North America Household Blender Market Outlook to 2030

Region:Global

Author(s):Meenakshi

Product Code:KROD10372

November 2024

99

About the Report

North America Household Blender Market Overview

- The North America Household Blender Market is valued at USD 0.76 billion, driven primarily by consumer demand for healthier lifestyles, including homemade smoothies, juices, and meal preparation. This trend is supported by advancements in blender technology, such as high-performance, multi-functional appliances that can process a variety of ingredients with ease. The surge in home cooking, partly influenced by lifestyle changes post-pandemic, has further fueled market demand, leading to sustained growth in the sector, supported by various consumer needs and health trends.

- In the North American market, the United States and Canada are the dominant countries. The U.S. leads the market due to its high consumer purchasing power, robust retail infrastructure, and strong adoption of premium, high-performance kitchen appliances. Additionally, urbanization and the increased popularity of at-home meal preparation have given rise to higher blender sales in major urban centers like New York, Los Angeles, and Toronto, where health-conscious consumers are inclined to invest in modern kitchen technology.

- Environmental regulations concerning packaging are becoming increasingly important in the household blender market. In 2024, the U.S. Environmental Protection Agency reported that the companies producing electrical appliances, including blenders, had switched to eco-friendly packaging solutions in response to regulatory pressure and consumer demand. This shift towards sustainable packaging aligns with broader environmental goals and government policies aimed at reducing waste and promoting recycling.

North America Household Blender Market Segmentation

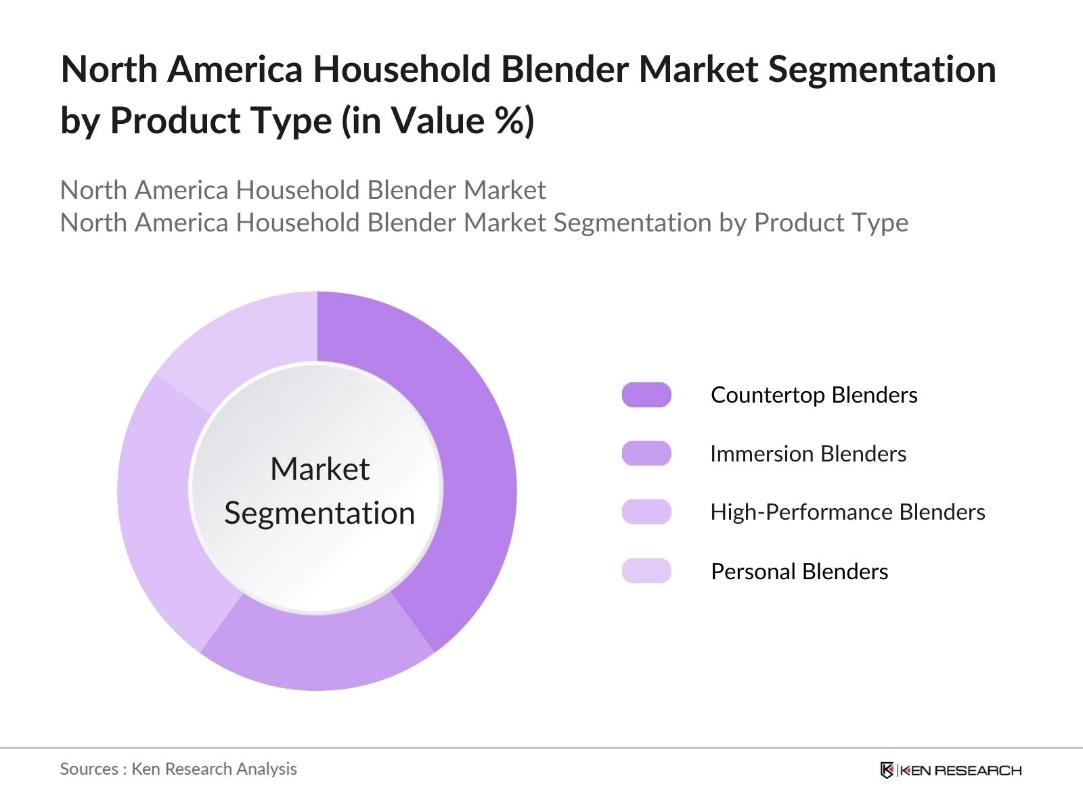

By Product Type: The North America household blender market is segmented by product type into countertop blenders, immersion blenders, high-performance blenders, and personal blenders. Among these, countertop blenders dominate due to their versatility and power, which allow them to handle various tasks from smoothies to soups. Countertop blenders are popular among consumers for their ability to handle large quantities and heavy-duty blending tasks, making them ideal for families and frequent users.

By Distribution Channel: The North America household blender market is segmented by distribution channels for household blenders include offline channels (such as hypermarkets, specialty stores, and appliance retail outlets) and online channels (eCommerce platforms and brand websites). The online segment is gaining dominance due to the convenience it offers, with eCommerce platforms like Amazon seeing increased sales of kitchen appliances. However, offline channels still maintain a strong presence, especially in retail chains where consumers prefer to physically test products before purchasing.

North America Household Blender Market Competitive Landscape

The market is moderately consolidated, with a few major players controlling significant market share. Leading companies, such as Vitamix, Breville, and Hamilton Beach, have established a strong presence through innovations in product design and enhanced functionality, catering to the premium appliance segment. Other global players like KitchenAid and NutriBullet also play significant roles by targeting mid-range and budget-conscious consumers.

|

Company Name |

Established |

Headquarters |

Revenue (USD Mn) |

Product Range |

Technology Innovation |

Sustainability Initiatives |

Customer Base |

Geographical Reach |

|

Vitamix Corporation |

1921 |

Ohio, USA |

||||||

|

Hamilton Beach Brands, Inc. |

1904 |

Virginia, USA |

||||||

|

Breville Group Ltd. |

1932 |

Sydney, Australia |

||||||

|

KitchenAid (Whirlpool) |

1919 |

Michigan, USA |

||||||

|

NutriBullet, LLC |

2003 |

California, USA |

North America Household Blender Industry Analysis

Growth Drivers

- Increasing Consumer Focus on Health: The growing awareness surrounding health and wellness in North America has significantly influenced the household blender market. According to the World Bank, the average life expectancy in the U.S. increased to 77 years in 2022, reflecting an enhanced focus on healthier lifestyles, including dietary choices. Households are increasingly adopting healthier food preparation methods, such as blending fruits and vegetables, contributing to increased blender usage. Government-backed campaigns on reducing obesity and chronic diseases have further propelled this trend, pushing consumers towards nutrient-rich smoothies and juices.

- Rising Trend of Smoothie and Juicing Diets: The surge in smoothie and juicing diets is further driving the blender market. The USDA, NASS August Crop Production forecast for U.S. peach production in 2024 is 719,000 tons, a 22 percent increase from the previous year. This trend is not only limited to personal use but has also led to growth in commercial establishments like juice bars and cafes, which are also increasingly using high-power blenders. The rising preference for plant-based diets has fueled the demand for juicing, contributing to the steady growth in blender sales.

- Technological Advancements in Blenders: Technological advancements are a key driver in the North American blender market. Features like multiple blending modes, touch screen controls, and self-cleaning systems have made blenders more convenient and efficient. Manufacturers are enhancing motor technology and durability, providing more power and quieter operation. These innovations cater to consumer demand for better performance and ease of use, boosting the market appeal of modern blenders.

Market Challenges

- Intense Competition in Pricing: The North American blender market experiences strong pricing competition due to its saturation and the presence of numerous brands. Manufacturers face challenges in balancing premium features with affordable pricing to appeal to cost-conscious consumers. Despite introducing advanced technologies, companies must offer competitive prices while maintaining profit margins, which is becoming increasingly difficult. This pricing pressure creates a challenging environment for brands striving to differentiate themselves in a crowded marketplace.

- Regulatory Compliance for Electrical Appliances: Manufacturers in the North American blender market must comply with stringent safety and energy efficiency regulations. Certification standards such as UL and CSA ensure that blenders meet required safety criteria before they reach consumers. Adhering to these regulatory frameworks can be a complex and costly process for manufacturers, as it involves rigorous testing and compliance with multiple standards. These requirements add operational challenges, impacting production and distribution.

North America Household Blender Market Future Outlook

Over the next five years, the North America household blender market is expected to experience continued growth driven by evolving consumer preferences towards healthier eating habits and advancements in smart kitchen appliances. The integration of technologies such as IoT and smart connectivity features will likely accelerate market expansion as consumers seek products that can be integrated into broader smart home ecosystems. Furthermore, growing environmental consciousness among consumers will prompt manufacturers to focus more on energy-efficient and sustainable blender designs.

Market Opportunities

- Expansion into Smart Kitchen Appliances: The demand for smart kitchen appliances is rapidly growing in North America, creating significant opportunities for manufacturers. Consumers increasingly seek convenience and connectivity in their homes, and smart blenders integrated with IoT features, such as voice control and app-based monitoring, are becoming popular. These innovations align with the expanding smart kitchen segment, offering enhanced functionality and ease of use, which appeals to tech-savvy consumers looking for modern kitchen solutions.

- Growing Popularity of Portable Blenders: Portable blenders have seen rising popularity, particularly among millennials and fitness enthusiasts who value convenience. These compact, battery-powered devices allow users to blend on the go, making them a favored choice for active lifestyles. As more consumers prioritize health and ease, portable blenders have become an essential kitchen accessory, offering a convenient solution for making smoothies and other beverages quickly and efficiently.

Scope of the Report

|

Product Type |

Countertop Blenders Immersion Blenders High-Performance Blenders Personal Blenders |

|

Power Capacity |

Below 300 Watts 300-600 Watts Above 600 Watts |

|

Blade Material |

Stainless Steel Titanium Other Materials |

|

Distribution Channel |

Offline Channels (Hypermarkets, Specialty Stores) Online Channels (eCommerce Platforms, Brand Sites) |

|

End-User |

Residential Commercial (Restaurants, Juice Bars) |

Products

Key Target Audience

Appliance Manufacturers

eCommerce Platforms

Consumer Electronics Companies

Kitchenware and Home Appliance Industry

Government and Regulatory Bodies (U.S. Consumer Product Safety Commission, Canadian Standards Association)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Vitamix Corporation

Hamilton Beach Brands, Inc.

Breville Group Ltd.

KitchenAid (Whirlpool Corporation)

NutriBullet, LLC

SharkNinja Operating LLC

Blendtec

Oster (Newell Brands)

Braun GmbH

Conair Corporation (Cuisinart)

Table of Contents

1. North America Household Blender Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Household Blender Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Household Blender Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Focus on Health

3.1.2. Rising Trend of Smoothie and Juicing Diets

3.1.3. Technological Advancements in Blenders

3.1.4. Growing Demand for Energy-Efficient Appliances

3.2. Market Challenges

3.2.1. Intense Competition in Pricing

3.2.2. Regulatory Compliance for Electrical Appliances

3.2.3. High Replacement Cycles

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Expansion into Smart Kitchen Appliances

3.3.2. Growing Popularity of Portable Blenders

3.3.3. Increasing Demand for High-Power Blenders

3.3.4. Penetration into Developing Regions in North America

3.4. Trends

3.4.1. Integration of IoT and Smart Features

3.4.2. Rise of Compact and Portable Blenders

3.4.3. Increase in Online Retailing and eCommerce Sales

3.4.4. Customization Options in Blender Designs

3.5. Regulatory Framework

3.5.1. Energy Efficiency Standards for Electrical Appliances

3.5.2. Safety and Compliance Certification (UL, CSA)

3.5.3. Environmental Regulations on Packaging

3.5.4. Labeling and Marketing Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Household Blender Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Countertop Blenders

4.1.2. Immersion Blenders

4.1.3. High-Performance Blenders

4.1.4. Personal Blenders

4.2. By Power Capacity (In Value %)

4.2.1. Below 300 Watts

4.2.2. 300-600 Watts

4.2.3. Above 600 Watts

4.3. By Blade Material (In Value %)

4.3.1. Stainless Steel

4.3.2. Titanium

4.3.3. Other Materials

4.4. By Distribution Channel (In Value %)

4.4.1. Offline Channels (Hypermarkets, Specialty Stores, etc.)

4.4.2. Online Channels (eCommerce Platforms, Brand Websites)

4.5. By End-User (In Value %)

4.5.1. Residential

4.5.2. Commercial (Restaurants, Juice Bars)

5. North America Household Blender Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Vitamix Corporation

5.1.2. Hamilton Beach Brands, Inc.

5.1.3. Breville Group Ltd.

5.1.4. SharkNinja Operating LLC

5.1.5. Blendtec

5.1.6. Conair Corporation (Cuisinart)

5.1.7. KitchenAid (Whirlpool Corporation)

5.1.8. DeLonghi Group

5.1.9. NutriBullet, LLC

5.1.10. Oster (Newell Brands)

5.1.11. Braun GmbH

5.1.12. Panasonic Corporation

5.1.13. Waring Commercial (Conair)

5.1.14. Electrolux AB

5.1.15. BLACK+DECKER (Stanley Black & Decker)

5.2 Cross Comparison Parameters(Revenue, Market Share, Product Portfolio, Innovation Index, Sustainability Initiatives, Price Strategy, Customer Base, Geographical Presence)

5.3 Market Share Analysis (Top 5 Companies by Value and Volume)

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. North America Household Blender Market Regulatory Framework

6.1. Electrical Safety Standards

6.2. Energy Efficiency Regulations

6.3. Product Certification Processes (UL, CSA, etc.)

7. North America Household Blender Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Household Blender Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Power Capacity (In Value %)

8.4. By Blade Material (In Value %)

8.5. By End-User (In Value %)

9. North America Household Blender Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved identifying major factors affecting the North America household blender market, including consumer demand, technological innovations, and regulatory developments. Extensive secondary research was conducted using proprietary and third-party databases to understand market dynamics comprehensively.

Step 2: Market Analysis and Construction

Historical market data for household blenders was analyzed, focusing on product sales, market penetration, and consumer behavior. This step provided insights into trends that helped shape the market, such as the shift towards health-conscious living and the popularity of home cooking.

Step 3: Hypothesis Validation and Expert Consultation

Market experts and key stakeholders were consulted to validate hypotheses. Interviews were conducted with representatives from leading companies, including product developers and sales managers, to gather their perspectives on future market trends and challenges.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from multiple sources to create a detailed report on the North America household blender market. Cross-referencing various data points ensured that the report presented an accurate and comprehensive analysis of market trends, consumer preferences, and competitive strategies.

Frequently Asked Questions

01. How big is the North America Household Blender Market?

The North America Household Blender Market is valued at USD 0.76 billion, driven by increasing demand for health-conscious products and home cooking appliances.

02. What are the challenges in the North America Household Blender Market?

Challenges in North America household blender market include fierce competition among brands, high product replacement cycles, and compliance with evolving energy efficiency regulations.

03. Who are the major players in the North America Household Blender Market?

Key players in the North America household blender market include Vitamix Corporation, Breville Group Ltd., Hamilton Beach Brands, KitchenAid, and NutriBullet, which dominate due to their innovation, product quality, and brand reputation.

04.What are the growth drivers of the North America Household Blender Market?

The North America household blender market growth is driven by increased consumer focus on health and wellness, technological advancements in high-performance blenders, and the rise of smart kitchen appliances integrated with IoT features.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.