North America Identity Theft Protection Services Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6294

December 2024

94

About the Report

North America Identity Theft Protection Services Market Overview

- The North America Identity Theft Protection Services Market is valued at USD 5.53 billion, based on a five-year historical analysis. This growth is driven by a rapid increase in digital transactions, particularly through e-commerce platforms and mobile banking. The rising incidences of identity theft across sectors like finance, healthcare, and retail have also created heightened demand for identity protection services.

- In terms of geographic dominance, the United States leads the market, driven by high internet penetration rates, a significant number of online financial transactions, and stringent government regulations on data protection. Cities like New York, San Francisco, and Washington, D.C. play a crucial role due to the concentration of financial institutions and tech companies, which are key drivers of identity protection solutions.

- The Federal Trade Commission (FTC) plays a crucial role in regulating identity theft in the U.S., enforcing strict rules for businesses to protect consumer data. In 2023, the FTC saw a rise in identity theft complaints, leading to stricter enforcement of the Identity Theft and Assumption Deterrence Act (ITADA). This law imposes severe penalties on companies failing to safeguard information, shaping the U.S. identity theft protection services market.

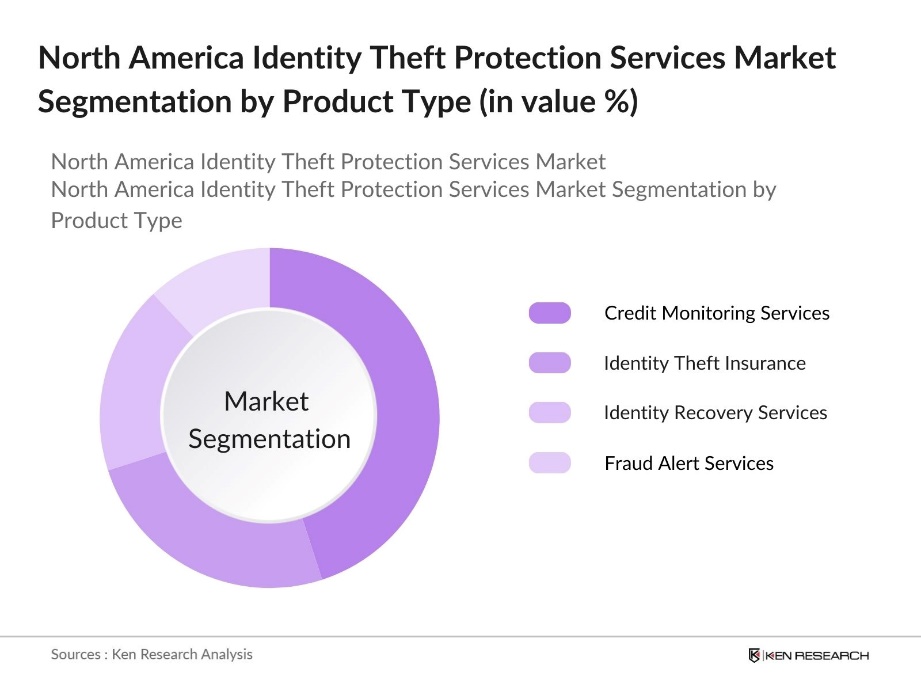

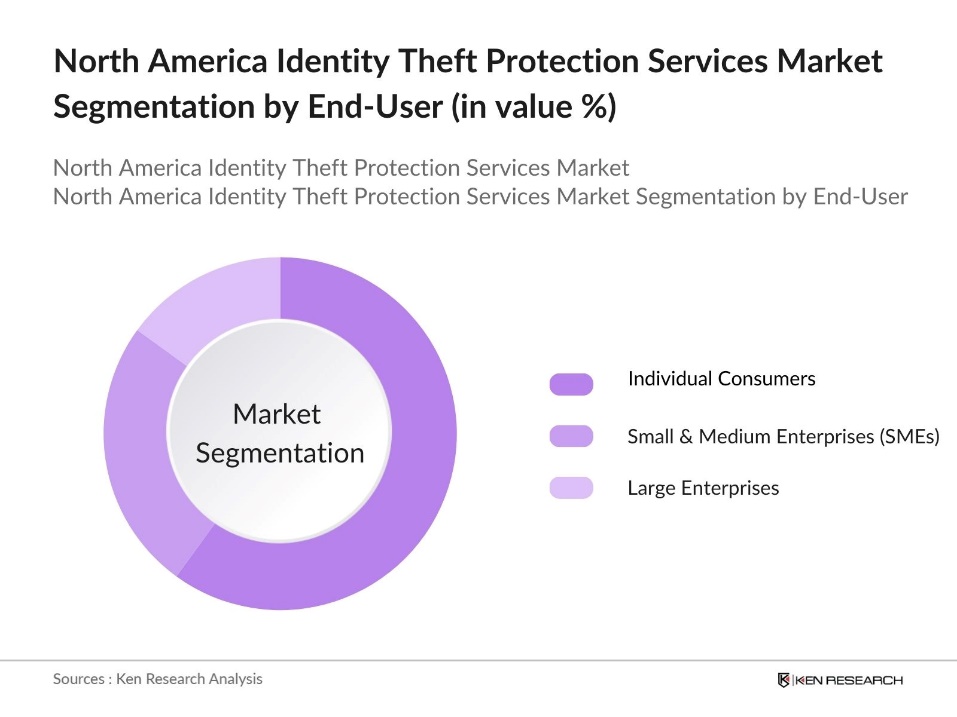

North America Identity Theft Protection Services Market Segmentation

By Product Type: The North America Identity Theft Protection Services market is segmented by product type into Credit Monitoring Services, Identity Theft Insurance, Identity Recovery Services, and Fraud Alert Services. Among these, Credit Monitoring Services hold the dominant market share. This dominance is attributed to the growing consumer demand for real-time alerts and reports on credit-related activities, allowing for the immediate detection of suspicious actions. Major service providers like Experian and TransUnion have built strong customer bases due to the increasing awareness of credit fraud risks and the ease of monitoring solutions.

By End-User: The North America Identity Theft Protection Services market is also segmented by end-user into Individual Consumers, Small & Medium Enterprises (SMEs), and Large Enterprises. Individual Consumers dominate this segment, holding the largest market share due to the increasing awareness of identity theft risks in everyday activities, such as online shopping, social media use, and digital banking. With the advent of more affordable subscription models and targeted marketing by major providers, individual users are opting for these services to safeguard their digital identities.

North America Identity Theft Protection Services Market Competitive Landscape

The market is dominated by both local and global players. Companies such as LifeLock (NortonLifeLock), Experian, and TransUnion are key market leaders, offering a wide array of protection services. These players dominate due to their extensive service portfolios, large customer bases, and strong partnerships with financial institutions. Additionally, new entrants focusing on AI-driven identity protection solutions are gaining momentum in this space.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Market Revenue |

Global Presence |

Technological Integration |

Customer Retention Rate |

Key Partnerships |

|

LifeLock (NortonLifeLock) |

2010 |

Tempe, Arizona, US |

||||||

|

Experian |

1996 |

Dublin, Ireland |

||||||

|

TransUnion |

1968 |

Chicago, Illinois, US |

||||||

|

IdentityForce |

2005 |

Framingham, US |

||||||

|

Identity Guard |

1996 |

Herndon, Virginia, US |

North America Identity Theft Protection Services Industry Analysis

Growth Drivers

- Rising Incidences of Identity Theft: Identity theft incidents in North America have been escalating, particularly in the U.S., where 1.037 million reports of fraud and identity theft were documented in 2023 by the Federal Trade Commission (FTC). This surge is attributed to an increase in digital footprints due to widespread online services. The U.S. population engaged in internet activities, the vulnerability to identity theft has grown significantly. This trend highlights the critical need for robust identity theft protection services to secure personal and financial data in the region.

- Increasing Digital Transactions (Mobile Payment, E-commerce): The rise in digital transactions, driven by the e-commerce boom and mobile payments, is creating a fertile ground for identity theft. In 2023, the U.S. recorded over 16 billion mobile payment transactions, fueled by the pandemic-induced shift to contactless payments. This increase in digital activity necessitates identity protection services as more financial and personal information is exposed. Countries like Canada also reported a significant rise in digital payment usage, with 30 million users regularly engaged in online transactions, making these markets increasingly susceptible to cyber threats.

- Awareness Programs for Cybersecurity: Governments in North America are actively promoting cybersecurity awareness to combat identity theft. Through various public initiatives, individuals and businesses are being educated about online security threats like phishing and hacking. These programs are increasing public knowledge and driving demand for identity theft protection services, as more people recognize the importance of securing their personal and financial information in the digital age.

Market Challenges

- High Subscription Costs: The identity theft protection market faces challenges due to the high costs associated with advanced protection plans. These subscription costs can limit accessibility for many individuals, especially those from low-income households. Although these services provide comprehensive protection, including monitoring and insurance, the expense remains a significant barrier to broader adoption. As a result, many potential customers are unable to afford the services, which could slow market expansion, particularly in more economically vulnerable areas.

- Data Breaches within Protection Firms: Ironically, identity theft protection companies themselves are not immune to data breaches. When these breaches occur, they undermine consumer trust in the services meant to protect personal data. Such incidents can deter potential customers from subscribing, as concerns over the reliability of these solutions grow. With increasing competition in the market, maintaining data security and trust becomes essential to sustaining consumer confidence in these services.

North America Identity Theft Protection Services Market Future Outlook

The North America Identity Theft Protection Services market is poised for significant growth over the coming years, driven by continuous advancements in AI-based detection systems, the rise of digital banking, and increasing consumer awareness of the risks associated with identity theft. Furthermore, collaboration between private companies and government entities to enhance data protection laws and cybersecurity will accelerate market growth.

Market Opportunities

- Expansion of AI-driven Identity Protection Solutions: Artificial Intelligence (AI) is becoming a crucial component in the identity theft protection market. AI-powered tools can efficiently analyze large amounts of data in real-time to detect suspicious activities and prevent fraud. These technologies offer more proactive and effective security measures, creating new opportunities for identity protection providers to enhance their offerings. As AI continues to evolve, its integration into cybersecurity solutions is expected to play a key role in improving identity protection capabilities across the market.

- Integration with Financial Institutions: Financial institutions across North America are increasingly collaborating with identity theft protection firms to offer integrated services. Many banks and financial organizations are incorporating identity protection solutions into their platforms to enhance customer security and build trust. These partnerships provide a strategic avenue for market growth, expanding the reach of identity theft protection services by embedding them directly into financial products. This integration helps customers access essential security features more conveniently, fostering stronger relationships between financial institutions and their clients.

Scope of the Report

|

Product Type |

Credit Monitoring Services Identity Theft Insurance Identity Recovery Services Fraud Alert Services |

|

End-User |

Individual Consumers SMEs Large Enterprises |

|

Application |

Banking & Financial Services Healthcare Retail & E-commerce Government |

|

Distribution Channel |

Direct Sales E-commerce Platforms Partnered Financial Institutions |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Cybersecurity Companies

E-commerce Platforms

Technology Solution Providers

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Federal Trade Commission (FTC), Personal Information Protection and Electronic Documents Act (PIPEDA))

Companies

Players Mentioned in the Report

LifeLock (NortonLifeLock)

Experian

TransUnion

Equifax

IdentityForce

ID Watchdog

Identity Guard

PrivacyGuard

CyberScout

Kroll Advisory Solutions

Table of Contents

1. North America Identity Theft Protection Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Identity Theft Protection Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Identity Theft Protection Services Market Analysis

3.1. Growth Drivers

3.1.1. Rising Incidences of Identity Theft

3.1.2. Increasing Digital Transactions (Mobile Payment, E-commerce)

3.1.3. Government Initiatives for Data Privacy

3.1.4. Awareness Programs for Cybersecurity

3.2. Market Challenges

3.2.1. High Subscription Costs

3.2.2. Data Breaches within Protection Firms

3.2.3. Complex Regulatory Landscape

3.3. Opportunities

3.3.1. Expansion of AI-driven Identity Protection Solutions

3.3.2. Integration with Financial Institutions

3.3.3. Customization in Subscription Models

3.4. Trends

3.4.1. Biometrics for Identity Authentication

3.4.2. Blockchain-based Identity Security

3.4.3. Multi-factor Authentication Adoption

3.5. Regulatory Framework

3.5.1. US Federal Trade Commission (FTC) Identity Theft Laws

3.5.2. Canadas Personal Information Protection and Electronic Documents Act (PIPEDA)

3.5.3. EU-GDPR Impact on North American Market

3.5.4. Public-Private Partnerships on Cybersecurity

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Identity Theft Protection Services Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Credit Monitoring Services

4.1.2. Identity Theft Insurance

4.1.3. Identity Recovery Services

4.1.4. Fraud Alert Services

4.2. By End-User (In Value %)

4.2.1. Individual Consumers

4.2.2. Small & Medium Enterprises (SMEs)

4.2.3. Large Enterprises

4.3. By Application (In Value %)

4.3.1. Banking & Financial Services

4.3.2. Healthcare

4.3.3. Retail & E-commerce

4.3.4. Government

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. E-commerce Platforms

4.4.3. Partnered Financial Institutions

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Identity Theft Protection Services Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. LifeLock Inc. (NortonLifeLock)

5.1.2. Experian PLC

5.1.3. TransUnion LLC

5.1.4. Equifax Inc.

5.1.5. IdentityForce Inc.

5.1.6. ID Watchdog (Equifax)

5.1.7. Identity Guard

5.1.8. PrivacyGuard (Trilegiant Corporation)

5.1.9. CyberScout LLC

5.1.10. Kroll Advisory Solutions

5.1.11. AllClear ID

5.1.12. MyIDCare (IDX)

5.1.13. InfoArmor Inc. (Allstate)

5.1.14. Zander Insurance

5.1.15. Aura Identity Guard

5.2 Cross Comparison Parameters (Service Offerings, Subscription Plans, Market Share, Inception Year, Customer Base, Technology Platforms, Client Retention Rate, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Identity Theft Protection Services Market Regulatory Framework

6.1. Privacy and Data Protection Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. North America Identity Theft Protection Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Identity Theft Protection Services Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. North America Identity Theft Protection Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved constructing an ecosystem map that includes all major stakeholders in the North America Identity Theft Protection Services Market. This was achieved through extensive desk research, utilizing proprietary and public databases to gather detailed information on the key variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data on identity theft cases, service provider penetration, and market revenue generation. Additionally, a thorough evaluation of service quality was conducted to ensure the accuracy and reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

To validate our market hypotheses, we conducted interviews with industry experts from leading companies through computer-assisted telephone interviews (CATIs). These consultations provided insights into both operational challenges and growth opportunities.

Step 4: Research Synthesis and Final Output

The final step included direct engagement with major identity theft protection service providers to validate the gathered data. This process ensured a comprehensive and validated analysis of the North America Identity Theft Protection Services market.

Frequently Asked Questions

01 How big is the North America Identity Theft Protection Services Market?

The North America Identity Theft Protection Services Market is valued at USD 5.53 billion, driven by the increasing number of digital transactions and growing awareness of cybersecurity threats.

02 What are the challenges in the North America Identity Theft Protection Services Market?

Challenges in North America Identity Theft Protection Services Market include high subscription costs, frequent data breaches, and the complexity of adhering to stringent government regulations. Service providers must also contend with the evolving nature of cyber threats.

03 Who are the major players in the North America Identity Theft Protection Services Market?

Major players in North America Identity Theft Protection Services Market include LifeLock, Experian, TransUnion, Equifax, and IdentityForce. These companies dominate the market due to their extensive portfolios, customer trust, and partnerships with financial institutions.

04 What are the growth drivers of the North America Identity Theft Protection Services Market?

The North America Identity Theft Protection Services Market is driven by increasing identity theft cases, government regulations aimed at data protection, and the growing adoption of digital financial services across industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.