North America Laser Technology Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD1977

December 2024

91

About the Report

North America Laser Technology Market Overview

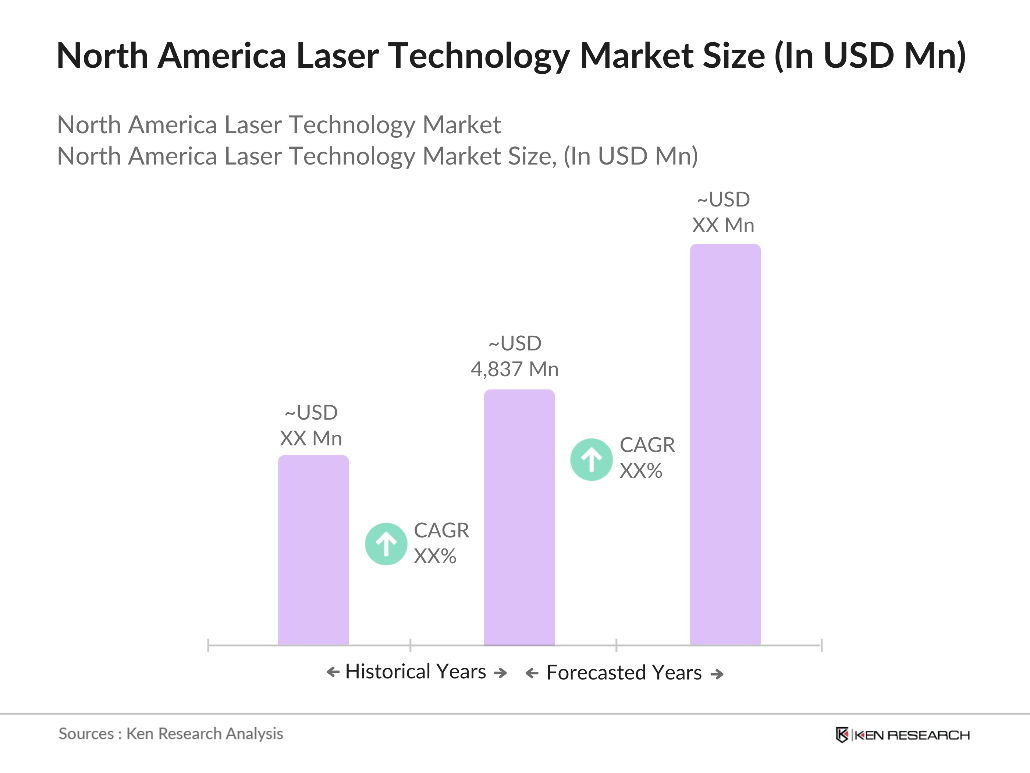

- In 2023, the North America Laser Technology market reached a market size of USD 4,837 million, driven primarily by the increasing adoption of laser technologies across various industries including healthcare, automotive, and defense. The growing demand for precise cutting, welding, and marking solutions is pushing industries to invest in laser technology. The technological advancements, combined with the focus on miniaturization and improved efficiency, have further boosted the market growth. The demand from sectors like semiconductor manufacturing is another significant driver.

- Some of the key players dominating the North American Laser Technology market include Coherent Inc., IPG Photonics Corporation, TRUMPF GmbH, Newport Corporation, and Lumentum Holdings Inc. These companies maintain a strong presence through extensive research and development initiatives and a broad portfolio of laser solutions tailored for industrial and medical applications. IPG Photonics, in particular, holds a significant market share owing to its robust fiber laser technology.

- In 2024, the U.S. Department of Energy (DOE) announced a funding program aimed at promoting advanced manufacturing technologies, including laser-based systems for clean energy production. This initiative encourages innovation and research in laser-based industrial applications to boost productivity while reducing environmental impact. The Canadian government, through the Innovation, Science and Economic Development Canada (ISED), also initiated a similar program to enhance technological adoption in the manufacturing sector.

- Silicon Valley, California, and Boston, Massachusetts, dominate the laser technology market in North America. The concentration of tech companies, universities, and research institutions in these regions has fostered innovation and industrial growth in laser applications. Boston, for example, is home to numerous medical laser research companies.

North America Laser Technology Market Segmentation

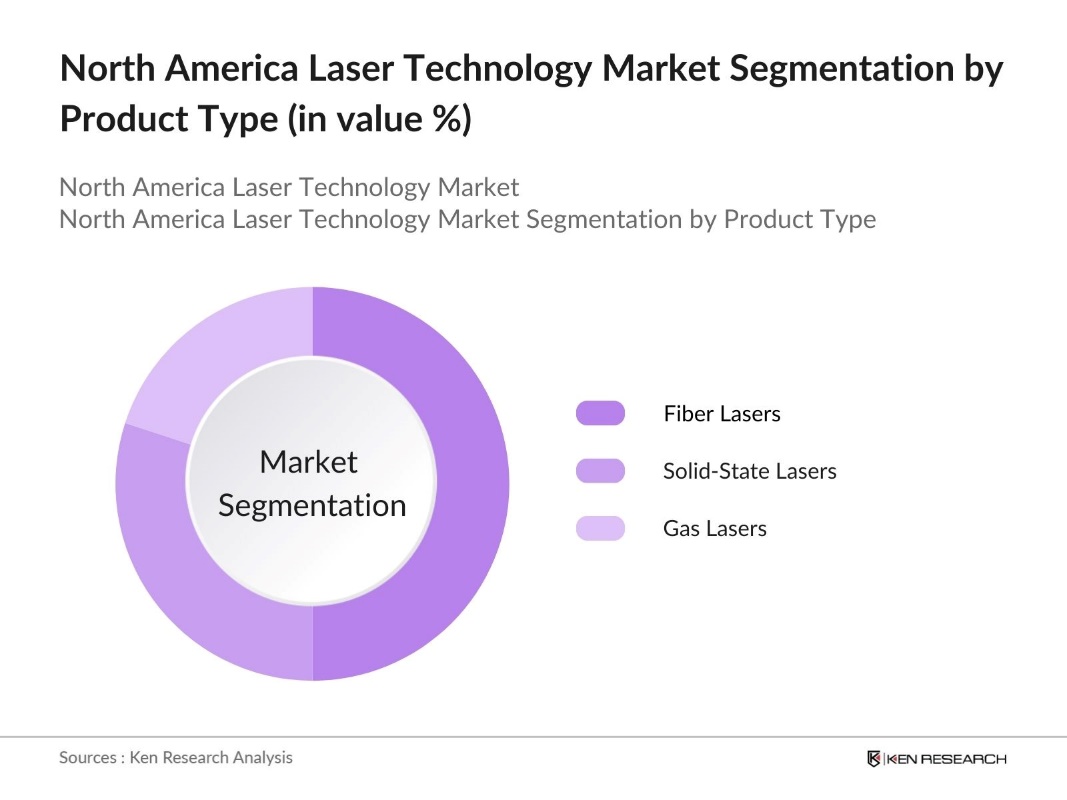

By Product Type: The North America Laser Technology market is segmented by product type into Gas Lasers, Solid-state Lasers, and Fiber Lasers. In 2023, Fiber Lasers held a dominant market share in the product type segmentation. The dominance of fiber lasers is due to their wide range of applications in industries such as automotive, aerospace, and defense, where precision and efficiency are crucial. Fiber lasers are known for their higher power output, flexibility, and lower operational costs, making them the preferred choice for high-volume manufacturing sectors.

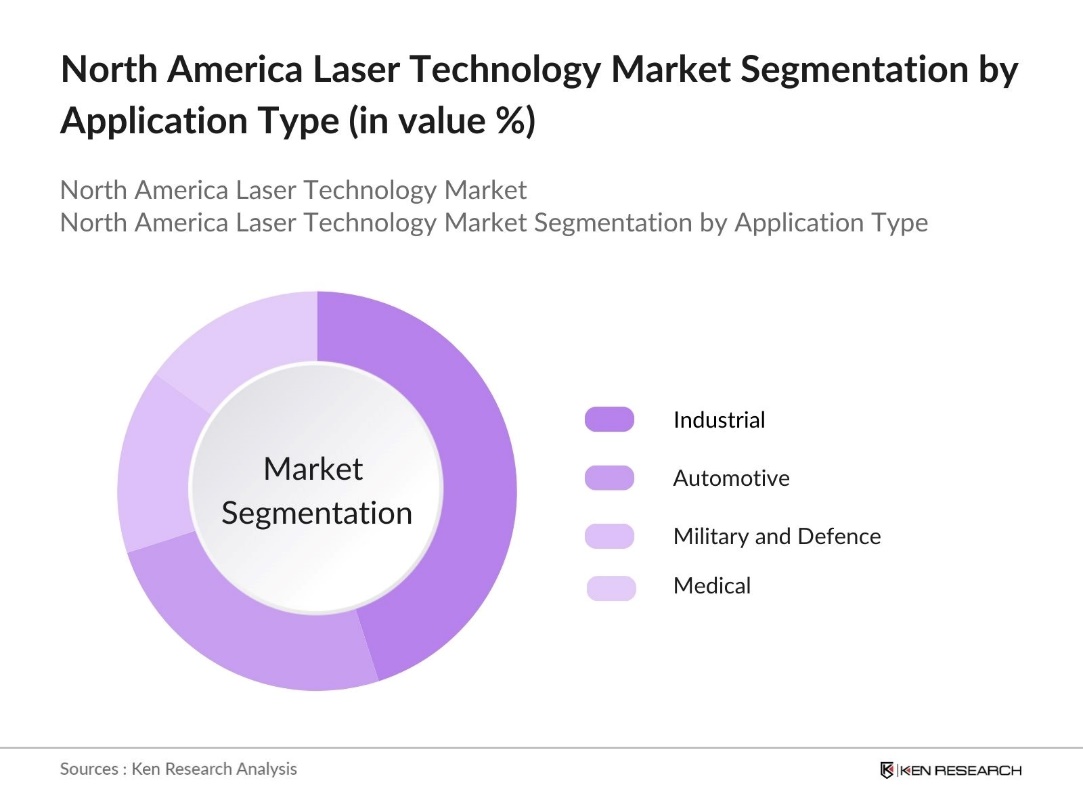

By Application: By application, the market is segmented into Medical, Industrial, Automotive, and Military & Defense. In 2023, the industrial segment dominated the market due to the widespread use of lasers for cutting, welding, and marking processes. The demand for automation and precision in manufacturing, particularly in the electronics and semiconductor sectors, has driven the adoption of laser technologies. Moreover, the automotive sector's push for innovation in production methods, such as laser welding, has solidified the industrial segment's leadership.

By Region: The regional segmentation divides the market into the USA and Canada. In 2023, the USA dominated the North American Laser Technology market. The USA's leadership stems from its robust industrial base, higher R&D investments, and the presence of global market leaders like Coherent and IPG Photonics. Additionally, the government's support for innovation in advanced manufacturing technologies further strengthens the country's position

North America Laser Technology Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Coherent Inc. |

1966 |

Santa Clara, CA, USA |

|

IPG Photonics Corporation |

1990 |

Oxford, MA, USA |

|

TRUMPF GmbH |

1923 |

Ditzingen, Germany |

|

Newport Corporation |

1969 |

Irvine, CA, USA |

|

Lumentum Holdings Inc. |

2015 |

Milpitas, CA, USA |

- Coherent Inc. Recent Developments: On May 30, 2024, Coherent introduced the PM10K+ high-power laser sensor, capable of measuring lasers up to 10 kW continuously (12 kW intermittently). This product addresses a gap in their offerings and enhances measurement capabilities for higher power lasers used in various applications

- TRUMPF GmbH Recent Developments: TRUMPF made headlines in 2023 by launching a laser system tailored for additive manufacturing (3D printing), targeting the aerospace and automotive sectors. The company's innovation has attracted investments from key players in the aerospace industry, including a $50 million order from a leading aerospace company for laser-based 3D printing systems.

North America Laser Technology Market Analysis

Growth Drivers

- Increasing Adoption of Laser Technology in the Automotive Sector: The increasing adoption of laser processing in the automotive sector plays an integral role in North America Laser Technology market. The need for high-precision cutting, welding, and surface treatment in electric vehicles (EVs) has led to greater integration of laser technology, which offers superior accuracy and efficiency in manufacturing processes.

- Defense Sectors Increasing Demand for Laser Weapons: The U.S. military has been a significant driver for the laser technology market, with a growing focus on developing laser weapons for defense applications. In 2024, the U.S. Department of Defense allocated $300 million towards the development of high-energy laser weapons, up from $250 million in 2023. This investment reflects the increasing need for precision and non-lethal deterrent technologies in defense, pushing forward the adoption of laser-based systems in both offensive and defensive operations.

- Growth in Medical Laser Applications for Surgical Procedures: The medical field is witnessing a surge in the use of laser technology for minimally invasive surgeries. Lasers are increasingly used in dermatology, ophthalmology, and oncology for precision treatments, reducing recovery times and improving patient outcomes.

Market Challenges

- High Initial Investment Costs in Laser Technology: One of the primary challenges facing the North American laser technology market is the high initial investment required for integrating laser systems into industrial operations. This presents a financial barrier for small- and medium-sized enterprises (SMEs), which may find it difficult to justify such a significant capital expenditure.

- Stringent Government Regulations on Laser Safety: The increasing use of lasers across various industries has led to stricter government regulations regarding laser safety, particularly in medical and industrial applications. In 2024, the U.S. Food and Drug Administration (FDA) imposed stricter guidelines for medical laser devices, requiring more comprehensive testing and safety compliance, which has increased the time-to-market for new products. These regulatory hurdles can delay innovation and add extra costs for manufacturers seeking to comply with new safety standards.

Government Initiatives

- U.S. Department of Energy's Clean Energy Laser Manufacturing Program: In 2024, the U.S. Department of Energy (DOE) introduced a program aimed at supporting the development of laser-based technologies for clean energy production. This initiative focuses on enhancing manufacturing capabilities that use lasers to improve efficiency and reduce emissions in industries like automotive and aerospace. The program is expected to boost R&D in laser technologies designed for green energy solutions, driving innovation and adoption across industrial sectors.

- U.S. Department of Defense Funding for Laser Weapon Development: The U.S. government has been increasing its focus on modernizing defense technologies, which includes significant investments in laser systems. This initiative aims to enhance military capabilities through advanced laser applications, particularly in areas such as directed energy weapons and precision targeting systems.

North America Laser Technology Market Future Outlook

TheNorth America Laser Technology Market is projected to grow exponentially in coming years. This growth will be driven by the increasing adoption of laser technology in the automotive sector growth in medical laser applications for surgical procedures and rising military demand for laser weapons and defense applications.

Future Trends

- Increasing Integration of Lasers in Autonomous Vehicle Manufacturing By 2028, the demand for laser-based systems in autonomous vehicle manufacturing is expected to grow significantly, driven by the need for precision in lidar systems and laser welding applications. North American automotive manufacturers are projected to increase their investments in laser technologies to meet the growing demand for electric and autonomous vehicles. The integration of lasers in sensor manufacturing and high-precision component assembly will be crucial for the next wave of automotive innovation.

- Adoption of Laser-Based 3D Printing for Aerospace Manufacturing The aerospace industry is expected to see a massive shift towards laser-based 3D printing by 2028, as the need for lightweight and durable materials grows. Laser systems will be central to additive manufacturing processes, especially in producing complex components for aircraft and spacecraft. This trend will be supported by increasing investments from aerospace companies in North America, with the 3D printing market projected to see a 25% annual growth in laser technology adoption.

Scope of the Report

|

By Product Type |

Gas Lasers Solid-state Lasers Fiber Lasers |

|

By Application |

Medical Industrial Automotive Military & Defense |

|

By Fuel Type |

Petrol Diesel Electric/hybrid vehicles |

|

By Region |

USA Canada |

|

By Technology |

Continuous Wave Lasers |

|

By End-User |

|

Products

Key Target Audience

Laser Equipment Manufacturers

Medical Device Companies

Automotive OEMs (Original Equipment Manufacturers)

Semiconductor Manufacturers

Military and Defense Contractors

Aerospace & Aviation Companies

Industrial Equipment Distributors

Energy Companies (for clean energy solutions)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Defense, U.S. Department of Energy)

Companies

Players Mentioned in the Report:

Coherent Inc.

IPG Photonics Corporation

TRUMPF GmbH

Newport Corporation

Lumentum Holdings Inc.

Raytheon Technologies Corporation

Applied Materials Inc.

Jenoptik AG

3D Systems Corporation

Prima Industrie S.p.A

Laserline GmbH

Novanta Inc.

GSI Group Inc.

Hans Laser Technology Industry Group Co., Ltd.

Rofin-Sinar Technologies Inc

Table of Contents

1. North America Laser Technology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Product Type, Application, Region, and Technology)

1.3. Market Growth Rate (Key Market Growth Metrics and CAGR for Different Segments)

1.4. Market Segmentation Overview (Product Types, Applications, Technology, End-Users, and Region)

2. North America Laser Technology Market Size (in USD bn)

2.1. Historical Market Size Analysis (Pre-2022)

2.2. Year-on-Year Growth Analysis (2022Present)

2.3. Key Market Developments and Milestones (Impactful Technological Advances, Investments)

2.4. Financial Performance (Revenue and Profit Analysis of Key Players)

3. North America Laser Technology Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Laser Technology in the Automotive Sector

3.1.2 Growth in Medical Laser Applications for Surgical Procedures

3.1.3. Rising Military Demand for Laser Weapons and Defense Applications

3.2. Challenges

3.2.1. High Initial Investment and Operational Costs

3.2.2. Complex Regulatory Framework for Laser

3.2.3. Shortage of Skilled Workforce and Technicians in Laser Technologies

3.3. Opportunities

3.3.1. Expansion into Medical Devices and Diagnostics Using Laser Technology

3.3.2. Technological Advancements in Semiconductor Manufacturing with Lasers

3.3.3. Integration of Lasers in Electric and Autonomous Vehicle Production

3.4. Trends

3.4.1. Rising Use of Fiber Lasers in Manufacturing (Automotive, Aerospace)

3.4.2. Adoption of Laser-Based Systems in Semiconductor and Electronics Industry

3.4.3. Surge in 3D Laser Printing Technology Adoption in Additive Manufacturing

3.5. Government Regulations and Policies

3.5.1. U.S. Department of Energys Laser Technology Research Initiatives

3.5.2. Canadian Government's Support for Advanced Manufacturing Using Lasers

3.5.3. Safety Regulations for Medical and Industrial Lasers (FDA and OSHA Guidelines)

3.6. SWOT Analysis

3.6.1. Strengths (Technological Leadership, High Precision)

3.6.2. Weaknesses (High Costs, Regulatory Barriers)

3.6.3. Opportunities (Medical Applications, Clean Energy)

3.6.4. Threats (Economic Slowdowns, Compliance Issues)

3.7. Ecosystem Analysis

3.7.1. Stakeholders (Manufacturers, Suppliers, End-Users)

3.7.2. Market Value Chain Analysis

4. North America Laser Technology Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Gas Lasers

4.1.2. Solid-State Lasers

4.1.3. Fiber Lasers

4.1.4. Semiconductor Lasers

4.2. By Application (in Value %)

4.2.1. Medical (Laser-Assisted Surgeries, Diagnostics)

4.2.2. Industrial (Laser Cutting, Welding, Marking)

4.2.3. Automotive (Laser Welding for EVs)

4.2.4. Aerospace (Laser-Based Additive Manufacturing)

4.2.5. Military & Defense (Laser Weapons, Countermeasures)

4.3. By Technology (in Value %)

4.3.1. Continuous Wave Lasers

4.3.2. Pulsed Lasers

4.3.3. Ultrafast Lasers

4.4. By End-User (in Value %)

4.4.1. Healthcare

4.4.2. Automotive

4.4.3. Aerospace & Defense

4.4.4. Electronics & Semiconductor

4.4.5. Energy and Utilities

4.5. By Region (in Value %)

4.5.1. USA

4.5.2. Canada

5. North America Laser Technology Market Cross-Comparison

5.1. Detailed Profiles of Major Companies (Inception Year, Headquarters, Revenue, Employees)

5.1.1. Coherent Inc.

5.1.2. IPG Photonics Corporation

5.1.3. TRUMPF GmbH

5.1.4. Newport Corporation

5.1.5. Lumentum Holdings Inc.

5.1.6. Raytheon Technologies

5.1.7. Jenoptik AG

5.1.8. Prima Industrie S.p.A

5.1.9. 3D Systems Corporation

5.1.10. Applied Materials Inc.

5.1.11. Laserline GmbH

5.1.12. Novanta Inc.

5.1.13. GSI Group Inc.

5.1.14. Hans Laser Technology Group Co., Ltd.

5.1.15. Rofin-Sinar Technologies Inc.

5.2. Cross-Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Product Portfolio (Laser Type, Application Areas)

5.2.3. Financial Metrics (Revenue, Profit Margins)

5.2.4. Geographical Presence

6. North America Laser Technology Competitive Landscape

6.1. Market Share Analysis of Key Players

6.2. Strategic Initiatives (Joint Ventures, Collaborations, R&D Investments)

6.3. Mergers and Acquisitions (Latest Acquisitions in the Market)

6.4. Investment Analysis

6.4.1. Government Funding (Grants, Innovation Funds)

6.4.2. Private Equity and Venture Capital (Key Funding Rounds)

6.4.3. Major Investments in Manufacturing Facilities

7. North America Laser Technology Market Regulatory Framework

7.1. FDA Regulations for Medical Lasers

7.2. OSHA Regulations for Industrial Lasers

7.3. Certification Processes for Laser Technology Products

7.4. Emission and Environmental Standards for Laser-Based Manufacturing

8. North America Laser Technology Market Future Market Size (in USD bn)

8.1. Future Market Size Projections (Key Growth Metrics)

8.2. Key Factors Driving Future Market Growth (Sector-Wise Outlook)

8.3. R&D and Innovation Focus (Future of Laser Technology)

9. North America Laser Technology Market Future Segmentation

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Technology (in Value %)

9.4. By End-User (in Value %)

9.5. By Region (in Value %)

10. Analyst Recommendations for North America Laser Technology Market

10.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Market)

10.2. Strategic Market Entry and Expansion Strategies

10.3. Key Marketing Initiatives and Channels

10.4. White Space Opportunity Analysis (Unexplored Applications and Geographies)

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping key stakeholders and identifying influential variables within the North America Laser Technology Market. This step utilizes desk research, drawing from proprietary and secondary databases to establish a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data on the North America Laser Technology Market, including use of laser technology in several industries. Additionally, service quality metrics are reviewed to ensure reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through industry expert interviews, which provide insights into operational and technological trends. These consultations reinforce market data accuracy and align findings with real-world applications.

Step 4: Research Synthesis and Final Output

The concluding phase engages directly with industry stakeholders to verify and supplement bottom-up data, ensuring a validated, comprehensive analysis of the North America Laser Technology Market. This step synthesizes data from all phases, resulting in a precise market report.

Frequently Asked Questions

01. How big is the North America Laser Technology Market?

The North America Laser Technology market was valued at USD 4,837 million in 2023, driven by the increasing demand for laser applications in industries such as healthcare, automotive, and defense. The adoption of laser systems in manufacturing and medical sectors continues to propel market growth.

02. What are the challenges in the North America Laser Technology Market?

Challenges in the North America Laser Technology market include high initial investment costs for advanced laser systems, stringent government safety regulations, and a shortage of skilled technicians to operate and maintain these technologies, which can hinder growth for smaller enterprises.

03. Who are the major players in the North America Laser Technology Market?

Key players in the North America Laser Technology marketinclude Coherent Inc., IPG Photonics Corporation, TRUMPF GmbH, Newport Corporation, and Lumentum Holdings Inc. These companies dominate through extensive R&D, a broad product range, and strong market presence across various industrial applications.

04. What are the growth drivers of the North America Laser Technology Market?

The North America Laser Technology market is driven by the increasing adoption of laser technology in the automotive sector growth in medical laser applications for surgical procedures and rising military demand for laser weapons and defense applications

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.