North America IoT Security Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1795

October 2024

96

About the Report

North America IoT Security Market Overview

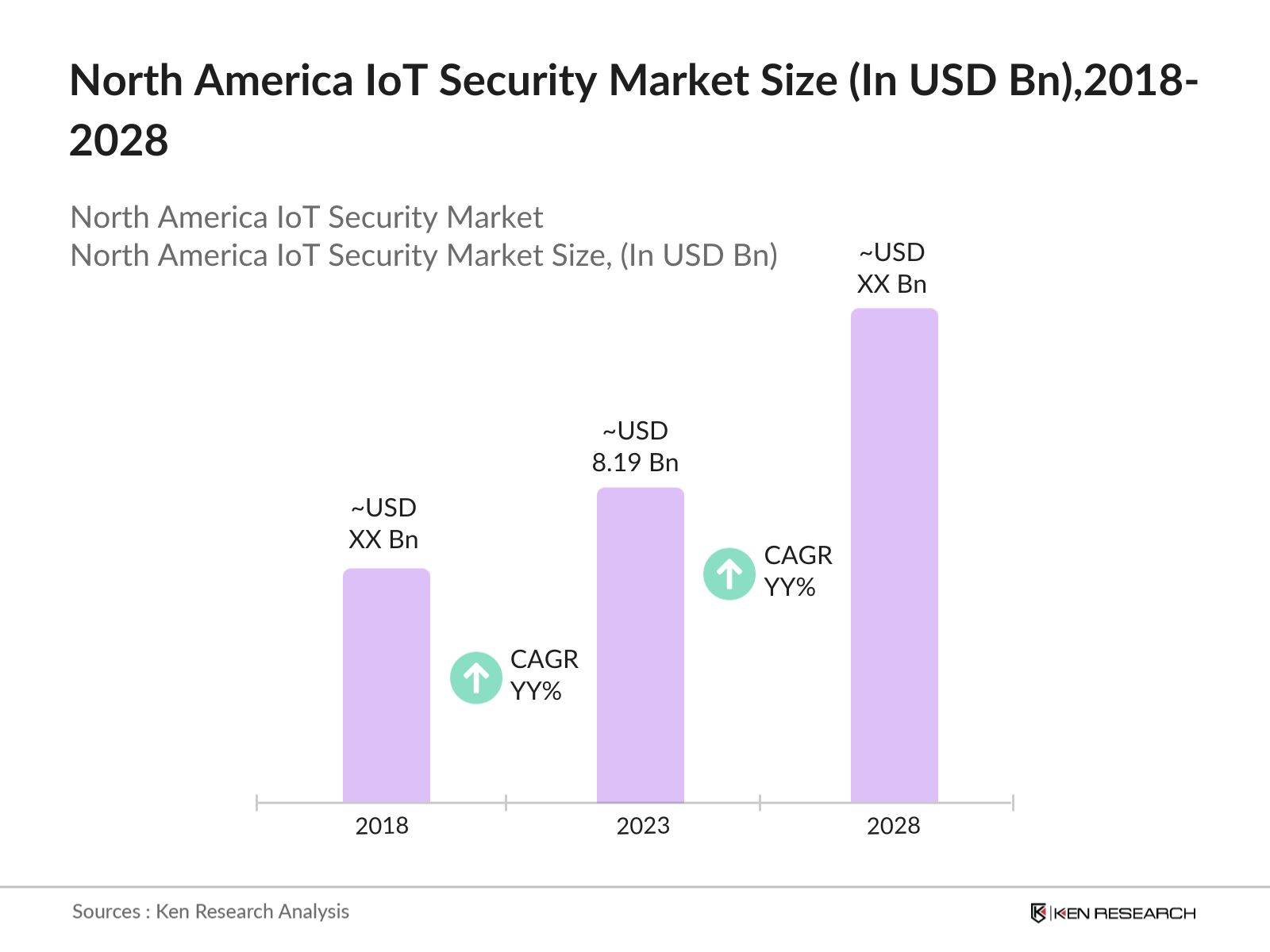

- The North America IoT Security Market size was valued at USD 8.19 billion in 2023. The market's growth is primarily driven by the rapid adoption of IoT technologies across various industries, such as healthcare, manufacturing, and automotive, where the need to secure vast amounts of data transmitted by connected devices is paramount.

- Key players in the market include Cisco Systems, Inc., IBM Corporation, Intel Corporation, Palo Alto Networks, Inc., and Fortinet, Inc. These companies have been at the forefront of developing advanced IoT security solutions that cater to the growing demands of various sectors. Their extensive product portfolios, coupled with strategic partnerships and acquisitions, have enabled them to maintain a major market share.

- In May 2024, Palo Alto Networks introduced new AI-driven security solutions like AI Access Security and AI Runtime Security, designed to combat advanced threats. These solutions, leveraging Precision AI, address zero-day and AI-generated attacks, enhancing protection for enterprises. The solutions will be available by late FY24 and early FY25.

- The state of California is leading the industry, largely due to the concentration of technology companies and startups in Silicon Valley. The state's early adoption of IoT technologies and stringent data privacy regulations. The presence of major tech giants like Cisco and Intel, which are headquartered in California, also contributes to the state's dominance in the market.

North America IoT Security Market Segmentation

The market is segmented into various factors like product, application, and region.

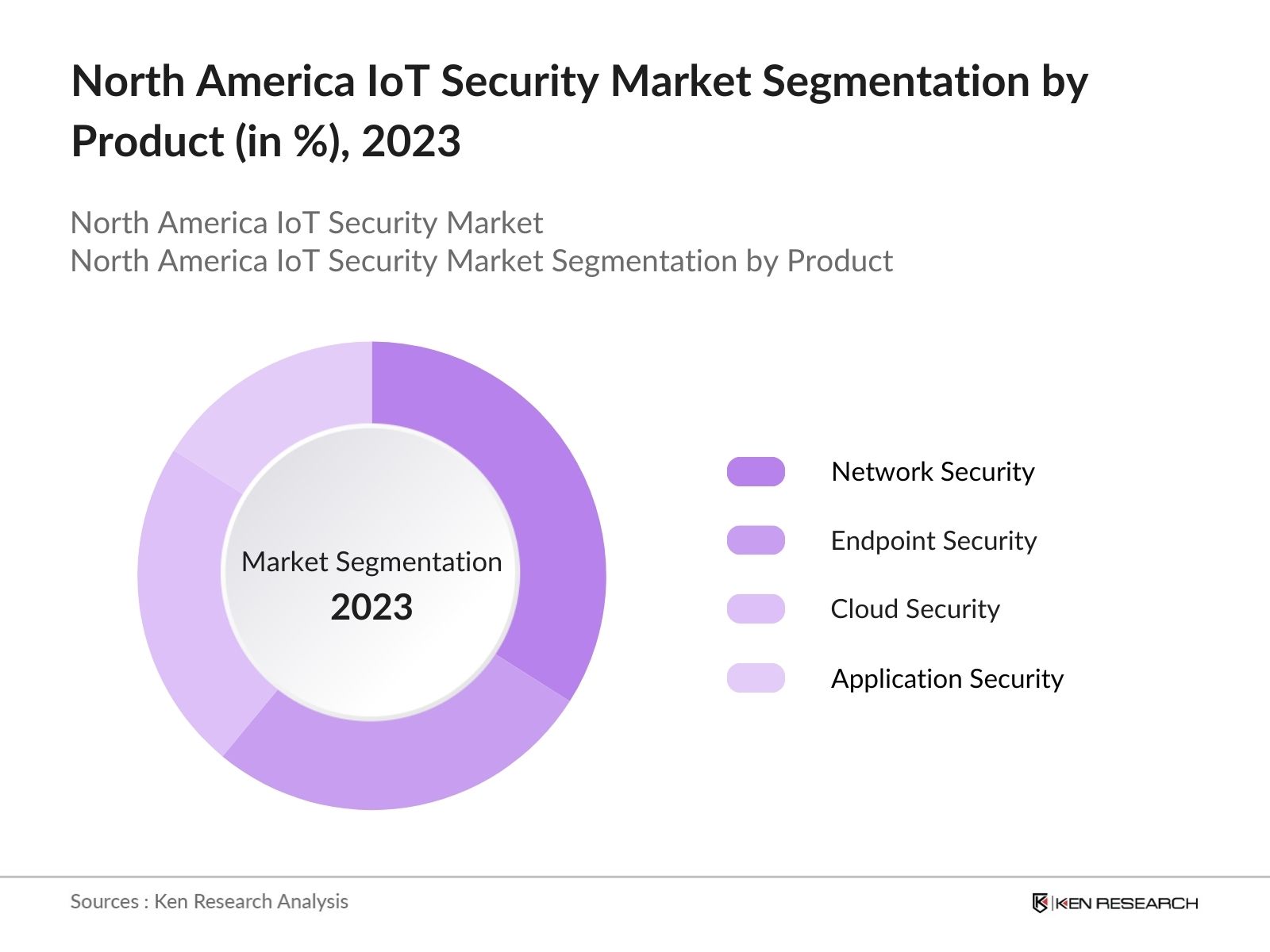

By Product: The market is segmented by product into network security, endpoint security, cloud security, and application security. In 2023, Network Security held the dominant market share, due to the increasing number of cyber-attacks targeting network infrastructures, particularly in the healthcare and manufacturing sectors. Companies are investing heavily in network security solutions to protect against unauthorized access, data breaches, and other cyber threats.

By Application: The market is segmented by application into healthcare, manufacturing, retail, and automotive. In 2023, the Healthcare segment dominated the market with the increasing use of connected medical devices and the need to comply with stringent regulations such as HIPAA have driven the demand for robust IoT security solutions in this sector.

By Region: The market is segmented by region into United States and Canada. In 2023, the United States held the majority of the market share due to the presence of major IoT security vendors and a high level of technology adoption across various industries.

North America IoT Security Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Cisco Systems, Inc. |

1984 |

San Jose, California |

|

IBM Corporation |

1911 |

Armonk, New York |

|

Intel Corporation |

1968 |

Santa Clara, California |

|

Palo Alto Networks, Inc. |

2005 |

Santa Clara, California |

|

Fortinet, Inc. |

2000 |

Sunnyvale, California |

- Cisco: In April 2024, Cisco Investments backed Upstream Security, a leader in IoT and vehicle cybersecurity solutions, with a strategic investment aimed at enhancing protection for over 10 million connected vehicles globally. This investment reflects Cisco's commitment to advancing IoT security, particularly in the rapidly growing automotive sector.

- IBM Corporation: In May 2024, IBM and Palo Alto Networks announced a strategic partnership, integrating IBM's QRadar SaaS with Palo Alto Networks' security offerings. This collaboration aims to enhance threat detection and response across 6 million connected IoT devices by leveraging advanced AI-driven analytics. The partnership signifies a major step in securing North America's IoT infrastructure.

North America IoT Security Market Analysis

Market Growth Drivers

- Expansion of 5G Networks: Global 5G connections reached nearly 2 billion in Q1 2024, driven by rapid adoption and sustained growth. North America leads with 5G comprising 32% of all wireless cellular connections, double the global average, totaling 220 million connections and adding 22 million new connections in Q1 2024.

- Adoption of IoT in the Automotive Industry: The automotive sector in North America is rapidly integrating IoT technologies, with over 16 million connected vehicles expected by the end of 2024. This adoption drives the demand for IoT security solutions to protect vehicle-to-everything (V2X) communication, ensuring safe and secure data transmission between vehicles and infrastructure.

- Investment in AI and Machine Learning: These technologies are being leveraged to predict and mitigate cyber threats in real-time, offering more dynamic and responsive security solutions. AI-driven security platforms have been deployed across 300 large enterprises in the USA, reducing the time to detect and respond to threats by half thereby improving overall security posture and driving demand for such solutions.

Market Challenges

- Diverse and Fragmented IoT Ecosystem: The IoT ecosystem in North America includes more than 25,000 device types, each with different operating systems and security requirements. This diversity creates challenges in implementing standardized security protocols, leading to vulnerabilities that can be exploited by cybercriminals.

- Evolving Cyber Threat Landscape: The cyber threat landscape in North America is rapidly evolving, with over 15,000 new IoT-targeted malware variants detected in 2024. This constant evolution requires continuous updates and advancements in IoT security technologies, posing a challenge for security providers to stay ahead of emerging threats.

Government Initiatives

- NIST IoT Security Framework: In 2024, the National Institute of Standards and Technology (NIST) released an updated Cybersecurity Framework (CSF 2.0) to help organizations of all sizes and industries enhance their cybersecurity practices.The updated framework focuses on governance, supply chain risk management, and alignment with other standards like the NIST Privacy Framework and ISO 27001.

- Federal Funding for IoT Security Research: In 2024, the Biden administration's budget proposal allocated USD 13 billion to cybersecurity initiatives, marking an increase from previous years. This funding aims to enhance the security of federal networks, including IoT devices, and improve resilience against cyber threats, reflecting the government's commitment to strengthening national cybersecurity infrastructure.

North America IoT Security Market Future Outlook

The future trends in the North America IoT security industry include the increased adoption of AI and machine learning for security, the rise of quantum-resistant encryption, expansion of 5G-driven IoT security, and the integration of blockchain for securing IoT networks.

Future Market Trends

- Growth of Quantum-Resistant Security Solutions: As quantum computing advances, the demand for quantum-resistant security solutions will rise. By 2028, industries like finance and healthcare are expected to integrate quantum-resistant encryption into their IoT devices, protecting against future quantum threats.

- Integration of Blockchain for IoT Security: By 2028, blockchain is expected to be widely used to secure IoT networks by providing decentralized and immutable ledgers for data transactions. This technology will enhance the security of IoT ecosystems by ensuring data integrity, preventing tampering, and reducing the risk of cyberattacks across industries such as supply chain management and healthcare.

Scope of the Report

|

By Product |

Network Security Endpoint Security Cloud Security Application Security |

|

By Application |

Healthcare Manufacturing Retail Automotive |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government Regulatory Bodies

Banks and Financial Institutions

Telecommunications Companies

Energy Companies

Manufacturing Firms

Insurance Companies

Venture Capitalist

Technology Companies

Software Companies

Companies

Players Mentioned in the Report:

Cisco Systems, Inc.

IBM Corporation

Palo Alto Networks, Inc.

Intel Corporation

Symantec Corporation

Fortinet, Inc.

Microsoft Corporation

AT&T Inc.

Trend Micro Inc.

McAfee, LLC

Arm Holdings

RSA Security LLC

Check Point Software Technologies Ltd.

FireEye, Inc.

CrowdStrike Holdings, Inc.

Table of Contents

1. North America IoT Security Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America IoT Security Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America IoT Security Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of IoT in Healthcare

3.1.2. Rise in Cybersecurity Incidents

3.1.3. Expansion of 5G Networks

3.1.4. Government Regulations and Compliance

3.2. Restraints

3.2.1. Diverse and Fragmented IoT Ecosystem

3.2.2. High Implementation Costs

3.2.3. Lack of Skilled Cybersecurity Professionals

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. International Collaborations

3.3.3. Expansion into New Industries

3.4. Trends

3.4.1. Adoption of AI-Driven Security Solutions

3.4.2. Integration with Smart City Projects

3.4.3. Increased Use of Edge Computing Security

3.5. Government Regulation

3.5.1. IoT Cybersecurity Improvement Act

3.5.2. National Cyber Security Strategies

3.5.3. FCC IoT Regulations

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. North America IoT Security Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Network Security

4.1.2. Endpoint Security

4.1.3. Cloud Security

4.1.4. Application Security

4.2. By Application (in Value %)

4.2.1. Healthcare

4.2.2. Manufacturing

4.2.3. Retail

4.2.4. Automotive

4.2.5. Others

4.3. By Region (in Value %)

4.3.1. United States

4.3.2. Canada

5. North America IoT Security Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Cisco Systems, Inc.

5.1.2. IBM Corporation

5.1.3. Intel Corporation

5.1.4. Palo Alto Networks, Inc.

5.1.5. Fortinet, Inc.

5.1.6. Symantec Corporation

5.1.7. Check Point Software Technologies

5.1.8. Trend Micro Incorporated

5.1.9. McAfee, LLC

5.1.10. Sophos Ltd.

5.1.11. Kaspersky Lab

5.1.12. RSA Security LLC

5.1.13. AT&T Cybersecurity

5.1.14. Amazon Web Services (AWS)

5.1.15. Google Cloud

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America IoT Security Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America IoT Security Market Regulatory Framework

7.1. Cybersecurity Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America IoT Security Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America IoT Security Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. North America IoT Security Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America IoT Security industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple IoT security companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such IoT security companies.

Frequently Asked Questions

01 How big is the North America IoT Security market?

The North America IoT Security Market size was valued at USD 8.19 billion in 2023. The market's growth is primarily driven by the rapid adoption of IoT technologies across various industries, such as healthcare, manufacturing, and automotive, where the need to secure vast amounts of data transmitted by connected devices is paramount.

02 What are the challenges in the North America IoT Security market?

Challenges in the North America IoT Security market include scalability issues, high implementation costs, a complex regulatory landscape, and interoperability issues between different IoT devices and platforms.

03 Who are the major players in the North America IoT Security market?

Key players in the North America IoT Security market include Cisco Systems, IBM Corporation, Palo Alto Networks, Intel Corporation, and Symantec Corporation. These companies lead the market with their advanced security solutions, extensive product portfolios, and continuous innovation.

04 What are the main growth drivers of the North America IoT Security market?

The growth of the North America IoT Security market is the proliferation of connected IoT devices, increased cyber threats, stringent government regulations, and rising investments in AI and machine learning technologies for enhancing IoT security.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.