North America Head Mounted Display Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD8961

November 2024

94

About the Report

North America Head Mounted Display Market Overview

- The North America Head Mounted Display market is valued at USD 3,547 million, based on a five-year historical analysis. This growth is driven by advancements in augmented and virtual reality technologies, particularly for applications in gaming, healthcare, and defense. As industries continue to explore immersive and interactive solutions, HMDs are emerging as essential tools for training, simulation, and entertainment, with increased adoption anticipated across sectors focused on experiential learning and remote collaboration.

- The United States is the dominant player in the North America HMD market due to its substantial investment in technology innovation and extensive research facilities. Companies in the U.S. lead in HMD applications across defense and healthcare sectors, with Canada following closely due to its growth in industrial and entertainment applications.

- The U.S. FDA regulates HMDs used in medical applications, ensuring they meet safety standards for health care usage. In 2023, the FDA approved over 20 new HMD models specifically designed for medical training and diagnostics, emphasizing their safety for healthcare settings. This regulatory oversight maintains high standards for HMD devices used in sensitive environments, particularly within hospitals and clinics.

North America Head Mounted Display Market Segmentation

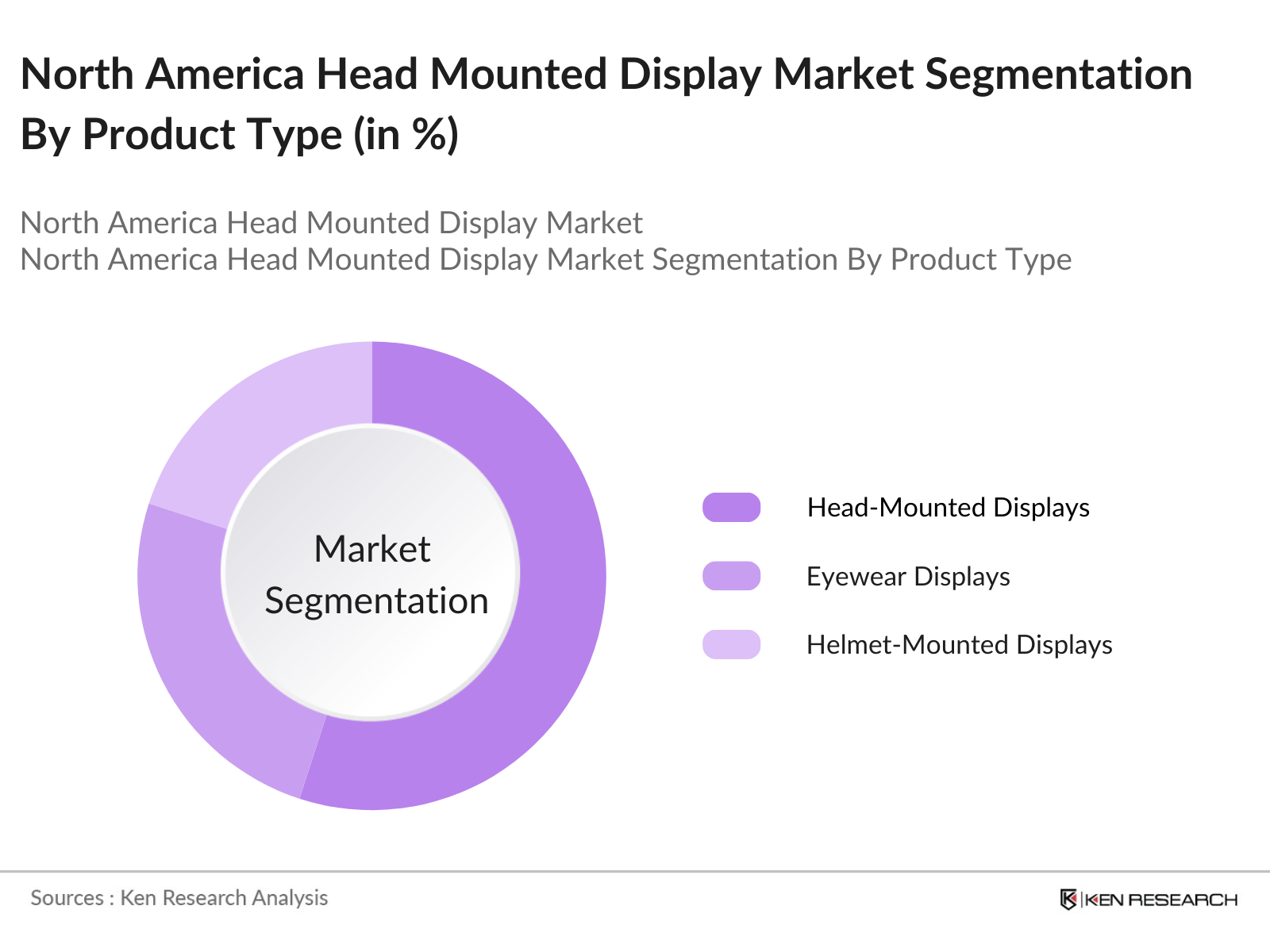

By Product Type: The market is segmented by product type into head-mounted displays, eyewear displays, and helmet-mounted displays. Currently, head-mounted displays (HMDs) hold a dominant share in the market due to their versatility across applications such as gaming and healthcare. The high adoption rate is largely due to the affordability and increasing accessibility of HMD devices for individual and commercial users.

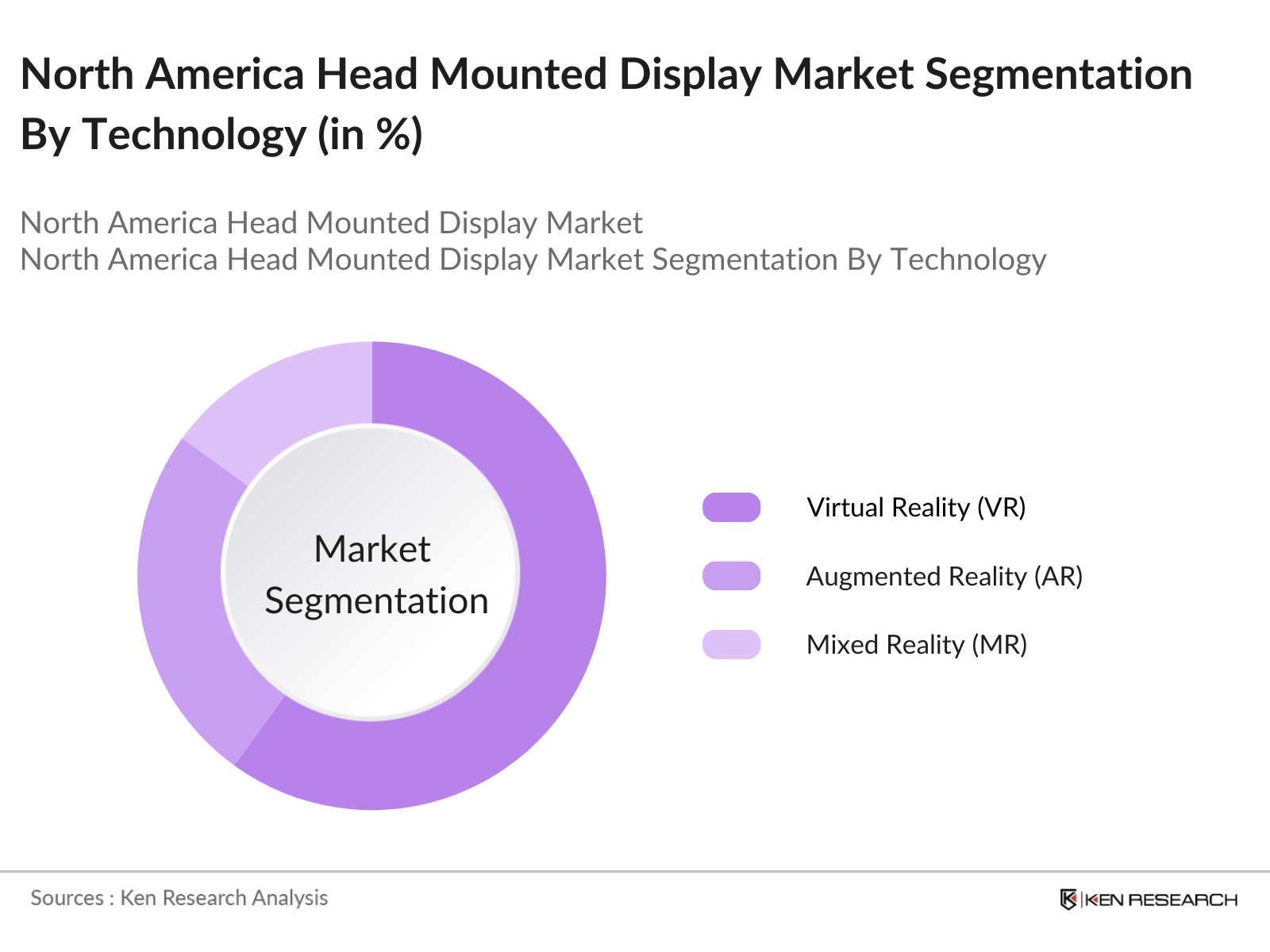

By Technology: The HMD market is categorized by technology into augmented reality (AR), virtual reality (VR), and mixed reality (MR). Virtual reality (VR) dominates this segment due to its significant presence in gaming and training applications. VR technology provides a completely immersive experience, which has proven highly popular, especially in gaming and entertainment.

North America Head Mounted Display Market Competitive Landscape

The North America Head Mounted Display market is dominated by major players, creating a competitive landscape shaped by technological innovation, strategic partnerships, and a focus on diversified applications.

North America Head Mounted Display Industry Analysis

Growth Drivers

- Rising Adoption in Healthcare and Education Sectors: Healthcare and education in North America are increasingly adopting HMDs for purposes like remote diagnostics, surgical training, and immersive learning. In 2024, the U.S. Department of Health and Human Services (HHS) reports a surge in telemedicine adoption, with 29 million annual telehealth visits in the U.S. alone. The education sector has seen an increase in immersive learning platforms, with approximately 1.2 million K-12 students using AR/VR tools to enhance interactive learning. These applications in HMDs help in driving advanced learning and diagnostic methodologies.

- Increasing Demand for Immersive Gaming Experiences: In North America, the gaming industry is one of the largest sectors for HMD adoption. The Entertainment Software Association (ESA) notes that 227 million gamers in the U.S. now lean towards VR-compatible games, spurred by technological advancements in VR gaming. High demand is due to greater accessibility to VR content libraries, with game developers creating 500+ new VR titles in 2023 alone. Immersive experiences in gaming are further supported by increasing digital content usage, enhancing HMD market penetration.

- Technological Advancements in AR/VR Technologies: The rapid evolution in AR/VR technologies drives HMD growth as manufacturers now achieve increased device efficiency and improved user experiences. The U.S. Department of Commerce reports that over 18,000 patents were filed in AR/VR technologies in 2023, enabling devices to support applications such as real-time motion tracking. Improvements in screen resolution, reduced latency, and expanded peripheral vision have improved HMD functionality, creating a more immersive experience for users across applications.

Market Challenges

- High Device and Maintenance Costs: While HMDs offer immense potential, high acquisition and maintenance costs limit adoption, particularly for small-to-medium businesses. As per the U.S. Bureau of Labor Statistics, IT equipment investments averaged $420 billion in 2023, but small businesses allocated only 10% toward advanced tech like HMDs due to cost constraints. These expenses include software updates, hardware servicing, and replacement parts, making long-term usage costly, impacting smaller organizations more significantly.

- Technical Issues (Latency, Field of View Limitations): HMDs still face technical barriers, with latency issues causing delays in real-time interactions and a limited field of view impacting user experiences. According to the National Institute of Standards and Technology (NIST), current devices achieve an average of 15-20ms latency, yet real-time applications ideally require sub-10ms. Field of view limitations restrict immersive capabilities, especially in professional environments like training simulations, leading to ongoing research for technological optimization.

North America Head Mounted Display Market Future Outlook

Over the next few years, the North America Head Mounted Display market is projected to experience substantial growth, driven by advancements in augmented reality, widespread VR adoption, and cross-industry applications. Increased investment in technology and partnerships with educational institutions, defense, and healthcare sectors are expected to further enhance market growth.

Market Opportunities

- Integration with 5G Technology: The advent of 5G enables HMDs to support faster data transfer and low-latency applications, vital for real-time functionalities. In 2023, the Federal Communications Commission (FCC) confirmed that over 260 million people in North America have 5G access, boosting prospects for seamless HMD usage in urban areas. This connectivity supports applications in real-time diagnostics, gaming, and remote operations, positioning 5G as a crucial enabler for the HMD market.

- Growth in Augmented Reality (AR) Applications: AR in North America is evolving rapidly, with sectors such as retail, automotive, and manufacturing using AR-integrated HMDs. The U.S. Department of Energy (DOE) estimates that AR technology applications have enhanced workflow efficiency by up to 30% in manufacturing operations, underscoring the value of AR-enabled HMDs in industrial and commercial environments. AR applications continue to provide significant potential for expanded HMD use across diverse industries.

Scope of the Report

|

Product Type |

Head-Mounted Displays (HMD) |

|

Technology |

Augmented Reality (AR) |

|

Application |

Gaming & Entertainment |

|

Connectivity |

Wired |

|

Component |

Displays |

|

Region |

United States |

Products

Key Target Audience

Technology Manufacturers

Gaming and Entertainment Companies

Healthcare Providers and Research Institutes

Defense and Military Contractors

Aerospace Companies

Automotive and Manufacturing Corporations

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, NIST)

Companies

Players Mentioned in the Report

Google LLC

Microsoft Corporation

Sony Corporation

Oculus VR (Facebook Technologies)

HTC Corporation

Samsung Electronics Co., Ltd.

Lenovo Group Limited

Vuzix Corporation

Magic Leap, Inc.

RealWear, Inc.

Table of Contents

1. North America Head Mounted Display Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Head Mounted Display Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Head Mounted Display Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption in Healthcare and Education Sectors

3.1.2. Increasing Demand for Immersive Gaming Experiences

3.1.3. Technological Advancements in AR/VR Technologies

3.1.4. Expansion of Remote Work Culture

3.2. Market Challenges

3.2.1. High Device and Maintenance Costs

3.2.2. Technical Issues (Latency, Field of View Limitations)

3.2.3. Concerns Over User Fatigue and Health Impacts

3.3. Opportunities

3.3.1. Integration with 5G Technology

3.3.2. Growth in Augmented Reality (AR) Applications

3.3.3. Increased Adoption in Automotive & Manufacturing Sectors

3.4. Trends

3.4.1. Rise of Wireless and Lightweight HMD Devices

3.4.2. Enhanced Customization and Personalization

3.4.3. Growing Use in Military Training and Simulation

3.5. Government Regulations

3.5.1. FDA Regulations for Medical HMDs

3.5.2. Data Privacy and Security Standards

3.5.3. Export Controls and Trade Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. North America Head Mounted Display Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Head-Mounted Displays (HMD)

4.1.2. Eyewear Displays

4.1.3. Helmet-Mounted Displays

4.2. By Technology (in Value %)

4.2.1. Augmented Reality (AR)

4.2.2. Virtual Reality (VR)

4.2.3. Mixed Reality (MR)

4.3. By End-User (in Value %)

4.3.1. Gaming & Entertainment

4.3.2. Healthcare

4.3.3. Aerospace & Defense

4.3.4. Industrial

4.3.5. Education & Training

4.4. By Connectivity Type (in Value %)

4.4.1. Wired

4.4.2. Wireless

4.5. By Component (in Value %)

4.5.1. Displays

4.5.2. Cameras

4.5.3. Sensors

4.5.4. Processors

4.5.5. Memory Modules

5. North America Head Mounted Display Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Google LLC

5.1.2. Microsoft Corporation

5.1.3. Sony Corporation

5.1.4. Oculus VR (Facebook Technologies)

5.1.5. HTC Corporation

5.1.6. Samsung Electronics Co., Ltd.

5.1.7. Lenovo Group Limited

5.1.8. Vuzix Corporation

5.1.9. Magic Leap, Inc.

5.1.10. RealWear, Inc.

5.1.11. Apple Inc.

5.1.12. Seiko Epson Corporation

5.1.13. Pimax Technology Co., Ltd.

5.1.14. Optinvent SA

5.1.15. Kopin Corporation

5.2. Cross-Comparison Parameters (Number of Employees, Revenue, Technology Portfolio, Regional Presence, Product Launch Frequency, R&D Investments, Strategic Partnerships, Patent Holdings)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Head Mounted Display Market Regulatory Framework

6.1. Safety and Compliance Standards for Wearable Devices

6.2. Data Security and Privacy Regulations

6.3. Certification Requirements for Medical Applications

7. North America Head Mounted Display Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Market Growth

8. North America Head Mounted Display Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Technology (in Value %)

8.3. By End-User (in Value %)

8.4. By Connectivity Type (in Value %)

8.5. By Component (in Value %)

9. North America Head Mounted Display Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved identifying primary market influencers across the North America Head Mounted Display ecosystem. Through a mix of secondary data sources and proprietary industry databases, we determined the critical factors impacting market growth, such as technological advancements, regulatory changes, and economic drivers.

Step 2: Market Analysis and Data Construction

Using historical data, we examined the Head Mounted Display market's development. This stage focused on calculating market penetration across key sectors, resulting in comprehensive revenue generation and performance evaluations for each segment.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and dynamics were validated through interviews with industry professionals across technology, healthcare, and defense sectors. These discussions provided direct insights into operational and financial patterns, contributing to accurate market estimates.

Step 4: Research Synthesis and Final Output

The final stage entailed synthesizing insights from both primary and secondary sources, followed by cross-referencing with industry reports. This rigorous approach ensured a well-rounded, validated understanding of the North America Head Mounted Display market.

Frequently Asked Questions

1. How big is the North America Head Mounted Display Market?

The North America Head Mounted Display market is valued at USD 3,547 million, based on a five-year historical analysis. This growth is driven by advancements in augmented and virtual reality technologies, particularly for applications in gaming, healthcare, and defense.

2. What are the main challenges in the North America Head Mounted Display Market?

Key challenges include high device costs, concerns over user fatigue, and data privacy issues, which could limit broader adoption in certain sectors.

3. Who are the major players in the North America Head Mounted Display Market?

Major players include Google LLC, Microsoft Corporation, Oculus VR, Sony Corporation, and HTC Corporation, known for their innovation in AR/VR technologies.

4. What are the growth drivers in the North America Head Mounted Display Market?

Growth drivers include advancements in immersive technology, increased applications in defense and healthcare, and the integration of 5G, enhancing device connectivity and performance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.