North America Landscaping Tools Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD10548

December 2024

96

About the Report

North America Landscaping Tools Market Overview

- The North America Landscaping Tools market is valued at USD 11.6 billion, driven by a growing preference for gardening and landscaping among both residential and commercial property owners. With an increasing interest in outdoor aesthetics, the markets growth is further propelled by advancements in tool technology, specifically battery-operated and ergonomic designs that cater to ease of use and efficiency. The market has seen robust expansion, owing to the availability of a diverse product range that meets the needs of both casual gardeners and professional landscapers.

- The market dominance lies primarily in the United States and Canada due to high consumer spending on outdoor living spaces, especially in suburban areas where lawn care and gardening are cultural norms. The U.S., with its large base of residential homes with backyards, has been particularly influential, while Canada has seen a rise in landscaping activities spurred by its seasonal gardening trends and increasing interest in sustainable outdoor environments.

- The U.S. EPA introduced stricter emissions regulations for landscaping tools in 2023, pushing the industry toward battery-powered alternatives. These regulations are expected to impact over 5 million gas-powered landscaping tools currently in use, emphasizing the need for cleaner, compliant solutions.

North America Landscaping Tools Market Segmentation

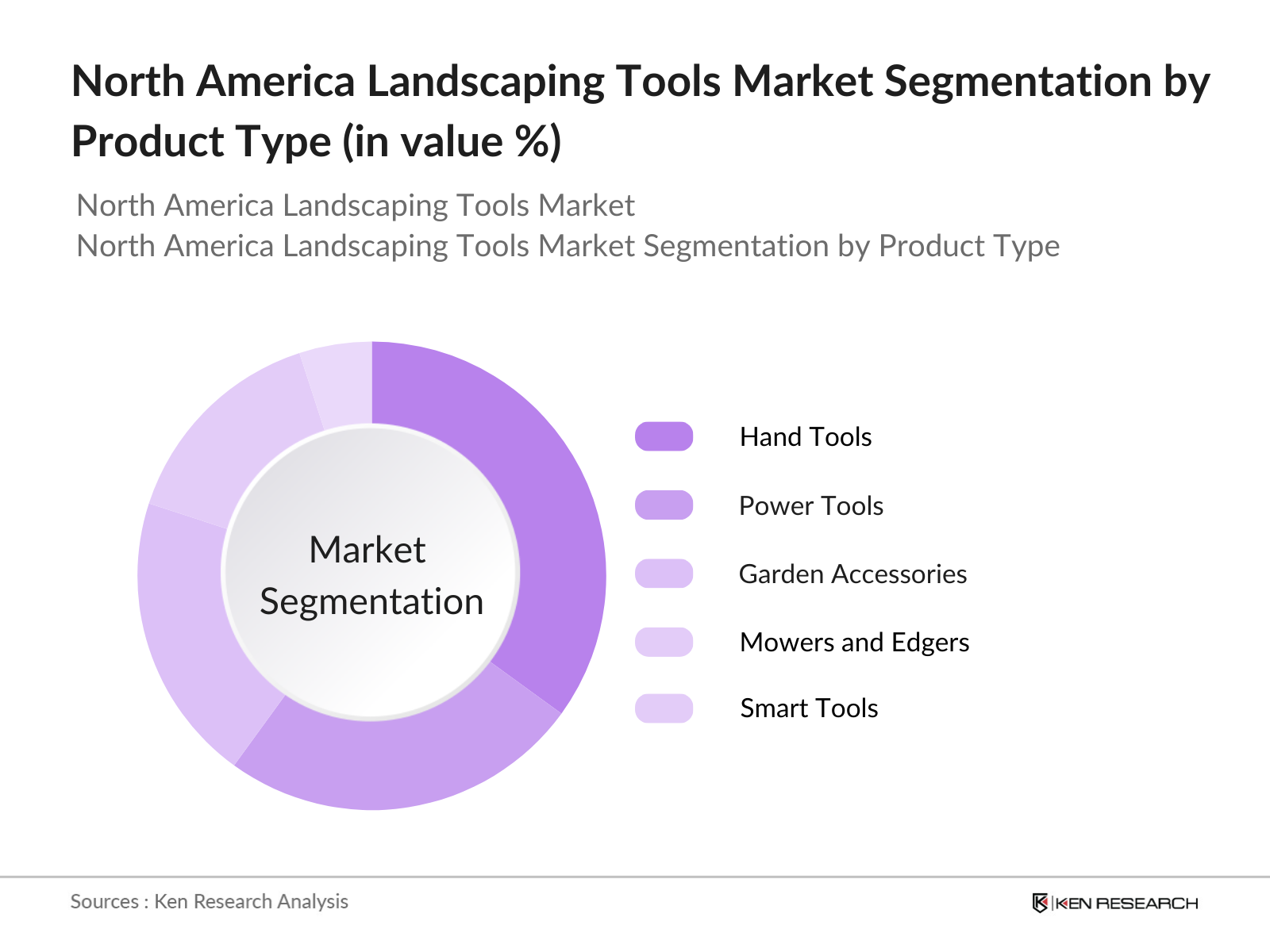

By Product Type: The market is segmented by product type into hand tools, power tools, garden accessories, and mowers and edgers. Among these, hand tools hold a dominant market share, largely due to their versatility and cost-effectiveness for both professional landscapers and DIY gardeners. Tools such as pruners, rakes, and shovels are indispensable for various gardening tasks and appeal to consumers due to their simplicity and reliability.

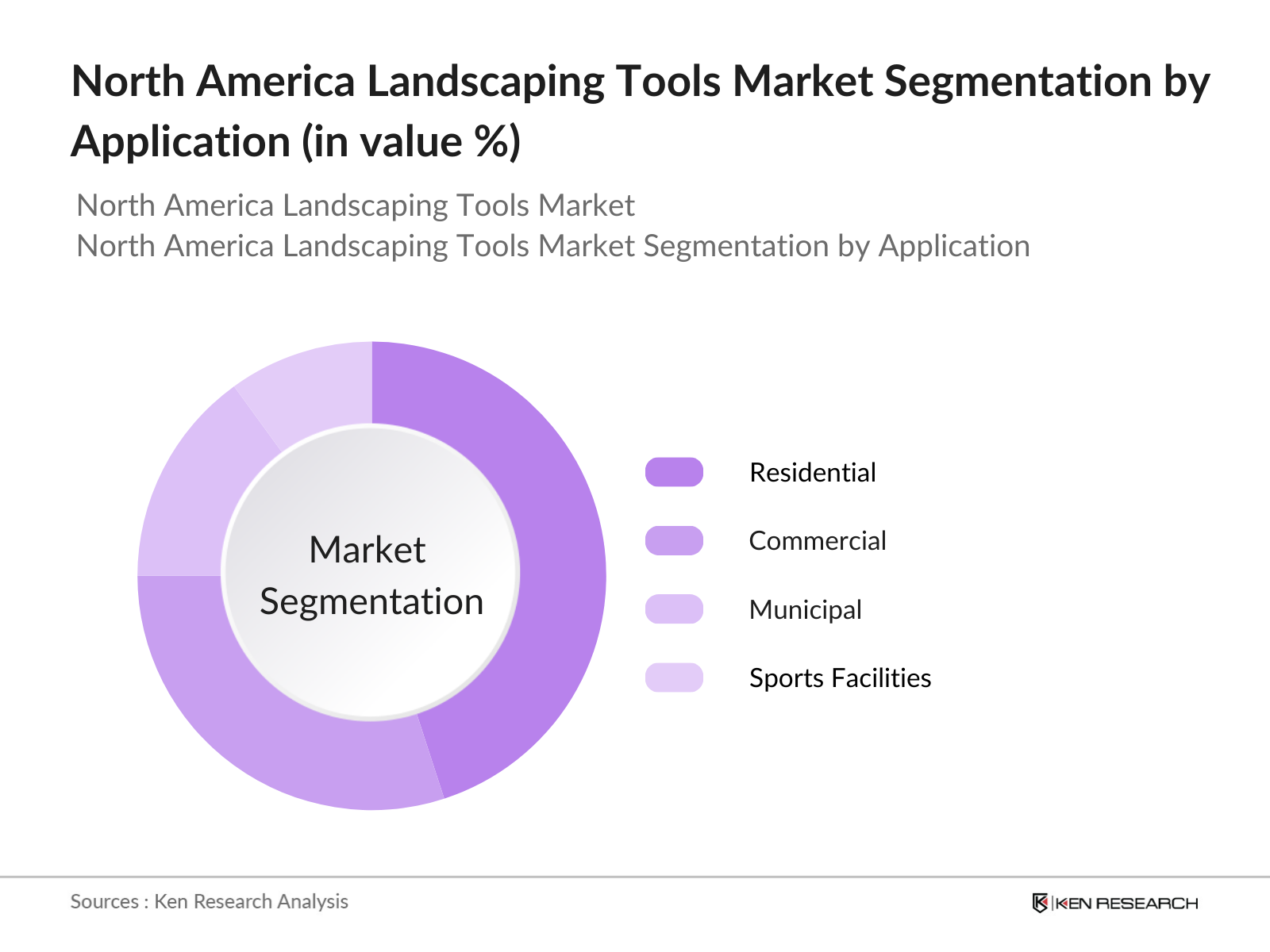

By Application: The market is also segmented by application into residential, commercial, municipal, and sports facilities. The residential segment leads the market share, driven by the strong culture of gardening and backyard landscaping in North American homes. This segment has seen consistent demand, fueled by trends in home improvement and a focus on outdoor living spaces. Additionally, an increase in DIY gardening activities has bolstered demand in this segment, as homeowners invest in basic tools for maintenance and beautification.

North America Landscaping Tools Market Competitive Landscape

The North America Landscaping Tools market is dominated by a few major players who hold substantial influence due to their extensive distribution networks and commitment to innovative, durable products. Market leaders such as The Toro Company and Husqvarna Group maintain dominance through a strong focus on R&D and product diversification, with models designed for both residential and professional use.

North America Landscaping Tools Industry Analysis

Growth Drivers

- Increase in Green Spaces: The expansion of green spaces in North America has driven demand for landscaping tools. In the U.S., over 1 million acres have been designated as public parks as of 2023, with cities like New York City, which increased its green space to 30,000 acres, investing substantially in urban greening projects. The Canadian governments National Parks system added over 150 square kilometers to its protected areas in 2022, showing a similar commitment. Such growth underlines an increased need for tools that support maintenance and landscaping in these spaces.

- Rise in Home Gardening Activities: Home gardening surged with over 16 million households across North America participating in gardening activities in 2023, according to government agricultural surveys. States like California and Texas saw gardening equipment sales spike by nearly 20%, indicating strong demand. This trend is driven by homeowners' interest in sustainability and local food production, with the USDA reporting significant growth in community garden initiatives that further necessitate landscaping tools.

- Advancements in Ergonomic Tool Design: The ergonomic tool design sector has grown, supported by a rising awareness of occupational health. In the U.S., over 30,000 cases of landscaping-related musculoskeletal injuries were reported in 2022, prompting the need for improved tool designs. A national survey found that 65% of landscaping professionals prefer ergonomic tools to reduce injury risk, leading to increased R&D spending in this area.

Market Challenges

- High Cost of Advanced Tools: Advanced landscaping tools, especially those integrated with IoT or automation capabilities, can cost over $1,500, limiting their adoption among smaller landscaping businesses. A 2022 survey of small landscaping firms revealed that 58% considered high costs a primary barrier to tool upgrades, affecting market penetration of innovative products.

- Seasonal Demand Fluctuations: Landscaping tool sales experience significant seasonality, with up to 70% of total sales concentrated in spring and summer months. This fluctuation impacts inventory management and cash flow for manufacturers, who face a nearly 40% sales dip in the winter. Seasonal employment trends corroborate this, with landscaping jobs declining by 25% in the winter, as reported by the U.S. Bureau of Labor Statistics.

North America Landscaping Tools Market Future Outlook

The North America Landscaping Tools market is set to experience robust growth over the next five years, driven by an increased focus on sustainable and eco-friendly landscaping practices. The markets growth trajectory is further bolstered by technological advancements in battery-operated and IoT-enabled tools, which are expected to gain widespread adoption among consumers. Additionally, with rising interest in urban gardening and community green spaces, demand is likely to expand across various consumer segments, from hobbyists to professional landscapers.

Future Market Opportunities

- Increasing Demand for Battery-Operated Tools: Battery-operated tools are seeing rising demand, accounting for 40% of power tool sales in North America in 2023 due to environmental regulations and consumer preference for eco-friendly options. The U.S. Department of Energy reported that battery technology advancements have doubled tool runtime, supporting the trend toward cordless, eco-friendly landscaping solutions.

- Smart Tools Integration: The adoption of IoT-enabled tools has accelerated, with 25% of landscaping firms in North America incorporating smart tools as of 2023, streamlining operations with real-time monitoring and maintenance alerts. The increase is driven by advancements in low-power IoT devices, enabling enhanced features like GPS tracking and automated diagnostics.

Scope of the Report

|

Product Type |

Lawn Mowers |

|

Application |

Residential |

|

Power Source |

Electric/Battery-Powered |

|

Sales Channel |

Online |

|

Country |

United States |

Products

Key Target Audience

Manufacturers of Landscaping Tools

Distributors and Wholesalers

Retailers and E-commerce Platforms

Professional Landscapers and Gardening Companies

Residential Property Owners

Commercial Real Estate Developers

Investment and Venture Capital Firms

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, Canada Ministry of Environment)

Companies

Major Players

Husqvarna Group

The Toro Company

STIHL Group

Black+Decker Inc.

GreenWorks Tools

Honda Power Equipment

Fiskars Group

Ariens Company

ECHO Incorporated

Makita Corporation

Stanley Black & Decker

Deere & Company

MTD Products Inc.

Briggs & Stratton

Blount International Inc.

Table of Contents

1. North America Landscaping Tools Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. North America Landscaping Tools Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Current Market Size Analysis

2.3. Year-On-Year Growth Analysis

2.4. Major Market Milestones and Developments

3. North America Landscaping Tools Market Analysis

3.1. Market Growth Drivers

3.1.1. Increase in Green Spaces (e.g., public parks, recreational areas)

3.1.2. Rise in Home Gardening Activities

3.1.3. Advancements in Ergonomic Tool Design

3.1.4. Sustainable Landscaping Trends

3.2. Market Challenges

3.2.1. High Cost of Advanced Tools

3.2.2. Seasonal Demand Fluctuations

3.2.3. Labor Shortages in Landscaping Sector

3.3. Opportunities

3.3.1. Increasing Demand for Battery-Operated Tools

3.3.2. Smart Tools Integration (IoT in Landscaping)

3.3.3. Expansion in the Commercial Landscaping Sector

3.4. Trends

3.4.1. Automation and Robotics in Landscaping

3.4.2. Customizable and Modular Tool Kits

3.4.3. DIY Landscaping Trends

3.5. Regulatory Analysis

3.5.1. Environmental Regulations on Emissions

3.5.2. Safety Standards for Power Tools

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. North America Landscaping Tools Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Hand Tools (e.g., pruners, shovels)

4.1.2. Power Tools (e.g., trimmers, chainsaws)

4.1.3. Garden Accessories (e.g., gloves, bags)

4.1.4. Mowers and Edgers

4.1.5. Smart Tools

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Municipal

4.2.4. Sports Facilities

4.2.5. Golf Courses

4.3. By Power Source (In Value %)

4.3.1. Electric

4.3.2. Gasoline

4.3.3. Battery-Operated

4.3.4. Manual

4.4. By Sales Channel (In Value %)

4.4.1. Retail Stores

4.4.2. E-commerce

4.4.3. Direct Sales

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Landscaping Tools Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Husqvarna Group

5.1.2. STIHL Group

5.1.3. Deere & Company

5.1.4. The Toro Company

5.1.5. Black+Decker Inc.

5.1.6. Makita Corporation

5.1.7. MTD Products Inc.

5.1.8. Stanley Black & Decker

5.1.9. Ariens Company

5.1.10. Honda Power Equipment

5.1.11. Briggs & Stratton

5.1.12. Blount International Inc.

5.1.13. Fiskars Group

5.1.14. GreenWorks Tools

5.1.15. ECHO Incorporated

5.2. Cross Comparison Parameters (Headquarters, Revenue, Production Volume, Distribution Networks, Product Range, Market Share, Sustainability Initiatives, Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Funding Rounds

5.8. R&D Expenditures

5.9. Partnership and Collaboration Analysis

6. North America Landscaping Tools Market Regulatory Framework

6.1. Environmental Compliance Requirements

6.2. Power Equipment Emission Standards

6.3. Import and Export Tariffs

6.4. Product Safety Certifications

7. North America Landscaping Tools Future Market Size (In USD Mn)

7.1. Projected Market Size

7.2. Key Factors Driving Future Market Growth

7.3. Market Projections by Segment

8. North America Landscaping Tools Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Power Source (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

9. North America Landscaping Tools Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Innovation Strategy

9.3. Customer Targeting Insights

9.4. Marketing and Brand Positioning Recommendations

9.5. White Space and Untapped Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the landscaping tools market, identifying major stakeholders, including manufacturers, distributors, and end-users. Secondary research is conducted using databases and reports to identify critical variables influencing market trends.

Step 2: Market Analysis and Construction

This phase includes collecting and analyzing historical data for the market, such as demand for various tool types and geographic trends. It evaluates sales trends, production levels, and market reach to construct reliable growth estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market drivers and challenges are developed and validated through structured interviews with industry experts and stakeholders. This provides real-time insights into consumer preferences, product development, and market shifts.

Step 4: Research Synthesis and Final Output

The final stage involves combining quantitative data with qualitative insights from manufacturers and retailers to ensure an accurate and comprehensive analysis. This results in a validated, cohesive overview of the North America Landscaping Tools market.

Frequently Asked Questions

01. How big is the North America Landscaping Tools Market?

The North America Landscaping Tools market is valued at USD 11.6 billion, supported by increased consumer spending on home improvement and outdoor spaces.

02. What are the growth drivers in the North America Landscaping Tools Market?

Key drivers in the North America Landscaping Tools market include the rise in DIY gardening activities, advancements in battery-operated tools, and a growing trend in outdoor landscaping for aesthetic and functional purposes.

03. Who are the major players in the North America Landscaping Tools Market?

Prominent players in the North America Landscaping Tools market include The Toro Company, Husqvarna Group, STIHL Group, Black+Decker Inc., and GreenWorks Tools, each leveraging strong distribution networks and diverse product lines.

04. What challenges exist in the North America Landscaping Tools Market?

Challenges in the North America Landscaping Tools market include seasonal fluctuations in demand, the high cost of advanced tools, and a shortage of skilled labor in professional landscaping sectors.

05. Which segment holds the largest market share in the North America Landscaping Tools Market?

Hand tools hold the largest share in the North America Landscaping Tools market due to their cost-effectiveness, ease of use, and versatility in both residential and commercial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.