North America Healthy Energy Drinks Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD4513

December 2024

89

About the Report

North America Healthy Energy Drinks Market Overview

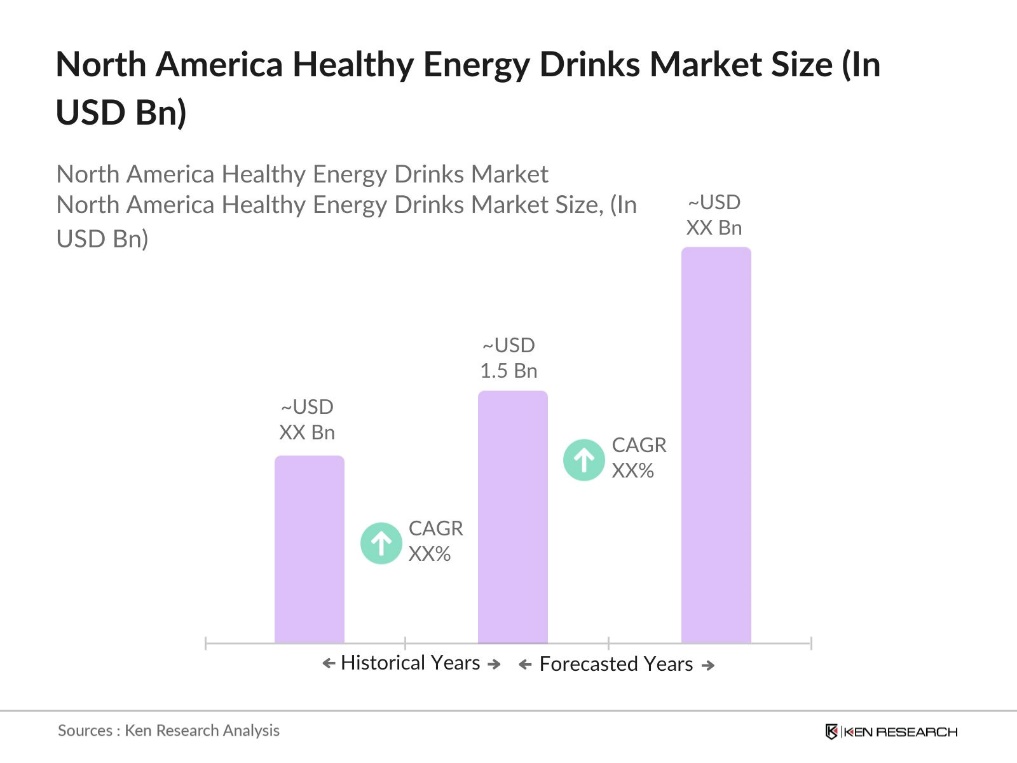

- The North America Healthy Energy Drinks Market is valued at USD 1.5 billion, driven by a combination of increasing health-conscious consumers and the growing demand for natural and clean-label beverages. Consumers in the region are actively seeking energy drinks that offer functional health benefits, with ingredients like vitamins, minerals, and natural stimulants becoming more popular. The rise of e-commerce and shifting consumer preferences toward convenience have further fueled the growth of the market.

- Key cities and countries that dominate the North American healthy energy drinks market include the United States, particularly major cities like Los Angeles, New York, and Chicago. The dominance in these areas is attributed to high disposable income levels, widespread health awareness campaigns, and a robust retail infrastructure. The proximity of manufacturers to these urban centers and the ease of distribution networks also contribute to their strong presence in these markets.

- Several states in the U.S. have implemented sugar taxes as a measure to combat obesity and related health issues. In January 2024 revealed that Philadelphia experienced a 46.8% decrease in sugary beverage sales following the implementation of its 1.5 cents per ounce tax on sweetened drinks. This was the most substantial decline among five cities studied, attributed to a 58.3% increase in prices due to the tax.

North America Healthy Energy Drinks Market Segmentation

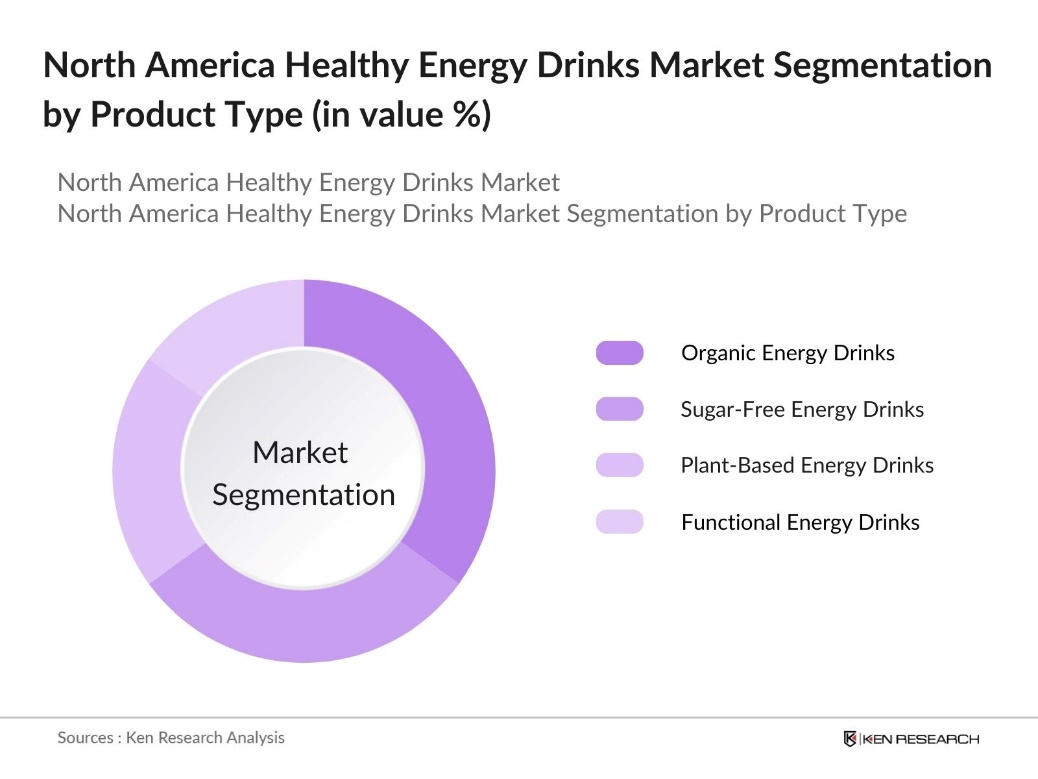

By Product Type: The North American healthy energy drinks market is segmented by product type into organic energy drinks, sugar-free energy drinks, plant-based energy drinks, and functional energy drinks. Among these, organic energy drinks hold the dominant market share due to the growing preference for organic products that are free from synthetic additives and chemicals. Consumers are becoming more mindful of the ingredients in their drinks and are drawn toward organic options that align with their desire for a healthy lifestyle.

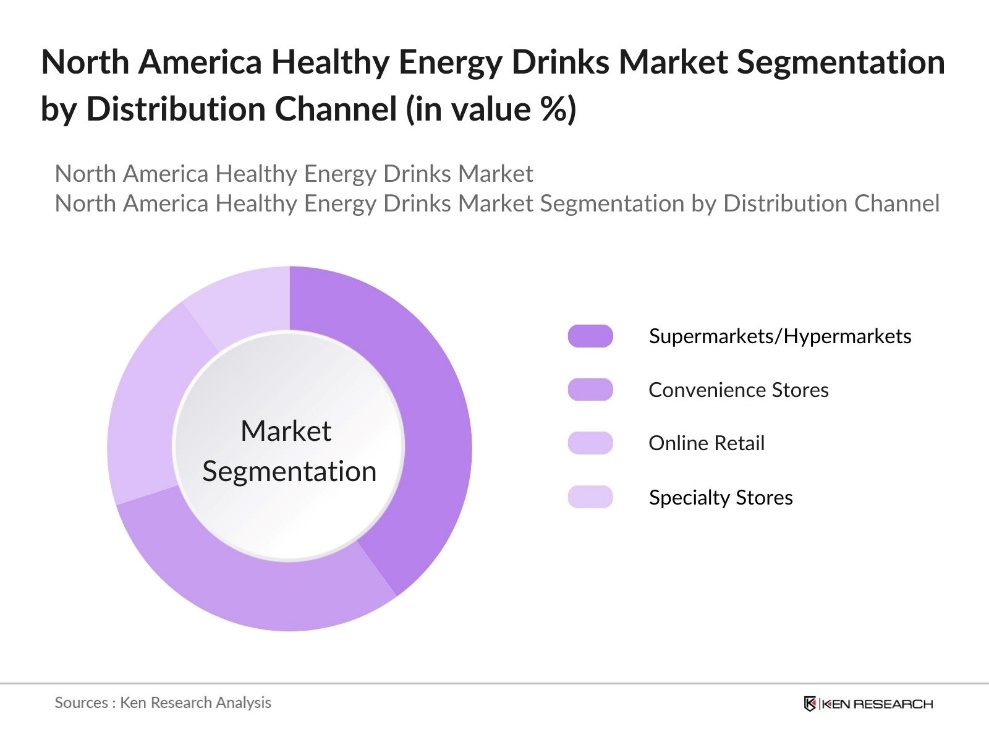

By Distribution Channel: The market is segmented by distribution channels into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets and hypermarkets dominate the market due to their wide reach and the convenience of availability for consumers. These stores often provide attractive promotions, discounts, and a diverse range of products, making them the go-to option for consumers purchasing healthy energy drinks.

North America Healthy Energy Drinks Market Competitive Landscape

The North American healthy energy drinks market is characterized by the dominance of both global and local players, with major players leveraging innovation, branding, and marketing strategies to maintain their positions. The consolidation of key players in the industry has led to a competitive environment where market leaders like Red Bull GmbH and Monster Beverage Corporation have significant control over market dynamics. This competitive landscape is driven by the continuous launch of new flavors, ingredient transparency, and marketing focused on health benefits.

|

Company Name |

Establishment Year |

Headquarters |

Number of Products |

Annual Revenue |

Key Ingredient Focus |

Consumer Base Focus |

R&D Expenditure |

|

Red Bull GmbH |

1987 |

Austria |

|||||

|

Monster Beverage Corp. |

1935 |

California, USA |

|||||

|

PepsiCo, Inc. |

1965 |

New York, USA |

|||||

|

Celsius Holdings, Inc. |

2004 |

Florida, USA |

|||||

|

Rockstar, Inc. |

2001 |

Nevada, USA |

North America Healthy Energy Drinks Industry Analysis

Growth Drivers

- Increasing Health-Conscious Consumer Base: The rise in health-conscious consumers across North America is driving demand for healthy energy drinks. According to the World Bank, North America's urban population reached 385 million in 2023, with increasing health awareness. Consumers are seeking functional beverages that offer energy without high sugar content. This shift is reflected in higher sales of low-sugar and functional energy drinks, with a growing interest in alternatives to traditional, sugar-laden options.

- Rising Demand for Low-Sugar and Natural Ingredients: With rising concerns over obesity and diabetes, the demand for energy drinks with low sugar and natural ingredients is increasing. The International Food Information Council 2023 food and health survey indicated that 72% of consumers are looking to limit or avoid sugar altogether. This has pushed manufacturers to reformulate their products using natural sweeteners like stevia. Moreover, natural energy sources such as green tea extracts and guarana are becoming more popular, driving further product diversification.

- Increasing Urbanization and Lifestyle Changes: As urbanization continues to rise in North America, the demand for convenient energy drinks has grown. Busy, fast-paced lifestyles, especially in large cities, have led consumers to seek quick and accessible beverage options that can be consumed on the go. Energy drinks, with their easy-to-carry packaging and immediate energy boost, fit seamlessly into this urban lifestyle. This shift in living patterns has driven a greater focus on ready-to-drink products that not only provide convenience but also cater to the growing health-conscious population looking for functional, energy-boosting solutions.

Market Challenges

- Regulatory Hurdles on Ingredient Use: Energy drinks in North America face regulatory scrutiny regarding ingredient use, particularly for caffeine and taurine. The U.S. Food and Drug Administration (FDA) has stringent guidelines that limit caffeine content per serving in energy drinks, specifically for general consumers. As a result, many brands have had to reformulate their products to comply with these regulations. Additionally, Canadian regulations restrict the use of artificial additives and preservatives, as enforced by Health Canada. These regulatory measures pose challenges for manufacturers in maintaining product compliance while meeting consumer demand for functional and innovative ingredients.

- High Competition from Established Beverage Brands: The market is dominated by a few well-established beverage companies that hold a substantial portion of the market share. This concentration makes it difficult for smaller, health-focused brands to compete for visibility and shelf space in retail outlets. Large beverage companies have the advantage of strong distribution networks and significant marketing resources, allowing them to invest in wide-reaching promotional campaigns. Smaller brands, which often focus on cleaner ingredients and healthier formulations, face the challenge of competing against this extensive brand presence and consumer loyalty built by industry giants.

North America Healthy Energy Drinks Market Future Outlook

Over the next five years, the North American healthy energy drinks market is expected to see significant growth driven by increasing consumer interest in wellness, fitness, and overall health. The demand for beverages that provide not only energy but also functional benefits such as mental clarity, immune support, and hydration is likely to grow. Additionally, the trend towards clean-label products and natural ingredients is expected to continue shaping the market. Innovations in plant-based drinks, sugar-free alternatives, and personalized formulations will further drive consumer adoption.

Market Opportunities

- Expansion into Untapped Markets: There is significant potential for healthy energy drinks to expand into untapped regions, especially in rural areas of North America. While much of the market has focused on urban consumers, rural populations represent an underexplored demographic that could drive further growth. E-commerce platforms provide an effective way for energy drink brands to reach these consumers without the logistical challenges of traditional retail distribution.

- Growing E-commerce Platforms for Direct-to-Consumer Sales: The rise of e-commerce has opened new avenues for energy drink manufacturers to engage directly with consumers. Online platforms offer a convenient way to sell a wide variety of products, catering to diverse consumer preferences. Direct-to-consumer sales allow brands to personalize marketing, offer exclusive products, and create stronger customer loyalty. Subscription models, where consumers regularly receive their preferred energy drinks, have become popular, providing a stable revenue stream for companies.

Scope of the Report

|

By Product Type |

Organic Energy Drinks Sugar-Free Energy Drinks Plant-Based Energy Drinks Functional Energy Drinks |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By Ingredients |

Caffeine-Based Drinks Ginseng-Based Drinks Guarana-Based Drinks Other Natural Ingredients |

|

By Consumer Demographics |

Adults (18-34 years) Adults (35-50 years) Elderly (Above 50 years) Athletes and Fitness Enthusiasts |

|

By Region |

USA Canada Mexico |

Products

Key Target Audience

Energy Drink Manufacturers

Packaging and Bottling Companies

Health Food Vending Companies

Beverage Industry

Bank and Financial Institutions

Government and Regulatory Bodies (e.g., FDA, USDA)

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Red Bull GmbH

Monster Beverage Corporation

PepsiCo, Inc.

Rockstar, Inc.

Celsius Holdings, Inc.

The Coca-Cola Company

Keurig Dr Pepper Inc.

Xyience Energy

VPX Sports (Bang Energy)

Runa

Natural Energy Lab

EBOOST

Zevia

Hiball Energy

Guru Organic Energy

Table of Contents

1. North America Healthy Energy Drinks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Healthy Energy Drinks Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Healthy Energy Drinks Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health-Conscious Consumer Base

3.1.2. Rising Demand for Low-Sugar and Natural Ingredients

3.1.3. Product Diversification by Key Players

3.1.4. Increasing Urbanization and Lifestyle Changes

3.2. Market Challenges

3.2.1. Regulatory Hurdles on Ingredient Use

3.2.2. High Competition from Established Beverage Brands

3.2.3. Consumer Concerns on Artificial Additives

3.2.4. Price Sensitivity Amongst Consumers

3.3. Opportunities

3.3.1. Expansion into Untapped Markets (Geographically)

3.3.2. Growing E-commerce Platforms for Direct-to-Consumer Sales

3.3.3. Collaboration with Fitness and Wellness Brands

3.3.4. Innovations in Functional and Clean-Label Drinks

3.4. Trends

3.4.1. Shift Towards Plant-Based Energy Drinks

3.4.2. Increasing Usage of Sustainable Packaging

3.4.3. Rise in Low-Calorie and Sugar-Free Variants

3.4.4. Customized Formulations Targeting Specific Health Benefits

3.5. Government Regulations

3.5.1. FDA Regulations on Ingredient Safety and Labeling

3.5.2. Sugar Tax Implementation

3.5.3. Energy Drink Advertising Regulations

3.5.4. Compliance with Organic Certification Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Healthy Energy Drinks Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Organic Energy Drinks

4.1.2. Sugar-Free Energy Drinks

4.1.3. Plant-Based Energy Drinks

4.1.4. Functional Energy Drinks

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Ingredients (In Value %)

4.3.1. Caffeine-Based Drinks

4.3.2. Ginseng-Based Drinks

4.3.3. Guarana-Based Drinks

4.3.4. Other Natural Ingredients

4.4. By Consumer Demographics (In Value %)

4.4.1. Adults (18-34 years)

4.4.2. Adults (35-50 years)

4.4.3. Elderly (Above 50 years)

4.4.4. Athletes and Fitness Enthusiasts

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

5. North America Healthy Energy Drinks Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Red Bull GmbH

5.1.2. Monster Beverage Corporation

5.1.3. PepsiCo, Inc.

5.1.4. Rockstar, Inc.

5.1.5. Celsius Holdings, Inc.

5.1.6. The Coca-Cola Company

5.1.7. Keurig Dr Pepper Inc.

5.1.8. Xyience Energy

5.1.9. VPX Sports (Bang Energy)

5.1.10. Runa

5.1.11. Natural Energy Lab

5.1.12. EBOOST

5.1.13. Zevia

5.1.14. Hiball Energy

5.1.15. Guru Organic Energy

5.2. Cross Comparison Parameters

(Revenue, Market Penetration, Ingredient Focus, Health Certifications, Energy Content, Consumer Preference, Marketing Strategy, Product Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Healthy Energy Drinks Market Regulatory Framework

6.1. FDA Compliance on Ingredients

6.2. Advertising and Labeling Standards

6.3. Certification Processes for Organic and Clean-Label Products

6.4. Health and Safety Regulations

7. North America Healthy Energy Drinks Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Healthy Energy Drinks Future Market Segmentation

8.1. By Product Type

8.2. By Distribution Channel

8.3. By Ingredients

8.4. By Consumer Demographics

8.5. By Region

9. North America Healthy Energy Drinks Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Strategies and Product Positioning

9.3. White Space Opportunity Analysis

9.4. Emerging Market Trends

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map of all major stakeholders in the North American healthy energy drinks market was created. This involved extensive secondary research using industry reports, public databases, and proprietary data to determine the key variables that influence the market.

Step 2: Market Analysis and Construction

Historical data was collected and analyzed to understand market penetration, sales channels, and revenue generation. This step also involved a detailed study of consumer preferences and product performance across various sub-segments to ensure the accuracy of the data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on initial findings and validated through interviews with industry experts, including manufacturers, distributors, and retailers. These consultations provided critical insights into operational and financial aspects of the market.

Step 4: Research Synthesis and Final Output

Data from both primary and secondary research was synthesized to create a comprehensive and validated market report. The analysis was fine-tuned based on feedback from industry professionals to ensure an accurate representation of the North American healthy energy drinks market.

Frequently Asked Questions

01 How big is the North America Healthy Energy Drinks Market?

The North America Healthy Energy Drinks Market is valued at USD 1.5 billion, driven by increasing demand for clean-label products, organic ingredients, and functional benefits like enhanced mental clarity and physical endurance.

02 What are the challenges in the North America Healthy Energy Drinks Market?

Challenges in North America Healthy Energy Drinks Market include regulatory hurdles related to ingredient use, price sensitivity among consumers, and intense competition from established beverage companies. Additionally, there is increasing scrutiny over health claims made by energy drink manufacturers.

03 Who are the major players in the North America Healthy Energy Drinks Market?

Key players in the North America Healthy Energy Drinks Market include Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc., Rockstar, Inc., and Celsius Holdings, Inc. These companies dominate the market due to their innovative product offerings and strong marketing strategies.

04 What are the growth drivers of the North America Healthy Energy Drinks Market?

The North America Healthy Energy Drinks Market is propelled by factors such as the increasing consumer focus on health and wellness, the rise of fitness culture, and the growing demand for organic and plant-based drinks. Additionally, the shift toward sugar-free and clean-label formulations is driving market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.