North America Hardware Security Modules Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1764

December 2024

92

About the Report

North America Hardware Security Modules Market Overview

- The North America Hardware Security Modules (HSM) Market was valued at USD 545 million in 2023. This growth is driven by increasing concerns over data security, the rising adoption of digital payments, and the need for robust encryption solutions across industries such as banking, finance, and healthcare. The growing awareness of cyber threats and stringent regulatory requirements also contribute significantly to the expansion of the HSM market in the region.

- Key players in the North American HSM market include Thales Group, Gemalto (now part of Thales), Utimaco, IBM Corporation, and Entrust Datacard. These companies dominate the market through continuous innovation, strategic partnerships, and a strong focus on cybersecurity solutions tailored to various industries.

- In 2023, Thales Group announced the launch of its next-generation Luna HSM, designed to offer enhanced encryption, key management, and authentication capabilities. This development is significant as it represents the industry's ongoing efforts to address the growing complexity of cyber threats. According to Thales, the Luna HSM series has already been adopted by several leading financial institutions in North America, indicating its market impact.

- In 2023, California was dominating the market due to its status as a tech hub, with a high concentration of financial institutions, technology companies, and startups that require robust data security solutions. The presence of leading HSM manufacturers and a favorable regulatory environment further strengthens California's position in the market.

North America Hardware Security Modules Market Segmentation

The North America Hardware Security Modules Market is segmented into different factors like by product type, by application and region.

By Product Type: The market is segmented by product type into General Purpose HSMs, Payment HSMs, and Others. In 2023, Payment HSMs held a dominant market share due to their critical role in securing financial transactions and payment processing. The growing adoption of digital payment methods, such as contactless payments and mobile wallets, has significantly increased the demand for Payment HSMs. The widespread use of these HSMs by financial institutions to comply with regulatory requirements further solidifies their dominance in the market.

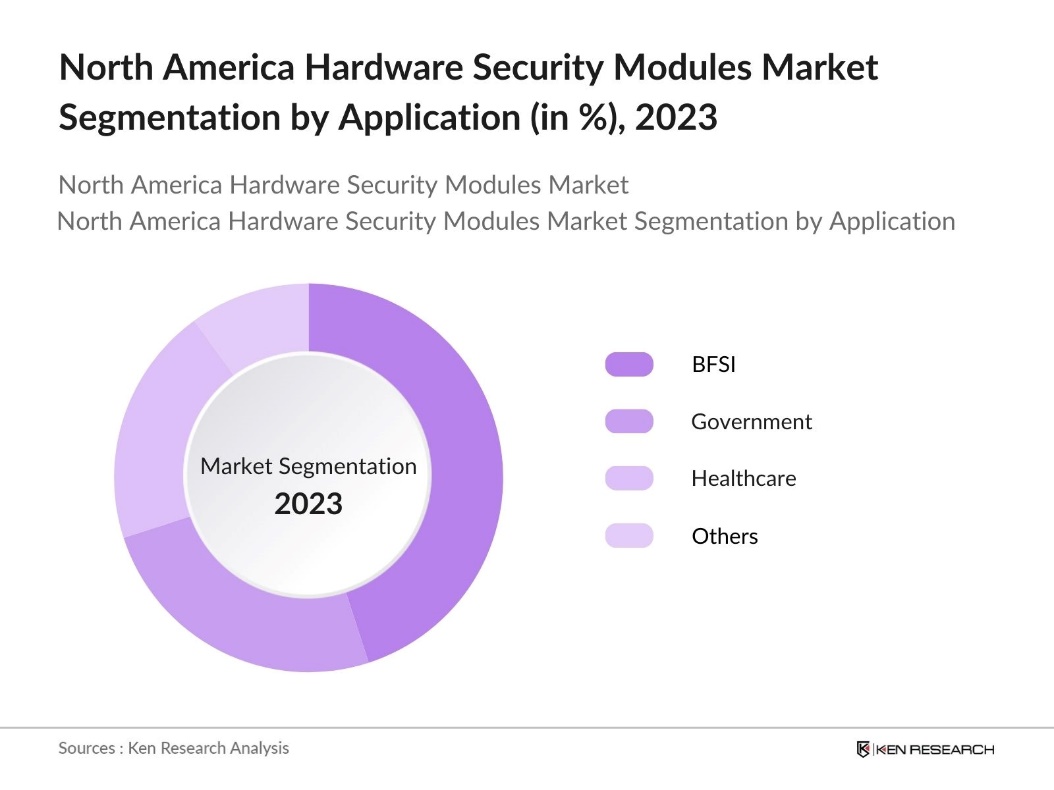

By Application: The market is segmented by application into BFSI (Banking, Financial Services, and Insurance), Government, Healthcare, and Others. In 2023, the BFSI sector dominated the market due to the increasing number of financial transactions requiring secure encryption and authentication. The strict regulatory environment in North America, particularly in the financial sector, has driven the widespread adoption of HSMs. Additionally, the rise of fintech companies and the growing popularity of digital banking solutions have further boosted the demand for HSMs in the BFSI sector.

By Region: The market is segmented by region into the USA and Canada. In 2023, the USA held a dominant market share, largely due to its advanced technological infrastructure, high concentration of financial institutions, and stringent cybersecurity regulations. The presence of leading technology companies and a strong focus on innovation in the USA has also contributed to its leadership position in the HSM market.

North America Hardware Security Modules Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Thales Group |

2000 |

La Dfense, France |

|

Utimaco |

1983 |

Aachen, Germany |

|

IBM Corporation |

1911 |

Armonk, New York, USA |

|

Entrust Datacard |

1969 |

Minneapolis, Minnesota, USA |

|

Atos |

1997 |

Bezons, France |

- Utimaco: In 2024, Utimaco, a global leader in IT security solutions, has announced the expansion of its Trust as a Service marketplace, introducing new features and deployment options. The updated marketplace allows businesses to seamlessly choose between on-premises and cloud-based solutions within a unified interface. With Utimaco's General Purpose Hardware Security Module (HSM) as a Service, customers can lower capital and labor expenses, eliminating the need for dedicated server rooms, secure environments, or data center selection.

- Entrust Datacard: In 2024, Entrust has launched the first commercially available Post-Quantum Ready PKI-as-a-Service platform. This platform allows organizations to issue quantum-safe certificates, supporting both current and quantum-safe cryptographic algorithms. It prepares enterprises for the future of quantum computing threats while integrating smoothly with existing systems, ensuring robust security for evolving cybersecurity needs.

North America Hardware Security Modules Market Analysis

North America Hardware Security Modules Market Growth Drivers

- Increased Adoption of Cloud-Based Services: The North America Hardware Security Modules (HSM) market is significantly driven by the growing adoption of cloud-based services across various industries. In 2024, the U.S. cloud services market is estimated to reach a significant size, with enterprises increasingly requiring hardware-based encryption to secure sensitive data in cloud environments. This surge in demand for cloud services is directly propelling the need for HSMs, as organizations prioritize data security to comply with stringent regulations such as the U.S. Federal Information Security Management Act (FISMA).

- Expansion of Digital Payment Ecosystems: The expansion of digital payment ecosystems in North America is another critical growth driver. According to Kepios Pte. Ltd., at the start of Q4 2023, 5.30 billion people globally (equivalent to 65.7% of the worlds total population) were using the internet, and around 84% of the mobile phones in use were smartphones. This is driven by the widespread adoption of contactless payments, mobile wallets, and e-commerce platforms. The need for secure transaction processing has led to a substantial increase in the deployment of Payment HSMs by financial institutions and payment service providers to ensure the integrity and confidentiality of transactions.

- Rising Cybersecurity Threats: The escalation of cybersecurity threats, including ransomware attacks and data breaches, is driving organizations to invest in advanced security solutions like HSMs. These modules provide the necessary encryption and key management capabilities to protect critical data and ensure the security of sensitive information across industries such as finance, healthcare, and government.

North America Hardware Security Modules Market Challenges

- Complexity of Integration with Existing Systems: Integrating HSMs with existing IT and security systems remains a complex and time-consuming process for many organizations. In 2024, over 60% of companies in North America reported difficulties in integrating HSMs with legacy systems, leading to operational disruptions and increased costs. The complexity of integration is a major deterrent for organizations considering HSM adoption, particularly in industries with deeply entrenched legacy systems.

- Evolving Cyber Threat Landscape: The constantly evolving cyber threat landscape presents a significant challenge to the North American HSM market. In 2024, new forms of cyber threats, including quantum computing-based attacks, are expected to emerge, potentially rendering traditional encryption methods obsolete. This evolving threat environment necessitates continuous innovation and updates to HSM technology, increasing the pressure on manufacturers and users to stay ahead of potential vulnerabilities.

North America Hardware Security Modules Market Government Initiatives

- Canada's new Digital Charter Implementation Act: In June 2022, the Canadian government introduced the Digital Charter Implementation Act (Bill C-27) to modernize personal information protection and regulate AI usage. The act comprises three key components: the Consumer Privacy Protection Act, the Personal Information and Data Protection Tribunal Act, and the Artificial Intelligence and Data Act. It aims to give Canadians more control over their data, increase transparency, and enforce stricter penalties for non-compliance.

- U.S. Department of Homeland Security (DHS): The U.S. Department of Homeland Security (DHS) has launched the Tribal Cybersecurity Grant Program, providing $18.2 million to enhance cybersecurity resilience among tribal communities. This initiative focuses on improving cybersecurity capabilities, protecting critical infrastructure, and increasing overall resilience against cyber threats. The funding supports initiatives such as implementing hardware security measures, enhancing encryption, and developing cybersecurity strategies tailored to the needs of tribal governments.

North America Hardware Security Modules Market Future Outlook

The North American HSM Market is projected to grow exponentially by 2028, driven by the increasing adoption of cloud-based services, IoT devices, and the ongoing digital transformation across various sectors. The integration of HSMs with emerging technologies like quantum computing and blockchain will further propel market growth. Additionally, the regulatory landscape is likely to become even more stringent, necessitating more widespread adoption of advanced security modules.

Market Trends

- Adoption of Quantum-Safe HSMs: Over the next five years, the adoption of quantum-safe HSMs is expected to accelerate as organizations prepare for the potential threats posed by quantum computing. By 2028, it is anticipated that quantum-safe HSMs will become the standard for securing sensitive data in North America, particularly in sectors such as finance and government. The ongoing development and implementation of quantum-safe encryption algorithms will drive this trend, ensuring that organizations remain protected against future quantum threats.

- Integration of HSMs with Blockchain Technology: The integration of HSMs with blockchain technology is expected to gain momentum in the coming years, driven by the need for secure and tamper-proof digital transactions. By 2028, HSMs will play a crucial role in securing blockchain networks, particularly in applications such as supply chain management, digital identity, and decentralized finance (DeFi). The increasing adoption of blockchain technology in North America will fuel the demand for HSMs that can securely manage cryptographic keys and ensure the integrity of blockchain transactions.

Scope of the Report

|

By Product Type |

General Purpose HSMs Payment HSMs Others |

|

By Application |

BFSI Government Healthcare Others |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Payment processing companies

Telecommunications companies

IT Companies

E-commerce platforms

Manufacturing companies

Oil and Gas Companies

Energy sector companies

Government agencies (U.S. Department of Homeland Security)

Banks and financial institutions

Investors and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Thales Group

Utimaco

IBM Corporation

Entrust Datacard

Atos

Gemalto (Thales)

Futurex

Yubico

Micro Focus

Securosys

nCipher Security (Entrust)

Keyfactor

Crypto4A

Feitian Technologies

Cavium (Marvell)

Table of Contents

1. North America Hardware Security Modules Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Hardware Security Modules Market Size (in USD Mn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Hardware Security Modules Market Analysis

3.1 Growth Drivers

3.1.1 Increased Adoption of Cloud-Based Services

3.1.2 Expansion of Digital Payment Ecosystems

3.1.3 Rising Cybersecurity Threats

3.1.4 Growing Focus on Regulatory Compliance

3.2 Challenges

3.2.1 High Implementation Costs

3.2.2 Shortage of Skilled Cybersecurity Professionals

3.2.3 Complexity of Integration with Existing Systems

3.2.4 Evolving Cyber Threat Landscape

3.3 Opportunities

3.3.1 Expansion of HSM-as-a-Service Offerings

3.3.2 Growing Demand for Quantum-Safe Encryption

3.3.3 Increased Adoption in IoT and Blockchain

3.3.4 Strategic Collaborations with Cloud Providers

3.4 Trends

3.4.1 Adoption of Quantum-Safe HSMs

3.4.2 Integration of HSMs with Blockchain Technology

3.4.3 Expansion of HSM-as-a-Service Model

3.4.4 Increased Government Regulations Mandating HSM Usage

3.5 Government Initiatives

3.5.1 Canadas Digital Charter Implementation Act

3.5.2 U.S. Tribal Cybersecurity Grant Program

3.5.3 National Cybersecurity Strategy (U.S.)

3.5.4 Federal Grants for Cybersecurity Enhancements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. North America Hardware Security Modules Market Segmentation, 2023

4.1 By Product Type (in Value %)

4.1.1 General Purpose HSMs

4.1.2 Payment HSMs

4.1.3 Others

4.2 By Application (in Value %)

4.2.1 BFSI (Banking, Financial Services, and Insurance)

4.2.2 Government

4.2.3 Healthcare

4.2.4 Others

4.3 By Technology (in Value %)

4.3.1 On-Premises

4.3.2 Cloud-Based

4.3.3 Hybrid

4.4 By Deployment (in Value %)

4.4.1 Hardware-Based

4.4.2 Software-Based

4.4.3 HSM-as-a-Service

4.5 By Region (in Value %)

4.5.1 USA

4.5.2 Canada

5. North America Hardware Security Modules Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1 Thales Group

5.1.2 Utimaco

5.1.3 IBM Corporation

5.1.4 Entrust Datacard

5.1.5 Atos

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Hardware Security Modules Market Competitive Landscape

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Venture Capital Funding

6.4.2 Government Grants

6.4.3 Private Equity Investments

7. North America Hardware Security Modules Market Regulatory Framework

7.1 Data Protection Regulations

7.2 Compliance Requirements

7.3 Certification Processes

8. North America Hardware Security Modules Future Market Size (in USD Mn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. North America Hardware Security Modules Future Market Segmentation, 2028

9.1 By Product Type (in Value %)

9.2 By Application (in Value %)

9.3 By Technology (in Value %)

9.4 By Deployment (in Value %)

9.5 By Region (in Value %)

10. North America Hardware Security Modules Market Analysts Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on North America Hardware Security Modules Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Hardware Security Modules Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple HSM companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from HSM companies.

Frequently Asked Questions

01 How big is the North America Hardware Security Modules Market?

The North America Hardware Security Modules (HSM) Market was valued at USD 545 million in 2023, driven by increasing concerns over data security, rising adoption of digital payments, and the need for robust encryption solutions across various industries.

02 What are the challenges in the North America Hardware Security Modules Market?

Challenges in North America Hardware Security Modules Market include the high cost of implementation, a shortage of skilled cybersecurity professionals, complexity in integrating HSMs with existing systems, and the evolving cyber threat landscape.

03 Who are the major players in the North America Hardware Security Modules Market?

Key players in North America Hardware Security Modules Market include Thales Group, Utimaco, IBM Corporation, Entrust Datacard, and Atos. These companies dominate through innovation, strategic partnerships, and strong cybersecurity solutions tailored to industry needs.

04 What are the growth drivers of the North America Hardware Security Modules Market?

Growth drivers in North America Hardware Security Modules Market include the increased adoption of cloud-based services, the expansion of digital payment ecosystems, rising cybersecurity threats, and a growing focus on regulatory compliance across various sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.