North America Healthy Snack Chips Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD5674

November 2024

84

About the Report

North America Healthy Snack Chips Market Overview

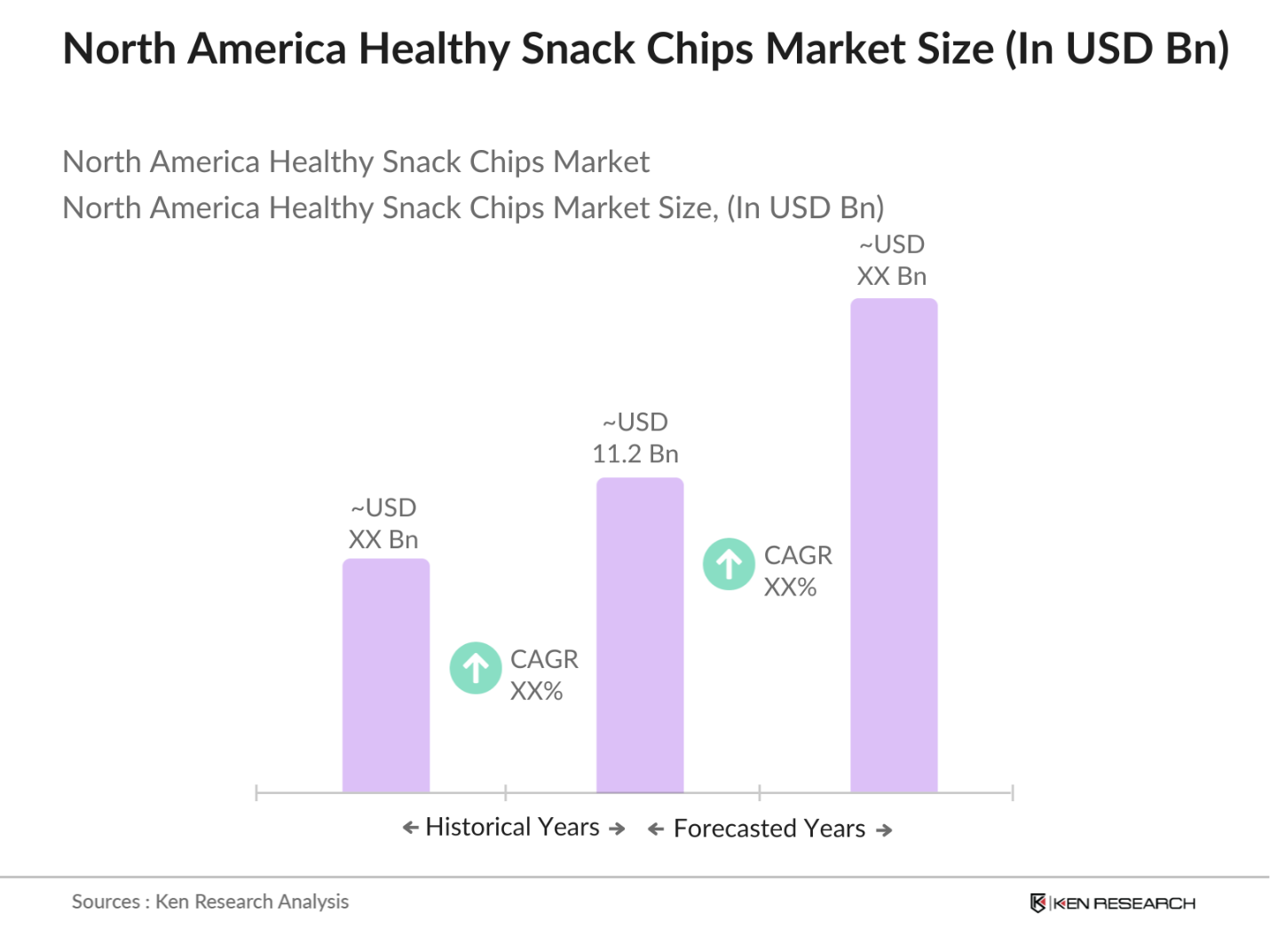

- The North America Healthy Snack Chips market is valued at USD 11.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for nutritious snacks as health-consciousness rises, particularly in the wake of concerns over lifestyle-related diseases such as obesity and diabetes. The availability of plant-based, gluten-free, and non-GMO options is another factor propelling the markets expansion. Additionally, the growing trend of clean-label products, where consumers demand transparency on ingredients, has led to increased adoption of healthier alternatives within the snack food category.

- The United States and Canada dominate the North America Healthy Snack Chips market due to higher disposable incomes, widespread urbanization, and an established retail network that facilitates easy access to a wide range of products. The U.S., in particular, is a leader because of its large base of health-conscious consumers, robust marketing strategies by leading brands, and the presence of several prominent snack manufacturers. Moreover, the demand for innovative snack products tailored to niche dietary needs, such as keto, paleo, and vegan, contributes to the dominance of these regions.

- The FDA's guidelines on nutritional labeling play a crucial role in shaping the healthy snack chips market. As of 2022, the FDA mandates that all packaged food products display clear nutritional information, helping consumers make informed choices about their diets. These regulations ensure transparency and promote healthier eating habits, aligning with public health objectives. The emphasis on accurate labeling has led to an increase in manufacturers reformulating products to meet health standards, further supporting the growth of the healthy snack segment.

North America Healthy Snack Chips Market Segmentation

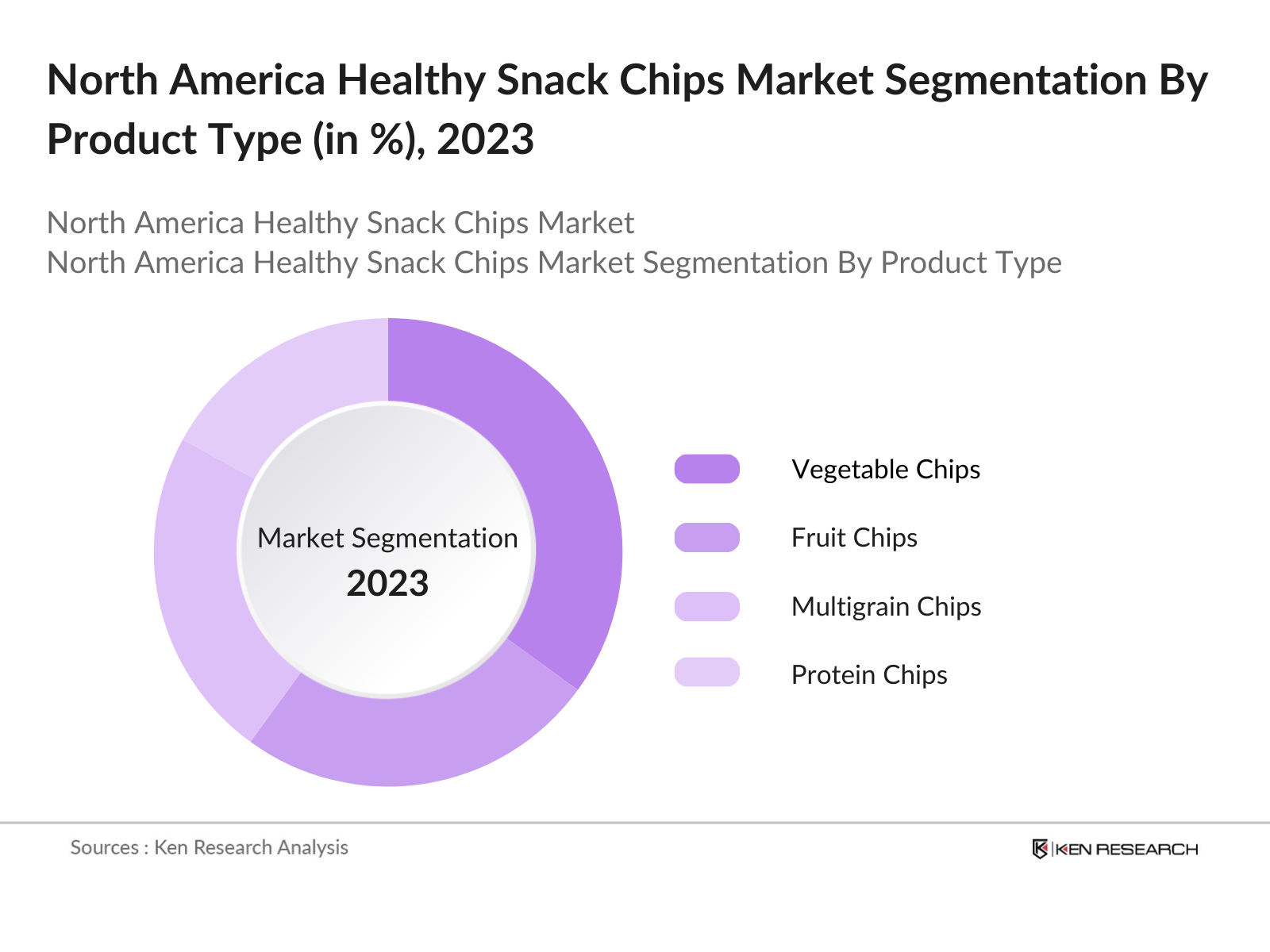

By Product Type: The North America Healthy Snack Chips market is segmented by product type into vegetable chips, fruit chips, multigrain chips, protein chips, and baked chips. Recently, vegetable chips have emerged as the dominant market share holder under this segmentation. This is attributed to the growing consumer preference for snacks perceived as natural and nutritious, as vegetable chips are often marketed as a healthier alternative to traditional potato chips. The inclusion of ingredients like kale, sweet potatoes, and beets has appealed to consumers seeking plant-based options with high nutrient density, such as vitamins and antioxidants.

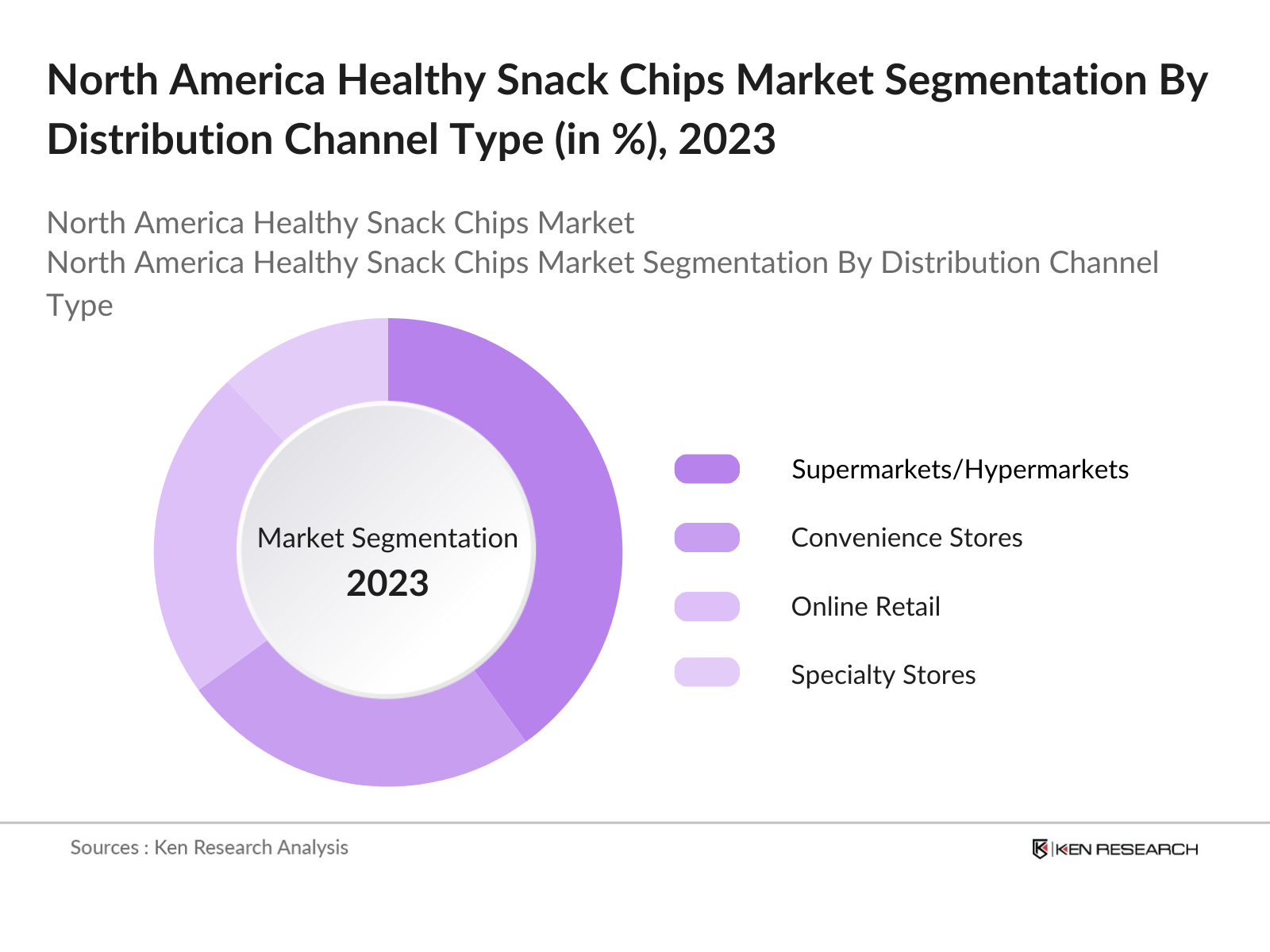

By Distribution Channel: The market is also segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, and others. Supermarkets and hypermarkets dominate this segmentation, accounting for a substantial portion of the market share. Their extensive physical presence and broad product assortment make them a preferred shopping destination for a wide range of consumers. Moreover, these outlets frequently run promotions and offer competitive pricing, driving the bulk of healthy snack chip sales. The wide reach of supermarket chains allows them to target both urban and rural consumers effectively.

North America Healthy Snack Chips Market Competitive Landscape

The North America Healthy Snack Chips market is dominated by several key players, each contributing to the market through innovative products, brand reputation, and effective distribution strategies. Companies with a focus on sustainability and health-conscious products tend to perform well in this market. The competitive landscape is shaped by a mix of large multinational corporations and smaller, innovative companies offering niche products. Major players have focused on expanding their product portfolios to cater to the growing demand for clean-label, plant-based, and functional snacks.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Mn) |

Number of Employees |

Sustainability Initiatives |

Product Portfolio Diversity |

Brand Awareness |

Distribution Reach |

Innovation Capability |

|

PepsiCo (Frito-Lay) |

1965 |

Purchase, New York |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Hain Celestial Group |

1993 |

Lake Success, NY |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Kettle Foods, Inc. |

1978 |

Salem, Oregon |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

General Mills |

1928 |

Minneapolis, MN |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Bare Snacks |

2001 |

San Francisco, CA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

North America Healthy Snack Chips Industry Analysis

Growth Drivers

- Increasing Demand for Health-Conscious Products: The North American market is experiencing a notable shift towards health-conscious eating habits, driven by consumer awareness of nutrition and wellness. In 2023, over 60% of American consumers actively sought healthier snack options, according to the U.S. Department of Agriculture. This trend is bolstered by a rise in nutritional information accessibility, with 87% of consumers reportedly reading food labels to make informed choices. Furthermore, data from the Food and Drug Administration indicates that sales of health-oriented products have surged, reflecting a growing preference for snacks with lower calories, sugars, and artificial ingredients.

- Rising Incidence of Obesity and Lifestyle Diseases: Obesity and related lifestyle diseases are increasingly prevalent in North America, with the CDC reporting that approximately 42% of adults were classified as obese in 2022. This alarming statistic highlights a critical public health issue, prompting consumers to seek healthier dietary options, including snack foods. Moreover, the American Heart Association states that nearly 130 million Americans suffer from cardiovascular diseases, further driving the demand for nutritious snack alternatives that promote health and well-being. As health concerns escalate, consumers are gravitating towards healthier snack choices to mitigate these risks.

- Expanding Retail and E-Commerce Networks: The retail landscape for healthy snack chips is rapidly evolving, with e-commerce platforms playing a pivotal role in increasing product accessibility. In 2022, e-commerce accounted for nearly 20% of total food sales in the U.S., as reported by the U.S. Census Bureau. This growth in online shopping is complemented by a surge in the number of health-focused retail outlets, with a 25% increase in the availability of health-oriented snack options in grocery stores and specialty shops. The integration of omnichannel strategies by retailers has further enhanced the distribution of healthy snacks, making them more available to consumers.

Market Challenges

- High Production Costs for Natural Ingredients: The healthy snack chips market faces challenges related to the high production costs of natural and organic ingredients. In 2023, the average cost of organic raw materials rose by 15%, driven by increased demand and supply chain constraints. According to the USDA, organic food production is subject to stricter regulations and requires greater resources, impacting overall production expenses. This increase in costs can result in higher retail prices, potentially deterring price-sensitive consumers from purchasing healthier snack options. The economic implications of these rising costs may hinder market growth.

- Price Sensitivity Among Consumers: Price sensitivity remains a significant challenge in the healthy snack chips market. In a recent survey conducted by the Bureau of Labor Statistics, it was found that 60% of consumers consider price the most important factor when selecting snack foods. The current inflation rate, which reached 4.2% in 2022, has exacerbated this sensitivity, as consumers are forced to make cost-effective choices. Consequently, even with a growing interest in health, many consumers are reluctant to pay a premium for healthier snack options, impacting sales volumes in the market.

North America Healthy Snack Chips Market Future Outlook

The North America Healthy Snack Chips market is poised for significant growth over the next five years, driven by the increasing awareness of healthy eating habits and the continued expansion of plant-based and organic product lines. As consumers become more knowledgeable about the nutritional content of their snacks, the demand for low-calorie, nutrient-dense chips is expected to rise. In addition, innovations in packaging sustainability and clean-label certifications will likely boost consumer confidence, thereby expanding the market further. The markets growth will also be supported by the increasing penetration of e-commerce channels, as consumers continue to shift towards online shopping for convenience.

Opportunities

- Product Innovation: The demand for innovative products in the healthy snack chips market presents significant opportunities for growth. Current trends indicate that over 45% of consumers are interested in snacks featuring superfood ingredients, such as quinoa and chia seeds, according to a report from the International Food Information Council. Additionally, the clean labeling movement is gaining momentum, with 65% of consumers preferring products with transparent ingredient lists. As manufacturers innovate to meet these demands, the introduction of new flavors and health-focused formulations will likely drive market expansion.

- Expansion into Emerging Health-Conscious Markets: Emerging markets in North America, particularly among younger demographics, represent a substantial growth opportunity for healthy snack chips. Currently, millennials and Gen Z consumers account for 30% of snack food purchases, as indicated by a Nielsen report. This demographic prioritizes health and wellness, creating a ripe market for brands that offer nutritious snack options. As manufacturers adapt their marketing strategies to target these health-conscious consumers, they can significantly increase their market share in these lucrative segments.

Scope of the Report

|

By Product Type |

Vegetable Chips Fruit Chips Multigrain Chips Protein Chips Baked Chips |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

|

By Ingredient Type |

Organic Non-GMO Gluten-Free High-Protein Ingredients Low-Sodium Ingredients |

|

By Consumer Demographics |

Adults Children Senior Citizens |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Health Canada)

Supermarket Chain Industries

Online Retailer Companies

Manufacturers of Natural Ingredient Companies

Packaging Supplier Comapnies

Health and Wellness Brand Comapnies

Companies

Players Mentioned in the Report

PepsiCo (Frito-Lay)

Hain Celestial Group

Kettle Foods, Inc.

General Mills

Bare Snacks

Jacksons Honest

Popchips

Late July Snacks

Rhythm Superfoods

Dang Foods

Table of Contents

1. North America Healthy Snack Chips Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Healthy Snack Chips Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Healthy Snack Chips Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Health-Conscious Products

3.1.2. Rising Incidence of Obesity and Lifestyle Diseases

3.1.3. Expanding Retail and E-Commerce Networks

3.1.4. Government Regulations Promoting Healthier Alternatives

3.2. Market Challenges

3.2.1. High Production Costs for Natural Ingredients

3.2.2. Price Sensitivity Among Consumers

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Product Innovation

3.3.2. Expansion into Emerging Health-Conscious Markets

3.3.3. Strategic Partnerships with Retailers for Better Shelf Space

3.4. Trends

3.4.1. Increasing Demand for Plant-Based Snack Chips

3.4.2. Growth of Organic and Non-GMO Chips

3.4.3. Rise of Low-Calorie and Functional Snack Chips

3.4.4. Focus on Sustainability in Packaging

3.5. Government Regulations

3.5.1. FDA Guidelines on Nutritional Labeling

3.5.2. Non-GMO and Organic Certifications

3.5.3. Food Safety Modernization Act Compliance

3.5.4. Advertising Regulations for Health Claims

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. North America Healthy Snack Chips Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vegetable Chips

4.1.2. Fruit Chips

4.1.3. Multigrain Chips

4.1.4. Protein Chips

4.1.5. Baked Chips

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.2.5. Others

4.3. By Ingredient Type (In Value %)

4.3.1. Organic

4.3.2. Non-GMO

4.3.3. Gluten-Free

4.3.4. High-Protein Ingredients

4.3.5. Low-Sodium Ingredients

4.4. By Consumer Demographics (In Value %)

4.4.1. Adults

4.4.2. Children

4.4.3. Senior Citizens

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Healthy Snack Chips Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo (Frito-Lay)

5.1.2. Hain Celestial Group

5.1.3. Kettle Foods, Inc.

5.1.4. General Mills

5.1.5. Bare Snacks

5.1.6. Jacksons Honest

5.1.7. Popchips

5.1.8. Late July Snacks

5.1.9. Rhythm Superfoods

5.1.10. Dang Foods

5.1.11. Beanfields Snacks

5.1.12. Terra Chips

5.1.13. Quest Nutrition

5.1.14. Saffron Road

5.1.15. Brads Plant Based

5.2. Cross Comparison Parameters (Revenue, Market Share, Distribution Reach, Product Portfolio, Brand Awareness, Sustainability Initiatives, Innovation Capability, Customer Loyalty)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Healthy Snack Chips Market Regulatory Framework

6.1. FDA Food Labeling Requirements

6.2. Organic and Non-GMO Certifications

6.3. Health and Nutritional Claims Regulations

6.4. Environmental Sustainability Standards

7. North America Healthy Snack Chips Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Healthy Snack Chips Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Consumer Demographics (In Value %)

8.5. By Region (In Value %)

9. North America Healthy Snack Chips Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavioral Trends Analysis

9.3. White Space Opportunity Identification

9.4. Strategic Market Entry Recommendations

Research Methodology

Step 1: Identification of Key Variables

The first stage involved constructing a comprehensive ecosystem map for the North America Healthy Snack Chips market. Extensive desk research was conducted using both secondary and proprietary databases to gather information on market drivers, key stakeholders, and industry dynamics. This process helped identify the critical variables influencing market trends and growth.

Step 2: Market Analysis and Construction

In this phase, historical data on the market was compiled and analyzed. This included a deep dive into market penetration rates, the balance between production and demand, and revenue streams. Additionally, various consumer preferences were studied to provide a thorough understanding of the drivers behind snack chip consumption.

Step 3: Hypothesis Validation and Expert Consultation

The initial hypotheses were refined through expert consultation, leveraging interviews with industry specialists from leading snack manufacturers. These insights helped validate the research data and offered on-the-ground perspectives on trends and challenges in the market.

Step 4: Research Synthesis and Final Output

The final phase of research involved synthesizing all collected data and insights. This comprehensive analysis was then translated into actionable insights for the North America Healthy Snack Chips market, ensuring the accuracy and relevance of market estimates and projections.

Frequently Asked Questions

01. How big is the North America Healthy Snack Chips market?

The North America Healthy Snack Chips market was valued at USD 11.2 billion in 2023. The market is driven by increasing health-consciousness, the availability of innovative product offerings, and strong retail networks.

02. What are the challenges in the North America Healthy Snack Chips market?

Key challenges include high production costs for organic and natural ingredients, supply chain disruptions, and the price sensitivity of consumers. The market is also highly competitive, with a mix of global and local players vying for market share.

03. Who are the major players in the North America Healthy Snack Chips market?

Major players in the market include PepsiCo (Frito-Lay), General Mills, Kettle Foods, Inc., Hain Celestial Group, and Bare Snacks. These companies dominate through their established distribution networks, innovative product lines, and brand loyalty.

04. What are the growth drivers of the North America Healthy Snack Chips market?

The growth of the market is fueled by increased consumer demand for healthier snack alternatives, the rise of plant-based and gluten-free options, and the expanding retail and e-commerce landscape.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.