North America Hyperscale Data Center Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD4749

December 2024

82

About the Report

North America Hyperscale Data Center Market Overview

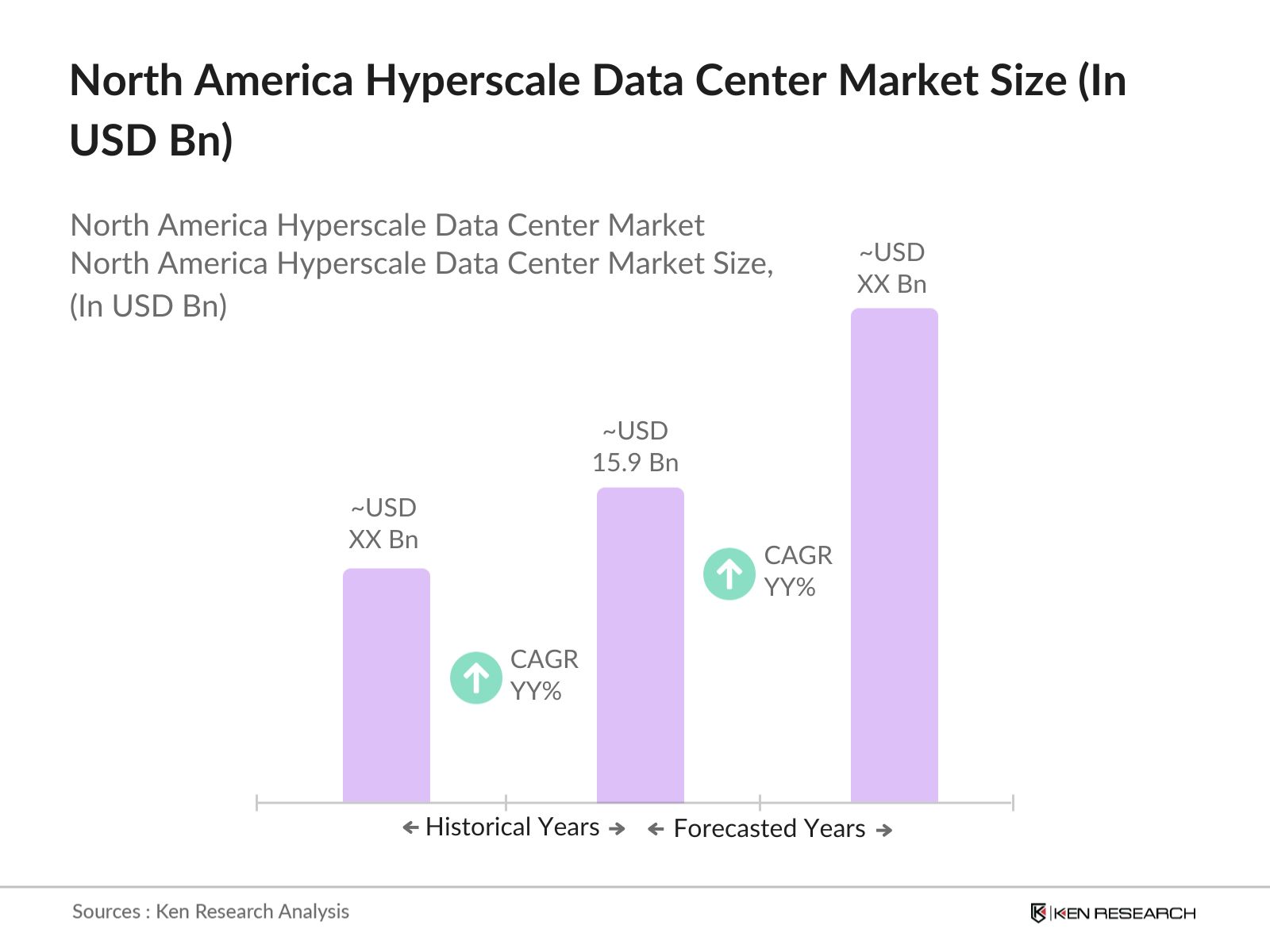

- The North America hyperscale data center market is valued at USD 15.9 billion, driven by a substantial increase in demand for data processing and storage capabilities from sectors like finance, healthcare, and e-commerce. This growth is fueled by the adoption of cloud services, which has propelled investments in high-capacity, energy-efficient infrastructure to accommodate the expanding needs of hyperscale data centers.

- The United States leads the market, attributed to its robust tech infrastructure, high internet penetration, and presence of major data center providers. Cities like Ashburn, Virginia, known as "Data Center Alley," and areas with tax incentives and access to renewable energy, such as Oregon and Texas, are particularly dominant.

- The U.S. Department of Energy has allocated $3 billion in funding to promote renewable energy integration in data centers. Hyperscale data centers are eligible for subsidies to incorporate solar, wind, and hydroelectric power sources, aligning with the governments aim to achieve net-zero emissions by 2035. This initiative directly supports data centers transitioning to green energy solutions.

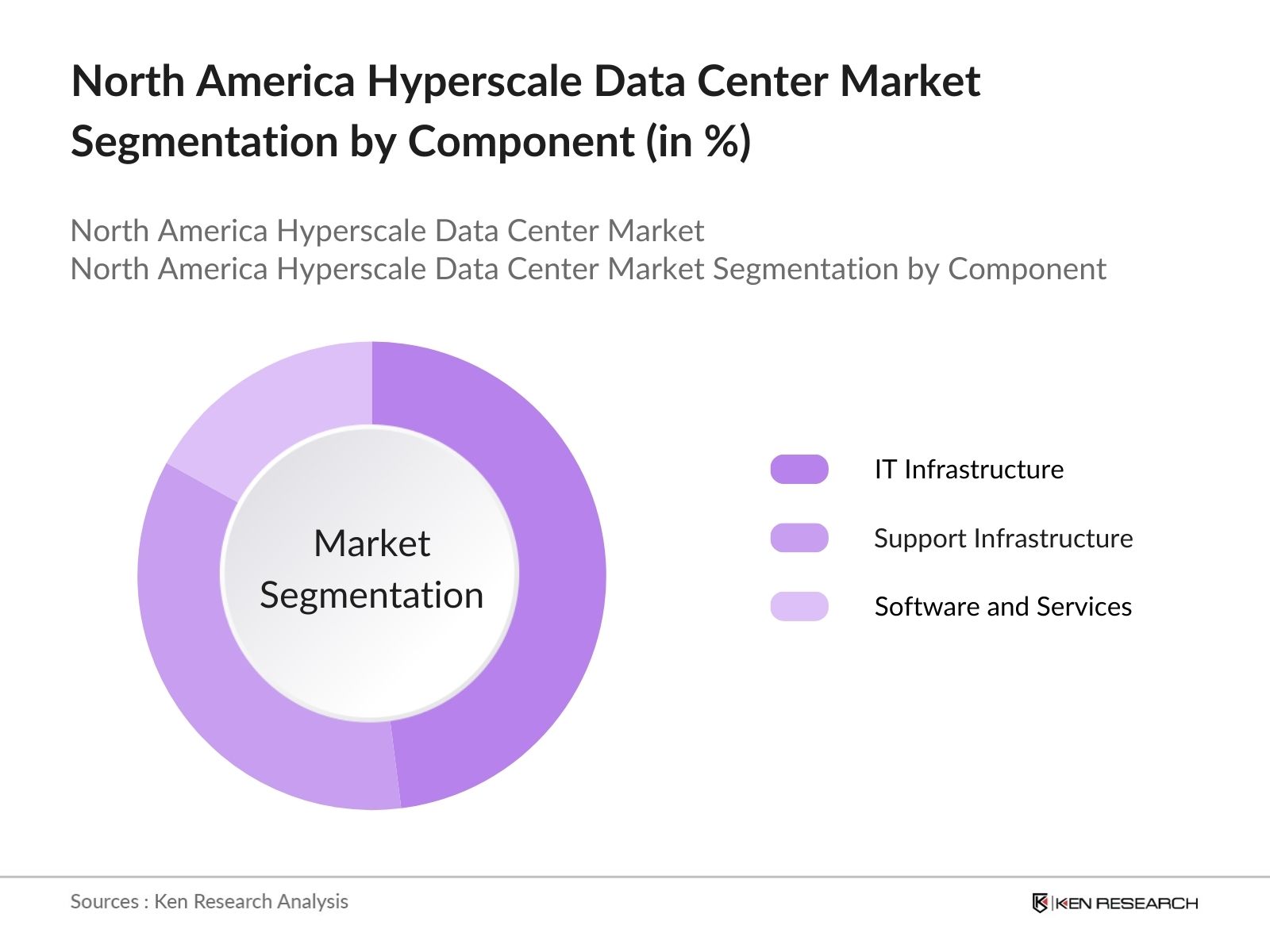

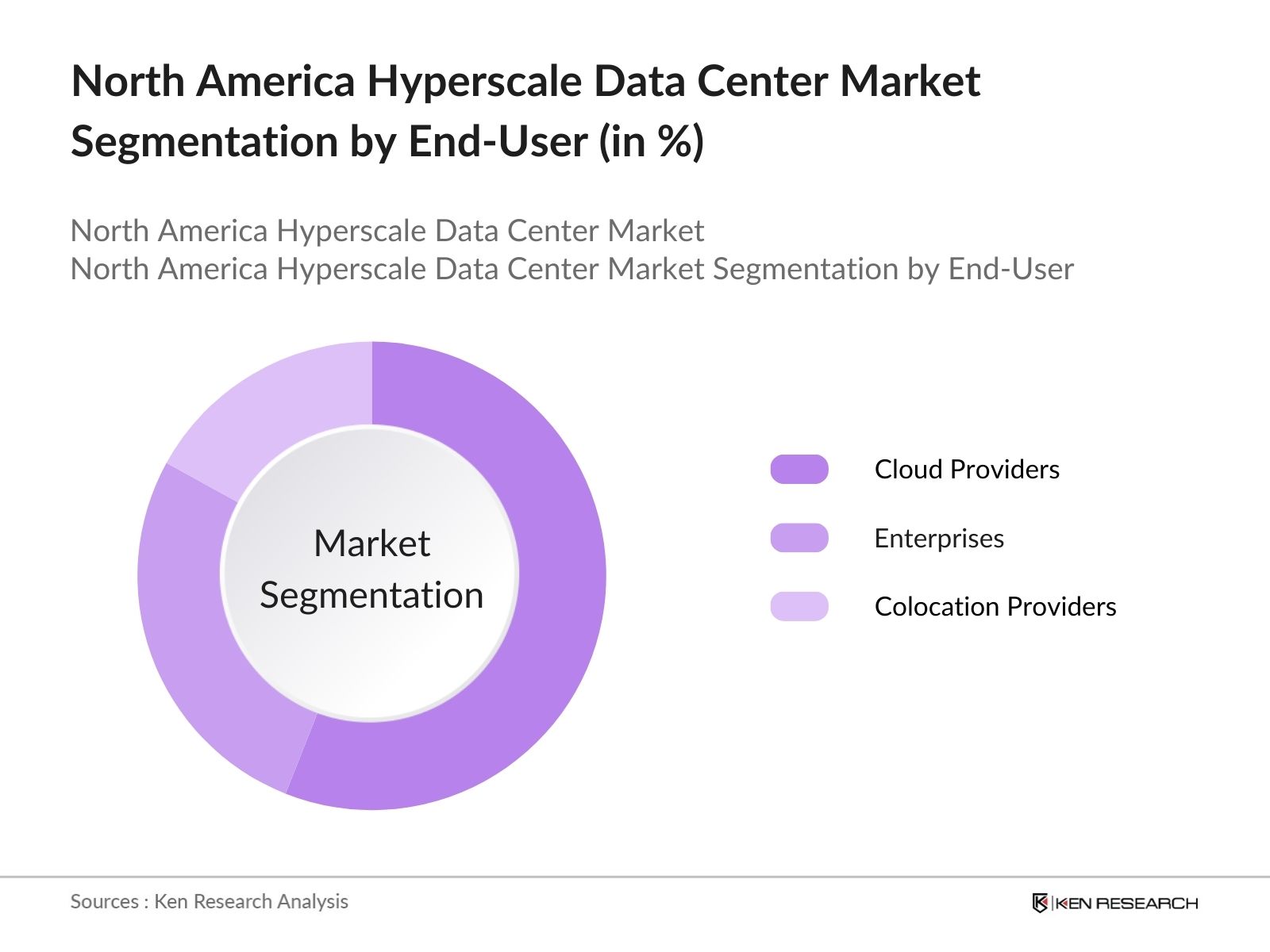

North America Hyperscale Data Center Market Segmentation

By Component: The market is segmented by component into IT Infrastructure, Support Infrastructure, and Software and Services. Recently, the IT Infrastructure segment has dominated market share, primarily due to the increasing demand for high-performance servers and storage solutions needed to handle vast volumes of data from cloud and AI applications. Key players in this segment, like NVIDIA and Intel, provide advanced processing capabilities that support high workloads, which are essential for hyperscale operations.

By End-User: The market is segmented by end-user into Cloud Providers, Enterprises, and Colocation Providers. Cloud Providers hold a dominant market share in this segmentation, driven by the growing adoption of cloud services from giants like AWS, Google Cloud, and Microsoft Azure. These providers continue to expand data center capacities to accommodate customer demand for scalable cloud solutions and on-demand processing power.

North America Hyperscale Data Center Market Competitive Landscape

The market is dominated by a mix of major cloud providers and data center companies that offer extensive infrastructure services. Companies such as Amazon Web Services and Google Cloud lead in this space, benefiting from their ability to deploy hyperscale facilities globally.

North America Hyperscale Data Center Market Analysis

Market Growth Drivers

- Expansion of Cloud Computing Needs: The surge in cloud computing requirements has led to an increase in the number of hyperscale data centers in North America. With cloud service providers like AWS, Microsoft Azure, and Google Cloud witnessing an average daily data volume of over 2 million terabytes, there is a clear need for more robust data center infrastructure. The International Data Corporation (IDC) reports that North American organizations cloud spending is projected to reach $200 billion in 2024, necessitating the expansion of hyperscale facilities to support this load.

- AI and Machine Learning Demand: The integration of artificial intelligence (AI) and machine learning (ML) across North American industries, including healthcare, finance, and retail, is driving demand for high-capacity data storage and processing capabilities. By 2024, AI-driven applications in North America are anticipated to process over 5 million terabytes of data daily, according to the U.S. Bureau of Economic Analysis (BEA). This scale of data processing requires the infrastructure that only hyperscale data centers can support, pushing significant market growth.

- Government Support for Digital Infrastructure: In 2024, the U.S. government allocated over $10 billion for digital infrastructure advancements, including grants and incentives specifically targeted at expanding data center capabilities. This investment aims to strengthen the nations digital backbone in alignment with the National AI Initiative, ensuring the U.S. retains a competitive edge globally. This push for enhanced digital capacity makes hyperscale data centers a pivotal element of the national strategy.

Market Challenges

- Rising Operational Costs Due to Skilled Labor Shortages: The demand for skilled data center professionals is projected to exceed 200,000 roles by the end of 2024, according to the U.S. Bureau of Labor Statistics. This shortage is driving up salaries, operational costs, and the cost of recruitment, making it challenging for hyperscale data centers to manage expenses efficiently. The need for specialized skills in data engineering, cybersecurity, and AI further complicates staffing efforts.

- Compliance with Stringent Environmental Regulations: Regulatory requirements for data centers are becoming increasingly stringent in North America. The U.S. government introduced updated environmental standards in 2024 that require data centers to implement enhanced cooling systems, water usage restrictions, and emissions reductions. These requirements add an estimated $1 million in compliance costs per data center, impacting the financial viability of new and existing facilities.

North America Hyperscale Data Center Market Future Outlook

Over the next few years, the North America hyperscale data center industry is expected to grow, driven by continuous investments from major cloud providers, advancements in AI, and increasing demand for digital transformation across various sectors.

Future Market Opportunities

- Growth in AI-Driven Autonomous Data Center Management: Over the next five years, North American hyperscale data centers will increasingly adopt AI-driven autonomous management systems to enhance operational efficiency. These systems will enable real-time monitoring and automatic adjustments, reducing operational costs by approximately $2 million annually per facility, as forecasted by industry experts.

- Expansion of Hyperscale Facilities in Rural Areas: Hyperscale data centers are projected to expand into rural North America, supported by government incentives and lower operational costs. By 2029, an estimated 70% of new hyperscale facilities are expected to be located outside metropolitan areas, driven by lower land costs and increased renewable energy availability.

Scope of the Report

|

Component |

IT Infrastructure (Servers, Storage, Network) |

|

Application |

BFSI |

|

End-User |

Cloud Providers |

|

Infrastructure Type |

New Construction |

|

Region |

United States |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hyperscale Data Center Providers

Cloud Service Providers

Enterprise Data Infrastructure Teams

Telecommunication Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, Canadian Ministry of Innovation)

Renewable Energy Suppliers

Hardware Manufacturers (servers, cooling systems)

Companies

Players Mentioned in the Report:

Amazon Web Services

Google Cloud

Microsoft Azure

IBM Corporation

Oracle Corporation

Apple Inc.

Alibaba Cloud

Digital Realty

Equinix

Facebook (Meta)

Table of Contents

1. North America Hyperscale Data Center Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Growth Rate and Forecast

1.4 Market Segmentation Overview

2. North America Hyperscale Data Center Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Hyperscale Data Center Market Analysis

3.1 Growth Drivers

3.1.1 Demand for Cloud Services (Cloud Adoption)

3.1.2 Edge Computing Integration

3.1.3 Data Explosion from IoT (IoT Data Surge)

3.1.4 Rise in AI Workloads (AI & ML Influence)

3.2 Market Challenges

3.2.1 High Energy Consumption (Power Efficiency)

3.2.2 Cooling Requirements (Thermal Management)

3.2.3 Limited Skilled Workforce

3.3 Opportunities

3.3.1 Renewable Energy Solutions

3.3.2 Expansion of Colocation Services

3.3.3 Modular Data Center Adoption

3.4 Trends

3.4.1 Use of AI for Operational Efficiency

3.4.2 Increased Use of Liquid Cooling Technologies

3.4.3 Growth of Hybrid Cloud Architectures

3.5 Regulatory Landscape

3.5.1 Data Privacy Regulations (GDPR, CCPA)

3.5.2 Environmental Compliance Standards

3.6 SWOT Analysis

3.7 Ecosystem Overview

3.8 Porters Five Forces Analysis

3.9 Competition Landscape

4. North America Hyperscale Data Center Market Segmentation

4.1 By Component

4.1.1 IT Infrastructure (Servers, Storage, Network)

4.1.2 Support Infrastructure (Power, Cooling, Security)

4.1.3 Software and Services (DCIM, Automation Tools)

4.2 By Application

4.2.1 Banking, Financial Services, and Insurance (BFSI)

4.2.2 IT & Telecommunications

4.2.3 Healthcare

4.2.4 Government & Defense

4.2.5 Others (Retail, Manufacturing)

4.3 By End-User

4.3.1 Cloud Providers

4.3.2 Enterprises

4.3.3 Colocation Providers

4.4 By Infrastructure Type

4.4.1 New Construction

4.4.2 Renovation/Expansion

4.5 By Region

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Hyperscale Data Center Market Competitive Analysis

5.1 Major Competitors

5.1.1 Google LLC

5.1.2 Amazon Web Services (AWS)

5.1.3 Microsoft Corporation

5.1.4 Apple Inc.

5.1.5 IBM Corporation

5.1.6 Oracle Corporation

5.1.7 Facebook, Inc.

5.1.8 Alibaba Group

5.1.9 Equinix, Inc.

5.1.10 Digital Realty

5.1.11 NTT Communications

5.1.12 China Mobile

5.1.13 CyrusOne Inc.

5.1.14 Switch, Inc.

5.1.15 Iron Mountain

5.2 Cross Comparison Parameters (Revenue, No. of Data Centers, Power Capacity, Renewable Energy Usage, Geographic Presence, Customer Base, Strategic Partnerships, Technical Support Offerings)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Funding & Venture Capital

5.8 Government Incentives

5.9 Private Equity Participation

6. North America Hyperscale Data Center Market Regulatory Framework

6.1 Data Privacy Standards

6.2 Compliance Regulations (ISO, SOC 2)

6.3 Environmental Certifications (LEED, Energy Star)

7. North America Hyperscale Data Center Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Hyperscale Data Center Future Market Segmentation

8.1 By Component (In Value %)

8.2 By Application (In Value %)

8.3 By End-User (In Value %)

8.4 By Infrastructure Type (In Value %)

8.5 By Region (In Value %)

9. North America Hyperscale Data Center Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Strategy Recommendations

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with constructing a stakeholder map of the North America hyperscale data center market, focusing on major players, including data center operators, hardware suppliers, and cloud service providers. The goal is to determine the primary variables that shape this market.

Step 2: Market Analysis and Construction

This phase involves collecting historical data on revenue growth and infrastructure expansion, such as the number of hyperscale facilities and power capacities. These metrics help establish a reliable baseline for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses around market growth, influencing factors, and competitive dynamics are validated through expert interviews and consultations with industry professionals, providing real-time insights into the North American market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes findings from multiple primary and secondary sources to create a validated, in-depth analysis of the North American hyperscale data center market.

Frequently Asked Questions

01. How big is the North America Hyperscale Data Center Market?

The North America hyperscale data center market is valued at USD 15.9 billion, driven by cloud adoption and increased digital demand from sectors like healthcare, finance, and media.

02. What are the challenges in the North America Hyperscale Data Center Market?

Challenges in the North America hyperscale data center market include high operational costs, stringent regulatory requirements on energy use, and the need for skilled IT professionals to manage advanced infrastructure.

03. Who are the major players in the North America Hyperscale Data Center Market?

Key players in the North America hyperscale data center market include Amazon Web Services, Google Cloud, Microsoft Azure, Digital Realty, and Equinix, supported by their extensive network infrastructure and strategic investments.

04. What drives the growth of the North America Hyperscale Data Center Market?

Growth in the North America hyperscale data center market is driven by the surge in cloud adoption, IoT applications, and AI-based data processing demands, prompting investments in data centers with high scalability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.