North America Insect Protein Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD2925

October 2024

88

About the Report

North America Insect Protein Market Overview

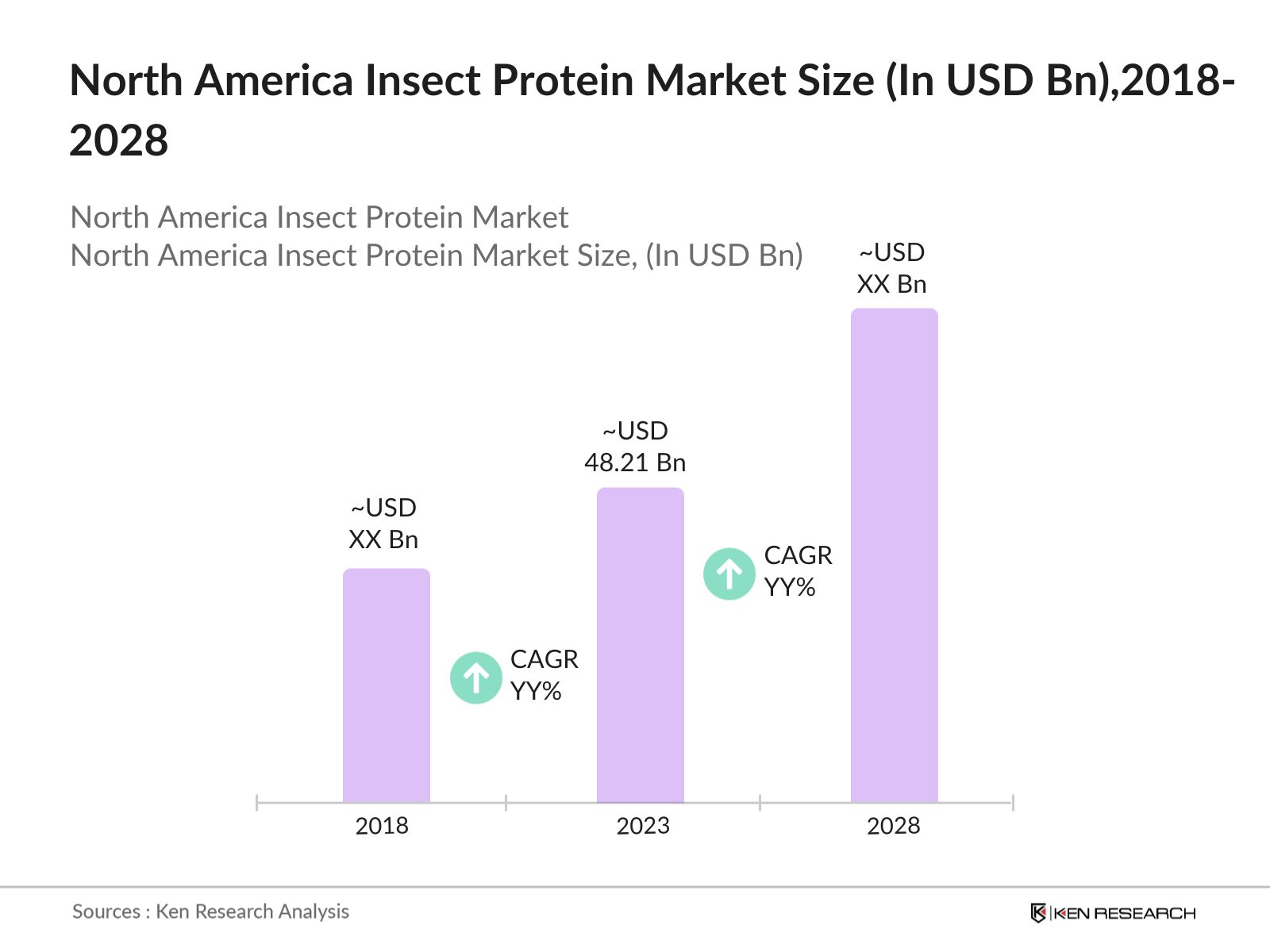

- The North America Insect Protein Market was valued at USD 48.21 billion in 2023. The growth is driven by the increasing consumer shift towards sustainable and eco-friendly protein sources. The market's growth is also supported by the rising awareness of the nutritional benefits of insect protein, which is rich in essential amino acids, vitamins, and minerals.

- Key players dominate the market are Protix (Netherlands), Aspire Food Group (Canada), Entomo Farms (Canada), Ynsect (France), and EnviroFlight LLC (USA). These companies have established themselves as pioneers in the insect protein industry, leveraging their expertise in insect farming and processing to meet the growing demand for alternative proteins.

- Aspire Food Group's new cricket protein facility in London, Ontario, is the world's largest, covering 150,000 square feet. It aims to produce9,000 metric tonsof cricket protein annually, equivalent to20 million pounds. The facility is expected to reach full capacity by early2024, supporting the growing$8 billionalternative protein market.

- Canada has emerged as a dominant player in the market, driven by strong government support and a well-established insect farming infrastructure. The province's dominance is attributed to its favorable regulatory environment, availability of funding for sustainable protein initiatives, and proximity to major markets in the U.S.

North America Insect Protein Market Segmentation

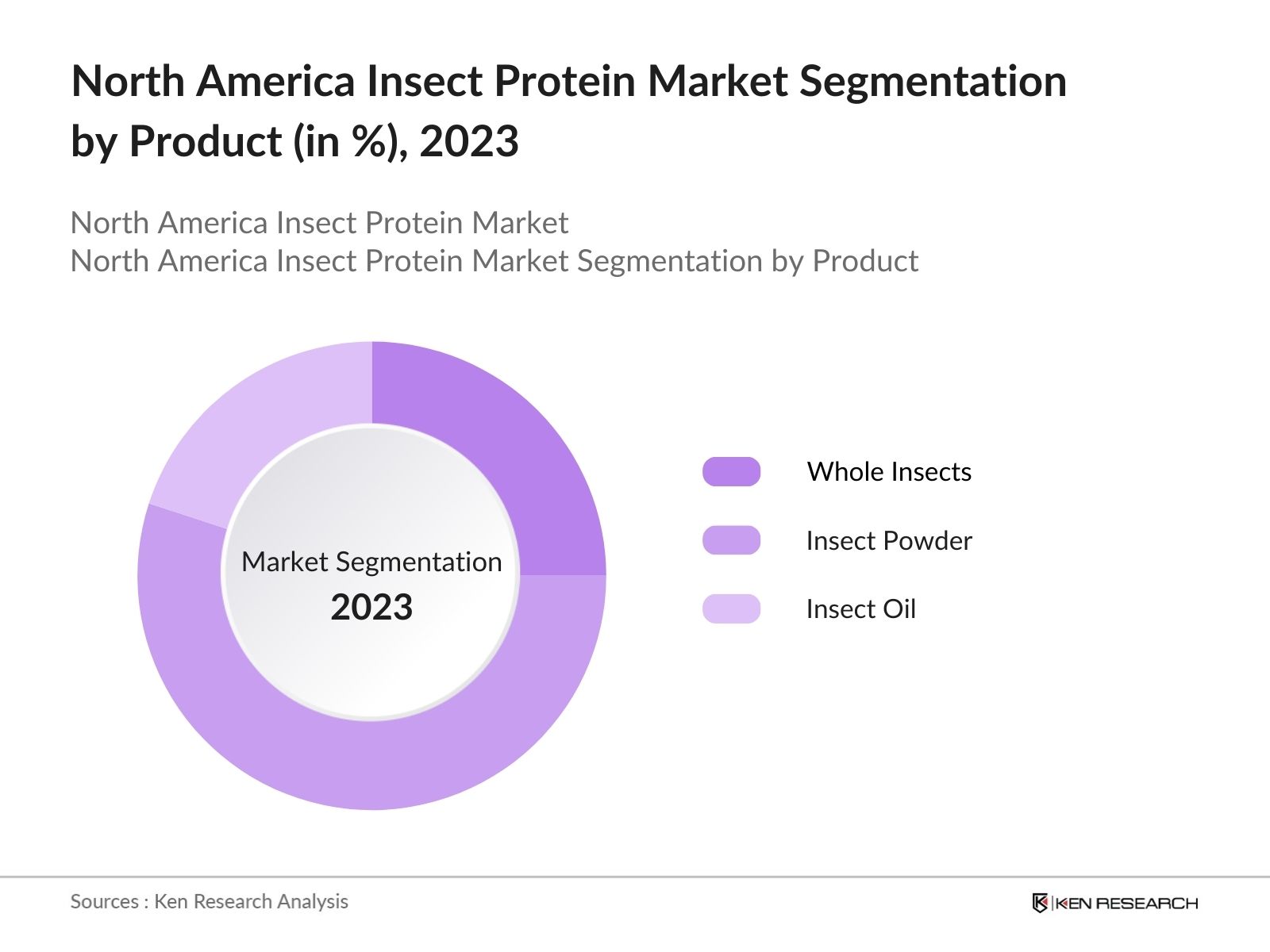

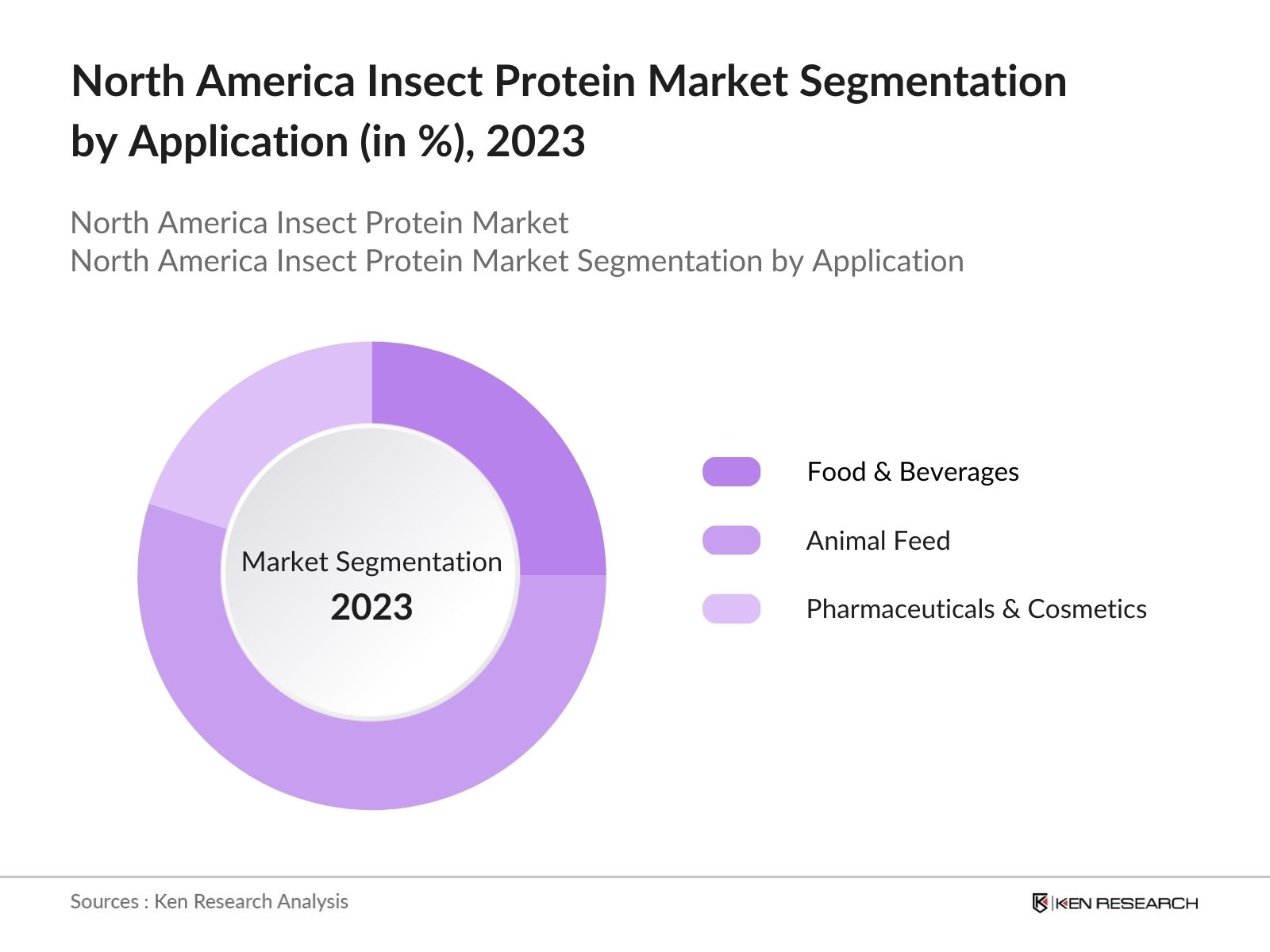

The market is segmented into various factors like product, application, and region.

By Product: The market is segmented by product into Whole Insects, Insect Powder, and Insect Oil. In 2023, Insect Powder held the dominant market share due to its versatility and ease of incorporation into various food and feed products.

By Application: The market is segmented by application into Food & Beverages, Animal Feed, and Pharmaceuticals & Cosmetics. In 2023, the Animal Feed segment dominated the market the high demand for sustainable and nutrient-rich feed ingredients in the aquaculture and pet food industries has driven the growth of this segment.

By Region: The market is segmented by region into the United States and Canada. In 2023, Canada led the market driven by strong government support, favorable regulations, and significant investment in insect farming infrastructure also with increased consumer acceptance and expansion of insect-based product offerings contributing to its market position.

North America Insect Protein Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Protix |

2009 |

Dongen, Netherlands |

|

Aspire Food Group |

2013 |

Ontario, Canada |

|

Entomo Farms |

2014 |

Ontario, Canada |

|

Ynsect |

2011 |

Paris, France |

|

EnviroFlight LLC |

2009 |

Ohio, USA |

- Protix: In December 2023, Protix secured a strategic collaboration with Tyson Foods, including a 55 million equity investment and a joint venture to build a U.S. insect protein facility. The facility is expected to produce up to 70,000 tons of larvae annually, significantly scaling up Protix's production capacity and advancing sustainable protein production.

- Ynsect: In January 2024, nsect became the first company authorized by the AAFCO to commercialize mealworm proteins for dog food in the U.S. This approval opens significant market opportunities, especially as the U.S. pet food market exceeded $42 billion in 2022. nsect's mealworm protein, shown to be highly nutritious and environmentally friendly, is set to revolutionize pet nutrition in North America.

North America Insect Protein Market Analysis

Market Growth Drivers

- Nutritional Benefits Driving Consumer Adoption: The high nutritional value of insect protein, particularly its rich amino acid profile, is a key growth driver. In 2024, over 5 million consumers in the U.S. purchased insect protein-based products, reflecting a growing awareness of its health benefits, especially among fitness enthusiasts and health-conscious individuals.

- Increased Demand in the Pet Food Industry: The North American pet food market is seeing a surge in demand for insect protein due to its high digestibility and sustainability. In 2023, over 500,000 metric tons of insect protein were used in pet food formulations, driven by growing consumer preference for eco-friendly and nutritious pet food options.

- Expansion of Retail Distribution Channels: Major retailers in North America have started stocking insect protein-based products, making them more accessible to consumers. In 2024, over 2,500 retail outlets across the U.S. and Canada began offering insect protein products, which significantly increased market penetration.

Market Challenges

- Consumer Acceptance and Perception: Despite the nutritional benefits, consumer acceptance of insect protein remains a significant challenge. In a 2024 survey, 6 million consumers in North America expressed reluctance to consume insect-based products due to cultural perceptions and concerns about taste, indicating that overcoming these barriers is crucial for market expansion.

- Supply Chain Constraints: The insect protein market faces supply chain challenges, particularly in scaling up production to meet growing demand. In 2024, over 50% of insect farms reported difficulties in sourcing raw materials and managing production costs, which could hinder the market's growth potential if not addressed.

Government Initiatives

- Canadas Sustainable Protein Strategy: In its 2023-2027 Departmental Sustainable Development Strategy, the National Research Council of Canada (NRC) committed CAD 25 million to advancing sustainable protein sources, including insect protein. This initiative is part of Canada's broader strategy to reduce greenhouse gas emissions and support innovative food production methods, promoting environmental sustainability in the agriculture sector.

- U.S. Department of Agriculture (USDA) Grants: In 2021, the USAID and USDA initiated a global research call to enhance insect production, focusing on sustainable protein sources. This initiative allocated USD 28 million for research into improving insect farming practices, aiming to boost food security and reduce the environmental impact of traditional protein sources.

North America Insect Protein Future Outlook

The future trends in the North America insect protein include increased adoption in human food products, expansion in animal feed, technological advancements in farming, and more favorable regulatory environments.

Future Market Trends

- Expansion of Insect Protein in Animal Feed: The use of insect protein in animal feed is projected to expand rapidly, particularly in the aquaculture and pet food sectors. By 2028, the total volume of insect protein used in animal feed in North America is expected to reach 150,000 metric tons, supported by growing demand for sustainable and nutritious feed ingredients.

- Technological Advancements in Insect Farming: Technological advancements in insect farming and processing are anticipated to play a crucial role in the market's future growth. By 2028, new farming technologies are expected to reduce production costs, making insect protein more competitive with traditional protein sources and driving wider adoption.

Scope of the Report

|

By Product |

Whole Insects Insect Powder Insect Oil |

|

By Application |

Food & Beverages Animal Feed Pharmaceuticals & Cosmetics |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Food & Beverage Manufacturers

Pet Food Manufacturers

Aquaculture Companies

Government Regulatory Bodies

Nutraceutical Companies

Pharmaceutical Companies

Cosmetic Product Manufacturers

Banks and Financials Institutes

Venture Capital Firms

Companies

Players Mentioned in the Report:

Protix

Aspire Food Group

Entomo Farms

Ynsect

EnviroFlight LLC

Beta Hatch

Chapul Inc.

Jiminis

AgriProtein

InnovaFeed

Entocycle

Hexafly

NextProtein

Biobeehive

Enterra Feed Corporation

Table of Contents

1. North America Insect Protein Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Insect Protein Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Insect Protein Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand in Pet Food Industry

3.1.2. Rising Investment in Insect Farming Startups

3.1.3. Expansion of Retail Distribution Channels

3.1.4. Partnerships with Major Food Brands

3.2. Restraints

3.2.1. Consumer Acceptance and Perception Challenges

3.2.2. Supply Chain Constraints

3.2.3. High Production Costs

3.3. Opportunities

3.3.1. Expansion into New Application Areas

3.3.2. Technological Advancements in Farming

3.3.3. Regulatory Approvals for New Uses

3.4. Trends

3.4.1. Increased Adoption in Human Food Products

3.4.2. Expansion of Insect Protein in Animal Feed

3.4.3. Technological Advancements in Insect Farming

3.5. Government Initiatives

3.5.1. USAID and USDA Research Initiatives

3.5.2. Canadas Sustainable Protein Strategy

3.5.3. Regulatory Reforms in the U.S.

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. North America Insect Protein Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Whole Insects

4.1.2. Insect Powder

4.1.3. Insect Oil

4.2. By Application (in Value %)

4.2.1. Food & Beverages

4.2.2. Animal Feed

4.2.3. Pharmaceuticals & Cosmetics

4.3. By Region (in Value %)

4.3.1. United States

4.3.2. Canada

5. North America Insect Protein Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Protix

5.1.2. Aspire Food Group

5.1.3. Entomo Farms

5.1.4. Ynsect

5.1.5. EnviroFlight LLC

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Insect Protein Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Insect Protein Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Insect Protein Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Insect Protein Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. North America Insect Protein Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on North America Insect Protein industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Insect Protein Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple insect protein manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such insect protein manufacturing companies.

Frequently Asked Questions

01 How big is the North America Insect Protein market?

The North America Insect Protein Market was valued at USD 48.21 billion in 2023. The growth is driven by the increasing consumer shift towards sustainable and eco-friendly protein sources.

02 What are the challenges in North America Insect Protein market?

The major challenges in the North America Insect Protein market include consumer acceptance, high production costs, supply chain constraints, and regulatory hurdles in new markets.

03 Who are the major players in the North America Insect Protein market?

Key players in the North American insect Protein market include Protix, Aspire Food Group, Entomo Farms, Ynsect, EnviroFlight LLC, and Beta Hatch, among others.

04 What are the main growth drivers of the North America Insect Protein market?

The growth of the North America Insect Protein market includes increasing demand for sustainable protein sources, rising awareness of environmental benefits, and expanding applications in food and feed industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.