North America Industrial Hemp Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD8950

December 2024

89

About the Report

North America Industrial Hemp Market Overview

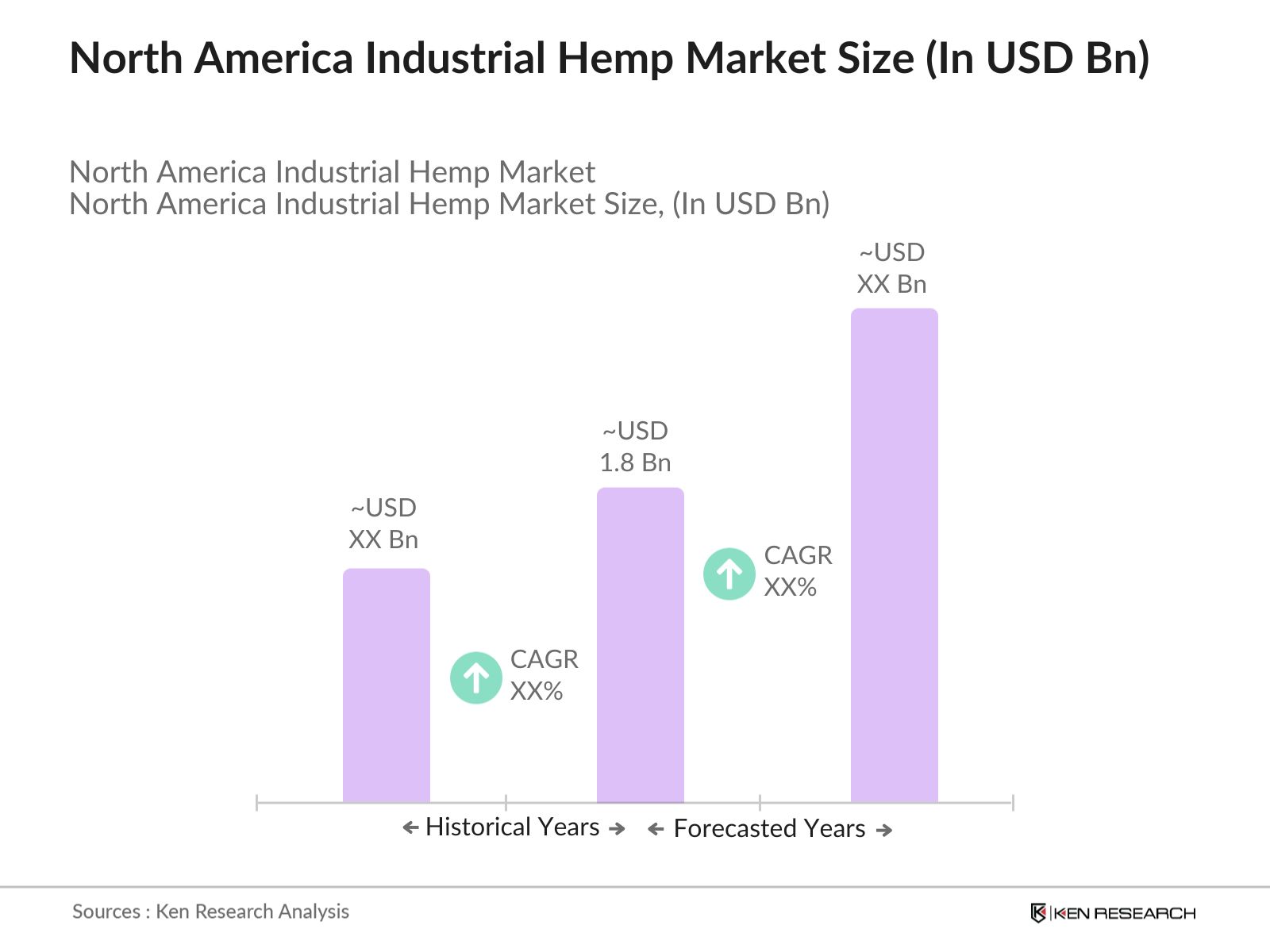

- The North America Industrial Hemp Market reached a value of USD 1.8 billion. This growth is largely propelled by the increased adoption of hemp in various industries, including textiles, bioplastics, nutraceuticals, and personal care. Driven by its versatility and sustainable properties, industrial hemp has garnered attention as a resource-efficient raw material with applications in diverse sectors. Government efforts to establish regulatory frameworks have further supported this market expansion, promoting hemp as a viable crop for economic diversification.

- The United States and Canada stand out as dominant regions within the North American hemp market. The United States has experienced a surge in production owing to the Farm Bill, which legalized hemp cultivation. Meanwhile, Canada, with an established regulatory framework, has become a central hub for hemp production, especially for hemp seeds and fiber. Both regions benefit from favorable climates, advanced agricultural infrastructure, and governmental support that collectively foster their leadership in the hemp market.

- USDA hemp production regulations outline the permissible THC levels and ensure standardized cultivation practices across North America. In 2023, the USDA regulated the inspection of hemp plants, enforcing the 0.3% THC threshold and affecting roughly 120,000 licensed hemp farmers. These rules help maintain compliance and foster safer production environments

North America Industrial Hemp Market Segmentation

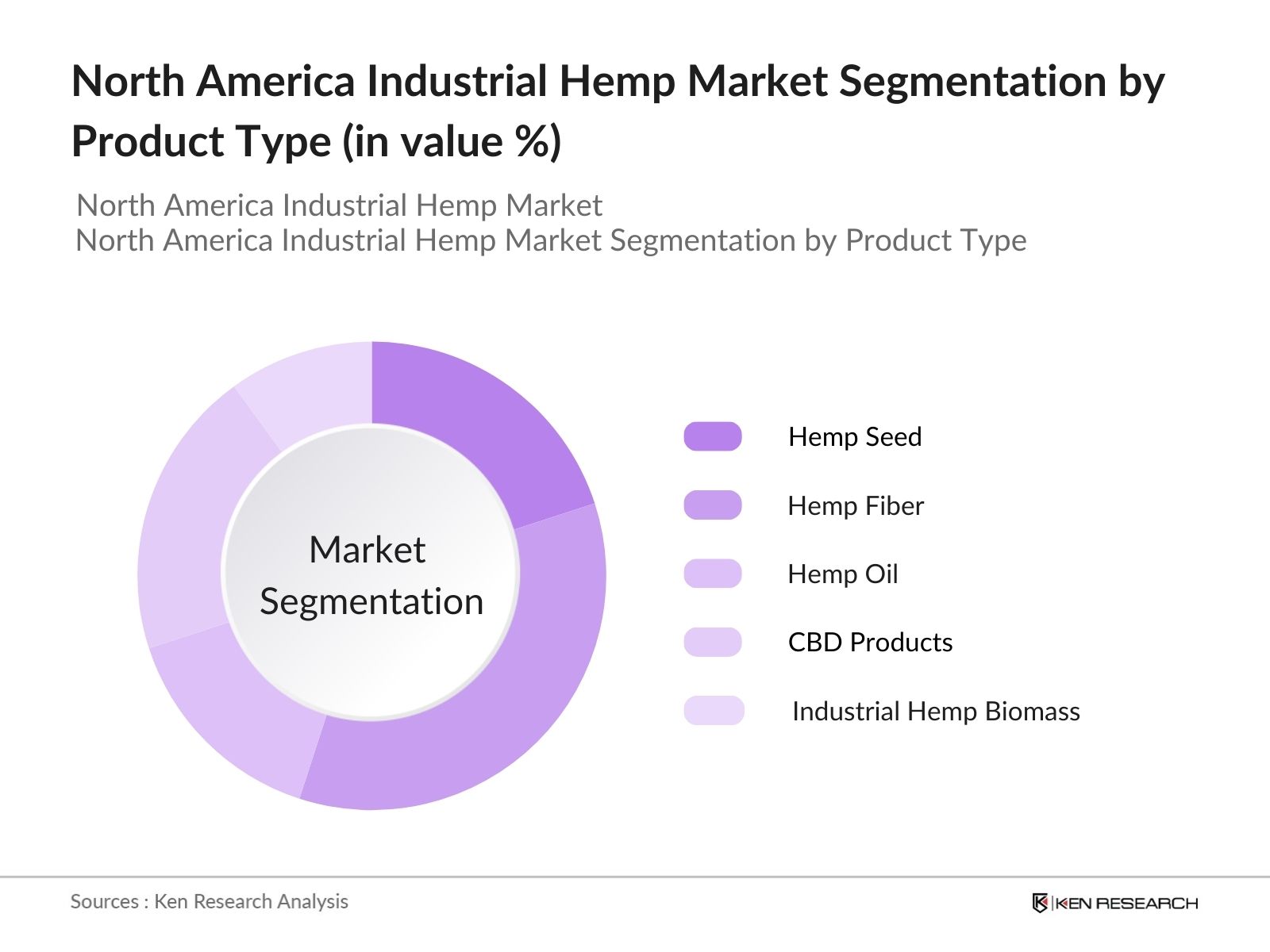

By Product Type: The Market is segmented by product type into hemp seed, hemp fiber, hemp oil, CBD products, and industrial hemp biomass. Currently, hemp fiber holds a dominant market position due to its broad application in the textile and automotive sectors, where sustainable materials are in high demand. Hemp fiber is favored for its strength, durability, and eco-friendly nature, positioning it as a preferred alternative to synthetic fibers. The automotive industry, in particular, has shown increased interest in hemp fiber for lightweight, sustainable vehicle components, contributing significantly to this segment's prominence.

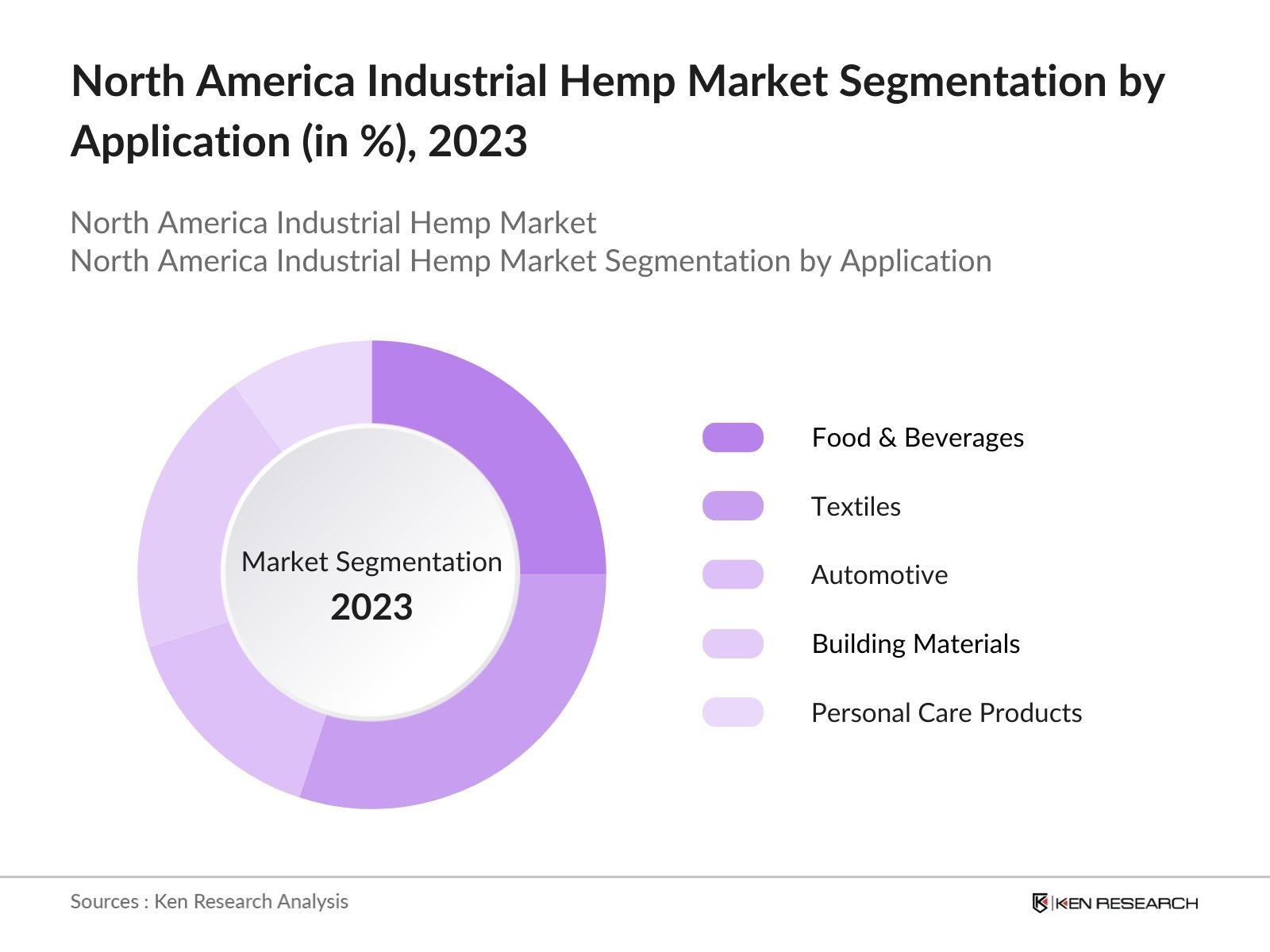

By Application: The market is segmented by application into food & beverages, textiles, automotive, building materials, and personal care products. Textiles dominate this segment due to their established market presence and the rising demand for sustainable and organic clothing. Hemp-based textiles are celebrated for their strength, comfort, and biodegradability, appealing to environmentally conscious consumers. Major brands in the apparel industry are increasingly adopting hemp to meet green standards, making it a leading application within this segment.

By Application: The market is segmented by application into food & beverages, textiles, automotive, building materials, and personal care products. Textiles dominate this segment due to their established market presence and the rising demand for sustainable and organic clothing. Hemp-based textiles are celebrated for their strength, comfort, and biodegradability, appealing to environmentally conscious consumers. Major brands in the apparel industry are increasingly adopting hemp to meet green standards, making it a leading application within this segment.

North America Industrial Hemp Market Competitive Landscape

North America Industrial Hemp Market Competitive Landscape

The North American industrial hemp market is led by a consolidated group of key players, which include prominent names in hemp cultivation and product innovation. These companies leverage extensive distribution networks and partnerships to strengthen their market position, focusing on sustainability and quality.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Production Capacity |

Regional Presence |

Product Portfolio |

Market Share |

R&D Investment |

Sustainability Initiatives |

|

Hemp, Inc. |

2008 |

Las Vegas, NV, USA |

|||||||

|

Canopy Growth Corporation |

2013 |

Smiths Falls, Canada |

|||||||

|

Aurora Cannabis |

2006 |

Edmonton, Canada |

|||||||

|

Ecofibre Limited |

2009 |

Brisbane, Australia |

|||||||

|

Charlotte's Web Holdings, Inc. |

2013 |

Boulder, CO, USA |

North America Industrial Hemp Industry Analysis

Growth Drivers

- Sustainable Material Demand: With rising environmental concerns, industrial hemps sustainable properties have made it increasingly favorable as a material choice across industries. In 2023, the U.S. Department of Agriculture reported hemps potential to absorb over 15 tons of CO2 per hectare, making it a powerful carbon sink compared to traditional crops. Additionally, hemp's rapid growth cycletaking only 3-4 months to maturefacilitates sustainable raw material availability, which aligns with North Americas commitment to lowering carbon emissions in various sectors.

- Rise in Textile and Automotive Industries: Industrial hemp fiber has seen significant adoption in North Americas textile and automotive sectors due to its durability and biodegradability. The U.S. textile industry, valued at $70 billion in 2023, increasingly incorporates hemp for eco-friendly textiles, reducing reliance on synthetic fibers. In automotive applications, hemp fiber is used to manufacture lightweight composite materials that reduce vehicle weight, thereby improving fuel efficiency. This aligns with the 2024 automotive industry standards prioritizing carbon neutrality.

- Increased Applications in Bioplastics and Construction: Hemp-based bioplastics have found applications in packaging and construction, supporting North America's push toward environmentally friendly materials. Industrial hemps high cellulose content, reaching up to 85% in certain varieties, makes it ideal for bioplastic production, which is essential as bioplastic demand reached 1 million tons in North America in 2023. In construction, hempcrete, a sustainable building material, has shown increased use in green buildings, reflecting the sectors shift towards sustainable architecture.

Market Challenges

- Limited Farming Infrastructure: North Americas infrastructure for processing and distributing industrial hemp is still underdeveloped, limiting its production efficiency. According to a 2024 USDA report, only 20% of hemp farms in the U.S. have access to specialized processing facilities, leading to significant post-harvest losses. This limitation affects market growth, as producers struggle with high logistical costs and limited market reach, further impeding scaling opportunities.

- Processing Cost Challenges: The cost-intensive nature of processing industrial hemp fibers poses a barrier to scalability. In 2023, the cost per hectare of hemp cultivation reached $3000, as per the USDA, while additional processing requirements add to the expenses. Without optimized processing facilities, these high costs make it challenging for smaller players to compete, which restricts market entry and hampers the market's overall growth trajectory.

North America Industrial Hemp Market Future Outlook

The North American industrial hemp market is projected to see sustained growth, driven by increased demand across industries including textiles, construction, and health & wellness. The markets future trajectory is supported by ongoing research into hemps environmental benefits, innovations in product development, and an expanding base of applications beyond traditional sectors. With governments providing clearer regulatory pathways, the market is set to capitalize on hemps diverse utility and economic potential.

Future Market Opportunities

- Bio composite Opportunities in Automotive Manufacturing: Hemp bio composites have seen rising interest in the automotive industry due to their light weight and biodegradability. In 2023, the U.S. automotive sector invested in hemp-based composites for car interiors, aligning with North Americas sustainability goals. With hemp-based composites reducing vehicle weight by up to 30%, they offer fuel efficiency advantages that are becoming increasingly critical in the automotive industry.

- Collaboration with Research Institutions: Research collaborations have emerged as a key opportunity for the industrial hemp market. In 2023, over 15 major universities in North America conducted studies on hemps applications in materials science, funded in part by the USDA. Such collaborations enhance product innovation and offer pathways for new industrial applications, bolstering the markets growth prospects.

Scope of the Report

|

Product Type |

Hemp Seed |

|

Application |

Food & Beverages |

|

Source |

Conventional |

|

Distribution Channel |

B2B (Direct Sales) |

|

Region |

United States |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FDA)

Industrial Hemp Processors

Textile Manufacturers

Food and Beverage Producers

Banks and Financial Institutes

Personal Care and Cosmetics Manufacturers

Environmental and Sustainability Agencies

Automotive Industry Players

Companies

Major Players

Hemp, Inc.

Canopy Growth Corporation

Aurora Cannabis

Ecofibre Limited

Charlotte's Web Holdings, Inc.

Manitoba Harvest

Elixinol Global

Medical Marijuana, Inc.

CV Sciences, Inc.

Greenlane Holdings, Inc.

HempFusion Wellness Inc.

New Leaf Pharmaceuticals

High Tide Inc.

Nutiva Inc.

GenCanna Global, Inc.

Table of Contents

1. North America Industrial Hemp Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Industrial Hemp Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Industrial Hemp Market Analysis

3.1 Growth Drivers

3.1.1 Sustainable Material Demand

3.1.2 Rise in Textile and Automotive Industries

3.1.3 Increased Applications in Bioplastics and Construction

3.1.4 Health Benefits for Nutraceutical Sector

3.2 Market Challenges

3.2.1 Regulatory Restrictions

3.2.2 Complex Licensing Requirements

3.2.3 Limited Farming Infrastructure

3.2.4 Processing Cost Challenges

3.3 Opportunities

3.3.1 Expansion in Personal Care and Cosmetics

3.3.2 Increased Demand for Hemp in Animal Feed

3.3.3 Biocomposite Opportunities in Automotive Manufacturing

3.3.4 Collaboration with Research Institutions

3.4 Trends

3.4.1 Organic and Sustainable Farming Practices

3.4.2 Development of Genetically Advanced Hemp Strains

3.4.3 Vertical Integration within the Industry

3.4.4 Expansion in CBD and Non-CBD Applications

3.5 Government Regulations

3.5.1 USDA Hemp Production Rules

3.5.2 Compliance with FDA Guidelines

3.5.3 Import/Export Regulations on Hemp Products

3.5.4 State-Level Cultivation Restrictions

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Industry Ecosystem Analysis

4. North America Industrial Hemp Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Hemp Seed

4.1.2 Hemp Fiber

4.1.3 Hemp Oil

4.1.4 CBD Products

4.1.5 Industrial Hemp Biomass

4.2 By Application (In Value %)

4.2.1 Food & Beverages

4.2.2 Textiles

4.2.3 Automotive

4.2.4 Building Materials

4.2.5 Personal Care Products

4.3 By Source (In Value %)

4.3.1 Conventional

4.3.2 Organic

4.4 By Distribution Channel (In Value %)

4.4.1 B2B (Direct Sales)

4.4.2 B2C (Retail)

4.4.3 E-Commerce

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Industrial Hemp Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hemp, Inc.

5.1.2 Canopy Growth Corporation

5.1.3 Aurora Cannabis

5.1.4 Ecofibre Limited

5.1.5 Manitoba Harvest

5.1.6 Elixinol Global

5.1.7 Medical Marijuana, Inc.

5.1.8 Charlotte's Web Holdings, Inc.

5.1.9 CV Sciences, Inc.

5.1.10 Greenlane Holdings, Inc.

5.1.11 HempFusion Wellness Inc.

5.1.12 New Leaf Pharmaceuticals

5.1.13 High Tide Inc.

5.1.14 Nutiva Inc.

5.1.15 GenCanna Global, Inc.

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Regional Presence, Product Portfolio, Market Share, R&D Investment, Distribution Network, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Industrial Hemp Market Regulatory Framework

6.1 Industrial Hemp Farming Act

6.2 Compliance with THC Content Limits

6.3 Certification Processes for Industrial Hemp Products

6.4 Environmental and Safety Standards for Hemp Cultivation

7. North America Industrial Hemp Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Industrial Hemp Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Source (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. North America Industrial Hemp Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping stakeholders within the North American Industrial Hemp Market, supported by extensive desk research and access to government and industry reports. This phase aimed to identify and define critical variables impacting the market dynamics.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data was performed, focusing on market penetration, product types, and end-use applications. This involved assessing market reach across industry verticals and calculating revenue generation based on the latest available data.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were developed and validated through expert consultations, employing computer-assisted telephone interviews (CATIs) with industry insiders from major hemp-producing companies. Insights from these interactions provided valuable validation of data points and operational knowledge.

Step 4: Research Synthesis and Final Output

The final stage included direct engagement with multiple hemp industry players to refine product-specific data, sales statistics, and consumer trends. This engagement reinforced the data reliability and comprehensiveness of the North America Industrial Hemp Market analysis.

Frequently Asked Questions

01. How big is the North America Industrial Hemp Market?

The North America Industrial Hemp Market was valued at USD 1.8 billion, driven by high demand in industries such as textiles, food & beverages, and automotive manufacturing.

02. What are the challenges in the North America Industrial Hemp Market?

Challenges include regulatory restrictions, limited processing infrastructure, and the complexity of hemp cultivation licenses. Additionally, high costs associated with hemp processing hinder widespread adoption.

03. Who are the major players in the North America Industrial Hemp Market?

Key players include Hemp, Inc., Canopy Growth Corporation, Aurora Cannabis, Ecofibre Limited, and Charlotte's Web Holdings, Inc., known for their robust production capabilities and diverse product portfolios.

04. What drives growth in the North America Industrial Hemp Market?

Growth is primarily driven by increased applications across various sectors, including textiles and nutraceuticals, along with government support for hemp as a sustainable crop. The health benefits associated with hemp-based products also contribute to its market expansion.

05. What opportunities exist in the North America Industrial Hemp Market?

Emerging opportunities include applications in the personal care and cosmetics sector, potential uses in animal feed, and demand for bio composites in automotive manufacturing. Additionally, strategic partnerships with research institutions are fostering innovation in hemp-based products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.