North America Lactic Acid Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD3946

December 2024

83

About the Report

North America Lactic Acid Market Overview

- North America lactic acid market is valued at USD 3 billion based on a five-year historical analysis. The growth of this market is predominantly driven by increasing demand for biodegradable plastics and lactic acids wide applications in food, pharmaceuticals, and personal care. The rise in awareness for sustainable practices, especially in packaging, has significantly influenced market expansion, with industries progressively moving toward bio-based alternatives.

- The United States dominates the North America lactic acid market, attributed to its advanced pharmaceutical, food, and cosmetics industries. Additionally, strong governmental support for the use of biodegradable products boosts demand. Canada also plays a significant role due to increasing consumer awareness of sustainability and the use of lactic acid in food and personal care industries. Both countries' focus on sustainability and regulatory frameworks support their market dominance.

- The FDA regulates the use of lactic acid in food and pharmaceuticals, ensuring its safety and efficacy. In 2023, the FDA reaffirmed its classification of lactic acid as GRAS (Generally Recognized as Safe), providing clear guidelines for its usage in food products. These guidelines support the growing demand for lactic acid in natural food preservation and clean-label products, ensuring that manufacturers comply with stringent safety standards.

North America Lactic Acid Market Segmentation

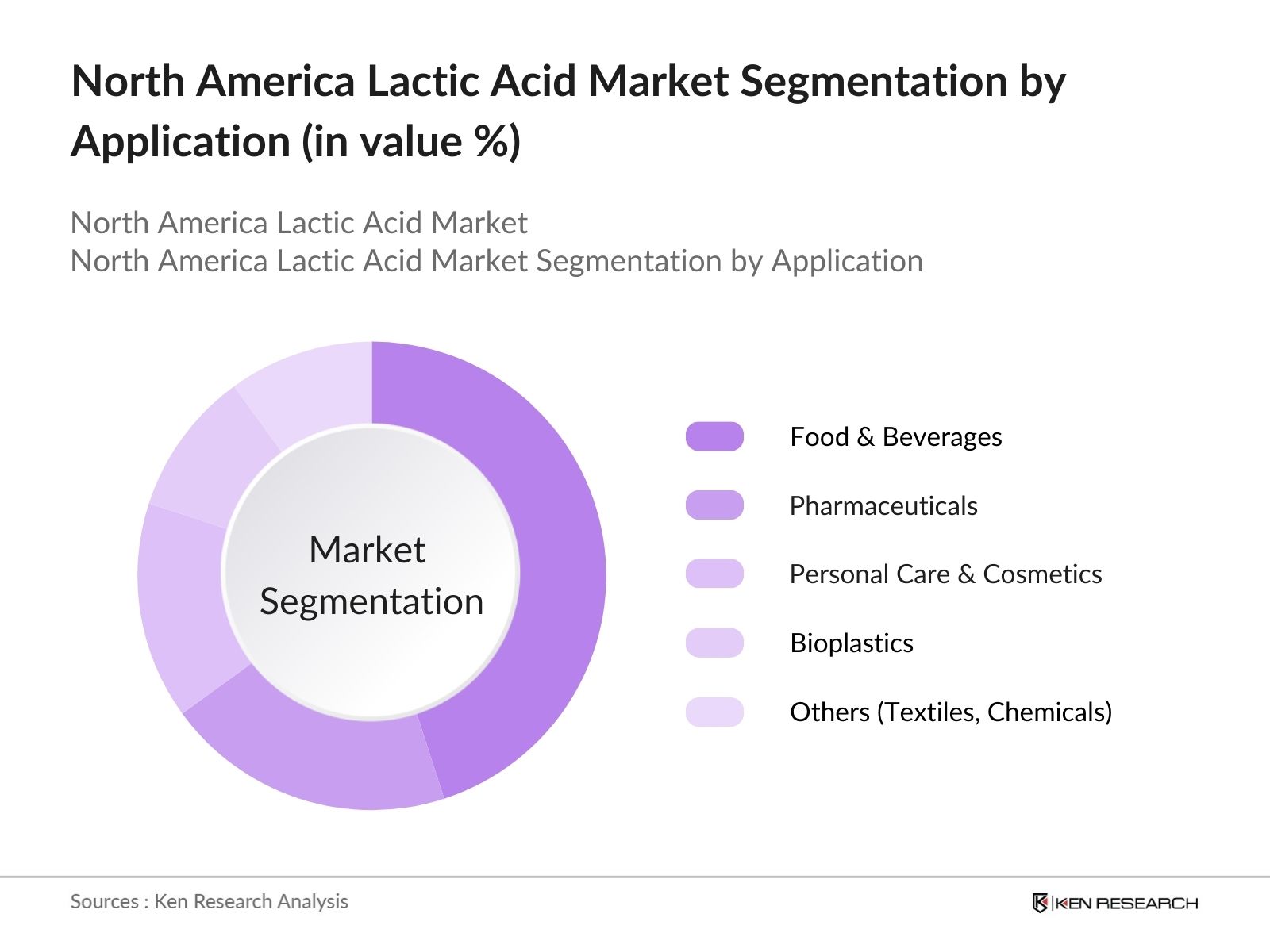

By Application: The North America lactic acid market is segmented by application into food & beverages, pharmaceuticals, personal care & cosmetics, bioplastics, and others. Among these, the food & beverages segment holds the dominant share, primarily due to the extensive use of lactic acid in food preservation and flavoring. The rising demand for clean-label food products and organic acids has solidified lactic acid's place in this sector. With increasing consumer awareness of food safety and natural preservatives, this sub-segment continues to grow.

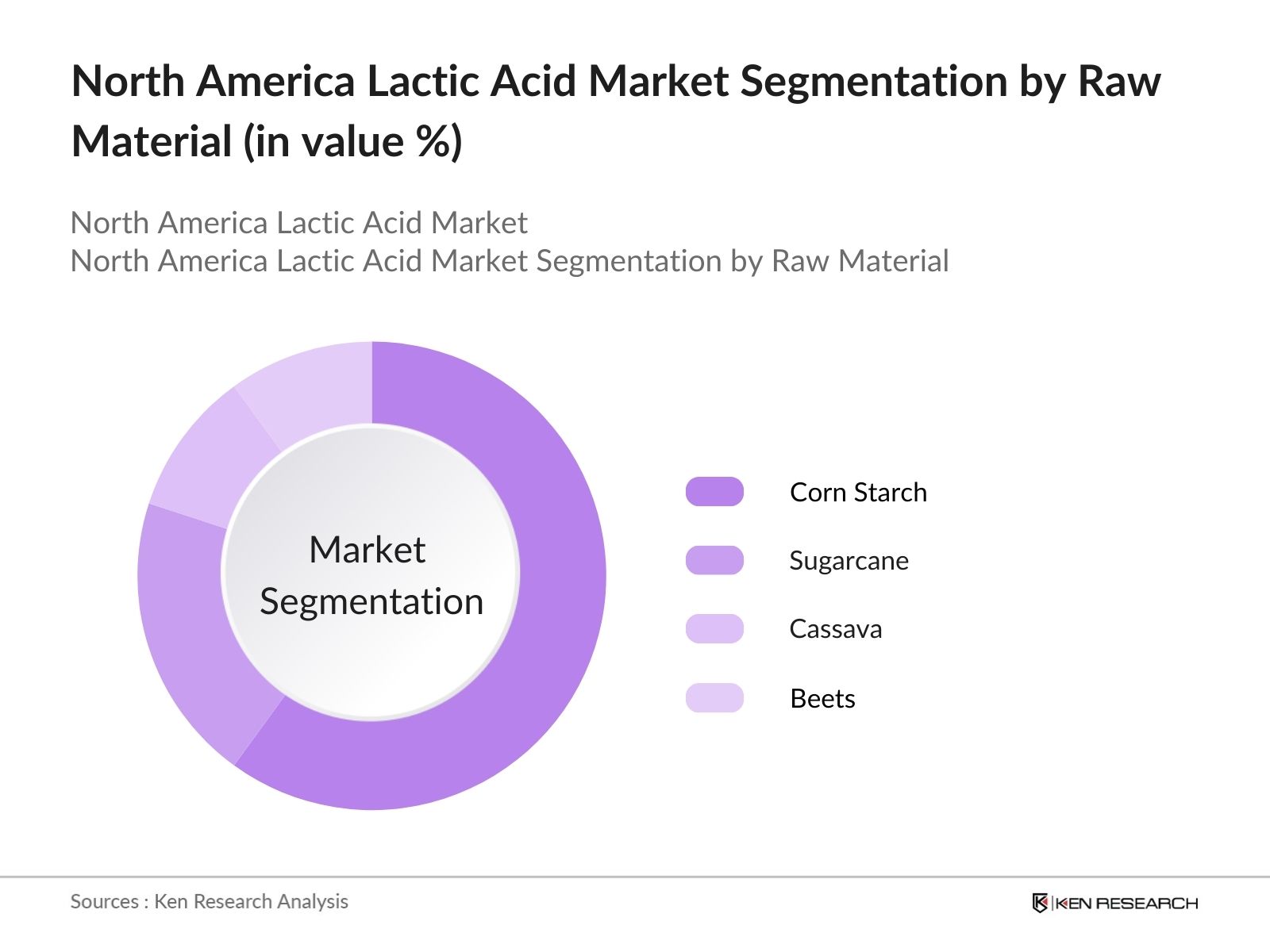

By Raw Material: Segmented by raw material, the market includes corn starch, sugarcane, cassava, and beets. Corn starch-based lactic acid production holds the largest share due to its high availability and cost-effectiveness in North America. The use of corn starch as a primary feedstock is driven by the regions robust agricultural infrastructure, making it a preferable and sustainable source for lactic acid production. Additionally, advancements in fermentation technologies further bolster its dominance.

North America Lactic Acid Market Competitive Landscape

The North America lactic acid market is dominated by a few major players, including Corbion N.V. and NatureWorks LLC. These companies, through strategic partnerships and continuous R&D, have maintained a strong market presence. Their focus on sustainability initiatives, production capacity expansions, and collaborations with bio-based material producers has driven their market leadership.

North America Lactic Acid Market Analysis

Growth Drivers

- Shift Towards Biodegradable Plastics: Lactic acid plays a vital role in producing polylactic acid (PLA), a biodegradable polymer used as an alternative to traditional plastics. In 2023, North American countries implemented policies that target the reduction of plastic waste by 10-20% annually, influencing companies to adopt biodegradable options. The U.S. government, through the Environmental Protection Agency (EPA), has set goals to reduce non-recyclable plastic packaging, creating a demand surge for lactic acid.

- Growing Demand for Personal Care Products: The North American personal care industry has witnessed a growing preference for natural ingredients, increasing the demand for lactic acid as a safe exfoliant and moisturizer in skincare products. In 2023, the U.S. cosmetics industry generated over $95 billion in sales, with organic personal care products experiencing double-digit growth, driven by health-conscious consumers. This trend, supported by increasing consumer spending and regulatory approvals from the Food and Drug Administration (FDA), has significantly boosted the adoption of lactic acid in personal care applications.

- Rising Health Awareness in Food & Beverages: Lactic acid is widely used as a preservative and acidity regulator in the food and beverage sector, where health-conscious consumers are pushing for cleaner, additive-free ingredients. In 2023, U.S. consumers spent over $2.6 trillion on food and beverages, reflecting the increasing demand for healthier, preservative-free products. The FDA has also classified lactic acid as generally recognized as safe (GRAS), further solidifying its role in clean-label food manufacturing, which continues to grow in popularity.

Challenges

- High Production Costs: Lactic acid production, primarily through fermentation, involves high operational costs due to the expensive fermentation substrates and complex purification processes. According to the U.S. Department of Energy, these processes account for nearly 60% of the total production costs, making lactic acid more expensive than petroleum-based alternatives. This cost barrier limits the widespread adoption of lactic acid, despite the demand for more sustainable products.

- Supply Chain Disruptions: The lactic acid market has faced significant supply chain disruptions due to global crises, such as the COVID-19 pandemic and geopolitical tensions. In 2023, the U.S. experienced shipping delays and raw material shortages, impacting the production of lactic acid across industries. According to the World Bank, supply chain constraints caused a 15% reduction in the availability of key inputs required for lactic acid fermentation. These disruptions have led to longer lead times and increased production costs, affecting market growth.

North America Lactic Acid Market Future Outlook

The North America lactic acid market is projected to experience significant growth over the next five years, driven by increasing demand for bio-based plastics and continuous developments in fermentation technologies. The shift toward biodegradable products and green chemistry across various industries such as food, packaging, and personal care is expected to further fuel the market expansion. Government regulations encouraging sustainable practices and the use of lactic acid in multiple applications will also play a crucial role in this growth trajectory.

Market Opportunities

- Expansion into Biomedical Applications: Lactic acid is finding growing applications in the biomedical field, particularly in the development of biocompatible polymers used for drug delivery and tissue engineering. The U.S. biomedical industry was valued at $246.1 billion in 2023, with increasing investments in biocompatible materials driving lactic acid's expansion. The materials ability to degrade naturally in the human body makes it an ideal candidate for implants and medical devices, aligning with the increasing demand for sustainable and safe biomedical solutions.

- Growing Demand in Food Preservation: Lactic acid's natural antimicrobial properties make it highly desirable in food preservation. The U.S. food preservation market saw a surge in demand, especially for natural preservatives in 2023, as consumers turned toward cleaner labels. Approximately 30% of U.S. households purchased organic food in 2023, driving the demand for natural food preservatives like lactic acid. This growing trend, coupled with FDA regulations supporting the use of natural preservatives, positions lactic acid for continued growth in the food industry.

Scope of the Report

|

Segments |

Sub-segments |

|

By Raw Material |

Corn Starch |

|

Sugarcane |

|

|

Cassava |

|

|

Beets |

|

|

By Application |

Food & Beverages |

|

Pharmaceuticals |

|

|

Personal Care & Cosmetics |

|

|

Bioplastics |

|

|

Others (Textiles, Chemicals) |

|

|

By Form |

Liquid Lactic Acid |

|

Powder Lactic Acid |

|

|

By Production Process |

Fermentation Process |

|

Chemical Synthesis |

|

|

By Region |

U.S. |

|

Canada |

|

|

Mexico |

Products

Key Target Audience

Lactic Acid Manufacturers

Food & Beverage Companies

Pharmaceutical Companies

Personal Care & Cosmetics Companies

Bioplastic Producers

Government and Regulatory Bodies (FDA, EPA)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Corbion N.V.

NatureWorks LLC

Galactic S.A.

Henan Jindan Lactic Acid Technology Co.

DuPont (Danisco)

Jungbunzlauer Suisse AG

Vigon International, Inc.

Synbra Technology B.V.

Wei Mon Industry Co., Ltd.

Musashino Chemical Laboratory, Ltd.

Table of Contents

1. North America Lactic Acid Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Lactic Acid Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Lactic Acid Market Analysis

3.1. Growth Drivers

3.1.1. Shift Towards Biodegradable Plastics

3.1.2. Growing Demand for Personal Care Products

3.1.3. Rising Health Awareness in Food & Beverages

3.1.4. Adoption of Sustainable Packaging Solutions

3.2. Market Challenges

3.2.1. High Production Costs (Fermentation Process)

3.2.2. Supply Chain Disruptions

3.2.3. Lack of Consistent Quality Standards

3.3. Opportunities

3.3.1. Expansion into Biomedical Applications

3.3.2. Growing Demand in Food Preservation

3.3.3. Increasing Use in Biodegradable Polymers

3.4. Trends

3.4.1. Innovations in Fermentation Technologies

3.4.2. Integration into Circular Economy Models

3.4.3. Rise of Vegan and Organic Product Demand

3.5. Government Regulation

3.5.1. Food and Drug Administration (FDA) Guidelines

3.5.2. Environmental Protection Agency (EPA) Regulations

3.5.3. Policies Supporting Biodegradable Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Lactic Acid Market Segmentation

4.1. By Raw Material (In Value %)

4.1.1. Corn Starch

4.1.2. Sugarcane

4.1.3. Cassava

4.1.4. Beets

4.2. By Application (In Value %)

4.2.1. Food & Beverages

4.2.2. Pharmaceuticals

4.2.3. Personal Care & Cosmetics

4.2.4. Bioplastics

4.2.5. Others (Textiles, Chemicals)

4.3. By Form (In Value %)

4.3.1. Liquid Lactic Acid

4.3.2. Powder Lactic Acid

4.4. By Production Process (In Value %)

4.4.1. Fermentation Process

4.4.2. Chemical Synthesis

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Lactic Acid Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Corbion N.V.

5.1.2. NatureWorks LLC

5.1.3. Galactic S.A.

5.1.4. Henan Jindan Lactic Acid Technology Co.

5.1.5. DuPont (Danisco)

5.1.6. Jungbunzlauer Suisse AG

5.1.7. Musashino Chemical Laboratory, Ltd.

5.1.8. Vigon International, Inc.

5.1.9. Synbra Technology B.V.

5.1.10. Wei Mon Industry Co., Ltd.

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Product Portfolio, R&D Investment, Regional Presence, Market Share, Sustainability Initiatives, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Lactic Acid Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. North America Lactic Acid Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Lactic Acid Future Market Segmentation

8.1. By Raw Material (In Value %)

8.2. By Application (In Value %)

8.3. By Form (In Value %)

8.4. By Production Process (In Value %)

8.5. By Region (In Value %)

9. North America Lactic Acid Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with mapping key stakeholders in the North America lactic acid market. This is achieved through extensive desk research and access to proprietary and secondary databases, focusing on critical market drivers like raw material availability, production capacity, and regulatory frameworks.

Step 2: Market Analysis and Construction

Historical data pertaining to market dynamics such as lactic acid production and consumption is analyzed to understand market trends. This phase also includes evaluating industry standards, supply chains, and regulatory compliance to ensure reliable market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market insights are validated through consultations with industry experts. These discussions focus on supply chain challenges, production bottlenecks, and sustainability goals to refine the market analysis and confirm projections.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating insights from manufacturers and market experts to ensure the comprehensive coverage of market trends, competitive analysis, and production capacities. This information is synthesized into a detailed market report for stakeholders.

Frequently Asked Questions

01. How big is the North America Lactic Acid Market?

The North America lactic acid market is valued at USD 3 billion, driven by the increasing adoption of biodegradable plastics and demand in food and beverage applications.

02. What are the major challenges in the North America Lactic Acid Market?

Key challenges in North America lactic acid market include high production costs, particularly with the fermentation process, and inconsistent quality standards across different industries, which affect mass adoption.

03. Who are the major players in the North America Lactic Acid Market?

Major players in North America lactic acid market include Corbion N.V., NatureWorks LLC, Galactic S.A., DuPont, and Henan Jindan Lactic Acid Technology Co., known for their strong product portfolios and regional presence.

04. What are the growth drivers of the North America Lactic Acid Market?

North America lactic acid market is driven by the rising demand for biodegradable plastics, increasing health awareness in food & beverages, and advancements in fermentation technologies that improve production efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.