North America Lithium Metal Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD10465

December 2024

92

About the Report

North America Lithium Metal Market Overview

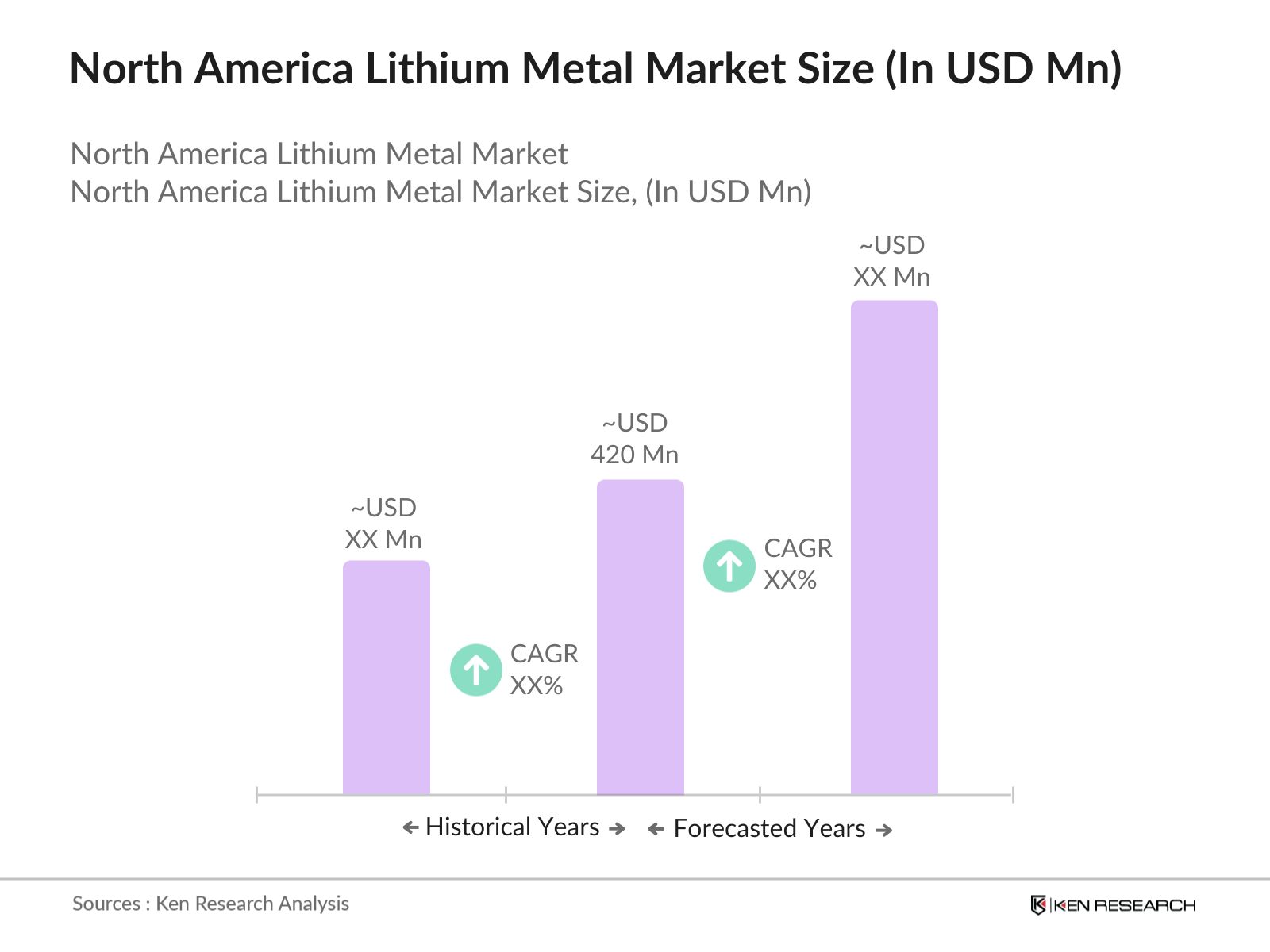

- The North America Lithium Metal market is valued at USD 420 million, driven by substantial demand from the electric vehicle (EV) and energy storage sectors. The critical role of lithium metal in high-energy-density applications, particularly in lithium-ion batteries, has led to its increased utilization. The expansion of renewable energy projects in North America further boosts demand, as lithium metal batteries offer efficient energy storage solutions. Growing investments in battery innovation continue to support this trend, making lithium metal a key component in achieving energy sustainability goals.

- Major regions such as the United States and Canada dominate the lithium metal market in North America. The United States leads due to its advanced battery manufacturing infrastructure, investment in EVs, and government support for lithium extraction initiatives. Canada follows closely with significant lithium mining capabilities and a focus on sustainable extraction, driven by both government policies and private sector engagement. These factors collectively contribute to the market dominance of these two countries within North America.

- The EPA has introduced stricter standards for lithium mining and processing, requiring companies to reduce water use and emissions in compliance with 2024 guidelines. These regulations, enforced through penalties and inspections, aim to limit the environmental impact of lithium production, promoting sustainable practices in North America.

North America Lithium Metal Market Segmentation

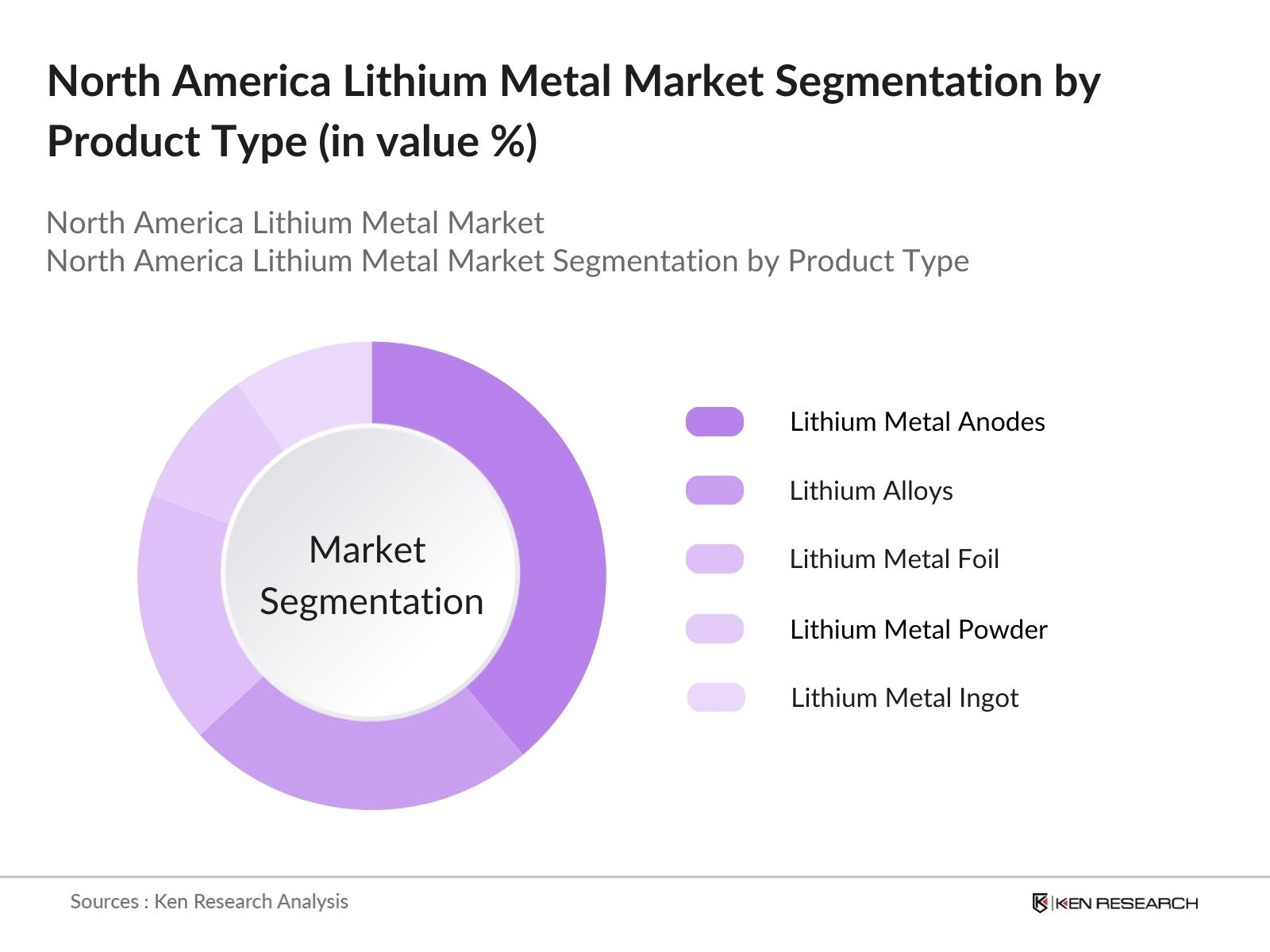

By Product Type: The North America Lithium Metal market is segmented by product type into lithium metal foil, lithium metal powder, lithium metal anodes, lithium alloys, and lithium metal ingot. Recently, lithium metal anodes have a dominant market share under the product type segmentation due to their extensive application in high-performance batteries. These anodes are essential in the development of advanced energy storage solutions, particularly for EVs and portable electronics. Their high energy density, ability to reduce battery weight, and longer lifespan drive preference, especially in EV battery manufacturing, where efficiency and performance are key factors.

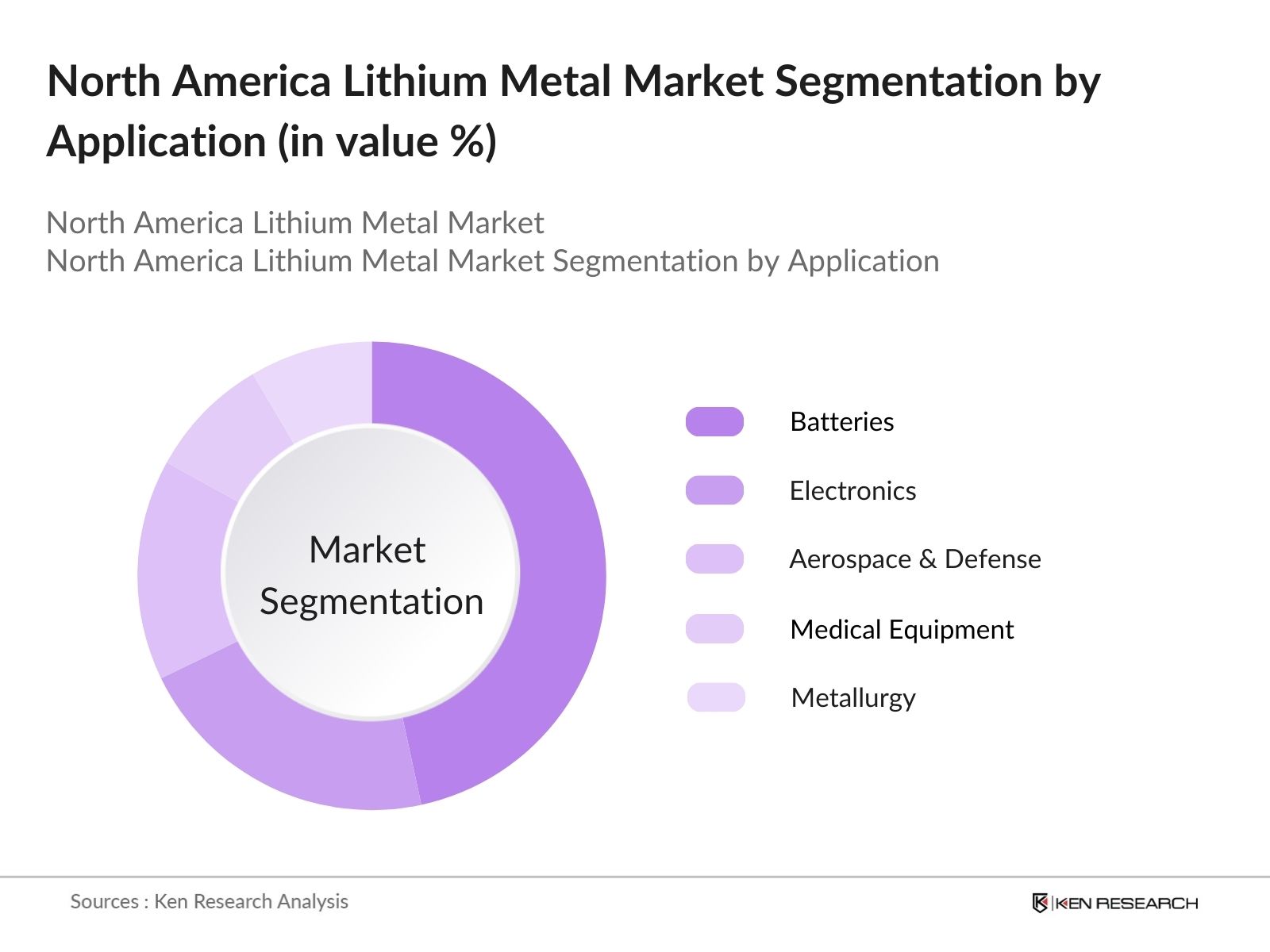

By Application: The North America Lithium Metal market is segmented by application into batteries, electronics, aerospace & defense, medical equipment, and metallurgy. Batteries hold a dominant market share within the application segment, primarily due to the surging demand for lithium-ion batteries in EVs and renewable energy storage. The adoption of lithium metal in batteries provides high energy efficiency and longevity, which are vital for both automotive and grid storage applications. This high-performance requirement, coupled with ongoing research to enhance lithium battery capacity, sustains the demand for lithium metal within the battery sector.

North America Lithium Metal Market Competitive Landscape

The North America Lithium Metal market is dominated by several key players who have established their market position through technological advancements, strategic partnerships, and expanded lithium production capabilities. Leading firms like Albemarle Corporation and Livent Corporation demonstrate considerable influence in the market, leveraging their vast resources and established customer base to maintain a competitive edge.

North America Lithium Metal Market Analysis

Growth Drivers

- Rising Demand in Energy Storage (Lithium-Ion Batteries): The demand for lithium in energy storage applications is rising, with North America experiencing significant investment in lithium-ion battery technologies. In 2024, the U.S. Department of Energy reported that lithium demand for battery storage systems reached over 70,000 metric tons, a result of increased energy storage projects tied to renewable energy grids. The surge in renewable energy capacity, projected to exceed 400 GW by year-end, supports this lithium requirement, underlining the critical role lithium plays in stabilizing grid systems.

- Advancements in Electric Vehicle Technology: Electric vehicle (EV) technology advancements have driven lithium demand as battery performance improves. In 2024, over 1.3 million electric vehicles were sold in North America, as reported by the International Energy Agency. This increase has fueled demand for high-purity lithium metal, particularly for next-generation lithium-metal batteries expected to enhance EV range and efficiency. Government incentives, including the Inflation Reduction Act, encourage EV adoption, creating a robust market for lithium in North America.

- Expansion in Electronics and Semiconductor Industries: Lithium demand is bolstered by its use in electronics, as North Americas electronics sector shows strong growth. As per the U.S. Census Bureau, consumer electronics shipments reached 2.4 billion units in 2024, demanding high-grade lithium for batteries. Lithium is essential in power-hungry devices like laptops and mobile phones, especially with the shift to faster processors and larger displays. This growth in consumer electronics has a direct impact on lithium demand.

Market Challenges

- Supply Chain Disruptions: In 2024, North America faced notable supply chain disruptions in lithium imports due to geopolitical tensions and limited shipping availability. According to the U.S. Bureau of Economic Analysis, delays in importing raw lithium materials resulted in a 14% rise in shipping costs. This challenge directly affects lithium availability for manufacturers, stressing the need for regional production and storage solutions.

- Environmental Concerns and Regulatory Constraints: Lithium extraction and production pose environmental concerns, with over 50,000 gallons of water required per metric ton of lithium, impacting water availability in regions with extraction activities. According to the U.S. Environmental Protection Agency (EPA), new regulations in 2024 require lithium producers to adhere to stringent water use and waste disposal standards, which increase production costs and pose challenges for supply expansion.

North America Lithium Metal Market Future Outlook

Over the coming years, the North America Lithium Metal market is poised for substantial growth, driven by the surging demand in the electric vehicle industry, innovations in battery technology, and supportive government policies. The increased focus on energy storage for renewables and the exploration of lithium metal for next-generation batteries presents significant growth opportunities. Advancements in sustainable lithium extraction and recycling processes will further enhance market growth, positioning North America as a critical region in the global lithium supply chain.

Market Opportunities

- Innovations in Extraction and Production Technologies: Innovations in lithium extraction, such as direct lithium extraction (DLE) methods, reduce environmental impact and improve yield. In 2024, a pilot project in Nevada demonstrated that DLE could increase lithium recovery by 40% compared to traditional methods, according to the Department of the Interior. Such technologies can help North America reduce reliance on imports by boosting local lithium supply.

- Strategic Partnerships and Collaborations in Mining: In 2024, North American lithium producers entered strategic partnerships with local and international mining firms to secure consistent supply. For instance, the U.S. formed agreements with Canada to develop joint lithium mining projects, enhancing resource availability across both nations. Such collaborations are essential for maintaining a steady supply and promoting energy independence.

Scope of the Report

|

By Product Type |

Lithium Metal Foil |

|

By Application |

Batteries |

|

By End-Use Industry |

Automotive |

|

By Technology |

Electrolytic Processes |

|

By Region |

U.S. |

Products

Key Target Audience

Electric Vehicle Manufacturers

Battery Manufacturing Companies

Renewable Energy Companies

Electronics Manufacturers

Aerospace and Defense Contractors

Government and Regulatory Bodies (U.S. Department of Energy, Canadian Energy Regulator)

Investment and Venture Capitalist Firms

Lithium Mining Companies

Companies

Players Mentioned in the Report:

Albemarle Corporation

Livent Corporation

FMC Lithium

American Elements

Ganfeng Lithium

SQM (Sociedad Qumica y Minera)

Nemaska Lithium Inc.

Lithium Americas Corp.

Tianqi Lithium

Sirocco Mining Inc.

Table of Contents

1. North America Lithium Metal Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Metric: % Growth)

1.4. Market Segmentation Overview (Product, Application, Region, etc.)

2. North America Lithium Metal Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Notable Milestones & Advancements)

3. North America Lithium Metal Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Demand in Energy Storage (Lithium-Ion Batteries)

3.1.2. Advancements in Electric Vehicle Technology

3.1.3. Expansion in Electronics and Semiconductor Industries

3.1.4. Increasing Investment in Renewable Energy

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Environmental Concerns and Regulatory Constraints

3.2.3. High Production Costs

3.2.4. Limited Natural Resources in Key Regions

3.3. Opportunities

3.3.1. Innovations in Extraction and Production Technologies

3.3.2. Strategic Partnerships and Collaborations in Mining

3.3.3. Expansion of Lithium Recycling Programs

3.3.4. Research and Development in Lithium Alternatives

3.4. Trends

3.4.1. Adoption of Sustainable Mining Practices

3.4.2. Investment in Research for Lithium Metal Anodes

3.4.3. Shift Toward Domestic Lithium Production

3.4.4. Exploration of Lithium Air and Solid-State Battery Technologies

3.5. Regulatory Landscape

3.5.1. Environmental Standards (e.g., EPA Standards)

3.5.2. Import/Export Regulations

3.5.3. Compliance Standards for Battery Safety

3.5.4. National and Regional Policies Promoting EV Adoption

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. North America Lithium Metal Market Segmentation

4.1. By Product Type (In Value %):

4.1.1. Lithium Metal Foil

4.1.2. Lithium Metal Powder

4.1.3. Lithium Metal Anodes

4.1.4. Lithium Alloys

4.1.5. Lithium Metal Ingot

4.2. By Application (In Value %):

4.2.1. Batteries

4.2.2. Electronics

4.2.3. Aerospace & Defense

4.2.4. Medical Equipment

4.2.5. Metallurgy

4.3. By End-Use Industry (In Value %):

4.3.1. Automotive

4.3.2. Renewable Energy

4.3.3. Consumer Electronics

4.3.4. Industrial

4.3.5. Defense

4.4. By Technology (In Value %):

4.4.1. Electrolytic Processes

4.4.2. Vacuum Distillation

4.4.3. Lithium Chloride

4.4.4. Lithium Recovery Techniques

4.5. By Region (In Value %):

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Lithium Metal Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Albemarle Corporation

5.1.2. Livent Corporation

5.1.3. FMC Lithium

5.1.4. American Elements

5.1.5. Ganfeng Lithium

5.1.6. SQM (Sociedad Química y Minera)

5.1.7. Nemaska Lithium Inc.

5.1.8. Lithium Americas Corp.

5.1.9. Tianqi Lithium

5.1.10. Sirocco Mining Inc.

5.1.11. China Lithium Products Technology Co.

5.1.12. Orochem Technologies Inc.

5.1.13. Mitsubishi Chemical Corporation

5.1.14. Rock Tech Lithium

5.1.15. Avalon Advanced Materials

5.2. Cross Comparison Parameters

5.2.1. Revenue (USD)

5.2.2. Production Capacity (Tonnes)

5.2.3. Lithium Metal Type Specialization

5.2.4. Operational Regions

5.2.5. Major Customers (Industry/End-Use)

5.2.6. R&D Investments

5.2.7. Partnerships and Alliances

5.2.8. Market Positioning (Leader, Challenger, etc.)

5.3. Market Share Analysis (In % per Competitor)

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. North America Lithium Metal Market Regulatory Framework

6.1. Environmental Standards (OSHA, EPA Regulations)

6.2. Import/Export Regulations (Trade Tariffs, Import Duties)

6.3. Lithium Metal Storage and Transportation Guidelines

6.4. Certification Requirements (ISO Certifications)

6.5. Compliance Standards for Safety in Battery Applications

7. North America Lithium Metal Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Lithium Metal Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. North America Lithium Metal Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Key Buyer Profiles)

9.3. Marketing Initiatives (Digital Presence, B2B Outreach)

9.4. White Space Opportunity Analysis (Unmet Needs in Market)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that includes primary stakeholders in the North America Lithium Metal Market. This stage is supported by comprehensive desk research utilizing secondary and proprietary databases to gather in-depth market data, with the aim of pinpointing critical variables impacting the lithium metal industry.

Step 2: Market Analysis and Construction

In this phase, historical data analysis is conducted to evaluate market penetration, lithium production volumes, and revenue trends. Metrics like production capacity and industry-specific challenges are also assessed to ensure reliability and accuracy of the market revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are then validated through interviews with industry experts, including representatives from battery manufacturing companies and lithium suppliers. These interviews provide critical insights that help fine-tune and verify data.

Step 4: Research Synthesis and Final Output

In the final phase, data is synthesized with additional insights gathered from lithium production firms to gain specific details on segment performance, end-use applications, and future demand. This consolidation helps ensure a comprehensive and accurate analysis of the North America Lithium Metal Market.

Frequently Asked Questions

01. How big is the North America Lithium Metal Market?

The North America Lithium Metal Market is valued at USD 420 million, with demand primarily driven by the electric vehicle and renewable energy sectors.

02. What are the challenges in the North America Lithium Metal Market?

Challenges in the North America Lithium Metal Market include supply chain limitations, high production costs, and environmental regulations on lithium extraction. Additionally, the limited availability of lithium resources poses a challenge.

03. Who are the major players in the North America Lithium Metal Market?

Leading companies in the North America Lithium Metal Market include Albemarle Corporation, Livent Corporation, FMC Lithium, American Elements, and Ganfeng Lithium. These companies maintain dominance through established production and technological advancements.

04. What drives the growth of the North America Lithium Metal Market?

The North America Lithium Metal Market growth is driven by the expansion of electric vehicle production, increased focus on energy storage, and significant investments in lithium metal battery technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.