North America Lithium-ion Battery Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD2333

November 2024

94

About the Report

North America Lithium-ion Battery Market Overview

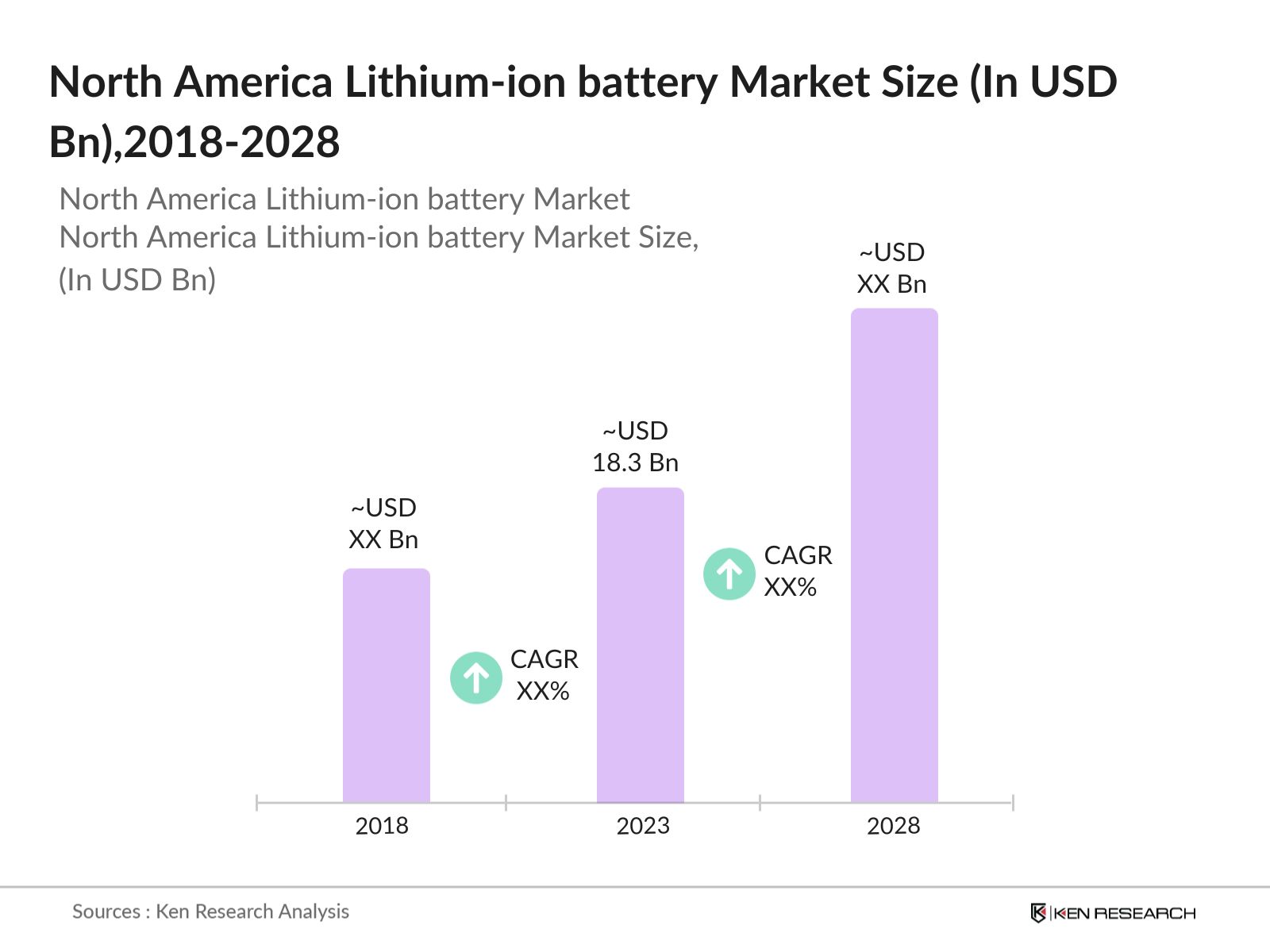

The North America Lithium-ion Battery Market was valued at USD 18.3 billion in 2023, driven by the growing demand for electric vehicles (EVs), renewable energy storage systems, and consumer electronics. The market is segmented into automotive, energy storage systems (ESS), consumer electronics, and industrial applications, with the automotive sector being the most dominant due to the increasing production and adoption of electric vehicles.

Major players in the North America Lithium-ion Battery Market include Tesla, LG Energy Solutions, Panasonic, CATL, and Samsung SDI. These companies are recognized for their advancements in battery technology, with a focus on energy density, safety, and reducing production costs. Tesla leads the market with its Gigafactory, which produces lithium-ion batteries for EVs and energy storage systems, positioning the company at the forefront of the industry.

In North America, the United States and Canada are the prominent markets, driven by government initiatives to promote clean energy and the increasing adoption of electric vehicles. The United States, particularly in states like California and Michigan, leads in EV adoption, while Canadas focus on renewable energy projects supports growth in energy storage systems.

In 2023, LG Energy Solutions announced plans to expand its production capacity in Michigan, focusing on producing advanced lithium-ion batteries for EVs and ESS. This reflects the ongoing trend of expanding domestic battery production capabilities to meet the growing demand in the region and reduce reliance on foreign imports.

North America Lithium-ion Battery Market Segmentation

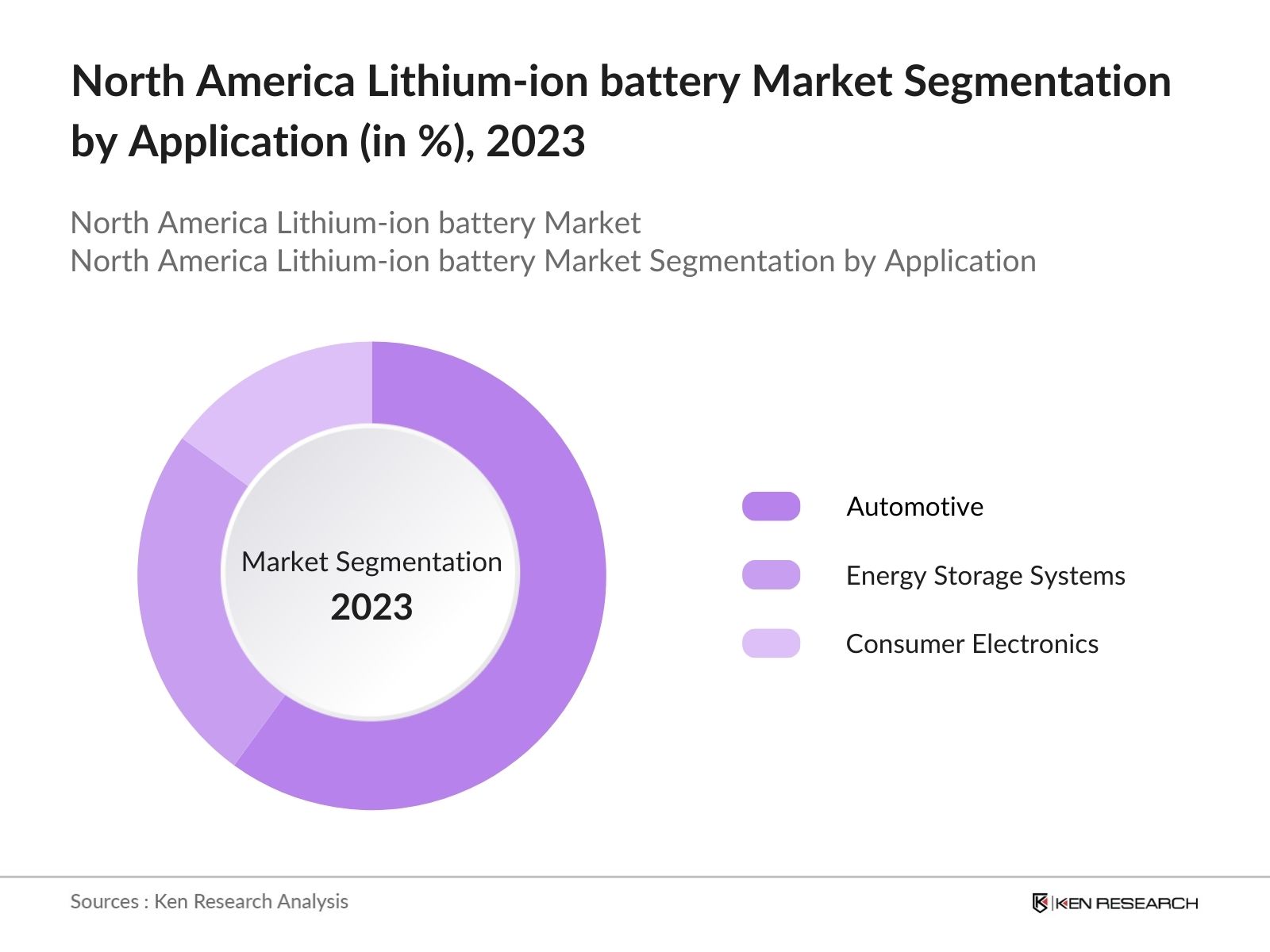

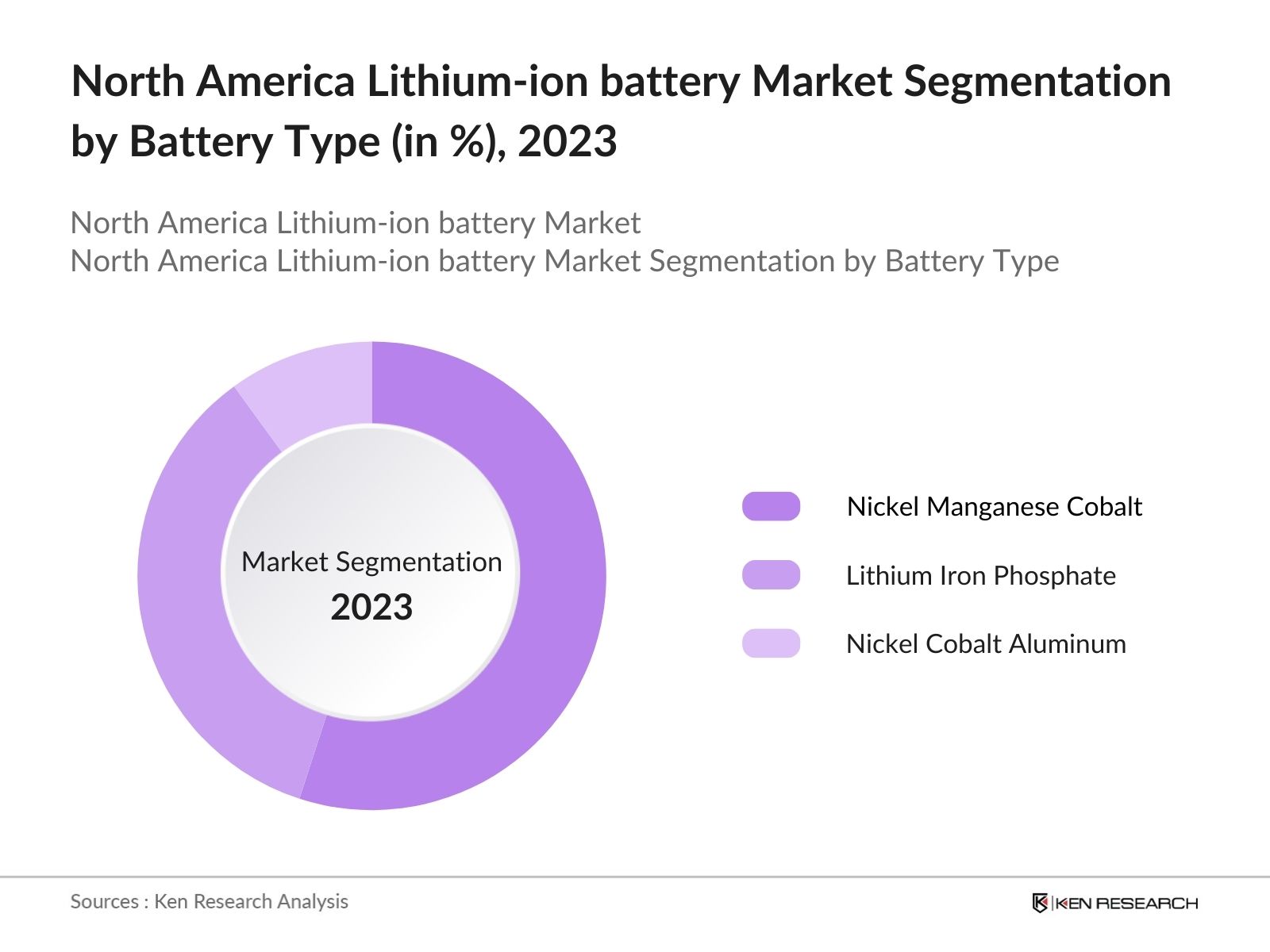

The North America Lithium-ion Battery Market can be segmented by battery type, application, and region:

By Battery Type: The market is segmented into lithium iron phosphate (LFP), nickel manganese cobalt (NMC), and nickel cobalt aluminum (NCA). In 2023, NMC batteries were the most dominant, driven by their use in electric vehicles due to their high energy density. However, LFP batteries are gaining popularity in energy storage systems for their safety and cost-effectiveness.

By Application: The market is segmented by application into automotive, energy storage systems (ESS), consumer electronics, and industrial applications. In 2023, the automotive sector led the market, driven by the rapid growth in EV sales. Energy storage systems are the second-largest segment, supported by increasing investments in renewable energy projects across the region.

By Region: The North America market is regionally segmented into the United States, Canada, and Mexico. In 2023, the United States dominated the market, driven by strong government support for EV adoption and investments in battery manufacturing. Canada is also a market, particularly in the ESS segment, supported by its push for renewable energy projects.

North America Lithium-ion Battery Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Tesla |

2003 |

Austin, USA |

|

Panasonic |

1918 |

Osaka, Japan |

|

LG Energy Solutions |

1947 |

Seoul, South Korea |

|

CATL |

2011 |

Ningde, China |

|

Samsung SDI |

1970 |

Yongin, South Korea |

- Tesla: In 2023, Tesla expanded its Gigafactory in Nevada to increase the production of high-performance lithium-ion batteries for its EV models, addressing the growing demand for electric vehicles in North America. Teslas continued investment in battery innovation has positioned it as a leader in the EV market.

- Panasonic: In 2024, Panasonic announced a new collaboration with Tesla to develop more efficient and affordable batteries for electric vehicles. This partnership aims to drive down the cost of EV batteries while improving their performance, supporting the broader adoption of EVs in North America.

North America Lithium-ion Battery Market Analysis

Market Growth Drivers:

- Increasing EV Adoption: The market has seen a significant rise in demand due to the growing number of electric vehicles (EVs) on the road. In 2023, the USA sold more than 1.3 million EVs, boosting the demand for lithium-ion batteries, as automotive companies ramp up production to meet growing consumer demand.

- Rise in Renewable Energy Projects: The rise in renewable energy projects, particularly in solar and wind, has driven the need for energy storage systems (ESS). In 2023, the USA installed over 50 gigawatt-hours of energy storage capacity, which relies heavily on lithium-ion batteries for efficient energy storage and distribution.

- Expansion of Charging Infrastructure: With the increase in electric vehicles, there has been a parallel rise in EV charging infrastructure. In 2023, the USA added over 50,000 public charging stations, which, in turn, drives the demand for lithium-ion batteries used in both the vehicles and energy storage systems supporting the grid.

Market Challenges:

- Raw Material Shortages: The market faces challenges due to shortages in key raw materials such as lithium, cobalt, and nickel. This has led to supply chain disruptions and increased production costs, affecting profit margins for manufacturers.

- Recycling and Disposal Issues: As the use of lithium-ion batteries increases, the need for proper recycling and disposal of used batteries becomes critical. The lack of established recycling infrastructure in North America poses a challenge to the sustainability of the battery industry.

- Competition from Alternative Technologies: While lithium-ion batteries dominate the market, emerging technologies such as solid-state batteries and hydrogen fuel cells pose potential competition. Companies are investing in the research and development of these alternative technologies, which could disrupt the lithium-ion market in the future.

Government Initiatives:

- Biden Administrations EV Infrastructure Plan: The Biden administration has committed USD 7.5 billion towards building a national network of EV charging stations, which is expected to drive demand for lithium-ion batteries in the coming years. This initiative is part of a broader push to achieve net-zero emissions by 2050, with electric vehicles playing a key role in this transition.

- Canadas Zero-Emission Vehicle Mandate: In 2023, the Canadian government allocated USD 1.7 billion to support the transition to zero-emission vehicles (ZEVs), mandating that all new light-duty vehicles sold by 2035 must be zero-emission. This funding includes grants for battery production facilities and infrastructure development for lithium-ion batteries.

North America Lithium-ion Battery Market Future Market Outlook

The North America Lithium-ion Battery Market is expected to experience growth through 2028, driven by the increasing adoption of electric vehicles, advancements in battery technology, and government support for renewable energy and clean transportation.

Future Market Trends:

- Expansion of Solid-State Batteries: While lithium-ion batteries currently dominate the market, solid-state batteries are expected to gain traction by 2028. These batteries offer higher energy density, improved safety, and faster charging times, making them an attractive option for electric vehicles and energy storage systems.

- Domestic Production Growth: In response to supply chain disruptions, there is an increasing focus on expanding domestic battery production in North America. Several companies have announced plans to build new battery manufacturing plants, reducing dependence on imported components and strengthening the regional supply chain.

- Integration with Smart Grids: The integration of lithium-ion batteries with smart grids is expected to play a key role in managing energy distribution and storage. As more renewable energy is added to the grid, the need for efficient energy storage systems will grow, driving demand for lithium-ion batteries.

Scope of the Report

|

By Region |

United States Canada Mexico |

||

|

By Battery Type |

Lithium Iron Phosphate Nickel Manganese Cobalt Nickel Cobalt Aluminum |

||

|

Automotive Energy Storage Systems Consumer Electronics |

||

|

By Sales Channel |

Direct Sales OEM Partnerships Distributors |

Products

Key Target Audience:

Battery Manufacturers

Electric Vehicle Manufacturers

Energy Storage System Providers

Government and Regulatory Bodies (DOE, EPA, FERC, NREL)

Automotive OEMs

Venture Capitalists and Investment Firms

Renewable Energy Project Developers

Technology Providers in Energy Storage

Raw Material Suppliers

Electric Utility Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Tesla

Panasonic

LG Energy Solutions

CATL

Samsung SDI

Northvolt

BYD

SK Innovation

Envision AESC

QuantumScape

Solid Power

Sila Nanotechnologies

SES AI

Amperex Technology

Romeo Power

Table of Contents

1. North America Lithium-ion Battery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Lithium-ion Battery Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Lithium-ion Battery Market Analysis

3.1. Growth Drivers

3.1.1. Electric Vehicle Adoption

3.1.2. Renewable Energy Projects

3.1.3. Government Incentives

3.1.4. Technological Advancements

3.2. Restraints

3.2.1. Raw Material Shortages

3.2.2. Recycling and Disposal Challenges

3.2.3. Competition from Alternative Technologies

3.3. Opportunities

3.3.1. Domestic Manufacturing Expansion

3.3.2. Advancements in Solid-State Batteries

3.3.3. Integration with Smart Grids

3.4. Trends

3.4.1. Battery Innovations

3.4.2. Growth of Charging Infrastructure

3.4.3. Focus on Sustainability

3.5. Government Regulation

3.5.1. U.S. EV Infrastructure Plan

3.5.2. Canadas Zero-Emission Vehicle Mandate

3.5.3. Investment Tax Credits

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America Lithium-ion Battery Market Segmentation, 2023

4.1. By Battery Type (in Value %)

4.1.1. Lithium Iron Phosphate (LFP)

4.1.2. Nickel Manganese Cobalt (NMC)

4.1.3. Nickel Cobalt Aluminum (NCA)

4.2. By Application (in Value %)

4.2.1. Automotive

4.2.2. Energy Storage Systems (ESS)

4.2.3. Consumer Electronics

4.2.4. Industrial Applications

4.3. By Sales Channel (in Value %)

4.3.1. Direct Sales

4.3.2. OEM Partnerships

4.3.3. Distributors

4.4. By Region (in Value %)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. North America Lithium-ion Battery Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla

5.1.2. LG Energy Solutions

5.1.3. Panasonic

5.1.4. CATL

5.1.5. Samsung SDI

5.1.6. Northvolt

5.1.7. BYD

5.1.8. SK Innovation

5.1.9. Envision AESC

5.1.10. QuantumScape

5.1.11. Solid Power

5.1.12. Sila Nanotechnologies

5.1.13. SES AI

5.1.14. Amperex Technology

5.1.15. Romeo Power

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Lithium-ion Battery Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Lithium-ion Battery Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Lithium-ion Battery Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Lithium-ion Battery Future Market Segmentation, 2028

9.1. By Battery Type (in Value %)

9.2. By Application (in Value %)

9.3. By Sales Channel (in Value %)

9.4. By Region (in Value %)

10. North America Lithium-ion Battery Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and technological advancements. We also assess regulatory impacts and market dynamics specific to the North America Lithium-ion Battery Market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (by battery type, application, and region), and distribution channels. We also analyze market share and revenue generated by leading companies, emerging trends in battery technology, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We conduct Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading battery manufacturers, automotive companies, and energy storage providers. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as production capacity, pricing strategies, and supply chain management.

Step 4: Research Output

Our team interacts with battery manufacturers, electric vehicle companies, energy storage experts, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and technological innovations. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How large is the North America Lithium-ion Battery Market?

In 2023, the North America Lithium-ion Battery Market was valued at approximately USD 18.3 billion. The market's growth is driven by the increasing demand for electric vehicles, energy storage systems, and consumer electronics.

02. What are the challenges in the North America Lithium-ion Battery Market?

Challenges in the North America Lithium-ion Battery Market include raw material shortages, particularly for lithium, cobalt, and nickel, which impact production costs. Additionally, recycling infrastructure for used batteries remains underdeveloped, and competition from emerging battery technologies poses future risks.

03. Who are the major players in the North America Lithium-ion Battery Market?

Major players in the North America Lithium-ion Battery Market include Tesla, Panasonic, LG Energy Solutions, CATL, and Samsung SDI. These companies lead the market with large-scale production capabilities, technological innovation, and strong partnerships with automakers and energy storage providers.

04. What are the growth drivers of the North America Lithium-ion Battery Market?

Key growth drivers include the increasing adoption of electric vehicles, advancements in battery technology, and rising investments in renewable energy projects. Government initiatives and incentives, such as the Biden administration's push for EV infrastructure and clean energy, also contribute significantly to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.