, stable government support, and substantial investments in clean energy.

- The North American Free Trade Agreement (NAFTA) and its successor, the USMCA, have positively impacted the graphite trade by reducing tariffs on raw materials. The elimination of tariffs under USMCA has allowed for a freer flow of graphite between the U.S., Canada, and Mexico. By 2024, trade in graphite raw materials across these countries had increased by 15%, according to the U.S. Census Bureau, bolstering domestic supply chains and reducing reliance on imports from non-regional partners.

North America Graphite Market Segmentation

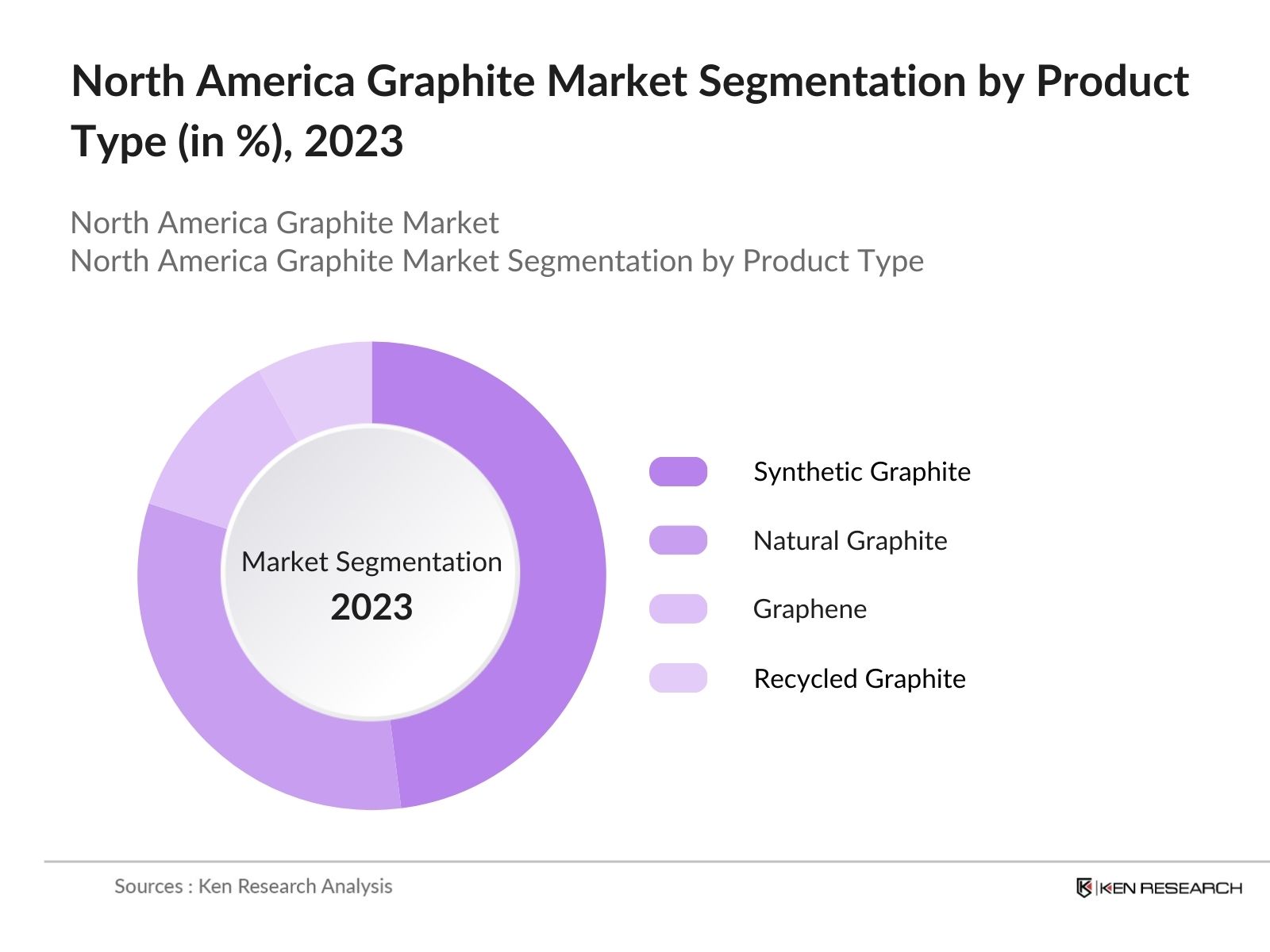

By Product Type: The North America Graphite Market is segmented by product type into natural graphite, synthetic graphite, graphene, and recycled graphite. Synthetic graphite dominates the market share due to its widespread use in battery production, particularly in electric vehicles. This dominance can be attributed to its higher purity levels and controlled production processes, which make it suitable for high-performance applications such as EV batteries and aerospace components.

By Application: The North America Graphite Market is segmented by application into batteries, refractories, foundry, lubricants, and electronics. Batteries have a dominant market share due to the exponential growth in electric vehicle production and the increasing demand for efficient energy storage systems. Graphite's role as an essential component in lithium-ion batteries, which are used extensively in electric vehicles and renewable energy storage systems, has driven the demand for this application.

North America Graphite Market Competitive Landscape

The North America Graphite Market is dominated by several key players who have established a strong foothold due to their extensive production capacities, technological advancements, and strategic partnerships. These companies are engaged in the production of both synthetic and natural graphite and have diversified their applications in industries such as energy storage, automotive, and metallurgy. This consolidation highlights the influence of established companies in driving market dynamics and technological advancements.

|

Company |

Established |

Headquarters |

Product Offering |

Technology Focus |

Production Capacity |

Raw Material Sourcing |

Geographical Reach |

Revenue (USD) |

R&D Investment |

|

GrafTech International |

1886 |

Ohio, USA |

|||||||

|

Northern Graphite Corporation |

2002 |

Ottawa, Canada |

|||||||

|

Westwater Resources |

1977 |

Alabama, USA |

|||||||

|

SGL Carbon SE |

1878 |

Wiesbaden, Germany |

|||||||

|

Focus Graphite Inc. |

1998 |

Quebec, Canada |

North America Graphite Industry Analysis

Growth Drivers

- Electrification of transportation (Graphite used in EV batteries): The rise of electric vehicle (EV) adoption in North America is significantly driving demand for graphite, especially as a key component of lithium-ion batteries. According to the International Energy Agency (IEA), North America saw a record of over 2.3 million EV sales by mid-2024, with each EV battery using around 55 kg of graphite.

- Demand in Steel and Foundry sectors (Graphite as a lubricant and refractory material): The steel industry is one of the largest consumers of graphite in North America, where it is used as a lubricant and a refractory material in furnaces. As of 2023, the U.S. steel production reached 90 million metric tons, with 35% of the graphite market serving this sector. The National Steel Policy is fostering continued investments in steel production, which directly impacts graphite consumption for its thermal conductivity and lubricating properties in extreme temperatures.

- Renewable Energy Growth (Graphite's role in solar panels and wind turbines): Graphite plays a critical role in renewable energy technologies, particularly in the manufacturing of solar panels and wind turbines. North America added 13 GW of new solar capacity in 2023, with Canada leading the region in wind energy expansion. The application of graphite in solar PV cells for conductivity and in wind turbines for heat resistance has seen a growing demand due to renewable energy policies.

Market Challenges

- Environmental Concerns (Mining impact, graphite's environmental footprint): Graphite mining, particularly natural graphite extraction, poses significant environmental concerns, including habitat disruption and water contamination. According to the U.S. Environmental Protection Agency (EPA), graphite mines are responsible for substantial environmental degradation, with over 75% of the graphite consumed in North America being imported from countries with less stringent environmental laws.

- Supply Chain Bottlenecks (Dependence on imported raw materials): North America is highly dependent on imported graphite, with 98% of its natural graphite sourced from international markets, primarily China and Mozambique, as per the U.S. Geological Survey. Supply chain bottlenecks, including transportation delays and trade restrictions, have significantly impacted the availability of graphite for critical industries.

North America Graphite Market Future Outlook

Over the next five years, the North America Graphite Market is expected to experience significant growth, driven by advancements in battery technologies, increased production of electric vehicles, and greater integration of renewable energy storage solutions. With government support in the form of incentives for clean energy technologies and the automotive industry's continued pivot towards electrification, the demand for both synthetic and natural graphite is anticipated to rise.

Market Opportunities

- Advancements in Graphite Processing Technology (Increased efficiency in production): Technological advancements in graphite processing are improving production efficiency and reducing environmental impact. By 2024, new technologies such as high-temperature purification and electrochemical processing have reduced energy consumption by up to 30%, according to the U.S. Department of Energy. These innovations make synthetic graphite production more cost-effective and environmentally sustainable, offering significant opportunities for scaling graphite production to meet rising demand in the battery and renewable energy sectors.

- Expansion in Battery Manufacturing (Lithium-ion and next-gen battery applications): The North American battery manufacturing sector is expanding rapidly, with 20 new gigafactories planned by 2025, driven by the electric vehicle and energy storage markets. Graphite, a critical component in lithium-ion batteries, accounts for nearly 30% of the battery's composition. Government incentives like the U.S. Department of Energy's USD 3 billion fund for battery material supply chains are accelerating this expansion, creating a surge in demand for graphite.

Scope of the Report

|

Product Type |

Natural Graphite Synthetic Graphite Graphene Recycled Graphite |

|

Application |

Batteries Refractory Materials Foundry Lubricants Electronics |

|

End-User Industry |

Automotive Electronics & Electricals Metallurgy Energy Chemicals |

|

Form Type |

Amorphous Graphite Flake Graphite Vein Graphite Spherical Graphite |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Electric Vehicle Manufacturers

Energy Storage Companies

Battery Technology Developers

Steel and Foundry Industries

Renewable Energy Producers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (EPA, Department of Energy, Environment Canada)

Mining and Raw Material Suppliers

Companies

Players Mentioned in the Report

GrafTech International

Northern Graphite Corporation

Westwater Resources

SGL Carbon SE

Asbury Carbons

AMG Advanced Metallurgical Group

Mason Graphite

Focus Graphite Inc.

Syrah Resources

Imerys Graphite & Carbon

Table of Contents

1. North America Graphite Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Graphite Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Graphite demand in EV batteries, Steel production, Green technologies)

3. North America Graphite Market Analysis

3.1. Growth Drivers

3.1.1. Electrification of transportation (Graphite used in EV batteries)

3.1.2. Demand in Steel and Foundry sectors (Graphite as a lubricant and refractory material)

3.1.3. Renewable Energy Growth (Graphite's role in solar panels and wind turbines)

3.1.4. Government Regulations and Clean Energy Initiatives (Supporting graphite mining and production for sustainable energy)

3.2. Market Challenges

3.2.1. Environmental Concerns (Mining impact, graphite's environmental footprint)

3.2.2. Price Volatility (Fluctuations in synthetic and natural graphite prices)

3.2.3. Supply Chain Bottlenecks (Dependence on imported raw materials)

3.3. Opportunities

3.3.1. Advancements in Graphite Processing Technology (Increased efficiency in production)

3.3.2. Expansion in Battery Manufacturing (Lithium-ion and next-gen battery applications)

3.3.3. Development of Graphene Applications (Graphite derivatives)

3.4. Trends

3.4.1. Use of Recycled Graphite (Sustainability trend in graphite sourcing)

3.4.2. Shift Towards Synthetic Graphite (Industries adopting synthetic over natural)

3.4.3. Growth of Graphene Technology (Emerging applications in electronics and energy storage)

3.5. Government Regulation

3.5.1. North American Free Trade Agreements and Tariffs (Impact on graphite trade)

3.5.2. Environmental Protection Regulations (Graphite mining regulations)

3.5.3. Clean Energy Acts (Government incentives for graphite applications in clean energy)

3.5.4. Mining Legislation and Permits

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Graphite Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Natural Graphite

4.1.2. Synthetic Graphite

4.1.3. Graphene

4.1.4. Recycled Graphite

4.2. By Application (In Value %)

4.2.1. Batteries (Including Lithium-ion)

4.2.2. Refractory Materials

4.2.3. Foundry

4.2.4. Lubricants

4.2.5. Electronics (Semiconductors, Conductors)

4.3. By End-User Industry (In Value %)

4.3.1. Automotive

4.3.2. Electronics & Electricals

4.3.3. Metallurgy

4.3.4. Energy (Renewables, Energy storage)

4.3.5. Chemicals (Industrial and Specialty)

4.4. By Form Type (In Value %)

4.4.1. Amorphous Graphite

4.4.2. Flake Graphite

4.4.3. Vein Graphite

4.4.4. Spherical Graphite

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Graphite Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. GrafTech International

5.1.2. Northern Graphite Corporation

5.1.3. Westwater Resources

5.1.4. SGL Carbon SE

5.1.5. Asbury Carbons

5.1.6. AMG Advanced Metallurgical Group

5.1.7. Mason Graphite

5.1.8. Focus Graphite Inc.

5.1.9. Syrah Resources

5.1.10. Imerys Graphite & Carbon

5.1.11. Graphite One Inc.

5.1.12. Graphite India Ltd.

5.1.13. Showa Denko Carbon

5.1.14. Triton Minerals

5.1.15. NextSource Materials Inc.

5.2. Cross Comparison Parameters (Market-specific: Production capacity, Synthetic vs Natural graphite use, Market share in end-use industries, Purity levels, Technological innovations, Geographical reach, Supply chain integration, Cost leadership strategies)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Graphite Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map of the North America Graphite Market, detailing major stakeholders such as mining companies, battery manufacturers, and end-use industries. Extensive desk research is conducted, drawing from both secondary and proprietary databases to gather critical market data.

Step 2: Market Analysis and Construction

In this step, historical data is analyzed to track market trends, supply chain dynamics, and revenue generation in various end-use applications. This includes the evaluation of industry-specific statistics related to graphite production and technological advancements in battery storage.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses are tested through expert interviews with industry professionals, including executives from leading graphite companies and battery manufacturers. These consultations are critical in validating market assumptions and providing insights on operational and financial dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from direct industry interactions and proprietary models, providing a validated and reliable analysis of the North America Graphite Market. This includes in-depth insights on product segments, revenue streams, and market trends.

Frequently Asked Questions

01. How big is the North America Graphite Market?

The North America Graphite Market is valued at USD 2 billion, driven by high demand from the electric vehicle and renewable energy sectors, as well as traditional industries like steel and foundry.

02. What are the challenges in the North America Graphite Market?

The North America Graphite Market challenges include environmental concerns regarding mining practices, price volatility of both synthetic and natural graphite, and supply chain dependencies on imported raw materials.

03. Who are the major players in the North America Graphite Market?

The North America Graphite Market key players include GrafTech International, Northern Graphite Corporation, Westwater Resources, and SGL Carbon SE. These companies dominate due to their extensive production capacities, technological innovations, and strategic partnerships.

04. What are the growth drivers of the North America Graphite Market?

The North America Graphite market is driven by increasing demand for electric vehicles, advancements in battery technology, and a growing focus on renewable energy. Graphites essential role in energy storage makes it a critical component in the transition to cleaner technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.