North America Hearth Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD8150

December 2024

99

About the Report

North America Hearth Market Overview

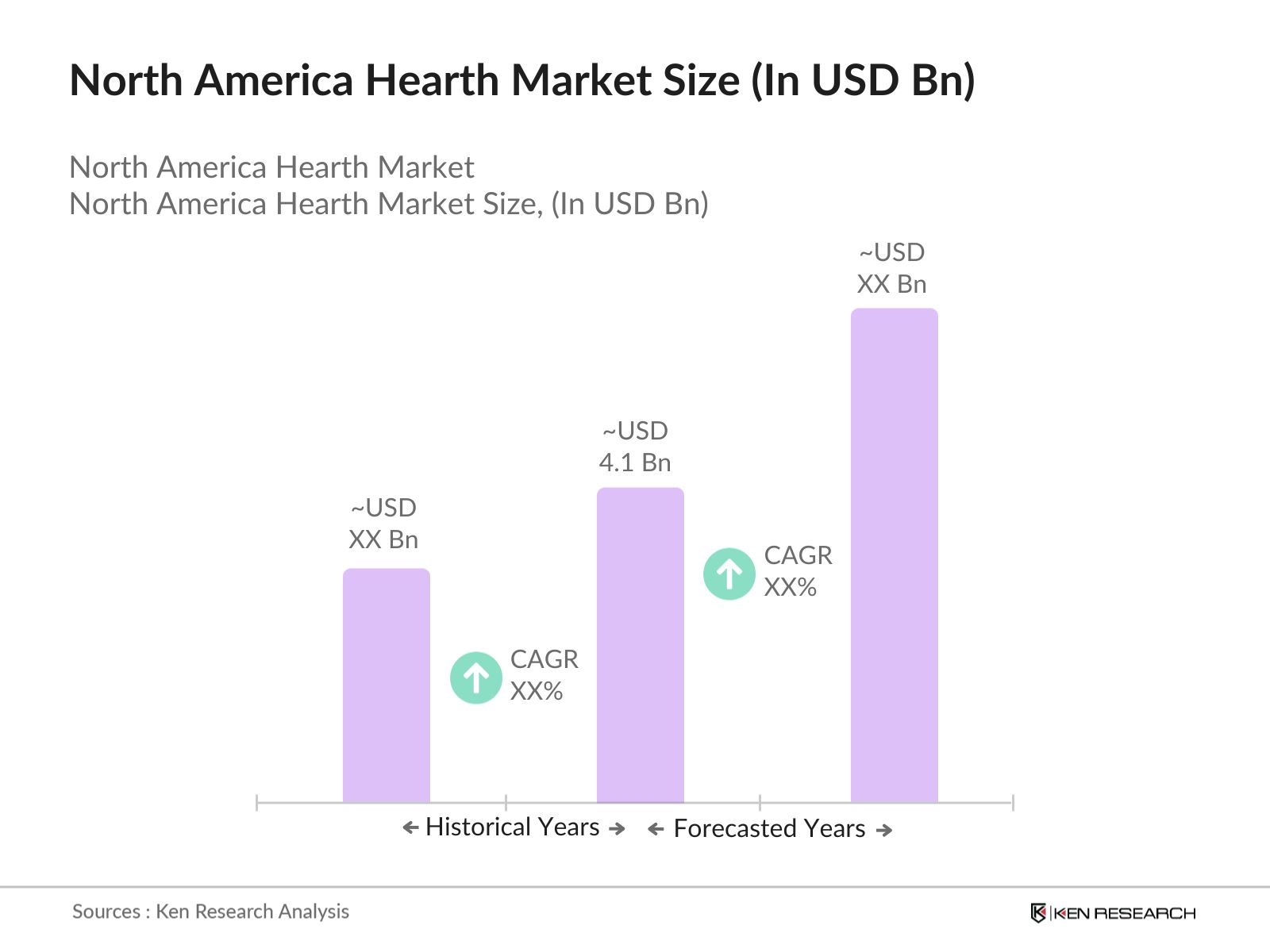

- The North America hearth market reached a valuation of USD 4.1 billion, according to a recent analysis. This growth is driven primarily by consumer demand for aesthetic home heating solutions that enhance interior dcor while providing efficient heating. The market benefits from increasing energy costs, prompting homeowners and businesses to seek energy-efficient heating solutions, including gas and electric hearths. Government incentives promoting eco-friendly heating further drive the market, encouraging adoption across residential and commercial segments.

- The North America hearth market sees significant demand from urban centers in the United States and Canada, where high energy costs and colder climates amplify the need for efficient heating solutions. The United States leads in demand due to its expansive residential housing market and preference for customizable heating solutions that align with interior design trends. Canada, with its colder climate, also exhibits robust market adoption, particularly for eco-friendly and energy-efficient hearth solutions as part of sustainable home initiatives.

- Strict emission standards in North America regulate hearth emissions, especially for wood-burning models. The EPAs New Source Performance Standards mandate that all new wood-burning hearths emit no more than 2.5 grams of particulate matter per hour. This regulation has influenced the design and production of hearths to align with cleaner-burning technologies, supporting air quality initiatives. Similarly, Canadian regulations in provinces like Ontario require adherence to low-emission standards, pushing manufacturers to develop eco-friendly models for compliance.

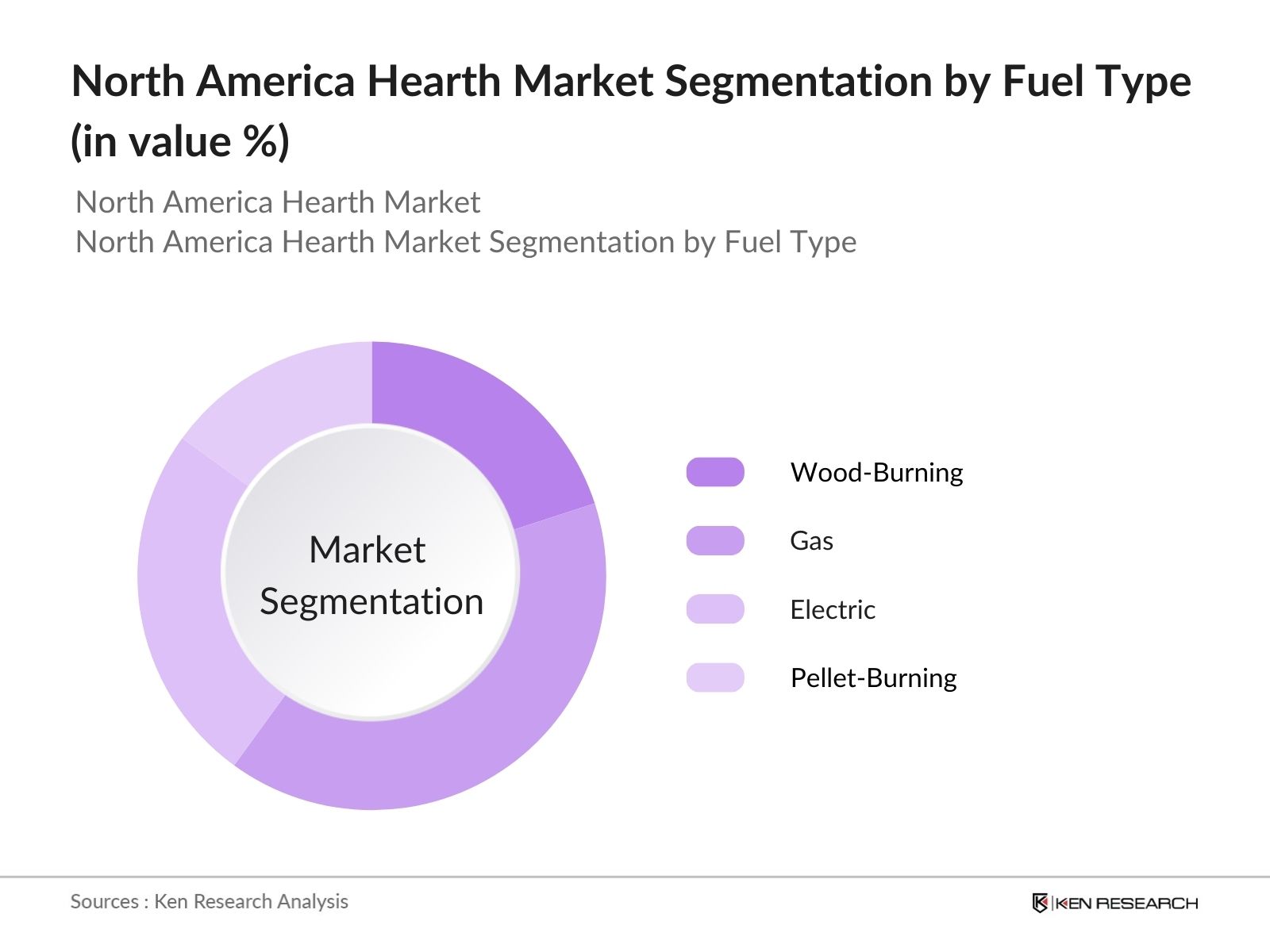

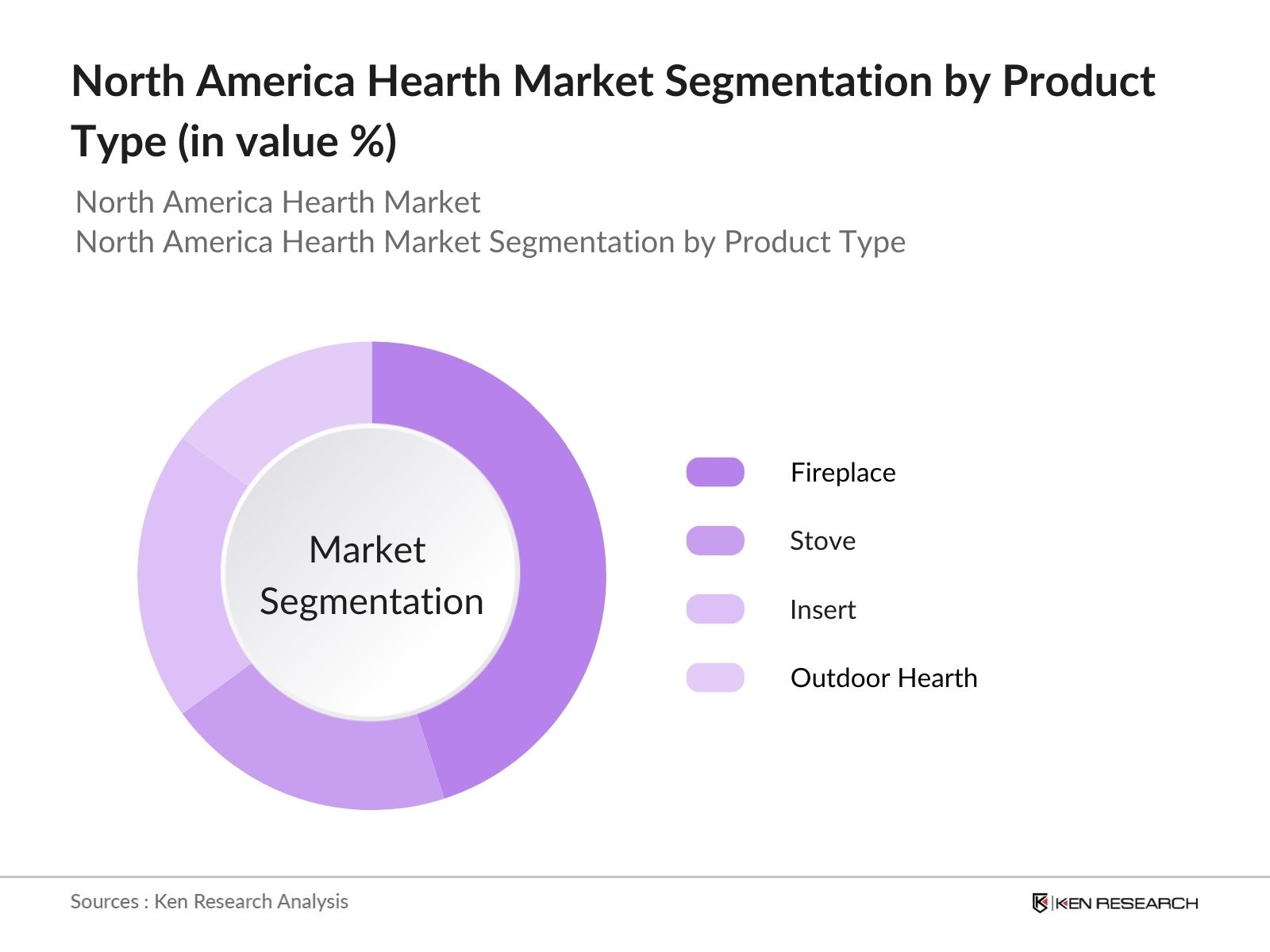

North America Hearth Market Segmentation

By Fuel Type: The market is segmented by fuel type into wood-burning hearths, gas hearths, electric hearths, and pellet-burning hearths. Gas hearths dominate this segment, as they offer convenience and cleaner burning compared to traditional wood options. Homeowners and businesses prefer gas hearths due to their ease of installation, minimal maintenance, and ability to control heating output efficiently. Brands offering gas hearth options capitalize on this demand, focusing on aesthetics and customizations that suit modern residential and commercial interiors.

By Product Type: The market is further segmented by product type into fireplaces, stoves, inserts, and outdoor hearths. Fireplaces hold a dominant market share in this category, driven by their appeal as both a functional and decorative element in North American homes. They offer homeowners the advantage of space heating while enhancing the aesthetic value of living spaces. The popularity of fireplaces has prompted manufacturers to offer a range of customization options to match diverse interior styles.

North America Hearth Market Competitive Landscape

The North America hearth market is dominated by a few key players, including Hearth & Home Technologies and Napoleon Products, which leverage innovation in design and energy-efficient technologies. This concentration of key brands underscores the competitive landscape's reliance on aesthetic appeal and technological advancements in energy-efficient solutions.

|

Company |

Established |

Headquarters |

Product Portfolio |

Technology Innovation |

Regional Presence |

Customer Satisfaction |

Environmental Compliance |

Strategic Partnerships |

|

Hearth & Home Technologies |

1975 |

Lakeville, MN, USA |

||||||

|

Napoleon Products |

1976 |

Barrie, Ontario, Canada |

||||||

|

Regency Fireplace Products |

1979 |

Delta, BC, Canada |

||||||

|

Empire Comfort Systems |

1932 |

Belleville, IL, USA |

||||||

|

Innovative Hearth Products |

2012 |

Russellville, AL, USA |

North America Hearth Market Outlook to 2028

Growth Drivers

- Consumer Interest in Aesthetic Home Heating: The North American hearth market is benefiting from an increasing consumer preference for aesthetically pleasing home heating solutions. In 2023, over 20 million U.S. homes had hearth installations, largely driven by demand for aesthetically integrated fireplaces that also serve as heating solutions. This trend aligns with high discretionary spending in the U.S., with Americans spending an average of $1,200 annually on home improvements and decor. Moreover, industry-specific surveys have found that homeowners view hearths as value-adding features, spurring growth in regions with significant disposable income, like New England and the Pacific Northwest.

- Rising Energy Costs: Rising energy costs in North America have increased the appeal of efficient hearth systems as alternatives to traditional central heating. In 2023, the U.S. saw average residential electricity rates climb to 15 cents per kWh, impacting household budgets significantly, particularly in colder states. Hearths, especially high-efficiency gas and electric models, are emerging as cost-effective alternatives, allowing homeowners to localize heating and reduce dependence on central systems. According to the U.S. Energy Information Administration, heating costs were a critical factor in energy expenditures, amplifying demand for energy-efficient hearths as an economic solution.

- Government Incentives for Energy-Efficient Heating: Government incentives across North America are fostering adoption of energy-efficient heating solutions, including modern hearths. The U.S. federal governments 25D Residential Energy Credit, which offers a tax credit for energy-efficient home heating systems, has led to increased consumer adoption of compliant hearths. In Canada, the Greener Homes Initiative offers rebates up to CAD 5,000 for homes installing energy-efficient appliances, including hearth systems. These programs are accelerating the shift toward energy-efficient hearth technologies, especially in colder regions like Quebec and the Northeast U.S., where heating costs are substantial.

Market Challenges

- High Initial Setup and Maintenance Costs: High initial setup and maintenance costs remain a barrier for hearth adoption, especially in lower-income regions. A standard hearth installation, particularly for high-efficiency wood and gas models, can cost upwards of $5,000, including necessary modifications to meet local building codes. The National Association of Home Builders noted that such upfront costs deter adoption among cost-sensitive homeowners, limiting hearth demand primarily to higher-income households or areas with incentives. This financial barrier affects market penetration in states where household income averages below $50,000 annually.

- Stringent Emission Regulations: Stringent emission regulations, particularly for wood-burning hearths, present challenges for manufacturers. The U.S. Environmental Protection Agencys (EPA) New Source Performance Standards require reduced particulate emissions from wood-burning appliances. Compliance costs for manufacturers to meet the less-than-2.5-gram-per-hour emissions cap are significant, potentially leading to higher consumer prices. In Canada, similar restrictions are enforced, limiting hearth installation in regions like Ontario and Quebec to certified low-emission models, thereby impacting market growth in wood-dependent areas.

North America Hearth Market Future Outlook

The North America hearth market is poised for significant growth, fueled by consumer demand for aesthetic and eco-friendly heating solutions. The market's trajectory is reinforced by technological advancements, particularly in smart hearth systems that allow remote operation and energy savings. An increase in eco-conscious consumers will likely drive demand for sustainable, fuel-efficient hearths that contribute to reduced carbon footprints in residential and commercial settings.

Future Market Opportunities

- Technological Advancements in Heating Efficiency: Advances in hearth technology, particularly in catalytic and non-catalytic wood-burning models, present significant opportunities for energy-efficient heating. The U.S. Department of Energy has reported that new hearth models achieve efficiency levels exceeding 70%, reducing fuel consumption substantially compared to older units. This shift has driven adoption among environmentally conscious consumers, particularly in northern states where prolonged heating seasons are common. The integration of catalytic converters in wood hearths further lowers emissions, making them attractive to markets with stringent environmental standards.

- Expansion in the Smart Home Segment: The growing integration of hearths within smart home ecosystems offers a major growth opportunity. In 2023, around 60 million U.S. households reported owning at least one smart home device, with fireplaces being integrated with remote control and automation capabilities. The surge in IoT-connected homes, particularly in metropolitan areas, has allowed consumers to control hearth settings remotely, enhancing convenience and energy efficiency. Smart hearths are increasingly popular in tech-savvy markets such as California and New York.

Scope of the Report

|

Fuel Type |

Wood-Burning Hearths Gas Hearths Electric Hearths Pellet-Burning Hearths |

|

Product Type |

Fireplace Stove Insert Outdoor Hearth |

|

Application |

Residential Commercial Hospitality |

|

Technology |

Conventional Smart Hearth Systems |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agency, U.S. Department of Energy)

Residential Real Estate Developers

Hospitality Sector Developers

Home Improvement Retail Chains

Smart Home Solution Providers

Sustainable Product Manufacturers

Fire Safety and Compliance Agencies

Companies

Major Players

Hearth & Home Technologies

Napoleon Products

Regency Fireplace Products

Empire Comfort Systems

Innovative Hearth Products

Twin Star Home

FPI Fireplace Products International Ltd.

Stove Builder International

Montigo Fireplaces

RH Peterson Co.

Valor Fireplaces

Ortal Fireplaces

European Home

Spartherm GmbH

Travis Industries Inc.

Table of Contents

North America Hearth Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Fuel Types, Technology, Heating Efficiency)

1.4 Market Segmentation Overview

North America Hearth Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis (Residential Adoption, Commercial Demand, Regulatory Changes)

2.3 Key Market Developments and Milestones

North America Hearth Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Interest in Aesthetic Home Heating

3.1.2 Rising Energy Costs

3.1.3 Government Incentives for Energy-Efficient Heating

3.1.4 Increasing Adoption in Commercial Establishments (Hotels, Restaurants)

3.2 Market Challenges

3.2.1 High Initial Setup and Maintenance Costs

3.2.2 Stringent Emission Regulations

3.2.3 Competition from Alternative Heating Solutions

3.3 Opportunities

3.3.1 Technological Advancements in Heating Efficiency

3.3.2 Expansion in the Smart Home Segment

3.3.3 Rising Demand for Eco-Friendly Fuel Options

3.4 Trends

3.4.1 Shift Towards Gas and Electric Hearths

3.4.2 Integration with IoT for Remote Control

3.4.3 Sustainable and Recyclable Materials Usage

3.5 Government Regulation

3.5.1 Emission Standards and Compliance

3.5.2 Incentives for Green Energy Adoption

3.5.3 Building Code Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem (Product Differentiation, Pricing Strategies)

North America Hearth Market Segmentation

4.1 By Fuel Type (In Value %)

4.1.1 Wood-Burning Hearths

4.1.2 Gas Hearths

4.1.3 Electric Hearths

4.1.4 Pellet-Burning Hearths

4.2 By Product Type (In Value %)

4.2.1 Fireplace

4.2.2 Stove

4.2.3 Insert

4.2.4 Outdoor Hearth

4.3 By Application (In Value %)

4.3.1 Residential

4.3.2 Commercial

4.3.3 Hospitality

4.4 By Technology (In Value %)

4.4.1 Conventional

4.4.2 Smart Hearth Systems

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

North America Hearth Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hearth & Home Technologies

5.1.2 Napoleon Products

5.1.3 Regency Fireplace Products

5.1.4 Empire Comfort Systems

5.1.5 Innovative Hearth Products

5.1.6 Twin Star Home

5.1.7 FPI Fireplace Products International Ltd.

5.1.8 Stove Builder International

5.1.9 Montigo Fireplaces

5.1.10 RH Peterson Co.

5.1.11 Valor Fireplaces

5.1.12 Ortal Fireplaces

5.1.13 European Home

5.1.14 Spartherm GmbH

5.1.15 Travis Industries Inc.

5.2 Cross Comparison Parameters (Employee Strength, Revenue, Product Portfolio, Market Presence, Fuel Type Innovation, Technology Integration, Customer Satisfaction Ratings, Regulatory Compliance)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Expansion Strategies, R&D Investments)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding and Partnerships

5.8 Private Equity Investments

North America Hearth Market Regulatory Framework

6.1 Emission Standards and Environmental Compliance

6.2 Safety Certification Processes (UL, CSA)

6.3 Energy Efficiency Standards

6.4 Tax Rebates and Incentives for Eco-Friendly Heating Solutions

North America Hearth Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Urbanization, Consumer Preferences, Technological Innovation)

North America Hearth Market Future Market Segmentation

8.1 By Fuel Type (In Value %)

8.2 By Product Type (In Value %)

8.3 By Application (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

North America Hearth Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Target Audience Segmentation Analysis

9.3 Customer Cohort Analysis

9.4 Marketing Initiatives and Strategic Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involved creating a comprehensive map of stakeholders across the North America hearth market. Detailed desk research was conducted using proprietary databases to gather insights on market influences and trends.

Step 2: Market Analysis and Construction

Historical data was compiled to evaluate market penetration across various segments, considering factors like product adoption, consumer preferences, and revenue generation in residential and commercial sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including hearth manufacturers and distributors. These consultations provided operational insights, further refining market data accuracy.

Step 4: Research Synthesis and Final Output

The final phase involved detailed engagement with industry manufacturers to verify consumer preferences, product segment insights, and validate findings derived from the bottom-up approach. This comprehensive analysis ensured reliable insights into the North America hearth market.

Frequently Asked Questions

01. How big is the North America Hearth Market?

The North America hearth market was valued at USD 4.1 billion, driven by consumer demand for energy-efficient, aesthetically pleasing heating solutions.

02. What are the challenges in the North America Hearth Market?

Challenges in the North America Hearth Market include high installation and maintenance costs, stringent emission regulations, and competition from alternative heating solutions.

03. Who are the major players in the North America Hearth Market?

Key players in the North America Hearth Market include Hearth & Home Technologies, Napoleon Products, Regency Fireplace Products, and Empire Comfort Systems, which dominate due to innovation and strong brand presence.

04. What are the growth drivers of the North America Hearth Market?

Growth drivers in the North America Hearth Market include increasing energy costs, rising demand for eco-friendly heating options, and government incentives for energy-efficient solutions.

05. What trends are shaping the North America Hearth Market?

The North America Hearth Market is shaped by trends like the shift to gas and electric hearths, integration with IoT, and demand for sustainable, recyclable materials in hearth products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.