North America Indoor Positioning and Indoor Navigation (IPIN) Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD7100

November 2024

85

About the Report

North America Indoor Positioning and Indoor Navigation Market Overview

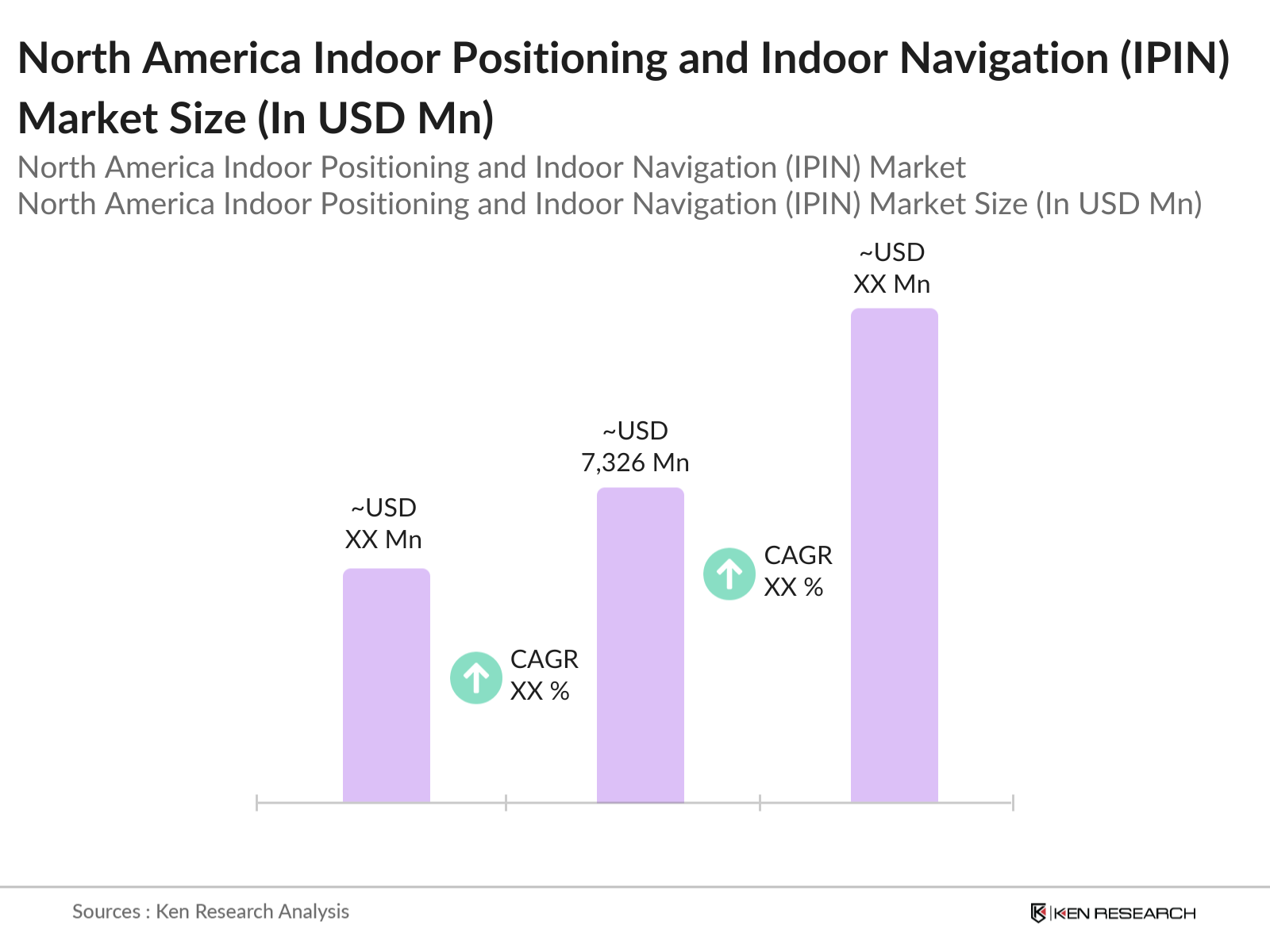

- The North America Indoor Positioning and Indoor Navigation (IPIN) market is valued at USD 7,326 million, based on a five-year historical analysis. The market's growth is primarily driven by increasing demand for accurate location-based services, particularly in sectors such as retail, healthcare, and transportation. Technological advancements like Bluetooth Low Energy (BLE) and Ultra-Wideband (UWB) are enhancing the precision of indoor navigation systems, catering to the rising need for real-time tracking and personalized customer experiences across large facilities and public spaces.

- The market is dominated by cities in the United States, particularly New York, San Francisco, and Chicago, which lead due to their high concentration of commercial enterprises, large airports, and adoption of smart city projects. Additionally, Canada, with cities like Toronto and Vancouver, contributes significantly due to strong government initiatives supporting smart infrastructure and digitalization. The regions dominance is attributed to the integration of advanced technologies and growing demand for seamless indoor navigation solutions in complex environments.

- The FCC has established regulations for LBS to ensure accuracy and privacy in indoor positioning systems. These regulations mandate that IPIN systems used for emergency services, such as 911 calls, must meet specific accuracy requirements within 50 meters. In 2023, the FCC updated its rules to include indoor positioning capabilities, ensuring that first responders can accurately locate individuals in multi-story buildings.

North America Indoor Positioning and Indoor Navigation Market Segmentation

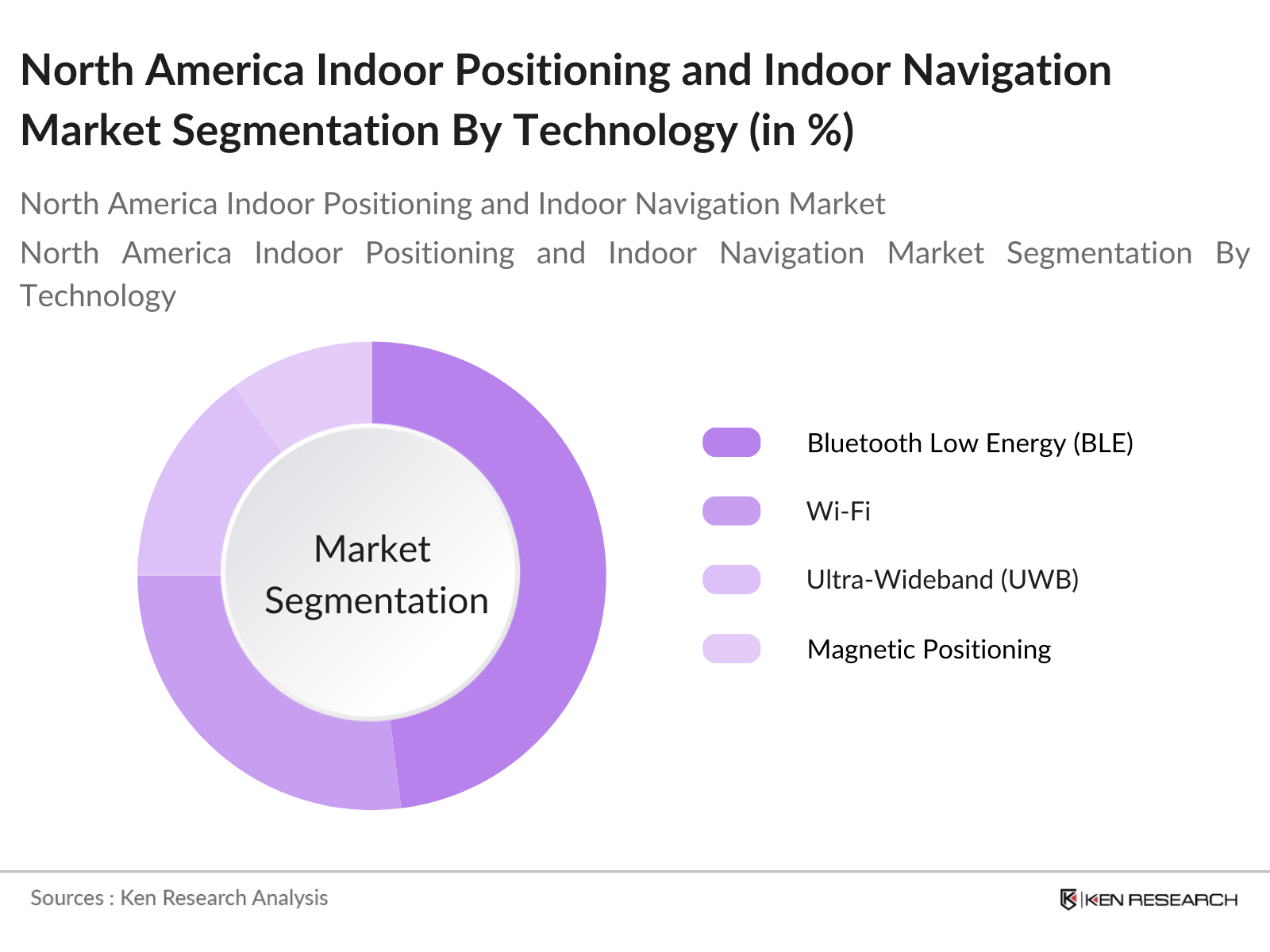

By Technology: The North America IPIN market is segmented by technology into Bluetooth Low Energy (BLE), Wi-Fi, Ultra-Wideband (UWB), Magnetic Positioning, and Radio-Frequency Identification (RFID). Among these, Bluetooth Low Energy (BLE) holds the dominant market share in 2023 at 42%. BLE is favored for its cost-effectiveness, low power consumption, and wide compatibility with smartphones, making it the technology of choice for retail and public building applications.

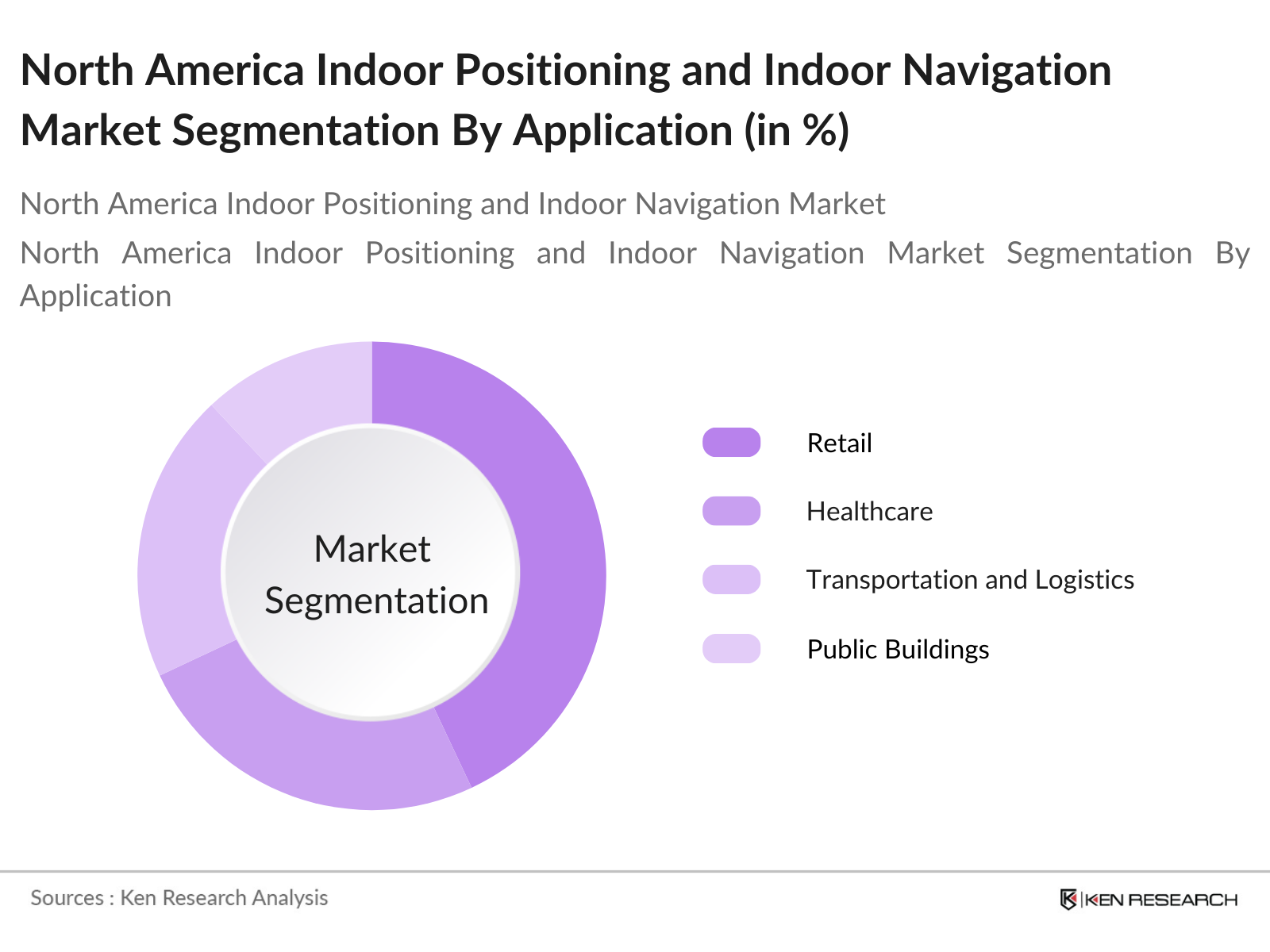

By Application: The market is also segmented by application into Retail, Healthcare, Transportation and Logistics, Public Buildings, and Manufacturing. Retail holds the highest market share at 34% in 2023. The growing demand for location-based services, such as in-store navigation, personalized promotions, and shopper analytics, has contributed to the retail sectors leadership in IPIN solutions.

North America Indoor Positioning and Indoor Navigation Market Competitive Landscape

The North America IPIN market is dominated by a few key players that drive innovation and market expansion. These companies leverage their extensive R&D capabilities, partnerships, and solutions to maintain a strong foothold in the market. The market consolidation underscores the influence these players have in shaping market trends and solutions. The North American IPIN market is characterized by a few leading companies, including Google, Apple, HERE Technologies, and Cisco Systems.

North America Indoor Positioning and Indoor Navigation Industry Analysis

Growth Drivers

- Proliferation of Smart Devices (Market Penetration): The widespread use of smartphones and smart devices in North America continues to drive the adoption of IPIN systems. In 2023, North America had 356 million mobile subscriptions, of which over 81% were smartphones, according to the International Telecommunication Union (ITU). The constant connectivity and enhanced location-based service offerings provided by these devices significantly support indoor positioning technologies.

- Increasing Demand for Location-Based Services (LBS): Location-based services (LBS) are a major driver for the IPIN market, as demand grows for enhanced indoor navigation and positioning solutions in commercial spaces. As of 2023, the U.S. has approximately 214 million active LBS users, according to the Pew Research Center. The adoption of LBS in retail, healthcare, and public services has become vital, improving navigation for users within complex indoor spaces. LBS systems' role in optimizing real-time tracking is a core growth factor as more industries integrate these services into their operations.

- Integration of AI and Machine Learning (Technology Evolution): Artificial intelligence (AI) and machine learning (ML) technologies are transforming IPIN systems by offering enhanced accuracy, contextual understanding, and predictive insights. According to a McKinsey report, AI-driven indoor positioning solutions have reduced navigation errors by up to 60% in various industries. The U.S. governments AI initiatives, which received $2 billion in funding through the National AI Initiative Act, continue to fuel research and deployment of AI in positioning systems, improving efficiency in indoor environments such as hospitals, warehouses, and airports.

Market Challenges

- High Implementation Costs: One of the significant barriers to IPIN adoption is the high cost of implementation, particularly for small businesses and public institutions. Indoor positioning systems require substantial investment in hardware, such as beacons, Wi-Fi access points, and mapping software. According to a Deloitte report, the average cost of deploying an enterprise-level IPIN solution in the U.S. is around $100,000, including infrastructure and software integration.

- Data Privacy and Security Concerns (Regulatory Compliance): Data privacy and security concerns have become increasingly prominent as IPIN systems collect vast amounts of location data. With the introduction of the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), organizations are required to implement stringent data protection measures. According to the Electronic Frontier Foundation, data breaches involving LBS and IPIN technologies increased by 18% in North America in 2023.

North America Indoor Positioning and Indoor Navigation Market Future Outlook

The North America Indoor Positioning and Indoor Navigation market is expected to witness substantial growth over the next five years. Driven by continuous technological advancements in AI, IoT, and 5G, alongside growing consumer demand for seamless indoor experiences, the market is set to evolve rapidly. The adoption of IPIN solutions in smart city projects, healthcare, and the retail sector will be instrumental in the markets growth trajectory.

Market Opportunities

- Rise of 5G Connectivity: The rollout of 5G in North America is set to revolutionize IPIN systems by enabling faster, more accurate, and real-time positioning services. As of 2024, the U.S. has more than 340,000 active 5G cell sites, according to the Federal Communications Commission (FCC), and Canada has allocated $2.2 billion for 5G infrastructure development. This increase in 5G deployment provides an opportunity for more precise and robust IPIN systems, particularly in high-density urban environments where fast data transfer and low latency are essential for navigation accuracy.

- Collaboration with Retailers for Customer Analytics: Retailers are increasingly collaborating with IPIN providers to gain insights into customer behavior through indoor tracking. For instance, Walmart uses IPIN to enhance customer navigation and collect analytics on foot traffic within stores. According to Retail Dive, over 58% of large U.S. retailers are currently using indoor tracking technologies. These collaborations provide opportunities for IPIN vendors to expand their footprint in the retail sector by offering location-based analytics to optimize store layouts and improve customer engagement.

Scope of the Report

|

Technology |

Bluetooth Low Energy (BLE) Wi-Fi, Ultra-Wideband (UWB) Magnetic Positioning RFID |

|

Application |

Retail, Healthcare Transportation and Logistics Public Buildings Manufacturing |

|

Solution Type |

Hardware Software Services (Managed and Professional) |

|

End-User |

Enterprises Public Sector Individual Consumers |

|

Region |

United State Canada Mexico |

Products

Key Target Audience

Technology Providers

Indoor Navigation Solution Providers

Retailers and Shopping Malls

Hospitals and Healthcare Providers

Public Sector Entities

Airports and Transportation Companies

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (FCC, NIST)

Companies

Players Mentioned in the Report

Google LLC

Apple Inc.

HERE Technologies

Cisco Systems, Inc.

Inpixon

Qualcomm Technologies, Inc.

Zebra Technologies

STMicroelectronics

Senion AB

Navigine

Table of Contents

1. North America Indoor Positioning and Indoor Navigation (IPIN) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview

2. North America Indoor Positioning and Indoor Navigation (IPIN) Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Indoor Positioning and Indoor Navigation (IPIN) Market Analysis

3.1. Growth Drivers

3.1.1. Proliferation of Smart Devices (Market Penetration)

3.1.2. Increasing Demand for Location-Based Services (LBS)

3.1.3. Integration of AI and Machine Learning (Technology Evolution)

3.1.4. Adoption of Smart Infrastructure (Urbanization Metrics)

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Data Privacy and Security Concerns (Regulatory Compliance)

3.2.3. Lack of Standardization

3.3. Opportunities

3.3.1. Rise of 5G Connectivity

3.3.2. Collaboration with Retailers for Customer Analytics

3.3.3. Growth in IoT Ecosystem Adoption

3.4. Trends

3.4.1. Use of BLE (Bluetooth Low Energy) Beacons

3.4.2. Integration with Augmented Reality (AR)

3.4.3. Demand for Hybrid Positioning Systems (Tech Penetration)

3.5. Government Regulations and Policies

3.5.1. FCC Regulations for Location-Based Services

3.5.2. Data Privacy Acts (CCPA, GDPR)

3.5.3. Public Sector Applications (Indoor Navigation for Emergency Services)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Indoor Positioning and Indoor Navigation (IPIN) Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Bluetooth Low Energy (BLE)

4.1.2. Wi-Fi

4.1.3. Ultra-Wideband (UWB)

4.1.4. Magnetic Positioning

4.1.5. RFID (Radio-Frequency Identification)

4.2. By Application (In Value %)

4.2.1. Retail

4.2.2. Healthcare

4.2.3. Transportation and Logistics

4.2.4. Public Buildings

4.2.5. Manufacturing

4.3. By Solution Type (In Value %)

4.3.1. Hardware

4.3.2. Software

4.3.3. Services (Managed and Professional)

4.4. By End-User (In Value %)

4.4.1. Enterprises

4.4.2. Public Sector

4.4.3. Individual Consumers

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Indoor Positioning and Indoor Navigation (IPIN) Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Google LLC

5.1.3. HERE Technologies

5.1.4. Qualcomm Technologies, Inc.

5.1.5. Cisco Systems, Inc.

5.1.6. Inpixon

5.1.7. Senion AB

5.1.8. Zebra Technologies

5.1.9. Esri

5.1.10. Microsoft Corporation

5.1.11. STMicroelectronics

5.1.12. Siemens AG

5.1.13. Navigine

5.1.14. Mist Systems

5.1.15. IBM Corporation

5.2. Cross Comparison Parameters

(Revenue, Market Share, Technology Focus, R&D Investments, Solutions Offered, Vertical Expertise, Partnerships, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Indoor Positioning and Indoor Navigation (IPIN) Market Regulatory Framework

6.1. Data Privacy Regulations

6.2. FCC Compliance

6.3. Certification Standards

7. North America Indoor Positioning and Indoor Navigation (IPIN) Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Indoor Positioning and Indoor Navigation (IPIN) Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By Solution Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. North America Indoor Positioning and Indoor Navigation (IPIN) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the entire ecosystem of the North America Indoor Positioning and Indoor Navigation Market, identifying key stakeholders such as technology providers, system integrators, and end-users. Extensive desk research, including proprietary databases and secondary sources, is conducted to gather critical market information.

Step 2: Market Analysis and Construction

We analyze historical data to assess market penetration, key market trends, and revenue generation by various industry verticals such as retail and healthcare. The analysis also covers the ratio of technology adoption between BLE, UWB, and other technologies, ensuring a comprehensive view of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, ranging from solution providers to end-users. These consultations provide firsthand insights into operational challenges, growth drivers, and competitive landscapes, refining the overall market data.

Step 4: Research Synthesis and Final Output

The final synthesis phase involves consolidating data from primary and secondary sources, creating a validated output that includes segment-wise revenue estimates, future market growth projections, and comprehensive market dynamics.

Frequently Asked Questions

01. How big is the North America Indoor Positioning and Indoor Navigation Market?

The North America Indoor Positioning and Indoor Navigation (IPIN) market is valued at USD 7,326 million, based on a five-year historical analysis.

02. What are the challenges in the North America Indoor Positioning and Indoor Navigation Market?

Challenges include high initial setup costs, data privacy concerns, and the lack of standardized solutions across different industries.

03. Who are the major players in the North America Indoor Positioning and Indoor Navigation Market?

Major players include Google, Apple, Cisco Systems, HERE Technologies, and Inpixon, all known for their innovations in location-based technologies.

04. What are the growth drivers of the North America Indoor Positioning and Indoor Navigation Market?

The growth drivers include advancements in BLE and UWB technologies, rising demand for indoor navigation in smart buildings, and the growing integration of IoT.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.